Oiltrading

Crude Oil Weekly Forecast 30 Jan - 3 Feb 2023 Crude Oil Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from OVX we can see that currently the IV for this week is at 40.5%, equal to last week.

This can be translated in +/- 5.62% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 84.54

BOT: 75.54

If we were to make a more accurate statement, based on the current percentile of the OVX( from 0 to 10) , we can apply a condition in the filter

to look for scenarios when the volatility were lower than 50 percentile( bottom half). If we were to take this data we can see, that our numbers would be:

74% according to the last 20 years of data

50% according to the data since 2022( I would recommend the 72% instead)

So we can use this data instead for proper calculation of our trading plan

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

31.5% to touch the previous weekly high

66% to touch the previous weekly low(already hit)

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: -26% Bearish Trend

D Timeframe: 0% Bearish Trend

W Timeframe: -53% Bearish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

4.65% from the open to the close candle for the bullish scenario

5.6% from the open to the close candle for the bearish scenario

Crude oil a leading inflation indicatorTwo observation made the last two years between crude oil and CPI:

1) There were 5 waves up and

2) 3 significant peaks

However, between the last 2 peaks of crude, it was a lower low follow-by its downtrend, and CPI followed this downtrend subsequently.

Among many commodities, crude oil moves the most in tandem with CPI, but crude seems to lead in this study.

Refer to the daily chart on your own, try drawing a downtrend line, you will see crude oil prices has broken above its downtrend line recently. If crude oil is going to transit to an uptrend from here, we will have to track CPI very closely. The inflation fear is still there.

Did a video on this observation last week, refer to the link below.

Crude Oil Futures

Minimum fluctuation

0.01 = $10

0.10 = $100

1.00 = $1,000

10.00 = $10,000

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Crude Oil. Winter isWhite Swan Harmonic Pattern Observed.

Support & Resistance (8H to 1W)

Falling wedge (Contracting) observed on 8H.

Bearish Ranging Channel (This can give us the perfect entry) on 8H

MACD divergence on Weekly Chart

RSI 47 on Weekly Chart

EMA 20 crossing over MA200

Last cross was observed on 6 Jan 2022

Looking forward...

The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment.

Do leave your valuable feedback & comments for any improvisations.

XTIUSD...SELL (5% Drawdown)The price of oil per barrel will definitely soar high but I see a chance of sell opportunity before its long momentum, currently looking at a clear sell chance for at least $4 price reduction per barrel of oil. XTIUSD is currently trading in my supply zone....so i expect more sells to jump into this market.

NB: All eyes on the breakout zone (blue box region) to accelerate or decelerate rice movements.

Red box ( rejection zone) might or will serve as a chance for another entry for sell or a push up to soar price movements high.

WTI DAILYThis may come as a shock to all of you but we are at the lower end of the market historically, and we have begun to see the rapid decline of market trends.

Long positions are being made which is why we are seeing such a short market to buy up all the great pricing for a swing to the 100s in the mid-year rise.

this cycle will place us in new market highs pretty soon.

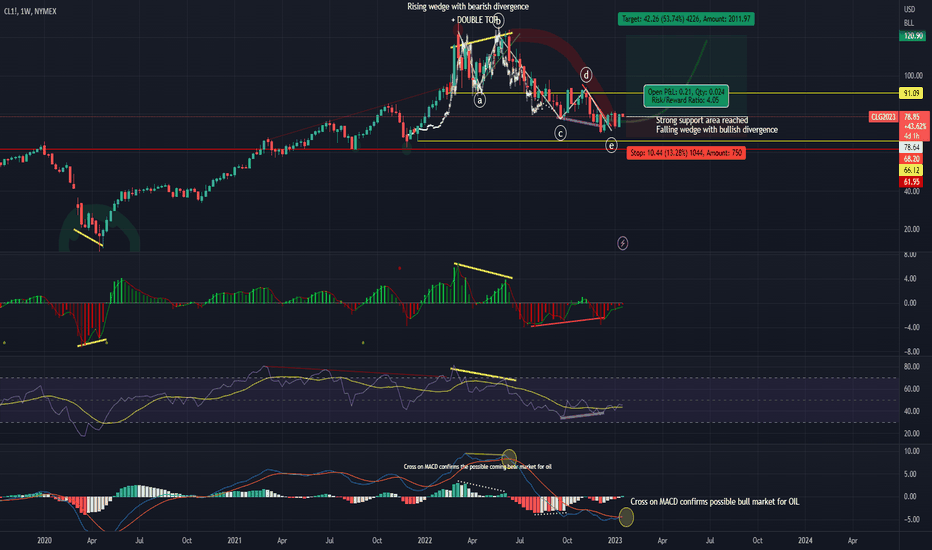

Nice R:R4 50% long setup for oilHey everyone,

after a patient play out of short seen below, finally a long setup popped up on me.

I see a finished EW correction topped out by falling wedge formation with bullish divergence on indicators.

Markets turning bullish and with Bitcoin and cryptocurrencies , I´m adding in bag some oil longs.

This is very nice and conservative Risk:Reward 4 ratio setup

Entry: 78-80 USD

SL: 68 USD

TP1: 100 USD

TP2: 120 UD

Chachain

KEYWORDS

Oil , CL1! , R:R, money management, risk, reward, technique, style, trading, bitcoin , bitcointrading, profitable trading, profittrading, profit trading, secret, divergence, bull divergence, bear divergence, divergencetrading, divergence trading, trading strategy, how to trade bitcoin , bitcoin trades, bitcoin trading, make profit, take profit, trading strategy, trading technique, successful, successful trader, successful technique, successful strategy, successful secret, how to trade, trend analysis, technical analysis , indicators, rsi , relative strenght index, let it rain, successful life, easy strategy, easy trading, easy technique, make money, crypto investing, investing, crypto, cryptocurrency, cryptocurrencies, mentoring, money, chartart, beyond

Potential SHORT/LONG on OIL IF...Like my previous analysis, i am looking to see if OIL rejects or breaks the trend-line which is at the $80 level. Coincidentally, this is also where the 50EMA is at. I would want to see what it does at he 80-81.4 price. 80 price is at the trend-line and 81.4 is the previous resistance. If it breaks that level, we can see a nice push to $90s. If we see rejections, we can see retest support at he $70 level

Crude oil💥1D -TIMEFRAME ANALYSISCrude oil💥1D -TIMEFRAME ANALYSIS

💗Hello ladies and gentlemen

This is my new idea for 💥Oil

I hope my idea is clear

Support me by like and share thank you

Stay Safe💯💲💲💲

Good luck💰😍

US OIL- Pt.2- Patience is the keyIn our previous post we explained how we believe that oil still needs to complete a cycle wave 2 in the area 57-60, where the 61.8% fibo retracement and the upper trendline of a big descending broadening wedge stand.

We then took a potential short opportunity at 75.8@, but we were kicked out at entry and we believe that the correction in wave ii of C of (Z) still has to complete higher, when the golden fibo level of i coincides with the level for which a=c. We are then waiting 78.14 to restrike.

Exxon mobil and other oil stocks are boughtNYSE:XOM

PEPPERSTONE:NATGAS

Oil stocks usally follow natural gas and the price of oil pretty closly.

this makes sense since they sell oil and if the price of oil goes down then should the stock selling that oil.

recently this has not been true as the price of oil and Natural gas have fallen Oil companies are not falling but why??

i belive this is because of very high profits which they got when the price of oil was high

and also investors thinking that the price of oil will rebound

i think oil is over bought as the underlying asset is down but the Stocks selling those assets arent

Not Financial Advice just an opinon

fell free to Correct me on any of my points if i didnt see something

XTIUSD Short Trade from 81.25Basing this trade off of a trendline touch on the weekly timeframe and the weekly 100EMA being aligned. Coupled with the previous high made on XTI's downtrend, makes for solid confluences for an intraday short. I am not expecting crazy pips from the zone but will have a modest target as Friday is profit taking day for institutes. Stops at 43 pips and full tp at 150. Would prefer to see this occur later in the day around 3-4pm GMT.

Any criticism appreciated, and if you've spotted this trade too!

Happy trading.