UCO a crude oil ETF LONGUCO popped in April and then dropped into a consolidation in May and June where

it set up a base shown by the POC line on the volume profile. Once over the POC

on July 6th on the daily chart coinciding with a golden cross on the HMA 56/210

combination the bull trend began. The dual time frame RS lines in the 60s suggest

more to come. I am trading UCO and similar oil-based instruments including USOUSD

or forex in the near term until I see signals of a topping that are not yet evident.

OILU

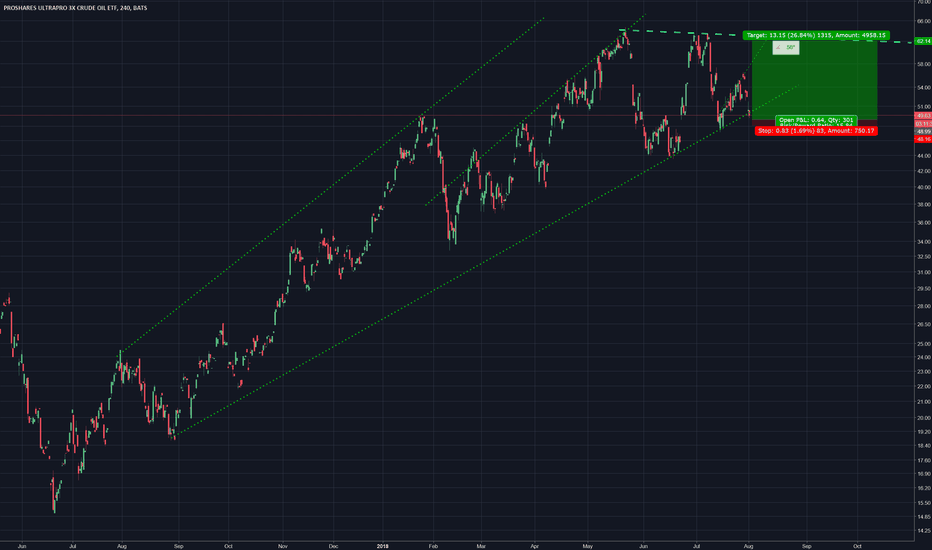

OILU an ETF for OIL - Leveraged and LongOILU is a risky high volatility ETF on oil exploration and production. Where there are risk

and volatility there can also be plentiful profits. On the 4H chart,OILU can be seen breaking

up through long-term anchored VWAP bands in a trend that began in mid-May. Price is

now approaching the mean VWAP lines. The POC line validates those VWAP lines coming in

at nearly an identical price level. On the MACD, negative amplitudes have gradually decreased

in a fashion consistent with bullish divergence. The RSI indicator shows the MTF RSIs to be

in mid-range suitable for taking an entry without evidence of oversold or overbought

parameters. Fundamentally, a variety of factors including

OPEC the re-emergence of the Chinese economy, Russia's war fear of a recession causing a

decrease in demand for oil all have contributed to a mixed picture. The chart is suggesting

a long trade to me and so I will take up the suggestion. I will set a stop loss at the recent

pivot low of $32 while targeting the highest VWAP band at $47. I will raise the stop loss

to break-even when price hits $38 while respecting the ATR and volatility. I see this as

a safe trade with a potential upside of about 33%

FEDS open federal land for oil exploration LONG SETUP USOUSDVANTAGE:USOUSD

With the news catalyst of massive new open leases on federal land for USOIL

and the big oil companies USOUSD has reacted with a big uptrend.

with major resistance 3 to 4 percent higher this may continue.

This seems to be a good setup for a swing long trade on USOUSD

and potentially any of the big oil stocks.

OILU LONG SET UP OILU ULTRAPRO 3X CRUDE OIL ETF

ENTRY 1 1.20

ENTRY 2 1.00

SL 0.13

TP.1 $8.00

TP.2 18.20

TP.3 28.20

TP.4 36.00

TP.5 48.00

act.webull.com

Your free stock is waiting for you! Join Robinhood and we'll both get a stock like Apple, Ford, or Facebook for free. Sign up with my link. join.robinhood.com

Short-term Trade: OILU / USOIL Extremely Favorable Risk-RewardI don’t believe OILU will stay at the $14 level for very long and conservatively speaking I’d say a 50% swing higher is likely.

Depending on your strategy, you could cap your loss at 2% or whatever your risk tolerance is and then go in full on a breakout. Personally, I’d buy half or a third now and hold. If prices fall, potentially up to 7% or so, I’d accumulate more and once the breakout happens go in full.

OIL LONG IDEAI've been watching OIL for a while now. I think the time is now to get on board. Keeping it simple. The cycle timing is right. The MACD is above zero, the PSAR is positive and the long term trend line is broken. Putin meets with OPEC today I believe. I am buying OILU instead of GUSH because the markets keep selling off, which could drag GUSH down despite improving oil prices.