$OKTA Gen AI tailwinds are not materializing as of now!- I'm a seller of NASDAQ:OKTA at $124 . Company was undervalued at 70s but has run so much without tangible materializing Gen AI tailwinds.

- Theoretically, Agentic AI should have been a great tailwind for SSO but it appears that industry is not yet focussed on security aspect of it when it comes to agentic AI.

- Even on application level, companies are struggling with developing orchestration framework and deploying them at Scale.

- Risk/Reward is not suitable for me to stay long. Short or Avoid/sell $OKTA.

- I might change my mind if they prove themselves today May 27, 2025.

OKTA

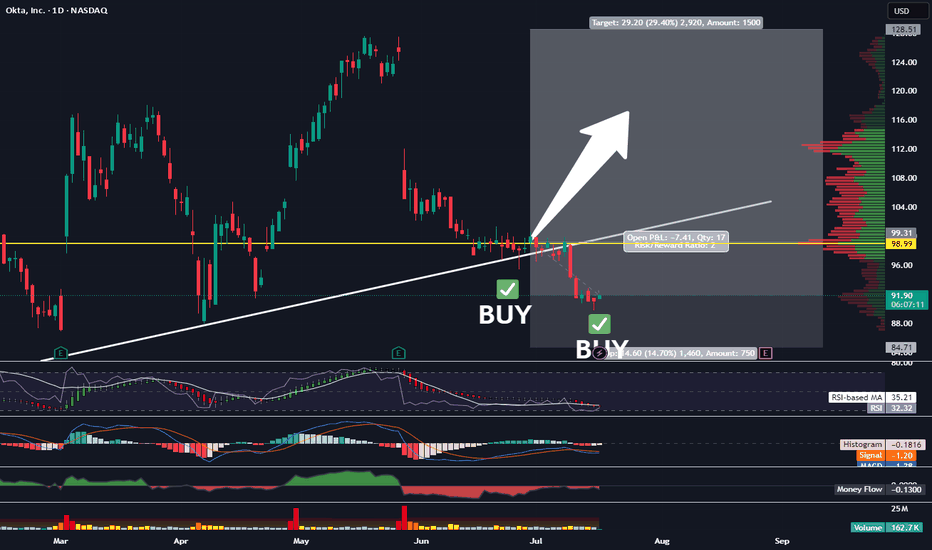

Picked Up More OKTATraders,

We’re nailing it in the stock division. Our portfolio has gained nearly 30% since the inception of our new indicator in Sept. of last year. And we’ve done that with 50% of our cash on the sidelines nearly the entire time, further reducing risk. It is amazing how I stumbled upon this new trade strategy purely by accident. Not by following anyone else on Youtube or TradingView or X. But simply by doing what I love to do and spotting trends and patterns. The combo of the indicators I have been utilizing is truly working, outbesting SPY hodl’ers by 3-to-1 since implementation.

At times, my indicator gives us more than one signal. This usually indicates that the move up will be stronger and more aggressive than previously indicated. Such is the case with our OKTA entry. We’ve got another BUY signal that has been given, and so, I am DCA’ing in. The target and SL will remain the same as our previous entry. All data can be found on the tracker.

Best,

Stew

Long OKTA To 128.50 For Nearly 30% PP. 1:2 RRR.Good Afternoon Trading Fam,

We are nailing it with our stock trades since implementing my new liquidity indicator. I've got another buy signal given here on OKTA with a 1:2 rrr ratio and potential profit of nearly 30%.

On the technical side, you can see that we are just above a large liquidity block where buyers have stepped in en masse in the past. Additionally, we have nice support being offered by our trendline. And finally, we have a large gap which often acts as a magnet and will most likely be filled sooner rather than later. The MACD has just crossed up, and our RSI is doing the same near oversold territory. All of these indications make this an easy choice for me, with an excellent opportunity to profit yet again.

More details on this trade and all of the others can be seen on my public portfolio, as always.

Best,

Stew

OKTA - DAY TRADE IDEAOKTA is setting up for a day trade scalp long...perhaps an aggressive swing trade as well. The day trade is a much higher probability of success around the $98.50-$99.30

Okta's stock has seen some volatility recently. After a strong rally earlier this year, it pulled back following cautious guidance from the company. Despite beating expectations on sales and earnings for Q1 fiscal 2026, investors were concerned about slowing growth, leading to a 14.6% drop in its stock price.

Okta reported $688 million in revenue, a 12% year-over-year increase, and positive free cash flow of $238 million, but its GAAP earnings were significantly lower than its adjusted earnings. The company maintained its full-year revenue forecast of $2.85 billion to $2.86 billion, reflecting 9% to 10% growth, but analysts tempered their optimism due to macroeconomic uncertainties.

Technicals

- Multiyear Support

- 50 % Fib Retrace

- Upsloping Trendline

- Positive Divergence building on 1/ 4 hour chart.

$OKTA is ready to RIP! 58% UpsideNASDAQ:OKTA was a big name I was talking about end of last year before we took a big dip in the markets...well we are back at the CupnHandle breakout level now and this trade looks ready to RIP!

Warning earnings on May 27th!

- Looking for a close on Friday above the breakout level for an entry here

- Green H5_L inidcator

- CupnHandle breakout

- Volume shelf launch

- Bullish Wr%

$139 First target

Measured Move is $186 for the cupnhandle

Not financial advice

Can Identity Security Redefine the Future of Digital Trust?In the labyrinthine world of cybersecurity, Okta Inc. emerges as a beacon of strategic innovation, transforming the complex landscape of identity management with remarkable financial resilience. The company's recent economic performance reveals a compelling narrative of growth that transcends traditional technological boundaries, showcasing how strategic investments and technological prowess can turn potential vulnerabilities into competitive advantages.

The digital landscape is becoming increasingly defined by complex security challenges, and Okta has established itself as a key player in this critical area. With a subscription revenue growth of 14% and strategic investments of $485 million in research and development, the company shows a strong commitment to advancing the possibilities in identity and access management. This approach is not just about providing technological solutions; it embodies a comprehensive vision for creating secure and seamless digital experiences that enable organizations to effectively navigate the increasingly intricate technological environment.

Despite facing significant market challenges, including intense competition and cybersecurity threats, Okta has transformed potential obstacles into opportunities for innovation. By maintaining a laser-focused approach to workforce and customer identity solutions, the company has survived and thrived, turning operating losses into a pathway toward profitability. The transition from a net loss of $81 million to a net income of $16 million underscores a strategic metamorphosis that challenges traditional narratives of technological enterprise, suggesting that true innovation emerges not from avoiding challenges, but from confronting them with intelligent, forward-thinking strategies.

As digital transformation continues to reshape enterprise security, Okta stands at the forefront of a critical revolution. The company's journey illustrates a profound truth: in an era of unprecedented technological complexity, the most successful organizations can transform uncertainty into opportunity, security into innovation, and technological challenges into strategic advantages. Okta's trajectory is more than a corporate success story—it's a testament to the power of visionary thinking in an increasingly interconnected world.

OKTA $OKTA | RANGE BOUND EARNINGS PLAY - Nov. 3rd, 2024OKTA NASDAQ:OKTA | RANGE BOUND EARNINGS PLAY - Nov. 3rd, 2024

BUY/LONG ZONE (GREEN): $78.75 - $99.00

DO NOT TRADE/DNT ZONE (WHITE): $71.50 - $78.75

SELL/SHORT ZONE (RED): $58.75 - $71.50

Weekly: Bearish

Daily: Bearish

4H: Bullish

1H: Bullish

NASDAQ:OKTA price movement has been range bound since the previous earnings report on Aug28th. I am now looking for this upcoming earnings report on Nov3rd post market to be the new catalyst for breaking out or down from this range. The bottom level of the range marks the 52 week lows. For the time being, price has made its way to the top of the range, if there is a negative reaction to the earnings report, price may only dip back down to the bottom of the range and stay within the sideways levels.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, earnings, earningsplay, earningsreport, upcomingearnings, oktaearnings, $oktaearnings, NASDAQ:OKTA , oktaearningsreport, oktatrades, oktatrade, oktarange, oktapricerange, oktatradesetup, oktaanalysis, oktarangelevels, oktapricelevels, oktaoptions, optionstrading,

OKTA Options Ahead of EarningsIf you haven`t bought OKTA before the previous breakout:

Now analyzing the options chain and the chart patterns of OKTA prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2025-5-16,

for a premium of approximately $7.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Okta Shares Down 6.21% On Q1 Fiscal Year 2025 Financial ResultsOkta ( NASDAQ:OKTA ), the leading independent identity partner, has announced its financial results for the first quarter of fiscal year 2025. The company reported a 19% year-over-year increase in Q1 revenue and a 20% year-over-year increase in subscription revenue. The current remaining performance obligations (cRPO) also increased by 15% to $1.949 billion. The company's CEO, Todd McKinnon, stated that the company began the new fiscal year with record non-GAAP profitability and cash flow.

The total revenue for Q1 was $617 million, an increase of 19% year-over-year. Subscription revenue was $603 million, an increase of 20% year-over-year. The RPO, or subscription backlog, was $3.364 billion, an increase of 14% year-over-year. The cRPO, or subscription backlog expected to be recognized over the next 12 months, was $1.949 billion, up 15% compared to the first quarter of fiscal 2024.

GAAP operating loss was $47 million, or 8% of total revenue, compared to a GAAP operating loss of $160 million, or (31)% of total revenue, in the first quarter of fiscal 2024. Non-GAAP operating income was $133 million, or 22% of total revenue, compared to a non-GAAP operating income of $37 million, or 7% of total revenue, in the first quarter of fiscal 2024.

GAAP net loss was $40 million, compared to a GAAP net loss of $119 million in the first quarter of fiscal 2024. Non-GAAP net income was $117 million, compared to a non-GAAP net income of $38 million in the first quarter of fiscal 2024. Net cash provided by operations was $219 million, or 36% of total revenue, compared to net cash provided by operations of $129 million, or 25% of total revenue, in the first quarter of fiscal 2024. Free cash flow was $214 million, or 35% of total revenue, compared to $124 million, or 24% of total revenue, in the first quarter of fiscal 2024.

The company's financial outlook for Q2 is expected to be stable but challenging, with growth rates of 13% to 14% year-over-year. For the full year, the company expects total revenue of $2.530 billion to $2.540 billion, with non-GAAP operating income of $490 million to $500 million, a non-GAAP operating margin of 19% to 20%, and a non-GAAP free cash flow margin of approximately 22%.

Technical Outlook

Okta shares is down 6.78% as of the time of writing trading with a weak Relative Strength Index (RSI) of 30.61 which is currently oversold. Due to the "Golden Cross Pattern" on the 11th of January, NASDAQ:OKTA shares surge to local monthly highs. The daily price chart depicts a long "Bearish Harami" candle stick pattern.

Okta Surges on Stellar Earnings: Riding the Cloud Identity WaveOkta Inc. ( NASDAQ:OKTA ) catapulted 28% in after-hours trading following its impressive quarterly performance, surpassing analyst estimates and raising its full-year sales forecast. The cloud identity software company's robust growth, fueled by a surge in larger enterprise customers, underscores its pivotal role in modernizing identity infrastructure and simplifying organizational processes.

For the fiscal fourth quarter, Okta ( NASDAQ:OKTA ) reported a remarkable 19% revenue increase year-over-year, soaring to $605 million, outpacing analysts' expectations by a substantial margin. Adjusted earnings of 63 cents per share further solidified its position as a market leader, surpassing the consensus of 51 cents per share. Notably, Okta( NASDAQ:OKTA ) added 120 customers in the quarter with a minimum annual contract value of $100,000, reflecting strong demand and expanding market reach.

"We’re pleased with the strong top-line performance, driven by strength with large customers. Organizations continue to turn to Okta to help modernize and simplify their identity infrastructure," stated the company in its earnings report, highlighting the growing reliance on its solutions among enterprises seeking enhanced security and efficiency.

Looking ahead, Okta ( NASDAQ:OKTA ) provided an upbeat outlook, projecting current-quarter revenue between $603 million and $605 million, surpassing analyst estimates and indicating sustained momentum in its business operations. Additionally, the company raised its full-year revenue forecast to a range of $2.495 billion to $2.505 billion, demonstrating confidence in its ability to capitalize on market opportunities and drive sustained growth.

The impressive earnings report also signifies Okta's resilience in the face of challenges, notably a significant security breach last year. Despite this setback, the company's financial performance remains robust, indicating its ability to navigate adversity and emerge stronger.

Analyzing Okta's ( NASDAQ:OKTA ) share price on the weekly chart reveals a notable breakout amid earnings-driven momentum. However, potential overhead resistance zones at $108 and $145 merit close monitoring, representing key areas where the stock may encounter selling pressure based on historical price action.

As Okta ( NASDAQ:OKTA ) shares surged to $107.61 in after-hours trading, investors are buoyed by the company's stellar performance and optimistic outlook. With its strategic positioning in the rapidly evolving cloud identity market and a strong foundation of enterprise customers, Okta is poised to sustain its growth trajectory and redefine the future of identity management in the digital era.

♨ Nvidia stocks are heading Up to recover, after September meltNvidia stocks moved higher in early Monday trading after analysts at Goldman Sachs NYSE:GS added the chipmaker, along with three other stocks, to its flagship list of stock recommendations.

Goldman Sachs analysts added Nvidia to the bank's "Americas Conviction List", a step up from the 'buy' rating it assigned to the stock in late August, while holding its price target in place at $605 per share.

"Look for Nvidia to maintain its statues as the accelerated computing industry standard for the foreseeable futures given its competitive moat and the urgency with which customers are developing and deploying increasingly complex AI models," Goldman argued.

The bank also added cybersecurity group Okta NASDAQ:OKTA , industrial supply group Cintas NASDAQ:CTAS and biotech Quanterix NASDAQ:QTRX to the "conviction buy" list while removing Salesforce NYSE:CRM and Johnson Controls NYSE:JCI .

Nvidia, the world's biggest AI chipmaker, forecast current quarter revenues of around $16 billion in August when it published stronger-than-expected second quarter earnings and later unveiled an make it easier for clients to run AI applications on Google Cloud NASDAQ:GOOGL using Nvidia-made chips with deeper integration between hardware and software offerings.

"We’re at an inflection point where accelerated computing and generative AI have come together to speed innovation at an unprecedented pace," said CEO Jensen Huang of the Google agreement. "Our expanded collaboration with Google Cloud will help developers accelerate their work with infrastructure, software and services that supercharge energy efficiency and reduce costs."

Nvidia shares were marked 3% higher in early Monday trading to change hands at $ 448 /share. The stock is up more than 200% for this year, and reached an all-time high of $487.84 on Aug 29, 2023.

Technical picture says, Nvidia NASDAQ:NVDA stocks are still on its positive path, and trading above 6- and 12-months simple moving averages.

Moreover the key breakout of technical indicator known as "a Triangle" is happening right here as stocks are recovering form the bearish hug.

OKTA - 2x Potential OKTA has been in a tight range for a long time.

Got rejected many times at 92 level.

If this breaks and holds above 92 level, go long.

Long above 92

Stop loss - 80

Target #1 120 (30%)

Target #2 184 (96%)

and after some pullback

Target #3 220 (135%)

Above 130, this doesn't have much resistance until 220.

OKTA Options Ahead of Earnings If you haven`t sold OKTA when Losses Exceeding Expectations:

Then analyzing the options chain and the chart patterns of OKTA prior to the earnings report this week,

I would consider purchasing the 72usd strike price Calls with

an expiration date of 2023-9-1,

for a premium of approximately $4.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

OKTA - Small Rise Before The FallOKTA - had a bad crash due to bad year-over-year earnings report despite crushing expectations.

Wave count suggests it was due, expanded flat setup, even with a good earnings report, very likely it would've rejected the 93.50 mark on the first attempt.

We're looking for a strong pullback followed by a lot more down-turn, towards the 1.272 expanded flat range of $60-$58 a share. VERY BULLISH AFTER THIS.

Okta to break higher?OKTA - 30d - We look to Buy a break of 88.08 (stop at 80.89)

The sequence for trading is higher highs and lows.

Daily signals are bullish.

A break of the recent high at 87.88 should result in a further move higher.

Our outlook is bullish.

This stock has seen good sales growth.

Our profit targets will be 105.48 and 108.48

Resistance: 82.50 / 86.50 / 87.90

Support: 79.50 / 76.00 / 74.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

OKTA looking for higher levels.OKTA - 30d expiry - We look to Buy a break of 88.08 (stop at 80.89)

The sequence for trading is higher highs and lows.

Daily signals are bullish.

A break of the recent high at 87.88 should result in a further move higher.

Our outlook is bullish.

This stock has seen good sales growth.

Our profit targets will be 105.48 and 108.48

Resistance: 78.00 / 82.50 / 86.50

Support: 73.30 / 70.00 / 65.50

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Resistance Analysis in Bottoming Stocks: IDXX, OKTAResistance Analysis in Bottoming Stocks: Looking Ahead to Q1 2023 Earnings

Stocks that are slowly crawling their way out of the correction of 2022 are now moving up to challenge the more difficult resistance levels from the intermediate-term downtrend. These resistance levels are sideways trends that developed during the downtrend of 2022 to the bottom low.

Most stocks that are showing improvement quarter over quarter have completed bottoms, such as IDXX.

Those that do not, such as OKTA, are often stocks that had anomalies in their revenue/earnings growth during the pandemic due to stimulus checks artificially inflating their sales to the point there was no possible way that the company could maintain such high revenues that were way off the normal growth levels annually.

IDXX has been trending up out of a bottom with sideways trends 2 times now. This is best seen on a weekly or 4 day chart. The stock has not reached the next strong resistance level yet but is probably going there during the next month as it reports in early May. If it continues sideways during the month of April, then the report is not likely to show a significant improvement over the financial data from last quarter.

The All-Time High will be Very Strong Resistance as it occurred at the peak of the pandemic's speculative gains.

The Moderate Resistance is one tier down from the top's all-time high. It can be more easily overcome as it is not a longer sideways trend and there was no sideways trend at that level on the way up to the top in the final months of 2021.

The Strong Resistance lowest red line is stronger because of the sideways trend from 2020 - 2021 and the sideways trend during the 2022 downtrend.

OKTA has an entirely different trend moving upward. The stock has not completed the bottom and first resistance level to complete the bottom is Very Strong Resistance. The next tier up is Moderate Resistance. The next Very Strong Resistance is the rounding top highs of 2021.

Okta posed to break higher?OKTA - 30d expiry - We look to Buy a break of 88.08 (stop at 80.89)

The sequence for trading is higher highs and lows.

Daily signals are bullish.

A break of the recent high at 87.88 should result in a further move higher.

Our outlook is bullish.

This stock has seen good sales growth.

Our profit targets will be 105.48 and 108.48

Resistance: 87.88 / 90.00 / 94.00

Support: 80.00 / 77.51 / 74.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.