OMG-BTC Trade SetupOMG seems to be reversing on daily chart.

There is a small resistance near the breakout.

SBS indicator signaled BUY on daily TF.

MACD and Stoch RSI is rising as well.

BUY at the breakout (R/S flip)

Targets and Sl are on the chart.

Watch out of BTC volatility

OMGBTC

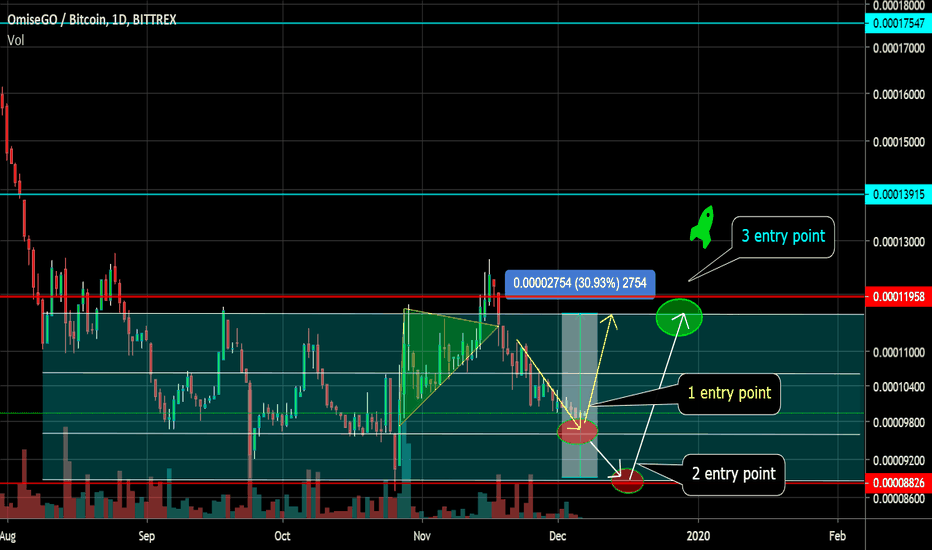

OMG / BTC Channel operation in 30% increments. Pivot points.After a false breakdown of the triangle, the price moved according to option 2 - trading in the channel.

OMG / BTC Operation in the horizontal accumulation channel in increments of 30%.

Pivot points breakthrough / retention of important support / resistance levels on which further movement I will depend on the chart.

I also showed various options for entering the market after confirming support for a certain local level.

The target are all on the chart depending on what price movement is confirmed.

A breakthrough of the channel and fixing the price above the resistance of the channel will open upside potential to higher targets than the potential of the channel.

Stop loss

Under key support levels during your entry into the market.

Do not forget to move Stop Loss during the price increase, but take into account the volatility of the coin.

OMG - Second Chance at Near Bottom PricesOMG has a very nice setup here. Looking at the daily chart, it is bouncing off its all-time low and testing overhead resistance. The MACD looks very bullish. It's curving support, showing a bullish cross, and is showing good bullish divergence. In fact, OMG is giving us a second chance to load up before its next move upward. This is a low marketcap alt so it can really fly if volume flows in.

OMG/BTC TA Update (Deep Pullback?)OMG/BTC

OMG made a higher high last Nov 16 but the price went below 50 Day MA and it's on a deep pullback.

If OMG can hold support between 950-1000 sats and bounce above 50 MA,

there is a high probability that a new higher low is now set and potential daily trend change.

Today`s ALT!!! OMGBTCBINANCE:OMGBTC

Exchange : Binance

Coin: OMGBTC

Buy Zone: 0.000113~0.000107

Target Point: 0.000118/ 0.0001255/ 0.00014/ 0.00015/ 0.000159/ 0.00017

S/L: 0.000106

Risk: HIGH

Term: Long

You should be careful in buying OMGBTC because of Bitcoin

It`s moving towards Down Trending Line(red line), making Symmetrical Triangle

Movement of The Chart and RSI are same

The Volume is slowly down

It needs more time to be pumping !!!

=====================================================================

Today`s ALT is that information is raised regardless of the Coin market situation

So sometimes there`s a high risk trading

Investment is your responsibility.

I'm just providing about coin`s information

=====================================================================

OMGBTC BUY OPPORTUNITYI have been following this coin for a couple of weeks now. The weekly chart shows it is very bullish, and the daily chart shows it has broken out from the triple bottom pattern as well.

Do you agree?

OMG Ascending Triangle. + 21% Channel + 30%. Entry points.OMG Ascending Triangle. Earnings with different price movements.

Rising triangles mostly work up. Perhaps this upward triangle will become a reversal pattern of a downtrend. A break of the triangle up and working it out to the widest part + 21% will mean a break of the channel. Just at a height of + 21% is the first resistance. If this happens and the price consolidates above the accumulation channel, a trend reversal may occur.

1 entry option.

We trade a triangle. Entrance on the breakthrough of the triangle or on the rollback after the breakthrough, depending on your strategy. The potential is from + 21% and the target is above the channel if the price can consolidate above the accumulation channel. And a trend reversal will occur.

2 entry option.

We trade channel potential. This is if a triangle is struck down. (Low probability). Entrance at the bottom of the horizontal channel, with confirmation of support. The potential to the upper boundary of the horizontal channel + 30%.

The pivot points of the price, on which this or that movement will depend, I showed on the chart.

____________________________________

Ascending triangle.

The ascending triangle is a figure of growth. This means that no matter what movements were in front of the figur, after the completion and confirmation of the figure, the price on the trading instrument goes up in 90% of cases. You need to understand that if one person (or group by conspiracy) controls a fully defined instrument (coin), then there is a high probability of fraudulent movements against logic and rules. But in 90% of cases it works up.

An ascending triangle is a bullish pattern and is formed on an uptrend as a figure of the continuation of the trend. It should be noted that in some fairly rare cases, the upward triangle may complete the downtrend (bearish) trend and act as a reversal pattern. However, regardless of whether it was formed on an uptrend or downtrend, its appearance is an indicator of accumulation, preceding the upward movement of prices. Very rarely there are exceptions.

Unlike neutral figures, an ascending triangle can be identified until the upper resistance line is broken.

In fact, the bulls encounter a strong level of resistance and make a number of attempts to break through it, forming approximately the same maximums on the chart. However, each subsequent correction will be less and less deep, which indicates a weakening bear pressure on the market and an upcoming continuation of the bull trend. Everything has its own reasons. You need to understand for what reasons and how one or the other figures are formed.

___________________________________________

Target

To determine the purpose of the price movement, it is necessary to measure the distance of the widest part of the figure and put it up at the breakpoint of the triangle. If we take the entire width as 100%, then we must leave the position at a distance of about 80% of the planned movement. It’s better to get out before everyone else. I always do that, especially when the position is big.

___________________________________________

Rules for all shapes of Triangles.

1) Price breaking is likely to occur in the direction of the previous trend.

2) An odd number of vibrations (waves) usually occurs inside a triangle. It is desirable that their number be at least five (three down and two up or vice versa). The more waves, the stronger the signal.

3) It is believed that if the last wave of the triangle did not touch the border and developed earlier, then this will lead to a sharp price movement when one of the parties breaks through.

4) It is not recommended to trade inside the triangle figure.

5) During the movement of the price inside the triangle, the volume indicators should decrease, and during the break through of one of the sides increase. If the price after a breakthrough of the border is trying to return, then for the model to be successful this return should occur on a declining volume.

6) If, after breaking through one of the sides of the triangle, the price “tries” to return, then this should happen with decreasing volume indicators (otherwise this serves as a “not good” signal).

7) To confirm the opening of a position, when a triangle is broken, it is advisable to wait until the closing price of the Japanese candlestick is outside the triangle and only then open the position.

8) It is desirable that the price breakout occurs at a distance from 1/5 to 3/4 of the horizontal length of the triangle. If this happened later, then the triangle loses its breakthrough momentum and further price movement may be uncertain.

9) If the angle of inclination of the triangle is more directed upwards, then most likely the price will go up and vice versa, if the angle of inclination of the triangle is more directed downwards, then most likely the price will also go down.

10) It is believed that the fastest way out of a triangle occurs when the last wave of the triangle does not touch its border, but unfolds earlier.

11) After breaking through one of the sides of the triangle, very often this side becomes the level of support / resistance (depending on where the price broke up or down).

12) After breaking through, the price will go towards breaking through at a distance equal to at least the height of the triangle in its largest part.

OMGBTC LONGIncredibly bullish at this time. Breaking out on multiple time frames.

God Speed,

Mr. Manbearpig

OMG - Bullish Breakout! Lots of Upside PotentialOMG had a strong breakout beyond resistance. The MACD also looks very bullish. This is a good entry point with lots of potential for positive gains.

OmiseGO / Bitcoin OMGBTC

Good buy opportunity as it have daily bullish MA cross.

Buy at 1100-1110

Sell

1202

1249

1300

1360

Stop loss at 1020 daily close.

OMG/BTC - TODAY (TIME TO BUY)Hello!

We see great opportunities to buy OMG.

XXX growth for altcoins coming soon ^_^

$OMG, Retesting just crossed resistance level at ~11k sats$OMG

Retesting just crossed resistance level at ~11k sats with increasing volume

Managing to bounce from here (R/S Flip) should lead to a new leg up with target at ~12.5k (~15%)

UCTS trendfinder green across multiple TFs

Tight SL just in case

#OMG

Managing my stop losses, take profits and trades over 3commas platform for Binance has been a great experience.

I have to do a few clicks and everything is managed automatically by the platform..

Thanks

Insider Trading?Looks like there was a massive volume spike out of nowhere and with no relavent shift in momentum when it occured. It was out of the blue which to me seemed a little strange at the time until I got an email this morning stating that OMG would be added to Kracken... Then I remembered.... Nothing happens by accident... May keep running but Im not going to chase it. Im going to trade with the DOM trend and short other ALTBTC pairs.

God Speed,

Mr. Manbearpig

$OMG, Showing great volume over the last 48hs$OMG

Showing great volume over the last 48hs, Currently crossing over ~11k sats // EMA50(green)

UCTS indicator Buy signals across the board

I'm waiting to see if it manages to flip this level into support for a potential new leg up with target at ~12.5k(13%)

Tight SL

#OMG

OMGUSD (1D): Buy.Could be an interesting possibility. OmiseGO (OMG) will soon be traded on Kraken. That could give another boost.

--

Let's see what happens.

Happy trading. :-)

--

OMG/BTC 2D Buy & Sell StrategyHeard OMG (OmiseGo) is getting listed on Kraken, a huge European Cryptocurrency Exchange.

You can trade it in 2D timeframe with the private script Cyatophilum H.A. Swing indicator, a buy signal is about to trigger!

OMISEGO Breakout BOOM! OMGBTC finally bottoms? time will tellI won't go into a whole dissertation or write an oped; given that I want to give folks a chance to make an entry without having to FOMO. Just know that this token has been compressed like a spring & for some time now analysts have been pointing to a bottom -- this may or may not be it: the fact remains, OMISEGO is vastly undersold right now and long due for an accumulation/consolidation.

RSI/BB/KC/Volume/50D MACD/SDMV all point to a healthy breakout on this pairing. Both short & long positions appear viable.

Believe it or not this is the beginning of the bullrun before whatever consolidation or retracement may follow; and while the window is closing...there is still time yet to make your entry.

Follow the green lines for fibo SHORT-MID

Red horizontal represents STOP-LOSS

DISCLAIMER

Not financial advise!

-@A1mtarabichi

The right time to determine the direction!Hi, Traders ! Monfex is at your service !

Please find below our Update on OmiseGO (OMG) - an Ethereum based decentralized banking and exchange token.

* OmiseGo is currently ranked 48th largest coin based on its market cap which is around $112 million.

* OmiseGo is one of the few outstanding projects with great potentials. As at the time of writing the coin is currently valued at $0.80 per unit.

* OMG has made its first attempt to recover and pull away from the bottom, reaching $0.95 on the 09Oct'19.

* Currently, the price is wedged between contracting trend-lines, while with the next attempt to break higher, OMG could reach $1.08 - $1.14 level.

* Considering that this crypto is mostly used for speculations, the new bullish momentum could catch up lots of eager traders to enjoy short-term profit occasion.

* MACD bullish divergence is intact and hasn't been discharged yet.

Active trade signal

Buy @$0.75 - $0.80.

Target: $1.08 - $1.14.

Stop-loss: $0.73.

Watch for our Updates to get real-time superior signals!

GOOD LUCK AND LOTS OF PROFITS !!

Disclaimer

This report is for information purposes only and should not be considered a solicitation to buy or sell any cryptocurrency or cryptocurrency product. Monfex accepts no responsibility for any consequences resulting from the use of this material. Any person acting on this trade idea does so entirely at their own risk.