ONGC

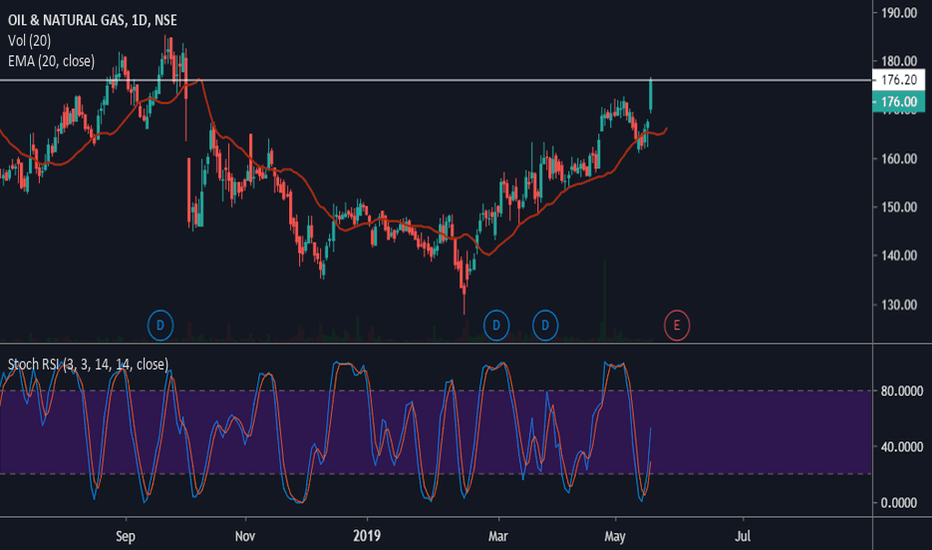

ONGC long termONGC has broken down below the long term wedge pattern. It should continue its downward movement below the wedge. In addition it also has a Head and Shoulders pattern which has already broken down. The volume has been climactic as well.

Bets off if it goes back inside the wedge and does a breakout above. It will turn very bullish in that case, but until that happens, I would stay away from the long side.

Disclaimer: Not a recommendation to buy or sell.

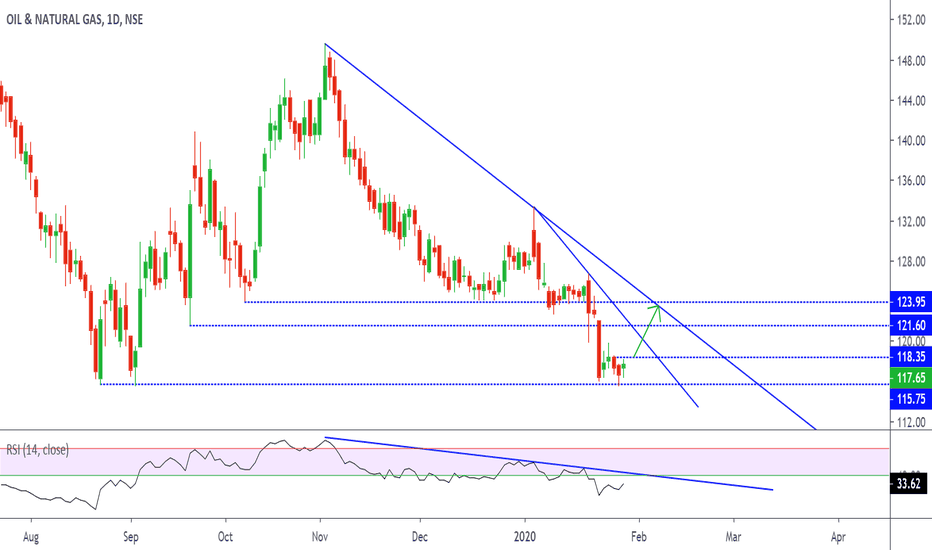

ONGC - Uptrend Start - Target 1 - 115$Swing Trade Opportunity here in an old INDIAN OIL Stock. On request charting for a friend.

I am a budding FOREX/ CRYPTO trader, with much of my experience coming from trading CRYPTO markets since 2016.

If you enjoy the idea and make gains, please leave a LIKE and hit Follow for more such posts.

Cheers

A possible Down before UpI have noticed an alternative pattern in ONGC. This could play out if the previous major patter was an ending diagonal. In the current pattern it is possible that ONGC has finished the B wave of the ABC and is now due for a C wave which should complete @ 150 kinda levels. A breakout to the lower side would confirm the continuation of the C wave and this seems to be highly probable, then followed by a possible up move. My view is that there is first a down move, then depending on the pattern that develops, there could be an up.

Ready for the Next move downONGC looks like its ready for its next move down, however, a correction on the 240 needs to happen that could confirm the same. This looks like its part of a bigger B wave, effectively making this one of the pieces to finish for the B wave completion. There could be a move down to retest the recent lows and then we might see one major up move.

NIFTY - Test Of 8200 / 8000 Inevitable - 11/4/2016Happy New Year to all. New year has arrived with new opportunities. It is always good to start a new year with profitable note. Our short NIFTY and other selected stocks positions ( via puts of courses ) is well in green and now it looks like the test of solid support levels near 8200 / 8000 is inevitable in coming sessions.

Many of the trades we have outlined here have performed the way sound technical analysis defines the chart geometry. Trading theme is, soggy IT sector, topped out auto and pharma sector, so-so oil sector and healthy but lack of momentum in FMCG sector. Here are some of the trades you can review based on such theme, ( Pls Check the Links )

Dr Reddy

Cipla

Glaxo

Lupin

Infosys

TCS

Wipro

ONGC

Dabur

Grasim

We have warned about sucker rallies in equities and have advised to be patient with a game plan. Armature investors ask wrong questions about what's going to happen and they tend to waste energy in trying to find when a particular security is going to reach 'where they believe it is heading towards'. Nobody can predict the exact timing and where the things are going to be. Only thing which matters is that what you are going to do when the stock reaches to the point you are interested in ! e.g. people ask, when XYZ stock will reach 100? Instead they should be thinking about what they will do when it reaches 100 or 50 or whatever level is defined as good support or resistance.

Let's enjoy the relaxed last weekend of Diwali holidays and get ready for the next week to trade Forex, Commodities and Equities. We are ready with a game plan for the new year, are you?!

Oil & Natural Gas Corporation ( ONGC ) - Time To Buy - 8/19/2016After a long slide from 450 to 200, finally it looks like ONGC ( Oil and Natural Gas Corporation of India ) wants to go higher or at least stabilize near this band. We are dabbling with long entries scattered near 220. There is still lot left in the tank if stock starts moving in the right direction.

Next significant hurdle comes in around 260 and after that 280 - 300. We are jobbing this 220/240 level but will take partial profit near 260 first and then reevaluate the situation. Meanwhile we are willing to keep the strong buy side bias until 220 is supported.

Other recent trades in long stocks are ICICI bank, Cipla Ltd. Dr Reddy's Laboratories Ltd still toying around our entry price of 3000 but with covered call selling during the bounce and doing some back and forth near that level it is looking good. Besides Pharmaceutical is the only sector where we buy more stock on every sizeable dip without any serious concerns and we have laid out reasons for that in our previous blogs. These stocks are for long term holding and the lower the price the better the bargain !