GBP/JPY Trap? Smart Money Might Be Setting Up the Next Drop📊 1. Technical Overview

Price broke the bullish structure decisively, closing below a key demand zone between 195.00–196.00, leaving a large unfilled imbalance.

Last week's recovery candle suggests a potential pullback toward 197.40–197.80, now acting as a resistance confluence.

The descending channel and weak RSI further support a continuation of the bearish trend.

Bearish targets: 193.50 and 192.20

📈 2. COT (Commitment of Traders) Report

GBP:

Non-commercials are cutting long positions (–5,961) and adding shorts (+6,637) → Bearish divergence developing on GBP.

JPY:

Non-commercials are heavily increasing short exposure (+15,113), but remain strongly net-long overall, indicating a potential exhaustion of bullish JPY positioning.

💭 3. Retail Sentiment

Positioning is neutral: 51% long / 49% short.

This balance suggests no excessive retail bias, leaving room for directional moves without immediate contrarian pressure.

📆 4. Seasonality

August is historically bearish for GBP/JPY:

• –2.82% (20Y average)

• –3.04% (15Y average)

• –1.44% (5Y average)

The data shows a consistent historical bias to the downside during this month.

🎯 5. Strategic Outlook

• Primary Bias: Bearish below 197.40–197.80

• Invalidation: Weekly close above 198.10

• Targets: 195.00 > 193.50 > 192.20

The confluence of technical rejection, bearish COT dynamics, neutral sentiment, and negative seasonality supports a corrective scenario for August.

Opec

NASDAQ at Key Turning Point 🔍Technical Context

After testing the 23,600–23,800 supply zone, price printed a strong bearish rejection with a weekly engulfing candle.

The RSI broke decisively below the midline, signaling a clear loss of momentum.

Price is now trading back within the weekly demand zone between 22,800 and 22,950.

If a pullback toward 23,200 occurs, it could offer a fresh short opportunity, with downside targets around 22,600.

🪙 COT Report – July 29

Non-Commercials (speculators):

Long: +8,581

Short: +4,355

Commercials (hedging):

Long: +4,955

Short: +8,556

The market remains net long, but commercials are increasingly hedging with shorts.

The current imbalance — 88.6% long vs 11.3% short — suggests excessive bullish positioning, raising the risk of a correction.

🗓️ Seasonality – August

August is historically strong for the NASDAQ:

+222 pts (10Y)

+400 pts (5Y)

+912 pts (2Y)

While the trend is clearly bullish seasonally, caution is warranted:

Tops are often formed during the first half of August, followed by more pronounced corrections in September.

📉 Operational Summary

Primary scenario:

Wait for a retest of the 23,200–23,250 area

Look for rejection signals → enter short

Target 1: 22,800

Target 2: 22,600

Alternatively:

If 22,800 breaks on a strong weekly close, deeper downside scenarios may unfold.

EUR/JPY Setup: Retail is 82% Short – Squeeze First, Drop After?🔹 Technical Context

Price reacted with a strong bullish wick in the 169.50–170.30 demand zone, signaling clear buyer defense. The RSI bounced from weakness but remains subdued, showing limited momentum.

📍 Current price action suggests a potential retest of the 172.50–173.30 area, which aligns with a supply zone, before a possible directional decision is made.

🗓️ Seasonality

Historically, August tends to be bearish for EUR/JPY:

5Y average: -0.48%

10Y average: -0.12%

15Y/20Y averages: -1.3% and -1.2%

📉 Seasonality indicates potential weakness, especially in the second half of the month.

🪙 COT Report (EURO & YEN) – July 22

EURO: Strong long accumulation by non-commercials (+6,284) and commercials (+17,575)

JPY: Net decline in both longs (-1,033) and shorts (-4,096), with a drop in total open interest

🧠 The market is heavily positioned on the Euro, while Yen positioning is fading. This creates a divergence between the two currencies, favoring a short-term technical bounce on EUR/JPY, though downside risks remain in the mid-term.

📉 Sentiment

82% of retail traders are short EUR/JPY

Volume: 1,564 lots short vs 352 lots long

📣 This extreme sentiment imbalance suggests a potential short-term squeeze against retail traders.

📊 Market Mood & DPO

Overall mood: Neutral

DPO at -9.0, Wyckoff score below 50

Momentum remains weak, but not showing a clear divergence.

🧩 Operational Summary

Retest of the 172.50–173.30 supply zone

Likely exhaustion in that area

Ideal setup: rejection + bearish confirmation

→ Targets: 170.30, then 169.00

SILVER Is About to Collapse? Watch This Critical Supply Zone!Price recently tapped a high near 39.20 before sharply rejecting from the 38.80–39.20 supply zone, confirming strong selling pressure. The current structure shows:

- Supply zone tested and rejected

- Likely return to the previous demand zone (36.50–36.00)

- RSI is turning down, confirming loss of momentum

A pullback toward 38.30–38.50, followed by a bearish continuation toward the 36.50 area, which acts as a key structural and institutional support.

🗓️ Seasonality

Historically, July is bullish for silver:

Last 5Y average: +0.89%

Last 2Y average: +2.18%

However, August–September are bearish months:

August: mildly positive, but weak

September: consistently negative across all time frames (-0.86% to -1.10%)

This increases the probability of a downward move starting in early August, in line with current price action rejection.

🪙 Commitment of Traders (COT) – July 22

Non-Commercials (speculators):

Longs: +656

Shorts: -516

Commercials (hedging):

Longs: +1,337

Shorts: +916

➡️ Commercials are increasing both long and short exposure, while non-commercials remain net long — a sign of moderate optimism.

However, long positioning is slowing down compared to previous weeks. A potential exhaustion in bullish momentum is forming.

📉 Sentiment

52% short vs 48% long

Volume: more lots on the short side (492 vs 454)

Sentiment remains neutral to slightly contrarian bullish, but not extreme. This may allow for a fake breakout before a deeper move down.

🧩 Operational Summary

Main bias: Bearish short to mid-term (starting August), supported by:

- Technical rejection at supply

- Negative seasonal tendencies ahead

- RSI showing momentum loss

- COT showing stabilization, not accumulation

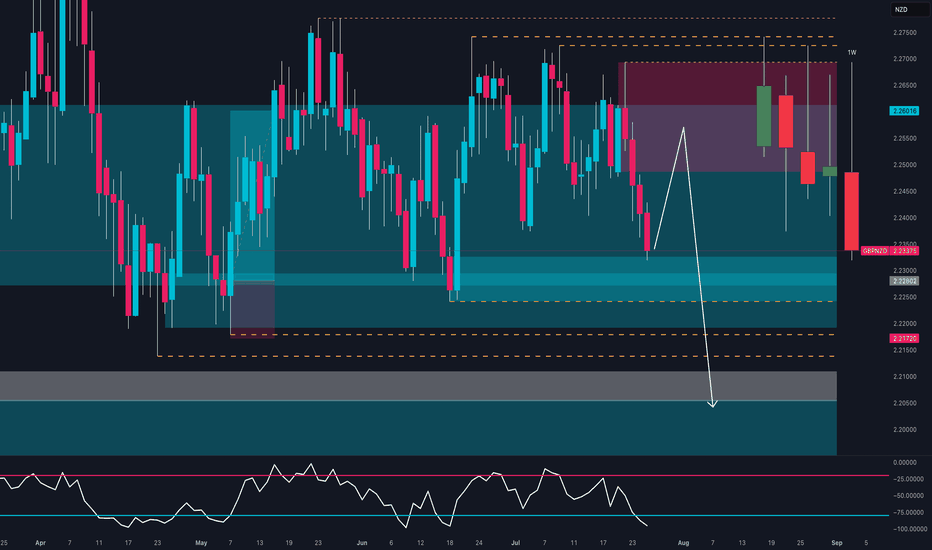

GBPNZD Breakdown – Smart Money Turns Fully Bearish🧠 Macro + COT + Sentiment Context

Commitment of Traders (COT) – Asset Managers

Institutional asset managers are significantly net short on GBPNZD, with positioning at its lowest level of the year and declining sharply since May. This reflects a clear bearish stance from smart money and reinforces the current downward pressure.

Sentiment & Momentum Indicators

DPO: -54.9 → Indicates a moderately bearish momentum phase.

Wyckoff: -20.3 → Price is in a distribution phase, suggesting weakness.

Speed: 3.2 → Low acceleration, but directional bias remains bearish.

Market Mood: Neutral, but leaning into oversold territory.

Seasonality (July 1st – Sept 30th)

Historically, GBPNZD performs positively in this period:

3Y: +1.7%, 5Y: +1.6%, 10Y: +2.3%, 15Y: +2.8%

However, in 2025, price is diverging sharply from seasonal norms. The pair is trading against historical patterns, suggesting a seasonal anomaly where institutional flow is dominating historical behavior.

🧱 Technical Outlook (Daily Chart)

GBPNZD had been consolidating in a clear range between 2.2170 support and 2.2750 resistance since May. The pair has now broken down with a strong, full-bodied weekly candle, closing below the 2.2320 demand zone.

Key Technical Zones:

Supply zone (2.2494–2.2659) → A clear rejection zone that initiated the current selloff.

Demand zone (2.2170–2.2300) → Has been tested twice already, increasing the probability of a clean breakdown.

RSI (Daily) → Currently neutral, with a sequence of lower highs and no bullish divergence in sight — indicating weak momentum.

✅ Conclusion & Trade Plan

Directional Bias: Bearish (Short)

Although seasonality typically supports bullish price action for GBPNZD in Q3, the current context is decisively bearish. Institutional positioning, price structure, and sentiment all confirm a potential shift in direction, reinforced by a confirmed weekly breakdown.

Bearish Targets:

📍 First: 2.2170 (recent support test)

📍 Second: 2.2000–2.1900 (April swing low)

📍 Extension: 2.1750 (base of previous accumulation zone)

Invalidation Criteria:

A weekly close above 2.2490 (supply zone breached)

Bullish RSI divergence + weekly recovery candle

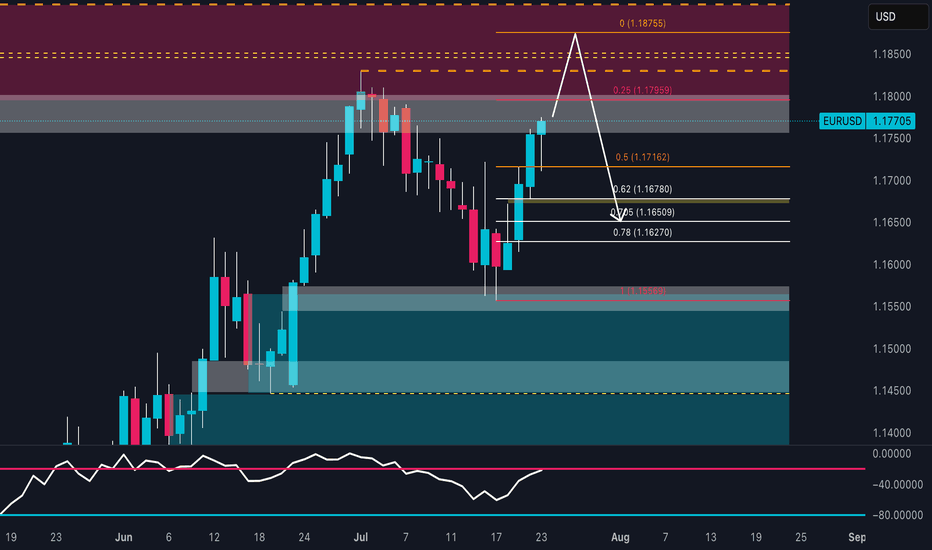

EUR/USD About to Trap the Bears? Final Push Before the Drop! EUR/USD is showing a solid short-term bullish structure, with a move initiated from the demand base around 1.1560, fueling a strong rally toward the current level near 1.1770. Price is now approaching a significant supply zone between 1.1790 and 1.1875, previously responsible for the last major bearish swing. This area also aligns with projected Fibonacci levels (25%-100%), reinforcing its relevance as a possible inflection point.

This movement suggests there’s still room for price to push higher, likely completing the final leg of this bullish cycle before a more convincing short setup develops. At this stage, Fibonacci levels are not acting as firm supports, but rather as hypothetical pullback projections: once price enters the 1.1800–1.1875 area, it will be key to monitor for signs of exhaustion. A rejection here may initiate a bearish retracement toward 1.1670–1.1650, in line with the 62–70.5% fib levels.

Retail sentiment remains highly contrarian: 76% of traders are short, positioning themselves too early against the trend. This imbalance adds fuel for a potential continuation higher, as the market may seek to "squeeze" these premature shorts. Additionally, the COT report confirms growing institutional interest in the euro, with non-commercials increasing their net longs, while USD net long exposure continues to shrink.

Seasonality adds further confluence: late July is historically bullish for EUR/USD, suggesting one final leg up could materialize before a typically weaker August.

✅ Trading Outlook

EUR/USD is technically aligned for a final push toward the 1.1800–1.1875 premium zone, where a potential short opportunity may arise. The rally is currently driven by overextended retail shorts and supportive institutional flows. Only after price interacts with the upper supply zone should reversal signs be evaluated, with correction targets around 1.1670–1.1650. The ideal play: wait for confirmation of bearish intent in August, when seasonal weakness typically kicks in.

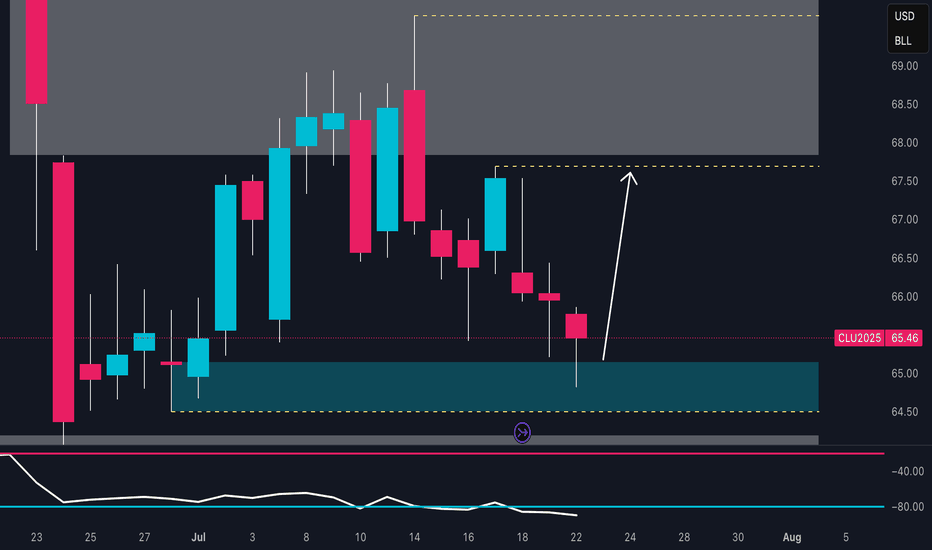

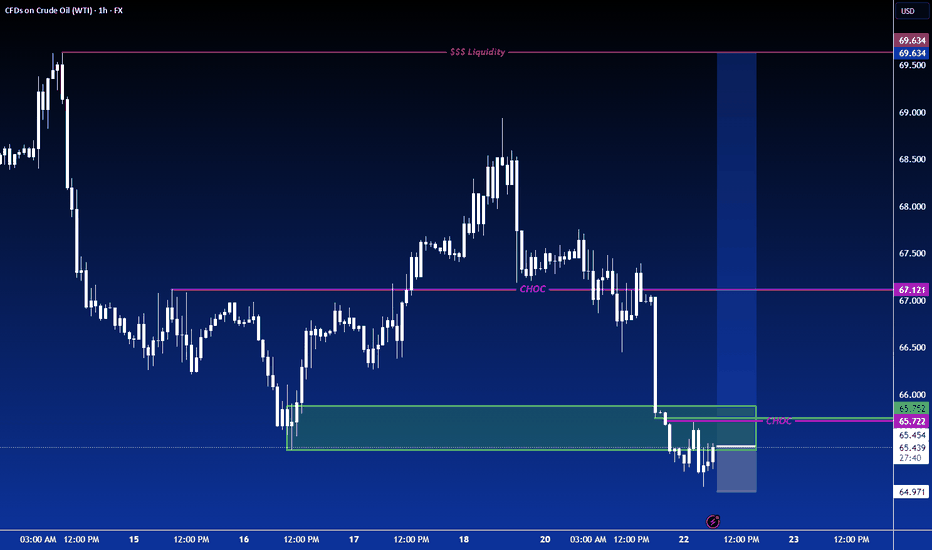

Crude Oil Rebound Incoming? Key Demand Zone 📈 1. Technical Analysis – Daily Chart (CL1!)

The price has returned to a demand zone between 64.60 and 65.30, an area that previously triggered strong bullish reactions.

The July 22nd candle shows a clear lower wick, indicating potential buyer absorption and a possible short-term reversal.

The next key resistance lies between 67.80 and 68.80, which aligns with a well-defined supply zone.

Daily RSI remains weak but shows signs of bullish divergence, suggesting potential accumulation.

Bias: bullish from current levels, targeting 67.50 – 68.00. Invalidation on a daily close below 64.40.

2. Institutional Sentiment – COT Report (CFTC, July 15, 2025)

Non-Commercials (Speculators)

Long: 308,915 (↓ -24,223)

Short: 146,488 (↑ +22,724)

Net Position: sharply declining → bearish divergence in speculative sentiment

Commercials (Hedgers)

Long: 857,803 (↑ +66,342)

Short: 1,046,199 (↑ +18,118)

Net Position: still negative, but improving → reduced hedging = less downside pressure

📉 Interpretation:

Funds are closing longs and adding shorts, showing bearish positioning. However, commercials are slowly reducing their hedging exposure, which could indicate short-term stabilization if the technical support holds.

3. Seasonality

Periods analyzed: 20, 15, 10, 5, and 2 years

July historically shows negative average returns:

-0.71% (20Y)

-1.26% (15Y)

-1.37% (10Y)

The seasonal pattern indicates continued cyclical weakness into August.

📌 Interpretation:

The summer period typically brings seasonal bearish pressure, which aligns with current 2025 performance.

🌐 4. Macro & Fundamentals

EIA inventory builds for 3 consecutive weeks → demand weakness in the U.S.

No additional OPEC+ cuts announced → supply remains ample

Stable inflation data in the U.S. and China → no uptick in energy demand

Overall macro data is neutral with a slightly bearish short-term bias

LONG ON USOIL OIL has just completed a sweep of sell side liquidity, leaving behind lots of BUY side liquidity.

DXY is falling on top of economic news stating trump will possibly fire Jerome Powell.

All this with OPEC increase oil production.

I expect oil to make a $5-$10 move throughout the rest of the week.

That's 500-1000 pips!

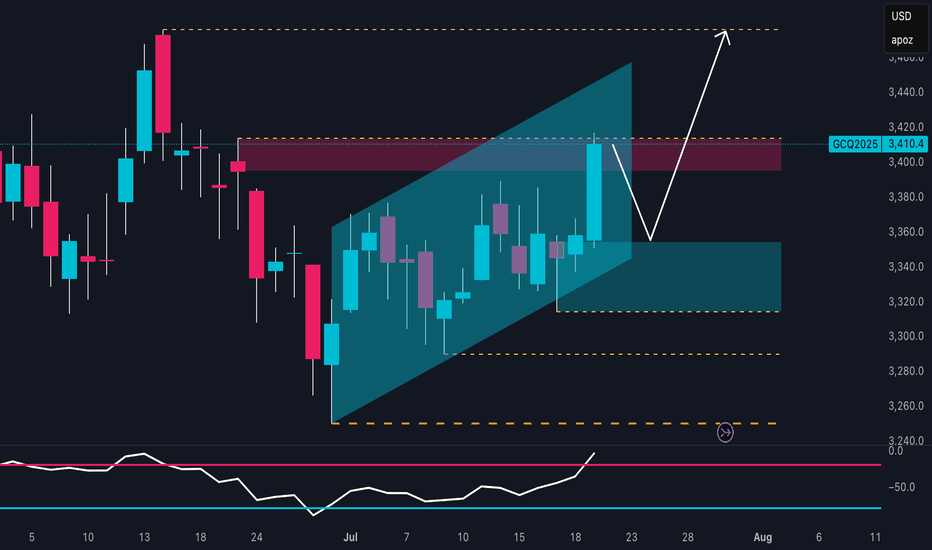

Gold Bulls Reloading? Smart Money Buys!The technical outlook on XAU/USD shows a well-defined bullish trend, developing within an ascending channel that started in late June. Price recently pushed toward the upper boundary of this channel, reaching a key resistance zone between 3,410 and 3,420 USD, which aligns with a previous supply area and significant daily structure. The reaction in this zone suggests a potential fake breakout, hinting at a short-term pullback before a continuation of the upward move.

The RSI oscillator supports this view, displaying bullish momentum with a breakout above the 60 level. However, the current slope hints at a possible minor correction before the next impulsive leg higher. The most relevant demand zone lies between 3,340 and 3,360 USD, at the base of the ascending channel—an ideal spot for buy orders to accumulate in anticipation of a move toward previous highs.

Backing this technical setup, the Commitment of Traders (COT) report as of July 15, 2025, paints a constructive picture. Non-commercial traders (institutional speculators) increased their long positions by over 8,500 contracts, while also cutting short positions by about 1,600 contracts, indicating a strong bullish bias. Commercials also increased their shorts (+16,448), a typical hedge during rallies, but not enough to invalidate the bullish structure.

From a seasonal perspective, July remains one of the historically strongest months for gold. According to MarketBulls data, over the past 2 years, gold has averaged gains of 105+ points in July, with solid returns also visible on the 5-year (+45 pts) and 10-year (+25 pts) averages. August also tends to be supportive, reinforcing the idea of a medium-term bullish extension.

Lastly, the retail sentiment is heavily skewed, with 72% of retail traders short, and only 28% long. From a contrarian standpoint, this is another strong bullish signal. When the majority of retail traders are short in a structurally bullish market, the potential for a short squeeze remains high.

EURJPY Hits Major Weekly Supply | Is the Bull Run Over?EUR/JPY – Institutional Macro Context (COT)

EUR (Euro)

Non-commercials net longs increased by +16,146 → strong buying.

Commercials added +25,799 long positions.

✅ Bias: Moderately bullish.

JPY (Japanese Yen)

Non-commercials decreased longs by -4,432.

Commercials cut -20,405 long contracts.

❌ Bias: Bearish pressure remains on JPY.

Conclusion (COT): EUR remains fundamentally strong, JPY structurally weak. Institutional flows favor long EUR/JPY, but positioning is stretched.

Seasonality (July)

EURJPY shows strong bullish seasonality in July, especially over the 2Y and 5Y averages (+1.03% and +0.66% respectively).

✅ Seasonality bias: Bullish.

Retail Sentiment

89% of traders are short on EUR/JPY.

Contrarian bias = bullish confirmation.

Technical Analysis (Weekly View)

Price is pushing into a major weekly supply zone around 172.50–173.00.

RSI still elevated but showing signs of weakening momentum.

Potential double top structure forming in confluence with liquidity grab.

First downside target sits around 169.50 (daily demand zone).

Awaiting a reaction in supply and confirmation for short.

Trading Plan (Top-Down)

Wait for price to reject the 172.50–173.00 area

Watch for bearish confirmation on Daily (engulfing or lower high)

Target: 169.50 zone

Risk: tight above 173.20 (invalidating supply zone)

Soybeans Loading a Bounce? Demand Zone + COT1. Price Action & Technical Structure

Price has bounced off a strong daily demand zone (1011–969).

Today’s daily candle shows a clear rejection wick from the low, and RSI is signaling a potential reversal.

The market is trading inside a falling channel, currently near the lower boundary — setting up a possible breakout move.

Technical Targets:

• First upside target: 1039–1049

Invalidation: daily close below 990, which would confirm structural breakdown.

2. COT Report – Soybeans Futures (as of July 9, 2025)

• Non-Commercials:

+11,539 spreads | +7,017 shorts | –7,520 longs → Slight bearish pressure, though spreads suggest growing speculative complexity.

• Commercials:

+7,876 longs | –9,084 shorts → Moderate commercial bullish bias.

• Open Interest:

+8,076 contracts → Market activity increasing.

Overall COT positioning is neutral to slightly bullish, with growing signs of accumulation around the 1000 level.

3. Seasonality – MarketBulls

Historically, July is one of the weakest months for Soybeans:

• –44.82 (20Y avg)

• –36.86 (15Y avg)

• –34.74 (10Y avg)

However, early August shows signs of seasonal recovery, and price action is already diverging from typical seasonal behavior.

This makes a deeper breakdown less likely — we could be nearing the end of the seasonal weakness.

Operational Takeaway

Current Bias: Neutral-to-Bullish

Confluence of signals supports the idea of a technical rebound:

✅ Bullish reaction candle in demand

✅ Fibonacci support + lower trendline touch

✅ COT data stabilizing with rising open interest

✅ Seasonal weakness possibly exhausted

EURJPY Hits Supply | Pullback Is ComingPrice has entered the daily supply zone (red area) between 170.80 and 171.80, showing immediate rejection with a long upper wick — a signal of potential short-term bearish reaction.

The RSI is turning lower, indicating loss of momentum, although it hasn’t reached extreme levels yet.

The current map suggests a technical pullback toward the 169.40–168.50 zone (FVG + dynamic support) before any potential bullish continuation toward 174+.

The overall structure remains bullish, but a correction looks likely due to technical exhaustion and retail positioning.

📊 2. COT Report (JPY Futures – as of 2025-07-01)

Non-Commercials (speculators) reduced long positions on the JPY by -7,779 contracts, and also slightly trimmed shorts → clear sign of position reduction.

Net positioning remains strongly negative (JPY weakness), but it's starting to recover slightly.

Commercials added both longs (+2,830) and shorts (+5,977), indicating indecision but growing interest.

Open interest slightly decreased (–516), though it remains elevated.

👉 The market has not yet reversed, but the JPY downtrend may be approaching exhaustion.

🧠 3. Retail Sentiment

86% of retail traders are short EUR/JPY — a strong contrarian bullish signal.

Average retail short entry: 166.27, while current price is 171.55 → retail traders are trapped and under pressure.

A short squeeze is likely underway or already completed, increasing the risk of a technical correction after distribution.

📅 4. Seasonality

July is historically weak for EUR/JPY:

20Y: -0.35

15Y: -0.49

10Y: -0.18

August tends to be even worse from a seasonal perspective.

This supports the idea of a potential pullback in the coming days or weeks.

Trading Conclusion

Current Bias: Short-term Neutral–Bearish, Medium-term Bullish.

✳️ Potential pullback from 172.30 toward 169.40–168.50

🎯 If price holds and builds clean bullish structure, expect continuation toward 174.00–175.00

❌ Invalidation on daily close below 167.80

EUR/USD Reversal Ahead? COT + DXY Strength Signal Price has broken below the ascending channel that started in mid-May.

The current candle is rejecting the weekly supply zone (1.17566–1.18319), leaving a significant upper wick.

Daily RSI is losing strength but has not yet reached extreme levels.

A key daily Fair Value Gap (FVG) lies between 1.1600 and 1.1480, with the first potential downside target at 1.14802, which aligns with support and the FVG zone.

A deeper bearish continuation could push price towards 1.1350, but only if the FVG lows are clearly broken.

📊 COT Data (CME - Euro FX & USD Index)

Euro FX

Net long: +15,334

Commercials increased both longs (+13,550) and shorts (+9,913) → mild divergence.

Non-Commercials (speculators) increased shorts (+4,786) more than longs (+1,188) → speculative bias tilting bearish.

USD Index

Strong net long accumulation across all trader types: +4,597 net.

Non-Commercials added +3,590 longs, with only a minor increase in shorts.

→ USD strength continues, reinforcing potential weakness in EUR/USD.

🧠 Retail Sentiment

67% of retail traders are short EUR/USD → typically a contrarian bullish signal.

However, the price is already showing distribution, not accumulation, so we may see price push lower first to trap remaining retail longs, invalidating the contrarian signal in the short term.

📅 Seasonality

July is historically bullish, especially on the 2Y (+0.0142) and 10Y (+0.0106) averages.

However, the 15Y and 20Y averages show a much more moderate performance (+0.007 / +0.0025).

Based on current price action, the seasonal rally may have already played out with the run-up to 1.1830. A correction now seems likely, even if the broader macro remains supportive mid-term.

🧩 Conclusion

Despite historically bullish seasonality for July, both price action and COT data indicate distribution with early signs of reversal.

Retail sentiment is too skewed short for a major breakdown just yet, but the technicals support a short-term pullback toward more balanced levels.

USD strength from COT and DXY structure reinforces a corrective short bias for now.

Tariff and oil volatility converge on July 9 Tuesday, July 9 marks a key deadline for two major market-moving events.

Tuesday is the official deadline for U.S.–EU trade negotiations. While a full deal is off the table, the EU hopes to secure a last-minute "agreement in principle" to avoid a threatened 50% U.S. tariff on some European exports.

President Trump’s history of moving deadlines adds uncertainty. Traders might like to watch for sharp intraday moves in EUR/USD and European equities tied to tariff risk.

OPEC’s International Seminar also kicks off on the 9th in Vienna. Energy ministers and CEOs from BP, Shell, and others will speak on oil supply, investment, and long-term strategy.

Crude has been volatile in July, and any signs of supply shifts or policy changes could drive WTI and Brent in either direction.

EUR/USD – Smart Money Trap at 1.18? Massive Rejection Ahead 1. Technical Context

The pair has been moving inside a well-defined bullish channel since May, forming higher highs and higher lows. Price is currently hovering around 1.1718, approaching the upper boundary of the channel and a key weekly supply zone (1.1750–1.1850).

➡️ Potential scenario:

A short bullish extension toward 1.1780–1.1820 to trigger stop hunts, followed by a bearish rejection toward 1.1500, and potentially 1.1380.

The daily RSI is overbought (>70), suggesting a likely short-term correction.

2. Retail Sentiment

80% of retail traders are short, with an average entry around 1.1318.

This signals a liquidity cluster above current highs, increasing the likelihood of a fake bullish breakout followed by a sell-off.

➡️ Contrarian insight: Retail heavily short → market may push higher first to wipe them out before reversing lower.

3. COT Report – USD Index (DXY)

Non-commercials (speculators) increased their short exposure on USD (+3,134).

Commercials cut their short positions (-1,994), indicating a potential bottoming on the dollar.

➡️ Conclusion: USD strength could return soon → bearish pressure for EUR/USD.

4. COT Report – EUR FX

Non-commercials increased longs on EUR (+2,980) and sharply reduced shorts (-6,602) → market is now heavily net long.

Commercials remain net short (581,664 vs 417,363 longs).

➡️ Over-leveraged spec longs → vulnerable to downside squeeze if macro sentiment shifts.

5. Seasonality

June tends to be mildly bullish for EUR/USD.

July historically shows even stronger upward performance over the last 5–10 years.

➡️ Shorts are high risk in the very short term, but a bearish setup is likely in the second half of July, especially if price action confirms.

6. Trading Outlook

📍 Short-Term Bias: Neutral to bullish toward 1.1780–1.1820

📍 Mid-Term Bias: Bearish on rejection from supply area and break of channel

🎯 Key Levels:

1.1780–1.1850: critical decision zone (liquidity + weekly supply)

1.1500: first key support

1.1380: next downside target (demand zone + previous POC)

📌 Final Conclusion

The most likely play is a short setup from 1.1780–1.1850 on strong rejection, supported by:

Extreme retail positioning (80% short),

COT pointing to USD recovery,

Extended technical structure,

Overbought RSI on the daily chart.

GBP/CHF Headed to 1.10 – But Bulls Might Regret It📉 1. Price Action & Technical Structure (D1)

Key demand zone tested with bullish reaction:

Price reacted strongly around the 1.0790–1.0840 structural demand area, previously the origin of a significant bullish impulse. The latest daily candle closed above the previous swing low, suggesting a potential technical rebound.

Immediate target:

The 1.0980–1.1010 zone, aligning with:

A clear supply area

RSI bouncing from oversold territory

A visible imbalance left unfilled

Technical bias: Short-term LONG to fill the imbalance before a potential institutional-driven short setup at supply.

2. Retail Sentiment

86% of traders are LONG, with an average entry of 1.0997

Only 14% are SHORT, with lower volume and better pricing

Current price: 1.0833, meaning most long traders are in drawdown

Contrarian view:

The heavy long positioning creates a liquidity pool between 1.0990–1.1010, making that zone highly attractive for institutional distribution and liquidation of retail longs, especially if accompanied by a structural shift.

🎯 Operational impact:

Supports a technical long to 1.10, but high risk of reversal once that level is reached.

3. COT Report

GBP (British Pound – CME)

Non-commercials:

Long: -6,434 → massive unwind of bullish exposure

Short: +2,028 → rising bearish bets

Net positioning is increasingly bearish

Commercials:

Long: +7,459 → increasing coverage against GBP weakness

Short: -569 → slight reduction

Positioning is mixed, but commercials are taking defensive long positions

GBP interpretation:

Bearish pressure rising from institutional speculators, despite some commercial support.

CHF (Swiss Franc – CME)

Non-commercials:

Long: +327

Short: +1,215

Net positioning still heavily short, but shorts increasing again

Commercials:

Long: +1,909

Short: +307

Commercials are accumulating long CHF positions (bullish sign)

CHF interpretation:

Divergence between commercials (bullish CHF) and speculators (still short) → shift may be underway.

4. July Seasonality

GBP:

Historically strong in July, especially the last 2 years (+3.5%)

Positive tendency across 10y/15y/20y averages

CHF:

Also seasonally positive in July, but underperforms GBP across most timeframes (except 2Y where CHF is also strong)

Operational impact:

Favors short-term bullish GBP/CHF bias, supported by seasonal momentum.

✅ Final Outlook

Current short-term bias is bullish, driven by:

Clear technical rebound

Visible imbalance toward 1.10

Seasonal divergence in favor of GBP

However, excessive retail long positioning + COT speculative pressure on GBP suggest this rally could be a distribution phase, offering an optimal short opportunity at 1.10.

Soybeans Crashing Into Demand — Reversal Coming or Trap?1. COT REPORT — Updated June 17, 2025

📌 Non-Commercials (Speculators)

Long: +5,661 → 195,984

Short: -9,226 → 110,761

✅ Net Long Increase: A clear bullish shift in speculative positioning (+14,887 net contracts). This is an early indication of a sentiment reversal.

📌 Commercials (Hedgers / Producers)

Long: +6,023

Short: -5,806

➡️ The decrease in net shorts suggests improving confidence among institutional players.

📌 Total Open Interest: 846,169 (down by 12,776)

❗ This slight drop may be linked to position rotation or partial profit-taking.

2. NET POSITIONS CHART INSIGHT

Commercial traders remain structurally net short, but their exposure has been gradually declining since March.

Non-commercial traders have increased their net long positions since April, aligned with the price's technical recovery.

The current price is trading near the historical mean, indicating neutral conditions with potential room for further upside.

🕰️ 3. SEASONALITY OUTLOOK

The June–July period has historically been bearish:

June Average Performance:

Last 5 years: -39.61

Last 2 years: -38.71

July Average Performance:

Last 20 years: -44.82

Last 2 years: -34.73

📉 August and September typically continue this seasonal downtrend.

🟨 Caution is advised on initiating long positions during this phase.

📊 4. TECHNICAL OUTLOOK —

Current Structure:

Rising channel has broken to the downside with a strong bearish impulse candle.

RSI is neutral but previously showed bearish divergence.

Key Support Zones:

1035–1025: Intermediate support area already tested.

1012–994: Golden Pocket aligned with a demand block — likely target zone with high potential for reaction.

Possible Scenarios:

🔴 Bearish Continuation: A retracement followed by a move down into the 994–1000 range, where a tactical long setup may emerge.

🔵 Bull Trap and Reversal: A rapid recovery above 1050, potentially triggering a continuation to 1080 (range top).

5. EXECUTION SUMMARY

Primary Bias: Bearish in the short term

🎯 Target Zone: 994–1000

🛑 Invalidation Level: Weekly close above 1055

Tactical Long Setup: Monitor price action at 994–1000 for bullish reaction.

Macro context and speculative positioning suggest a structural bottom may develop in Q3 2025, but current conditions are not yet favorable for a full swing position.

CADCHF at the Cliff's Edge – Is a Breakdown Imminent? 🧭 Technical Context

Price is currently sitting at the key support area of 0.5890–0.5900, tested multiple times since April.

This week’s candlestick shows a clear close below the intermediate micro-structure (two consecutive closes under recent lows), confirming bearish pressure.

The weekly RSI remains in a neutral-to-low zone, trending downwards with no active bullish divergence.

📉 Technical Conclusion: Active bearish bias. Watch out for potential false breaks below 0.5890 as liquidity traps.

📊 COT Report – as of June 17, 2025

🇨🇦 CAD

Non-Commercials: added +8.5k long contracts, aggressively cut −18.3k shorts

→ Excessive optimism, potential exhaustion on the buy-side

Commercials: added +31k shorts

→ Typical hedge behavior – signaling protection from CAD devaluation

🇨🇭CHF

Net positions in gradual decline with no sharp moves → CHF remains in consolidation, with a defensive tone

Open Interest dropped by −19.5k → Institutional money exiting positions

→ Interpretation: Market likely preparing for a directional breakout, CHF could act as a safe haven

📉 COT Conclusion: CAD appears overbought, CHF still gathering strength. Bearish bias on CADCHF remains intact.

📅 Seasonality – June Pattern

CHF tends to strengthen in June:

+0.0095 (10Y average), +0.0068 (5Y average)

CAD shows structural weakness in June:

−0.0027 (10Y), −0.0076 (5Y)

📉 Seasonality Conclusion: June favors CAD weakness and CHF strength → Bearish confirmation for CADCHF

🧠 Retail Sentiment

92% of retail traders are long CADCHF, only 8% are short

→ Extreme imbalance = classic contrarian signal

📉 Sentiment Conclusion: Confirms potential for continued downside on CADCHF

✅ Trade Plan Summary

📌 Base scenario:

Short CADCHF if we get a daily/weekly close below 0.5890

🎯 Target 1: 0.5820

🎯 Target 2: 0.5770

🚫 Invalidation: daily close above 0.5960 (invalidates current setup)

📌 Alternative scenario:

Short from 0.5960–0.6000 if we get a bearish rejection pattern → ideal for better R/R

AUDCHF at Make-or-Break Zone: Smart Money Reversal or Breakdown?1. Price Action

Price is currently trading within a descending channel, with 0.5244 hovering near a key demand zone (0.5150–0.5200), where a first bullish reaction has already occurred.

The structure suggests a potential fake breakdown, with room for a rebound toward static resistances at 0.5330, and possibly 0.5450.

RSI is rising from oversold, showing signs of a potential bullish divergence.

📌 Technical bias: Waiting for confirmation of a reversal at key support.

Upside targets: 0.5330 > 0.5450.

Ideal stop-loss below 0.5160.

2. Retail Sentiment

72% of retail traders are long, with an average entry at 0.5551, now facing a 300+ pip drawdown.

This increases short-term contrarian bearish pressure, but also signals liquidity above the highs, which could be targeted before a true bullish reversal.

3. Commitment of Traders (as of June 17, 2025)

AUD – Bearish

Massive drop in both commercial longs (-60k) and shorts (-60k) suggests broad disengagement.

Non-commercials remain net short (-69k), with overall open interest declining.

CHF – Neutral to Bullish

CHF also sees declines in positioning, but commercial traders remain firmly net long (+51.7k).

Non-commercials are net short (-25.5k).

📌 COT Conclusion: AUD remains structurally weaker than CHF, but both currencies are showing signs of positioning uncertainty. This compression phase may precede a technical rebound on AUDCHF.

4. Seasonality

AUD

June historically shows modest strength on 10Y and 5Y averages.

However, 2Y data points to weakness → any rally may be short-lived or fragile.

CHF

CHF tends to be strong in June, especially on 20Y and 10Y views.

Yet, short-term (2Y) data shows end-of-month weakness, suggesting possible profit-taking ahead.

✅ Operational Outlook

Short-term bias: Long AUDCHF (corrective rebound)

Medium/long-term bias: Bearish (still in a downtrend)

CADJPY Bearish Reversal? Smart Money + Seasonal Confluence🧠 COT Sentiment

Speculators are heavily net short on CAD (–93K), while maintaining a strong net long position on JPY (+144K).

→ This positioning clearly favors JPY strength over CAD weakness.

Commercials are hedging JPY downside, but the dominant flow remains JPY bullish.

📅 Seasonal Patterns

Historically, June is weak for CAD (5Y, 10Y, 15Y averages all negative).

Meanwhile, JPY tends to strengthen in the second half of June.

→ Seasonality supports a bearish outlook on the pair.

📉 Technical Structure

Price has reacted precisely to the Fibonacci 0.705 retracement (106.23) and is showing signs of RSI divergence.

We are trading within a key supply zone between 106.70 and 108.30, which also aligns with a major resistance cluster and harmonic extension.

First target sits at 103.88, with potential extension to 101.20 if breakdown confirms.

🛢 Macro Catalyst

Oil remains under pressure.

CAD retail sales dropped significantly.

Risk-off sentiment (cautious Fed + geopolitical tensions) favors JPY as a safe haven.

📊 Retail Sentiment

62% of retail traders are short, but with an average entry at 108.49.

→ A break below 106 could trigger liquidation, fueling further downside.

🧩 Trade Setup

🔹 Entry zone: 106.70–107.00

🔸 SL: Above 108.40 (invalidates the bearish thesis)

🎯 TP1: 103.88 (S/R retest)

🎯 TP2: 101.20 (extended target on risk aversion)

🧭 Synthesis

Every angle aligns toward a potential bearish reversal on CAD/JPY:

✅ COT positioning

✅ Seasonality

✅ Macro narrative

✅ Technical confluence

✅ Retail sentiment trap

Smart Money Just Flipped Bearish on USD/CAD. Are You Still Long?🧠 1. COT Context & Institutional Flows

🇨🇦 CAD COT Report (CME) – June 10, 2025

Non-Commercials (speculators): net short 93,143 contracts (19,651 long vs. 112,794 short), with a short reduction of -14,319 → early bearish unwinding.

Commercials: net long 91,207 contracts (223,285 long vs. 132,078 short), with strong accumulation (+27,999 longs).

🔄 Net open interest change: +18,436 → renewed institutional interest on the long CAD side.

🇺🇸 USD Index COT Report (ICE) – June 10, 2025

Non-Commercials: net long 1,402 contracts (17,027 long vs. 15,625 short), with a +1,279 increase in longs → modest USD support.

Commercials remain net short -35 contracts, no clear shift.

🔄 Total open interest +2,652 → mild bullish interest in USD.

📌 Implication: Strong institutional support for CAD, USD mildly supported. Net positioning favors downside pressure on USD/CAD.

💹 2. Technical Analysis & Price Action

Primary trend: clearly bearish from the 1.38 zone.

Current price: 1.3552, testing a macro demand zone (1.3470–1.3540).

Daily RSI remains deeply oversold → possible technical bounce, but no reversal structure confirmed.

Recent candles show lower highs and lower lows, with no bullish momentum.

📌 Implication: The bearish trend remains in control. A technical rebound is possible, but bias stays short as long as price trades below 1.3640.

📈 3. Retail Sentiment

77% of retail traders are long USD/CAD, with an average entry at 1.3646.

Only 23% are short, positioned better at 1.3790.

📌 Implication: Retail is heavily long → contrarian bearish signal confirmed.

📊 4. Seasonality

June is historically weak for USD/CAD:

5Y Avg: -0.0118

2Y Avg: -0.0081

The June seasonal curve shows a stronger downside acceleration into the second half of the month.

📌 Implication: Seasonality adds downward pressure into month-end.

Retail is 86% Long on GBPCHF… But Smart Money Is Setting a Trap📊 1. RETAIL SENTIMENT

Long Positions: 86% – Average Entry: 1.1196

Short Positions: 14% – Average Entry: 1.0999

Current Price: 1.1010

Analysis:

Retail positioning is heavily skewed towards longs, with the average long entry significantly above the current market price. This creates vulnerability to downside pressure through stop-loss hunting or a bearish squeeze. Such extreme retail bias often acts as a contrarian signal: smart money may continue pushing the price lower to flush out retail traders before any meaningful reversal occurs.

🧾 2. COMMITMENTS OF TRADERS – COT REPORT (June 10, 2025)

🔹 British Pound (GBP)

Non-Commercials (Speculators): Net Long increasing by +7.4K → now at +51.6K

Commercials (Hedgers): Net Short decreasing by -13.9K → now at -60.5K

Total Open Interest: Decreased by -19K

Interpretation:

Speculators are maintaining strong long exposure on GBP, while commercials are covering some shorts—potentially signaling a short-term pause in bullish momentum. However, the drop in overall open interest suggests possible consolidation or short-term uncertainty.

🔹 Swiss Franc (CHF)

Non-Commercials: Net Shorts reduced by -2.7K

Commercials: Net Longs increased by +2.5K

Total Open Interest: Increased by +5.6K

Interpretation:

The CHF is gaining strength. Commercial participants are increasing their long exposure while speculators reduce their shorts—this positive divergence supports a bullish outlook on CHF, especially against retail-heavy long pairs like GBP.

📈 3. CHF SEASONALITY – JUNE

Average CHF Performance in June:

20-Year Avg: +0.0099

15-Year Avg: +0.0138

10-Year Avg: +0.0099

5-Year Avg: +0.0039

Analysis:

Historically, June is a seasonally strong month for the Swiss Franc. This seasonal bias aligns with current macro conditions, reinforcing the bullish case for CHF.

📊 4. TECHNICAL ANALYSIS (Daily Chart)

Pattern: Descending channel with a recent false breakdown and re-entry

Key Support Zone: 1.0980–1.1000 → tested and defended with a bullish wick

Target Resistance: 1.1170–1.1200 → prior retail cluster, supply zone, and average long entry

Scenario: A confirmed breakout of the channel could trigger a short squeeze toward 1.1170–1.1200

📌 STRATEGIC OUTLOOK

The current GBP/CHF setup is technically and sentimentally delicate. The price sits on a major daily demand zone, while sentiment and macro flows suggest downside pressure remains in play—but also allow room for a potential contrarian rally (short squeeze).

👉 Action Plan:

Wait for intraday/daily confirmation:

Go long above 1.1045 (breakout confirmation) → target 1.1170

Go short below 1.0980 (bearish continuation) → target 1.0860

USD/CAD Trap in Progress? Smart Money Flips BearishUSD/CAD is currently in a rebalancing phase after the strong downside correction seen over recent weeks. Following a rejection in the 1.3900–1.4000 supply zone, price retraced down to a major demand area between 1.3500 and 1.3650, where it has shown a notable bullish reaction. The pair is now trading at 1.3734, and multi-frame data suggests we are in a transitional phase—not yet a confirmed bullish trend reversal.

COT Report – Institutional Positioning

The latest Commitments of Traders data (June 10th) reveals critical signals:

Commercials (hedgers and large institutions) have aggressively increased their long exposure on CAD, adding +27,999 contracts. This indicates strong expectations of Canadian dollar appreciation—bearish implications for USD/CAD in the medium term.

Non-Commercials (speculators) reduced their short CAD exposure by -14,319 contracts, signaling that speculative players are starting to unwind long USD/CAD positions.

Overall, the net shift shows institutional sentiment turning bearish on the pair, potentially pointing to a deeper downside once the current technical pullback completes.

USD Index COT – Dollar Momentum Weakening

On the USD Index, Non-Comms have added +1,279 long contracts, but positioning remains moderate. Commercials are flat, suggesting the dollar lacks strong bullish backing. This makes any sustained USD/CAD rally structurally fragile.

Retail Sentiment

Retail traders are 57% short and 43% long on USD/CAD. Although not extreme, this imbalance suggests confidence among retail participants in a bearish move—often preceding a short-term upward squeeze before an eventual trend continuation.

We could therefore see price move toward 1.3900 as a liquidity grab, setting the stage for a larger reversal.

Technical Analysis – Outlook

Key highlights:

A strong bullish reaction occurred from the 1.3500–1.3650 demand zone, previously well-respected.

The weekly RSI is still below the 50-level but is turning upward—momentum is improving.

Price structure shows room for a pullback to the 1.3900–1.4000 supply zone, which aligns with higher-timeframe order blocks.

This zone remains a critical resistance, and unless the macro and positioning context changes, a renewed bearish impulse is expected from this area.

Trading Outlook

The current picture presents a tactical short-term long opportunity, followed by a potential structural short setup.

📈 Scenario 1 – Bullish Pullback (in play):

With price above 1.3700 and consolidating, there’s space for a rally toward the 1.3900–1.4000 supply zone. Ideal for short-term targets.

📉 Scenario 2 – Structural Short (priority bias):

Should price reach 1.3950–1.4000 and show bearish confirmation (e.g., engulfing, doji, rejection on H4/H1), this would be a prime area to initiate swing shorts, targeting 1.3600 and eventually 1.3450.

✅ Final Bias: Structural Bearish – Corrective Bullish

Watch for potential false breakouts above 1.3800–1.3900 to liquidate retail shorts before a more meaningful downside move. The sharp increase in commercial net long CAD positions supports a bearish USD/CAD bias for the coming weeks.