EUR/USD: Daytrade-Opportunities!Hey tradomaniacs,

welcome to another free signal!

Important: This is a PULLBACK-Trade of current momentum BUT with the primary trend!

For now, Target 1 is more likely to be a nice sell-area!

-----------------------------

Type: Daytrade

Buy-Limit: 1,12950

Stop-Loss: 1,12719

Target 1: 1,13169

Target 2: 1,13488

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

Opportunities

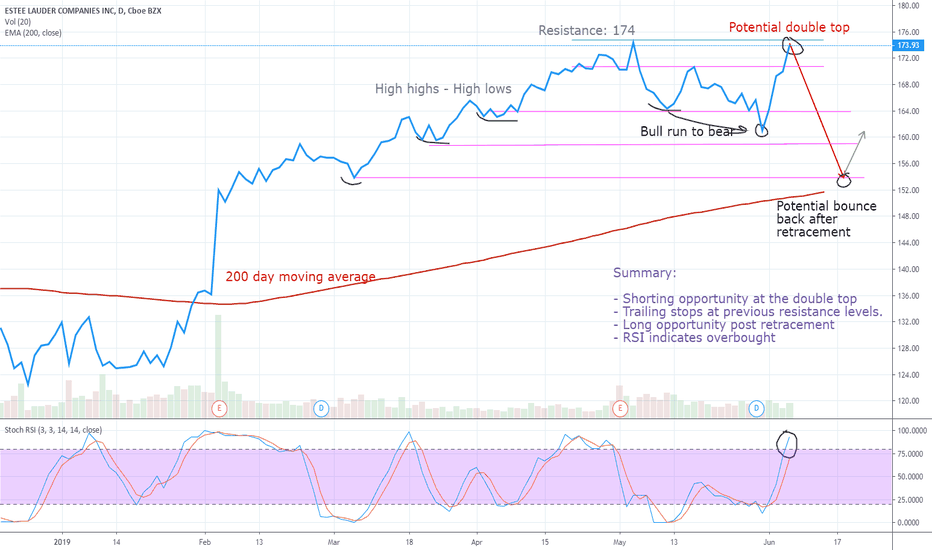

Estee Lauder Shorting OpportunityAfter a 5-month bull run, EL seems to have the symptoms of a tired bull.

The sequences of high high high lows have recently turned into low high low lows. Although news about strong Q3 books, robust travel retail, buyouts might have caused the bull some confidence and momentarily shows signs of strength and stamina. The bear is likely to overcome this with a strong swipe at the 174 mark in the coming months and bend the bull to the markets will.

See chart for details

CERN Revisit Chart AnalysisCERN is a stock that was analyzed in April and continues to outperform the market at this time. CERN has shifted to a consolidation, which should provide more upside opportunities.

EUR/CAD: Swing-Setups! Two PLANS and OPPORTUNITIES!Hey tradomaniacs,

welcome to another free signal!

Important: Wait for the market to break through the horizontal Resistance! Place a BUY after rejection!

If we don`t break through, make sure to read PLAN B!

-----------------------------

Type: Swingtrade

Plan A: After break through resistance!

Buy-Limit: 1.50983

Stop-Loss: 1.50658

Target 1: 1.51501

Target 2: 1.51739

-----------------------------------------------

Plan B: After rejection of Resistance!

Sell @1.50715

Stop-Loss: 1.151

Target 1: 1.50318

Target 2: 1.50

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

GOLD: Preparation for the week! Looks very BULLISH!OpportunityHey tradomaniacs,

welcome to the weekly outlook of GOLD.

Overall we still see a correction between two very important price-levels.

We can consider that the market does continue the rally unless the stock-market climbs aswell.

Sentiment:

What we`ve seen is a changing cash-flow out of Gold into the stockmarket even though the volume is very very low.

This almost flat-type-correction in form of a falling wedge which retraced almost 38,2% of the impulse is actually a joke compared the price-run of indicies such as SPX500.

But still... we see very low volume and probably a fake-rally.

Anything else I want to say is shown in the chart!

What do you think will happen?

Have a great start into the week! :-)

-----------------------------------------------------------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

HANG SENG: Weekly OUTLOOK!#OpportunityHey tradomaniacs,

welcome to my analysis for HANG SENG HSI.

Everything I want to say is shown in the chart.

Since this market is political-driven we should still wait for the outcome of the tradewar, especially for China and USA.

Every good news seems to be enough for the market to buy.. but still with a very low volume!

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

EUR/USD looks very BEARISH! S&R FLIP?Hey tradomaniacs,

welcome to another weekly outlook for EUR/USD.

Everything I wanna say is shown in the chart!

Have a nice start into the week!

----------------------------------------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

DAX: Weekly OUTLOOK! Rally SHOULD go on...?Hey tradomaniacs,

welcome to another weekly outlook for DAX!

Everything I wanna say is shown in the chart!

Have a nice start into the week!

-------------------------------------------------------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

BTCOIN and WHAT we NEED for a BULL-RUN!#OverviewHey cryptoheads,

welcome to antother analysis of Bitcoin.

In this chart we keep it very simple and look at the price-action, time-cycles and commin indicators.

All I want is to make sure that you guys don`t freak the hell out and buy the peaks.

Stay calm and rational in order to make good decisions.

In order to see a wealthy uptrend we need to see the folowing things:

1. S&R-Flips of Trendline and FAN.

2. A cross above the respected 50 M/A.

3. A strong bullish Time-Cycle

4. Higher Highs and Higher Lows

Everything else I wanna say is indicated in the chart.

Good Luck everyone. Let`s hope the King is Cryptomaniac has recovered. :-)

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

Simple BTC short tradeAre you a bull or a bear?

It doesn't matter much here to be honest.

It's not hard to see where is the resistance and support for BTC.

Are you a bull and you think BTC is going back to 20k and than 50k or maybe up to 250k? Maybe someday it will...

But even if BTC found the bottom and we are in uptrend it's just very unlikely for the price to sky rocket through 6k. So why not short it?

After it bounces from the resistance the only support at the moment lies down at ~4250 area. It's really not much else in between. No man's land. At least for now. I expect price will stay between in 4.2-6k area for quite some time as well.

It's hard to imagine that BTC will switch from bear to bull mode so smooth (even if some alts suggest so). So we should get some retests of lower level(s). Some ugly red bars to get rid of all of panic sellers.There will be plenty of them. Than you can go long. As a trade or even more as long term hold if you want.

Are you a bear?

Than it's even easier. Take some profit when price comes down to support and hold some if you think we will see new BTC bottom. Short again if it comes back to resistance at ~5850.

You must be wondering what if price slices through resistance.

Well guess what --> You are risking around 4% to gain 25%. This trade needs to work only one time out of 7. So if you think there is like 20%+ chance price will bounce of the resistance at around 5850 than this trade is printing money on the long run.

Even if you got stopped out more often than not.

This is why you have stop loss!

_______________________________________________________________________________________________________________________________________________________________________________________________________________________

If you've learned something new by reading this you can choose to support my work!

--> Sign up on Binance with my Refferral link: www.binance.com

--> Sign up on BitMEX and get 10% discount on all fees for 6 months after you sign up using this affiliate link: www.bitmex.com

The supporters will get all the help needed to learn using different trading platforms AND understand risk management in trading. So now your account can be long term safe.

Do you know why you should always use Stop Limit instead of Stop Market on BitMEX? If you don't you can wake up someday with an empty account.

You can also choose to just simply donate to any of my addresses:

BTC: 12qe5buhPQTAEnqmMYBNafymePd9BAgqJT

ETH: 0x134c60f13c48fe1ea48b10f980a2c68070f1bf82

LTC: LTuRNgXDU2ojj7DseX4GRhQcFyJzXo82mn

I always suggest trading on demo accounts at least until you have decent sample size of trades without losing money.

NASDAQ INC: WEEKLY OUTLOOK!Hey tradomaniacs,

welcome to the weekly outlook!

I think the charts says enough!

Will the Double-Top get triggered?

The current situation says "NO" to Double-TOP but it looks like the current cycle is going to be bearish down to the previous "Supply-Zone."

The market just bounced off the 50 and 100 MA and seems to continue the rally downwards to complete WAVE 2.

After that we should see another attempt upwards cklose the the marked up target-zone of TEAM BEAR!

Great chance should come very soon!

---------------------------------------------------------------------------------------------------------------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

What's going on with Brexit? The end of March is fast approaching so all eye should be on GBP just in case we get a big move. Here we discuss what happening in the UK Parliament this week and what the possible outcomes will be.

This is not investment advice

I'll up date this idea as it develops

Please remember to give this idea a thumbs up even if it just for effort

Steve Nixon

Trainer & Mentor

EURUSD: Interesting moves scattered aroundEURUSD has presented different opportunities and conflicting signals. 'Everybody' wants to know which way it is going. This is the wrong question.

In this screencast I show different opportunities relative to trends on different time frames. Where price is going, depends heavily on which time frame trend you're stalking - and whether you'r willing to take a controlled loss on that time frame (alias stop-loss). As I do not work with a 'predictions' model, I simply cannot predict where price is going or any targets.

My personal bias was for price on 1D time frame to move south. But now the evidence on the charts confront me. It is also probable that a lower time frame trend could eventually move the bigger time frames north. This is how big trend get reversed - it just makes sense.

The way I see it is that all traders exploit trends - by some methodology. The trick - which is not easy - is controlling loss, extracting the money and running like hell! :)

To be clear this post is not a recommendation to take any particular position.

Tesla buying opportunity I believe Tesla is nearing a new breakout. My belief is based on technical patterns, the current narrative, improving fundamentals, and potential inclusion into the indexes.

There's always something going on with this name. It wouldn't be Wall Street's darling otherwise. Options traders can make a living trading this stock alone. Volatility can be vomit inducing or put you to sleep, depending on the week. To my best understanding the current narrative on the stock is that the recent quarter was strong, but executive departures and Big Money reducing holdings have overshadowed the price action. Morgan Stanley emphasized how the currently expanding and already massive supercharger network will act as a moat against the aspiring competition; this note was likely released because most saw the Audi commercial during Super Bowl and so the word is out that other brands are now focusing on electric options. I see this as Tesla fulfilling their mission statement to accelerate the adoption of sustainable technology and a bullish event. In my opinion the 2020 Roadster looks better than the Audi concept art but by inspiring brand pride the electric vehicle segment looks ready to explode and Tesla is already positioned well. Another huge piece of the current narrative is the looming convertible debt. The price is much too low for the conversion and you can bet your hat short-sellers will do anything in their power to prevent the current cash balance from growing. This leads me into the recent developments in the last two quarters.

Before I explain the technical analysis above I would like to highlight some very important developments at a fundamental level. Since inception (barring two outlier quarters) Tesla has been a negative EPS company with a cash burn that accelerated faster than a Falcon Heavy. At times the outlook for the company looked bleak. However, with two quarters of positive and increasing cash flow and two quarters of positive EPS the future now looks much brighter. Particularly because these results seem to be organically driven rather than financially engineered. Demand for the Model 3 is explosive and isn't likely to wane anytime this year. More information regarding the model Y is going to be revealed next month and the Semi should be reaching consumers soon. Assuming the demand for these products stays how it has stayed for many years its safe to assume the step-wise compounding ramp Elon has explained is not just feasible but probable. This excludes developments on the solar front which have been largely hushed since the massive success in Australia. If Tesla maintains positive earnings into 2019 its large market cap will qualify it for nomination into the major indexes which will cascade a flood of inflows from index funds re-balancing to match the index compositions. I can't emphasize how bullish this scenario would be without putting a number on it: $500.

My technical analysis above supports the narrative and the fundamental developments and so we'll begin from the left and move toward the present. In 2013 Tesla made its first big run. It consolidated here into a massive bull flag (fraught with volatility and an environment that favored bearish opinion) until 2017 when the next leg up occurred. I highlight these moves with red lines of equal size that should be easily noticed. Another long term trend line I like to use is the compounding curve from inception anchored at critical points. My critical points here were the 2016 lows and the base of the subsequent leg up. We'll refer to this again in a moment.

The current chart environment looks almost identical to the previous leg-up and flag, with one key difference: volatility. Compared to the previous consolidation cycle this recent cycle has had its dips bought quickly and vigorously. Possibly due to the radically improving financial statements. I've used a mix of fib retracements to generate price ranges for the near term future and this is where I derived my price balloons. Notice that the price structure is forming what looks like a double-bottom inverse head and shoulders. Today's current price of $307.55 is sitting right on this fib 0.382 line. Support here suggests we move up toward the neon green area with my short term price target at $336.22. Reaching this price point by about mid 2019 would coincide with a rare alignment of tailwinds. First off, it would represent a full 2 year consolidation from the previous run up in 2017, similar to the duration of the consolidation cycle after 2013. Also, we'll have a couple more quarters of hopefully positive results from Tesla by then igniting the "index" narrative.

This name comes with absolute risk and shouldn't be purchased or sold without understanding that. At any moment a bearish thesis could stick and the price could quickly find itself touching $280 or even barrelling toward the $250's lows. As a long term investor I say buy those dips, but don't rush into buying a falling knife either. Wait for consolidation and materialized resistance to make your move. If the price ever gets below the lows of the initial consolidation dump everything or buy a ton of puts. Prudent but wise use of puts can and probably should be used at all times when overweight this ticker.

Many followers of the stock will know that Baird has had a $500 price target on Tesla for years now. Not ironically, the alignment at 4 full quarters of positive and hopefully growing earnings paired with my compounding curve and previous leg-ups would put the price just over $500. I'll stick with my $550 because the Tesla Network is going to revolutionize what it means to own a Tesla.

USD/JPY: Effects of COMEX OPEN on GOLD

I saw the COMEX OPEN on twitter twitter.com

Thank you for your support and for sharing your ideas.

Disclaimer:

Please note that I am not a professional trader and these are my personal ideas only. The information contained in this presentation is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. CozzamaraDaZena is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

GBP/USD: Swing-Setup! Range-Breakout with a great opportunity!Hey tradomaniacs,

welcome to another free signal!

Important: Wait for the retracement down to the trendline and wait for a trigger!

-----------------------------

Type: Swingtrade

Buy-Limit: 1,27110

Stop-Loss: 1,26155

Target 1: 1,284

Target 2: 1,29

Targt 3: 1,29508

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

EUR/USD: Swing-Setup#1! Important: READ the description!Hey tradomaniacs,

welcome to another signal by trading2ez.

Important: Don`t do anything before we`ve seen that the market bounces of the triangle again!

EUR/USD could easily go back into this pattern since the market is so volatile and uncertain!

---------------------------------------

Type: Swingtrade

Sell-Stop: 1,13146

Stop-Loss: 1,13622

Target 1: 1,270

Target 2: 1,21155

----------------------------------------

Attention:

We could see a "FED-RALLY" this week but is that likely?

The problem is the current interest yield curve of the UST 2s and 10s.

Banks are suffering from the inverted curve which causes that short-term-loans are

more profitable than long-term-credits thus it is "more risky" to lend money in the short-term due to

the current circumstances showing a cool down of the economy.

Usually investors begin to invest into safe havens in the long-term in order to protect their cash

from a crash of the markets. That means that long-term-investments or "credits" are less risky and

less profitable.

Why is that a problem? Because the banks buisness is to lend money in the short-term in order

to use that money for lending long-term-credits.

So if short-term-loans are more expensive than the long-term-credits are profitable, then why should a bank continue with

that business? They would have to pay more for the money they borrow than they earn with the loan originating.

This is btw. called the "term transformation".

So if the banks stop to lend we`ll see less liquidity, and less liquidity means less consume and less investments

and is a huge problem for ineffecient companys that "survived" by the previous cash injections.

Can the FED safe the Wallstreet this week?

The saisonality is great and a dovish statement could spread optimism!

-----------------------------------------------------------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

DAX UPDATE: Weekly overview! Best price to buy?Hey Tradomaniacs,

this is an update of my previous weekly anylsis and an addition to

CHECK IT OUT! =)

LEAVE A LIKE AND A COMMENT _ I appreciate every support! =)

-----------------------------------------------------

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

SPX: Weekly outlook! Best price to buy?Hey tradomaniacs,

welcome to another outlook of the S&P500!

Tuff times and volatile markets are giving Swingtraders hard times to trade the market.

On the other hand, we`ve seen much volatility and perfect preconditions for daytrading! :-)

The S&P500 as the "world index" should be on your watchlist to observe the market carefully!

Will we crash? Or can we stay above the panic-zone?

SPX500 is currently dancing between 2.600 and 2.800 since 03. October!

With two rallys after the the Sell-Off the market was trying to get above the 2.800 but coouldn`t make it.

Every rally has got totally invalidated by the market due to uncertainity driven by news over news.

The MAC-D is showing us a "Bullish divergence", creating higher lows, while SPX lows are going sideways!

Overall we have seen more bearish commitment, it seems the market wants to safe profits as fast as possible.

The political situation is cooling down and relationship between China and teh USA seems to be headed in the right direction.

If cruide oil climbs, we could see more optimism and at least another try to break through 2.800!

Cann we holf 61,8% retracement and 2.600? We will see! :-)

I wish you a great start into the new week!

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

-----------------------------------------------------------------------------------------------

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

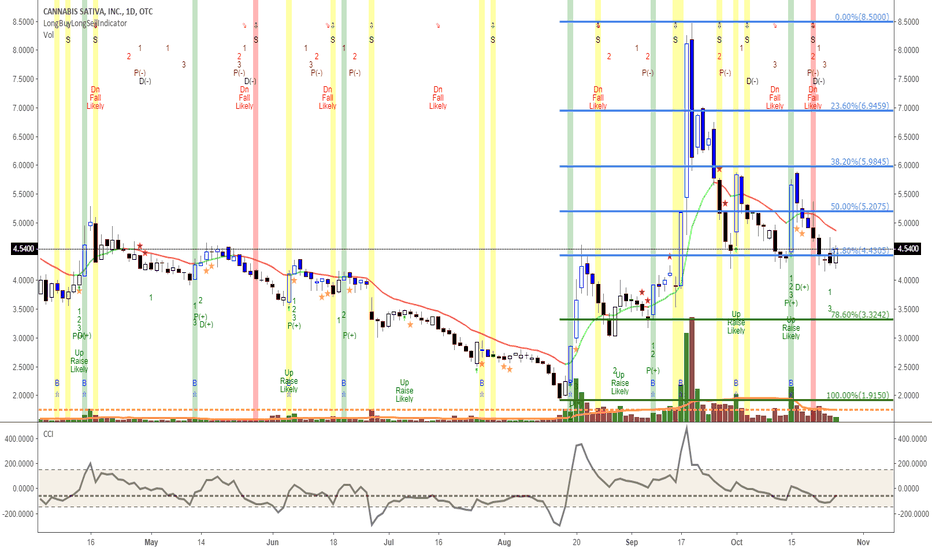

CBD Oil - pain relieving gainsCBDS CVSI GWPH INSY OTC:EMHTF

CBD oil as extracted from PCR HEMP has many pharmacological/nutraceutical benefits.

* Sleeping better

* Relieves stress / reducing anxiety

* Pain Relief & joint pain - and is non-psychotropic (PCR HEMP contains < 0.3% THC and often less in CBD Oils)

* Epilepsy and epileptic seizures

* IBS/Crohn's disease studies in process

* Helps immunity and found to reduce cancer

* Reduce risk of diabetes

* Reduces nausea and vomiting

* Alleviates skin irritations & itching (psoriasis)

All of these stocks offer various growth options in CBD Oil.

USD/TRY: Swing-Setups! BE ready for all scenarios! :-)Hey tradomaniacs,

welcome to another signal by trading2ez.

In this case we want to be ready for both scenarios. Whether it`s going down or up, we can make profit with it!

Bullish scenario:

After the Breakout of the trendline, we wanna make sure that we don`t buy a Fakeout.

Wait for the retest of 5.3! After that we should see bears coming into the market following the downtrend.

Right after we should see a retest of the previous high, which was @ 5,25!

A bounce off that area would show a new high and a higher low confirming the crossed MAC-D and RSI above 50!

This third wave has huge potential, our first target would be the top of the range @ 5.40 - 5.45!

After that we can head to 5.5!

Indicators:

MAC-D should get above the 0-Line crossed upwards!

RSI: Should bounce off 50% and go upwards!

-----------------------------------------------------------------------------------------------------------------------------------

Bearish scenario:

IF we see a Fakeout and bounce back into the trendchannel, we wait for the retest of the recent bottom @ 5.12917!

After that, we should see bulls coming into the market until we retest the trendchannel.

THIS is our chance to sell the market until we`ve reached the important mark of 5.0!

Indicators:

MAC-D should cross downwards below the 0-Line to confirm that trade!

RSI should get below 50%!

-----------------------------------------------------------------------

SETUPS

Short:

Sell-Limit: 5.14397

Stop-Loss: 5.23019

Target 1: 5.05

Target 2: 5.0

---------------------------------------------------------------------

Long:

Buy-Stop: 5.25

Stop-Loss: 5.14

Target-Zone 1: 5.36 - 5.4036

Target 2: 5.56

Leave a like and a comment - I appreciate every support! :-)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)