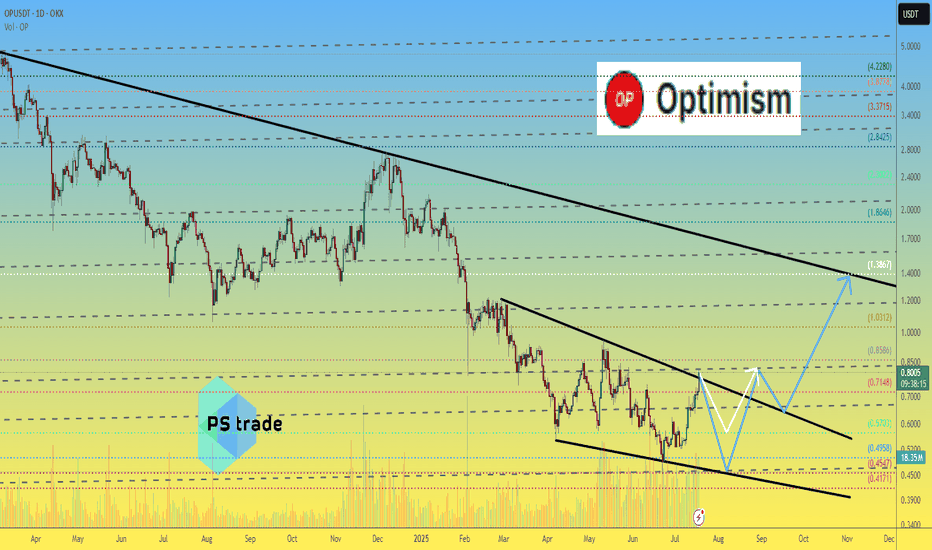

Optimism OP price analysisCurrently, the price of #OP does not look very optimistic (a little pun to start with )))

🟢 An optimistic forecast would be for the price of OKX:OPUSDT to rise to $1.40

🟡 But it looks like this growth will not happen now, but after a correction.

🔴 Correction: only to $0.57 or again to $0.45 — this is also an open question.

👌 Patience to holders and fans of the #Optimism project, the “microclimate” in the crypto market is improving — the time will come, and this coin will also be pumping...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Optimismprice

Optimism OP Became Optimistic AgainHello, Skyrexians!

We continue analyze altcoins with big potential for the bull market. Couple of days ago we have already observed another one layer 2, today it's time for BINANCE:OPUSDT . Price of this crypto formed very interesting formation which can confuse most of traders. We analyzed it using the combination of Elliott waves analysis with our algorithmic indicators. Hope it will give you enough knowledge to make your own decision.

On the price chart you can see the weekly time frame. We can consider all movements as the large accumulation zone because Optimism appeared in the most severe stage of past bear market. Its first growth is more likely to be the wave 1. After that we can see almost the same formation as for Arbitrum. This is the irregular correction in the wave 2, which consists of ABC waves.

Wave C is likely to be finished. It touched the 0.61 Fibonacci retracement zone and Bullish/Bearish Reversal Bar Indicator printed the green dot. This is very high probability long setup. You can see earlier on the chart that this indicator flashed the red dot and after that we have see the huge bearish wave. We need to pay attention to its signals.

The next potential move is the global wave 3. It can happen very fast and the target for it is defined by the Fibonacci extension. This is the zone between $7.71 and $11.68. Lower band of the zone is almost 10x from the current price.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

OP:b-b-e📊Analysis by AhmadArz:

🔍Entry: 2.487

🛑Stop Loss: 2.145

🎯Take Profit: 2.88 - .3.299 - 3.586

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!

OP → Optimism 200% Bull Run! About to Reverse? Let's Answer.Optimism had a 200% bull run from November 9th to December 27th. With three legs up, and multiple failed attempts to break $4.20, are we due for a reversal to the downside?

How do we trade this? 🤔

Short answer, no. We don't have enough data to enter a short because we're lacking confirmation. Three pushes in a trend is an indicator that we need to start looking for signs of a trend change, the failed attempts to break $4.20 is another great reversal example, the RSI falling around 61.00 and below the moving average is the cherry on top. However, we're still above the 30EMA going sideways and there are no laws saying we can't have a 4th leg up.

We likely need to go sideways for a while and retest $4.20. It's almost important to watch Bitcoin as a market indicator and see how it responds to the recent sell-off from the measured move top. Bitcoin could make a run to $50,000 which surely could take Optimism with it for a 4th leg. If Bitcoin falls and starts its pullback, we should have a shot to short scalp OP.

For now, wait on the sidelines for the price action to deliver the required behavior. Until then, you'll be much wealthier waiting on the sidelines!

💡 Trade Idea 💡

Short Entry: $3.60

🟥 Stop Loss: $4.34

✅ Take Profit: $2.50

⚖️ Risk/Reward Ratio: 1:1.5

🔑 Key Takeaways 🔑

1. Three Pushes up in a Bull Channel.

2. Potential Double Top at Resistance Zone

3. Gap to 30EMA and Support Zone

4. Enter 1:1.5 Short Scalp with Confirmation

5. RSI at 61.00 and below Moving Average. Bias to Short.

💰 Trading Tip 💰

The RSI on its own is a weak datapoint to make a trade decision. But when used as a supplement to key price action analysis, can be a fantastic orientation check on the state of the market.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and comment if you found this analysis useful!

OP: Channel DownTrade setup : Benefiting from the launch of Worldcoin (WLD) , which is based on Optimism protocol . Trends are mixed but improving as the price bounced from $0.90 and broke back above a couple of key levels ($1.20, $1.50). Overall, it’s trading in a Channel Down pattern and we’re waiting for a breakout, ideally above 200-day Moving Average (~$1.95) that would confirm a trend reversal to Uptrend, with potential upside to $2.80 thereafter.

Pattern : Price is trading in a Channel Down pattern. With emerging patterns, traders who believe the price is likely to remain within its channel can initiate trades when the price fluctuates within its channel trendlines. With complete patterns (i.e. a breakout) – initiate a trade when the price breaks through the channel’s trendlines, either on the upper or lower side. When this happens, the price can move rapidly in the direction of that breakout.

Trend : Uptrend on Short- and Medium-Term basis and Downtrend on Long-Term basis.

Momentum is Bullish (MACD Line is above MACD Signal Line and RSI is above 55).

Support and Resistance : Nearest Support Zone is $1.20, then $0.90. The nearest Resistance Zone is $1.50, which it broke, then $1.80, and $2.80

Optimism OP price responds well to the work of the teamToday, let's take a look at the OPUSDT price chart

Given that the previous idea worked out well with a 30% increase, we can try to "guess" again)

By the way, in the previous idea, we described the main upgrade features implemented by the Optimism team.

Today, the next Optimism (OP) network upgrade will take place, the main task of which will be to reduce the average transaction inclusion delay from 2-4 seconds to 0-2 seconds.

Also, today we announced a "fresh indicator" U.S. CPI (YoY): 3.0% (forecast 3.1%, previous value 4.0%)

So all the fundamental conditions for growth are in place, now it's up to the market)

Let's assume that the next target for the OPUSDT price will be a breakout of $1.50 and continued growth to $1.75

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more