PTON Peloton Interactive Options Ahead of EarningsIf you haven`t bought the dip on PTON:

Now analyzing the options chain and the chart patterns of PTON Peloton Interactive prior to the earnings report this week,

I would consider purchasing the 7.50usd strike price Calls with

an expiration date of 2025-8-8,

for a premium of approximately $0.46.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Optionstrader

NIFTY50 Closing Price: ₹24,722.75 (4th Aug 2025, 02:00PM UTC+4)Comprehensive Technical Analysis for NIFTY50

world wide web shunya trade

Closing Price: ₹24,722.75 (4th Aug 2025, 02:00PM UTC+4)

Time Frames:

Intraday: 5M, 15M, 30M, 1H, 4H

Swing: 4H, Daily, Weekly, Monthly

1. Japanese Candlestick Analysis

Intraday (5M-4H)

4H: Bearish Engulfing at 24,722.75 signals rejection of highs.

1H: Dark Cloud Cover below 24,750 confirms weakness.

30M/15M: Shooting Stars at 24,720 indicate exhaustion.

5M: Three Black Crows pattern suggests strong bearish momentum.

Outlook: Bearish reversal likely if 24,700 breaks.

Swing (4H-Monthly)

Daily: Gravestone Doji at 24,722.75 warns of trend exhaustion.

Weekly: Bearish Harami after 3-week rally signals distribution.

Monthly: Long-legged Doji at all-time highs (24,800) indicates indecision.

2. Harmonic Patterns

Intraday

4H/1H: Bearish Butterfly completing at 24,722.75 (D-point).

PRZ: 24,700–24,750 (127.2% XA + 161.8% BC).

30M: Bullish Crab forming at 24,600 (secondary setup).

Swing

Daily: Bearish Gartley near 24,750 (78.6% XA retracement).

Weekly: Potential Bullish Bat at 24,500 if correction extends.

3. Elliott Wave Theory

Intraday

4H: Wave 5 of impulse cycle peaked at 24,722.75.

Structure: Completed 5-wave sequence from 24,200 → 24,722.75.

Corrective Phase: ABC pullback targeting 24,500 (Wave A).

1H: Sub-wave (v) ending with RSI divergence.

Swing

Daily: Wave 3 of primary bull cycle nearing completion at 24,750.

Weekly: Wave (iii) of larger impulse, expecting Wave (iv) correction to 24,300.

Monthly: Wave V of multi-year bull run, nearing major resistance at 24,800.

4. Wyckoff Theory

Intraday

Phase: Distribution (after markup from 24,200 → 24,722.75).

Signs: High volume at 24,722.75 (supply), failed upthrust above 24,750.

Schematic: Phase C (markdown) initiating.

Swing

Daily: Late Markup → Distribution at 24,750.

Weekly: Accumulation completed at 23,500; now in Markup but showing signs of exhaustion.

5. W.D. Gann Theory

Time Theory

Intraday: Key reversal windows:

UTC+4: 10:00–12:00 (resistance test), 14:00–16:00 (trend reversal).

Swing:

Daily: 8th Aug (4 days from close) for time squaring.

Weekly: 12th Aug (1 week) for cycle turn.

Square of 9

24,722.75 → Resistance Angles:

0° (24,750), 90° (24,850), 180° (25,000).

Support: 45° (24,500), 315° (24,250).

Angle Theory

4H Chart: 1x1 Gann Angle (45°) from 24,200 low at 24,500. Price overextended.

Daily Chart: 2x1 Angle (63.75°) at 24,722.75 acting as resistance.

Squaring of Price & Time

Price Range: 24,200 → 24,722.75 (522.75 points).

Time Squaring: 522.75 hours from 24,200 low → 24,750 resistance.

Ranges in Harmony

Primary Range: 24,000–25,000 (1,000 points).

50% Retracement: 24,500 (critical support).

61.8% Retracement: 24,380.

Secondary Range: 24,500–24,750 (250 points).

Price & Time Forecasting

Intraday Targets:

Short-Term: 24,500 (61.8% Fib).

Extension: 24,380 (Gann 45° angle).

Swing Targets:

Weekly: 24,300 (Wave (iv) target).

Monthly: 23,800 (38.2% retracement of entire bull run).

6. Ichimoku Kinko Hyo

Intraday (4H)

Cloud (Kumo): Price below Kumo (bearish).

Tenkan-sen: 24,700 (flat, resistance).

Kijun-sen: 24,650 (support).

Chikou Span: Below price (confirms bearish momentum).

Swing (Daily)

Cloud: Thick cloud resistance at 24,750–24,800.

Tenkan/Kijun: Bearish crossover at 24,700.

7. Indicators

Intraday

RSI (14): 68 (4H) → Overbought; divergence at highs.

Bollinger Bands: Price tagging upper band (24,750); contraction signals volatility.

VWAP: 24,680 (acting as dynamic resistance).

Moving Averages:

50 SMA: 24,600 (support).

200 EMA: 24,400 (major support).

Swing

Daily RSI: 72 (overbought, divergence).

Weekly BB: Upper band at 24,800 (resistance).

Monthly VWAP: 23,500 (major support).

200 WMA: 22,800 (long-term bull support).

Synthesized Forecast

Intraday (Next 24H)

Bearish Scenario (High Probability):

Trigger: Break below 24,700 (1H close).

Targets: 24,500 (T1), 24,380 (T2).

Timeline: 8–12 hours (UTC+4 22:00–02:00).

Bullish Scenario (Low Probability):

Trigger: Sustained close above 24,750.

Target: 24,850 (Gann 90° angle).

Swing (1–4 Weeks)

Bearish Scenario:

Targets: 24,300 (Wave (iv)), 23,800 (38.2% retracement).

Timeline: 5–10 trading days.

Bullish Scenario:

Trigger: Close above 24,800.

Target: 25,200 (Gann 180° angle).

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.(world wide web shunya trade)

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya.Trade

world wide web shunya trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

MA Mastercard Incorporated Options Ahead of EarningsIf you haven`t bought MA before the rally:

Now analyzing the options chain and the chart patterns of MA Mastercard Incorporated prior to the earnings report this week,

I would consider purchasing the 545usd strike price Puts with

an expiration date of 2025-8-8,

for a premium of approximately $4.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

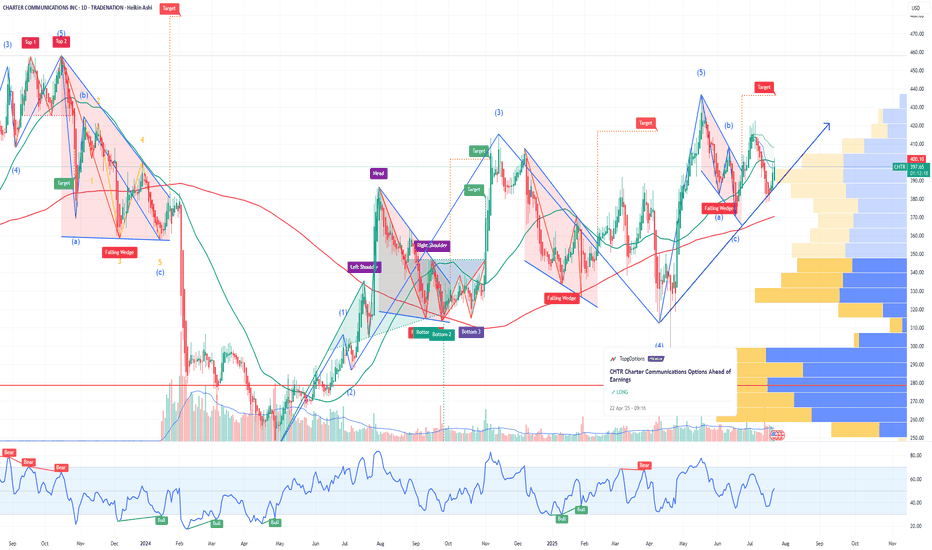

CHTR Charter Communications Options Ahead of EarningsIf you haven`t bought CHTR before the previous earnings:

Now analyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week,

I would consider purchasing the 387.5usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $22.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Jade Lizard on PLTR - My 53DTE Summer Theta PlayMany of you — and yes, I see you in my DMs 😄 — are trading PLTR, whether using LEAPS, wheeling, or covered calls.

I took a closer look. And guess what?

📈 After a strong move higher, PLTR was rejected right at the $143 call wall — pretty much all cumulative expiries cluster resistance there

Using the GEX Profile indicator, scanning all expirations:

After a brief dip, the market is repositioning bullish

Squeeze zone extends up to 150

The most distant GEX level is sitting at 160

On the downside, 130 is firm support, with some presence even at 120 — the market isn’t pricing in much risk below that

📉 From a technical standpoint:

We’re near all-time highs

125 (previous ATH) and 100 are key support levels

The OTM delta curve through August is wide, and the call side is paying well — with a current call pricing skew

🔬 IVx is at 57, trending lower + call pricing skew📉 IV Rank isn't particularly high, but the directional IVx matters more here

💡 Summer Theta Play: Jade Lizard on PLTR

Since I’ll be traveling this summer and don’t want to micromanage trades, I looked for something low-touch and high-confidence — and revisited an old favorite: the Jade Lizard.

If you're not familiar with the strategy, I recommend checking out Tastytrade's links and videos on Jade Lizards.

🔹 Why this setup?

Breakeven sits near $100, even with no management

On TastyTrade margin:~$1800 initial margin ~$830 max profit

53 DTE — plenty of time for theta to work

Earnings hit in August — I plan to close before then

Covers all bullish GEX resistance zones

Quickly turns profitable if IV doesn’t spike

Highly adjustable if needed

My conclusion: this strategy covers a much broader range than what the current GEX Profile shows across all expirations — so by my standards, I consider this to be a relatively lower-risk setup compared to most other symbols right now with similar theta strategies.

🔧 How would I adjust if needed?

If price moves up:

I’d roll the short put up to collect additional credit

Hold the call vertical as long as the curve supports it

If price drops:

Transition into a put ratio spread

Either extend or remove the call vertical depending on conditions

🛑 What’s the cut loss plan?

I have about 20% wiggle room on the upside, so I’m not too worried — but if price rips through 160 quickly, I’ll have to consider early closure.

If that happens, the decision depends on time:

If late in the cycle with low DTE:→ Take a small loss & roll out to next month for credit

If early with lots of DTE remaining:→ Consider converting to a butterfly, pushing out the call vertical for a small debit→ Offset this with credit from rolling the put upward

As always — stay sharp, manage your risk, and may the profit be with you.

See you next week!– Greg @ TanukiTrade

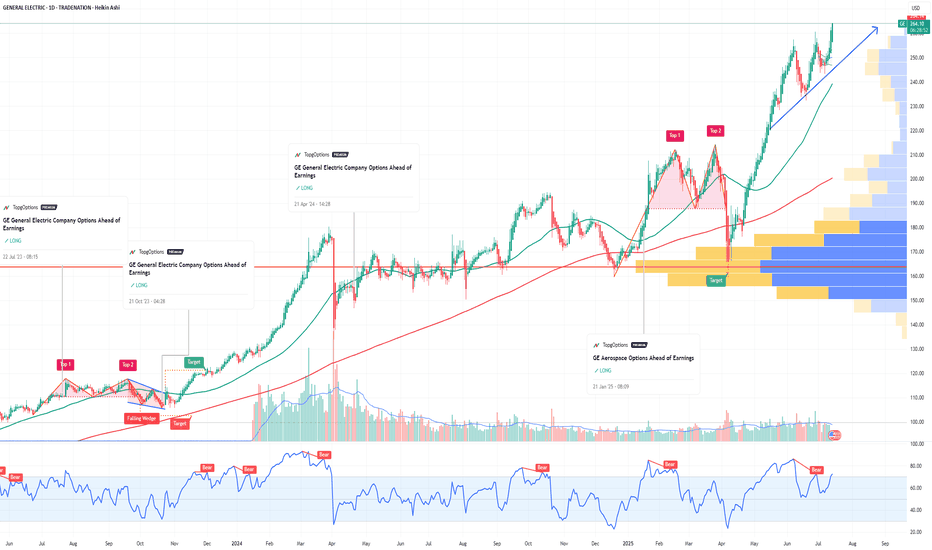

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the rally:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 270usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $8.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

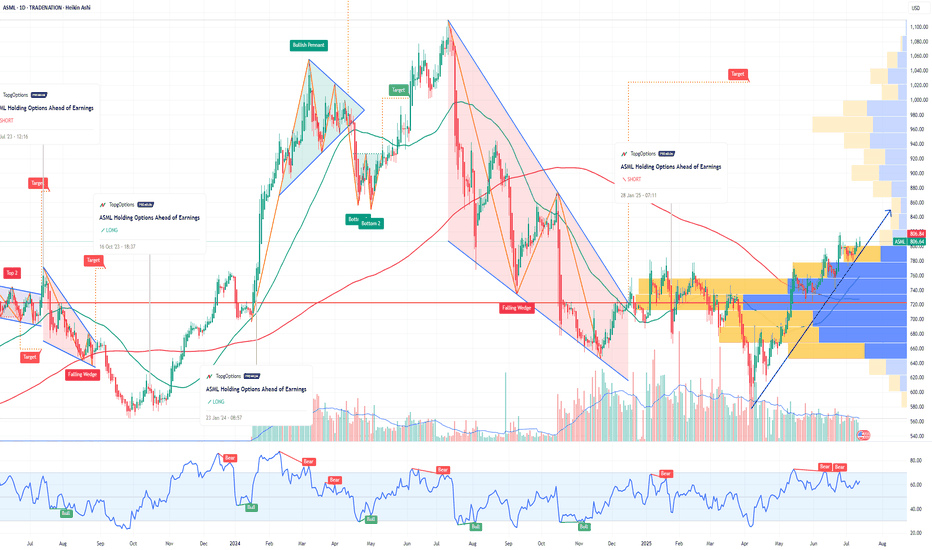

ASML Holding Options Ahead of EarningsIf you haven`t bought the dip on ASML:

Now analyzing the options chain and the chart patterns of ASML Holding prior to the earnings report this week,

I would consider purchasing the 800usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $32.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MP Materials Options Ahead of EarningsIf you haven`t bought MP before the previuos earnings:

Now analyzing the options chain and the chart patterns of MP Materials prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $2.97.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Carvana Leading Auto Retail – Outpacing LAD & AN-Financial Performance & Momentum:

Carvana reported a record-breaking adjusted EBITDA of $488M in Q1 2025, up $253M YoY, with an EBITDA margin of 11.5% (+3.8pp YoY). The company's strong operational efficiency positions it as a leader in the auto retail industry, nearly doubling the margins of competitors like Lithia Motors (LAD) and AutoNation (AN).

- Competitive Positioning & Growth Outlook:

Carvana’s EBITDA quality is superior due to lower non-cash expenses, enhancing long-term sustainability. The company expects sequential EBITDA growth in Q2 and targets 13.5% EBITDA margins within 5-10 years.

-Peer Comparison:

- Lithia Motors (LAD): EBITDA margin at 4.4% (up from 4% YoY), facing tariff-related headwinds that could impact pricing and demand.

- AutoNation (AN): SG&A as a percentage of gross profit rose to 67.5% in Q1, expected to stay between 66-67% in FY 2025, pressuring margins further.

-Options Flow & Institutional Activity - Key Levels: $350/$370

Recent institutional flow activity indicates strong positioning around $350/$370 strikes, potentially signaling a vertical spread in play rather than outright selling:

1️⃣ Momentum Confirmation:

- CVNA has strong upside momentum following its Q1 results, reinforcing a bullish outlook for near-term price action.

- Institutional traders may be accumulating bullish vertical spreads rather than unwinding positions.

Vertical Spread Setup ($350/$370 Strikes)

- Long Call ($350 Strike) → Signals expectations for further upside.

- Short Call ($370 Strike) → Caps max profit while reducing cost.

- Breakeven Price: $359 → CVNA must close above $359 for profitability.

Profit & Risk Zones

- Above $370: Maximum profit achieved.

- Between $359-$370: Partial profit zone (spread remains in play).

- Below $359: Spread loses value, making recovery dependent on extended upside momentum.

Why IonQ (IONQ) Could Be the NVDA of Quantum ComputingIf you haven`t bought IONQ before the rally:

Now you need to know that IonQ isn’t just another speculative quantum stock — The company is building a robust ecosystem around its best‑in‑class trapped‑ion architecture and targeting fault‑tolerant, networked quantum systems. With record bookings, major acquisitions, and a strong balance sheet, IonQ could emerge as the NVIDIA equivalent for quantum infrastructure.

Key Bullish Arguments

1) Superior Quantum Tech – Trapped‑Ion Advantage

IonQ’s trapped-ion processors boast 99.9% two-qubit fidelity, demonstrating higher accuracy and scalability than superconducting alternatives

These systems also operate at room temperature, meaning simpler deployment and lower costs

2) Ecosystem Strategy & Acquisitions

The $1.08B acquisition of Oxford Ionics (expected close in 2025) expands IonQ’s qubit control tech, pushing toward planned 80,000 logical‑qubit systems by decade’s end

Combined with ID Quantique and Lightsynq, IonQ is building a full-stack quantum and networking offering

3) Strong Revenue Growth & Cash Runway

Revenue soared from $22M in 2023 to $43.1M in 2024, with bookings of $95.6M

. Q1 2025 saw $7.6M revenue and EPS –$0.14, beating expectations; cash reserves near $697M provide years of runway

4) Real Commercial Deployments

IonQ sold its Forte Enterprise quantum system to EPB ($22M deal) for hybrid compute and networking, marking real-world commercial applications

5) AI & Quantum Synergy

Involvement in NVIDIA’s Quantum Day and hybrid quantum‑classical AI demos (e.g., blood pump simulation with Ansys, ~12 % faster) indicates strategic synergy and positions IonQ as a critical piece in the future AI stack

Recent Catalysts:

Texas Quantum Initiative passes – positions IonQ at forefront of U.S. state-backed innovation

Oxford Ionics acquisition pending – major expansion in qubit scale & tech

Barron’s analyst buys – industry analysts see long-term potential; IonQ among top quantum picks

Broader quantum optimism – McKinsey & Morgan Stanley forecasts highlight synergy between quantum and AI, benefiting IonQ

AAPL: Premium PlayApple beat expectations this quarter—revenue, profit, EPS—all slightly better than analysts hoped. But the stock dropped to $196.26, down from $212.83. Why? Investors are still worried about tariffs, margin pressure, and supply chain changes.

Tim Cook talked about strong product sales (iPhone, Mac, iPad) and all-time high Services revenue. But he also admitted tariffs and regulatory issues are weighing on Apple’s outlook.

My Covered Call Strategy

I’m selling the $202.5 call and buying the $210 call for June 27, 2025. Big money seems to be doing the same—there was a huge premium sale over $2 million, likely betting Apple stays range-bound short term.

- Why this works:

- Resistance near $202.50 gives me a clear ceiling

- Apple fundamentals are strong, but macro risk caps upside

Chart Notes

- Resistance: $202.50 and $210

- Support: Around $192.50

Bottom line:

I like this trade as a way to bring in income while defining my risk. If Apple grinds sideways or pushes a bit higher, the trade still pays. Clean structure, high odds.

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 128usd strike price Calls with

an expiration date of 2025-6-27,

for a premium of approximately $5.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$META - Consolidation Cluster Bullish Flagging Ahead of The FedPrice held above key levels after breakout and is now flagging near highs.

700+ zone holding as new support

Strong structure with rising 9EMA catch

Volume cooling, but MACD remains bullish

Eyeing potential expansion above $708–710 range

This setup favors continuation. Watching for a clean break and close above $708 to confirm next leg higher.

MU Options Insight: Bulls Eyeing $123Fundamental Overview

Micron Technology's $200 billion expansion plan aligns with the broader push for domestic semiconductor manufacturing. The company is investing $150 billion in fabrication plants across Idaho, New York, and Virginia, while $50 billion is allocated for high-bandwidth memory packaging and R&D. This move strengthens Micron’s position in AI-driven demand and supply chain resilience.

The CHIPS and Science Act funding of $6.4 billion and eligibility for the Advanced Manufacturing Investment Credit further bolster Micron’s financial outlook. CEO Sanjay Mehrotra emphasized that this expansion will create tens of thousands of jobs and reinforce U.S. tech leadership.

Technical Analysis

Micron’s stock is currently near a 12-month high, up 37% year to date. The momentum remains strong, with institutional activity suggesting bullish sentiment.

- Options Flow Insight: A vertical bull spread was spotted in Times & Sales, with 118 strike contracts executed on the ask and 123 strike contracts executed on the bid simultaneously. This suggests a bullish stance, as traders anticipate further upside.

- Expiration Consideration: The June 20 expiration (4 days away) indicates a short-term bullish outlook, likely targeting a breakout above $123.

- Institutional Positioning: The 500 additional contracts at 118 reinforce the bullish bias. If MU moves beyond $123, traders holding the spread still profit, confirming strong conviction in upside potential.

Why Recursion Pharmaceuticals RXRX Could Be the NVDA of BiotechRecursion Pharmaceuticals RXRX is rapidly emerging as a transformative force in drug discovery, leveraging cutting-edge artificial intelligence and automation to industrialize and accelerate the development of new medicines. Here’s why RXRX could be the next NVIDIA (NVDA) of biotechnology and why its stock could soar by year-end:

1. AI-Powered Drug Discovery Platform with Unmatched Scale

Recursion integrates AI, machine learning, automation, and advanced data science to decode biology and chemistry, dramatically reducing the time and cost of drug discovery.

The company’s proprietary BioHive-2 supercomputer, built with NVIDIA’s DGX H100 systems, is the most powerful AI computing system wholly owned by any biopharma company, enabling Recursion to process biological data at unprecedented speeds.

By reducing the number of compounds needed for clinical candidates from thousands to just 136–200 and shrinking development timelines to under a year, RXRX is fundamentally changing the economics of pharmaceutical R&D.

2. Strategic Partnerships and Industry Validation

RXRX has forged high-profile partnerships with pharmaceutical giants such as Bayer, Roche/Genentech, Takeda, and Sanofi, validating its platform and unlocking milestone payments that could exceed $20 billion over time.

The company’s collaboration with AI biotech Exscientia in a $700 million deal further cements its leadership in the AI-driven drug discovery space, creating a pipeline of 10 clinical and preclinical programs with hundreds of millions in potential milestones.

NVIDIA itself holds over 7.7 million shares of RXRX, making it one of NVIDIA’s largest biotech investments and a strong endorsement of Recursion’s technology and long-term vision.

3. Explosive Revenue Growth and Strong Cash Position

Analysts forecast Recursion’s revenue to grow at a 65% CAGR from $58.8 million in 2024 to $263 million by 2027, far outpacing the broader biotech sector.

The company ended 2024 with over $600 million in cash, providing a solid runway for continued investment in R&D, platform expansion, and clinical trials.

Wall Street analysts expect more than 50% upside in RXRX stock over the next 12–24 months, with multiple clinical milestones and partnership announcements as near-term catalysts.

4. Disruptive Vision: The “Virtual Cell” and Beyond

RXRX is building toward a “virtual cell,” where AI models can simulate biological processes with such accuracy that wet lab experiments shift from data generation to validating computational predictions.

This approach could dramatically improve drug development success rates, addressing the industry’s notorious 95% failure rate and positioning Recursion as the go-to platform for next-generation drug discovery.

5. Market Sentiment and Institutional Support

RXRX has caught the attention of growth investors and major funds, including Cathie Wood’s ARK Invest, further boosting its profile and liquidity.

Recent stock surges and high trading volumes reflect growing investor confidence in Recursion’s disruptive potential and the broader AI-in-biotech trend.

IOT Samsara Options Ahead of EarningsIf you haven`t sold IOT before the previous earnings:

Now analyzing the options chain and the chart patterns of IOT Samsara prior to the earnings report this week,

I would consider purchasing the 44usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $1.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RBRK Rubrik Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RBRK Rubrik prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $5.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NVDA GEX Earnings Outlook by OptionsNVDA reports earnings this Wednesday, and it’s a big deal. A major move could impact both the indexes and broader tech sector.

The OTM 16 delta curve essentially overlaps with both the GEX profile and the expected probability zone — signaling strong confluence.

📈 Rising IV with falling call skew: Volatility is rising into earnings, while the call skew is dropping — a sign of growing interest in downside hedging/speculation.

🔷 Key inflection zone (129): Above 129, the market is unlikely to surprise. Below it, however, a domino effect could trigger increased volatility and put-side flows.

Implied move into earnings is 6.62%, reflecting binary risk expectations from the options market.

Strong gamma squeeze territory exists between 140–145, with significant call wall buildup around 140.

The nearest expiry shows a positive net GEX — supporting short-term mean-reversion or hedging flow stability above 129, at least until the earnings print.

🔴 Downside risk scenario:

In the event of a downward move, the market is most heavily hedged around the 125 level, which aligns with the deepest put support.

💡 Wheeling Opportunity Idea

ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term), this might be a great time to start the wheeling strategy.

Because earnings inflate volatility, you can sell a near-term cash-secured put (CSP) for solid premium — even on a 53DTE (July) option.

Based on current GEX levels, we’re seeing:

-Support (squeeze zone) around $125

-Call resistance around $140

-A potential upside squeeze extending to $145-$150

These align roughly with ~20 delta OTM options, so the premium is attractive.

How would I personally start this:

Sell a CSP for May 30 with the intention to get assigned if NVDA drops.

If I do get assigned, I’m happy to own shares.

Then, I sell a 60DTE covered call right after to collect another round of premium.

If I’m not assigned, I sell a new 45–60DTE put the following week — still benefiting from the relatively high IV.

👉 Remember: High IV = synthetic time value. With this two-step method, you can harvest premium twice in quick succession.

I used the same technique with NASDAQ:INTC , and it’s been performing well.

💥 ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term)!

ZS Zscaler Options Ahead of EarningsIf you haven`t bought the dip on ZS:

Now analyzing the options chain and the chart patterns of ZS Zscaler prior to the earnings report this week,

I would consider purchasing the 250usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $29.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Personal Trade Plan – Nifty50 25100 June Call OptionToday, I entered a long position in the Nifty50 25100 June (Monthly) Call option , securing an average price of ₹469.10 . I plan to accumulate additional lots at lower prices, with a strategy to hold until expiry.

📌 Disclaimer: This is not a trade recommendation. Please conduct independent research and assess risk factors before making any trading decisions.

#nifty50

RUM Rumble Options Ahead of EarningsIf you haven`t bought RUM before the recent rally:

Now analyzing the options chain and the chart patterns of RUM Rumble prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $1.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

WULF TeraWulf Options Ahead of EarningsIf you haven`t bought WULF before the rally:

Now analyzing the options chain and the chart patterns of WULF TeraWulf prior to the earnings report this week,

I would consider purchasing the 2usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $0.43.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.