Oracle (ORCL) shares surge 24% in a week, hitting all-time highOracle (ORCL) shares surge 24% in a week, hitting an all-time high

Last week, Oracle (ORCL) shares:

→ rose by approximately 24% — marking the strongest weekly gain since 2001;

→ broke through the psychological level of $200 per share;

→ reached an all-time high, with Friday’s session closing above $215. It is possible that a new record may be set this week.

What’s driving Oracle (ORCL) shares higher?

The main catalyst was the quarterly earnings report released last week:

→ Earnings per share ($1.70) exceeded analysts’ expectations ($1.64);

→ CEO Safra Catz projected revenue growth of 12–14% in upcoming quarters;

→ Company founder Larry Ellison highlighted “astronomical” demand for data centres, as well as Oracle’s competitive edge in building and servicing them.

Notably, Oracle provides infrastructure services for both OpenAI and Meta Platforms.

Technical analysis of ORCL shares

ORCL shares have shown high volatility throughout 2025, largely influenced by news surrounding Donald Trump. His promises to strengthen the US position in AI served as a bullish signal, while plans to impose international trade tariffs had a bearish impact.

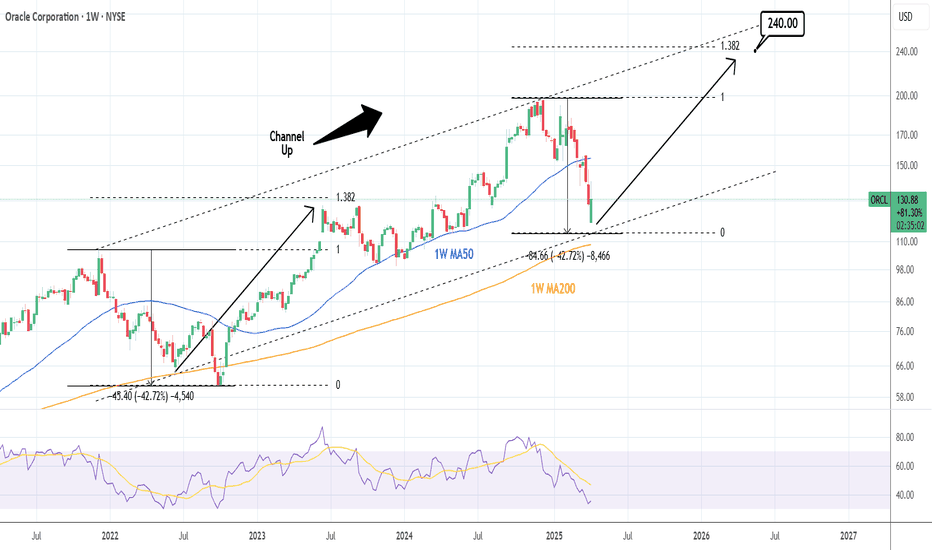

As a result, a broad upward channel has formed on the chart, with the following key observations:

→ the price has repeatedly bounced sharply from the lower boundary (1), indicating strong demand;

→ by early June, the price had risen and stabilised near the channel’s median line (2).

Currently, the ORCL chart shows that the earnings-driven rally has pushed the price into the upper quartile (3) of the channel.

With the RSI indicator at extreme highs, it is reasonable to assume that ORCL may be vulnerable to a pullback. However, if a correction does occur, it is unlikely to be deep — perhaps testing the psychological $200 level — given the company’s strong fundamentals.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Oracletrading

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term buy opportunity. The bullish wave after the 2022 bottom almost reached the 1.382 Fibonacci, so we have a technical level to target this time also (TP = 240).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Oracle: Tilting Downward…After a sharp rebound from the $152.02 support following the steep drop from the peak of the beige wave II, Oracle is once again tilting downward as expected. The next step should see the price fall below $152.02 to reach the projected low of the beige wave III. After a countermovement of wave IV, the broader downward movement as part of the beige five-wave decline should extend further, ultimately driving the stock to the low of the overarching blue wave (A). If Oracle instead breaks above the $198.31 resistance in the short term, the macro-level light green wave alt. will rise to a new high. However, this alternative scenario holds only a 34% probability. Primarily, we assume that wave was completed with the December peak.

Oracle: Correction Started!Although ORCL is currently still trading above the $147.50 support level, we believe the green wave has reached its peak. This implies that the overall upward trend has concluded, and we anticipate a significant correction moving forward. This correction should unfold in five parts, with the beige wave I extending well below the $147.50 level. Afterward, we foresee a corrective counter-movement back above $147.50 during wave II before the price resumes its downward trajectory.

ORACLE: Sharp correction may turn into a 1 year buy.Oracle is having a sharp sell off during September, the strongest since September last year (2022), which formed the market bottom. It is almost oversold on the 1D technical outlook (RSI = 30.957, MACD = -2.920, ADX = 37.867) with the price approaching the 1W MA50, which is untouched since November 7th 2022.

On this 1W chart we have market the time of a 1W MA200 breach that was followed soon after with a strong rebound. Our trading strategy is to enter a long term buy and hold on the 1W MA50 and if by any chance (unlikely) tests the 1W MA100, then unload the rest of longs there. This will be an ideal long term buy opportunity (TP = 130.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##