Orderblocks

DXY Dual Perspective: Smart Money OB Short vs. Mid-Term LongThis chart presents two perspectives:

My Perspective (Dipanshu - GreenFireForex):

Expecting a bearish reversal from the current Order Block (OB) between 101.9 – 103.2, possibly due to inefficiency and early liquidity sweep.

ChatGPT’s Refined Perspective:

OB refined to 102.4 – 103.0 zone, aligning with imbalance and previous H4 structure break. A rejection from there is more probable.

Target:

Both views expect a drop toward the Demand Zone at 96.4 – 96.3, with bullish reversal expected from that key support.

Let’s observe whether the DXY respects early inefficiency or reaches full OB.

Comment your bias below!

---

EU SHORTS FOR TODAY___ Mount Olympus Capital says.I am looking for a short on the EURO. Price showing clear signs of bearish orderflow and structure with and signatures (accumulation manipulation and distribution).

Looking to target previous day and Asia session low!

LETS GET IT! and safe trading everyone.

NAS100USD: Bearish Confluence Builds as Market WeakensGreetings Traders,

Despite the broader bullish context on NAS100USD, current confluences suggest a potential short-term move to the downside. As we enter the New York session—with a key news release on the horizon—we anticipate heightened volatility. The critical question now becomes: where is price most likely to draw?

Key Observations:

1. Shift in Market Structure:

Price failed to break above the previous high and instead formed a lower high, signaling weakness and suggesting a possible reversal. This lower high, marked by multiple rejection wicks, forms what we identify as a rejection block—a zone often used by institutions to initiate sell orders.

2. Displacement and Bearish Arrays:

Following this rejection, the market displayed strong displacement to the downside, confirming a market structure shift. This supports the likelihood of bearish continuation and increases the validity of bearish institutional arrays holding as resistance.

3. Current Zone of Interest:

Price is now trading within a fair value gap (FVG) aligned with a reclaimed order block—a strong confluence area for potential bearish continuation. Just above this zone lies a bearish order block and another FVG, which may act as a secondary resistance should price wick higher before moving down.

Trading Plan:

Wait for confirmation at the current resistance zones before considering entries. If validated, look to target the liquidity pools resting at lower, discount price levels.

Stay patient, trade with precision, and let the market confirm your idea.

Kind Regards,

The Architect

XAUUSD – 1H Short Setup | Premium Entry Targeting Weak Low📉 GOLD (XAUUSD) SHORT – May 5, 2025 | SMC Breakdown

We’ve just tapped deep into premium levels (70–79%), perfectly aligning with a Strong High zone. The price showed rejection, and this bearish reaction looks poised to target the Weak Low marked below.

🧠 Smart Money Confluences:

🔺 Strong High: Price taps into prior supply / premium zone

🔻 Weak Low: Magnet for liquidity below

📐 Fib Confluence: 70–79% rejection zone

📊 Price Action: Strong bearish reaction candle from zone

⚠️ Liquidity: Equal lows resting below the Weak Low

🧩 Entry Strategy:

📍 Entry: ~$3,308–$3,310

🛡️ SL: Above strong high ~$3,360

🎯 TP: ~$3,187 (or trail down if LTF supports it)

🧮 RRR: Approx 1:4+ (prime sniper zone)

🛠️ Execution Tips:

Monitor 15min structure – wait for break + retest

Set alerts around 3,250 for partials

Use trailing SL after breaking 3,275 for safety

Adjust entries on lower TF OB confirmation

💬 Chart Ninja Wisdom:

"Strong Highs are protected—until they’re not. But Weak Lows? They’re always targets. Follow the narrative."

📣 Smash 💬 if you’re stalking this Gold short.

🔁 Share this play with your trading crew.

🧠 Save for reference next time Gold plays in Premium!

NAS100USD: Bearish Setup Builds as Price Retests Key Supply ZoneGreetings Traders,

In today’s analysis on NAS100USD, we continue to observe bearish institutional order flow, and as such, our objective is to align our trading opportunities with this directional bias.

Key Observations:

1. Bearish Break of Structure and Retracement:

Following a clear bearish break of structure, price has retraced into a mitigation block. This zone represents an area where institutional buying previously occurred. As price trades back into it, institutions often mitigate those earlier positions and reintroduce sell-side interest—offering us an opportunity to follow their lead.

2. Confluence at the Mitigation Block:

The mitigation block is further reinforced by the presence of a bearish order block, adding strength to the resistance zone. This alignment suggests the area may serve as a high-probability reversal point for bearish continuation.

Liquidity Sweep Scenario:

There remains a possibility that price may take out nearby buy-side liquidity (buy stops) before continuing downward. If this occurs, we will wait for confirmation before entering short positions, maintaining alignment with the overall bearish narrative.

Trading Plan:

Upon confirmation of rejection at the mitigation zone, we will seek to engage in short setups targeting liquidity pools in discount pricing zones.

Remain patient, disciplined, and ensure each trade aligns with your strategy.

Kind Regards,

The Architect

Mastering Order Blocks: How to Trade Like Smart MoneyIntroduction

Order Blocks (OBs) are one of the most critical concepts in Smart Money trading. They represent areas where institutional traders have entered the market with significant volume, typically leading to strong price movements. Identifying and trading Order Blocks gives traders an edge by aligning with the footprints of Smart Money.

What is an Order Block?

An Order Block is the last bearish candle before a bullish move for bullish OBs, or the last bullish candle before a bearish move for bearish OBs. These candles represent areas where institutions accumulated or distributed large positions, leading to a market shift.

Types of Order Blocks

A Bullish Order Block appears at the end of a downtrend or during a retracement just before the price moves sharply upward. It is typically represented by the last bearish candle prior to an impulsive bullish move. Price will often return to this level to mitigate institutional orders before continuing upward.

A Bearish Order Block, in contrast, forms at the end of an uptrend or retracement where price begins a downward reversal. It is characterized by the last bullish candle before a strong bearish move. Price tends to revisit this level to mitigate before continuing lower.

How to Identify a Valid Order Block

The key to identifying a valid Order Block is first observing a strong impulsive move, also known as displacement, that follows the OB candle. The move must also result in a break of market structure or a significant shift in direction. Order Blocks that produce Fair Value Gaps (FVGs) or Market Structure Shifts (MSS) tend to be more reliable. Another important sign is when price returns to the OB for mitigation, offering a potential entry.

Entry Model Using Order Blocks

After locating a valid OB, the next step is to wait for price to return to this area. The ideal entry happens within the OB body or near its 50% level. For extra confirmation, look for a Market Structure Shift or Break of Structure on a lower timeframe. Entries are more powerful when combined with additional elements like Fair Value Gaps, liquidity grabs, or SMT Divergences. The stop-loss should be placed just beyond the OB’s high or low, depending on the direction of the trade.

Refinement Techniques

To increase precision, higher timeframe OBs can be refined by zooming into lower timeframes like the 1M or 5M chart. Within a broad OB zone, identify internal market structure, displacement candles, or embedded FVGs to determine a more precise entry point. One effective refinement is the Optimal Trade Entry (OTE), which is often found at the 50% level of the Order Block.

Order Blocks vs. Supply and Demand Zones

While they may seem similar, Order Blocks are more narrowly defined and specifically related to institutional order flow. Supply and Demand zones are broader and typically drawn around areas of price reaction, but OBs are derived from the final institutional candle before a large move and are often confirmed by structure shifts or displacement. This makes OBs more precise and actionable in the context of Smart Money concepts.

Target Setting from Order Blocks

Targets after entering from an OB should align with liquidity objectives. Common targets include internal liquidity like equal highs or lows, or consolidation zones just beyond the OB. External liquidity targets such as previous major swing highs or lows are also ideal, especially when they align with imbalances or Fair Value Gaps. It's important to adjust targets based on the current market structure and trading session.

Common Mistakes to Avoid

A frequent mistake is treating any candle before a move as an OB without verifying key signals like displacement or a Break of Structure. Entering without other confirmations, such as an MSS or liquidity sweep, can lead to poor trades. Another common error is placing the stop-loss too tightly within the OB, instead of just beyond it, increasing the chance of premature stop-outs. Traders should also avoid executing OB trades during low-liquidity sessions where price action can be unpredictable and wicky.

Final Thoughts

Order Blocks are foundational to Smart Money trading. They allow you to enter where institutions have placed large positions and offer clear invalidation and entry logic. With practice, you can identify high-quality OBs and combine them with other concepts like FVGs, MSS, and SMT for powerful, precise trades.

Practice on different timeframes and assets, and always look for clean displacement and structure confirmation. Mastering OBs is a big step toward becoming a consistently profitable trader.

Trust the Blocks. Trade with Intention.

USDJPY Bearish Forecast, More Bearish Order FlowAfter the recent change of character from Monday, UJ continued lower and broke the H1 structure. As we all know, whenever you get a break of structure, expect a pullback. On the H4 there is a nice bearish OB which serves as a nice point of interest for price to rally back towards, be mindful this OB is big so we don't know what to expect once price reaches it.

For now this is how I see the dollar heading towards.

USDCHF: More Bearish Order FlowSimilar to USDJPY , USDCHF has exhibited a change of character, initiating a bearish order flow for the week. Price has reached a key point of interest where a potential continuation to the downside could occur. The DXY is reflecting similar behaviour, supporting the bearish outlook.

An entry position has been established, and now it is a matter of monitoring the trade and allowing the market to develop accordingly.

"BTCUSD | Smart Money Discount Play | Watch the Liquidity Trap"⚡ BTCUSD Analysis - 1H Timeframe | April 27, 2025

📊 Price Action Summary:

BTC has tapped perfectly into the Discount Zone after orchestrating a clean liquidity sweep below the prior lows.

🔥 Key Moves:

Liquidity Grab: We can clearly see those liquidity spikes — textbook fakeout behavior.

ChoCH (Change of Character): After the liquidity sweep, a strong bullish shift (ChoCH) appears, signaling a potential reversal.

Strong Low Created: This strong low within the discount zone is now protected by Smart Money players.

🧠 What's Actually Happening Behind the Scenes:

Retail traders: "It's breaking down! Sell everything!" 🚨

Smart Money: "Thanks for your liquidity. We’re loading up. 🛒"

🧩 Why This Setup Matters:

BTC swept liquidity, trapping sellers.

We saw a bullish change of character — proof of demand stepping in.

Entry opportunity now exists inside the yellow Discount Zone, where risk is minimized and upside is juicy.

🎯 Trade Setup Idea:

Entry: Inside the Discount Zone AFTER confirmation.

Stop Loss: Below the strong low (~93,455) — surgical precision.

Take Profit Zones:

Weak High (~94,500) for first scale-out 🎯

Strong High (~95,773) for the real bag 🚀

💬 Pro Tip:

"Smart Money buys red and sells green. Retail does the opposite."

Watch how BTC reacts around the ChoCH — this is where the BIG BOYS decide the next move. 🧠🔍

🚀 Summary:

✅ Liquidity sweep complete

✅ Change of character confirmed

✅ Discount zone respected

✅ Probability favoring upside expansion

🧘♂️ Be patient, wait for confirmations, and execute with sniper discipline.

✍️ Save this chart, journal it, and study how liquidity manipulation looks in real-time!

➡️ Comment "BULL MODE" if you’re positioning inside the Discount Zone!

➡️ Tag a trader who still thinks markets move randomly. 😂📉📈

NAS100USD: Reclaimed Order Block Signals Further DownsideGreetings Traders!

In today’s analysis of NAS100USD, we observe a momentary shift into bearish institutional order flow, confirmed by the formation of successive lower lows. This structural development signals the potential for continued downside movement.

Key Observations:

Bearish Institutional Order Flow:

The consistent break of lows supports a bearish bias, providing a framework for seeking short opportunities in alignment with institutional intent.

Confluent Bearish Arrays:

Key bearish arrays—including the mitigation block and a reclaimed order block—are currently aligned. These zones, if respected, could serve as strong resistance and provide high-probability entry areas for short positions.

Trading Strategy:

Should price retrace into these arrays and provide confirmation, we can look to enter sell positions with the expectation of further downside aligned with the prevailing order flow.

Stay disciplined, remain patient, and trade only with confirmation.

Kind Regards,

The Architect

NAS100USD: Will Price Fill the Gap?Greetings Traders!

In today’s analysis of NAS100USD, we observe that the market is currently operating within a broader bullish institutional order flow. However, recent price action has left behind an inefficiency—a gap that may serve as a short-term draw on liquidity.

KEY OBSERVATIONS:

1. Gap in Price – Inefficiency Identified:

Price has created an imbalance that is yet to be filled. Typically, such inefficiencies act as magnets for price, drawing it back before resuming its primary trend. In this case, the gap may be partially filled as the market seeks equilibrium.

2. Draw on Liquidity – Last Point of Efficiency:

The last point of efficiency below current price levels may serve as the draw on liquidity. This level could attract price action as institutions look to rebalance orders and facilitate continuation.

3. Active Order Block – Potential Entry Zone:

Price is currently testing a bearish order block. Upon confirmation, this area may offer a short-term selling opportunity with the objective of targeting the liquidity pool and the inefficiency below.

TRADING PLAN:

Entry Consideration:

Look for bearish confirmation within the current order block zone before entering. The goal is to trade the short-term retracement within a bullish environment.

Profit Targets:

Target the liquidity pool and the unfilled gap near the last point of efficiency as short-term objectives.

Remain diligent, patient, and aligned with your trading plan. Always conduct your own analysis to ensure any setup is in harmony with your strategy and risk tolerance.

Kind Regards,

The Architect

XAUUSD ScenariosHi, market kept rallying up. Right now 2325 is a temporary level acting as a resistance. Below it market could drop to 3207 and 3197 levels.

In order to go long you need to wait for the market to reach to demand levels specified in the chart and act accordingly.

Make sure to add your intuition and knowledge into this and don't take everything blindly.

Be honorable

XAUUSD BUY OR SELLHello guys,

in Today's analysis , market is rallying up, the blue line is the resistance in which many would think of selling . And too many stops have been gathered there. So one scenario would be hunting the stops above blue line and hitting the resistance around 2413 and see sellers coming in.

3100 is the last resistance which now acts as a support. below that 3089 would be demand level.

stay gold

Ultimate Guide to Smart Money ConceptsWhat Are Smart Money Concepts?

Introduction:

If you’ve been trading for a while, you’ve probably noticed that sometimes the market moves in ways that just don’t make sense. You’ve got your technical analysis all set, but the market seems to go in the opposite direction. That’s where Smart Money Concepts (SMC) come in.

At its core, SMC is all about understanding how big players in the market (think hedge funds, institutions, and banks) move prices. These players have massive amounts of capital and information, and they don’t trade like the average retail trader. Understanding their behavior can help you see where the market is going next before it happens.

What is Smart Money?

In the world of trading, smart money refers to the institutional investors who move markets with their huge orders. Unlike retail traders, who might be relying on indicators or patterns, smart money trades based on liquidity, market structure, and order flow.

While retail traders are typically reacting to price movements, smart money is the one causing those moves. They’re out there seeking out places where they can accumulate positions or distribute them. The tricky part is that they’ll often make the market go in one direction just to trap retail traders and get them to take positions before flipping it back to where they wanted it to go in the first place.

Key Concepts in Smart Money Trading

1. Market Structure

Market structure refers to the way price moves in a trend. It’s essentially a pattern of higher highs and higher lows for an uptrend, or lower highs and lower lows for a downtrend.

Smart money uses these patterns to their advantage. When they see the market creating a series of higher highs and higher lows, they’ll take advantage of that momentum to push prices further, knowing retail traders will follow along.

But when they want to reverse the market, they’ll push it in the opposite direction, creating a market structure shift or a break of structure, which signals that the trend is over and a new one is starting.

2. Liquidity

Liquidity refers to the amount of orders available to be filled at different price levels. Smart money knows exactly where retail traders are likely to place their stops or buy orders.

They’ll often push the price to these levels, triggering those stops and collecting the liquidity. Once that liquidity is grabbed, they’ll reverse the price and move it in the intended direction.

A common way to spot liquidity is by looking for equal highs or equal lows, where traders often place their stop-loss orders. These are often areas smart money will target.

3. Order Blocks

Order blocks are areas on the chart where institutions have placed big orders. These are key levels that represent where price might return to later, and they can act as areas of support or resistance.

Order blocks are usually found after big price moves. Institutions place these orders to either accumulate positions or offload them, and price often comes back to these levels to fill orders that were left behind.

4. Fair Value Gaps (FVG)

Fair value gaps, or imbalances, are price areas where the market moves quickly, leaving gaps between candlesticks. These gaps represent areas where the market has moved too fast for regular orders to fill, and price tends to return to these levels to fill the gaps.

Smart money knows that these imbalances are critical areas for future price action, and they’ll use them to re-enter the market after a move has been completed.

Why Does Smart Money Matter?

Understanding smart money concepts is like learning to think like an institution. Instead of chasing after price based on typical retail indicators, you start looking for the big moves that smart money is making. You begin to notice when the market is setting traps for retail traders, and how these large players accumulate positions before pushing price in a big way.

With SMC, you stop guessing and start anticipating. By looking for liquidity zones, order blocks, and market structure shifts, you can get in sync with the big players and follow their moves, not fight them.

Conclusion

Smart Money Concepts are all about shifting your perspective. Instead of thinking like a retail trader looking for quick breakouts, oversold/overbought conditions, or chasing trends — start looking at the market as the big players do. Pay attention to where the liquidity is, identify key order blocks, and use market structure shifts to guide your trades.

By learning to spot these key signs, you’ll stop being the one who’s trapped and start being the one who’s in sync with the smart money.

Ready to trade smarter? Keep an eye on those order blocks and liquidity zones — they’re where the real money is made.

Next Steps

- Start practicing by reviewing charts through the SMC lens.

- Keep refining your understanding of market structure, liquidity, and order blocks.

- Stay patient, smart money trades aren’t about quick wins, but about positioning yourself for big moves.

__________________________________________

Thanks for your support!

If you found this guide helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

NVIDIA: Time for a Graphic Comeback?🔍Analysis:

Following up from a previous breakdown, NVIDIA has now tapped into a high-probability Weekly Order Block (OB) just above the sell-side liquidity zone at $88.97. This level also aligns with a structural area of support, making it a prime zone for a potential bullish reversal.

Key signs:

Price is showing early signs of displacement from the OB.

If this zone holds, we could be looking at a 77% move back up to the buyside liquidity at $157.92.

Watch for a strong weekly candle close above $96.30 to confirm the bounce.

🛑 Invalidation:

If price fails to hold this OB and breaks below $88.97, expect a deeper move into the $76.06 zone.

💡 Summary:

Patience is key. We’re sitting on a solid base for a potential bullish push — now it’s all about the confirmation candle. 📊

DYOR — Don't just HODL, study the chart!

Block orders showing we are entering a buy range 719 -735 could be a potential sell area.

4 hour block chart is showing we are entering a buy range. I usually try to put stop loses in a little under the buy range for liquidity grabs. However this is where I begin investing funds till it fails or goes to the sell range. This could take hours to days though off the 4 hour chart.

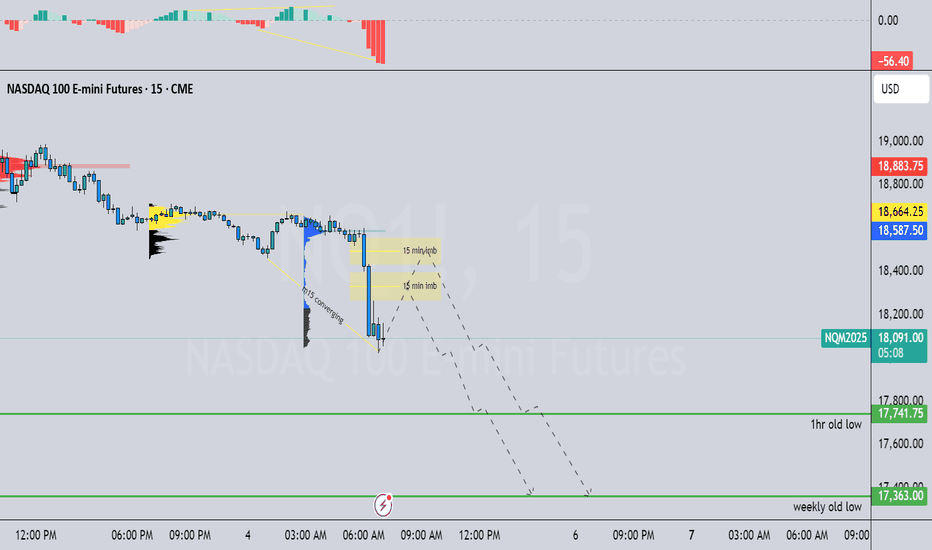

we might continue dropping daily hidden divergence, price might want to continue seeking sell side liquidity

4hr is making a new low and taking out old lows (sell side liquidity) to the left MACD is not converging as of yet

1hr hbrsh-div price is dropping ahead of red news this Friday, could head to 1hr old low or weekly low, waiting to see how price reacts to news

m15 price is below POC of previous NY session POC, as well as overnight Asian and London session converging nicely ahead of news I would favor price reacting short-term from m15 bearish imbalance before reaching the lows around the NY open after news but we will see

Road to riches - paved with good intentions Order block 1 day timer has yet to fall to the previous buy zone

Order block 1 hour timer just hit the bottom of a buy zone and may reverse to 800 zone.

The 4 hour order block is half way thru a plunge of 3 buy zones

Once 1 hour recovers and higher ones do too.

But how much further will we drop?

Right now we entering a high order block buy zone that can drop to 400 or 500 zone.

Be careful trading lower time frames - we are still seeing turbulence.