$BTC Daily OutlookBINANCE:BTCUSDT.P

Weekly Chart:

Bitcoin has now printed three consecutive weekly closes above the former higher-high threshold at $111 960. That series is enough to confirm a clean breakout of the prior HH-HL range and keeps the long-term bias pointed firmly higher.

That said, a near-term pullback is still on the table:

• First support — the breakout shelf at $111 960 (re-test of structure).

• Deeper support — the next V-level around $98 115.

Why the caution?

Last week’s candle left a small Failed Auction just above the new high, and Footprint data shows a cluster of aggressive buy-delta trapped in that wick. Those buyers may need to get washed out before the trend resumes.

Big picture: weekly structure is bullish; any dip into the levels above is a potential reload zone while the breakout holds.

Daily Chart:

Price action remains firmly bullish: multiple Failed-Auction rejections at the $116 860 higher-low vLevel keeps supply thin and reinforce the up-trend toward the prior ATH.

That said, remember Auction Market Theory rule #5: “When time or volume builds at the edge of balance, price often pushes through.”

• Each failed auction is absorbing resting bids.

• If sellers lean in again with size, the level can flip from support to resistance very quickly.

In practice that means:

•Base case – continuation to the highs while the Daily structure holds.

•Risk scenario – a clean break of $116 860 would open room for a deeper weekly pullback toward $107456.0

For now we treat the current weekly pullback as a fresh opportunity: scouting intraday longs as price reacts to the 1-Hourly zone.

From the footprint read-out, today’s bar finished with a neutral delta, but note where the profile is stacked: both the Value Area Low and the POC sit right at the bottom of the candle. That tells us the bulk of volume printed down at the session lows and it skewed negative, sellers were leaning hard, trying to extend the move lower.

Orderflowtrading

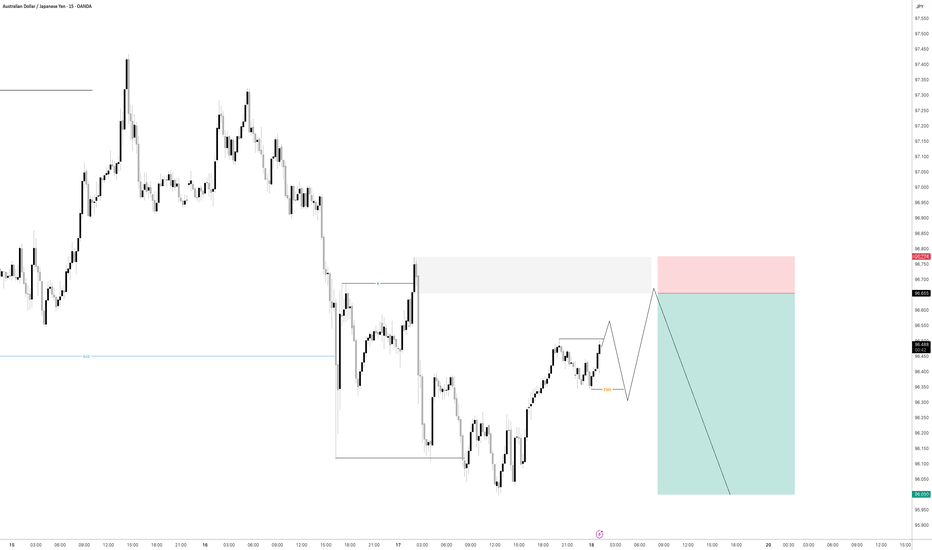

AUDJPY - POTENTIAL?USDJPY is getting super interesting.

If we can get some bearish intent to try and induce the early sellers to the downside creating some buyside liquidity then i will be all over this for a trade.

Lets see how price has moved by the morning as it does need a bit more development before we can consider entering for a short position

$BTC Daily Outlook BYBIT:BTCUSDT.P

Macro Picture

Weekly Chart

Both Bias & Momentum aligned bullish

Moving towards 111968.0 vLevel (HH) - ATH

Be careful with Weekly FA from that Level

More upside room from here

vLevels Range between 111968.0 - 77083.5

Daily Chart

Both Bias & Momentum aligned Bullish

Failed Auction at 102000.0

Validated from Volume Footprint Charts - Selling Delta trapped on this Failed Auction - POC & Value Area at Wick Lows

vLevels Range between 111968.0 - 102000.0

More Upside room from here, but overall consolidation for now as we are inside a High Volume Node

A pullback would be ideal to look for entries

10-Hour Chart

Price is currently inside an Inside Bar Range between 109740.9 - 107134.7

Overall momentum from the Intraweek Chart (10-Hour) is bearish due to a Failed Auction around 109740.9

Need to wait for confirmation for New Failed Auction Today.

vLevels zone around 105335.0 - 104567.0

Would be nice to have a pullback towards this zone, in which we can start looking for rejections for Intra-Week Longs

Nice zone to look for longs is also IB Range Low 107134.7

Intraday Picture

1-Hour Chart

No outlook for now, waiting for Intra-Week Chart Confirmation

No shorts from here, as HTF bias & momentum remain bullish

Patience - Overall range, don't want to get chopped here.

10-Minute Chart

No Outlook for now, waiting for MTFs and HTFs confirmation

Bitcoin Outlook — Narrative Recap

On the higher time-frames the picture is straightforward: both weekly and daily bias and momentum are in sync to the upside. Price is grinding toward the prior all-time high vLevel at 111 968 USD. Treat that level with respect, if a weekly failed auction (FA) forms there, it could mark the next inflection, but for now there is still air between price and that resistance. The broader weekly value range spans from 111 968 USD down to 77 083 USD.

The daily chart reinforces the bullish thesis. A failed auction printed at 102 000 USD, and volume-footprint data show sell-side delta trapped at those wick lows; the point of control and value area also sit there. 102 k is now strong support. Price is chopping inside a high-volume node, so a healthy pullback toward 102 k (or at least into value) would be the ideal place to reload longs before the next push higher.

Drop to the 10-hour “intra-week” view and momentum tilts short-term bearish. Price is boxed inside an inside-bar range between 109 741 USD and 107 135 USD after a failed auction at the range high. The preferred play is patience: let price drift into either the IB low at 107 135 USD or, even better, the deeper vLevel cluster at 105 335 USD – 104 567 USD. There we’ll watch for a fresh failed auction or obvious seller exhaustion to trigger new longs targeting the ATH zone.

On the 1-hour and 10-minute intraday charts there is no edge yet, conditions are choppy and hostage to the intra-week setup to align with the Higher Timeframes. With higher-time-frame bias still firmly bullish, fading strength makes little sense; stand aside until the 10-hour chart confirms a pullback and reversal.

Bottom line: stay bullish, stalk a pullback, and look to join strength from 107 k or 105–104 k. A decisive daily close back below 102 k would force a rethink; until then, patience is the edge.

$ETH - Top DownBYBIT:ETHUSDT.P Top Down (10/06/25)

V-Levels Bias

Weekly = Bullish

Daily - Bullish

10-Hour = Bullish

1-Hour = Bullish

V-Levels Momentum

Weekly = Bearish FA

Daily = Neutral

10-Hour = Neutral

1-Hour = IB Range (Neutral)

DeCode Market Breakdown

Macro Context

Weekly Chart

Strong bullish MS, printing clean HHs and HLs.

Price has rejected from the same V-Level multiple times.

Rejections are paired with high relative volume and aggressive selling footprints → indicates strong passive interest above.

This area is not ideal for aggressive long entries.

Daily Chart

Still in bullish structure, holding above key POCs and range lows.

The Failed Auction at IB lows has added fuel for upside momentum.

However, we’re trading right into a potential liquidity pocket just below resistance.

Context calls for a wait-and-see approach: either clear breakout or rejection confirmation.

Intraday Picture (10H & 1H)

10H Chart

Still within an Inside Bar (IB) range.

FA at range lows suggests momentum continues upward — but we are at the top of the range.

Key risk: trap above range highs → ideal area for shorts if we get absorption and selling imbalance.

1H Chart

Market is rotating inside the current IB range.

No breakout confirmed yet.

Best short setup: Rejection from IB Highs + Absorption on CVD / Footprint charts.

Breakdown scenario: Short on range low breakdown with volume confirmation.

Longs: Only valid if HTFs confirm breakout → then look for bullish retest or mid-retest entries.

⸻

Summary & Trade Plan

Big Picture: Still bullish, but this isn’t the area to long blindly.

Short Setup 1: Rejection from IB Highs with clear absorption + imbalance.

Short Setup 2: Breakdown below IB Range Lows with volume follow-through.

Long Setup: Wait for HTF confirmation of breakout. If confirmed → retest of prior resistance as support.

Final Notes

This is where traders get chopped. HTF resistance meets LTF momentum.

Let price prove itself. Let volume confirm the move.

No breakout = no long. No trap = no short.

$BTC - Top Down BYBIT:BTCUSDT.P Top Down (10/06/25)

V-Levels Bias

Weekly = Bullish

Daily = Bullish

10-Hour = Bullish

1-Hour = Bullish

V-Levels Momentum

Weekly = Bullish

Daily = Bullish

10-Hour = Neutral

1-Hour = Neutral

Analysis & Insights

DeCode Market Breakdown

Macro Context

Overall, the Weekly structure remains bullish — both in bias and momentum. We’re trading below a key level at $111,968.0, and continuation is likely unless we see a clear Failed Auction at that level.

That would trigger some serious red flags and force a reevaluation of the directional bias.

Daily Chart

Daily structure is extremely bullish at the moment.

The price recently showed a Failed Auction around the $102,000.0 V-structure Higher Low — indicating aggressive absorption and buyer strength.

As long as price holds above that area, the priority is to stay on the long side.

⸻

10-Hour Chart

Still holding a bullish structure overall.

One thing I’ll be watching closely: the price reacting to the previous High at $110,660.8.

If we get a rejection + Failed Auction at that level, that opens up the possibility for intraday shorts; as a short-term shift in momentum and local resistance kicks in.

1-Hour Chart

📈 Long Setup: Waiting for a clean entry from an OTE / Fib zone + Over/Under structure.

📉 Short Setup: Watching for a sweep of the current highs + a clear Failed Auction (ideally with footprint confirmation).

There’s visible compression between $104k and $105k, so price might look to grab liquidity there first before any real move upward.

10-Min Chart

Currently, no clear trade setups on the 10M.

The 1H hasn’t reached optimal trade zones yet. I’ll be watching closely for any structure shifts or setups aligning with the macro bias.

⸻

🔍 Trading Plan Summary

Bias: Bullish (Weekly + Daily)

Look for longs aligned with HTF support + intraday confirmation

Short opportunities only if we get clear rejection from $110,660.8 + footprint signals

Gold Futures (GC) – May 28, 2025

Gold is currently trading within a clean range, and I’m keeping it simple:

🔴 I will only sell in the red supply zone, but only after seeing confirmed seller reaction and order flow backing the move.

🟢 I will only buy in the green demand zone, once buyers clearly show strength and the flow supports it.

📉 My target for any trade is always the opposite zone — if I sell in the red, I’ll target the green. If I buy in the green, I’m aiming for the red.

All of this holds until aggressive order flow tells me new participants are stepping in and shifting the narrative.

No trades in the middle. Discipline and confirmation first.

#GoldFutures #GCAnalysis #SmartMoney #OrderFlow #SupplyAndDemand #FuturesTrading #PriceAction #TradingDiscipline #TechnicalAnalysis

Calm before the storm. Waiting for the rockets to launchI've covered many topics in this video

The difference between myself and others is that I speak from real world experience whilst others keep trying the 'sell the dream'

bullsh*t baffles brains, and that's not what I'm about

So if you are a student of the markets I hope you are taking notes of these golden nuggests

Aggressive or ( X + X0 ) Entry Model 15m : must be we are in Kill zone of any session

X = LQ Swept against previous HL

X0 = LQ Swept against previous candle

after X + X0 happened, wait for last recent candle close then mark it as 15m Demand zone

LTF( 1m ) :

1. 15m Demand zone must be mitigated in LTF

2. LTF unmitigated Order Flow must be mitigated

After points 1 and 2 are met, we should be ready to place a market order as soon as a bullish confirmation candle appears on the 1-minute chart.

Since X and X0 happened at the same time, this entry should be considered an Aggressive Entry.

EUR/USD ShortContext:

• DXY has upwarts potential: Supports short in EUR/USD

• Monthly neutral

• Weekly neutral to bearish bias

• Daily one confirmed bearish swing, respected daily FVG and disrespected bullish FVGs. Broke through prev. day low and took out weekly demand. Closed below these lows

Ideas / Entry:

• Short in the 4h-FVG

→ Shown with black arrow

• Preferred: Short around 1.072 which is in the area of the broken lows with 1h Reversal setup

1) Blue arrows: Reversal with respecting lower 1h-FVG. Look for entry on LTF, for example 5min-15min

2) Orange arrows: Last resort and higher risk! Needs strong and confirmed reversal on preferred 15min.

Scenario invalidated:

• 4h Close above 4h FVG

• Break above 1.0745

• High caution if 4h close above broken lows around 1.072! Immediate reversal needed (confirm on LTF), otherwise cancel trade

Stop

• Above your entry signal or 1.0745 if traded on 4h

Take Profit(s)

• 1st at daily low around 1.067

• 2nd around 1.065

• 3rd around 1.06 (optimistic)

Please feel free to comment!

Smart Trading For EURUSD 1h When you look at a one-hour timeframe chart of the EUR/USD currency pair, you see a large number of order blocks, and for each one, with proper planning and observing Wyckoff patterns, you can create a good plan. Sometimes, due to rapid growth or decline and not recognizing the pattern, we don't enter into these types of positions. So, recognizing the Wyckoff pattern significantly helps us trade in the right direction.

Yes, recognizing Wyckoff patterns and proper planning can help you trade more effectively and confidently in the EUR/USD market. Wyckoff patterns identify price and volume patterns in the market and allow you to determine the optimal timing for entering or exiting a trade.

Recognizing Wyckoff patterns can help you identify stronger entry and exit points in the EUR/USD market and prevent faulty analysis or trading mistakes. By focusing on price patterns, volume, and price changes, you can identify both common and uncommon patterns and have a better understanding of the market.

However, it's important to acquire sufficient study and education to effectively use Wyckoff patterns, correctly identify them, and have a comprehensive understanding of market behavior and technical tools in the EUR/USD market. Additionally, skill and experience in trading are of great importance.

Before using Wyckoff patterns in trading EUR/USD, it's advisable to familiarize yourself with your own strategy and utilize reputable resources to learn about patterns and related concepts. Additionally, always be cautious and base your trading decisions on your personal analysis and understanding of the EUR/USD market, as there is no guaranteed strategy or pattern for profitability in the financial market.

ETHUSDT Trading Plan---X--- : Potential reversal

square : demand and supply

The analysis is based on ORDERFLOW.

The trend structure in H4 is bull , so we are going to entry long positions before becoming bear .

We could identify some demand and supply zones by orderblock regarded as a large-scale buy or sell zone .

It was mentioned above , the trend is a going up , therefore we will hardly entry short positions , ALWAYS FOLLOW THE TREND .

There are 2 opportunities to trade

Long : 1675.74

SL : 1653.23

TP : 1886.46

RR=9.36

Long : 1632.18

SL : 1610.31

TP : 1886.46

RR=11.63

if price goes to the yellow line before reach our limit orders, the trades should be cancelled .

CADJPY BULLISH SETUPTrade the financial markets using SMART MONEY CONCEPTS strategy for high to low timeframe. Ultimate STRATEGY FOR traders looking to profit from the forex markets.

*****FOLLOW AND SHARE FORE MORE CONTENT LIKE THESE******

#smartmoney #orderblocks #orderflowtrading #smartmoneyconcepts

Bitcoin Consolidation Scalp and Swing trade levels this week!CME:BTC1! CRYPTOCAP:BTC BINANCE:BTCUSDT INDEX:BTCUSD BYBIT:BTCUSDT.P BTCUSD.P

Bitcoin has respected the nPOC mentioned in my last video at $22100.

I talk about the scalp trades that are possible in this consolidation range and the larger areas of Support and resistance for Swing long and Swing Short trades

#BTC #Bitcoin

Not Financial Advice.

Paper trade before using real money!

Safe Trading and book those profits always!

Regards,

Shawn

Swing BTC daily 1D timeframe ₿BTC is in sideway from Feb 16th. We can see red high volume at zone 24785, but today I'm seeing the daily red candle close in valuable range so my plan is going to short it.

My plan is really simple. Price can move down to zone 22884 or 21405

22884 is really a strong support for now.

21405 zone will be the next support for BTC if buyers at 22884 zone could not protect their positions.

Let see how BTC goes :)

Happy trading guys :) B

EUR/USD 30M Swing trading 💶Plan 1 Green 🟢: Price has the potential to go up to zone 1.08862 and hit zone sellers, price move down to 1.08652.

Plan 2 Cam 🟠 : after touching zone Buyers and penetrating to go to zone 1.0845 - 1.0835.

Plan 3 ⬭ : Rejection Buy occurs at the red ellipse and the price moves up to 1.08539

They are all my vision and It is highly subjective because it is on big timeframe, so be careful guys! Happy trading :)

Ray

XAUUSD Prediction the price 🪙XAUUSD BIAS UP (Scalping trading timeframes 1m-5m-15m)

Plan 1 Pink: It's possible that the price sideway between 1928 - 1925 and it will move up to zone 1930 or 1934

Plan 2 Blue: The price crashes through zone buyers at 1924 and downwards at 1920. When the price comes to this second zone buyers which will move up to zone 1925 or 1930

Plan 3 Orange: 2 zones of buyers can not protect their positions and the price move down to 1916.5, then the Rejection buy happens at red elip - the price will move up to zone 1925 or 1930

These plans will help you having a good picture of market :) Have a great day traders!