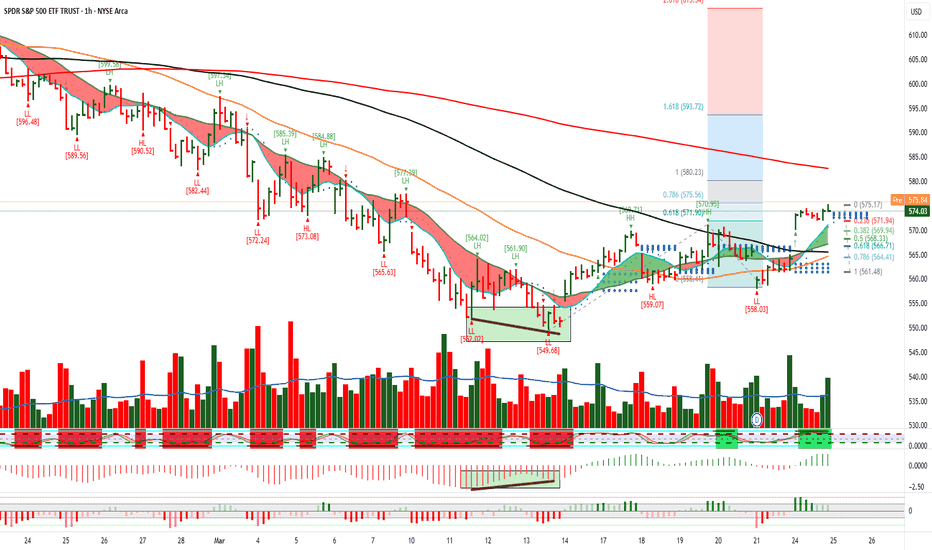

$SPY March 27, 2025AMEX:SPY March 27, 2025

15 Minutes.

AMEX:SPY struggling to move upwards as expected.

For the rise 561.48 to 576.42 it has retraced 61.8 levels to 567 levels.

Not it is taking support at 200 averages in 15 minutes

For the fall 576.33 to 567.92 570-571 is a good level to short for an initial target 565- 566 levels for the day.

Since below 200 in 5 minutes not a time to g long for the yet.

Oscillators

The 3 Steps System Called "The Rocket Booster Strategy"Yesterday I took a long walk and i thought about you.

Because I want to help you learn how to trade.

Look at this chart in order to find this chart I used the rocket booster strategy.

What is the rocket booster strategy?

Yesterday I took a long walk and i thought about you.

Because I want to help you learn how to trade.

Look at this chart in order to find this chart I used the rocket booster strategy.

What is the rocket booster strategy?

It has 3 Steps:

#1-Price has to be above the 50 EMA

#2-Price has to be above the 200 EMA

#3-Price has to Gap up

These shows you a strong uptrend on the week and on the day ratings.

Also considering the oscillator

Should give you a sell signal on your *New* TradingView screener.

But this has to be on a daily chart.

But one last step.

The MACD signal line (blue) Should be below the MACD level line (orange).

This gives you a red bar below the zero line.

If you don't understand this don't worry I will make video for you next time.

For now understanding the technical terms

Including the Rocket Booster Strategy is the key.

Learn more rocket boost this content

Disclaimer ⚠️ Trading is risky please learn Risk Management And Profit Taking Strategies. Also feel free to use a simulation trading account before you use real money.

Russell 2000 Futures: Bearish Reversal in Play?Russell 2000 futures may resume the bearish trend established earlier this year, trading below wedge support following the completion of an evening star reversal pattern on Wednesday.

Shorts could be established on the break with a stop above the former uptrend for protection. Support may be encountered around 2050, although 1994.8 looms as a more appropriate target for those seeking greater risk-reward.

RSI (14) has rolled over, while MACD remains negative despite grinding higher over the past fortnight, painting a picture of waning momentum that complements the bearish price signals.

If RTY were to reclaim the former uptrend, the bearish setup would be invalidated.

Good luck!

DS

ANKRUSDT: A Strong Demand Zone or Breakdown Risk?ANKRUSDT is currently sitting at a crucial demand zone, a level that has historically triggered massive price movements. This same area in February 2021 acted as a springboard for huge gains, leading to a double top formation at $0.21 before experiencing a major downtrend. Since August 2022, the price has been stuck in a sideways range, with no clear breakout in sight—until now.

Why This Demand Zone is Key

The weekly support level within the range has proven to be resilient, holding strong since 2021. Additionally, the Stochastic RSI is in oversold territory, signaling a potential loss of selling pressure. This setup suggests that buyers might step in soon, making this zone a prime accumulation area for long-term holders.

Best Buy Zone:

🔹 $0.015 - $0.022 → A historically strong support level, ideal for long-term positions.

Potential Targets:

📌 Short-Term Target: $0.057 - $0.066 (Top of the current range)

📌 Mid-Term Target: $0.097 (Potential supply zone)

📌 Long-Term Target: $0.21 (Previous all-time high)

Bearish Scenario: What If Support Breaks?

While the demand zone is strong, there's always a chance of a breakdown. If price fails to hold support, the next major demand zone lies at $0.008—a crucial level for long-term investors to watch.

Final Thoughts

✅ The setup is strong, with price at weekly support and indicators signaling a potential reversal.

⚠️ But always have a plan—if the demand zone breaks, be ready for lower levels.

💡 Risk management is key—stick to your strategy, and trade with confidence!

What’s your take on ANKR? Are you bullish or waiting for more confirmation? Let’s discuss in the comments! 🚀

Keep it shiny~!

KinaStar

GBPUSD Wave Analysis – 26 March 2025

- GBPUSD reversed from resistance area

- Likely to fall to support level 1.2800

GBPUSD recently reversed down from the resistance area between the resistance level 1.3035 (which has been reversing the price from October), resistance trendline of the daily up channel from January and the upper daily Bollinger Band.

The downward reversal from this resistance area created the daily Japanese candlesticks reversal pattern Evening Star which started the active wave 3.

GBPUSD can be expected to fall to the next support level 1.2800, the former monthly high from December.

Why I Think EURUSD Will Continue to Sell...Technical AnalysisHey Rich Friends,

I think EURUSD will continue to sell today and maybe this week. This is only my technical analysis, so please check the news and cross-reference the indicators you have on your chart. Here is what I am looking at:

- The market has rejected the most recent highs around 1.08610

- Bearish candles have picked up momentum in the last few hours

- Structure was broken on H1 and support was retested as resistance

- The STOCHASTIC is facing down, the orange line (slow) is on top of the blue line (fast), both have crossed below 50% and 80%

These are all bearish confirmations for me. I will set my SL at a previous high and use previous lows as my TPs. Good luck if you decide to take this trade. Let me know how it goes in the comments below.

Peace and Profits,

Cha

NVDA breaking supportSince June of last year NASDAQ:NVDA has been developing a $113 support level. Today we saw a retest of this level with strong momentum in accordance with a weakening market. I believe the Stock will break this level and continue down to its next significant support level at $96. Technically, the stock is bouncing off of a return to its 21 EMA below the 50 EMA which would have been the optimal entry point on this trade. Today also had a cross below the 14-day SMA in RSI. Finally, looking at the technical indicators provided by Trading View the stock is showing sell or neutral signals across all indicators except for 1.

GBPCAD Wave Analysis – 26 March 2025

- GBPCAD reversed from resistance zone

- Likely to fall to support level 1.8230

GBPCAD recently reversed down from the resistance zone between the resistance level 1.8625 resistance trendline of the weekly up channel from 2023 and the upper weekly Bollinger Band.

The downward reversal from this resistance zone created the weekly Shooting Star candlesticks reversal pattern – which started the active wave iv.

Given the strongly bearish sterling sentiment and the overbought weekly Stochastic, GBPCAD can be expected to fall to the next support level 1.8230.

Free Report #1:How To Build A Solid WatchlistFinding this chart pattern took about two days.

First i had to create a screener to find the momentum

then today i looked at the watch list.

While looking at the watchlist i tried to screen

for a candle stick pattern,

This candlestick pattern is called the lower long shadow.

It is part of another chart pattern called the frying pan

bottom.

This means the chart price has hit higher new low

as you can see from the drawing on the chart

that looks like a triangle

ALso remember that on this chart is

a technial analysis system called

the rocket booster strategy.

Check out the references to learn about this

strategy.

Also take note of one the best osicllators

in technical analysis called the MACD

look close you will see two lines Crossing

This is rare sight to behold

and this is why i have to document this

and share it with you as well

Trade safe.

Rocket boost this content to learn more

Disclaimer: Trading is risky please learn risk management

and profit taking strategies.Also feel free

to use a simulation trading account before you

trade with real money

Silver’s Bullish Breakout Raises Stakes for $34.24 RetestSilver delivered a monster bullish candle on Tuesday, completing a morning star pattern while smashing through wedge resistance that had capped gains earlier in the week. With RSI (14) setting higher lows and MACD on the verge of a bullish crossover, price and momentum signals suggest a growing risk of a retest of the March 18 high at $34.24.

Silver has a habit of gravitating toward round figures, making any pullback toward $33.50 a potential buying opportunity where longs could be established above with a stop beneath for protection. Resistance may emerge near $34, though $34.24 appears a more meaningful initial target. A break above that could encourage bulls to chase a move toward the October high of $34.87.

If silver reverses back beneath former wedge resistance and holds there, the bullish bias would be invalidated.

Good luck!

DS

FART/USDTSEED_WANDERIN_JIMZIP900:FART Cup and Handle on 1D chart! 🔥

✅ The cup is nicely rounded - a sign of bullish accumulation.

✅ Neckline around 0.5561-0.6119 (V-WVWAP) - price is hitting resistance here.

✅ Volume is increasing during the breakout attempt - which is a positive signal.

✅ Possible "eye" - price may correct back to support before further growth.

Targets:

🔹 Cup height measurement: Bottom around 0.3194, neckline 0.5561, gap ~0.2367.

🔹 Target level: 0.5561 + 0.2367 = ~0.7928 (possible bull target on patterning confirmation).

🔹 Fib levels may help - I see first resistance around 0.6176.

How to play it?

📌 Ideal entry: after a pullback to neckline (retest) or during a confirmed breakout with volume.

📌 Stop-loss: Below the last low of the neckline or below the neckline if it becomes support.

📌 Confirmation.

Overall, the pattern looks very bullish, but the reaction to 0.5561-0.6119 will be important. If it fails there, the ears may go lower.

HSI testing resistance levels —will it break through or bounced?25/03/2025

🚨🚨🚨

HSI resistance is being tested for short-term!

Investors tend to take profit towards quarter end.

HSI:HSI

MACD - Deadcross formed 20/3/2025.Resistance 24750-24600 level.

4H chart: PEPPERSTONE:HK50

at point of writing ✍️: the Index uptrend mode is paused and moving out of bound from the uptrend channel.

MACD : moving below zero line - Bearish mode.

KDJ: below 30 level in the bearish zone. Hopefully the divergence cycle completing soon for a strong reversal.

BB - ranging at lower BB; mid-line:23986 (this is your 🗝️ level for your long/short TP/SL level)

Set your TP/SL and let the markets works.

For this week trade plan: Most likely short the index for days to few weeks until get confirmation of trendline back to uptrend channel. Buy into support Sell at resistance. Set your TP/SL.

🚨 as of ✍️ :

Support/Resistance Levels :

22979

23030

23242(23374)

23526

23997

24385

24586

24648

24945

🗝️🗝️🗝️Level: 23526-23620

HSI continues its Bullish mode.

W Chart:-

17Mar2025 -

24Mar2025 -

📰 another -ve news, but this might be distraction. 🚨

www.tradingview.com

Shares in Hong Kong slumped 487 points or 2.0% to 23,417 on Tuesday morning, reversing gains from the prior session amid concerns over U.S. recession risks and China’s deflation threat.

www.tradingview.com

** Hong Kong's benchmark Hang Seng Index declined 2.2%, and the Hang Seng Tech Index

HSTECH lost 3.5%.

For current markets condition, the CHN & HKG can be volatile with the continuing noise from tariff.

🎯 Reminder: For long term (6-18 months) continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets. If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

Let's follow our own strategy and zen with 📙 and 🍵 for profits.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies.

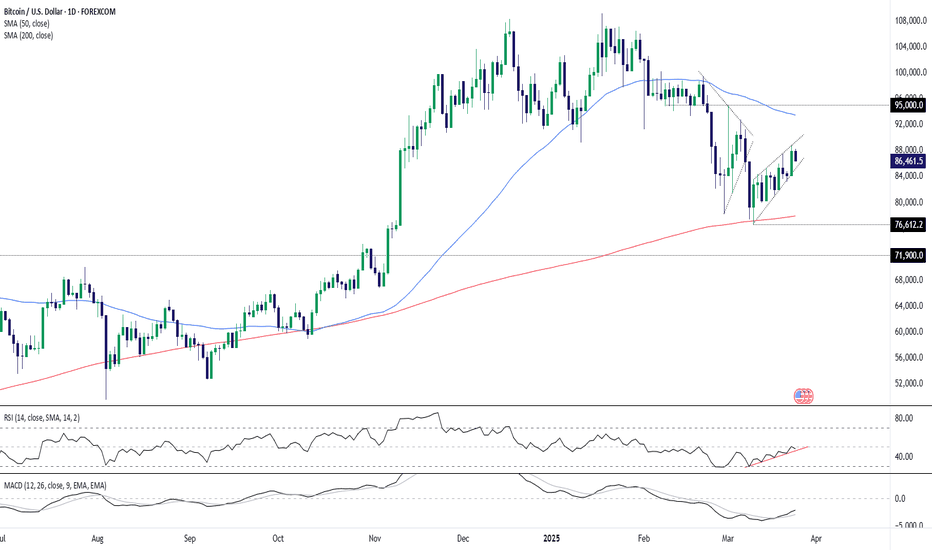

Bitcoin on Breakdown Alert as Rising Wedge FormsBitcoin traders should be alert to the risk of renewed downside with the price forming a rising wedge pattern that often signals weakness ahead. While it's holding for now, the narrowing range suggests price momentum is fading, increasing the risk of a breakdown.

If the signal proves accurate, traders could establish shorts beneath wedge support with a stop above for protection. The obvious target would be the key 200DMA where the price bounced strongly from on March 11.

RSI (14) and MACD are both grinding higher, reinforcing the need to see a bearish price signal first before considering the trade.

Good luck!

DS

TTD longNASDAQ:TTD long

(The Trade Desk, Inc. (TTD) is a technology company that provides a demand-side platform for digital advertising. Here's a quick overview:

1. Business: TTD specializes in programmatic advertising, using AI and data analytics to automate and optimize ad placements in real-time across various digital platforms.

2. Financial Performance:

- 2024 Revenue: $2.4 billion (26% year-over-year growth)

- Q4 2024 Revenue: $741 million (22% year-over-year growth)

3. Stock Performance:

- Current Price: $59.34 (as of March 24, 2025)

- Year-to-date performance: Down approximately 36%

4. Growth Drivers:

- Connected TV (CTV) advertising

- Shift to programmatic advertising

- Privacy-friendly advertising model

5. Challenges:

- Recent earnings miss and lower-than-expected Q1 2025 guidance

- Increased competition from major tech companies

- Economic slowdowns potentially impacting ad spending

6. Market Position:

- Leader in the demand-side platform (DSP) market

- Strong presence in CTV advertising

- No reliance on first-party data, unlike competitors like Google and Meta

Despite recent challenges, analysts remain generally bullish on TTD's long-term prospects in the growing digital advertising industry)

BTCUSD Golden Ratio Support + VWMA Buy Signal + SMC Order Block1️⃣ Fibonacci Golden Ratio (61.8%) Rejection:

Price is reacting at the golden ratio level.

Strong resistance zone → Possible reversal signal.

2️⃣ Volume-Weighted Moving Average (VWMA) → Light Sell Condition:

Price is struggling to hold above VWMA.

Momentum weakening, confirming bearish pressure.

3️⃣ Smart Money Concept (SMC) Order Block Above Price:

Liquidity grab above order block → Smart Money may push price lower.

Potential short setup with tight invalidation.

📉 Possible Trade Setup:

🔹 Short Entry: Near 61.8% Fib + VWMA confluence.

🔹 Stop-Loss: Above 78.6% Fib level or recent high.

🔹 Target: 50% or 23.6% Fib retracement levels for TP1 & TP2.

🔹 Extra Confirmation: Watch for bearish candle patterns (e.g., engulfing, pin bars).

ADAUSDT Flashing Bearish Signals – Is a Drop Incoming?Yello, Paradisers! Are we about to see a strong rejection on ADAUSDT? Let’s break it down.

💎ADAUSDT has filled the Fair Value Gap (FVG) and formed a double top with bearish divergence. Notably, the right top is slightly above the left, signaling a liquidity grab. Following this, we’ve seen a Change of Character (CHoCH) to the bearish side, increasing the probability of a downside move.

💎If ADAUSDT retraces from this level, it will strengthen a high-probability bearish setup from the 1-hour FVG, where the 0.5 Fibonacci level aligns—offering an attractive risk-to-reward (RR) opportunity for shorts.

💎However, if price breaks and closes above the 0.786 Fibonacci level, our bearish outlook will be invalidated. In that case, it would be best to step back and wait for stronger confirmation before taking action.

🎖 Patience and discipline win the game, Paradisers! Don’t chase—wait for the best setups and protect your capital like a pro.

MyCryptoParadise

iFeel the success🌴

‘Cagey’ Rebound on BTC/USD?Since BTC/USD (Bitcoin versus the US dollar) rebounded from the 200-day simple moving average (SMA) earlier this month at US$78,111, speculative bullish interest has been uninspiring.

Further Downside

As far as I can see, the major crypto pairing demonstrates scope to continue exploring south until it reaches support from US$68,926 on the monthly timeframe (I also noted this in previous analysis), which (somewhat) helps explain why technical demand from the 200-day SMA could be lacking.

Another technical observation supporting the lacklustre bullish showing is the Relative Strength Index (RSI), recently exiting overbought territory and fast approaching the neckline of a double-top pattern on the monthly chart, extended from the low of 60.44. A break beyond this line highlights the RSI’s 50.00 centreline threshold as a possible downside target. Adding to this, the RSI on the daily chart may have rebounded from oversold territory (forming a possible double-bottom), but remains south of 50.00 and is shaking hands with resistance around 45.46.

Monthly/Daily Support Area Warrants Attention

While I am not saying that a move to the upside won’t be seen, the path of least resistance appears to be to the downside, at least targeting space below the 200-day SMA at daily support from US$73,575. So, for me, the playbook here will be watching for possible fading opportunities at the underside of the daily range between US$108,396 and US$91,591 (which happens to converge closely with the 50-day SMA at US$93,608 and trendline resistance, extended from the all-time high of US$109.580). Alternatively, we could see price sell-off at current levels and aim for the noted daily support. It is this level, coupled with monthly support mentioned above at US$68,926, that I expect to see bulls attempt to make a show.

Written by FP Markets Market Analyst Aaron Hill

2/21/25 - DNA: new SELL mechanical trading signal.2/21/25 - DNA: new SELL signal chosen by a rules based, mechanical trading system.

DNA - SELL SHORT

Stop Loss @ 16.36

Entry SELL SHORT @ 10.82

Target Profit @ 6.98

Analysis:

Higher timeframe: Prices have stayed below the upper channel line of the ATR (Average True Range) Keltner Channel and reversed.

Higher timeframe: Victor Sperandeo's (Trader Vic) classic 1-2-3 SELL pattern...where the current highest top breakout price is less than the preceding top price.

Higher timeframe: Price peaked above the ATR (Average True Range) breakout high and then reversed.