CADCHF - Weekly outlookFollowing on from the Daily analysis I posted, this is the Weekly outlook.

We of course don't know what's going to happen, but it's always advisable to stay ahead of the market and prepare for as many eventualities as possible.

Option A

The red box is the PRZ on the Daily TF.

This falls short of the overall down trendline, but sits nicely in a strong Supply Zone on the Weekly TF.

Option B

This is where the decision point is likely to be made if we break the Lower Low on the Weekly TF.

Summary

Considering the strength of the bullish momentum on the way up, we've already taken out one Supply Zone (labelled 'i'). This is true to the characteristics of an advanced harmonic pattern (in this case a Daily bearish Bat formation). If we compare the strength of the buyers vs sellers at the PRZ, I'm expecting the trade to be successful, but anticipating some serious buying resistance.

Outlook

Year-end gold prediction: $970-$1030Technicals

This very strong trendline has been lasting for gold for some time now, and I don't expect it to stop, and it has just been touched, so this looks like a very good place to get in with a short position if you agree with this outlook (many will disagree!).

Disadvantages

The US economic data is currently not bad, but not great, and consumer spending most certainly isn't great. This suggests that the Fed may not reach, or get much closer to, their inflation target. This could result in backtracks on interest rates which will ultimately result in the price of gold increasing. In addition to this, the markets are pricing in a 13% chance of negative interest rates by 2017!

Advantages

Despite consumer spending data, I think that the Fed will continue to raise interest rates for the duration of the year. This is because labour statistics remain strong, and the US economy isn't in a poor enough state, in my opinion, for the Fed to halt their rate path.

I have tagged an alternative opinion from someone else below.

AUDUSD - Weekly outlook1) First of all we saw a break to the upside and retested the downtrend trendline, meanwhile respecting the CTL.

2) Breaking the CTL we retested the back of the downtrend trendline (2i)

3) We have since pulled back into previous structure which happens to be a 61.8% fib level and the back of the CTL. We have also formed a nice rejection candle which could be the first of the shooting star formation.

I think if we get the right conditions with the major news releases next week, we can expect this to fall to as low as 0.6500 with a few stop offs at 0.6800 and 0.6600.

EURUSD MAYBE LONG ON THE DAILY (NO TRADE TAKEN)Hello again,

Just doing some more analysis on another pair, this is what I think may happen as the FED will be increase their information on whether to keep or change interest rate in the next couple of days which may weaken the dollar.

Again I welcome any feedback good or bad as mentioned I am only testing my knowledge before I go LIVE trading.

Macro Outlook : Crude Oil vs Fed Funds RateHi Traders,

We are probably very close to a bottom in crude oil prices due to last hike on Fed Funds interest rates.

The charts shows certain correlation , not purely exact but it provides forward guidance, with the exceptional period of QE .

Technically it formed a channel that supports reversion to the mean

Not necessarily represents an inmediate rally in crude oil prices, but a consolidation period .

I hope it helps

Josep Pocalles

AUD/USD: Tradetostart WEEK 7 I am back with more analysis.

Use them how u want them to use, this is my opinion and my way of profitable trading. I don't recommend following people blindly.

U can find the other "tradetostart's" on my instagram : FXB_Buddy

Check it out! The link to my website is also on there.

CADJPY : Long OpportunityA confluence of Fibonacci and support line around a harmonic pattern spells a long opportunity. The price may try to reach a Fibonacci level of 127.2% at 85.76 but fail since it is seriously oversold. For those who can't wait for the formation to complete as indicated on the chart, wait for at least 87.5 to break set stop a few pips below 85.76

SYMMETRICAL TRIANGLE FORMATION ON USDJPY Price on the daily perspective has been capped within a symmetrical triangle for just over a month. Price is currently coming to the very end of the triangle and could potentially break to the upside or downside, giving two different scenarios for trading opportunity.

In the case of a break to the upside: it is ideal to wait for a break of the resistance level 120.75 for a confirmation to go long. Targets 123.75 and 123.5

In the case of a break to the downside: it is ideal to wait for a break of the support level 119 for confirmation of a short position. Targets - 116.5 and 116.25

GBPCAD OUTLOOK: BULLISH SHARK TO BEARISH 5-0 CONTINUATIONMy daily outlook on GBPCAD is bearish, but I see one more bounce occurring before bearish PA continues. A bullish shark will potentially be completing at point 4 in a parallel channel. Traders who are short this pair, like myself, may think about taking profit in the PRZ and re-entering after this move is completed. Alternatively, this may be traded as a scalp to grab the pips off the bounce of the bottom parallel. Either way, I expect this setup to produce short term bullish movement before the bearish 5-0 pattern continues to target. Short-term long targets are placed at the .382 and .618 retracements of the shark CD leg. When I re-enter short, I will take profit at either the 1-4 WW target line or the 1.272 5-0 projection, whichever target is hit first.

Overall Bearish Outlook:

Bullish Confluence in the PRZ:

1. Bullish shark pattern completion

2. Parallel channel support

3. 1.786AB=BC

4. 1.618BC projection

Thank you for viewing!

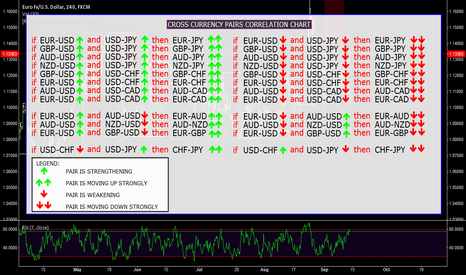

CROSS CURRENCY PAIRS CORRELATION - ADVANCED ANALYSIS Hi all, I wanted to share this chart with you - I am hoping it works when I publish it and the arrows stay inline with the text - something very interesting we all know about currencies moving in tandem with each other to some degree different economic events causing them to stop moving together but eventually they will again.

As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs correlation, because of two main reasons:

1- You avoid taking the same position with several correlated currency pairs at the same time and so you do not increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- If you know the currency pairs correlations, it may help you predict the direction and movement of a currency pair, through the signals that you see on the other correlated currency pairs.

If you would like more information describing the affects - reply with a short note and I will paste a URL

EURUSD If we take a look at the Monthly chartAs you can see EURUSD has 2 channels to play in on the monthly chart, wich means on lower timeframe charts it still has potential to touch the lowest monthly channel as seen in my 4Hr published idea.

If you look at my RSI in the past you see this similar bounces occure.

EURUSD might be heading slowly for a Monthly retracement move to the upside after wich it might reach a new bottom around 0.90 as it did in the past and if the bullish channel holds on the low, the EURUSD might come into a bullish stream.

Usd/JpyContext:

this pair is ranegbound with support @118.600 and resistance @120.400 ,

the actual rejection of res. brought us near support again but still price resulted in a higher low

the induced rallie however got rejected @120.140 and formed a lower high , we stay in this range till we left that

range for good ;) till then selling and buying at the extremes is ok,

signs of strenght:

support holds

higher low

signs of weakness:

resistance holds

lower high

Gbp/Usd Daily Market outlookContext:

after a strong rallie price broke a major supplyline, but found resistance @1.555x

the correction resulting in that , brought us near the 50% retracement of the rallie, where price

now makes another attempt to tackle the resistance level, price formed somewhat near the recent high

an indecsion but it resoloved itself to the upside , which is a sign of stenght, if price fails again to takeout the

resistance we may form a range with support @50280 and resistance @555x , however a break of @555x is also a

major sign of strenght returning to the market

signs of strenght:

rallie broke major supplyline

50% retracement holds

indecision resolved itself to the upside

signs of weakness:

resistance still holds

Aud/Usd Daily Market outlookContext:

After the strong rallie attempt we failed to takeout the recent high on a 2nd attempt (0.8070) and formed a lower high

price then retraced somewhat back to the broken resistance , which now holds some minor support, as we formed

a higher low, we nolw have evidence of indecision at hands, and the future course of the market will be decided on

how that indecision will resolve itself.. breakout to the upside or downside ?

signs of strenght:

strong rallie

broken resistance

resistance tunred support

signs of weakness:

Lower high

Indecision

Eur/Usd Daily Market outlookContext:

After a nice rallie , we rejected a former middlepoint @1.135x , price tunred down and broke a demandline

formed a indecsion and cleared it to the downside , we have found some minor support @1.1135 ,

if that level fails to hold we head back to test the broken resistance @10200

signs of strength:

uptrend

broken resistance

signs of weakness:

rejection of MP

broken demandline

series of lower highs and lows

EURUSD Elliott Wave Analysis. Flat Correction CompletedEURUSD has potentially completed the wave 5 of the Flat correction on the higher degree time frame which is Wave IV correction. What this means is that the down trend resumes for the EURUSD and would break the previous lows. USDOLLAR Index is also showing the same chart patterns of Expanded Flat correction giving confirmations. One can go short on this pair with stop loss and targets as shown on the chart. A great risk reward potential on this trade.

Please do your own analysis before taking any positions.

Happy Trading!!

GBP/USD: Brearish Outlook.GBP/USD Pair is looking bearish. That's why I still looking for short postion in this pair. 1.4980 - 1.5010 zone is behaive lika a strong resistance for this pair and 1.4850-1.4840 zone is behaive like as strong support for this pair. If break this pair I hope our next target is 1.4698 level, 1.46330 level and 1.44890 level. I hope this pair touch those level.

We can take short position between 1.4980-1.5010 zone and out stoploss is 1.5080 or 100 pips. Or we can take short positon after break this 1.4850-1.4840 zone and out stoploss is near swing high point or 50 pips. Lets see what's happen.

Best of luck and happy trading.

USD/CAD: Bullish OutlookIn H1 TF I found a nice Acending Triangle Pattern, if break this triangle, I think this pair may be go to 1.30 level which is very strong resistance. And this pair is also in uptrend mode. We looking for Long position after break this above resistance line of triangle or after retrece from this resistance line. And put stop loss near swing low point of this pair. Our profit target should be at 1.2950 - 1.30 Level.

If usd/cad pair did not break upper resistance line of triangle and return from this level we look for long positon near support line.

So, keep eyes on this pair. Best of luck.