Potential outside week and bearish potential for HCWEntry conditions:

(i) lower share price for ASX:HCW below the level of the potential outside week noted on 4th July (i.e.: below the level of $0.72).

Stop loss for the trade would be:

(i) above the high of the outside week on 30th June (i.e.: above $0.785), should the trade activate.

Outsideweek

Potential outside week and bullish potential for CNIEntry conditions:

(i) higher share price for ASX:CNI above the level of the potential outside week noted on 4th July (i.e.: above the level of $1.795).

Stop loss for the trade would be:

(i) below the low of the outside week on 30th June (i.e.: below $1.655), should the trade activate.

Potential outside week and bullish potential for CXOEntry conditions:

(i) higher share price for ASX:CXO above the level of the potential outside week noted on 27th June (i.e.: above the level of $0.1025).

Stop loss for the trade would be:

(i) below the low of the outside week on 20th June (i.e.: below $0.083), should the trade activate.

Potential outside week and bullish potential for PRNEntry conditions:

(i) higher share price for ASX:PRN above the level of the potential outside week noted on 2nd May (i.e.: above the level of $1.38).

Stop loss for the trade would be:

(i) below the low of the outside week on 28th April (i.e.: below $1.29), should the trade activate.

Potential outside week and bullish potential for CQREntry conditions:

(i) higher share price for ASX:CQR above the level of the potential outside week noted on 6th June (i.e.: above the level of $4.10).

Stop loss for the trade would be:

(i) below the low of the outside week on 2nd June (i.e.: below $3.91), should the trade activate.

Potential outside week and bullish potential for NEMEntry conditions:

(i) higher share price for ASX:NEM above the level of the potential outside week noted on 13th June (i.e.: above the level of $88.35).

Stop loss for the trade would be:

(i) below the low of the outside week on 11th June (i.e.: below $80.70), should the trade activate.

Potential outside week and bearish potential for TLXEntry conditions:

(i) lower share price for ASX:TLX below the level of the potential outside week noted on 2nd June (i.e.: below the level of $24.91).

Stop loss for the trade would be:

(i) above the high of the outside week on 5th June (i.e.: above $27.40), should the trade activate.

Important note for the trade:

- Observe market reaction at two key areas illustrated in the chart above, should the trade activate ($24.79 and $24.47), which could act as support against the short trade.

Potential outside week and bullish potential for KCNEntry conditions:

(i) higher share price for ASX:KCN above the level of the potential outside week noted on 2nd May (i.e.: above the level of $1.825).

Stop loss for the trade would be:

(i) below the low of the outside week on 28th April (i.e.: below $1.54), should the trade activate.

Potential outside week and bullish potential for SPREntry conditions:

(i) higher share price for ASX:SPR above the level of the potential outside week noted on 28th March (i.e.: above the level of $1.955).

Stop loss for the trade would be:

(i) below the low of the outside week on 25th March (i.e.: below $1.685), should the trade activate.

Potential outside week and bearish potential for CAREntry conditions:

(i) lower share price for ASX:CAR below the level of the potential outside week noted on 28th March (i.e.: $32.16).

Stop loss for the trade would be:

(i) above the swing high of 26th March (i.e.: above $34.05), should the trade activate.

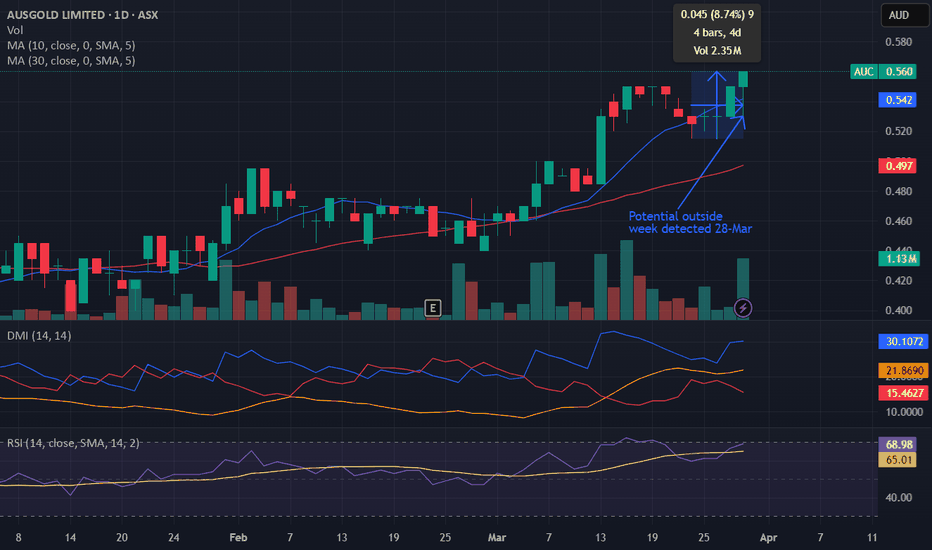

Potential outside week and bullish potential for AUCEntry conditions:

(i) higher share price for ASX:AUC above the level of the potential outside week noted on 28th March (i.e.: above the level of $0.56).

Stop loss for the trade would be:

(i) below the low of the outside week on 26th March (i.e.: below $0.515), should the trade activate.

Potential outside week and bullish potential for KAREntry conditions:

(i) higher share price for ASX:KAR above the level of the potential outside week noted on 14th March (i.e.: above the level of $1.595).

Stop loss for the trade would be:

(i) below the low of the outside week on 11th March (i.e.: below $1.465), should the trade activate.

Potential outside week and bullish potential for ADTEntry conditions:

(i) higher share price for ASX:ADT above the level of the potential outside week noted on 21st February (i.e.: above the level of $4.41).

Stop loss for the trade would be:

(i) below the low of the outside week on 19th February (i.e.: below $3.97), should the trade activate.

Potential outside week and bullish potential for GSNEntry conditions:

(i) higher share price for ASX:GSN above the level of the potential outside week noted on 21st February (i.e.: above the level of $0.024).

Stop loss for the trade would be:

(i) below the low of the outside week on 18th February (i.e.: below $0.020), should the trade activate.

Potential outside week and bearish potential for GYGEntry conditions:

(i) lower share price for ASX:GYG below the level of the potential outside week noted on 21st February (i.e.: $38.58).

Stop loss for the trade would be:

(i) above the swing high of 19th February (i.e.: above $45.99), should the trade activate.

Potential outside week and bullish potential for RMSEntry conditions:

(i) higher share price for ASX:RMS above the level of the potential outside week noted on 31st January (i.e.: above the level of $2.48).

Stop loss for the trade would be:

(i) below the low of the outside week on 28th January (i.e.: below $2.26), should the trade activate.

Potential outside week and bullish potential for OCCEntry conditions:

(i) higher share price for ASX:OCC above the level of the potential outside week noted on 23rd January (i.e.: above the level of $1.635).

Stop loss for the trade would be:

(i) below the low of the outside week on 20th January (i.e.: below $1.27), should the trade activate.

Potential outside week and bullish potential for AMIEntry conditions:

(i) higher share price for ASX:AMI above the level of the potential outside week noted on 30th/31st January (i.e.: above the level of $0.20).

Stop loss for the trade would be:

(i) below the low of the outside week on 29th January (i.e.: below $0.17), should the trade activate.

Potential outside week and bullish potential for AUZEntry conditions:

(i) higher share price for ASX:AUZ above the level of the potential outside week noted on 10th January (i.e.: above the level of $0.016).

Stop loss for the trade would be:

(i) below the low of the outside week on 7th January (i.e.: below $0.008), should the trade activate.

Potential outside week and bullish potential for PBHEntry conditions:

(i) higher share price for ASX:PBH above the level of the potential outside week noted on 20th December (i.e.: above the level of $1.045).

Stop loss for the trade would be:

(i) below the low of the outside week on 16th December (i.e.: below $0.925), should the trade activate.

Potential outside week and bullish potential for RSHEntry conditions:

(i) higher share price for ASX:RSH above the level of the potential outside week noted on 4th October (i.e.: above the level of $0.043).

Stop loss for the trade would be:

(i) below the swing low of 1st October (i.e.: below $0.033), should the trade activate.

Potential outside week and bullish potential for RRLEntry conditions:

(i) higher share price for ASX:RRL above the level of the potential outside week noted on 11th October (i.e.: above the level of $2.20).

Stop loss for the trade would be:

(i) below the swing low of 9th October (i.e.: below $2.00), should the trade activate.