Agilent looking for technology rallyMy models say the Fed cannot raise rates beyond 0.5 points tomorrow or they cannot be trusted in the future. We should see a quick rally to end this week and perhaps begin next week, before the reality of $6+ fuel prices set in again and we continue the bear market.

Based on historical movement, the trough could occur anywhere in the larger red box. The final targets are in the green boxes. The pending top should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated BUY on June 10, 2022 with a closing price of 121.62.

If this instance is successful, that means the stock should rise to at least 122.53 which is the bottom of the larger green box. Three-quarters of all successful signals have the stock rise 2.205% from the signal closing price. This percentage is the bottom of the smaller green box. Half of all successful signals have the stock rise 3.812% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock rise 6.56% from the signal closing price which is the top of the smaller green box. The maximum rise on record would see a move to the top of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The peak of the rise can occur as soon as the next trading bar after signal close, while the max rise occurs within the limit of study at 50 trading bars after the signal. A 0.4% rise must occur over the next 50 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 18 trading bars; half occur within 28 trading bars, and one-quarter require at least 38 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

Oversold

TXN to join quick tech rally?My models say the Fed cannot raise rates beyond 0.5 points tomorrow or they cannot be trusted in the future. We should see a quick rally to end this week and perhaps begin next week, before the reality of $6+ fuel prices set in again and we continue the bear market.

Based on historical movement, the trough could occur anywhere in the larger red box. The final targets are in the green boxes. The pending top should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated BUY on June 10, 2022 with a closing price of 159.445.

If this instance is successful, that means the stock should rise to at least 160.195 which is the bottom of the larger green box. Three-quarters of all successful signals have the stock rise 2.0335% from the signal closing price. This percentage is the bottom of the smaller green box. Half of all successful signals have the stock rise 3.732% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock rise 5.295% from the signal closing price which is the top of the smaller green box. The maximum rise on record would see a move to the top of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The peak of the rise can occur as soon as the next trading bar after signal close, while the max rise occurs within the limit of study at 50 trading bars after the signal. A 0.4% rise must occur over the next 50 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 17.0 trading bars; half occur within 31.5 trading bars, and one-quarter require at least 45.0 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

BTC Swing analyzehello friends.

hope u are good.

you can see in my chart that maybe we are in 4th wave

and we can grow till 50% retracement level (or maybe 38.2 or 61.8)

and after that we can fall.

also we can see the RSI trendline breaked up and it can be the buy signal.

we see a divergence between RSI and price that i show it in my chart with

orange circles.

we see the stoch momentum in oversold area.

hope u enjoy my analyze.if you like it plz support me.thanks

(this is not trading advise and you must trade in your own starategy friends.)

WSIENNAUSDT - OversoldThis one will be quick:

1) Look at the RSI. Self explanatory

2) Bollinger bands tightening sharply. Indicating imminent big move.

3) Last time it did 180% in 2 days. Enough said.

4) Project has great fundamentals

Careful with leverage here. Small position only (especially with this BTC volatility). Maybe wait until BTC stops capitulating.

Timeframe: Could be days (week(s) for the bigger targets)

Return: 0.4x - 3.3x (targets: 1.4, 2.4, 3.3)

Amount risked: 5-6% of funds

ETH - Oversold Zone!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

ETH is overall bearish trading inside the brown channel and now approaching the lower trendline acting as non-horizontal support.

Moreover, the green area is a demand zone and round number 1000.0

So the highlighted purple circle is a very strong area to look for buy setups as it is the intersection of demand in green and the lower brown trendline, which I also consider an oversold area.

As per my trading style:

I will be waiting for it to approach the highlighted purple circle (area) to look for possible buy setups (like a double bottom, trendline break, and so on...)

If you like the idea, do not forget to support with a like and follow.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

$BTC RSI is beautiful right now, let's see if the same happen?$BTC RSI is beautiful right now, let's see if the same happen?

You can see at the last cycle, it broke the RSI downtrend and slowly played around for a few weeks, then back up.

To me, because this current drop is so slow, because we are so oversold, and because other major indicators are showing a sign of reversal within the next month or so, we are close to the bottom.

Of course, anything can happen, but I think that $20,000 BTC will be held and protected.

ANYTHING CAN HAPPEN

DCA your position.

the 4 hr is at critical .5 level and oversold stochfib of bounce gives us about 50% retracement if there is some recovery to tighten in range we could look back up at 22.23-22.48 setting a daily higher low if market decides to gap up friday. if vwma keeps rising and trama flattens out we will have a bounce in semis. if these indicators keep bearish divergence we are likely continuing lower in broader markets. $23 is still a critical level for this trade. $20.96 is the next level if we continue this pop down. semis started this correction only they can get it out.

Riot Blockchain solidified support for a move to the Upside.Riot Blockchain has been overlooked over the last few months. As Clearly seen on the chart, the correlation to Bitcoin's movements is closely correlated.

> I Believe that an ascending support line has been tested multiple times but both Riot Blockchain and Bitcoin.

> With the momentum driven by earnings season in the stock market providing significant upside potential for all equities, especially in the Tech Space.

> Combined with Bitcoin's Recent strong upwards momentum from yet another confirmation of strong support.

> We are likely to see a rapid rise in the price of Riot over the next few weeks. I think this is an ideal range to DCA at the lowest risk level we have seen Riot Blockchain range in for a significant time.

1) Be greedy when others are fearful.

2) If you believe in a Companies business and promising future outlook. Don't let a discount be the reason NOT the DCA in lower to a stock you believe will be significantly higher in the long term.

3) The fundamentals are one, if not the strongest in the mining business. With huge mining capacity coming online over the next few months.

>>> Eyes on the Medium to Long Term Chap <<<

Just one Long term focused Investor/Traders Opinion, not financial advice.

pop, pop, fizz, fizz-- no more yield curve inversioni think this is headed for a terminal thrust or wave 5, and abc will correct on some support in the given lower ranges TLT. after seein all time highs, i believe the 10 year will fade if it enters weekly consolidation, and fails some break out level forming a false breakout of upper 90% range. TLT is on watch for bullish divergence macd, stoch, rsi monthly

Soooooooo... CONTINUATION?! Or nah...I think everythings gonna keep moving the same way! I mean, AJ might've roc'd me a bit but that 200pip move on gold was saucy! EU did me som justice too. They also BLEW TF UP AGAIN! But, its not about trading all the time, its about trading well often ;)

So with that being said, make it do what it do my trading family!! Happy trading <3

Bitcoin short-term view - RSI oversold - recovery likelyBitcoin short-term view - RSI oversold - recovery likely

Since the volume level $30.630 was ignored the last two times I am pretty sure price will remember and a likely correction might get there.

Would mean a touch of the SMA200 as well.

Another downside move can find support at $28.728.

What do you think dear Crypto Nation?

Drop me a nice comment.

*not financial advice

do your own research before investing

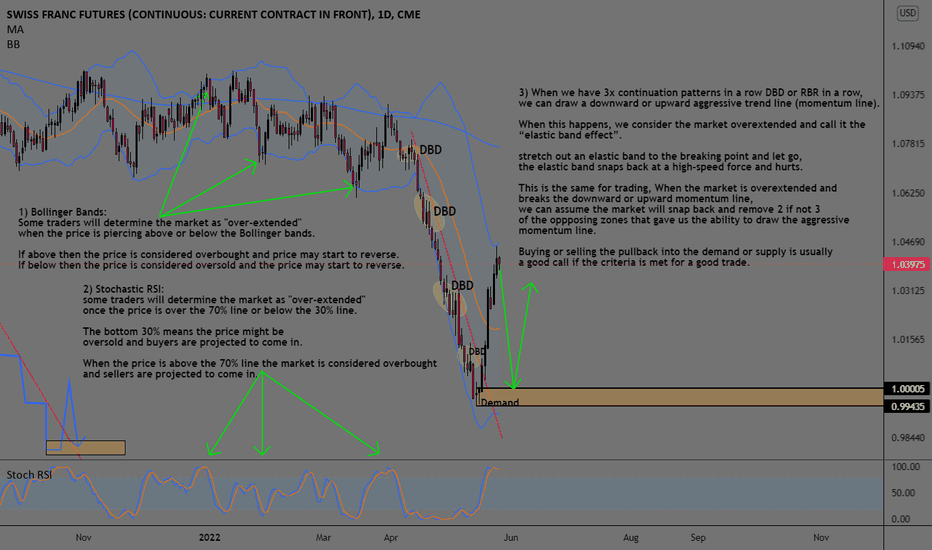

Overextended Markets (Overbought And Oversold)1) Bollinger Bands:

Some traders will determine the market as "over-extended"

when the price is piercing above or below the Bollinger bands.

If above then the price is considered overbought and price may start to reverse.

If below then the price is considered oversold and the price may start to reverse.

2) Stochastic RSI:

some traders will determine the market as "over-extended" once the price is over the 70% line or below the 30% line.

The bottom 30% means the price might be oversold and buyers are projected to come in.

When the price is above the 70% line the market is considered overbought and sellers are projected to come in.

3) Supply And demand

When we have 3x continuation patterns in a row DBD or RBR in a row, we can draw a downward or upward aggressive trend line (momentum line).

When this happens, we consider the market overextended and call it the “elastic band effect”.

stretch out an elastic band to the breaking point and let go, the elastic band snaps back at a high-speed force and hurts.

This is the same for trading, When the market is overextended and breaks the downward or upward momentum line, we can assume the market will snap back and remove 2 if not 3 of the opposing zones that gave us the ability to draw the aggressive momentum line.

Buying or selling the pullback into the demand or supply is usually a good call if the criteria are met for a good trade.

BTC weekly, want to see the truth? here it is!I want people to look clearly at this example of RSI!

Every time BTC RSI has been between 33 and 28

look at the bullish move it has made...Im very sick

and tired of seeing professional traders and chartest

totally bypass what this chart is presenting to us...

Dont we use indicators for a reason? Lets say the

TWATTER and all the influencers were not crying

FEAR to everyone?... would the sentiment be different?

I believe so...the RELATIVE STRENGTH INDEX (RSI)

is and always will be king when assets are overbought,

or oversold...BTC has never been lower than 28

and the was back in 2015...if you look at where it

is now, it actually appears to be curling back bullish

on the weekly. The weekly shows us truths about

any asset on a chart...I believe we could dip a bit more,

$28k, then $24k, $20k and then $18k, worst $10k-$13k

but that would be worse case scenario but im in the

camp that regardless, in the next 300 days, we will get passed

all time highs again. If you see the % gains, every time

its bounced, it surpassed the previous %...Im looking

at $80k-$240k levels when this passes 365 days

if this data stands correct. The FEAR meter is low teens...

lets give a breather and know why we look at charts.

BNBUSDT - Short Term AnalysisCHART PATTERN:

The pair appear to be creating an ascending triangle and be prone to a new downturn. We will likely see BNB try the 312 level once more before having any kind of breakthrough.

OSCILLATORS:

Stochastic and RSI are rapidly approaching oversold areas hinting a possible an upward rally in the next few hours/days.

LIKELY SCENARIOS:

- OPTIMISTIC - If the new attempt at 312 level will be successful BNB is likely to rally to 337 level before encountering resistance. Likely if BTC or ETH will soon start to gain traction.

- PESSIMISTIC - If BNB will be rejected we will likely see a pretty huge dump to 267. Likely if new news about regulation and oversight will appear in the immediate future

- INDECISIVE - Both the chart and the market in this period are very undecisive so there is also a non small chance that the pair will keep trading between 312 and 267 while the market in general decide its direction. Likely if nothing major happens and the market just keep idling in the wait of a sign.

A long-overdue small-cap reboundThe small-cap Russell 2000 Index has been the underdog among the four major US indices since last year. Its post-pandemic rally halted in early 2021, and subsequently, it went sideways for more than a year without making new highs. Meanwhile, the tech darlings continued to go north all the way until the beginning of this year.

The first half of 2022 has been marked by widespread risk-off sentiment and a precipitous drop in the US equity market. After being down almost 30% from the high, we now find the Russell 2000 Index at significant technical support levels that we believe a meaningful rebound will likely ensue.

The Index has bounced right at the 50% Fibonacci retracement level near 1700. We also observed bullish RSI Divergence where price made lower lows, but RSI showed higher lows, suggesting the bearish momentum is waning and at the cusp of a reversal.

Entry at 1806, stop above 1680. Targets are 1880 and 2100.

Disclaimer:

The contents in this idea are intended for information purposes only and do not constitute investment recommendations or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.

AUDUSD DAILY:TARGET 0.6987 DONE,OVERSOLD BUT STILL TARGET 0.6776AUDUSD broke below 0.7134 and hit 0.6987 target.

As I said in previous outlook, "Break below 0.7134 potentially target 0.7086 & 0.6987."

AUDUSD hit low at 0.6829. Now, AUDUSD rebound and regain 0.6987.

There is stiil possibility for a move toward 0.7086,

Next resistance at 0.7134, 0.7165 & 0.7266 (former support).

Break above 0.7458 would open the way to retest 0.7555, 0.7616 & 0.7662.

Anyway, while below 0.7266 still bearish.

Break Below 0.6829, bearish continue with target toward 0.6776 & 0.6685.

BTC daily is way OVERSOLD?BTC daily chart has now fell into the biggest area of

support to stay on track for a nice retracement up to

the Golden Pocket Zone. IF BTC falls, these are the

areas of support. But look at the RSI...look at the circles

I drew up...Every time BTC RSI was OVERSOLD in the Black area,

the price made a nice move up. History should repeat itself, right?,

take a look on the RSI from the last 2 years, same

exact scenario.

Unless another black swan event happens, I see a

high probability, BTC grinds its way back into the Golden Pocket Zones..

If not, the support zones are listed...The RSI

and the

DeMark 9 indicator is whats showing we hit a bottom...

all we can do is analyze it like this.

AMD Bullish outperform on the Horizon? Higher Actual Earnings?!?AMD has a History of outperforming Earnings Estimates. I believe this provides Stark Fundamentals, in order to support the TA Case for a reversal to the upside:

> Q1 2021 18% higher than expected

> Q2 2021 16% higher than expected

> Q3 2021 9% higher than expected

> Q4 2021 21% higher than expected

With the above earnings in mind. The last 4 Quarterly reports provided an average of 16% out performance for Actual over Estimated earnings.

I have become very Bullish on the Fundamentals of AMD. A company in which, I and other already consider to have stronger Financials that Nvidia. (Also bullish on NVIDIA - just more for AMD)

Even with the "Ukrainian Heroic Freedom War" effect on the companies earnings, I would expect a slight out performance to repeat.

>>I have all the earnings dates laid out with the Vertical lines<<

Technical Analysis

I believe that the Green Horizontal line, which has been substantial resistance, support, resistance and now Support. Will be the foundation for a reversal to the upside. The Tech Sector, more particularly AMD, is at one if not the most Oversold level(s) in the companies History. One must only look at the distance from the Moving Averages to see this. My Quantitative models have highlighted this as one the three most attractive equities at present on My Radar.

>>Alongside Riot Blockchain and Netflix<<

In my opinion, AMD is the most attractive from a combined Fundamentals and Technical Analysis Evaluation.

Having DCA over yesterday and today into AMD. I believe a significant short to mid term rally to the $130 range is possible.

> Supported by a bounce from the general market being oversold.

> Tax season selling finished.

> Rate hike news already over priced in the market. (Strong belief that most (not all) of the rate hikes are being used as a stick waved to slow the market and economy. Rather than a tool that will be used to brutally beat the economy into recession)

> AMD being significantly more oversold than the greater market.

> Long term pricing models, factoring earnings and industry growth would suggest a significantly higher price in the coming weeks/months.

>>Finally, don't lever up and keep some dry powder always<<

>>Keep the Long term in mind Chaps<<

This is my own opinions, analysis and a trade I am currently undertaking in my portfolios. This is not Financial advice purely my own Analysis and Research.

Will be sharing the TA modelled charts over the coming Days for those interested.

BITCOIN LONG @29.xxx$ ? BTC LONGOne could roll the dice on Bitcoin, once we hit that support zone between 30k and around 28.5k and speculate on a reflex rallye. Trade setup TP is put on the .50 fibonacci retrace of the last mark down. Would be a decent reflex rallye. Stop below 28.5k support and pull the stop on entry once bitcoin shows some bullish momentum to be safe to the downside.