Cisco Momentum Trade on volume impetus (Range)Reasons for entering trade:

LOCATION: Double bottom forming off of .618, not yet confirmed.

Price currently between .618 and .786 from fib off of breakout and uptrend from 2017.

MACD: Triple bullish Divergence (Market Structure in MACD)

WILLY: Coming out of oversold (Market Structure in Willy)

VOLUME: Green bar Impetus

Notch in volume profile needs to be filled

Huge gap needs price discovery

At POC for support.

Cons:

No moving average convergence

Would like to see price action form W at a little lower level between most recent .618 and .786

Fundamentally:

Cisco is a leader in video conferencing, strong fundamentally against a backdrop of Covid isolation and quarantine. Unfortunately, lots of other very significant events happening in the US and globally that could disrupt and invalidate any TA.

Trade: R/R 6.4:1 NASDAQ:CSCO

Front run the double bottom formation and enter trade off of .618 @ $38.74. Set stop just below bottom of potential W formation at $37.44. Sell order at $45.79 for the whole position at a fill of the notch, a revisit to the gap, and a touch of volume high on volume profile.

*Not trade advice, for entertainment purposes only. DYOR

Oversold

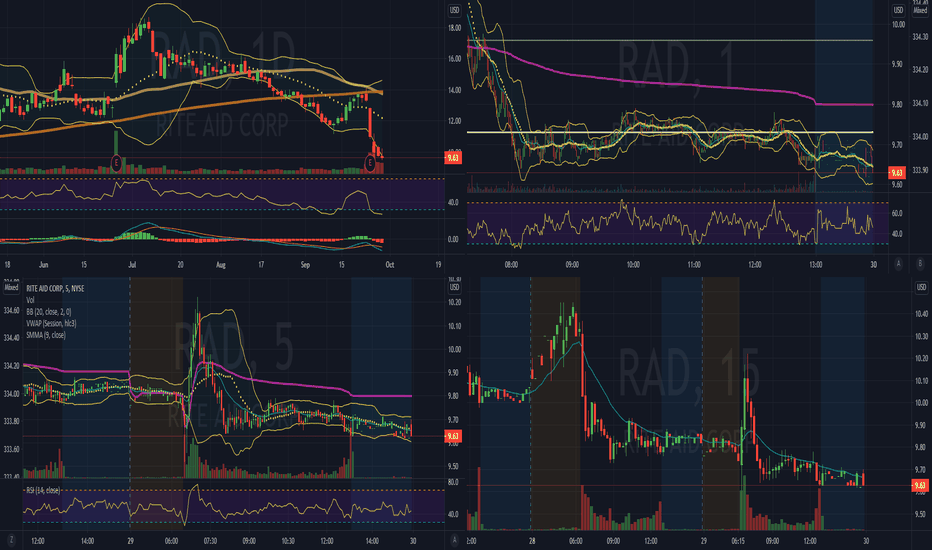

Good time to accumulate Rite Aid $RAD? Rite Aid got double whammed last week. First with terrible earnings and the next day with a downgrade. The stock has traded the last three sessions with a floor around $9.60s. At open at the stock flushed and quickly hit the high from yesterday before selling off. If you are one for a long, I would hold RAD for a $11 move within the next week. At this price level which we saw in the March lows, we should start to see a recovery this week. I bought a bunch of $11 Calls for the end of November.

Relative Strength Index Masterclass Part 1Relative Strenght Index(RSI)

RSI is a momentum oscillator, whereas the momentum is the rate of the rise or fall in price.

RSI is an oscillator ranging between two extremes, in the case of RSI, it ranges from 0 to 100.

The relative strength index is computed with: RSI = 100RS/(1+RS); where RS is relative strength.

RS= (Previous Average gain*13+Current gain)/(Previous Average loss*13+Current loss)

Relative Strength is a ratio of a stock price performance to a market average (index) performance.

RSI will rise as the number and size of positive close increases and will fall as the number and size of losses increase.

There are two terminologies for RSI:

Lookback period: The time frame that is used to calculate the relative strength, by default it is 14. A look-back period greater than 14 will give a smoother RSI signal while less than 14 will give a rough volatile RSI signal

Threshold Frequency: The oversold-overbought value ranges are the threshold frequency, default is 70-30 (which depend on various factors reasons such as risk factor), for eg. 80-20(less risk) and 66-33 (more risk)

RSI touching the overbought condition is a bearish sign (prices are likely to go down) while RSI attaining oversold condition is a bullish sign (prices are likely to increase)

There are many ways of using RSI as an indicator

Oversold-Overbought Region :

Oversold Region - The situation at which a lot of selling has happened and everyone who was willing to sell has sold, RSI value less than 30

Overbought Region - The situation at which a lot of buying has happened and everyone who was willing to buy has bought, RSI value greater than 70

In this, we have default values for the lookback period(14) and threshold frequency(70-30) which you can change according to your requirement and risk management.

A look-back period of more than 14 would be more interested in long term trend while less than 14 would be inclined towards short term trades. The look-back period can also be increased to smoothen out the RSI line.

A threshold of 80-20 (more-safer) or 66-33 (more-riskier) can be taken into consideration.

A Buy signal will be generated when RSI is less than 30 i.e. the oversold region while a Sell signal will be generated when RSI is greater than 70 i.e. overbought region.

50-Level RSI Midline

The overbought-oversold condition helps detect sudden changes in the momentum of price without providing much information about the overall trend of the market, therefore using the overbought-oversold strategy without getting information on the overall trend could be a bit risky.

Thus we use RSI with different timeframes and the threshold for trend information as well as signal generation.

In this we will have two different RSI:

A RSI with the look-back period of 20-days and 50-50 frequency, also called midline RSI. In an uptrend, this RSI is above 50 and below 50 for a downtrend.

A RSI with the look-back period of 5-days and 66-33 frequency, the look-back period is sufficiently low so that in a predominant trend, local maxima or minima can be used for generating buy or sell signal with the small look-back period RSI ensuring the signal is reactive to current price fluctuations.

Thereby, an uptrend is signaled if 20-RSI is greater than 50, with the buy signal being generated in the uptrend with 5-RSI in the oversold region while a downtrend is signaled if 20-RSI is less than 50, with the sell signal being generated in the downtrend with 5-RSI in the overbought region.

A buy signal is generated when 20-RSI is greater than 50 and 5-RSI is less than 33 while a sell signal is generated when 20-RSI is less than 50 and 5-RSI is greater than 66.

A lot more interesting things can be done using RSI, about which we'll be talking in the next Masterclass on RSI, STAY TUNED!

----------------------------------------------------------------------------------------

Your questions and comments are most welcome.

If you find the post useful, please like, share, and follow to make sure that you get more information once I publish it.

- Mudrex

GOLD is going down!Gold is looking bad if you selected this asset as a short term investment plan. Based on the technical analysis the asset passed the crucial mark of $1900 with good volume and very aggressive selling.

On the hourly timeframe the RSI indicator started to show some divergence. As a result, we expect the asset to retrace back. The maximum retracement that we expect is the area of 0.38 - 0.5 Fibbamnacii level. This will be the area of $1900 and will re-check this level as new resistance.

At the same time, it is possible to have a very small retracement or no retracement at all and the continuation of the downward trend towards the area of $1811. This is the level of July's Point of Control. If this will happen then such action will most likely create the divergence on the 4H RSI and may create a nice point for the short term long position.

Best of luck with your trading!

MRNA - THE CEO THAT SOLD - SHARE YOUR FEEDBACKPLEASE READ THE ENTIRE POST, IT MIGHT JUST SAVE YOU A SOUR INVESTMENT

I have been following MRNA for about a month now, and something interesting has happened that not many people know about.

On 4 September, news came out that the CMO, the President AND the CEO have sold large if not all of their holdings.*

Now the company says that this is no reason to panic. (sounds like what we were told about corona in December...)

On the trading platform I use, I have also gotten a notification about insiders selling. This is a built in strategy used along with others to determine the market consensus of the stock (buy, strong buy, hold etc)

We can all probably agree that when head management sell most of their holdings, and not 1 person but 3 senior members, it is generally not a good sign.

Now here is where I'd like your feedback - The large selling off their stocks hasn't been reflecting in the market. In fact, MRNA has been on one long bull run with minor short term bearish chart patterns.

Why would it be that the sell off doesn't reflect in the market?

I personally sold my stock immediately after I saw a report on this from Gurufinder, later confirmed by more mainstream news and other platforms. My opinion is that The company has to portray that they believe their stocks are going all the way up which in this case, selling off massive holdings at the peak tells me that they are taking their profit. Compare this to PFE (Pfizer), whos director INCREASED his holdings. Now that speaks of confidence in the company, right?

* INFO FROM MY TRADING PLATFORM

CEO, SOLD $1,293,810, DATE 18.09.20

PRESIDENT, SOLD $1,228,468, DATE 15.09.20

CMO, SOLD $1,255,321, DATE 15.09.20

Please share your constructive and respectful feedback, and thank you !

Hit like if you found this interesting,

Ev

$BTC Still expecting 11.2-11.4s before actually breaking downI dont see any reason to be super bearish here. Yes we have sell signals from 4h-9h.

Short scalps are safe but I am still holding ontop my swing longs from 98/99 until we get to atleast 11.2-11.4 zone. The black area that is highlighted has not been tested yet. Usually $BTC likes to retest areas that it previously break down from before breaking into a new range.

Conclusion. I am scalping shorts but looking to fill more longs on the way do wn. I think 10.7s will provide a generous bounce back up.

Follow me for updates on bitcoins move. I will be releasing youtube content shortly explaining how I scalp with the indicators!

SU SUNCOR OVERSOLDSU SUNCOR is oversold, and I'm using 3 indicators to confirm that.

The reasons why I bought now:

Warren Buffett added SU

George Sorros added SU

and lastly, because it is oversold.

It is also a common consensus that this company will flourish if JB wins the US election.

Happy trading and hit like if you found this useful and helpful.

Thanks, E

GSW hammered & oversold GSW is just another one junk stock with a bright future one may say.

Anyway, due to not so great financials, but very nicely hammered price value and oversold lvl my play is Buy, with a SL in a range of .33 and TP .56

LONG GBP/NZD.LONG GBP/NZD, ***IF there is a clear rejection around the current level. The market reached the 1,91500 monthly key level (psychological level), it is also on a the bottom of a uptrend channel dated from October 3 2016 and the market is starting to be oversold (seen on the RSI). IMPORTANT : I am only showing an analysis on one of the many timeframes that I use.

Oversold looking to move higher after breaking symmetrical wedgeAfter an inside week, EA was on my watchlist this past week and unfortunately fell out of the symmetrical wedge as the market pulled back. Short of a catalyst the low volume was not enough to propel it upward. Closing at just over $130 it seems to have found support from the lowest fib, and with oversold conditions nearly <20 SlowStoch an aggressive and safe entry is provided at the fib levels shown. Most conservative entry would be on a break of the .786 fib with first target above.

ETH 1h Chart Buy signal

Update from my last post we could be going slightly more down but to me perfect buy signal in Eth right under $400 like i said Earlier when it was at $407 i wasnt getting a buy signal from it just yet at that price

Sell Signal on the hourly we are waiting to see a 60 or higher on the RSI

Trade smart

GBPCHF, Potential BUY: Oversold zoneGBPCHF it's on an Oversold zone , and it is on a perfect BUY position. Look at the red zones I marked. On the 2nd red zone (the most intense one), the price couldn't pass downside, leaving A LOT of wicks (demand signal). Take profit on 61.8% of a Fibonacci Retracement.