JP225 Long Trap or Bull Escape? Heist in Motion.🦹♂️🎯 JP225 Ninja Heist: Breakout Loot Plan 💥💰 (Long Game Playbook)

🌟Hi! Hola! Ola! Bonjour! Hallo! Assallamu Allaikum!🌟

Dear Money Makers, Market Raiders & Silent Robbers, 🤑💰💸✈️

It’s time to gear up for the ultimate breakout heist on the JP225 / NIKKEI Index CFD Market. Based on my 🔥Thief Trading style🔥—a mix of slick technical strategy and deep fundamental recon—this operation is primed for a bullish break-in.

🧠 Plan of Attack:

Our team is targeting a long-side entry only, aiming to loot the market before it hits the Electric Trap Resistance Zone ⚡—a known danger zone where big bears lie in wait. Let’s outsmart them!

🚪 Entry Plan – The Door to Gold

📈 "The heist is on once we crack that resistance vault!"

📍Trigger: Wait for candle close above 40,100 – that's your breakout cue.

🧲Pullback Setup: Place Buy Limit near recent swing low on the 15/30 min timeframe, or stack multiple DCA-style orders to scale in silently.

🔔 Don’t forget to set alerts—you snooze, you lose.

🛡️ Stop Loss – Don’t Get Caught

🛑 "Keep your escape plan ready, always!"

📍Preferred SL: Recent swing low on 4H timeframe @ 39,500

🎯 Adjust based on your risk level and lot sizing.

🧠 Smart robbers move stop loss only after breakout confirmation—don’t let hesitation cost you your cut.

🎯 Profit Target – Secure the Bag

🏴☠️ Escape Plan: Aim for 41,200 or bail early if the scene gets messy.

Use trailing SLs to protect your stash.

Scalpers, only play long side. Let the swing traders set the traps while you slice the pie.

📊 Why This Trade Works:

JP225 is currently fueled by:

🔼 Strong bullish momentum

🔍 Technical breakout setup

💹 Fundamental backdrop: macro trends, institutional flow, COT report, and global sentiment lining up like guards on break

🗞️ Want more intel? Check out the broaderr macroeconomic, sentiment, and positioning insights 🔗🔗🔗

⚠️ Risk Management Alert:

📰 During news hours, don’t act greedy.

❌ Avoid entries near big news drops.

✅ Use trailing SLs to protect profits from volatility whiplash.

❤️ Robbery Crew Boost Request

💥Hit that Boost if this plan helps you grab the market loot!

Let’s grow our Thief Trading Army together—every trader deserves a smooth escape and a fat wallet 🏆💪💸

📌 Disclaimer: This is not financial advice. Just a masterplan from a fellow market raider. Adapt your risk and strategy based on your own style. Markets can flip faster than you can say “bank run”—stay updated, stay sharp, and stay stealthy. 🕶️

🎭 See you at the next heist.

Community ideas

USD/CAD Institutional Buy Zone – Thief Trading Alert!🔥 USD/CAD "LOONIE BANK HEIST" 🔥 – THIEF TRADING STYLE (BULLISH SNIPER PLAN)

💸 ATTENTION: Market Robbers & Profit Pirates!

"Steal Like a Pro – Escape Before the Cops Arrive!"

🎯 MASTER TRADE PLAN (Based on Thief Trading Tactics):

Entry Zone (Pullback Heist):

📌 Pullback-1: Market Maker Trap Zone (1.35400+) – Wait for retest!

📌 Pullback-2: Institutional Buy Zone (1.33500+) – Confirm bullish momentum!

"Patience = Perfect Heist Timing. Don’t rush—ambush the trend!"

🎯 Profit Target: 1.38100 (or escape earlier if momentum fades).

🛑 Stop Loss (Escape Route): Nearest 4H Swing Low (wick/close) – Adjust based on risk & lot size!

🚨 SCALPERS’ WARNING:

"Only snipe LONG! Big pockets? Strike now. Small stack? Join swing robbers & trail your SL!"

📉 WHY THIS HEIST? (Bullish Triggers):

Technical + Fundamental alignment (COT, Macro, Sentiment).

Overbought but institutional demand holding strong.

"Bears are trapped—time to rob their stops!"

⚠️ CRITICAL ALERT:

News = Volatility = Police Ambush!

Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits before reversals.

💥 BOOST THIS HEIST!

"Hit 👍, 🔔 Follow, and 🚀 Boost to fuel our next robbery! Let’s drain the banks together!"

🔮 NEXT HEIST COMING SOON… Stay tuned, partner! 🎭💰

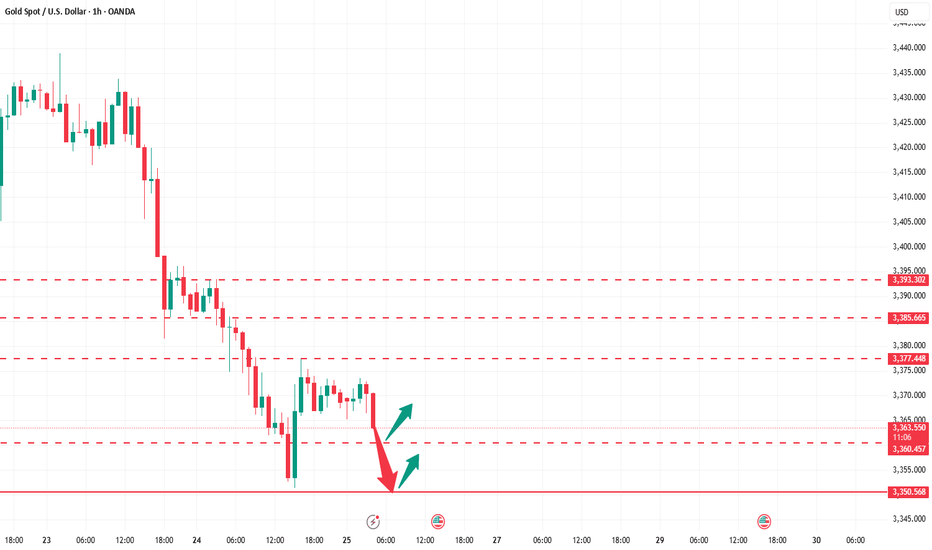

How can we seize the golden opportunity steadily and accurately?Yesterday, gold showed a trend of falling first and then rising to bottom out and rebound. After falling back to 3351, it quickly rebounded to around 3377. The overall fluctuation rhythm was highly consistent with our prediction. We accurately grasped the opportunity to arrange long orders and promptly notified the high position to reduce positions and make profits. The rhythm was properly controlled and we gained good returns.

From a technical point of view, the four-hour line fell and rebounded, and the short-term short momentum slowed down. Although it has not completely turned into a long structure, the short trend is no longer valid. At this stage, we will not look at new lows for the time being, and the operation is mainly based on the main long idea. At the daily level, pay attention to the long-short watershed of 3385. If it breaks through this level, it is expected to open up the upward space and look to 3392 or even above 3400; if it does not break, the market may continue the shock and wash pattern. Pay attention to the support below around 3365-3350. As long as it does not break and stabilizes, you can still choose to arrange low and long positions. In the short term, pay attention to the breakthrough of the rebound high point 3377. If it successfully stands firm, it will further enhance the continuity of the long position.

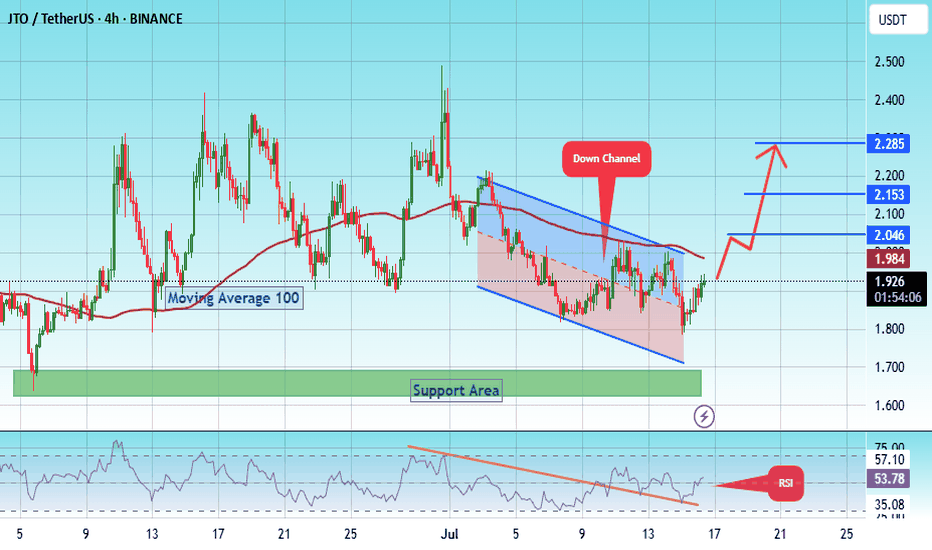

#JTO/USDT Forming Bullish Wave #JTO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 1.73.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.65, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.92.

First target: 2.046.

Second target: 2.15.

Third target: 2.28.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

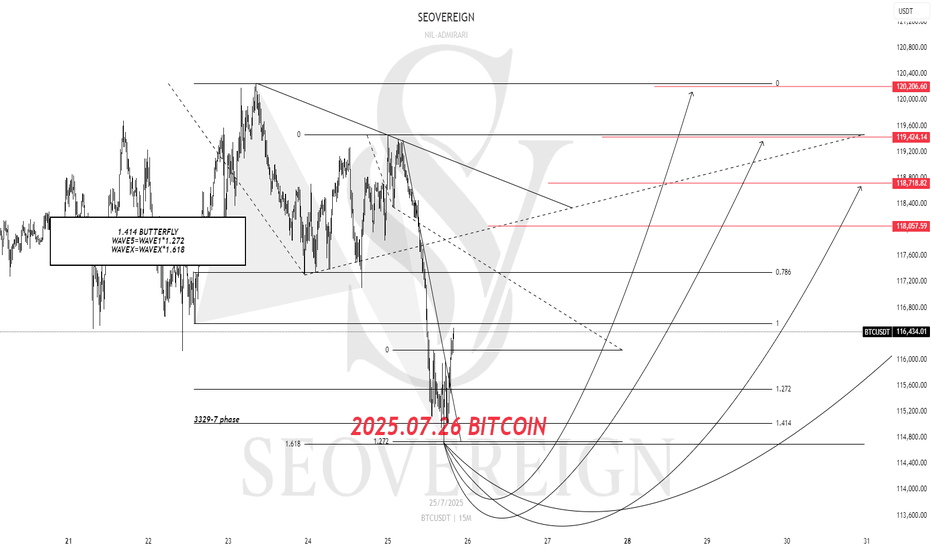

[SeoVereign] BITCOIN BULLISH Outlook – July 26, 2025The previous idea did touch the average TP price, but showed a rather disappointing rebound, so I will once again attempt to capture the starting point of the rebound. It is still considered that one more upward wave remains.

Accordingly, the TP is suggested at 118,057 USDT.

As always, I will carefully observe how the chart develops over time and update this idea with further explanations by organically integrating its specific interpretations and underlying rationale.

Thank you.

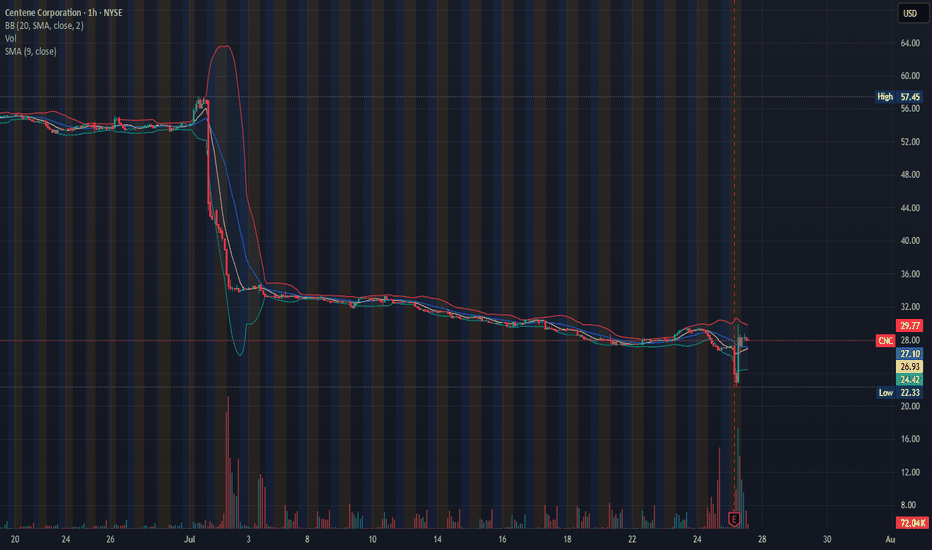

SOMETHING SEEMS NOT RIGHT: INSIDE TRADING?In the early hrs of 07/25/2025, between 6-7 am, right before the earning, the stock plummeted 16.16%. Can you smell inside trading here? because I do. Then, magically, during the earning call, with the promise of a " better future", the stock recovered and gained 6%. If you look for the beginning of the month, when the stock collapsed almost 50% from $57 - $34 you can tell what an empty promise looks like.

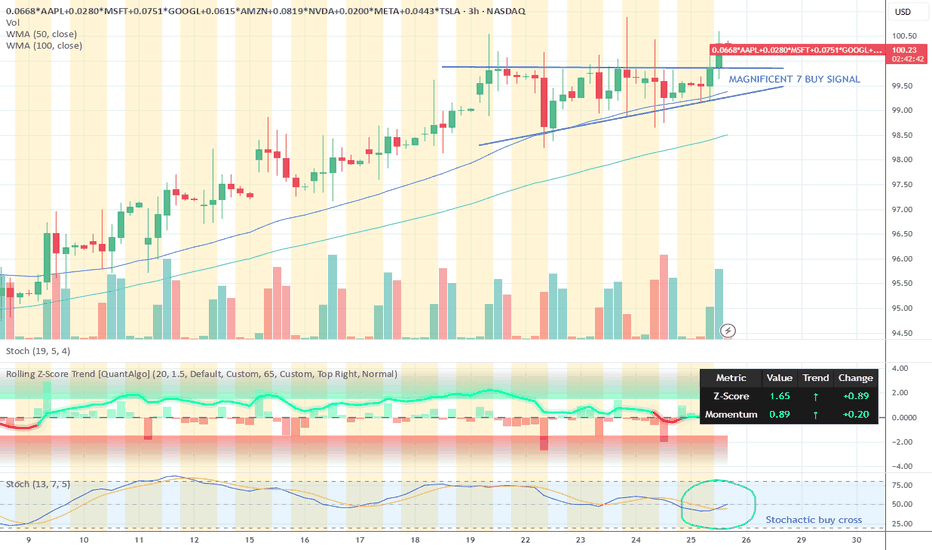

RIOT / 3hAs illustrated on the 3-hour chart above, NASDAQ:RIOT appears to be extending the third wave of an impulsive advance within Minor degree wave 3.

And as anticipated, a sideways correction is unfolding as the fourth wave of the ongoing extension in Minuette degree wave (iii).

Fib Extension Targets >> 17.17 & 20.23.

>>> In this timeframe, I'm analyzing the initial rising tide within the ongoing Intermediate degree wave (1), where a nested series of waves have quite well revealed: 1, 2 → i (circled), ii (circled) → (i), (ii) → i, ii. The extreme high of this impulsive sequence lies beyond the visible range of the current chart.

NASDAQ:RIOT CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

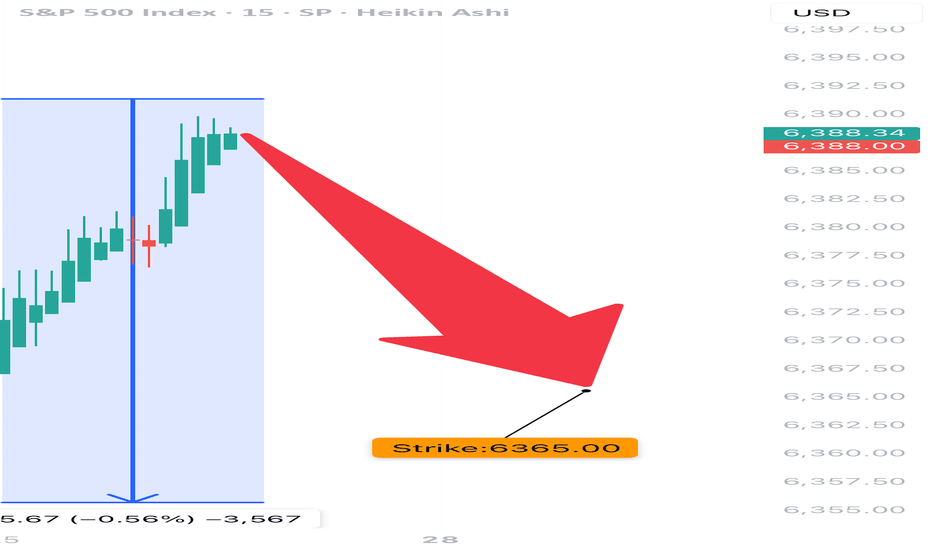

SPX 0DTE TRADE IDEA – JULY 25, 2025

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

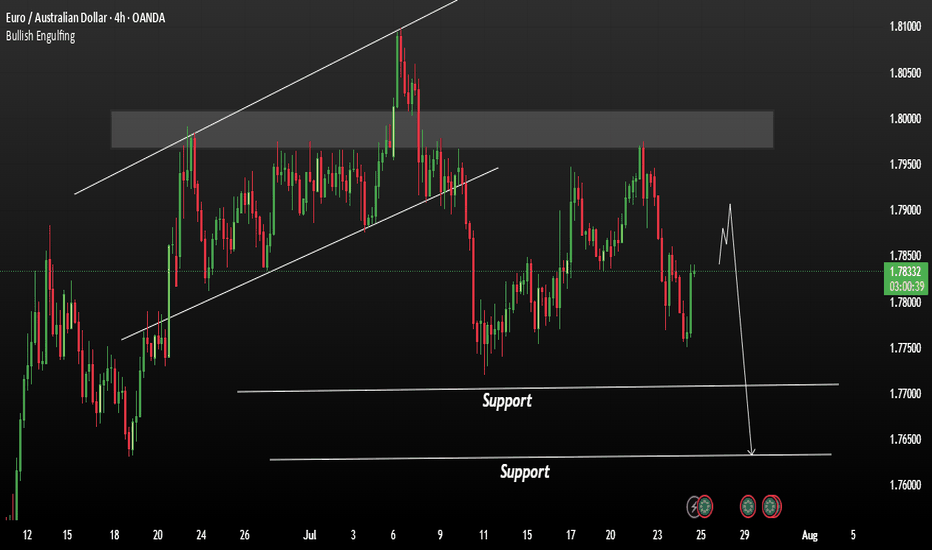

EURAUD is currently showing signs of a bearishEURAUD is currently showing signs of a bearish trend continuation. Despite short-term upward movement driven by optimism around the ECB, the overall structure remains vulnerable to downside pressure.

The European Central Bank (ECB) is expected to keep interest rates unchanged, potentially ending a seven-year streak of cuts. While this could bring temporary strength to the Euro, the technical setup still favours the bears.

Watch for a Break Below the Neckline

If price manages to break below the neckline of the current pattern, it could trigger a strong bearish move. First support: 1.77100 Second support: 1.76300

You May find more details in the chart.

Ps: Support with like and comments for more analysis.

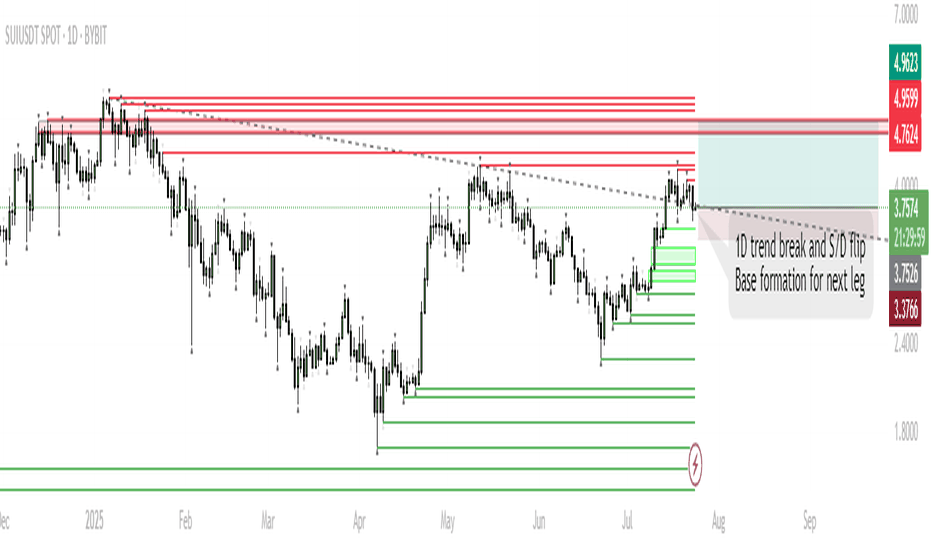

SUI – Base Formation for Next Leg HigherTrend Shift:

SUI has broken the 1D downtrend and is now consolidating above a key supply/demand zone, suggesting accumulation.

Short-Term Range:

Expect ranging/chop as price tests acceptance above broken resistance. This phase could last up to a week.

Trigger for Next Move:

Sustained closes above $4.0 will signal buyers are in control, opening the way for a move higher.

Targets:

If the base holds and SUI establishes above resistance, the next push is toward $5.10–$5.40 (previous highs/ATH zone).

Invalidation:

A sustained move below $3.37 would invalidate the bullish base thesis and open the door for deeper retrace.

SUI has flipped its 1D trend and is now consolidating above a key S/D level. Historically, such consolidations above reclaimed resistance often precede strong trend continuation. While a short-term range is likely as the market digests recent gains, the structure favors an eventual push toward previous highs and potentially new ATHs in August. Patience during this ranging phase is key; the setup remains bullish unless price falls back below $3.37.

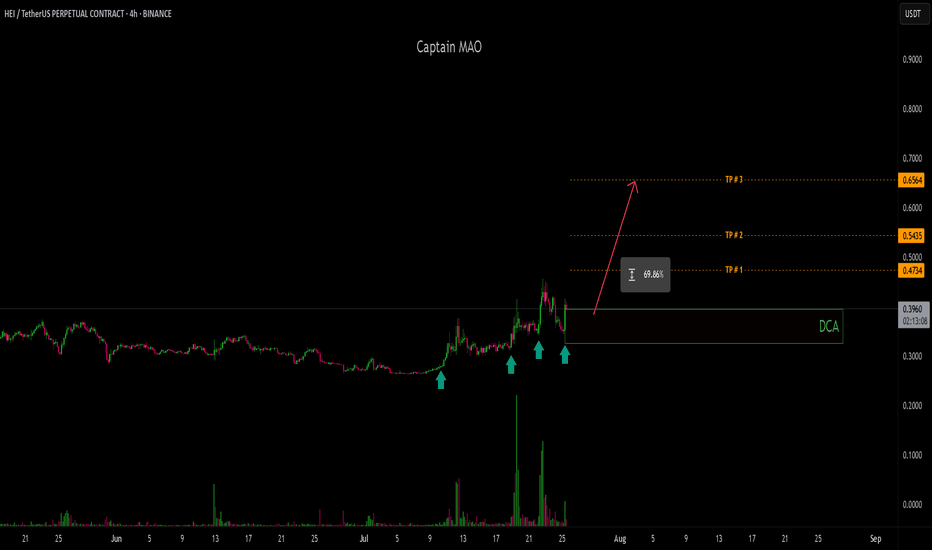

HEI/USDT - Higher !!showing strong bullish price action, consistently printing higher highs and higher lows with aggressive buyer pressure. The structure indicates sustained momentum, and the current consolidation above recent support suggests strength.

marked the green box as a buy zone starting from the current market price, as this area aligns with previous S/R flip zone turned support. This provides a favorable entry for continuation toward the next key resistance levels.

SL : 0.32

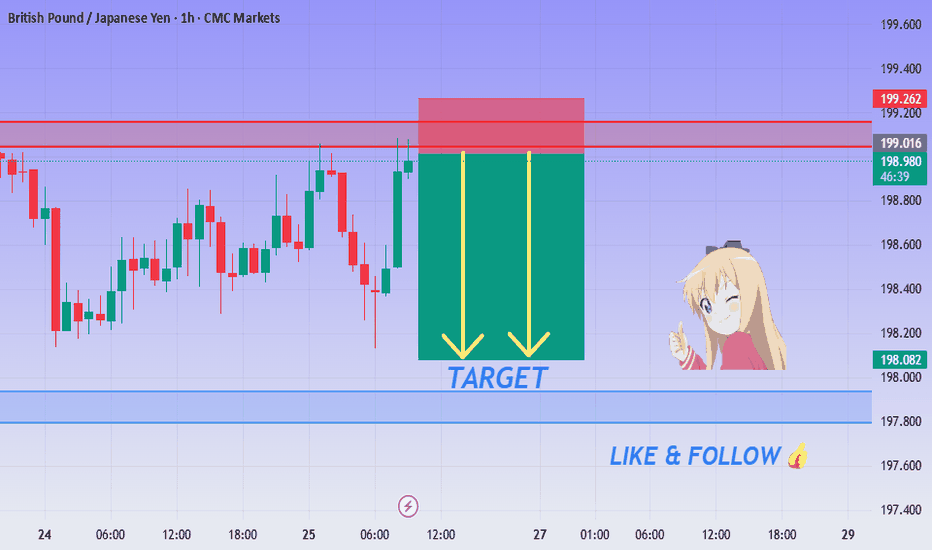

GBP/JPY Breakdown Alert - Bears Taking Control!💙 GBP/JPY Resistance Rejection ! SELL Setup Activated!

👩💻 Dear traders,

After analyzing GBP/JPY on the 1H timeframe, we have a clean short opportunity developing from a key resistance zone around 199.00 – 199.26. Price has stalled and rejected strongly, signaling potential for a bearish move.

Bias – Bearish

🎯 Target – 198.20

🎯 Target – 197.90

🎯 Final Target – 197.70

🛑 Safe Stop Loss – 199.26

📊 Reasoning:

– Price rejected a clear resistance/supply zone

– Red box marks historical rejection area

– Yellow arrows indicate downside momentum zone

– Bearish pressure forming at the top of the range

– Excellent intraday short with clean R:R structure

🍀 Stay patient, trust your levels, and trade smart!

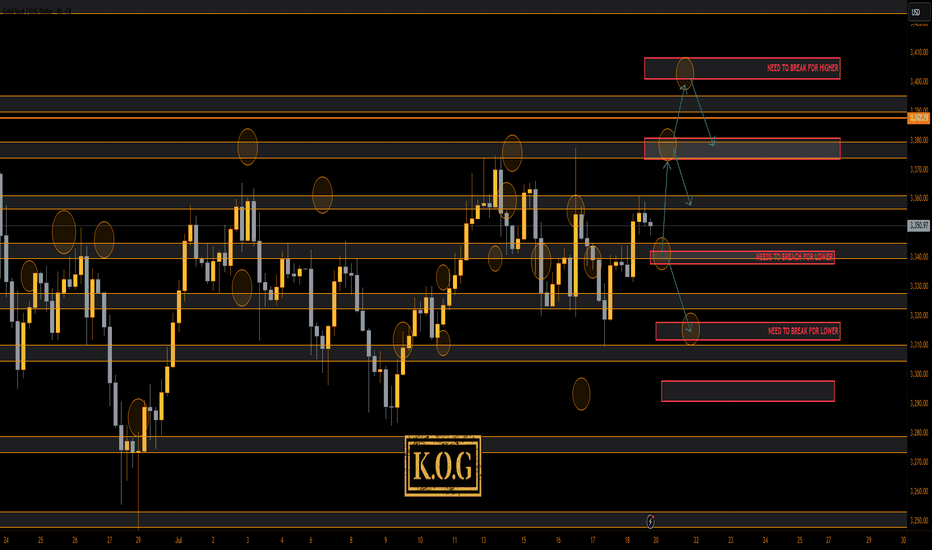

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for a price to attempt the higher level red box sitting around the 3370-75 region and if not breached, we felt an opportunity to short would be available from that region. We said if that failed and the move commenced, we would be looking at a complete correction of the move back down into the 3330-35 region, where we would then monitor price again in anticipation of a long from there or the extension level of 3310 which was also a red box short target (move complete). As you can see from the above, not only did we get that higher red box, we rejected, completed the move downside and then our traders managed to get that long trade all the way back up into the Excalibur target, red box targets and the hotspots shared in Camelot.

A decent week again, not only on Gold but also the numerous other pairs we trade, share targets on and analyse.

So, what can we expect in the week ahead?

For this week we can expect more ranging price action, but due to the previous range from last week being so tight, it looks like we’ll see a breakout coming in the latter part of the week unless there is news to bring us unexpected volume.

We have the key level below 3335-40 support and above that resistance and a red box sitting at 3375-80. This is the region that needs to watched for the break, and if broken we should hit the range high again at 3400-10. However, if rejected, we could again see this dip to attack that lower order region 3310-6 before attempting to recover.

Last week we wanted to see that curveball and although we did see some aggressive price action, I think we will see something extreme for this week. It’s that lower level 3310-6 that is a key region for bulls, if broken we can see a complete flush in gold taking us down into the 3250’s before we start the summer run. That for us would be the ideal scenario going into the month end, but, we’ll play it how we see and as usual, we go level to level and update any changes as we go along.

KOG’s Bias for the week:

Bullish above 3340 with targets above 3355, 3361, 3368, 3372 and above that 3385

Bearish below 3340 with targets below 3335, 3330, 3322, 3316, 3310 and below that 3304

RED BOX TARGETS:

Break above 3350 for 3355, 3361, 3367, 3375 and 3390 in extension of the move

Break below 3340 for 3335, 3330, 3320, 3310 and 3306 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

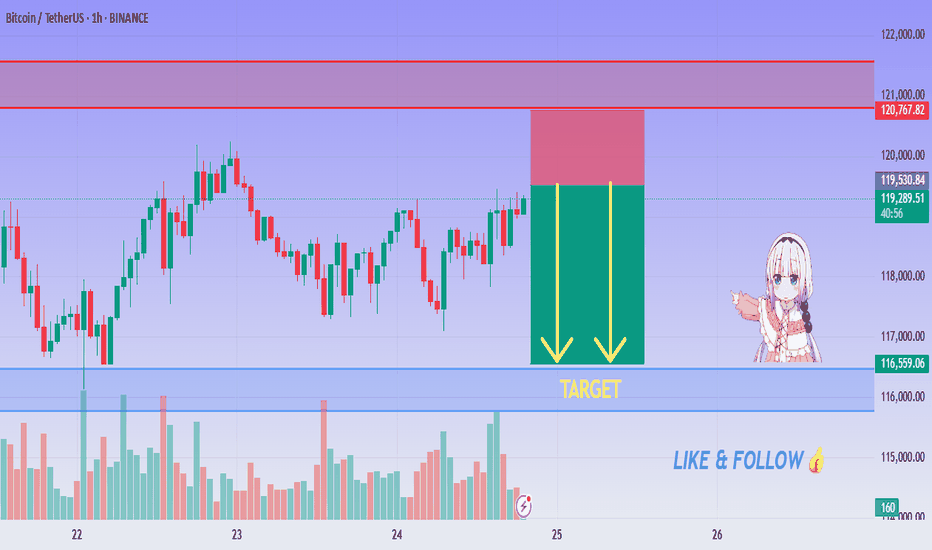

BTC SELL Setup - Big Drop Loading Below Resistance!💙 BTC/USDT Rejection Confirmed ! SELL!

👨💻 Dear traders,

After careful analysis of the recent price action on BTC/USDT (1H timeframe), here is the conclusion:

Price has entered a strong supply zone between $120,000 – $121,000, where clear signs of rejection have appeared.

Bias – Bearish

🎯 Target – $118,000

🎯 Target – $117,000

🎯 Final Target – $115,000

🛑 Safe Stop Loss – $121,200

📊 Reasoning:

– Price touched key resistance and is showing double rejection wicks

– Bearish momentum building below the red zone

– Two yellow arrows highlight expected move range (target box)

– Clear risk-to-reward with defined SL above zone

– Volume confirming slowing bullish pressure

🌟 Stay patient, follow risk management & trade safe!

🍀 WISHING YOU GREEN PIPS! 💰

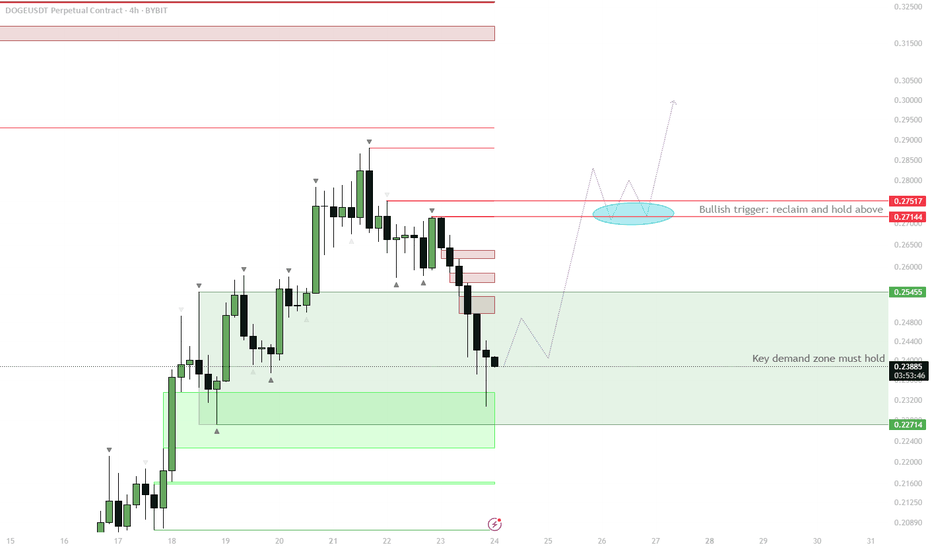

DOGE H4 – Demand Zone Reclaim as Bullish Trigger

Price is currently testing the H4 demand zone (~0.227–0.254).

Watch for price to reclaim the demand zone and close back above 0.254.

If confirmed, expect a move up toward the red resistance cluster at 0.271–0.275.

Consolidation above this area (highlighted in blue) would be a strong signal for continuation.

Invalidation: clean breakdown and acceptance below 0.227 signals failure of demand and deeper retrace.

This setup aims to capitalize on a classic liquidity sweep and demand reclaim. Typically, after taking out the flat open and collecting late shorts/stop losses, strong buying often steps in if demand is genuine. A successful reclaim and consolidation above the previous resistance will set the stage for bullish continuation. If this zone fails to hold, the move is invalidated and lower targets come into play. Waiting for confirmation reduces the risk of a failed bounce.

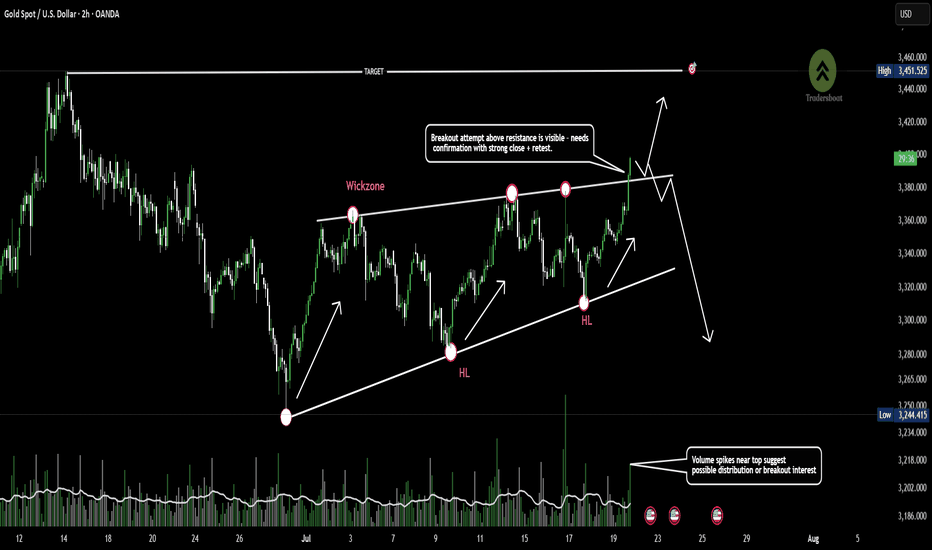

Gold approaches wedge resistance -Breakout or Fakeout incoming?Gold is trading within a rising wedge pattern, showing consistent higher lows and repeated rejections near the 3400 resistance zone.

Price is now approaching the upper trendline, an area of prior wick rejections and potential liquidity grab.

A confirmed breakout could signal continuation, while failure to sustain above this level may indicate bearish divergence or a reversal setup.👀📉

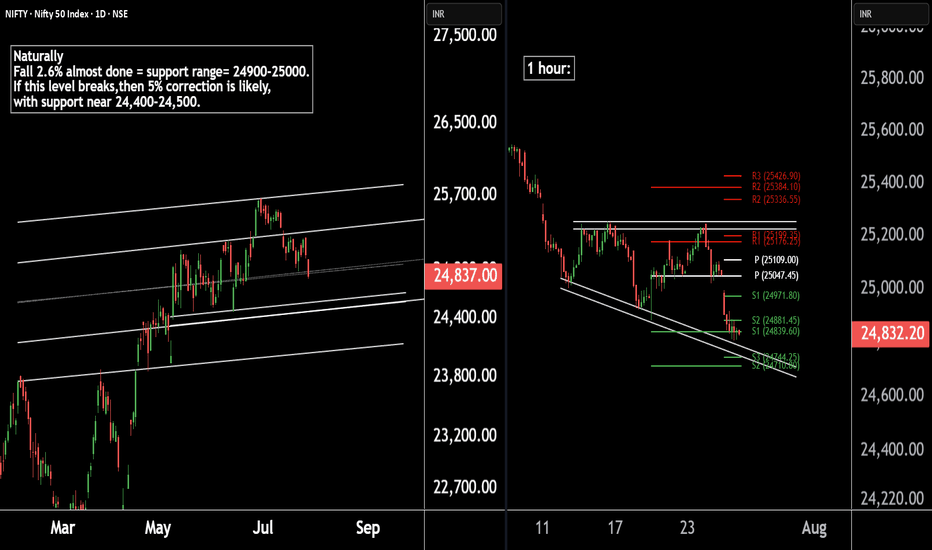

Nifty 50 Update | Technical Levels MappedThere are two chart of Nifty50.

Nifty 50 is trading within a well-defined parallel channel. As part of its natural corrective phase, a potential decline of around 5% cannot be ruled out, with key support anticipated near the 24,400–24,500 zone.

Nifty is forming a broadening wedge pattern on the 1-hour timeframe, with crucial support around 24,740. Additionally, both the weekly and monthly pivot supports are aligned in the 24,740–24,710 zone, reinforcing the significance of this level.

If this level sustain then we may see higher prices in Nifty50.

Thank You !!

GOLD Melted , 2 Best Places To Sell Clear , Don`t Miss 200 Pips Here is My 30 Mins Gold Chart , and here is my opinion , we Again Below 3377.00 and we have a 30 Mins Candle closure below this strong res , so i`m waiting the price to go back and retest this res and new support and give me a good bearish price action to can enter a sell trade and we can targeting 200 pips , and we have a good res @ 3365.00 we can sell from it also if the price didn`t reach 3377.00 and targeting from 100:200 pips , and if we have a Daily Closure below This res this will increase the reasons for us , just wait the price to back a little to retest it and then we can sell it . if we have a daily closure aboveit this idea will not be valid anymore .