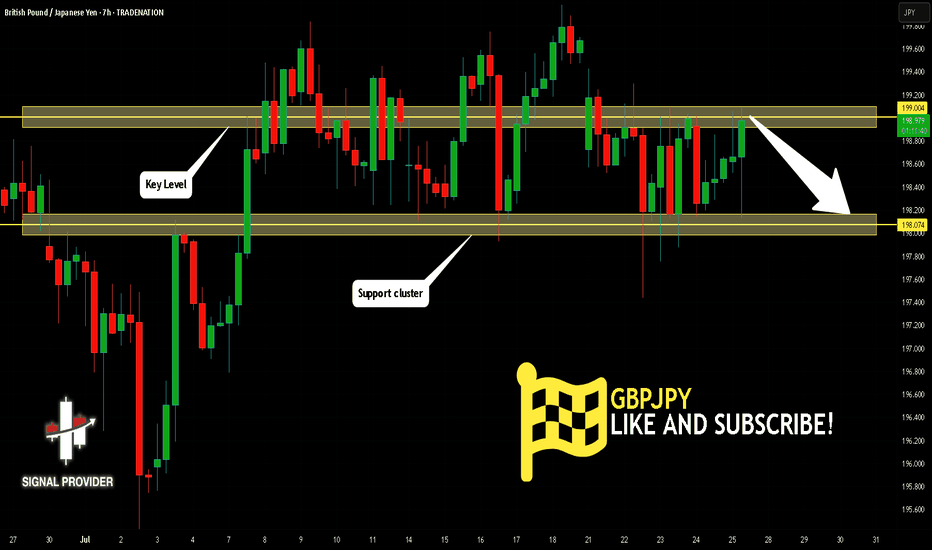

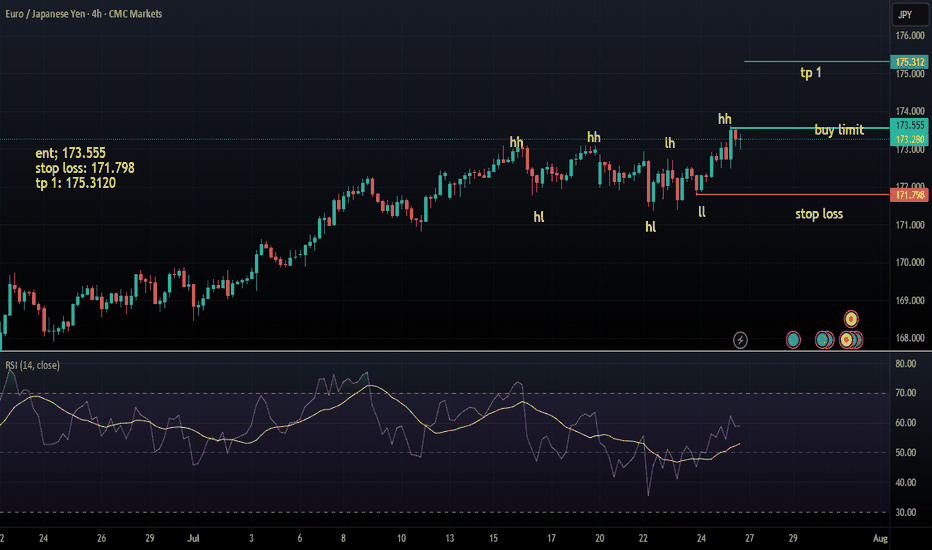

GBPJPY Is Very Bearish! Sell!

Please, check our technical outlook for GBPJPY.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 199.004.

The above observations make me that the market will inevitably achieve 198.074 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Community ideas

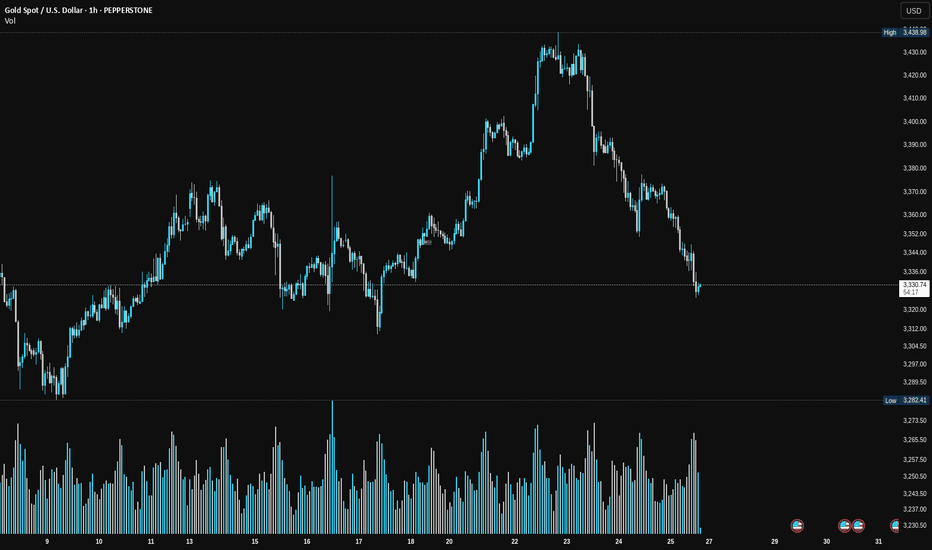

Is Smart Money Selling Gold? A VSA LookHey Traders,

Let's take a look at the Gold (XAU/USD) 1-hour chart using Volume Spread Analysis (VSA). The price made a strong run-up to a new high around $3,438, but the volume is telling us a story of potential weakness.

Here’s a simple breakdown of what I'm seeing.

The Trap at the Top (Signs of Weakness)

Think of the market as being moved by "smart money" (professionals) and "herd money" (the crowd).

Climax Volume: See that huge volume spike right at the peak on July 23rd? While it looks like strong buying, this is often a classic sign of a Buying Climax. This is where smart money starts selling their positions to the excited crowd who are buying at the top, fearing they'll miss out.

No Real Buyers Left: After the peak, notice how the price tried to push higher a few times but on much lower volume? This is a "No Demand" signal. It’s like a car trying to rev its engine, but it's out of gas. It shows there isn't enough buying power to push the price any higher.

Sellers Take Control: As the price started to fall from the top, look at the volume on the down bars. It got bigger. This tells us that supply (selling pressure) is now in control, and they are pushing the price down with force.

Where Are We Now?

The price has dropped and is now hovering around the $3,330 area. The volume has dried up for now, which means the market is taking a pause and deciding where to go next.

What to Watch For Next

Based on the VSA story, here are two possible scenarios:

Scenario 1 (Bearish 📉): The weakness continues. If we see the price try to rally from here but the volume is very low, it would be another major red flag. It would suggest sellers are still in control, and we could see a break below the recent low of $3,320 for another leg down.

Scenario 2 (Bullish 📈): This is a bear trap. For this to happen, we would need to see a strong sign of buying returning. For example, a sharp drop on massive volume that is quickly bought back up. This would signal that the sellers have been absorbed and smart money is starting to buy again.

Conclusion:

For now, the evidence points more towards weakness. The action at the top suggests that smart money was distributing (selling) their gold.

Key Takeaway: Be cautious of any weak-looking bounces. The sellers appear to have the upper hand until we see a clear sign of strength with high buying volume.

This is not financial advice. This is just my interpretation of the chart using VSA. Always do your own research and manage your risk. Good luck trading!

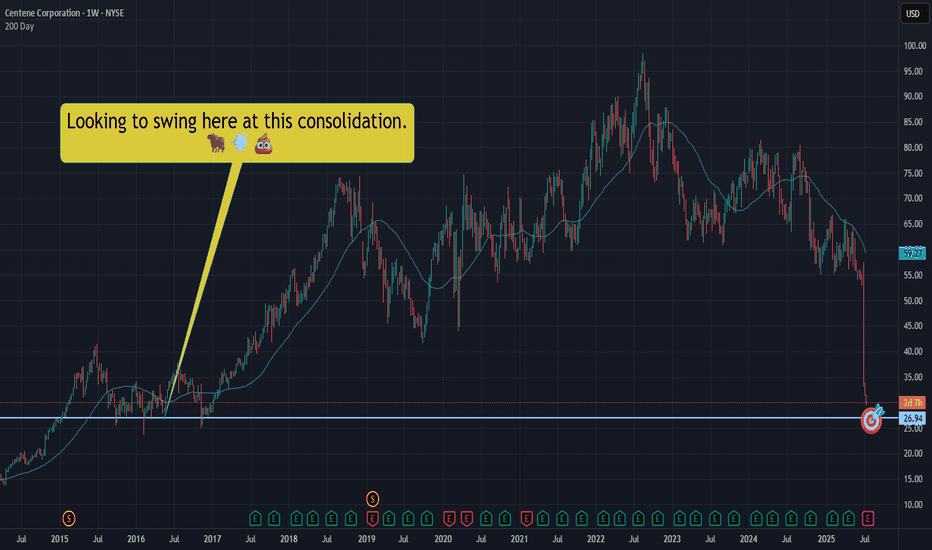

CNC|Let's take a swing at a falling dagger! NYSE:CNC slicing through the void, well.... like a falling dagger through a void.

Not trying to catch this bad boi, but we should expect a bounce at some point. Let's swing for a bounce in that $26.90ish area.

This is NOT a YOLO and I hope it's not an "oh no!" Let's keep our wits about us - starter position only. We can add if we need to, but let's just hope we sell and make some quick Christmas money.

THANK YOU FOR YOUR ATTENTION ON THIS MATTER

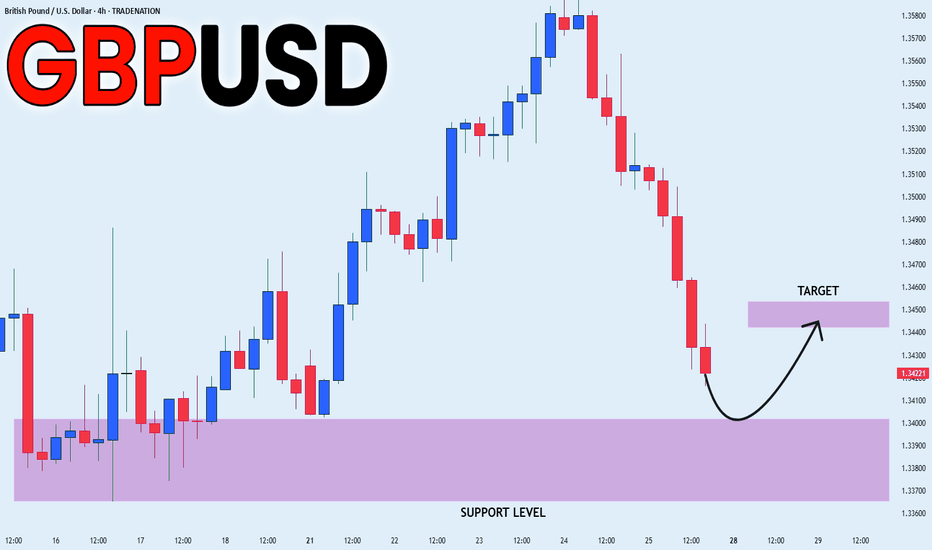

GBP_USD LONG FROM SUPPORT|

✅GBP_USD has been falling recently

And the pair seems locally oversold

So as the pair is approaching

A horizontal support of 1.3399

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

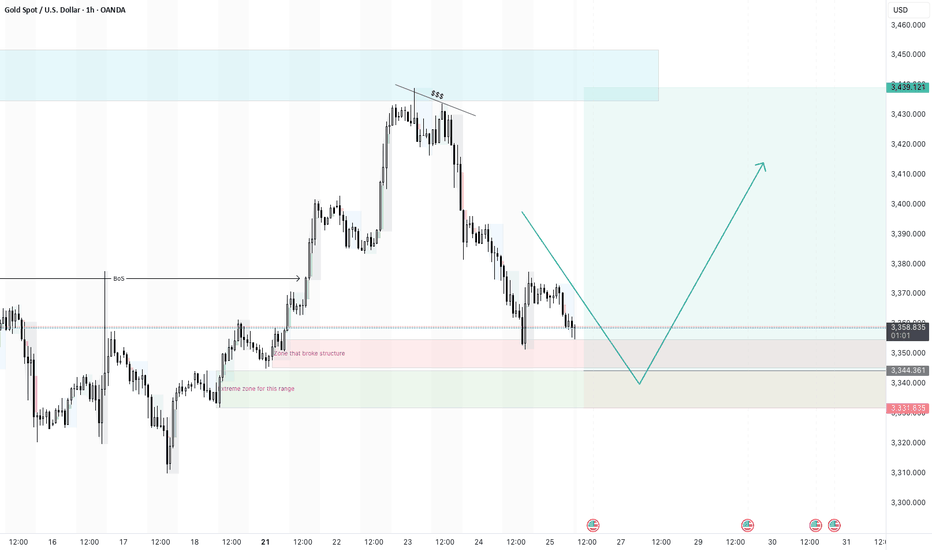

XAUUSD continuation of larger bullish move - 25/7/25Gold did touch the higher timeframe supply zone and pull back. It is now at a point where i am looking for a pivot to form to continue bullish.

I did place a buy limit trade at the extreme zone that started the break of structures.

i will wait a see if it drops and triggers or forms a pivot at the 4H zone that broke structure.

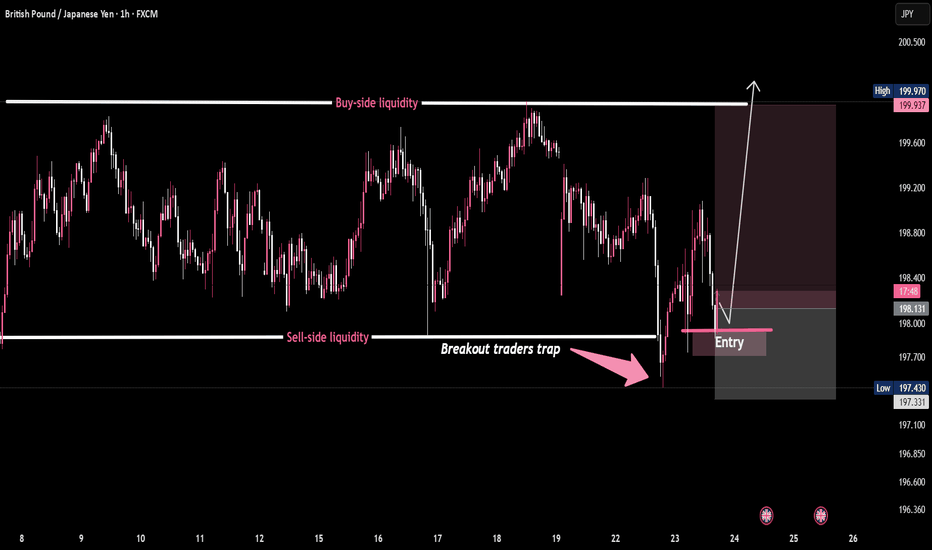

GBP/JPY - Classic Breakout Trap in PlayPrice nuked below range lows to sweep sell-side liquidity, trapping breakout sellers.

Smart money scooped it up. Entry reclaimed — now eyeing buy-side liquidity above 🎯

This is how the game is played:

1️⃣ Liquidity grab

2️⃣ Breakout trap

3️⃣ Reclaim & reverse

4️⃣ Target resting orders up top 🚀

📈 GBP/JPY – Classic Breakout Trap in Play 🧠💥

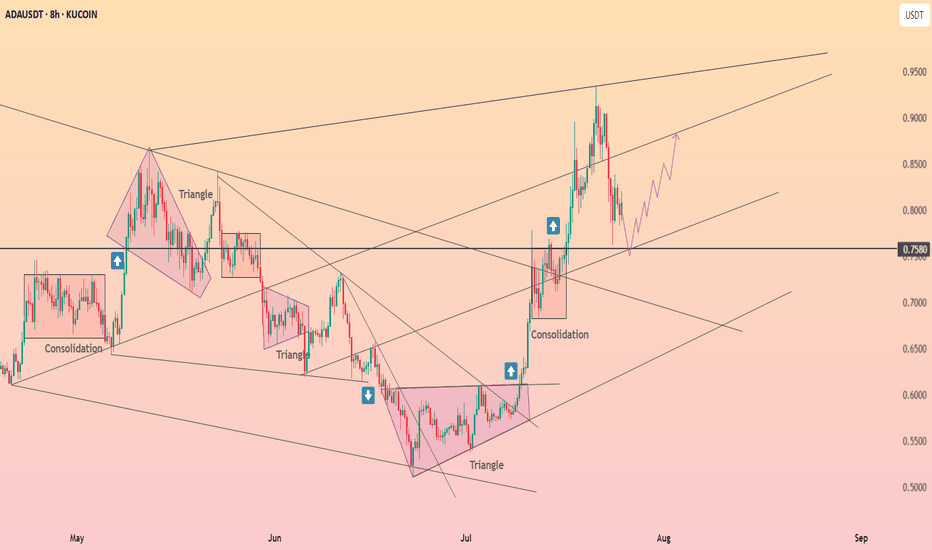

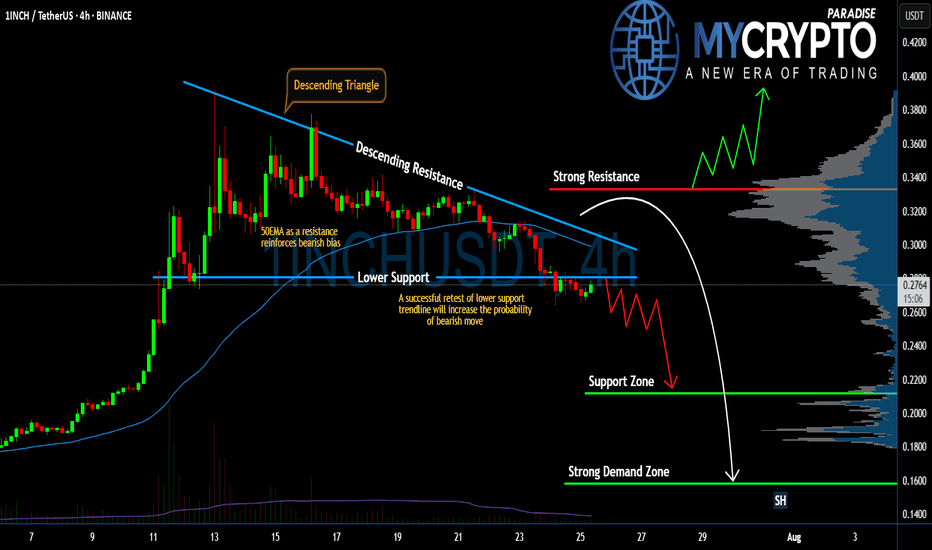

#1INCH Setup Favors Bears | Can Bears Pull it Down Further? Yello Paradisers! Are you prepared for what might be the next big move on #1INCHUSDT? The #1INCHNetwork is flashing clear warning signs:

💎#1INCH is currently trading inside a Descending Triangle, a pattern that historically favors bears. The price has broken down the lower support and is coming to retest it. If #INCHUSD retests the lower support and doesn't enter the descending triangle, the probability of the bearish pressure will increase.

💎The 50 EMA is acting as a strong dynamic resistance, reinforcing the bearish bias. Every attempt to reclaim higher levels has been rejected, and as long as we remain capped below the descending resistance, bulls are at a clear disadvantage.

💎A successful retest of the lower support trendline will significantly increase the probability of a breakdown. If this triangle finally breaks to the downside, we should be watching the $0.2116 support zone as the first key level to catch any temporary reaction.

💎But the real danger — and opportunity for patient traders — lies lower. If $0.2116 fails, the next strong demand zone sits at $0.1582, which could be the level where real buyers finally step back in. Until then, any bullish scenario remains invalid unless the price breaks and closes above the strong resistance at $0.3332.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

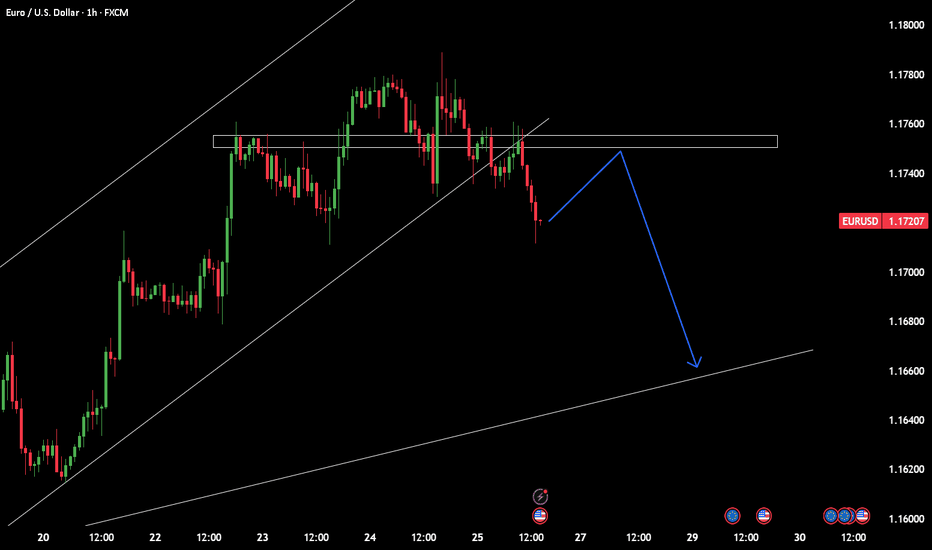

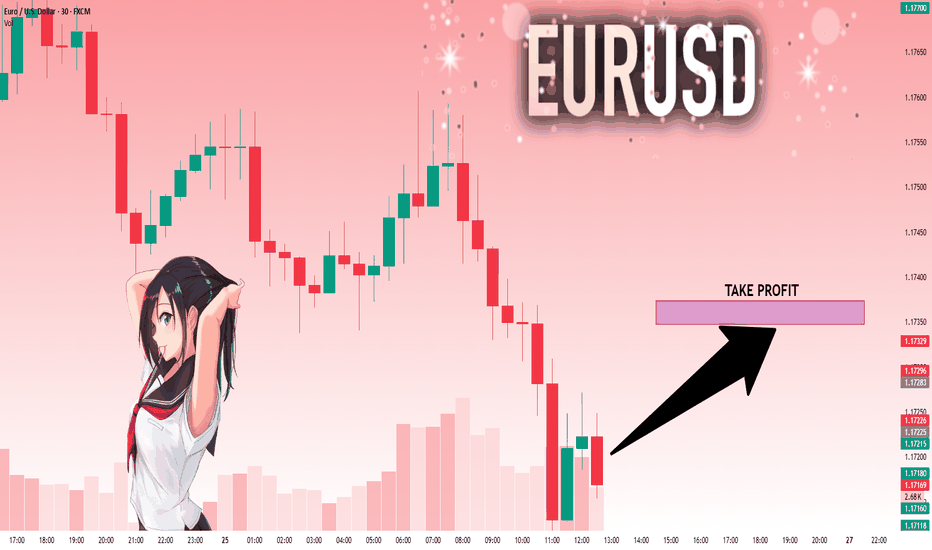

EURUSD: Will Go Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.17201 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.17348.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

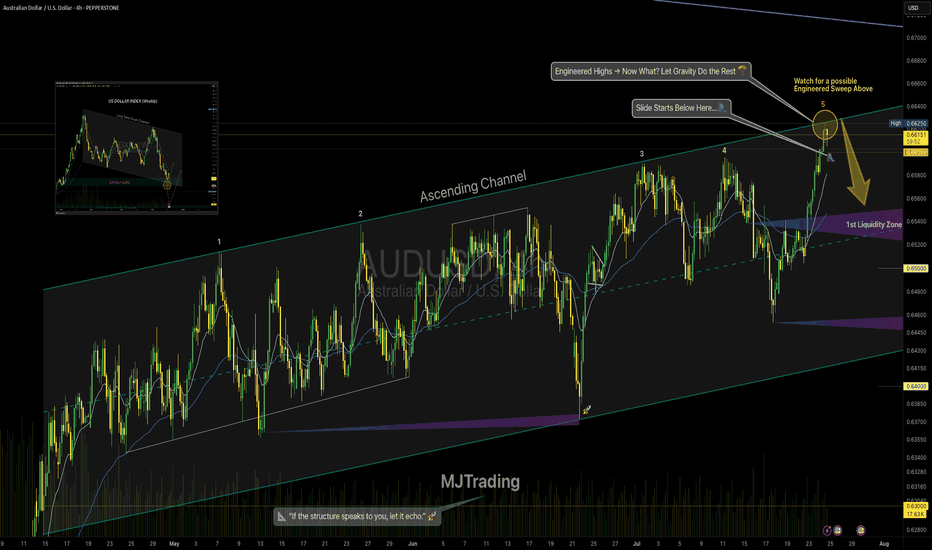

AUDUSD Engineered to Drop?🧠MJTrading:

📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

🔻 OANDA:AUDUSD – Tagged the Top | Smart Money Eyes Lower Levels??

📍 Perfect Respect of Channel Structure

AUDUSD has just kissed the upper boundary of a long-standing ascending channel, showing sharp rejection — a sign that premium pricing might now shift toward discount levels.

📈 The aggressive push into the highs likely aimed to clear buy stops — fulfilling smart money objectives before a potential reversal.

📉 And here’s the subtle clue:

Just below the last bullish candle lies a thin slide — a structural weakness.

If price breaks and closes below that full body bearish candle (Below 0.66000), the market could slip fast, unleashing a momentum-driven drop into the first liquidity zone (0.6520s).

🧠 For smart money lovers, this is the classic:

Sweep → Trap → Slide

📏 And for fans of parallelism, the chart’s geometry offers a rare beauty — lines in harmony, structure in rhythm, and opportunity in alignment.

🔍 What to Watch For:

Break below 0.66000 (last candle body) = entry signal

0.6520–0.6540: first liquidity zone

0.6400–0.6300: deeper cleanout, if bearish pressure sustains

Inset: DXY bouncing from long-term demand supports bearish thesis

Manage your risk wisely...

For Lower time frame traders:

Psychology Always Matters:

(Click on the pictures for caption and concepts)

#AUDUSD #SmartMoney #LiquiditySweep #ChannelTrading #ChartDesigner #MJTrading #PriceAction #Forex

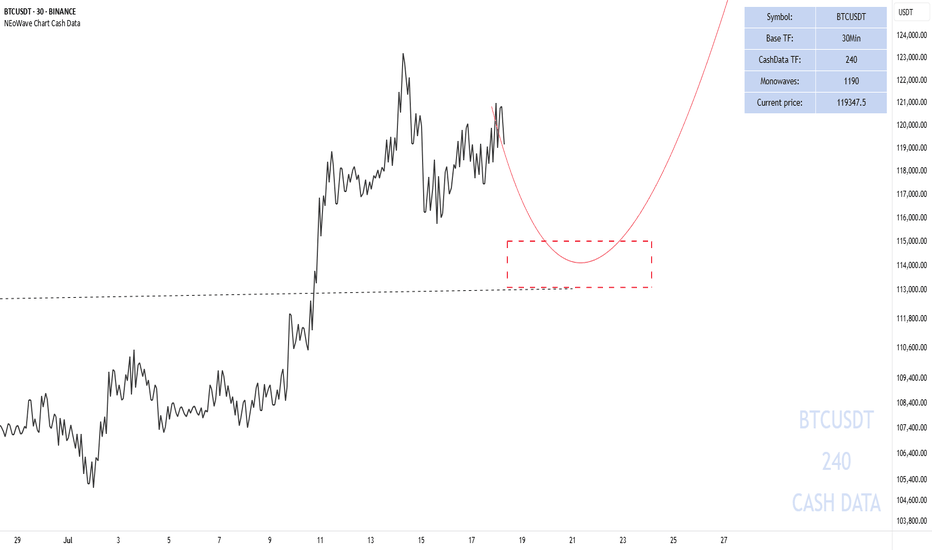

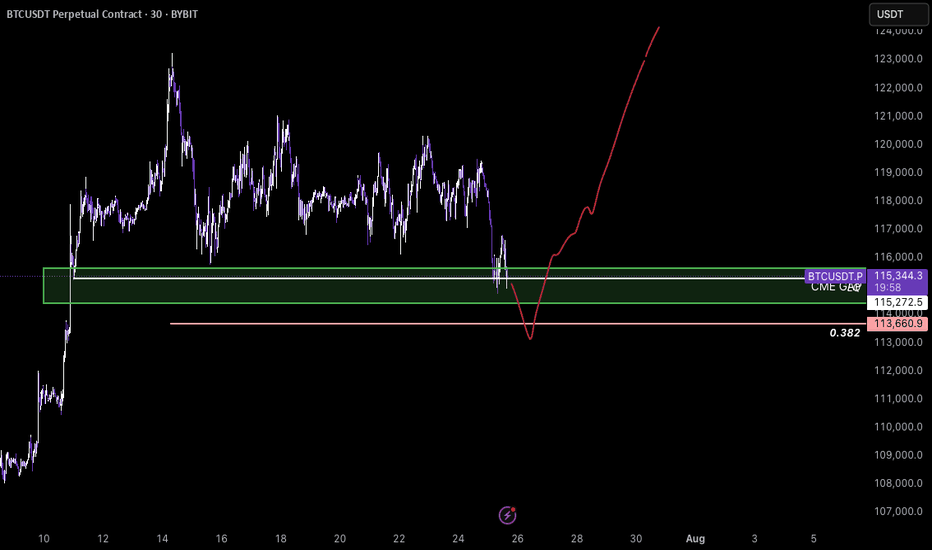

BTC- New ATH?BTCUSDT – Potential Reversal from CME Gap Support

Bitcoin is currently trading around a key demand zone aligned with a CME gap between ~$115,272 and $114,000. Price recently swept local lows with increased volatility and is showing signs of absorption just above the 0.382 Fibonacci retracement ($113,660), which adds confluence to the area.

If BTC continues to hold above this zone and shows volume confirmation, I expect a strong bullish reaction. This move could initiate a rally toward the previous high and potentially lead to a breakout to new all-time highs (ATH), as outlined in the red projected path.

Key levels- LQ, Fibbo 0.382, CME gap - futures

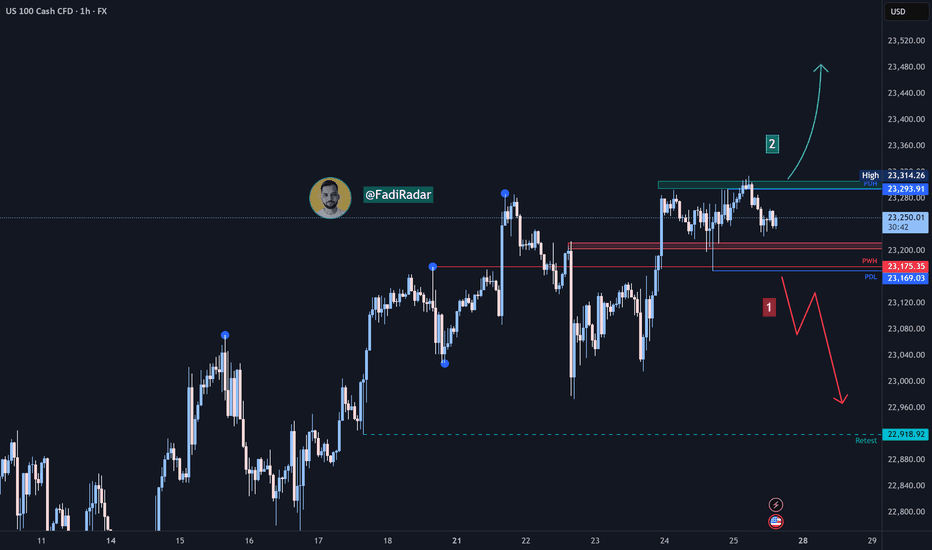

Nasdaq Index (US100 / NASDAQ) Technical Analysis:The Nasdaq index continues its medium- to long-term uptrend. Yesterday, it tested the 23,170$ level and rebounded upward, reaching 23,310$.

🔹 Bearish Scenario:

If the price breaks and closes below 23,200$, it may decline toward 23,000$, followed by 22,920$.

🔹 Bullish Scenario:

If the price holds above 23,300$, the uptrend is likely to continue toward a new high near 23,400$.

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always monitor the markets and perform your own analysis before making any trading decisions.

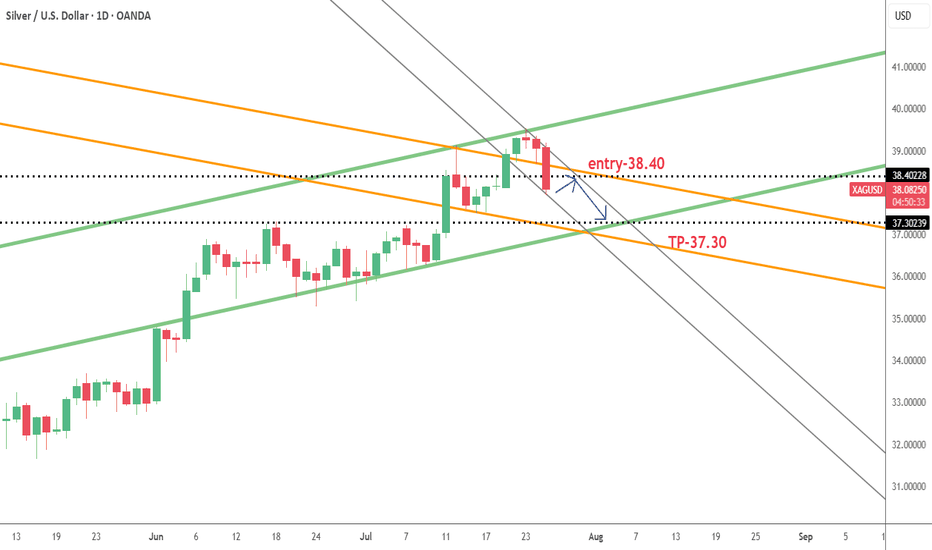

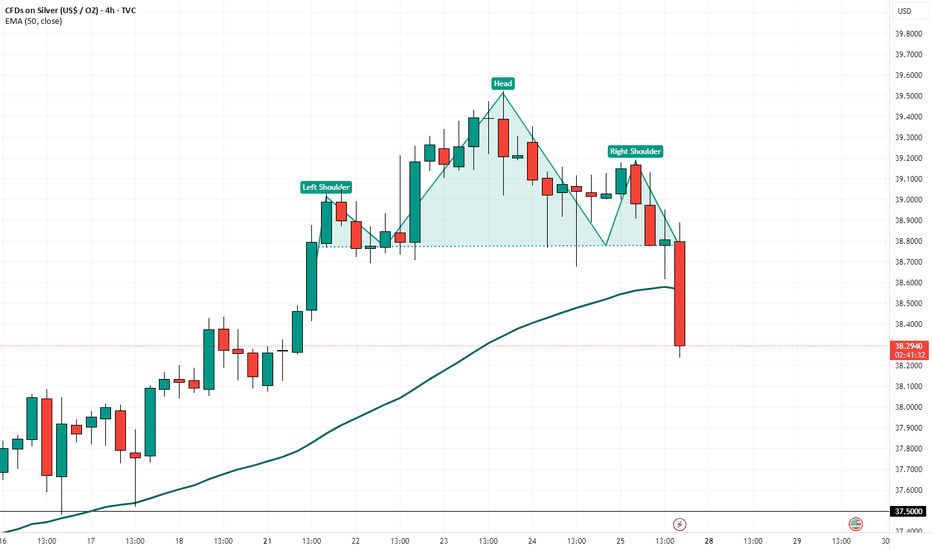

Head & Shoulders Pattern Confirmed bearish sign A clear Head and Shoulders pattern has formed on the 4H timeframe, and confirmation is in place after a decisive break below the neckline around $39.00.

🔍 Technical Breakdown:

Left Shoulder: Formed around July 11–15

Head: July 19–23 peak

Right Shoulder: Developing through July 24–25

Neckline: ~$39.00 zone (now broken)

Current Price: ~$38.30

Target: ~$38.00 – $37.80 (based on pattern projection)

The break below the 50 EMA adds bearish confirmation. Caution is advised unless price reclaims the neckline level.