Community ideas

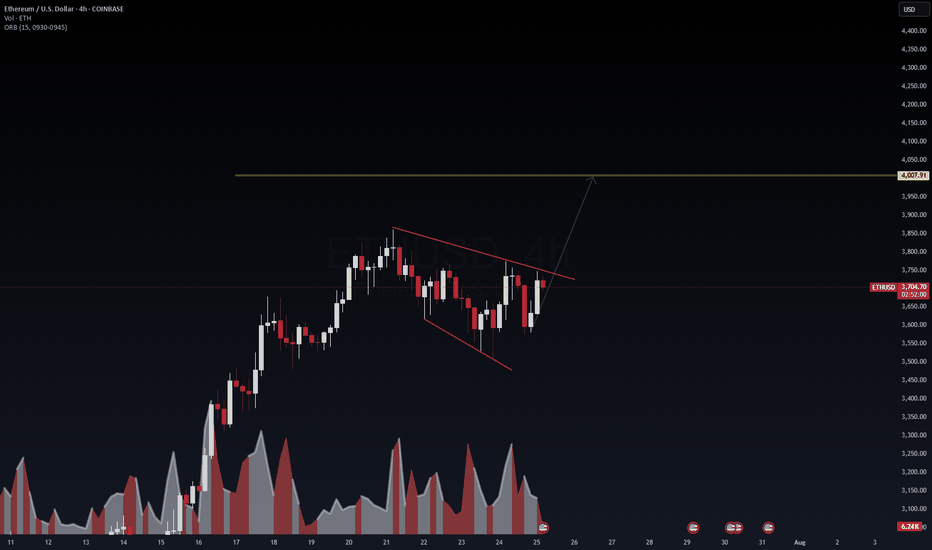

ETHUSD: Road to 4K today after a breakout. ETH/USD – 4H Outlook: Targeting $4,000+

Ethereum is coiling within a descending wedge, signaling potential breakout momentum. Volume compression indicates that once ETH breaks above the wedge resistance (~$3,750), it could accelerate toward the $4,000–$4,050 supply zone.

Key Levels:

Resistance: $3,750 → $4,000

Support: $3,650 → $3,550

Breakout Target: $4,007 (mid-term)

VolanX Protocol Insight:

Institutional liquidity clusters sit above $3,800. A clean breakout with strong volume could trigger stop runs and a swift rally to 4K.

Risk Management:

Entry after breakout retest above $3,750.

Stop-loss: Below $3,640.

Take-profit: $3,980–$4,050.

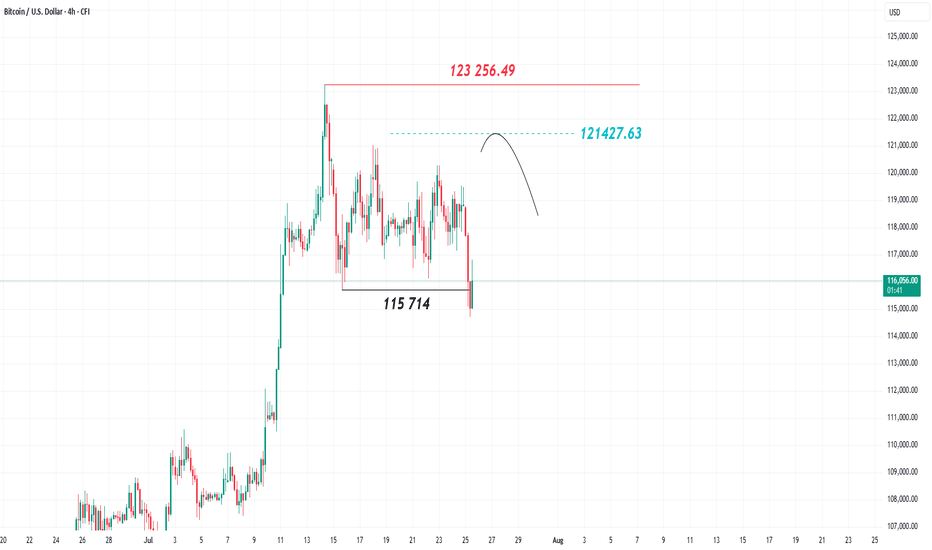

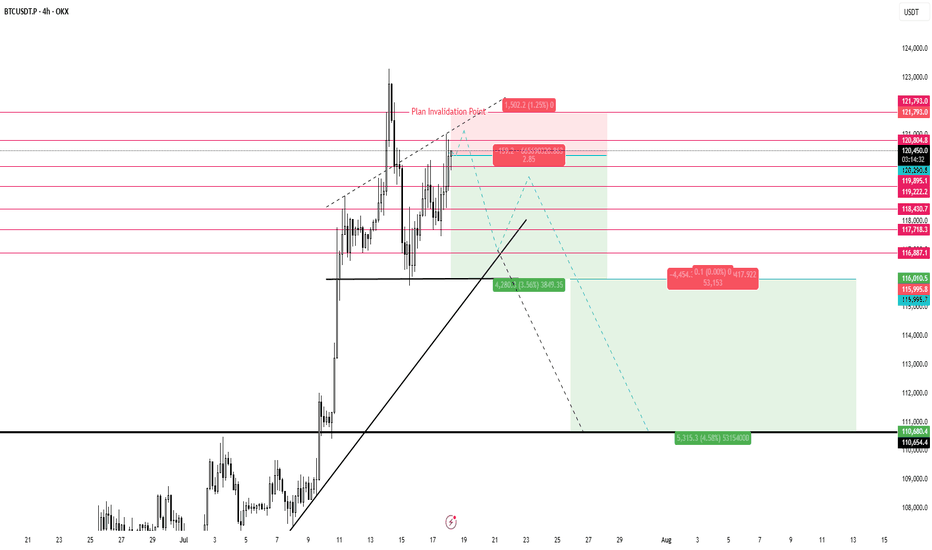

What's next for BITCOIN?After hitting a new all-time high at 123,256.49, Bitcoin, the world’s leading cryptocurrency, pulled back this week, closing on the 4-hour chart below the 115,714 level. This indicates a shift in trend from bullish to bearish and increases the likelihood of a short-to-medium-term decline.

The recent price rise appears to be corrective, and the 121,427 level is considered important and carries downside pressure, as it represents the 78% level of the Fibonacci retracement tool when measured from the recent high to the latest low. Holding below the 123,256 mark and failing to break above it would support the bearish scenario for Bitcoin.

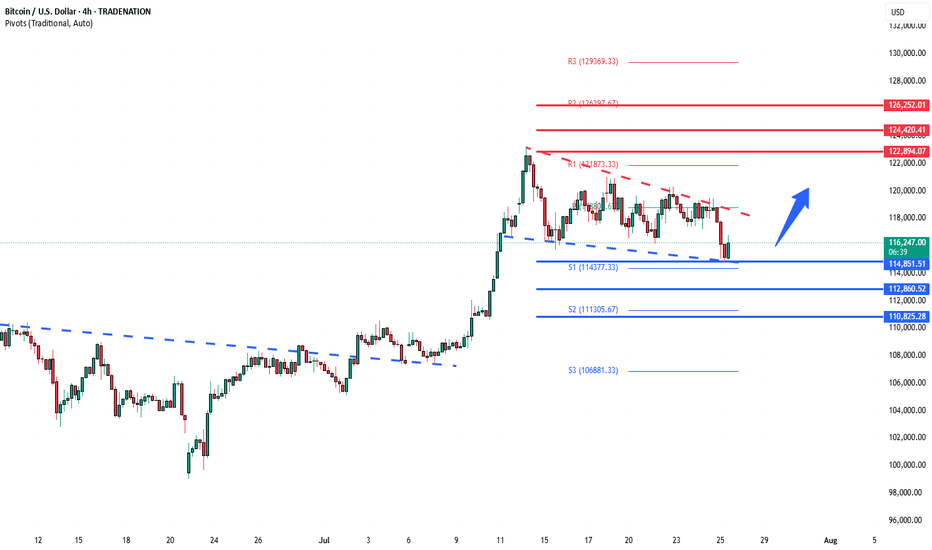

BTCUSD support retest at 114,850 The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at:

122,900 – initial resistance

124,420 – psychological and structural level

126,250 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 114,850 would weaken the bullish outlook and suggest deeper downside risk toward:

112,860 – minor support

110,825 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the BTCUSD holds above 114,850. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

NSDQ100 pushing to new ATH?Thursday was a slightly positive session for equities, with the NASDAQ 100 rising +0.18% to close at a fresh record high, driven by strong economic data. However, overall market action was subdued, with the S&P 500’s trading range the narrowest since February (0.35%).

Notably, the equal-weighted S&P 500 fell -0.33%, highlighting underlying weakness outside mega-cap tech.

A key drag on the NASDAQ came from Tesla (-8.20%), which slumped after disappointing earnings. This weighed on the Magnificent 7, which declined -0.21% despite gains in the other six members.

On the macro front, the US dollar strengthened as Donald Trump downplayed his dispute with Fed Chair Jerome Powell, though continued to pressure the Fed on interest rates. Meanwhile, the FCC approved Paramount’s merger with Skydance, signaling a green light for M&A activity in media despite political tensions.

Conclusion – NASDAQ 100 Trading View:

The NASDAQ 100 remains technically bullish, setting new highs amid resilient economic data. However, breadth is weakening, and headline risk—especially around earnings (e.g., Tesla)—could trigger short-term volatility. Traders should stay long with caution, watching for sector rotation or profit-taking near highs, and monitor Fed-related rhetoric for macro-driven moves.

Key Support and Resistance Levels

Resistance Level 1: 23480

Resistance Level 2: 23600

Resistance Level 3: 23790

Support Level 1: 23070

Support Level 2: 22950

Support Level 3: 22750

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Understanding ROI in Crypto: More Than Just a NumberHello, Traders! 👏

Return on Investment (ROI) is often the first metric new investors focus on when evaluating an asset, a strategy, or even their trading performance. It’s easy to see why. It's simple, intuitive, and widely used across both traditional finance and the cryptocurrency sector. One formula, and suddenly you have a "score" for your investment. Green is good. Red is bad. Right?

Well…Not quite.

In the crypto market, where price swings can be extreme, timelines are compressed, and risk profiles differ significantly from those in traditional markets, a simplistic ROI figure can be dangerously misleading.

A 50% ROI on a meme coin might look great, until you realize the token is illiquid, unbacked, and you're the last one holding the bag. Conversely, a 10% ROI on a blue-chip crypto asset with strong fundamentals might be significantly more meaningful in risk-adjusted terms.

In this article, we'll delve beyond the basic formula and break down what ROI really tells you, how to use it correctly, and where it falls short. Let's go!

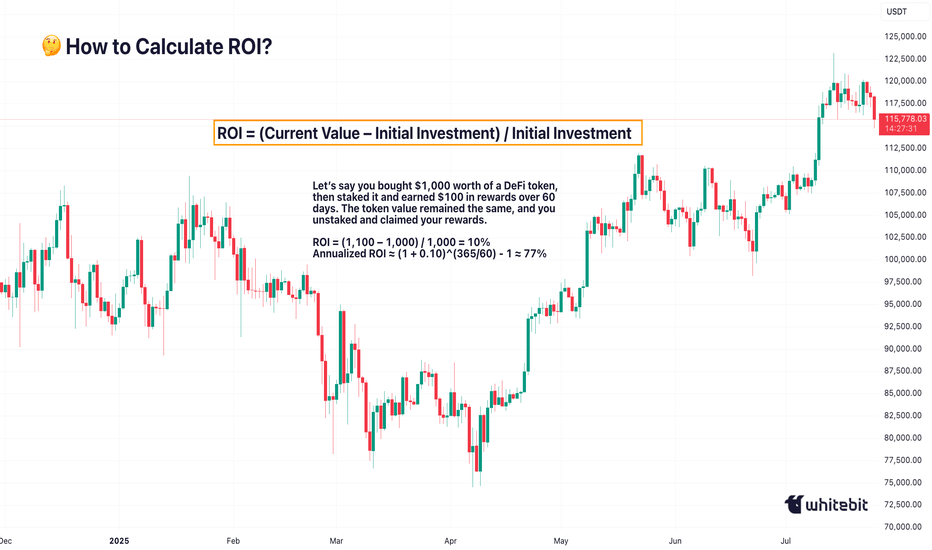

What Is ROI and How Do You Calculate It?

The Basic Formula for Return on Investment Is: ROI = (Current Value – Initial Investment) / Initial Investment.

Let’s say you bought ETH at $2,000 and sold it at $2,600: ROI = (2,600 – 2,000) / 2,000 = 0.3 → 30%. Seems straightforward. You made 30% profit. However, crypto is rarely straightforward.

What if you held it for 2 years? Or 2 days? What if gas fees, staking rewards, or exchange commissions altered your real costs or returns? Did you include opportunity cost and the profits missed by not holding another asset? ROI as a raw percentage is just the beginning. It’s a snapshot. However, in trading, we need motion pictures, full narratives that unfold over time and within context.

Why Time Matters (And ROI Ignores It)

One of the most dangerous omissions in ROI is time.

Imagine two trades: Trade A returns 20% in 6 months. Trade B returns 20% in 6 days.

Same ROI, very different implications. Time is capital. In crypto, it’s compressed capital — markets move fast, and holding a position longer often increases exposure to systemic or market risks.

That’s why serious traders consider Annualized ROI or utilize metrics like CAGR (Compound Annual Growth Rate) when comparing multi-asset strategies or evaluating long-term performance.

Example: Buying a Token, Earning a Yield

Let’s say you bought $1,000 worth of a DeFi token, then staked it and earned $100 in rewards over 60 days. The token value remained the same, and you unstaked and claimed your rewards.

ROI = (1,100 – 1,000) / 1,000 = 10%

Annualized ROI ≈ (1 + 0.10)^(365/60) - 1 ≈ 77%

Now that 10% looks very different when annualized. But is it sustainable? That brings us to the next point…

ROI Without Risk Analysis Is Useless

ROI is often treated like a performance badge. But without risk-adjusted context, it tells you nothing about how safe or smart the investment was. Would you rather: Gain 15% ROI on a stablecoin vault with low volatility, or Gain 30% ROI on a microcap meme token that could drop 90% tomorrow?

Traders use metrics such as the Sharpe Ratio (which measures returns versus volatility), Maximum Drawdown (the Peak-to-Trough Loss During a Trade), and Sortino Ratio (which measures returns versus downside risk). These offer a more complete picture of whether the return was worth the risk. ⚠️ High ROI isn’t impressive if your capital was at risk of total wipeout.

The Cost Side of the Equation

Beginners often ignore costs in their ROI math. But crypto isn’t free: Gas fees on Ethereum, trading commissions, slippage on low-liquidity assets, impermanent loss in LP tokens, maybe even tax obligations. Let’s say you made a 20% ROI on a trade, but you paid 3% in fees, 5% in taxes, and lost 2% in slippage. Your actual return is likely to be closer to 10% or less. Always subtract total costs from your gains before celebrating that ROI screenshot on X.

Final Thoughts: ROI Is a Tool, Not a Compass

ROI is beneficial, but not omniscient. It’s a speedometer, not a GPS. You can use it to reflect on past trades, model future ones, and communicate performance to others, but don’t treat it like gospel.

The real ROI of any strategy must also factor in time, risk, capital efficiency, emotional stability, and your long-term goals. Without those, you’re not investing. You’re gambling with better math. What do you think? 🤓

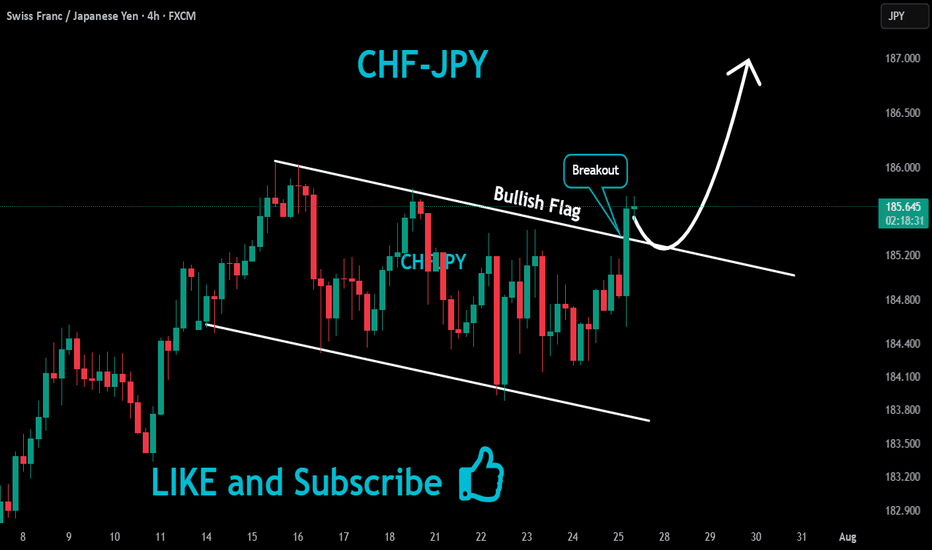

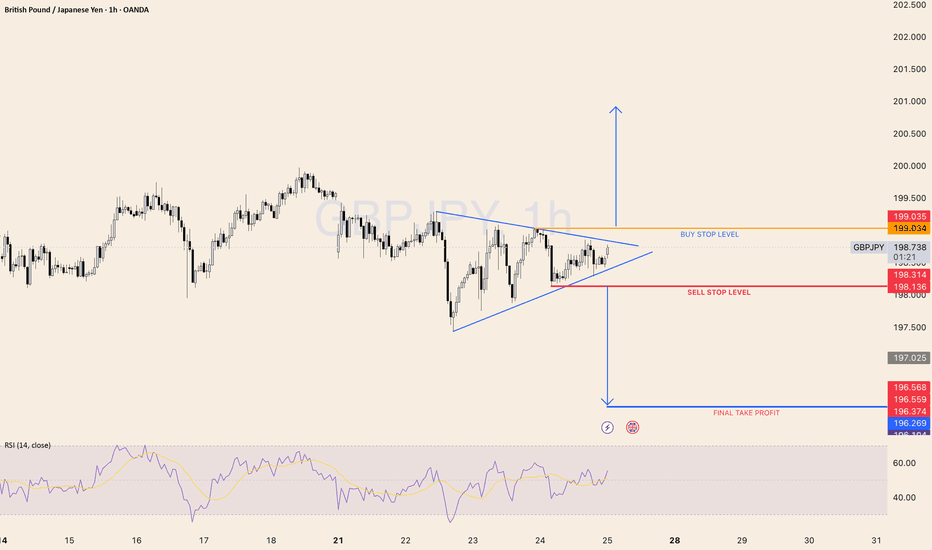

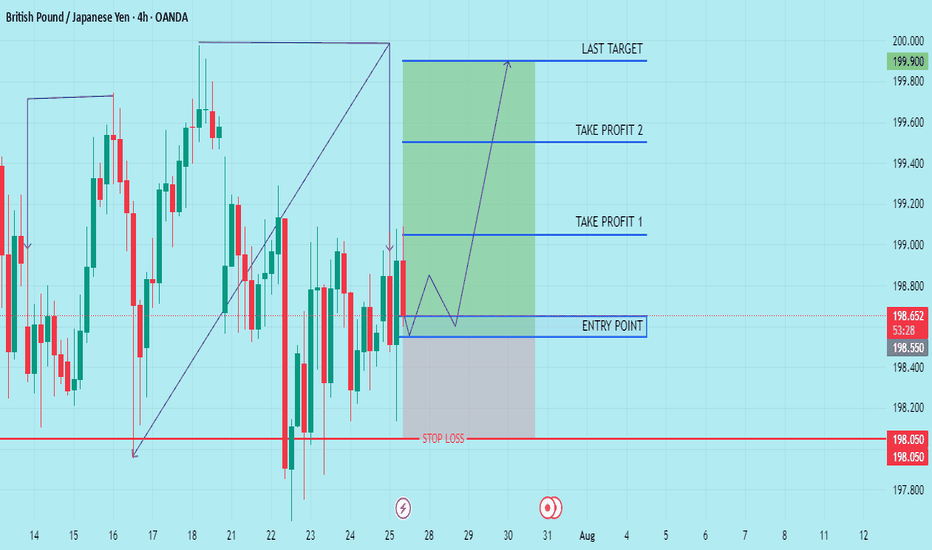

GBP/JPY SYMMETRICAL TRIANGLESYMMETRICAL TRIANGLE Completion: A potential breakout scenario for GBP/JPY involves the currency pair moving sharply out of a symmetrical triangle pattern. If the pair breaks above the upper trendline, it could signal a bullish move, with traders targeting higher resistance levels. Conversely, a break below the lower trendline may indicate a bearish trend, prompting a search for support levels.

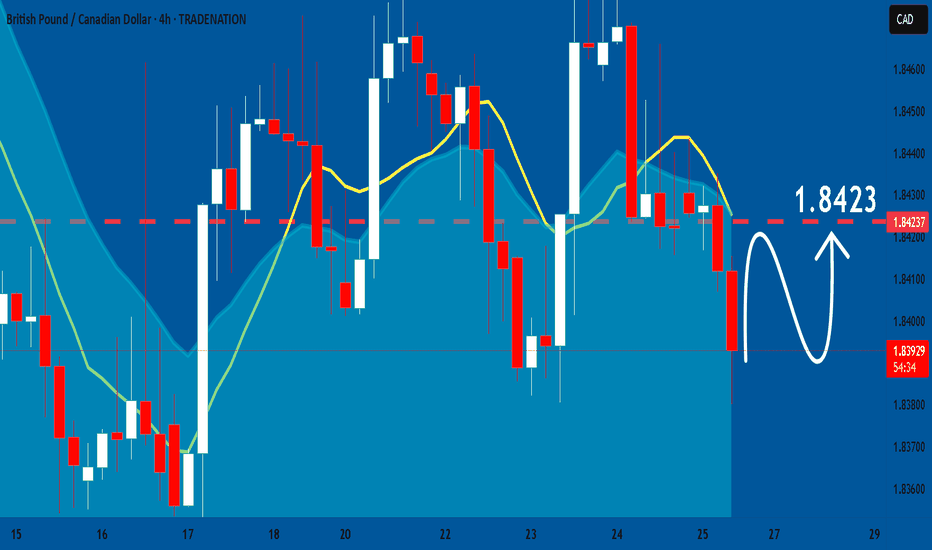

GBPCAD: Growth & Bullish Continuation

The price of GBPCAD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

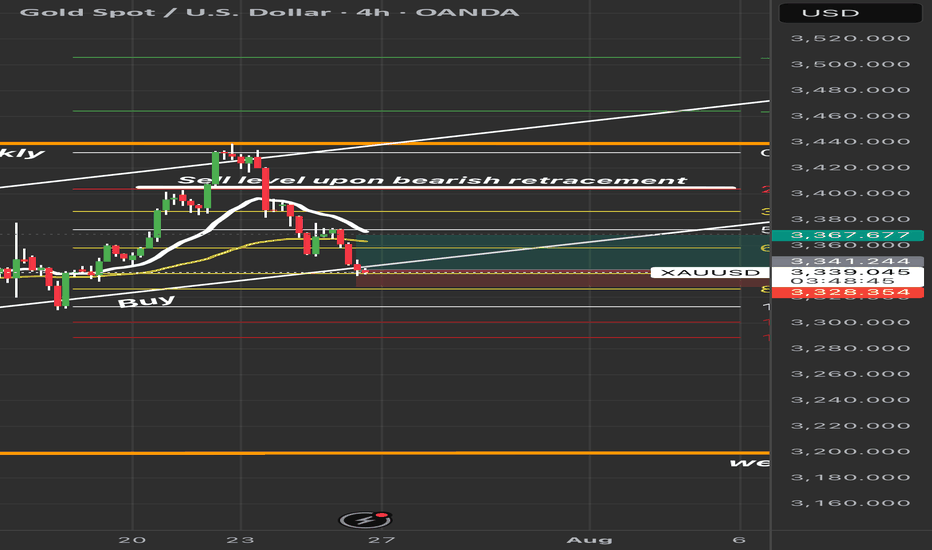

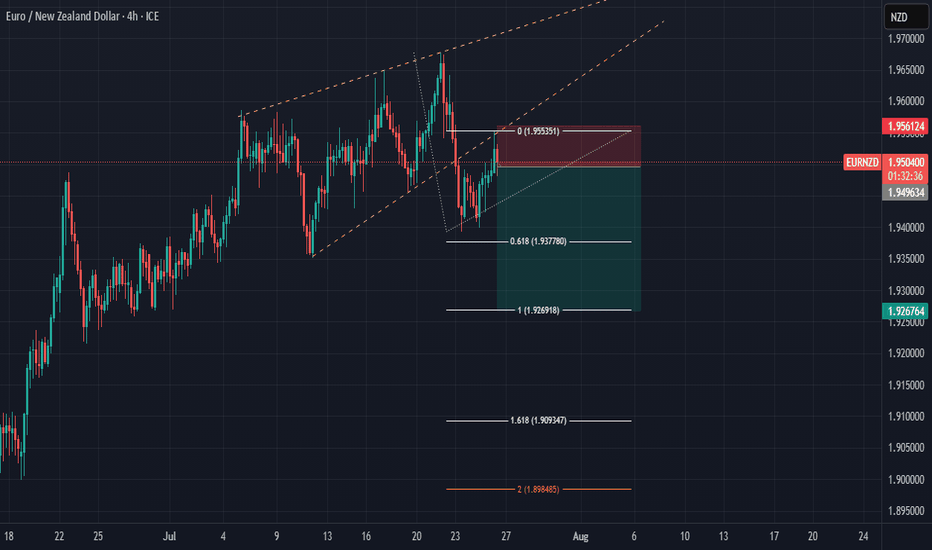

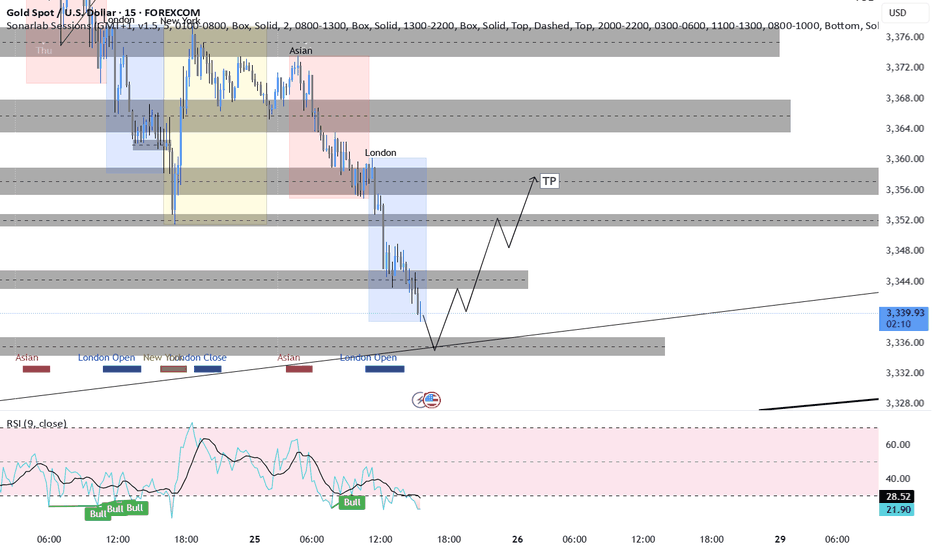

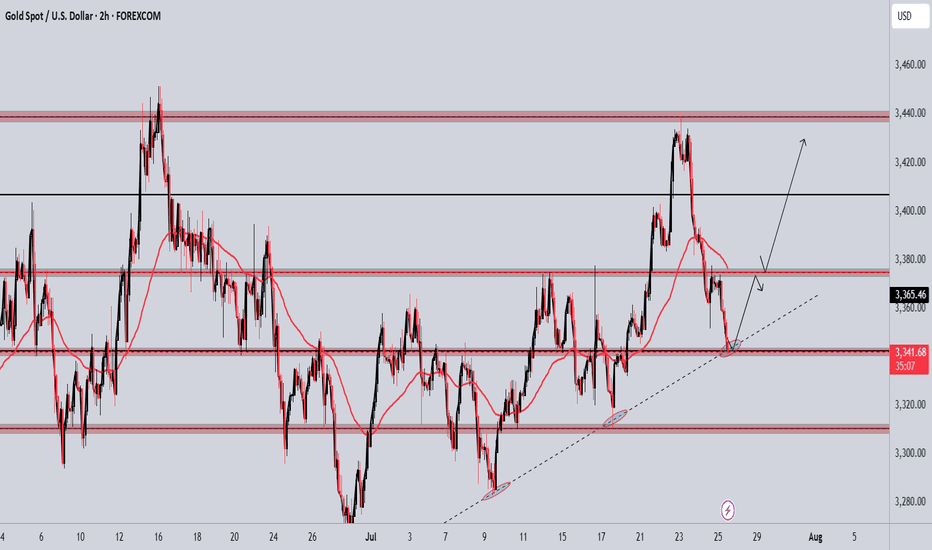

XAU/USD Bearish Retest in Motion – Watch 3340 for Breakout 🔍 XAU/USD (Gold) – Bearish Reversal Outlook

Timeframe: 30-Minute

Date: July 25, 2025

Indicators Used: Ichimoku Cloud, BOS (Break of Structure), Trendlines, Support & Resistance Zones

---

⚙ Technical Breakdown:

1. Previous Market Structure – Accumulation to Expansion:

Descending Channel (Red Box): Market moved within a bearish channel until the breakout occurred.

Key Break of Structure (BOS) around 3365 level signaled the beginning of bullish momentum — a textbook shift from accumulation to expansion phase.

Rally towards 3445 zone: Strong impulsive wave followed by higher highs and higher lows within a green rising channel.

2. Bull Trap and Structural Breakdown:

At the 3445-3460 resistance zone, price failed to maintain momentum and formed a double top / distribution setup.

The second BOS near 3385 confirmed a shift from bullish to bearish market structure.

Ichimoku Cloud also flipped bearish — price is now trading below the cloud, signaling potential continued downside.

3. Current Consolidation and Bearish Retest:

Price is now trapped in a bearish flag / rectangle pattern between 3360 – 3380.

Recent rejections from the descending trendline and overhead supply zone indicate weak bullish attempts and presence of strong selling pressure.

4. Anticipated Move – Bearish Continuation:

The projected red path suggests a retest of the diagonal resistance, followed by a breakdown toward key demand zone at 3340 – 3320.

If that zone fails, we may see a deeper move toward 3280.

---

📌 Key Technical Zones:

Zone Type Price Level (Approx.) Description

Resistance 3445 – 3460 Double Top / Strong Supply

Support 3340 – 3320 Historical Demand Zone

Short-term Resistance 3375 – 3385 BOS Retest + Trendline

---

🎯 Trading Insight:

📉 Bias: Bearish

⚠ Invalidation Level: Break above 3385 with volume

📊 Potential Target: 3340 → 3320

🧠 Trade Idea: Look for short entries on weak retests near descending trendline or cloud rejection.

---

🏆 What Makes This Chart Unique for Editors’ Picks:

✅ Multiple Confluences: Structural shifts (BOS), trendlines, Ichimoku, and classic patterns (channels, flags).

✅ Clear Visual Storytelling: Logical flow from bearish to bullish and back to bearish structure.

✅ Forward Projection: Predictive outlook based on strong technical context — not just reactive analysis.

✅ Educational Value: Useful for beginners and intermediate traders alike to understand structure transitions and key levels.

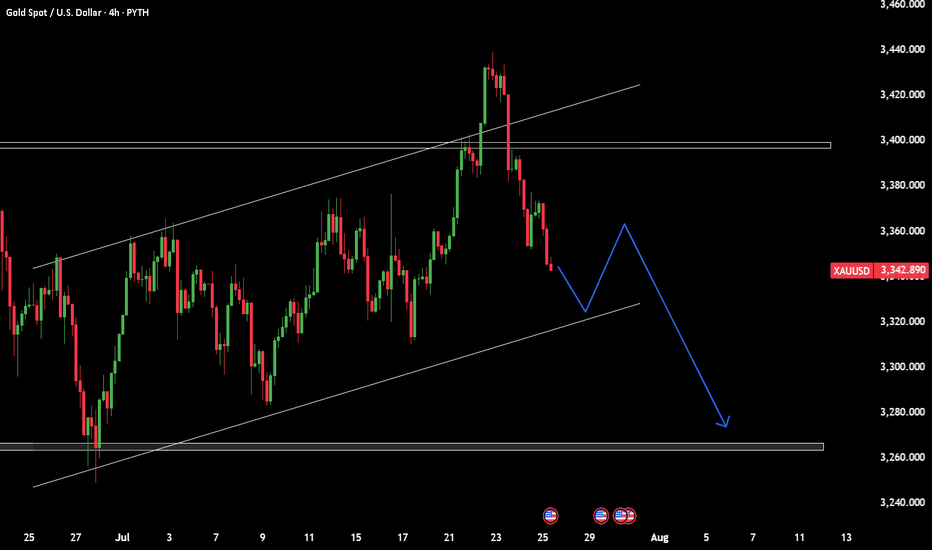

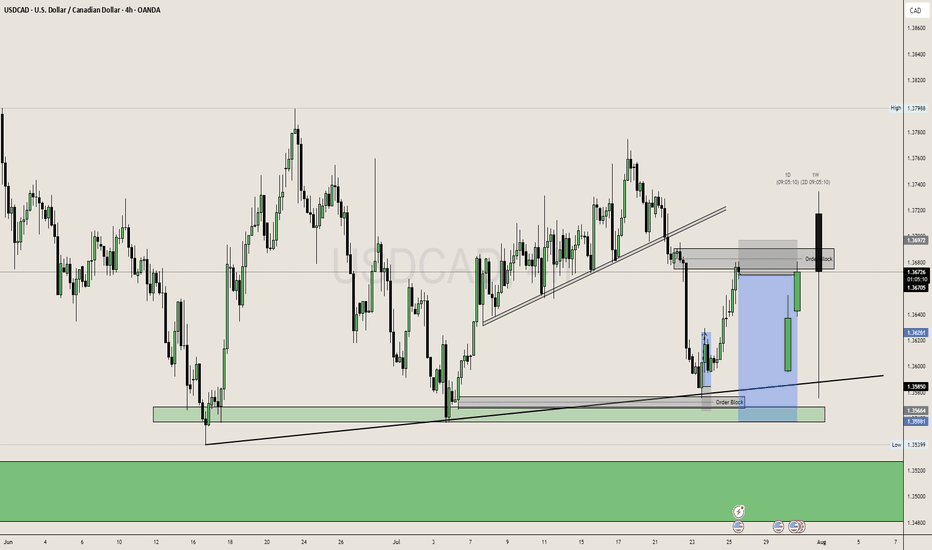

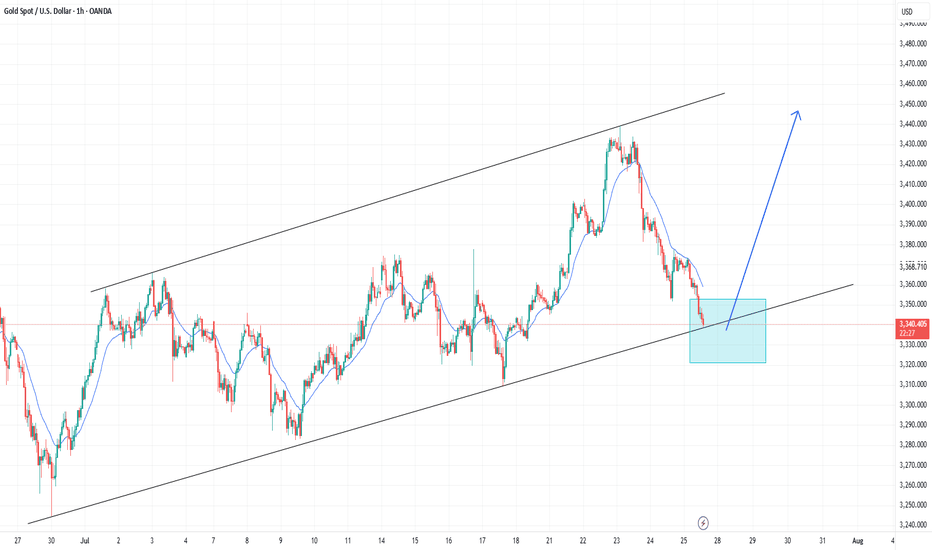

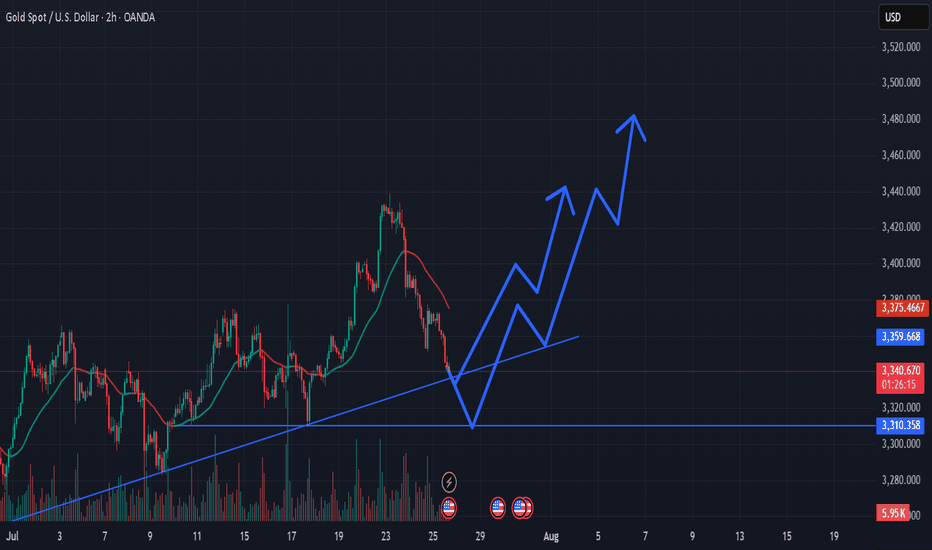

XAU / USD 4 Hour ChartHello traders. Happy Friday. Taking a look at the 4 hour chart, I have marked my current area of interest for potential scalp buy / sell trade set ups for gold today. We are curretnly retesting / revisiting the area where gold originally broke out from. Let's see if we move back up to take out any short positions in profit, or do we keep pushing down and break past the bottom of the channel. Trade the trend and never try to force or rush a trade. Shout out to Big G. Let's see how things play out over the next hour or so. If I take a trade, I will post a chart or update this one. Otherwise, have a great weekend. Be well and trade the trend.

BTC / USD Daily ChartHello traders. This chart is for leveraged Bitcoin traders. Anyone freaking out about what Bitcoin will do should know that this dip now is only about a 10% dip or so from the ATH. We could easily shake out all the long positions in profit by revisiting the area marked on the chart. These temporary dips are for buying, not for getting taken out. Never forget that in order for you to win a trade using a leveraged account, someone or some entity must lose a trade. So it's better to try and ride the wave and trade the trend than to think we can outsmart algolorithmic stop loss hunting programs designed to take your profits. Better to DCA Bitcoin and Ethereum than to take chances of blowing your account on a perfect, yet volatile asset like BTC. Big G gets my thanks. Be well and trade the trend. Happy Friday.

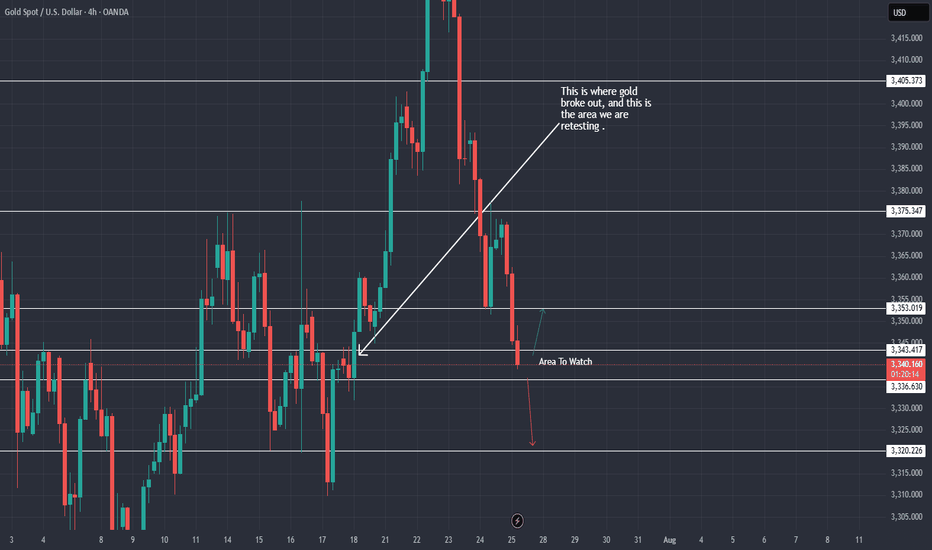

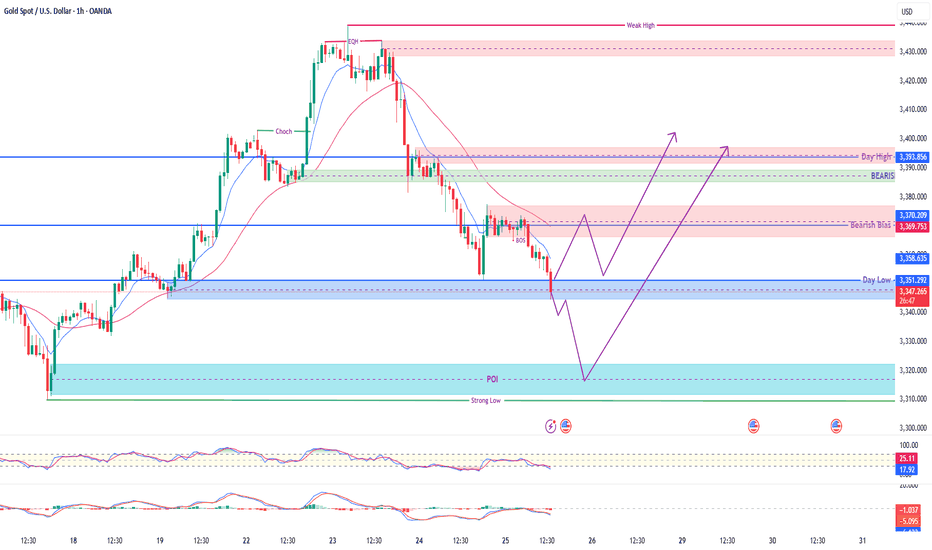

GOLD SPOT STRUCTURAL OUTLOOK & TRADE PLANCurrent Market Overview:

Gold is currently trading around 3345, sitting just above a strong intraday pivot point and previous Day Low support. Price recently experienced a Break of Structure (BOS) confirming bearish pressure from the higher OB (Order Block) and rejection near the bearish breaker zone.

📍 Key Levels to Watch:

🔴 Bearish OB (Resistance): 3369 – 3370

🟣 Bearish Breaker Zone: ~3380

🔵 Day High OB (Major Supply): 3393 – 3395

🟢 POI / Strong Low: 3310 – 3320 (Reversal Zone)

🔵 Day Low & Pivot: 3351 – 3345 (Short-Term Support)

📈 Possible Scenarios:

Scenario A – Bounce from Pivot (Aggressive Entry):

If price respects the pivot at 3345–3351, we may see a short-term bullish reversal toward 3369–3370, with extended targets at the Day High OB.

Scenario B – Deeper Sweep & Bullish Reversal:

A liquidity sweep below 3340 into the POI zone (3310–3320) may offer a premium long opportunity targeting 3370 → 3395.

⚠️ Bias:

🔻 Short-Term Bearish below 3370

🔼 Potential Bullish Reversal from 3320–3350 zones

✅ Technical Confluence:

✅ BOS confirms supply control

✅ POI aligned with historical reaction zones

✅ RSI and MACD showing signs of divergence – early reversal signals

✅ Multiple OBs mapped out for precision entries

🎯 Trade Setup Example (Scenario B):

Buy Limit: 3318

SL: 3305 (Below Strong Low)

TP1: 3370

TP2: 3393 (Day High OB)

Risk-Reward: ~1:4+

XAU/USD Buy Setup – Trendline + Support ConfluenceReasons for Possible Buy:

Price is sitting on a rising trendline acting as dynamic support.

Strong horizontal support zone previously acted as demand.

Signs of a potential bullish reaction or bounce after extended downside.

Trade Plan:

Looking for bullish confirmation (candle structure or momentum shift) around this level.

If confirmed, potential targets:

First target: $3,365–$3,380

Second target: $3,431

🔹 Invalidation: Clean break below $3,320 zone or trendline support would invalidate the setup.

This is a high-reward area if buyers step in again like they did previously. Patience for confirmation is key before executing.