Pairs

Hypothetical UK Election Trade ...Election results come in...

(for which party will be in government). which results in a rise or fall in GBP

due to it's significance (in this instance it was seen as a good result and GBP rose).

-We know there is going to be volatility, so we can profit regardless of whether the

price goes up or down as when the price reaches certain points (A if price rises and

B if price falls) it will trigger a trade which will cancel the other one

-Can be executed on many pairs/ stocks if large results are due.

-Eliminates bias with OCO order.

--(DISCLAIMER) Set TP and Trigger point on major support resistance,

you don't want to trigger then go the opposite direction!!

Straddle Trades can be good for profiting regardless on where the price goes (in times of high volatility) and you could have made some good profits here, this could be replicated for trades such as EUR/GBP, Non farm payroll, US Elections etc... and are also known as OCO (One Cancels the Other) orders

EURNOK: Buy opportunity on the Rising Wedge.The pair is trading within a 1W Rising Wedge (RSI = 59.298, MACD = 0.080, Highs/Lows = 0.0000). Yesterday not only it made contact with the Higher Low trend line, but also touched the 1D MA50 (blue line). This indicates that the price has more probabilities to rebound towards a new Higher High. Our Target Zone is 10.400 - 10.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURCHF: Sell opportunity on symmetrical approach.The pair has been on a rise since the September bottom but 1D has turned neutral again (RSI = 45.114, MACD = 0.000) as the price pulled back on the 1W Resistance. So far it has found support on the 1D MA50 but this is far from comforting as we had the very same candle sequence in September - October 2018, when the price followed with a strong bearish reversal towards the previous low.

The RSI sequences are also similar so we are expecting an identical pattern, targeting 1.08150.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

AUDJPY: Buy opportunity on the 1D MA50.The pair has been trading within a 1D Channel Up (RSI = 55.246, MACD = 0.410, Highs/Lows = 0.0000) since the August bottom. Last Friday we got a rejection on the 1D MA200 similar to what happened in April, so that requires attention. As long as the Higher Low zone (green shape) holds, the 1D MA50 (blue line) should support then next Higher High on the 76.150 Resistance, which is our Target.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

CADJPY: Cyclical Long opportunity.CADJPY has been on a strong 1D Channel Up (RSI = 53.040, MACD = 0.280, Highs/Lows = 0.0000) since August, breaking above the 1W MA50 (blue line) but was eventually rejected near the 1W MA200 (orange line).

Looking back on the 1W chart this is a cycle that is repeated since 2006, with Death and Golden Cross formation marking it. At the moment the price is preparing an aggressive rise into a new consolidation zone (green Rectangle). This will most likely be marked by a Golden Cross. Our long term Target Zone is 89.000 - 91.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

NZDJPY: Short opportunity.The pair is trading within a multi year Falling Wedge with the whole 2019 year being a bearish leg/ Channel Down (RSI = 40.270, MACD = -2.190, Highs/Lows = -1.6579) on its own. The 1W RSI has hit the top of the Falling Wedge and appears to be reversing. We take that as a Short Signal with our Target at 66.375.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURILS: Further downside expected.The pair is on a strong 1M Channel Down (RSI = 37.575, MACD = 0.082, Highs/Lows = -0.1355) since the beginning of the year. We are expecting another test of the 3.7870 1D Support. Based on the RSI (despite being a bullish divergence) we are expecting a symmetric low outside the Channel. That should be the 3.7870 contact.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

DKKJPY: Short opportunity on the 1W Resistance.The pair has been on a 1D Channel Up since September (RSI = 54.610, MACD = 0.760, Highs/Lows = 7.6694) which has recently hit the 16.25000 1W Resistance. So far that level has been holding for 10 sessions, indicating strong sell bias. Being also the Higher High of the Channel and since the previous times the 1D RSI has been on similar levels a decline took place, we are expecting at least 16.0200 on this pull back.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

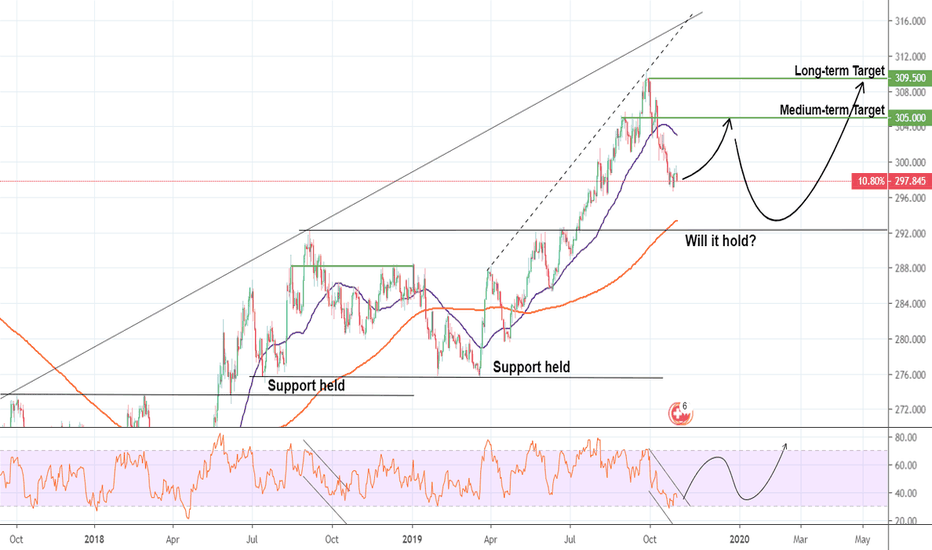

CHFHUF: Mid/ Long-term Bullish Targets.The pair is trading on a strong 1D bearish leg (RSI = 37.148, MACD = -1.594, Highs/Lows = -0.8378) that has rebounded on the pivotal 30.000 RSI level. Based on CHFHUF's past price action on that level, we are expecting a medium term rebound to 305.000. On the long term, assuming the Support from the previous Monthly High holds (as it has done since 2018), we are expecting 309.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

GBPSEK: The short opportunity of the Golden Cross.The pair is trading within a strong long term Channel Up since October 2017 on the 1M (monthly) chart (RSI = 60.289, MACD = 0.143, Highs/Lows = 0.3378). It is currently testing the 12.6000 1W Resistance following a Golden Cross on the 1D chart.

This formation has delivered a roughly -4% drop on the past two occurences. Since the RSI topped at 80.000 which is always a sell zone on 1D, we are going short with TP = 12.2000 or once the 1D RSI touches 38.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

SGDHKD: Short opportunity near the 1W Resistance.The pair stopped the uptrend near the 1W Resistance Zone (5.77540 - 5.78100) with the 1D RSI hitting 74.000. Based on that we are expecting a rejection to the nearest Support which is 5.71500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

trading follows the same rules we use for life. Real Life

Trading Philosophy - Watch out for that big truck in your lane!If you are driving down the road and a truck is coming straight at you, in your lane, do you stay in that lane or swerve across to the empty lane where you are not supposed to be? The rules are clear, you are not supposed to be over there. The system says don’t do it, but reality is an 18-wheeler coming toward you in your lane. Do we follow all the rules of safe driving, or do we adapt to the situation at hand? Survival is a function of adaptation. Reality rules. On the road, in the markets.

The first rule of life is to survive; the second rule is that all rules can be broken if that supports the first rule. Take this as your trading philosophy.

Day trading follows the same rules we use for life. Successful trading is the art of using knowledge (systems) at the right time. This means when it is time to use the system or rule, you check for an oncoming 18-wheeler. That is what thinking is all about. We do need systems of living and systems for trading. But it is not mandatory that you follow all systems exactly all the time (just 99% of the time!). The reason is that systems do not adapt to any new bits of reality. That is what our mind is for, to observe, to record, to note changes, and then to develop an optimum use of the system.

simpletradingrules.com

CADCHF: Sell opportunity (short/ medium/ long-term targets).The pair has been trading within a long term 1W Bearish Megaphone (RSI = 54.429, MACD = 0.000, ADX = 24.402, Highs/Lows = 0.0014) since February making Lower Highs but more importantly wider Lower Lows. We are currently on the Lower High zone and traders who want to sell on the medium and long term can aim at 0.73620 and 0.72700 respectively.

On the short term 1D has been a Rectangle (RSI = 57.232, MACD = 0.002, Highs/Lows = 0.0005) since early September trading within 0.75650 - 0.74350. Short term traders may sell with 0.74350 as their target.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

AUDCHF: Lower Buy opportunity on the short term.The pair is approaching the 0.66520 4H Support on a 4H Ascending Triangle (RSI = 46.715, MACD = 0.001, Highs/Lows = -0.0012). This neutral short term price action is ideal for buying on the Buy Zone (illustrated on the chart) and taking profit on a Higher High. Our projected target is 0.68100.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

NZDCAD: Sell opportunity within a 6 month Channel Down.The pair is trading within a 1W Channel Down (RSI = 37.641, MACD = 0.014, Highs/Lows = -0.0048) since the end of March 2019. The pattern has provided clear Lower Highs (to short) and Lower Lows (to long). At the moment the price is rebounding off a Lower Low on a bullish 1D RSI sequence. Last time this 1D sequence took place within the Channel Down was in May and followed with a marginal cross above the 1D MA50 (light blue trend line) as it priced the Lower High.

We expect a similar price action this time as well, so be ready to short the cross with a potential Target Zone of 0.81000 - 0.82000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

CHFPLN: Long opportunity within a 1D Rectangle.The pair has been trading sideways within the 3.94000 1D Support and the 4.05500 1D Resistance since early August, forming a Rectangle pattern on 1D (RSI = 42.228, MACD = -0.007, Highs/Lows = -0.0314, ADX = 25.098).

At the moment it is near the 1D Support, hence on optimal buy levels, even though the RSI shows there is still a minor potential for a lower pull (if the previous bottom is repeated). Our Target Zone is 4.04000 - 4.05500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURSGD: Sell opportunity on recurring pattern.The pair has been trading within a 1M Channel Down (RSI = 40.510, MACD = -0.011, Highs/Lows = -0.0132) since the start of the year. Recently is has been following a previous pattern within the Channel Down that calls for a bearish extension. We are taking this sell opportunity to aim near the 1.4810 Support. Attention is required and readiness for an early exit as this levels has been holding since November 2015.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

CHFJPY: Buy opportunity on Double Bottom.The pair has been trading within a 1W descending channel for most of the year (RSI = 40.168, MACD = -0.690, Highs/Lows = -0.5054) and last week rebounded on the 106.885 1D Support. This is a potential Double Bottom formation and we are taking this buy opportunity to aim at the nearest 1D gap at 108.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.