Pancakeswap

CAKEUSDT Pump📊 On the 4H BINANCE:CAKEUSDT chart, price has broken above the mid-term channel resistance and is currently pulling back. If the support zone holds, there’s potential for continuation toward higher resistance levels. A bullish reaction from the 2.299 USDT area could validate the next leg up.

🔄 If the correction deepens, the highlighted pink zone offers a strong re-entry opportunity. Key targets on the upside include 2.570, 2.740, and potentially 2.940 USDT if momentum continues.

✅ Key Support Levels:

🟥 2.401 USDT

🟥 2.299 USDT

🟥 2.035 USDT

🟥 1.830 USDT

🚫 Key Resistance Levels:

🟩 2.570 USDT

🟩 2.740 USDT

🟩 2.940 USDT

Urgent: Pancakeswap about to go Hyper-Bullish (CAKEBTC)Pancakeswap grew 6,000% vs Bitcoin back in early 2021. It took exactly 105 days, a little more than three months. Full blown bullish action. Amazing growth.

CAKEBTC. This growth happened between January and April 2021. The orthodox end of the previous bull market for Bitcoin was April 2021. So if we can extrapolate the data from the past and project it into the present market, we could say that this bull run would happen at the same time as Bitcoin produces its bull run.

It is a bit hard to explain. Let's try a different method.

Between April 2021 and February 2025 there is a clear and very strong downtrend on this pair, CAKEBTC. The pattern goes completely awry after February 2025. Volume goes off the chart. The highest buying-volume since 2021 and the pattern changes from lower lows to sideways and slowly higher.

In short, the bottom is in after almost four years.

After the bottom is in there can be nothing other than growth. The urgent happening is that growth will not be ordinary, CAKEBTC (and CAKEUSDT) will produce extraordinary growth, based on the market and this chart.

This is the best I can do. And it is my job which I love.

I can alert you of the event before it happens. It is your job to extract maximum profits from this situation. It is your job to take advantage of this situation. It is your job to win and win big.

You have my support.

You can do this brother-sister.

Namaste.

Pancakeswap: Slow Growth vs Fast Swings & Strong Shakeouts—1000%A prolonged rise is a strong bullish development. If a market takes 4 months slowly rising, this is nothing other than good. That's exactly what has been happening with CAKEUSDT.

It can be seen as no action or slow action or boring action, but this is the type of action that leads to a 300% bullish jump within a few short days.

Say from February through August 2025 Pancakeswap grows by 1,000%. Just an example. And consider the following scenarios:

1) CAKEUSDT goes sideways for five months and then grows 900% in the last month.

2) CAKEUSDT produces bullish consolidation growing slowly for three months, some 200-300% and then growths an additional 800-700% in the remaining three months.

3) Strong 300% growth in the first two months followed by a 2 months correction then a recovery and growth that totals 1,000% by August 2025.

These are very different scenarios, different roads that all lead to the same place. This can happen.

You can see a pair growing slowly and this is good as long as it isn't producing lower lows. It grows and grows and then some speed at the end, easy win. But, a pair can move lower and lower and then produce an equally strong bullish breakout and recovery and grow even faster than one that was producing bullish consolidation.

What I am leading to is this; patience is key.

It doesn't matter what happens in the short-term, there will be growth long-term. The way to win is to be in early and wait. Wait patiently because the market takes care of the rest.

There are no complexities in trading Cryptocurrencies you just buy and hold. Do not believe me? Do it now, buy now and wait until later this year and we will see what happens. If the market shakes, ignore.

I'll see you at the top.

Namaste.

CAKEUSD Ahead of a monumental Triangle break-out.PancakeSwap (CAKEUSD) has been trading within a Triangle pattern since the December 04 2024 High and the price has been on the tightest squeeze possible since.

As you can see, it has been ranged for the past 2 weeks withing the 0.382 - 0.618 Fibonacci range and this is also reflected on the 1D RSI sequence.

If the price breaks above the top of the Triangle (Lower Highs trend-line), we expect a rally towards the 2.0 Fibonacci extension (5.3000). Alternatively, you may target on a safer note either Resistance 1 or the 1.618 Fib ext.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CAKEUSDT Short Setup – Watching 2.40 Zone for RejectionHey Traders,

CAKEUSDT is currently trading within a well-defined downtrend, consistently forming lower highs and lower lows. The recent move appears to be a corrective rally, bringing price back toward a key daily resistance zone around 2.40, which also aligns with the descending trendline.

I’m monitoring this area closely for potential bearish price action to develop, signaling a continuation of the dominant bearish trend.

Key Confluences:

Major daily resistance at 2.40

Approaching descending trendline

Market still in a clear downtrend

Possible lower high formation in progress

Trade Plan:

If I see bearish confirmation in this zone (e.g. rejection candles, bearish structure break on lower timeframes, or weakening momentum).

A strong break and hold above 2.40 would invalidate the setup!

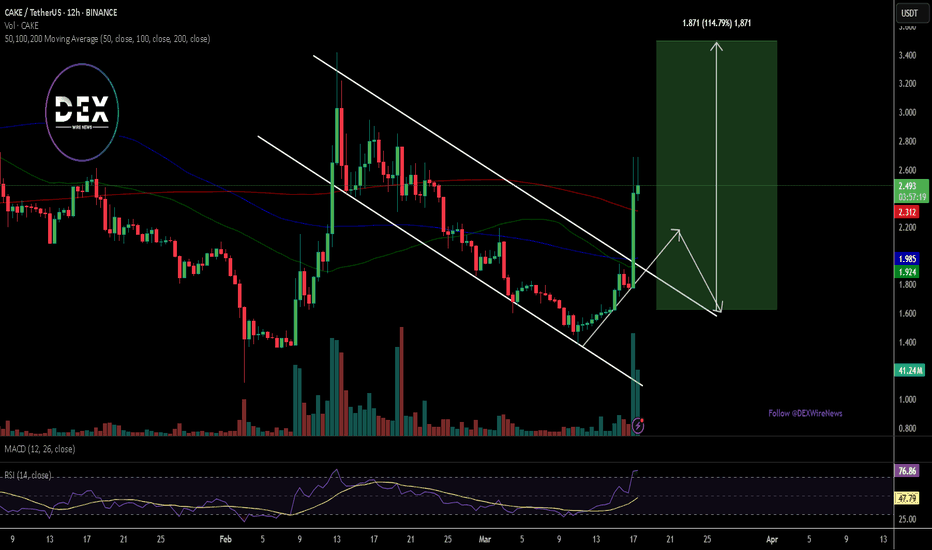

Breaking: $CAKE Surge 16% Amidst Breakout of a Falling wedge The price of Pancakeswap saw a noteworthy uptick of 16% today amidst breakout of a falling wedge pattern. With the Relative Strength Index (RSI) at 72, more upside is envisioned in the long run as traders step in sparking a move to the $3.8 pivot point.

About PancakeSwap

PancakeSwap is a decentralized exchange (DEX) built on multiple blockchains, primarily BNB Chain and Ethereum, offering trading, staking, and yield farming services. The platform uses automated market makers (AMM) to enable users to trade cryptocurrencies directly from their wallets, with CAKE as its native token that powers various platform features and rewards. Since its launch, it has evolved into one of the largest DEXs by trading volume, incorporating features like perpetual trading and cross-chain functionality.

PancakeSwap Price Live Data

The live PancakeSwap price today is $2.79 USD with a 24-hour trading volume of $399,375,543 USD. PancakeSwap is up 15.87% in the last 24 hours, with a live market cap of $816,022,085 USD. It has a circulating supply of 292,717,453 CAKE coins and a max. supply of 450,000,000 CAKE coins.

Breaking: $CAKE Surge 45% Today Amidst a Falling Wedge BreakoutPancakeswap native token NASDAQ:CAKE saw a noteworthy uptick of 45% today amidst a falling wedge breakout.

Pancakeswap was originally built on the BNB Chain and allows users to trade tokens without using a centralized exchange.

Pancakeswap innovates quickly and ships new products regularly. In April 2023, PancakeSwap voted to transition to a deflationary token model called "Ultrasound CAKE." The protocol passed a proposal called CAKE Tokenomics v2.5 to create a structure combining real yield (no supply impact) and reduced token emissions. Over 102% of minted CAKE is burned weekly. This is intended to provide a multi-year runway for emissions and incentivize locking up CAKE, making the token more valuable long-term.

PancakeSwap has an anonymous team of “Chefs,” working in the PancakeSwap “Kitchen.” The platform is open-source and has been audited by multiple reputable blockchain security firms like Peckshield and Slowmist.

Although the bear market has impacted TVL and trading volume for the protocol, PancakeSwap still boasts an annualized revenue of $27 million, with 42% of CAKE is staked.

Technical Outlook

As of the time of writing, NASDAQ:CAKE is up 40.37% currently overbought with the RSI at 77 a trend reversal could be looming ahead. Similarly, a breakout above the $3 resistant point could set NASDAQ:CAKE on a bullish course as the all time high is pegged at $44 with a market cap of just $732 million a move to $5 isn't far fetched.

CAKE/USD: Ready for a Massive Breakout?Chart Analysis:

1. Timeframe and Price Context

Timeframe: Daily chart (each candlestick represents 1 day of trading).

Price Levels:

The current price is $15.486779, as indicated on the chart.

The price range on the chart spans from near $0 (early 2021) to a peak of approximately $47.862159 (late 2024), followed by a sharp correction to the current level.

Trend Overview:

2021-2023: CAKE starts near $0 and experiences a strong uptrend, likely driven by the growth of the Binance Smart Chain (BSC) and DeFi adoption, peaking around $40-$50 in 2021-2022, with some consolidation.

Late 2024: A significant rally pushes the price to $47.862159, followed by a sharp correction.

Early 2025: The price has stabilized around $15.486779, within the annotated "Buying Zone."

2. Key Patterns and Annotations

Post-Rally Correction:

After reaching a peak of $47.862159, CAKE experienced a steep decline (approximately 68% drop to $1.5486779), indicating a strong correction phase.

This correction likely reflects profit-taking or broader market pressure after the rally.

Buying Zone:

The chart labels a "Buying Zone" around the current price level of $15.486779, suggesting this is a perceived support area where accumulation by traders or whales might occur.

This zone aligns with a horizontal support level where the price has consolidated after the correction.

Breakout Prediction:

An upward arrow with the annotation "TG 4BS" suggests a bullish target, which I interpret as $48 (given the price scale and the prior peak of $47.862159). This would represent a ~210% increase from the current price of $1.5486779.

The target aligns with the prior all-time high, indicating a potential retest or breakout to new highs.

3. Support and Resistance Levels

Support:

The "Buying Zone" at $1.5486779 appears to be a strong support level, where the price has stabilized post-correction.

If this support breaks, the next significant level could be around $10-$12 (a psychological and historical support from 2023).

Resistance:

The immediate resistance is likely around $20-$25, a prior consolidation zone during the uptrend.

The $47.862159 level (recent high) is a major resistance, and the $48 target (as annotated) is the next key level to watch.

4. Volume and Momentum (Not Visible but Inferred)

Volume bars are not clearly visible, but typical behavior suggests:

Volume likely spiked during the rally to $47.862159 and decreased during the correction as selling pressure eased.

A breakout would require a volume surge to confirm, especially if the price moves toward $48.

Momentum indicators (e.g., RSI or MACD) could indicate whether CAKE is oversold or showing bullish divergence, supporting a reversal.

5. Potential Scenarios

Bullish Breakout:

If CAKE breaks above the $20-$25 resistance with strong volume, it could confirm a bullish trend, targeting the $48 level.

The "Buying Zone" at $1.5486779 suggests accumulation, which could fuel a rally if buying pressure increases. This would align with a ~210% move, consistent with prior bullish cycles in DeFi tokens.

Bearish Breakdown:

If the price fails to hold the $1.5486779 support and breaks below, it could signal further downside.

The next support at $10-$12 could be tested, potentially leading to a deeper correction.

Consolidation:

If the price remains within the "Buying Zone" (around $15-$18), it might continue to consolidate until a catalyst (e.g., BSC ecosystem growth, market rally) triggers a move.

6. Market Context

DeFi and BSC Influence: CAKE, as the governance token of PancakeSwap (a leading DEX on BSC), is influenced by DeFi adoption, BSC network activity, and broader crypto market trends (e.g., Bitcoin and Ethereum performance from your previous charts).

Whale Activity: The "Buying Zone" annotation suggests whales or smart money might be accumulating at this level, similar to your earlier analyses of Ethereum, UNISWAP, Bitcoin, and Dogecoin. This could set the stage for a breakout.

Timing: On a daily timeframe, a breakout could occur within weeks to months, depending on market conditions and catalysts.

PancakeSwap Token: Volume Signal (New All-Time High In 2025)This volume signal reveals the bottom, together with candlestick patterns and price action. Let's get into it.

Good evening my...

Ok. We are going straight to present day.

The 3-Feb. session ended as a perfect "neutral" Doji. This session produced a multi-year low, the lowest price since October 2023 and yet, a higher low. This session is a reversal signal on its own and the green week that follows works as confirmation. This session has really high volume and the week that follows has the highest volume ever. These sessions are green.

After this initial price bounce, there is a retrace, classic retrace, and this retrace is set to end, will end, in a higher low. This higher low is a bullish signal. The volume signal gives the bottom away; the bottom reveals the bull-market, the bull-market implies maximum growth.

A sideways market for years, CAKEUSDT (PancakeSwap Token) is about to turn green.

Let me know if you agree and if you do, follow me.

If you don't agree, make sure to follow anyway. Sometimes, it is good to read stuff that are contrary to our thoughts. Sometimes, it is better to be guided, because no one can approach the high level of accuracy exhibited by the Master of the charts.

Just kidding.

PancakeSwap Token (CAKE) is set to rise bigly and strongly and it will do so for the long-term. A new All-Time High in 2025.

Thank you for reading.

It is my pleasure to write for you again today.

Namaste.

Incoming BNB chain forks with 0,75s block time!BNB chain upcoming forks significantly reducing block times, increase TPS and decrease fees!

The Pascal hard fork in March 2025 is a big milestone in BNB Chain’s evolution setting the stage for the two upcoming BNB Chain forks:

1. Lorentz (April 2025): Reduces block intervals to 1.5 seconds

2. Maxwell (June 2025): Further reduces block intervals to 0.75 seconds

Very bullish for all BNB chain projects and it´s main token BNB and defi platforms like CAKE. Finally Ethereum compatible chain's direct hit to Solana's heart and it's performance. The Maxwell fork in June will be game changer for crypto industry.

Almost instant defi experience with decreasing Ethereum activity might lead to 2025 be a BNB chain season.

Liquidity sweep at 2usdRecent price action surprised many. The reason behind this is open sell position for aprox. 5M of cake tokens at 2usd price level. Not speculating who did this but all who is following this project for long-term can understand there is tight competition on the market. Price will rise from this level, once reached 2usd liquidity will be swept quickly.

CAKE Triangle break out + nex supportThe triangle was broken and now on the way to test lower support at 2,03-1,88usd. All driven by BTC now, if BTC falls lower the probability of upward momentum grows and might be very quick for whole market. I´d avoid any short positions and rather DCA on the way down.

$CAKE Token Set to Spike to $5 Amidst Falling Wedge BreakoutNASDAQ:CAKE , the native token of PancakeSwap, a leading decentralized exchange (DEX) built on the BNB Chain. Recently, NASDAQ:CAKE has been making headlines with a remarkable 70% surge in just seven days, climbing from $1.5 to $2.8. But this could just be the beginning. We are now predicting a potential spike to $5 in the near term,

Technical Analysis

The NASDAQ:CAKE chart is currently painting a bullish picture, with a falling wedge pattern that has been forming since December 2024. Falling wedges are typically reversal patterns, signaling a potential breakout to the upside. For NASDAQ:CAKE , this breakout appears imminent, with the token testing key resistance levels.

The falling wedge pattern suggests that selling pressure is weakening, and buyers are stepping in. A confirmed breakout above the wedge’s upper trendline could trigger a significant upward move, potentially propelling NASDAQ:CAKE to $5 in the short term.

The 38.2% Fibonacci retracement level is acting as a strong support zone for $CAKE. This level has historically served as a springboard for price rallies. In the event of a minor pullback, this support level is expected to hold, providing a solid foundation for further upside.

The immediate resistance lies at the 1-month high, which, if broken, could act as a major pivot point for NASDAQ:CAKE ’s next leg up. Beyond $5, the next target is $10, a level that could be achieved if bullish momentum continues and broader market conditions remain favorable.

Ultrasound CAKE, Four.memes, and PancakeSwap’s Ecosystem

While the technical setup is compelling, NASDAQ:CAKE ’s fundamentals are equally impressive. PancakeSwap has consistently innovated and expanded its ecosystem, making NASDAQ:CAKE one of the most versatile tokens in the DeFi space.

1. Ultrasound CAKE: A Deflationary Mode

In April 2023, PancakeSwap transitioned to a deflationary token model called “Ultrasound CAKE.” This model, approved through the CAKE Tokenomics v2.5 proposal, combines real yield with reduced token emissions. Over 102% of minted CAKE is burned weekly, creating a supply squeeze that enhances the token’s long-term value.

2. Four.memes: A Catalyst for Growth

One of the key drivers behind NASDAQ:CAKE ’s recent surge is the launch of Four.memes, a BNB token creation toolkit. This platform allows users to create and graduate meme coins to PancakeSwap once they reach a bonding curve. Four.memes has not only increased activity on the PancakeSwap platform but also brought new users and liquidity into the ecosystem.

3. Strong Financials and Staking Metrics

Despite the bear market’s impact on the broader crypto space, PancakeSwap continues to generate impressive revenue. The platform boasts an annualized revenue of $27 million, with 42% of NASDAQ:CAKE ’s circulating supply staked.

Market Sentiment and Future Outlook

The current market sentiment around NASDAQ:CAKE is overwhelmingly positive. With a market cap of $845 million and a 24-hour trading volume of $444 million, NASDAQ:CAKE is firmly positioned as a top-tier DeFi token.

Conclusion: NASDAQ:CAKE is Ready to Rise

The falling wedge breakout, combined with PancakeSwap’s innovative ecosystem and deflationary tokenomics, sets the stage for a significant price surge. With a potential target of $5 in the near term and $10 in the coming weeks, NASDAQ:CAKE is poised to deliver substantial returns for investors.

#PancakeSwap #CAKE LONG TERM TARGETS IN 2025Based on the CAKE token’s chart, it can be observed that its price movements are quite channeled and orderly. In November, it broke out of its channel, and recently it has pulled back again to the channel’s upper boundary. Considering the price movement model from October 2023 to February 2025, it appears that its corrective structure has likely come to an end, and we can anticipate price growth throughout 2025.

TARGETS:

1- 7.5$

2- 10.5$

3- 20$

4- 27$

STOPLOSS: 0.95

CAKE picking up from the dustNot much to say here, want to highlight two points. Price is being attracted to huge FGV areas created by panic sell-offs, the second, massive sell orders at 1,2usd indicate overleveraged positions were closed by margin calls removing possible sell-offs later at higher prices.

Cake fell much more than other coins, hope we can pickup soon as the platform is one of the best if not the best defi in my honest opinion.

Idea will be invalidated at strong 2usd price pushback.

Cake demand/supply resistanceCake is approaching the nearest resistance level around 2usd, needs to be broken and become support so wait for break out and then one leg down to settle down at this support. Market conditions positive, altseason outlook promising. Keep in mind price below this demand zone, below 1,8usd can trigger depression and sell-off. For now holds steady even btc dropping as this coin suffered a lot sell-offs recently.

Cake supply/demand zones with volumeCake touched the nearest demand zone and bounced back as BTC sell-off was intensive but short. Might be re-visiting this zone and even lover to 1.664. All depends on the general market condition and mood. The altcoin season is slowly approaching. This time it takes BTC dominance to climb higher much longer due to competitors among alts and general world economy condition. During alt season might be surprisingly outperforming competitors but it will not last long. This coin is still not made for long-term holding rather for short-term trading. Lower highs and higher lows are narrowing the corridor for upside breakout with strong potential.

CAKE on the way upCake just entered the tiny buy channel crossing 2.17usd with several local bearish targets on the way back to 4.5usd.

As you see on the chart the sell-off from the previous local top 4.5usd was mainly caused by panic sellers/whales, there are 8 fair value gaps (red squares) going down from 4.5usd whereas the growth to 4.5usd counts only 2 (green squares)! FVG (fair value gap) acts as a magnet in both directions, which means the red ones attract the price from below levels up and the green ones from upper levels down. In other words, if the price was unnaturally pushed down, it can jump the same way up and vice versa.

The price was pushed down significantly which may be an opportunity.

CAKE discount zone on 4hCAKE has been under sell pressure since ATH. Overcame several changes and finally became deflationary but of course, it takes time to gain the users' trust and boost the adoption.

The discount zone at 4h says it all. Strong support at 2usd. Undervalued number 1 bnb chain defi which is now deflationary.

Price approaching Weekly and Monthly lows with V4 coming this is a good opportunity to jump in for the incoming altcoin season.