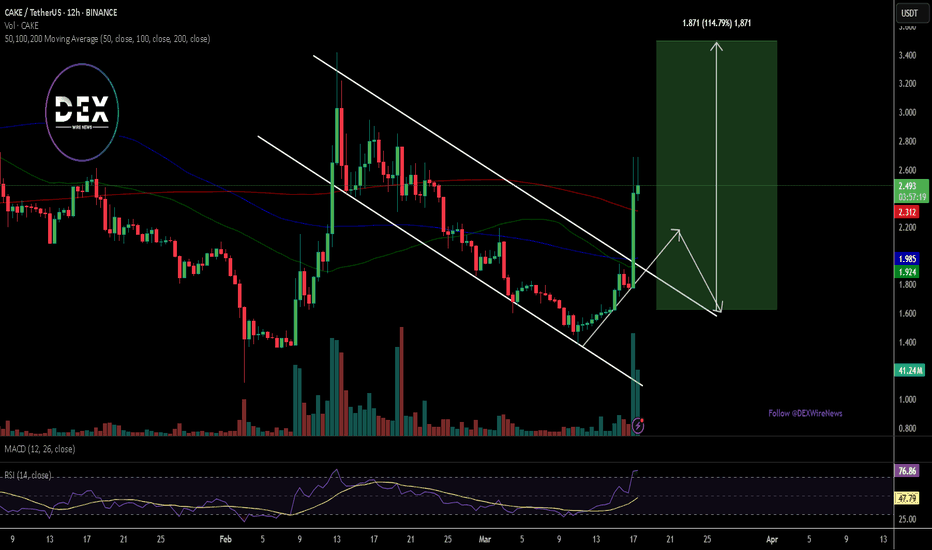

Breaking: $CAKE Surge 16% Amidst Breakout of a Falling wedge The price of Pancakeswap saw a noteworthy uptick of 16% today amidst breakout of a falling wedge pattern. With the Relative Strength Index (RSI) at 72, more upside is envisioned in the long run as traders step in sparking a move to the $3.8 pivot point.

About PancakeSwap

PancakeSwap is a decentralized exchange (DEX) built on multiple blockchains, primarily BNB Chain and Ethereum, offering trading, staking, and yield farming services. The platform uses automated market makers (AMM) to enable users to trade cryptocurrencies directly from their wallets, with CAKE as its native token that powers various platform features and rewards. Since its launch, it has evolved into one of the largest DEXs by trading volume, incorporating features like perpetual trading and cross-chain functionality.

PancakeSwap Price Live Data

The live PancakeSwap price today is $2.79 USD with a 24-hour trading volume of $399,375,543 USD. PancakeSwap is up 15.87% in the last 24 hours, with a live market cap of $816,022,085 USD. It has a circulating supply of 292,717,453 CAKE coins and a max. supply of 450,000,000 CAKE coins.

Pancakeswapbusd

Breaking: $CAKE Surge 45% Today Amidst a Falling Wedge BreakoutPancakeswap native token NASDAQ:CAKE saw a noteworthy uptick of 45% today amidst a falling wedge breakout.

Pancakeswap was originally built on the BNB Chain and allows users to trade tokens without using a centralized exchange.

Pancakeswap innovates quickly and ships new products regularly. In April 2023, PancakeSwap voted to transition to a deflationary token model called "Ultrasound CAKE." The protocol passed a proposal called CAKE Tokenomics v2.5 to create a structure combining real yield (no supply impact) and reduced token emissions. Over 102% of minted CAKE is burned weekly. This is intended to provide a multi-year runway for emissions and incentivize locking up CAKE, making the token more valuable long-term.

PancakeSwap has an anonymous team of “Chefs,” working in the PancakeSwap “Kitchen.” The platform is open-source and has been audited by multiple reputable blockchain security firms like Peckshield and Slowmist.

Although the bear market has impacted TVL and trading volume for the protocol, PancakeSwap still boasts an annualized revenue of $27 million, with 42% of CAKE is staked.

Technical Outlook

As of the time of writing, NASDAQ:CAKE is up 40.37% currently overbought with the RSI at 77 a trend reversal could be looming ahead. Similarly, a breakout above the $3 resistant point could set NASDAQ:CAKE on a bullish course as the all time high is pegged at $44 with a market cap of just $732 million a move to $5 isn't far fetched.

$CAKE Token Set to Spike to $5 Amidst Falling Wedge BreakoutNASDAQ:CAKE , the native token of PancakeSwap, a leading decentralized exchange (DEX) built on the BNB Chain. Recently, NASDAQ:CAKE has been making headlines with a remarkable 70% surge in just seven days, climbing from $1.5 to $2.8. But this could just be the beginning. We are now predicting a potential spike to $5 in the near term,

Technical Analysis

The NASDAQ:CAKE chart is currently painting a bullish picture, with a falling wedge pattern that has been forming since December 2024. Falling wedges are typically reversal patterns, signaling a potential breakout to the upside. For NASDAQ:CAKE , this breakout appears imminent, with the token testing key resistance levels.

The falling wedge pattern suggests that selling pressure is weakening, and buyers are stepping in. A confirmed breakout above the wedge’s upper trendline could trigger a significant upward move, potentially propelling NASDAQ:CAKE to $5 in the short term.

The 38.2% Fibonacci retracement level is acting as a strong support zone for $CAKE. This level has historically served as a springboard for price rallies. In the event of a minor pullback, this support level is expected to hold, providing a solid foundation for further upside.

The immediate resistance lies at the 1-month high, which, if broken, could act as a major pivot point for NASDAQ:CAKE ’s next leg up. Beyond $5, the next target is $10, a level that could be achieved if bullish momentum continues and broader market conditions remain favorable.

Ultrasound CAKE, Four.memes, and PancakeSwap’s Ecosystem

While the technical setup is compelling, NASDAQ:CAKE ’s fundamentals are equally impressive. PancakeSwap has consistently innovated and expanded its ecosystem, making NASDAQ:CAKE one of the most versatile tokens in the DeFi space.

1. Ultrasound CAKE: A Deflationary Mode

In April 2023, PancakeSwap transitioned to a deflationary token model called “Ultrasound CAKE.” This model, approved through the CAKE Tokenomics v2.5 proposal, combines real yield with reduced token emissions. Over 102% of minted CAKE is burned weekly, creating a supply squeeze that enhances the token’s long-term value.

2. Four.memes: A Catalyst for Growth

One of the key drivers behind NASDAQ:CAKE ’s recent surge is the launch of Four.memes, a BNB token creation toolkit. This platform allows users to create and graduate meme coins to PancakeSwap once they reach a bonding curve. Four.memes has not only increased activity on the PancakeSwap platform but also brought new users and liquidity into the ecosystem.

3. Strong Financials and Staking Metrics

Despite the bear market’s impact on the broader crypto space, PancakeSwap continues to generate impressive revenue. The platform boasts an annualized revenue of $27 million, with 42% of NASDAQ:CAKE ’s circulating supply staked.

Market Sentiment and Future Outlook

The current market sentiment around NASDAQ:CAKE is overwhelmingly positive. With a market cap of $845 million and a 24-hour trading volume of $444 million, NASDAQ:CAKE is firmly positioned as a top-tier DeFi token.

Conclusion: NASDAQ:CAKE is Ready to Rise

The falling wedge breakout, combined with PancakeSwap’s innovative ecosystem and deflationary tokenomics, sets the stage for a significant price surge. With a potential target of $5 in the near term and $10 in the coming weeks, NASDAQ:CAKE is poised to deliver substantial returns for investors.

PancakeSwap Wraps Up 2024 With a Record-Breaking Year PancakeSwap, one of the leading decentralized exchanges (DEXs), has achieved a significant milestone, recording a total trading volume of $310 billion in 2024. This marks a staggering 179% increase compared to 2023, highlighting the growing adoption of decentralized finance (DeFi) and layer-2 (L2) blockchain networks.

Record-Breaking Trading Volume

In 2024, PancakeSwap achieved $310 billion in trading volume, up from $111 billion in 2023. This growth was fueled by increased activity on L2 blockchains like Arbitrum and Base, which saw explosive year-over-year (YoY) increases of 3,656% and 3,539%, respectively.

Key Contributors to Growth

- DeFi Adoption: The rise in total value locked (TVL) across DeFi platforms—from $54 billion at the start of the year to $121 billion by December 24—boosted trading volumes.

- Cross-Chain Expansion: PancakeSwap expanded its presence on Ethereum (+251% YoY) and the BNB Chain (+155% YoY), showcasing its adaptability to multi-chain ecosystems.

- User-Centric Upgrades: Enhancements like the revamped swap interface, PancakeSwapX, and tools like the Telegram Swap bot have improved user experience, encouraging higher engagement.

Innovative Features

PancakeSwapX, launched in October 2024, introduced zero-fee trading and gasless asset swaps on Ethereum and Arbitrum. This innovation significantly reduced onboarding complexities for new users, making DeFi more accessible to mainstream investors.

Technical Analysis

As of the time of writing, NASDAQ:CAKE is trading at $2.53, up 1.75% within a consolidation channel. Despite recent price stagnation, several indicators suggest potential movement:

Relative Strength Index (RSI): The RSI is currently at 46, indicating neutral momentum. However, the overall market sentiment remains positive.

All-Time High (ATH) Potential: After peaking at $4.6 earlier this month, NASDAQ:CAKE has retraced. With the altcoin market gaining momentum, a post-Christmas rally could push NASDAQ:CAKE back toward its ATH.

Competitive Position

PancakeSwap is currently the second-largest DEX by daily trading volume ($2.23 billion), trailing Uniswap ($3.11 billion). It remains a dominant force in the DeFi space, supported by strong community engagement and a focus on innovation.

Outlook for 2025

With the continued expansion of DeFi and L2 adoption, PancakeSwap is well-positioned for sustained growth in 2025. The platform’s emphasis on simplifying the user experience and integrating innovative features like gasless swaps will likely attract a broader audience, further solidifying its position as a top-tier DEX.

Final Thoughts

PancakeSwap’s $310 billion milestone underscores the platform’s ability to adapt and thrive in the rapidly evolving DeFi landscape. As NASDAQ:CAKE approaches the new year, both its technical setup and PancakeSwap’s fundamental advancements point toward a promising trajectory for 2025.

PancakeSwap Unveils its Own Token Creation Tool SpringBoardPancakeSwap, a leading decentralized exchange (DEX) on the BNB Chain, has recently launched a groundbreaking platform called SpringBoard. This initiative aims to democratize token creation by simplifying the process to the point where no coding skills are required, and there are no launch fees. PancakeSwap's SpringBoard is designed to be an all-in-one platform for token issuers, enabling them to:

Launch tokens effortlessly: With just a few clicks, users can create tokens, set basic parameters, and integrate them directly into the PancakeSwap ecosystem.

Ensure liquidity: SpringBoard features automatic liquidity pool integration once liquidity hits 100%, ensuring tokens are tradable with ease.

Boost with CAKE: The SpringBoard Farm Program uses CAKE to enhance community engagement and liquidity provision.

Fundamental Impact

The launch of SpringBoard has several fundamental implications for both PancakeSwap and the broader DeFi space:

Accessibility: By removing the need for coding and launch fees, SpringBoard opens the door for a wider audience to engage in token creation, potentially leading to an explosion in the number of new tokens on the BNB Chain.

Decentralization: The platform's fair launch mechanism, which avoids pre-sales or seed rounds, promotes a more decentralized token distribution, aligning with the ethos of DeFi.

Technical Analysis of NASDAQ:CAKE

As of the latest data:

NASDAQ:CAKE Price: Currently trading at $4.14 USD, up by 30.97% in the last 24 hours with a trading volume of $727,884,413 USD.

Market Position: NASDAQ:CAKE holds the #105 spot on CoinMarketCap with a market cap of $1,185,333,784 USD and a circulating supply of 286,235,458 coins.

Technical Indicators:

The Relative Strength Index (RSI) for NASDAQ:CAKE stands at 80, indicating an overbought status. This suggests a potential for a short-term correction or consolidation before any further upward movement.

Support Zone: The 38.2% Fibonacci level could act as a significant support zone, providing a potential buying opportunity if NASDAQ:CAKE pulls back to this level.

Market Sentiment and Future Prospects

The introduction of SpringBoard has not only pushed the price of NASDAQ:CAKE up but also sparked a significant uptick in the value of CRYPTOCAP:BNB , reflecting the market's positive response. Here's what this might mean:

Innovation and Growth: PancakeSwap continues to innovate, keeping it at the forefront of DeFi. This could attract more developers and projects to the BNB Chain, increasing its ecosystem's value.

Tokenomics: With the shift towards a deflationary model via "Ultrasound CAKE," reducing emissions while increasing burns, NASDAQ:CAKE could see long-term value appreciation, making it an attractive hold for investors.

Conclusion

PancakeSwap's SpringBoard platform marks a significant step forward in making token creation accessible to all, potentially leading to a surge in token innovation on the BNB Chain. While the current market dynamics suggest a short-term overbought condition for NASDAQ:CAKE , the fundamental changes in token creation and distribution could drive sustained interest and investment.

Investors and project creators should keep an eye on the technical indicators and market responses, as SpringBoard could very well set a precedent for how new tokens are launched in the DeFi space.

By simplifying token creation, PancakeSwap not only empowers developers but also enriches its own ecosystem, setting the stage for a vibrant future in decentralized finance.

CAKE/USDT > Highly Probable > Strong Bullish Weeks AheadHello everyone,

first of all, please take a look at my recent ideas on the pair (CAKE/USDT) from back in

FEB 5th:

& March 7th:

NOW,

I can imagine two HIGH PROBABILITY scenarios with different timings yet exactly the same target for the near term future of (CAKE/USDT)

both of which are drawn as paths on the chart.

Scenario A: RED PATH / lower probability (30%)

Scenario B: GREEN PATH / higher probability (50%)

* what I clearly mean here is that there's a 20% chance for an unforeseen third path in which this idea is not valid anymore!

** please take the fact into account that PANCAKESWAP is of relatively small market cap and it's token's price is subject to strong fluctuations due to whale activity and big money moves.

Have a great trading and always KEEP IT SIMPLE...

PancakeSwap Price Spike as DEX Burns $35 Million $CAKE TokensPancakeSwap, the decentralized exchange (DEX) synonymous with the Binance Smart Chain (BSC) ecosystem, has ignited a flurry of excitement in the cryptocurrency community with its recent strategic maneuvers. As the platform burns over 8.7 million NASDAQ:CAKE tokens worth a staggering $35 million, investors eagerly anticipate the implications for both PancakeSwap and its native token, $CAKE.

The decision to burn NASDAQ:CAKE tokens, a practice aimed at reducing the circulating supply and enhancing scarcity, underscores PancakeSwap's commitment to value creation and sustainable growth. By incinerating fees collected across various platforms, including V3, V4, NFTs, games, and Automated Market Makers (AMM), PancakeSwap not only bolsters the token's scarcity but also redistributes value back to its community of users.

The CAKE token's price surged nearly 3% in response to this bold move, reflecting investor enthusiasm for PancakeSwap's proactive approach to tokenomics. However, the rally isn't solely attributable to the token burn; PancakeSwap's strategic collaboration with Stryke, a decentralized options exchange, adds another layer of excitement to the mix.

The introduction of CLAMM Options Trading, a joint initiative between PancakeSwap and Stryke, marks a significant step forward in expanding the platform's utility and attracting a broader audience of DeFi enthusiasts. With the ability to trade options, provide on-chain liquidity, earn premiums, and swap fees on Arbitrum, PancakeSwap users are poised to access a diverse array of financial instruments and opportunities.

Despite recent volatility that saw CAKE token experience a dip of nearly 13% over the past week, Monday's gains signal a potential turning point for PancakeSwap. As the platform embarks on its recovery journey, fueled by strategic partnerships and innovative tokenomics initiatives, investor confidence in PancakeSwap's long-term prospects remains palpable.

At $4.021 per token, NASDAQ:CAKE 's resilience amidst market fluctuations underscores its status as a formidable player in the DeFi landscape. With PancakeSwap's unwavering commitment to innovation and value creation, the future looks promising for both the platform and its vibrant community of users.

As PancakeSwap continues to redefine the boundaries of decentralized finance (DeFi) and pave the way for a more inclusive and accessible financial ecosystem, investors eagerly await the next chapter in this groundbreaking journey.

Pancake swap looking attractive as bulls increasePancakeSwap, a decentralized exchange (DEX) built on the Binance Smart Chain (BSC), is currently showing bullish signs in the cryptocurrency market.

According to recent analysis, PancakeSwap's 20 and 50 exponential moving averages (EMAs) have crossed over in a bullish direction, indicating that the asset may be poised for upward price movement. Additionally, the daily chart for PancakeSwap is displaying higher lows, which is another bullish indication.

Investors and traders alike are keeping a close eye on PancakeSwap, as a positive trend in the DEX could lead to increased interest and adoption of the BSC ecosystem. PancakeSwap's liquidity, fast transaction times, and low gas fees have made it a popular choice for decentralized trading, and the current bullish trend is adding to the excitement surrounding the project.

However, it's important to note that cryptocurrency markets can be highly volatile and subject to rapid price movements. As with any investment, it's essential to conduct thorough research and understand the potential risks before making a decision.

Overall, PancakeSwap is one to watch in the coming days and weeks, as the DEX continues to show promising signs of growth and bullish momentum.

PancakeSwap CAKE price is trying to break up from downtrendThe CAKEUSDT price has been in a falling trend channel since April 2021.

In fact, almost immediately after "the hype CAKE" exited into the market, when the price of CAKE rose from $10 to $44 in a month, the search for a fair market price began.

Looking at the chart, we can see aggressive buying of CAKEUSD from $3

After, buyers of PancakeSwap twice time bought back the price from the critical $3.60 level, giving him the status of a "mirror"

Roughly speaking, we can say that a price zone of $3-5 is a zone of fair market price , which satisfies both buyers and sellers for the last six months.

Therefore, in case of positive developments in the cryptocurrency market, we can expect the CAKEUSDT price to exit the falling channel.

The first task of buyers is to break through and consolidate above $5.50.

If this condition is met, in the medium term, you can start dreaming about growth to the region $8.75 - 9

If the wave of negativity again covers the crypto market and the price of CAKE drops below $3.60, then it is not worth buying CAKE again before $2.90-3.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

PancakeSwap (CAKE) formed Bullish Gartley | Good buy opportunityHi dear friends, hope you are well and welcome to the new trade setup of PancakeSwap (CAKE) with Bitcoin .

On a 4-hr time frame, CAKE has formed a bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

Gonna have my CAKE and eat it tooPancake swap on BSC gonna fly DEFI due for a run and the apy in defi the only place to go w reduced staking rewards and returns in some of these more common avenues. GL not financial advice this may still see downside in June out of mid may as i assume all markets will, but the upside is here i also really like the look of WAGYU swap and a variety of defi as a cyclical change.

Cake to 36.86 $ USD?In my last analysis we were able to observe a triangle that was invalidated as a result of the market crash, however not everything is negative. This fall managed to show us a bullish channel in #CAKE which is very positive.

Within this new bullish channel we have a new triangle that should break no later than the beginning of October and would have as its main target $ 31 and then $ 36.86.

If the market remains bullish, I have no doubt that Cake will have a big rally, assuming that we are days away from its first anniversary and that every Monday there is a burning of tokens that represents 1% / 3% of the current supply. #Cake #Pancakeswap

Pancake Swap ($CAKE) Buy Zone Around $10.65 With BTC CorrectionI'm starting to get more bullish long-term on Pancake Swap and would love to grab more tokens in the range of $10.65-10.75.

This one will take off once we get out of this correction with lots of good news and they are taking their coin inflation seriously.

With more tokens going over the Binance to reduce fees for buyers, Pancake Swap is quickly gaining market share.