So here’s what I’m doing: Not Panicking.This analysis is provided by Eden Bradfeld at BlackBull Research.

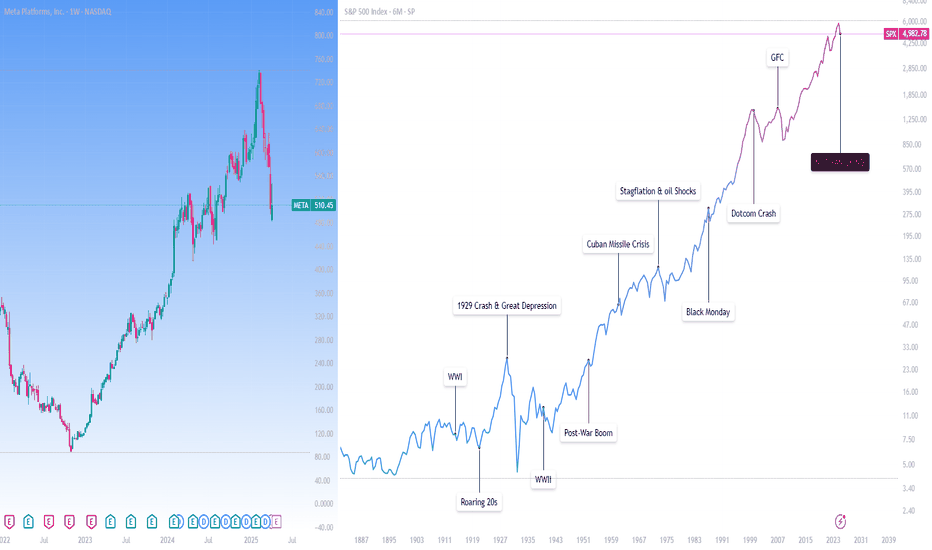

Listen, the US has survived the depression of WWI, the Great Depression, the depression of WWII, oil shocks, the dot com bubble, the GFC, the COVID-sell off. It’ll likely survive this.

In the scope of history, that $1 survived very well indeed. Panicking and running for the hills does not do so well. Winston Churchill was a great and flawed man but a terrible investor; he bought and sold shares prior to the 1929 crash in such speculative investments as mining companies, railways, and so on — most of them lost money (hence why Churchill continued to write at such a pace — to fund his Champagne-and-spec stock lifestyle). Hetty Green, on the other hand, (known as the “Queen of Wall Street”, managed to do very well her time — her quote?

I buy when things are low and no one wants them. I keep them until they go up, and people are crazy to get them.

Now, that’s something I can get behind.

Nobody wanted Meta a few years ago. I wrote an internal memo, close to its plummet in ‘22 (it got to $99 or so a share!). I wrote this:

ii) Yet what if we were to tell about about a company with this set of heuristics? Let’s call it “Company A”

Company A has a 31% return on equity and a 20% return on capital.

It has a net income margin of 37% and a FCF margin of 21%

Its income has a compounded annual growth rate over the last 5 years of 41%

If we add in numbers, now, let’s say the net income for 2020 was $29 billion, and $10 billion of that was used to repurchase stock from shareholders?

Let’s say the unlevered FCF is around $6 billion per quarter, and let’s say the debt to equity ratio is about 9x.

In other words, Company A is grows at a quick clip, and has done sustainably for the majority of its life. Its return on capital and return on equity would make any investor happy. Its FCF is an absolute machine.

Would you buy Company A?

Company A was Meta . You would’ve roughly made 4x or 5x’d your money if you’d bought around then. The point is, the fundamentals of a business matter, and right now there a quite a few exceptional businesses with good fundamentals trading at a good price. Alphabet (Google) trades at ~16x earnings. LVMH trades at ~18x earnings. And so on. Brown-Forman trades at ~15x earnings. These are all “inevitables” — Google will continue to be a dominant advertising platform, LVMH will continue to sell luxury, and Brown-Forman will continue to sell Jack Daniel’s and so on.

I talked to my ma in the weekend. She is not really a share person. Her portfolio is a bunch of “inevitables”. It’s done very well. She said “aren’t you worried about this stock market?”, and I said “You love supermarket shopping, Mum. If you see something at a 25% discount you buy it. You come home, and you’re delighted that you found some mince on special²”

She was like, “oh, that makes sense”.

The problem is you have a lot of people looking at charts and catching worry that the world will end. The world, I am delighted to say, has a magnificent disposition to carry on.

Panic

Financial Apocalypse? Markets Crash as Billions Flow into Cash –A New Wave of Market Turbulence: How Trade Wars and Uncertainty Affect Investors

The US stock market is currently undergoing a massive sell-off, which analysts compare to previous financial crises. Both institutional and retail investors are actively exiting equities and high-risk instruments, including cryptocurrencies. The accumulated anxiety is driven not only by the global economic cycle but also by specific political decisions: trade wars and protectionist measures are putting significant pressure on corporate earnings and market expectations.

Early Signs: Tariffs and Escalation

When Donald Trump announced increased tariffs on imports from China a few years ago, the stock market reacted sharply but briefly. Many analysts hoped the tensions would turn out to be short-lived negotiating tactics. Ultimately, however, the trade confrontation evolved into a prolonged phase, affecting not only the US and China but also European partners.

Today we see a continuation of this policy, where new restrictions and tariff threats have been added to the previously introduced measures. This has prompted capital outflows and increased uncertainty, as global supply chains have come under question, and the prospects for global trade recovery are murky.

Parallels with the 2008 Crisis

Comparisons to 2008 are inevitable due to the scope and speed of the drop in stock prices. However, while the primary trigger in 2008 was the collapse of the subprime mortgage market and the banking sector, the current negative factors lie in the realm of trade and geopolitical tensions.

Leading companies' financial results are declining because of rising costs for raw materials and logistics due to mutual tariffs. Global demand is weakening, and heightened instability is causing management teams to cut back on investment programs. All this is reflected in stock market indices, which continue to lose several percentage points in a single trading session.

Buffett’s Role and the Cash Accumulation Strategy

Warren Buffett, one of the largest and most conservative investors, prepared for such a scenario by amassing an unprecedented amount of cash. Buffett’s approach does not involve “catching a falling knife” at the peak of panic, but as soon as the situation stabilizes or compelling long-term opportunities arise, he will likely begin buying undervalued assets.

This strategy is typical for major players who focus on fundamental indicators. They are not looking at short-term fluctuations but rather the potential gains when the market recovers and prices return to fair value.

Cryptocurrencies: Expectations vs. Reality

Many assumed that cryptocurrencies would serve as a haven during crises. However, experience shows that in periods of global uncertainty, risk-averse investors exit digital assets alongside everything else. Bitcoin and Ethereum have lost 20–30% since the latest “flare-ups” began, and even statements about a “national bitcoin strategy” have so far failed to influence their prices.

Meanwhile, fundamental factors—limited supply, the development of blockchain technology, and IT-sector interest—have not disappeared. These arguments gain traction when investors’ risk appetite returns. But when the market is dominated by fear of further declines, they tend to avoid risky trades and prefer liquid, proven instruments.

Where the Money Goes

Unlike previous downturns, capital has not rushed into gold. While gold prices reached their peak a few weeks ago, their growth has since slowed, as some investors opt to keep their funds in cash, considered the safest choice.

Such behavior may suggest that the sell-off is nearing its climax: when capital remains “on the sidelines,” it eventually starts seeking new opportunities—whether in bargain-priced shares of large industrial giants, the tech sector, or even the cryptocurrency market with its depressed valuations. The volume of outflows from the US stock market is colossal; over the last couple of weeks, the total market cap of leading indexes has fallen by several trillion dollars. It is expected that a substantial portion of this money will re-enter the market, though likely redistributed among different asset classes.

Medium- and Long-Term Outlook

Investors with a six-month or longer horizon often see the current levels as potential entry points. Historically, global conflicts and economic crises end sooner or later, opening opportunities for those who can tolerate temporary volatility.

However, short-term trading remains extremely risky: as uncertainty persists, we may see more waves of sell-offs that knock out speculators with weak nerves or insufficient liquidity. During such moments, those who remain disciplined and steadfast can find profitable opportunities.

Conclusion

Today’s financial market conditions stem from a convergence of factors: aggressive trade policies, geopolitical risks, and the natural winding down of certain economic cycles. The mass sell-off of stocks and cryptocurrencies indicates that investors are unwilling to take on new risks until tariff disputes calm down, a clearer picture emerges for corporate profits, and major economic centers reach some form of agreement.

Nevertheless, the market retains its cyclical nature: historical parallels show that after the steepest drops, recovery periods often follow. The only question is when the turnaround will occur and who will be the first to capitalize on it.

That's the Way the Bitcoin TumblesWhy I Think the Sell-Off Isn’t Over Yet

Bitcoin is already in the middle of a sharp sell-off, but at least half the market seems convinced the worst is over and that a recovery is underway. I don’t see it that way. Bitcoin has been grinding sideways into the Bollinger Bands on the weekly chart, and now that it’s finally colliding with the basis lines, I think it’s about to plunge straight through them. This doesn’t look like a market that’s ready to bounce—it looks like one that’s about to take another leg down. Maybe I’m wrong, maybe I’m early, but in my experience, when people start celebrating too soon, things tend to get a whole lot worse.

CRYPTO:BTCUSD

CRYPTOCAP:BTC

CME:MBT1!

CME:BTC1!

CRYPTO:MOBILEUSD

COINBASE:RNDRUSD

CRYPTO:SHPINGUSD

CRYPTO:FXUSD

CRYPTO:ALEOUSD

CRYPTO:HONEYUSD

COINBASE:ACSUSD

CRYPTO:ASMUSD

CRYPTO:BATUSD

CRYPTO:FILUSD

CRYPTO:VTHOUSD

CRYPTO:B3USD

As always, this is not investment advice, any trade you make is on you, because good golly Miss Molly, I got my own things to worry about.

ETH – What Happened? A Detailed Breakdown and What to do next!Crypto Panic or Manipulation? Breaking Down Ethereum’s Crash and the Entire Market

🔥 Hello everyone, this is Ronin!

The last two trading days have seen one of the biggest crashes in the history of the cryptocurrency market. 📉 We witnessed a massive wave of liquidations that burned through the capital of many traders.

Looking at the numbers:

Most assets lost 10–30% of their value.

Some altcoins dropped by 50%.

The total crypto market capitalization shrank by more than 10% in just a few days.

But the biggest victim of this crash was not Bitcoin, nor low-cap altcoins—it was Ethereum (ETH) itself.

What Happened to Ethereum? Why Did It Drop from $3600 to $2000?

If we talk about the strangest asset in this cycle, Ethereum stands out.

While other coins were breaking all-time highs, ETH didn’t even come close to its peak valuation. This is despite:

The launch of Bitcoin ETFs, bringing in a wave of institutional capital.

News that Donald Trump was reportedly buying ETH for his projects.

Growing interest in L2 scaling solutions and Ethereum network upgrades.

None of these bullish catalysts helped ETH break even $4000.

And then, within just four days, Ethereum plunged from $3600 to $2000. On Binance’s futures market, the price briefly hit $2080.

❓ Has Ethereum ever seen such a sharp drop before?

Personally, I don’t remember such a massive drop happening in such a short time without catastrophic fundamental events.

This wasn’t a network hack, a mining ban, or a major DeFi collapse—nothing fundamentally bad happened.

So who crashed the market, and why?

Who Benefited from This Crash?

Let’s analyze the key question: who had the most to gain from this crash?

The obvious answer is that the biggest winners were major crypto exchanges and market makers.

Why Didn’t Bitcoin Drop as Much?

At the time of the crash:

📌 Bitcoin’s liquidation zones were nearly empty. Many traders had both buy and sell orders in place, so there was no strong incentive to push BTC down.

What About Ethereum?

📉 ETH futures open interest exceeded tens of billions of dollars.

📉 Leverage was heavily skewed towards long positions, meaning liquidations brought massive profits to exchanges.

📉 ETH’s open interest was even higher than BTC’s, making it a prime target for manipulation.

How Crypto Exchanges Made $2 Billion in One Night

The cryptocurrency market is unique because the major players not only provide liquidity but also profit from liquidations.

💰 Crypto exchanges are not just trading platforms—they are global market makers who actively move prices.

📌 On Sunday night, the following happened:

Big players spotted an overloaded leverage in ETH long positions.

They triggered a wave of sell-offs, forcing liquidations.

On Binance alone, exchanges raked in $2 billion in a single day from liquidations.

⚠ Ask yourself this: if you had the power to make $2 billion in a single day, wouldn’t you do it?

Of course, they want to and they do.

How the Smart Money Strategy Works

If you’ve heard of Smart Money trading strategies, you know that big players always think ahead.

📌 The classic scheme:

1️⃣ Pump the market up—give traders confidence that the rally will continue.

2️⃣ Open short positions in zones overloaded with leverage.

3️⃣ Dump the market sharply, triggering stop losses and liquidations.

4️⃣ Buy back at the bottom, raking in billions.

📉 This is exactly what happened with Ethereum—exchanges used a false news narrative about trade sanctions to tank the price.

How I Survived This Crash

🔥 I was long on Ethereum with leverage and held a total position of over 200 ETH.

Honestly, that night was brutal.

📌 When the price dropped to $2080, I had two options:

❌ Panic and close the position, taking a six-figure loss.

✅ Hold and wait for a recovery, because I knew this was a fake move.

I chose the latter. Not only that—I added to my position at the lower levels.

This doesn’t mean the market can’t drop further, but…

📌 Trading rule: Buy when everyone is selling—Sell when everyone is buying.

📌 Right now, the market is in panic mode—which means some smart players are accumulating ETH at these prices.

Conclusion: What Comes Next?

📌 This was an artificial correction—big players intentionally crashed the market.

📌 The coming days should see a recovery, especially if trading volumes start picking up again.

📌 Market psychology is the key factor. When everyone is afraid, that’s when big players accumulate assets.

If you’re interested in how I will navigate my $200,000 ETH drawdown, follow me on TradingView—I’ll be posting regular updates.

🚀 In upcoming articles, we’ll break down the analysis of other altcoins and provide a microeconomic perspective on the most promising assets.

💬 Boost this post if you found it insightful—your engagement helps, and a little positive activity never hurts!

This was Ronin—stay tuned for more updates! Big things are coming. 🎯

Understanding Gold Panic Selling Reactions BetterThis video is designed to help you better understand how Gold works as a hedge instrument and how to attempt to measure Panic Selling phases in Precious Metals.

Metals offer an incredible opportunity when Panic Selling hits. But it can also present some very real risks because of price volatility.

Panic selling in the markets is usually an event-driven sell-off in almost all markets (including metals).

This type of selling is usually related to traders pulling assets (CASH) away from all market sectors because of some crisis or geopolitical event. It is a way for traders to react to the fear of the event while sometimes ignoring how metals will react to the future revaluation event.

Yet, who wants to hold Gold when it may fall 8.5% to 15% throughout this panic selling process?

If you learn how to spot the base/bottom efficiently (using my Excess Phase Peak patterns), you'll be able to pinpoint some incredible opportunities in metals.

I hope this video helps you to understand exactly how these Panic Selling events unfold - and lear to spot/trade them more efficiently.

The reality of the current market environment is that the Trump win is the event (call it a crisis or not - I don't care). This event is causing markets to revalue current asset classes (notice the strength of the US Dollar since Election Day).

I believe this revaluation event is nearly over and prices will begin to adjust into what I'm calling my "Anomaly Event" - where price levels settle back into a reversion (normal) type of contraction event before moving into a late-stage Santa Rally.

If I'm right, we'll see a base/bottom in metals happen after November 15-19, 2024.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

BTC - Make or Break Zone!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 After rejecting the $70,000 round number, BTC has been overall bearish trading within the falling channel marked in red.

Currently, BTC is hovering around the lower bound of the channel which is lining up perfectly with the $50,000 round number.

🏹 The highlighted blue circle is a strong rejecting area to expect the bulls to kick in from.

📉 However, if the $50,000 fails to hold, a bearish continuation towards the $40,000 demand zone would be expected.

Which scenario do you think is more likely to happen and why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Psychology: Trade Smart - Focus on Facts, Not wishes!See the Truth: Trading Without Bias

Discover the critical importance of objective analysis in trading.

Learn how to avoid emotional biases, stay neutral, and focus on what the market truly shows you. This guide will help you improve your trading strategies and achieve more consistent results.

Lessons of Trading by News - MMTC - "Let it" or "Delist it" ???Time and again the stock market gets some knee jerk reaction from Investors based on some Hot News. But most news are shortlived and forgotten in forthcoming days.

One such interesting counter is MMTC - A PSU Mineral Trading Company with 89% stake with Govt of India.

Technical Analysis:

Monthly - Inverted Head and Shoulder pattern indicating a Multi-bagger return

Our initial position was at 61.55 levels and booked profit around 87-88 in just 1 month

The primary reason to book profits was due to a Hot News in October from Govt that they are going to De-list the company. The counter eroded all gains within same month and fell below our entry point. For next 2 months - there is no News about de-listing - no progress - and all the Hype settled down and now when I look at the charts - its back to its beauty. You won't even remember that something happened in Oct looking at the chart now.

The Original Tech pattern (Inv H&S) is still perfectly intact

MMTC is once again on the verge of Breaking Out the Inv H&S pattern.

It has to settle above 68 WCB for neckline BO confirmation

Further it also has to close above 72 WCB for resistance BO and further upside

CAUTION: New Entrants / Safe Players - please AVOID this counter. There is still no clarity on delisting process from Govt. Existing players hold for further gains and make most out of this until you see a significant reversal

Disclaimer:

Stocks-n-Trends is NOT a SEBI registered company. We do not provide Buy / Sell recommendations - rather we provide detailed analysis of how to review a chart, explain multi--timeframe views purely for Educational Purposes. We strongly suggest our followers to "Learn to Ride the Tide" and consult your Financial Advisors before taking any positions.

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends

Metals Setup Apex "V" (PANIC) Bottom - Rally Will ContinueGold and Silver are setting up a nearly perfect deep "V" bottom after a bout of PANIC selling over the past few weeks. This sets up a move for Gold to rally above $2250 and Silver to rally above $28.50.

Ultimately, I believe Gold will exit the Setup Phase and peak in the next phase, the Breakaway Phase, above $2450. Silver will follow with a rally to levels above $31 as it moves away from the Setup Phase and peaks in the Breakaway Phase.

These are big moves for Gold and Silver - 15% to 25% or more.

This also sends a clear message to the general/global markets that traders are hedging the uncertainties of the conflicts and the central bank/global economy credit issues. I see the next 14 months, before the US POTUS elections (Nov 2024) and possibly a few months beyond, as very concerning for the US/Global markets.

Where will the economic growth come from to drive expansion? China is contracting. Asia is contracting. Europe is contracting. The US is still operating reasonably well, considering much higher interest rates. Canada is still holding up okay, considering an extremely over-inflated asset bubble.

How long before something breaks if the US Fed decides enough is enough and moves to PAUSE rate hikes?

I guess we won't see a pause in the US Fed until possibly May/June 2024. And that will drive a fear/hedging/panic cycle where USD assets and precious metals become an effective hedge against risks.

Pay attention. This next move in metals should be very explosive.

Silver To skyrocketHey Guys,

Banks are realizing bonds arent the safety they thought and need to diversify has shown in a big way with the yields decline, metals bulling and DXY rising. I expect silver to possibly have another leg down with any major panic we might have but once we are past the panic gold and silver will bull just like 2009-2012 and the 80s. Above is the larger picture of silver targets to keep in mind.

can you feel it? can you smell the change in the air?Can you smell what the market is cooking?

mmmm

Reward based behavior is term I learned this year for a concept Ive been studying for many years.

Behavioral finance.

The markets are wild because people are wild.

we get too greedy, then reality shifts. then we panic. then it shifts. and that panic was a fire sale. rinse and repeat.

because math is hard and those who dont know how to explain it to those who need to know.

its hard.

its another language.

Im not saying I know, but I am trying to let the knowledge seep in my dense monkey brain.

any who, panic is on the weather forecast.

have a good day.

kthanxbye.

Bitcoin Shorts With Targets based on riskThis is the case for shorters. Targets based on actual risk at the time.

Bitcoin has gone up to almost liquidate 3x positions that have sold the current bottom. There was not been a 5% drop until price has topped out. Shorters are in panic and praying for price to reach 17.5k to 18k again so they can exit their short.

QQQ weekly bullish hammer at the end of wave 5 wave 5 downtrendOrder BUY QQQ NASDAQ.NMS Stop 274.21 LMT 274.21 will be automatically canceled at 20230401 01:00:00 EST

QQQ weekly bullish hammer at the end of wave 5 wave 5 downtrend. Either ABC correction to MA 100 or beginning of uptrend. My only concern we didn't panic and capitulate yet, so probably ABC correction.

DIS weekly bullish hammer at a monthly buying zoneOrder BUY DIS NYSE Stop 99.30 LMT 99.30 will be automatically canceled at 20230401 01:00:00 EST

DIS bullish hammer at a monthly support buying zone maybe that's it for the downtrend except for we didn't have exhaustion volume / capitulation / panic event.

Quick countertrend 1.2R

OXY AND HURRICANESIt is time to put Oil on your radar for two reasons. One thing that is really striking is how the stores are already selling completely out of water this weekend, after visiting 8 stores and coming up empty handed. BUT, how will the country be faced with gasoline shortages as mass panic begins to strike into the human mindsets, fear, and much more. Especially with not knowing the exact placement of the hurricane and the strength of destruction as the country is facing record high inflation and the government is depleting the strategic reserves of our Oil. THEY will need to start buying the Oil off the market at a rapid pace before the price of oil begins to aggressively increase - thus fueling the demand for buying; causing a momentum spike in price action.

I am linking my home repair and oil charts below for simplicity purposes.

My support/resistance lines are represented with the horizontal lines. You can use those as targets and/or entries for positions based on bounces of those areas or rejections.

What is the lowest possible price for bitcoin?Ask yourself what is the lowest possible price for bitcoin?

20000? 15000? Theoretically, the price will be - 0.

I'm not saying that there will be such a price, but if there is a panic in the market, keep this in mind.

By the way, how much is Terra Luna now?

Keep in mind that bitcoin was worth exactly zero at first.

And the correction will probably drag closer to that number as well.

You may start to panic.

In May 2010, 10 thousand bitcoins were equal to $40-$50 (an American bought two pizzas for 10 thousand bitcoins).

That is, a person sold 10 thousand bitcoins and he actually just gave them away. It is clear that not all of his bitcoins.

Perhaps he had 100 thousand bitcoins and he did not feel sorry for selling them. That is, there are people who have a bunch of these bitcoins.

Many years have passed, but in fact nothing has changed globally, everything except the value of bitcoin.

I can't take and buy anything with bitcoin, there are just a bunch of people who want to sell it for more.

I took 2009 as a starting point and drew trend lines from zero.

At first, we don't have prices until we sold two pizzas for 10,000 bitcoins. Then the price started to rise sharply.

As you can see, each subsequent wave of the trend has less strength.

In fact, if you look at the real from afar, bitcoin has not yet hit the real bear market, where the next wave will cover the bottom of the previous one.

But as the trend fades, it can happen and the next wave could rewrite the 3000 low.

Perhaps this will not happen and bitcoin will hold the 3000 level or be higher than it, but look at the trend.

Looks like waves 1, 2, 3 are fixing now.

Now look at the volume in 2015 and 2020-2022. Someone is now quietly fixing and distributing bitcoins,

At the same time, there are no serous purchases and panic sales. Everything is still ahead!

Is it over for crypto??The market does look bad. BTC has lost weekly and monthly supports that turned into resistance. Is bitcoin about to print 10th(!!!) weekly red candle? I have never seen such bearish sentiment in 5 years. Are bears gonna get away with it so easy? Easiest long trade would be if BTC could reclaim weekly support ant 31.5k. My personal view is that we should have a relief bounce sooner than later. Probably BTC will continue to range forming bullish divergence and initiate the squeeze into 38-40k area as shown in green scenario. From there we could continue crawling down again. Worst cast scenario, which is very unlikely IMO, we just continue to dump with no bounces into the next weekly support. If you are looking for shorts, you are too late IMO.

BTC fear and panicSo this is it.. As I posted before, the plan I was waiting for is now reached. BTC reached the 25-26k level, and now we hope it closes weekly above 31.5k to confirm that it is still in the range. This would give clear signal to build a position into 40ks. Otherwise, wait until we comeback into the range or buy btc at the next weekly support (20k) or best bet is monthly support (14k). I don't think we will reach these targets though and if stock market doesn't puke I believe the bottom has been reached or is very near.

have no fear, the professional idiot is here!to save the day.

CV is a hoax.

but on some real stuff they've poisoned our water supply.

i would know, i'm nuttier than a peanut allergy.

this schnitzlefrats is so overly simple, it's actually hilarious. KINDA. well, actually, kindareally hilarious.

papa trump is workin the economy to make people money. not just him. not his cronies. not your grandpa.

you. and everyone you care about. yet, panic? papa trump rewards you for being a good citizen of this

dear country and you turn around and S E L L due to people who C O U G H?

Know how I know that? Because I'm a professional amateur, and even I can see this incredibly easy pattern.

Know how hard it is to figure out that pattern, as a complete idiot/noob/amateur/banana, etc?

ezpzlmnsqz.

go to google.

type in elliott wave correction stuff

search around

look at patterns

see if patterns match current pa

???profit

Here, let me Google that for you:

www.elliottwave.net

scroll down a bit.

look at traingles

just so happens the "Corrective Wave (Horizontal) traignles " section shows EXACTLY what we are doing, at the BOTTOM of the 8 examples.

the 4th one down. the bottom one. hmm.

ANYONE can do this. stop being lazy. stop panicking. you have a stupidly easy once-a-decade-if-that opportunity here. utilize it.

www.investors.com

won't you take me to

keksitown

won't you take me to

keksitown

won't you take me to

DON'T PANIC!!! The market is crashing but...DON'T PANIC!!!

The market is crashing but the M'M's have convinced you it isn't

This is not a correction

It's a crash

But a slow motion one

Only if the red lines hold can this be averted

Otherwise SPX is going to 3600 and QQQ to 260

Probably within 6-8 weeks

DON'T PANIC!!!

GRI 2022

Chart- taking 3 pivots- pre-corona crash, post corona drop and the A.T.H

Andrews and Modified Schiff forks off those pivots

Geometry Matters!!!

NOT TRADING ADVICE