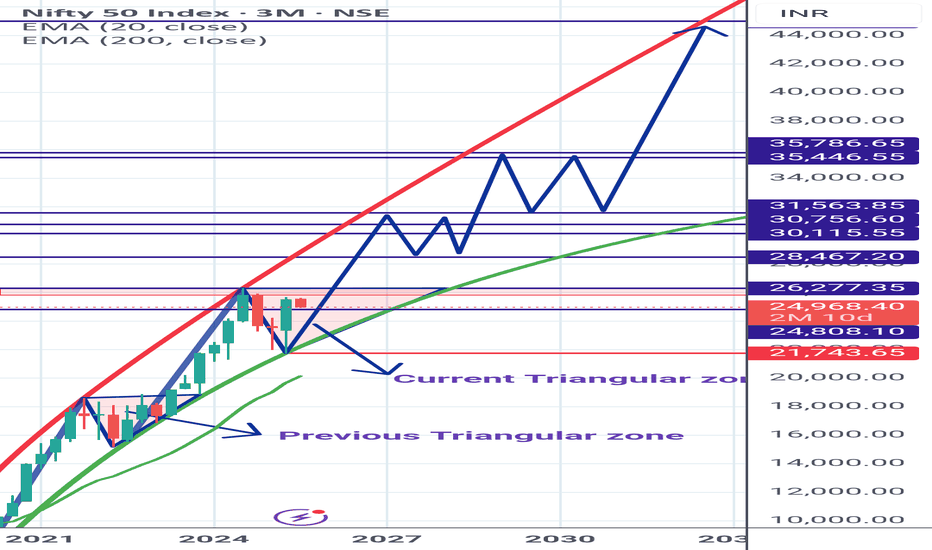

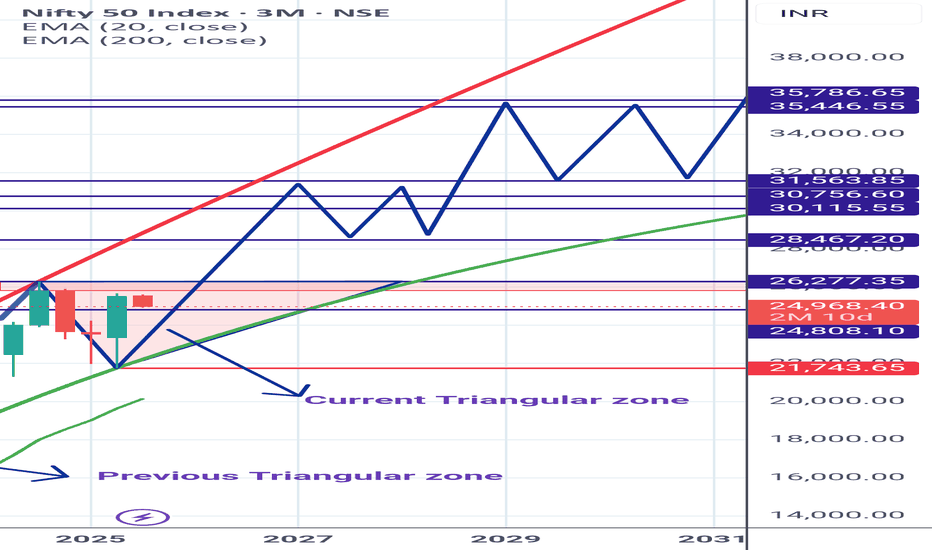

Parabolic

Samvardhna Motherson Getting ready Samvardhna Motherson

Earlier mentioned about Elliptical Pattern Breakout and the Rally in it .

Currently retesting the Parabolic trend support and trading inside the Triangular zone.

View is : Slowly getting ready for big rally. Stay invested.

Purely based on My STUDY . Lets see how it works.

Don't get biased by my views.

I may be wrong too.

Always do your own research.

Shared it for Reference purpose

Golden Cross on GME WeeklyGME Chart Breakdown, Déjà Vu or Destiny? Something big just lit up the weekly chart, the 50 MA has pierced through the 200 MA, forming that golden cross traders dream about. On the weekly timeframe. Not a drill.

Now, let’s rewind. The last time this pattern appeared? January 2021. The infamous squeeze. Back then, GME didn’t just nudge upward, it catapulted nearly 4000%, going from a $3 floor to $120 in a blink.

Fast forward to today, new golden cross, new setup, and a $23 floor. If history rhymes even remotely, we’re staring down a hypothetical $1000 per share move. Yes, one thousand.

Is lightning about to strike twice? Stay tuned to find out!

Bitcoin Could Hit as High as $400KWhen comparing our macro cycle to the 2017 cycle, we see the potential for a very parabolic run on Bitcoin. I believe Bitcoin could hit as high as $400K by 2029. This is because Bitcoin tends to follow the stock market, and I anticipate a major blow-off top coming for the stock market. I expect one more big parabolic run on the Dow Jones leading up to 2029, which would fuel Bitcoin’s rise to $400K.

The lowest I see Bitcoin going during this parabolic run is $250K. On the higher end, I could see it hitting $400K or even more. Big things are coming.

As always, stay profitable.

— Dalin Anderson

$RDAR - Massive Weekly Slingshot, 1000x Potential RunnerWeekend scan continues to find the best candidates into this 8 year cycle - OTC:RDAR , wow is all I can say, this has massive potential once it breaks into sub territory with volume. The hype is in the AI buzz and the constant awareness for their product in the media.

Raadr Inc. (OTC: RDAR), also known as Telvantis Inc., is a U.S.-based technology company specializing in AI-driven software solutions aimed at combating cyberbullying and online harassment. The company offers tools for real-time monitoring of social media and digital platforms, targeting parents, schools, and law enforcement agencies.

If we learned anything about share structures with bloated OS/AS, it won't mean a damn thing once this sling gets going to the upside - remember how HMBL/ENZC/SNPW, had massive floats and still ran from trips to dollars... I got that itchin' feelin' again, taking a starter Monday and will add on momentum into the sling.

MOODENG Up 1561% — Is a 50% Crash Next?MOODENG has gone full parabolic — launching from $0.0206 to $0.34 in just 36 days. That’s a staggering +1561% gain. But after a move this vertical, it’s time to ask the real question: can it sustain this pace… or is a correction looming?

Let’s break it down.

Technical Snapshot

MOODENG just tapped a major resistance zone — the 0.786 Fibonacci retracement (log scale) of the entire bear trend from $0.70 down to $0.0206. That drawdown was a brutal -97% over 143 days, defining the last macro bear cycle. The current rally has now retraced almost 80% of that decline.

And now? It’s knocking on exhaustion’s door.

RSI Screaming Hot

The RSI on the daily chart is currently at 96 — a level rarely sustained for long. Historically, these readings lead to sharp corrections as early bulls take profit and late buyers get trapped.

Key Structure:

The key swing high at $0.31982 was just taken out, possibly as a liquidity grab.

Price is now hovering at this level — hovering… or topping?

Potential Retracement Zone

If MOODENG enters a standard corrective phase, the $0.15411 level stands out. — it lines up as a logical 50–61.8% retracement zone from the recent parabolic leg. A return to that level would mean a -50%+ crash from current highs.

Short Trade Idea (On Confirmation Only)

Entry: Break below $0.32 and retest it as resistance

Stop-Loss: Above $0.34 (structure invalidation)

Target: $0.15411 (0.618 Fib retracement)

R:R: 7:1+

This setup requires patience. Don’t front-run it — let price lose $0.32 with conviction and treat a clean retest as your trigger.

📘 Bonus Insight:

Whenever you see extreme RSI paired with major Fib levels (like 0.786), you’re likely looking at the exhaustion phase of a move — especially when paired with psychological price levels and historical resistance. That’s where smart money exits… and emotional money enters.

🧠 Educational Note: Why You Should Be Cautious with Parabolic Moves

These kinds of explosive rallies are exciting, but they’re often unsustainable. When price goes vertical and indicators like RSI hit extreme levels, smart money starts exiting — and emotional money starts chasing.

Parabolic moves often end with sharp, sudden crashes. Chasing these tops may feel tempting, but more often than not, it leads to losses. The real edge comes from waiting — for structure, confirmation, and setups with defined risk. Don’t trade hype. Trade the chart.

Summary

MOODENG up +1561% in just over a month

Tapped the 0.786 Fib of its entire macro downtrend

Daily RSI at 96 → overheated

Break & retest of $0.32 = ideal short setup

Targeting a possible -50% correction to $0.15411

Keep your emotions out of it — parabolic runs like this are exciting, but it’s discipline that gets you paid. Let price confirm. Then strike. 📉🔥

Multiple Ingredients for a Supernova Soup - $SESLet's start with the fact that this small cap hit my scanner at around 73 cents - and triggered a Tier 1 and Tier 2 buy program above $1.00 - The initial buy signal gap took weeks to fill and confirmed this was not a one-off... to top it all off earnings just blew everyone's socks off with almost a 200% revenue surprise, and if that wasn't good enough they announced a $30mm share buyback of common stock at retail - all of this combined with the AI buzz and a weekly slingshot that looks juicier than ever - we have ourselves a good chance at a multi week runner here. Will not be surprised to see a parabolic move between $10 and $20 PPS.

$OBLG #OBLG BUY ALERT FOAT IS LOCKED, $17.6+ then $60+ INCOMING!NASDAQ:OBLG #OBLG NASDAQ:OBLG My name is Landon Wogalter & this is the next NYSE:GME #GME NYSE:GME / NYSE:HKD #HKD NYSE:HKD type move, I am also the reason that NASDAQ:CHSN #CHSN NASDAQ:CHSN went to $44 that I called & locked the float from <1.80 & called for $30+, & even emailed the company in August 24’ stating that their stock would see $30+.

Oblong price targets are as follows:

17.6+ , 60+, 150+, 2900 past 404< #FLOAT IS #LOCKED THERE IS NO OTHER SET UPS LIKE THIS ON THE MARKET AND NEVER HAS BEEN. #ZERO #DEBT OBLG wants #parabolic (This is not promotion nor/or financial advice😘) I’m your daddy forever & ever.

TIA | Next Altcoin to MOON ??In the macro, it's clear that TIA has been in a downward trend for an extended period of time. This means, it's a great place to buy - because the bullish cycle is up next.

In an earlier publication, I made an update about the ideal entry point for TIA:

A key indicator to watch is the daily timeframe, when the price begins to trade ABOVE the moving averages - that's when you'll have the first confirmation of a bullish turn around. It is a bullish sign to see the gradual higher lows.

Moving Averages:

Parabolic Curve Weekly History BTCBring into consideration that we may be in a reaccumulating phase as in my previous notes (check them out if you haven't) and see how this is leading up to Base 4 solidifying. As we expand out and take our previous bull cycle parabolic curve, overlay it on our current one, and the pattern indicator measured move if it breaks the wedge to the upside; BTC still has one last leg up to potentially getting 280k-300k. Still waiting for the Spring on the Reaccumulation phase at 89-91k (Falling Wedge on Daily I feel is getting too stretched but we shall see), but we must see a quick recovery or this will quickly turn into a Double Top. Good Luck Everyone and I wish y'all the best BITSTAMP:BTCUSD

Insane volatility imminent conspiracyI've seen one other TA notice this parabolic base forming (pink area) which I believe we'll be exiting over the next few years. Maybe it will happen this bull cycle. However, I think it's also possible that this bull cycle will be somewhat lackluster, not exceeding $150k, before correcting down to the 80's with wild volatility. I think this will shake out A LOT of investors and now that we have the likes of Black Rock et al in the mix, it's my theory that they don't want us in at the bottoms they want us in as their exit liquidity. When BTC does exit this formation and is supported above it very briefly, we're going to see the proverbial 'god' candle with absolute vertical movement. This will likely be nation states and corporations finally having the eureka moment. And it will occur during the 'usual' bear market.

As the title states, this is a conspiracy but it seems like a very plausible scenario. Of course there's fundamental theory laced in with TA which I shouldn't do here but we're living in wild times. Am I stupid? Let me know!

Understanding Parabolic SAR: A Guide to Trend ReversalsThe Parabolic SAR (Stop and Reverse) is a popular technical analysis tool that helps traders identify trend direction and potential reversal points. Developed by J. Welles Wilder, the Parabolic SAR is particularly useful in trending markets and provides straightforward buy and sell signals.

What is Parabolic SAR?

The Parabolic SAR is a series of dots plotted above or below the price on a chart:

- Dots Below the Price: Indicate an uptrend.

- Dots Above the Price: Indicate a downtrend.

The "SAR" stands for "Stop and Reverse," reflecting the tool's ability to signal when a trend might reverse direction.

How Parabolic SAR Works

The Parabolic SAR formula calculates the position of the dots based on:

- EP (Extreme Point): The highest high or lowest low in the current trend.

- AF (Acceleration Factor): A multiplier that increases over time to speed up the SAR's responsiveness.

As the trend progresses, the dots move closer to the price, acting as a trailing stop level. When the price crosses the dots, a reversal signal is generated.

Key Features of Parabolic SAR

1. Trend Direction:

- Dots below the price indicate a bullish trend.

- Dots above the price indicate a bearish trend.

2. Reversal Signals:

- When the price crosses above or below the SAR dots, it suggests a potential reversal.

3. Trailing Stop:

- The SAR level can be used as a trailing stop to protect profits in a trending market.

How to Use Parabolic SAR in Trading

1. Identifying Trends:

- Use the position of the SAR dots to confirm whether the market is in an uptrend or downtrend.

2. Spotting Reversals:

- A change in the position of the SAR dots (from below to above or vice versa) indicates a potential trend reversal.

3. Setting Stop-Loss Orders:

- Place stop-loss orders at the SAR level to minimize risk.

4. Combine with Other Indicators:

- Pair the Parabolic SAR with moving averages, RSI, or MACD to validate signals and reduce the likelihood of false reversals.

Strengths of Parabolic SAR

- Simplicity: Easy to interpret and apply.

- Clear Signals: Provides unambiguous buy and sell signals.

- Effective in Trending Markets: Works well in markets with sustained uptrends or downtrends.

Limitations of Parabolic SAR

- Ineffectiveness in Sideways Markets: Generates false signals in choppy or range-bound conditions.

- Fixed Parameters: The default settings (e.g., AF starts at 0.02 and increments by 0.02) may not suit all market conditions. Adjusting these parameters can improve accuracy.

Best Practices for Using Parabolic SAR

1. Avoid Flat Markets:

- Use Parabolic SAR only in trending markets to minimize false signals.

2. Adjust Parameters:

- Experiment with the acceleration factor to tailor the indicator to the specific asset or timeframe.

3. Combine with Other Tools:

- Use additional indicators or chart patterns to confirm Parabolic SAR signals.

Example of Parabolic SAR in Action

Imagine Bitcoin (BTC) is trading at $94,000 in an uptrend. The Parabolic SAR dots appear below the price, confirming the bullish trend. As BTC rises to $98,000, the dots gradually move closer to the price. If the price falls and crosses the SAR dots, the dots shift above the price, signaling a potential downtrend and a sell opportunity.

Conclusion

The Parabolic SAR is a powerful yet straightforward tool for identifying trends and potential reversals. While it excels in trending markets, traders should be cautious in sideways markets where it may produce false signals. Combine it with other indicators and sound risk management practices to enhance its effectiveness. Regular practice and adjustments to the settings can help traders maximize its potential.

Bitcoin[BTC] - Do you see a similarity ?#BTC/USD #Analysis

Description

---------------------------------------------------------------

+ Dec 2024 Bitcoin chart looks exactly like the pattern of the Dec-2023

+ In Dec-2023 we saw similar channel formation and price broke down from the support line briefly and then bounce back in January.

+ The same pattern we are seeing now, channel formation completed and price broke down from the support line of the channel.

+ I'm expecting price to decline further upto 85k zone and bounce back from there.

+ A bounce back from this zone will push the bitcoin price parabolic.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

DOGE parabolicHello,

I would like to draw your attention to the Blue forecast. This is a long range favorite for what DOGE does in these excited runs. Can you imagine a $69 Doge by mid February? Wowser!

There must be an unlimited money supply out there…. Ah yes… flowing in to the crypto sphere from black rock ETF through BTC and ETH. Bu those insane prices already anticipated this ETF… buy the rumor, sell the news.

And after everyone dumps BTC… what are they gonna do with it? The DOGE tribe is growing… and bound by LOVE.

Love is the future… fear and greed the past.

TradeCityPro | HNTUSDT Don’t Miss the New Move!👋 Welcome to TradeCityPro Channel!

Let’s get ready for the upcoming week! We’ll either see a strong movement or some consolidation, so let’s prepare our triggers in advance and analyze all scenarios before the market moves.

🌍 Bitcoin Overview

As always, let’s start by checking Bitcoin to complement our altcoin analysis. Today, BTC broke its 102,135 trigger but faces a significant resistance at 103,504. With increased volume, a breakout above this level could finally help BTC clear the critical $100K barrier.

For the upcoming week, if Bitcoin’s dominance rises and BTC follows suit, prioritize Bitcoin trades or coins that perform well against BTC. If BTC dominance drops, focus on altcoins. However, the first bullish move will likely coincide with rising BTC dominance.

⏰ Weekly Time Frame

Helium (HNT) shows relatively strong performance compared to other altcoins and is a good candidate to add to your portfolio this week!

HNT started its upward movement before the current bull run, maintaining a positive trend since 2023. This year, it recorded a higher low compared to 2023 and is now approaching its main resistance, attempting to break through.

The coin follows a parabolic trajectory, which is inherently bullish. Each time it hits the lower boundary of this parabola, it rebounds strongly, and this trend could continue.

This week’s candle closing above the SMA7 signals buyer strength despite seller presence. Buyers have emerged victorious with significant volume. After this candle closes, you can consider a spot buy with a risky stop loss below the shadow or a safer stop loss at 5.437. If RSI enters the overbought zone, expect a sharp upward move.

📅 Daily Time Frame

On the daily chart, HNT has outperformed other altcoins during its recovery and is currently testing a daily resistance level. A breakout here could trigger a sharp upward move.

Volume analysis shows reduced activity during the correction phase and increased volume during upward movements, confirming buyer strength in the market.

After breaking the trendline and finding support at 5.524, the coin moved upward. A potential buy entry lies at the breakout of 9.244. Follow this closely for spot or futures long positions, especially if RSI enters the overbought zone, which would provide excellent confirmation.

🔍 4-Hour Timeframe Analysis

HNT is currently facing a critical resistance at 9.393. Buyers have been active, attempting to break this level, which could lead to further bullish continuation after a successful breakout.

Before discussing triggers, let’s briefly cover the Fake Breakout strategy. This occurs when a support or resistance is initially broken but quickly reversed in the next candle, potentially signaling a trend change. Identifying this on lower timeframes can guide you to a solid entry after the first breakout.

📈 Long Position Trigger

breakout above 9.393 is a great trigger. Personally, I’ll be looking for a long entry above this level and will continue to hunt for long triggers as long as HNT stays above 8.004.

📉 Short Position Trigger

I’m not considering any short positions for now. If the market enters a bearish phase, I’ll look for lower long triggers instead.

💡 BTC Pair Insight

Against Bitcoin, HNT is in a ranging box with less volatility compared to BTC and hasn’t experienced severe drops like other altcoins. Its absence from Binance and limited volume data make it less prominent, but these factors have helped it avoid extreme sell-offs.

HNT has risen from a higher low within its range. With Bitcoin dominance closing green on the weekly chart, HNT’s weekly candle also closing green is a positive sign. After breaking the box’s upper boundary, I’ll consider holding it longer.