Parallel Channel

GBPJPY will likely to continue the bullish channelwith no significant sign of reversal, the price seems ok to continue the parallel channel as it has touched the lower trendline the next possible move is that it will hit the upper trendline as it has done in the previous situations. Area of the next HH has also been marked on the chart, and also buy position with instant been shown.

To the moon? Hang on a second...I'm reluctant to jump to a conclusion on this count as yet, but it certainly looks like that centre line strike is as much as we get. I can't imagine there would be as big an announcement possible as American Bitcoin, with Eric T "all in ".

Well, seems like moon it is then, but nothing wrong with some skepticism nonetheless. I'm not convinced it can't still get down to that 41k ish level although it might be wishful thinking. Maybe more realistic is an accumulation around here plus or minus 5k or so, while it rolls around the converging daily moving averages, perhaps even with another spikey test of the 75k region. Losing that level would be great for a 41k superbuy, with 59 another potential barrier on the way to it.

If break outs to the upside happen, there will always be a back test to look for good buying opportunities.

41k though one time please thanks

SOLANA(UPDATE)Hello friends

Due to the heavy price drop, you can see that buyers are slowly entering and the price is creating a good ascending channel, which now provides a good opportunity to buy in stages and with capital management and move towards the specified goals.

Don't forget to save profit on each target.

*Trade safely with us*

Some of you won't be able to holdWeekly stoch RSI crossed bullish. It's the weekly, some more downturns can be had. But are you waiting to time this? Seriously?

Check out my other CHZ ideas for different views on this coin.

Will you be able to hold till the top? It might come within 3 months.

Rustle

$NIO Wyckoff Accumulation – Schematic #1 or #2 in PlayMy base case at the moment is Wyckoff Accumulation Schematic #2 , where the Secondary Test ( ST-B ) could mark the very bottom. This idea will be validated for me especially if we see interaction with the High Time Frame Channel projection.

Green Zone:

We have multiple levels of confluence around this zone:

0.786 Fibonacci Retracement from the 2020 low to the 2021 top

MO – Monthly Open level

Volume cluster from previous local consolidation

Blue Zone:

If price drops as low as VAL, I expect it to be just a quick, volatile wick breaching into the Blue Zone.

High Time Frame Channel projection:

Gold - They All Call Me Crazy!Gold ( TVC:GOLD ) is just starting the next rally:

Click chart above to see the detailed analysis👆🏻

Just a couple of months ago, Gold perfectly broke out of the long term rising channel formation. After we then witnessed the bullish break and retest confirmation, it was quite clear that Gold will head much higher. This just seems to be the beginning of the next crazy major bullrun.

Levels to watch: $4.000

Keep your long term vision!

Philip (BasicTrading)

GOLD → Growing economic risks increase interest ↑FX:XAUUSD rallied aggressively due to high interest driven by rapidly rising economic risks, mainly related to Trump's tariffs. For selling, the risk is very high, with the stock and cryptocurrency market declines only adding to the interest in the metal

Markets are taking refuge in defensive assets amid WSJ reports of Trump's possible tariff hike of up to 20% for most US trading partners. This could trigger inflationary pressures and stagflation, weakening the dollar and bond yields, which supports the gold price.

This week all eyes are on Trump's speech on Wednesday, PMI, NonFarm Payrolls and Powell's speech

Technically, it is not worth selling now as it is high risk, and for buying we should wait for a correction to key support levels

Resistance levels: 3127

Support levels: 3103, 3091, 3085

We are not talking about any trend reversal now. It is worth waiting for a local correction or consolidation, the market will mark important levels, liquidity zones or imbalances against which you can build a trading strategy. Gold will continue to grow because of the strongly increasing risks.

Regards R. Linda!

USDJPY → Key Level Retest. Attempt to change the trend FX:USDJPY in the correction phase is retesting the previously broken boundary of the downtrend. The market is trying to break the trend on the background of the dollar correction

The dollar is having a rather difficult life because of economic and geopolitical nuances regarding the USA, as well as high inflation. Against this background, the index may continue a deeper correction, as the rhetoric of interest rate cuts may be prolonged, which may put pressure on the markets.

The currency pair tried to overcome the downtrend resistance earlier and succeeded, but this is not enough for a trend change, it needs confirmation.

Support levels: 148.92, 148.21

Resistance levels: 150.16, 150.95

If the bulls hold the defense above 148.92 - 149.5, we have a good chance to catch a trend change. It will be the readiness to go to the resistance of 150.16 range, and the breakout of this level and price fixation above it will be the confirmation of the trend change

Regards R. Linda!

EURAUD Wave Analysis – 31 March 2025

- EURAUD rising inside impulse wave iii

- Likely to reach resistance level 1.7400

EURAUD currency pair recently reversed from the support zone between the support level 1.7080 (low of the previous wave a), 20-day moving average and the support trendline of the daily down channel from the start of March.

The price earlier broke the resistance trendline of the aforementioned down channel – which accelerated the active impulse wave iii.

Given the clear daily uptrend and the bullish euro sentiment, EURAUD currency pair can be expected to rise to the next resistance level 1.7400 (which stopped the previous impulse wave i).

How low will it go? The S&P Bear MarketI don't believe the market has bottomed yet. There is more to come.

Trump's tariffs will continue to cause uncertainty and as economic figures confirm a US slowdown, stock markets could fall further.

From a technical perspective, I will be looking to buy between 4700 and 5200. This is based on evident weekly horizontal levels, bullish channel support, and 100 and 200 SMA's.

VANTAGE:SP500 PEPPERSTONE:US500 ICMARKETS:US500 OANDA:SPX500USD

GOLD → Correction after a false breakout. A reversal?FX:XAUUSD is forming a false break of the channel resistance within the rally, we should wait for a correction, but not for a trend reversal. Let's see what we can expect from the price in the short and medium term.

Gold is reacting to market turmoil over Trump's tariff plans. Investors are looking for protection ahead of the possible imposition of new duties from April 2, boosting demand for the metal

Fears of a trade war and a slowing global economy are supporting gold despite positive US GDP data. PCE data and tariff updates will be key catalysts for further movement. Higher inflation could dampen the rally, while weak data will reinforce bets on a Fed rate cut, helping gold to rally further.

The energy to continue the move is gone, so I am waiting for a correction to the imbalance zone or to 0.7 Fibo to accumulate potential. The price may consolidate in the zone of 3050 - 3075 before it continues its growth

Resistance levels: 3075, 3085, 3095

Support levels: 3059, 3055

The correction after a strong rally can be quite deep. The imbalance zone 3066 - 3063 and liquidity zone 3057 play an important role. False breakdown of support may resume growth.

Regards R. Linda!

SPY $545 Downtrend ContinuesSymbol: SPY

Timeframe: 30-minute chart (for your analysis)

Bias: Short (after the anticipated bounce)

Prediction: I anticipate a short-term bounce in SPY from Friday's sell-off towards the upper level of the weekly regression channel, around 560. I plan to look for a short entry at this level, expecting the price to then continue its downtrend towards the monthly regression channel support around 545.

Analysis:

Weekly Trend Channel (Blue Double Lines): The blue double lines on my chart represent a weekly trend channel for SPY. This channel was determined by performing a linear regression on the price action over the past week. The upper and lower boundaries of the channel are set at two standard deviations away from this linear regression line. This method helps to identify the statistically probable range within which the price is likely to trade over the weekly timeframe.

Monthly Trend Channel (Yellow Double Lines): Similarly, the yellow double lines indicate a monthly trend channel. This channel is derived from a linear regression of SPY's price action over the past month, with the boundaries set at two standard deviations. I expect SPY to eventually find support within this monthly channel, with the lower boundary currently around the 545 level. This is my primary downside target.

Recent Price Action and Anticipated Bounce: The aggressive 2% downtrend on Friday likely pushed SPY towards the lower end of the weekly channel, potentially creating oversold conditions in the short term. I am anticipating a bounce from this sell-off towards the upper boundary of the weekly channel, which I estimate to be around 560. This level is expected to act as resistance.

Short Entry Opportunity: I will be closely watching price action around the 560 level, which coincides with the upper boundary of the weekly regression channel. If I observe signs of rejection or bearish confirmation at this resistance, I will look to enter a short position.

Contributing Factors: President Trump's aggressive tariff policies continue to contribute to market uncertainty and the overall bearish sentiment, supporting the technical outlook for further downside.

Conclusion:

I am predicting a short-term bounce in SPY to approximately 560, which aligns with the upper level of the weekly regression channel. I will be looking for a short entry at this level with the expectation of a subsequent move down towards the monthly regression channel support around 545. This strategy aims to capitalize on a potential retracement within the established downtrend, guided by regression-based trend channels and influenced by fundamental concerns regarding tariff policies.

Disclaimer: This is my personal analysis and not financial advice. Please conduct your own research before making any trading decisions.

JPY/GBP - Potential Reversal SetupHey traders! Today we’re diving into a high-probability setup on the JPY/GBP pair with up to 22% upside on the monthly chart. I’ll cover the technicals, fundamentals, and exactly how to trade it.

📉 Chart pattern

Looking at the chart, we’ve got a textbook falling channel stretching back from mid-2020. This descending structure has been consistent, but right now, we’re testing the upper boundary - and that could signal a trend reversal is coming.

Momentum indicators back it up too. The RSI is rising off oversold levels, sitting around 41. And check out the MACD: bearish momentum is fading. Classic setup for a bullish breakout.

📌 Trade setup

Wait for a monthly close above the upper channel , ideally between 0.00530 to 0.00535. That’s your breakout confirmation. You can place a buy stop just above the breakout zone.

Set your stop-loss below the recent swing low - about 0.00490 - to protect against false moves.

Now for the profit targets :

* First target: 0.00580, that’s 12% above current levels.

* Second target: 0.00630, that's 22% upside potential.

That gives you a potential risk-reward ratio of up to 1:4 - solid.

🌐 Fundamentals

On the macro side, this setup makes even more sense. Japan is finally stepping away from ultra-loose monetary policy, possibly hiking rates. Meanwhile, the UK looks set to pause or even cut rates in 2025. That shift could give the Yen the edge over the Pound, driving this move higher.

🛎️ Now, smash that like button if you found this helpful, and subscribe for more trade ideas.

Bitcoin can correct to support level and then continue to growHello traders, I want share with you my opinion about Bitcoin. Looking at this chart, we can observe how the price began to decline around the mirror line and soon reached the 88500 resistance level. After that, BTC attempted to move upward but resumed its decline, eventually breaking below the 88500 level and falling toward the support area, which aligned with the buyer zone. Following this drop, Bitcoin bounced back into the buyer zone and even pushed slightly higher, beginning a steady rise within an ascending channel. Inside this channel, BTC reached the 82200 level and broke through it, made a minor correction, and then continued climbing to the upper boundary of the channel. The price then pulled back to the buyer zone, rebounded again, and returned to the channel’s resistance line before continuing its upward move. Eventually, BTC touched a key resistance level, hovered around it for a while, and then began to decline. Shortly after, the price broke out of the channel and dropped back to the support zone. However, more recently, it has started to rise again. In my view, BTC might first revisit the support area once more before continuing its upward movement. For this scenario, I’ve placed my first target near the resistance level at 87000 points. Please share this idea with your friends and click Boost 🚀

GOLD (XAUUSD): 3100 soon?!

Gold closed on Friday, consolidating within the intraday range.

Probabilities are high that growth will resume next week.

Your signal to buy will be a breakout of the underlined resistance on the hourly time frame.

1H candle close above 3087 will confirm the violation.

A bullish continuation will be expected to 3100 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NASDAQ 100 IndexThe price has already dropped to the support line of the inner channel (in light blue), which is at one standard deviation.

If this support line is also broken, the next support level is the outer channel (in yellow), which is at two standard deviations.

(Logarithmic price axis, channel starting from 2008)

S&P500 IndexIf the midline of the linear regression channel is broken, the price will continue to decline until it reaches the support line of the inner channel (in light blue), which is at one standard deviation.

In the less likely event that this support line is also broken, we have the support line of the outer channel (in yellow), which is at two standard deviations.

(Logarithmic price axis, channel starting from 2008)

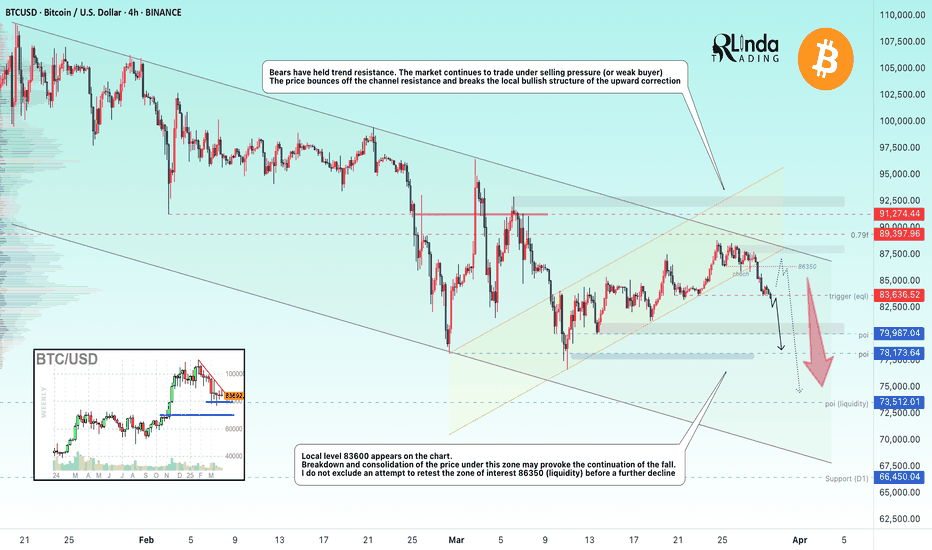

BITCOIN → Break of the bullish structure. Moving to 78-68KBINANCE:BTCUSD has been slowly recovering for the last two weeks, but failed to overcome the resistance. The bears held the trend. The price is breaking the local bullish structure and preparing for a strong fall.

Bitcoin's fundamental background is weak, expectations were not met by the crypto summits, nor by any major announcements or hints of a crypto reserve. The crypto community still didn't get what they expected from Trump. The strong drop was triggered by the SP500 index falling, driven by rising inflation, reduced consumer pressure and new trade tariffs. These factors have contributed to increased uncertainty in the markets, prompting investors to move to safer assets such as gold and government bonds

Technically, the price has been in consolidation (correction channel) for two weeks and after breaking the support of the figure, the price entered the realization phase within the global downtrend.

Resistance levels: 85300, 86350, 89400

Support levels: 83600, 81270, 79980, 78100

Emphasis on the support at 83600. The price fixing under this zone may provoke further fall to 80-78K. But I do not exclude the fact that a small correction to the zone of interest is possible (to capture liquidity) before a further fall to the previously identified key zones of interest.

Regards R. Linda!