XRP Breakout Alert! Time for a 40% Move?OKX:XRPUSDT.P has been trading inside a parallel channel for 66 days since January 16, 2025. Now, the price is breaking out to the upside!

💡 The key strategy here is waiting for a retest if the price successfully flips the channel into support, it could be the perfect entry for a strong upward move.

📈 Potential upside? 40%+ if the breakout holds and momentum kicks in!

🔍 Watch for:

✅ Retest & confirmation of support

✅ RSI & momentum indicators aligning

✅ Heatmap support

✅ Gold cross of MA 200-D/50-D

Are you catching this move? Share your thoughts in the comments! 🚀🔥

Parallel Channel

DOGEUSDT soon after or before touching 0.10 pump is coming Two major daily supports which are:

A. 0.13$

B. 0.09

are ahead and can soon pump the price and after breaking this descending channel to the upside heavy pump will lead and we are looking for targets like 0.50$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

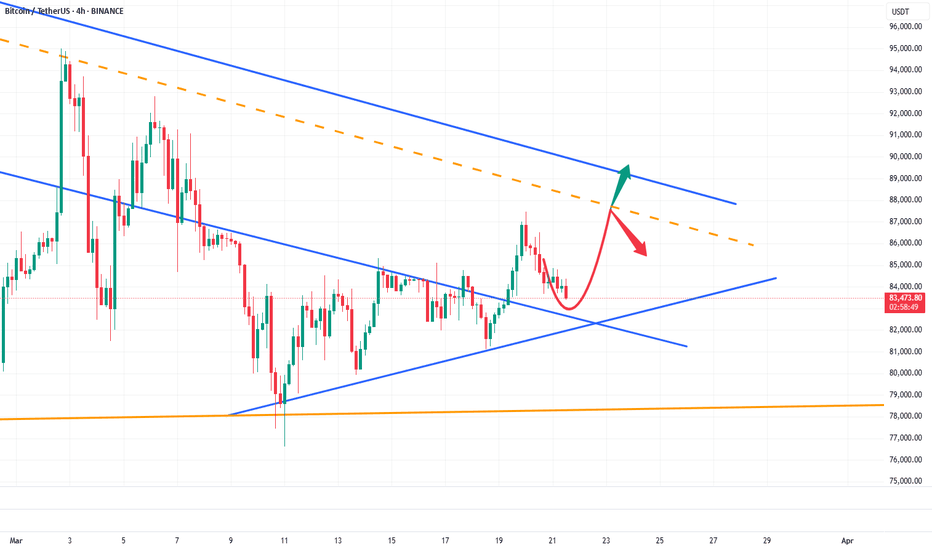

BTC/USDT Bearish Setup – Sell Limit & Target ZonesMarket Overview:

Bitcoin (BTC/USDT) is currently trading within a well-defined descending channel after an extended bullish rally. The price action shows signs of a lower high formation, indicating a possible continuation of the downtrend. This setup aligns with a sell limit strategy, anticipating a rejection from a key resistance level before a potential decline toward lower support areas.

Technical Breakdown:

📉 Descending Channel Formation:

BTC has been trading in a downward-sloping parallel channel, with multiple touches on both the upper and lower boundaries.

The price is currently attempting to retest the upper trendline of the channel, which could act as strong resistance.

💰 Sell Limit Placement at Resistance ($88,907):

The chart highlights a key resistance level at $88,907, which aligns with:

The upper boundary of the descending channel.

A previous supply zone, where sellers were active.

A potential area of rejection, leading to further downside.

📌 Fair Value Gap (FVG) & Handle Trendline:

The D1 Fair Value Gap (FVG), marked on the chart, suggests an imbalance in price that may get filled before any reversal.

Additionally, BTC is hovering around the upper trendline of the handle formation, making this a crucial confluence zone for decision-making.

📊 Bearish Target Levels:

Primary downside target: $74,431 – A strong historical support and previous reaction zone.

Secondary target: $73,829 – This level coincides with the mid-level of the fair value gap.

Final bearish target: $68,972 – The lowest target inside the demand zone, potentially acting as a key reversal point.

🚨 Bearish Confirmation:

If BTC gets rejected from the sell limit zone ($88,907) and breaks below support structures, it could trigger a further decline.

Break of trendline support + volume confirmation will strengthen the bearish bias.

Trading Plan:

✅ Sell Limit Entry: $88,907

🎯 Target 1: $74,431

🎯 Target 2: $73,829

🎯 Target 3: $68,972

❌ Invalidation: A strong breakout above $88,907 with volume could invalidate this setup.

Insmed (INSM) - Breakout Opportunity 📌 Insmed ( NASDAQ:INSM ) – Breakout Opportunity

Insmed is a clinical-stage biopharmaceutical company focused on serious and rare lung diseases. The stock more than doubled in May 2024 following positive Phase 3 results for its drug Brensocatib. The FDA has granted Priority Review, with a PDUFA date set for August 12, 2025 — and commercial launch expected in H2 2025.

Technical Overview:

Since the massive gap up in May 2024, INSM has been trading inside a well-defined horizontal channel between:

🔻 Support: $61.65

🔺 Resistance: $84.82

Currently, price is near the upper third of the range (~$79.92), showing signs of renewed momentum with rising volume and RSI trending higher.

Plan

----

📍 Entry: Daily close above $85 with strong volume ( >2.5M )

Targets

🎯 Target 1: $94 (+11%)

🎯 Target 2: $106 (+25%)

🛑 Stop: $82 (-4.7%)

Risk ratio:

🟠 Target 1: > 2:1

🟢 Target 2: > 5:1

---

📊 Key Indicators to Watch:

✅ RSI > 60 with upward slope

✅ MACD bullish crossover

✅ Break above 20-day EMA with volume

✅ Volume expansion on green candles

⚠️ This content is for informational and educational purposes only and does not constitute investment advice ⚠️

NZDUSD BULLISH BREAKOUT AHEAD?! *NZD/USD: Bullish Breakout Ahead?*

A potential buying opportunity has emerged in the NZD/USD pair, with a key resistance level in focus.

*Trade Idea:*

The NZD/USD pair is poised to fly to 0.6000 from its current price, driven by:

1. *Bullish Technicals*: Technical indicators are flashing bullish signals, hinting at a potential upswing.

2. *RBNZ's Monetary Policy*: The Reserve Bank of New Zealand's decision to maintain its monetary policy stance may support the Kiwi Dollar.

3. *US Dollar Weakness*: A weakening US Dollar, driven by concerns over the US economy and monetary policy, may boost the NZD/USD pair.

*Trade Specifications:*

- *Buy Entry:* Current price (around 0.5850)

- *Target Level:* 0.6000 (150 pips above entry)

- *Stop-Loss:* 0.5750 (100 pips below entry)

*Market Outlook:*

The NZD/USD pair is experiencing a consolidation phase, with market participants awaiting key economic data releases and central bank decisions. A break above the 0.5900 resistance level could trigger a sharp rally.

*Trading Strategy:*

Buy NZD/USD at current price, with a stop-loss at 0.5750. Use the target level to take profits or adjust the stop-loss to break even.

*Risk Management:*

- *Risk-Reward Ratio:* 1:1.5

- *Position Sizing:* 2-3% of trading capital

*Your Feedback Matters:*

If this trade idea and analysis helped you, please:

- *Like* to show appreciation

- *Share* your opinions and feedback

- *Follow* for more trade ideas and market analysis

Keep share your valuable ideas to the Travis 💯

Pepe - Elliott Wave Local and Long Term Idea 22 Mar 2025Eliiot Wave Update

Firstly, I'm bias that I believe were in Wave 4.

Depicted wave count 1 2 3 4 5 in orange may very well be as it is, in that the last low is 5. My bias comes in because from what I've read, 5th wave usually 1.27 fib extension drawn from 1 to 1 to 2. As can be seen, 1.272 is at 0.0000336.

The green paralellel channel from the high to the next higher high. As can be seen with circle support, we found a good reaction to the upside.

Short/medium term looking at the Anchored VWAP (White) and channel top as resistance.

Currently 1.0 a strong support as well as resistance.

My biase based wave theory means that were currently in the 4th wave to the upside, so looking at resitance EXACTLY at the anchored VWAP (white), breaking that to the upside targets of the short fibs drawn to the right that arent extended all the way to the right. Meaning, resistance being,0.382, 0.5, and 0.618.

If that is the end of Wave 4. The price would then see a retracemment to Wave 5, to 1.272.

Non bias view where Wave 5 has been hit already.

Were in a corrective ABC pattern. (This is the part I'm not so sure about).

Then Were in A(1) here no one knows how deep that is but it's good that were going up because A = up B = down and C = up (c or 3 being the longest waves.

If were in the corrective phase, currently were in Wave A (1).

Technically nothing changes. I think. Wait to see how It plays out.

Overall, currently I would NOT be bearish, looking at the next resistance first!Which is (either Wave 4 or correction) 0.236 price 0.000095

Swing Trade Idea – AVXL Anavex Life Sciences ( NASDAQ:AVXL ) is a clinical-stage biotech developing precision medicine therapies for CNS diseases like Alzheimer’s, Rett syndrome, and Parkinson’s. Its lead drug has shown promising Phase IIb/III data in Alzheimer’s.

The company holds strong IP, operates debt-free, and benefits from long-term tailwinds in neurodegenerative treatment demand and regulatory fast-track pathways.

Technical

Since Feb 28, AVXL has been climbing within a rising channel on increasing volume, signaling accumulation. RSI is rising but still below overbought. A breakout above $10 with strong volume could trigger a momentum leg toward $11.50–13.00. Pullbacks to $9.50–9.60 offer low-risk entries.

Setup

Entry: $10

Targets:

🎯 $10.50

🎯 $11.50

🛑 $9.20

Risk/Reward ratio:

⚠️ 1:3

Factors to watch this week for NASDAQ:AVXL

👉🏼 Price holding above $9.50 support and within rising channel

👉🏼 Breakout attempt above $10 with strong volume

👉🏼 Rising volume on green days (watch for volume > average ~1M)

👉🏼 RSI staying above 60 and trending toward 70

👉🏼 Reaction to any pullback – buying pressure near $9.50–9.60 = bullish confirmation

Gold | Bullish Price Channel Since H2 2024Gold has traded in an upward price channel since June 2024. This channel's upper and lower bands have acted as support and resistance several times, which reinforces their predictive value.

The balance of probabilities suggests that gold could pull back either to the channel's midpoint, which coincides with its 50-day moving average, or to the lower bound of its price channel, which coincides with its 100-day moving average.

How are you trading this?

XAUUSD Weekly Analysis – Bearish Correction ExpectedGold (XAUUSD) has recently broken above a rising wedge resistance on the weekly timeframe but is now showing early signs of potential exhaustion. Price action is currently hovering around the $3,024 level after a strong bullish rally. However, historical patterns and structure suggest a possible bearish correction ahead.

📊 Key Technical Observations:

Rising Wedge Pattern: Price has been following an ascending channel with a sharp parabolic curve. The structure hints at overextension, making it vulnerable to a pullback.

Previous Corrections: Two notable corrections (-8.89% and -8.15%) provide a historical benchmark, reinforcing the possibility of a similar retracement.

Bearish Scenario :

A potential double-top formation and rejection zone is developing around the $3,050 area.

Target Zones:

TP1: $2,935.95 – first major support/resistance flip zone.

TP2: $2,782.94 – deeper retracement aligned with previous corrective structure.

🧠 Trading Bias:

Bearish bias in the short to medium term as gold may seek to correct before any continuation of the bullish trend.

BITCOIN → Flag (consolidation) before falling to 78-73KBINANCE:BTCUSD is consolidating after a short-squeeze relative to 85-87K. A bearish set-up is being formed, the break of which may strengthen further decline to the key target of 73K

A symmetrical triangle is forming within the downtrend on D1, a breakdown of this structure may strengthen the decline. Locally, within the channel a flag - bearish figure is formed (on the local TF false uptrend, the crowd enters to buy from the support or at the break of local resistance, at accumulation of the necessary potential the big player removes the limit order and releases the price, which is dispersed by liquidation of traders), regarding 85K-86.6K the liquidity capture is formed and the price returns to the selling zone. Consolidation below 85K may trigger a breakdown of the figure support and further fall to 80K-78K

Fundamentally: the market sells off any positive news very quickly (negative background is created):

crypto summits, (Trump said nothing new at the second summit)

positive resolutions of problems (for example between SEC and XRP, or removal of restrictions from local exchanges)

crypto reserve

The only nuance, bitcoin's dominance index is still high despite the price drop...

Resistance levels: 85150, 866700, 89400

Support levels: 82K, 80K, 78200

There are no positive signs for growth. The zone where we can consider a trend reversal ( if something supernatural happens ) is 89-91K, but it is very far away.

But now I would consider a breakdown of the flag, or 83.5 - 82.5 and price consolidation below this zone with the purpose of further fall to the local important level 78173. Then another consolidation or correction is possible before a further fall to 73.5K

Regards R. Linda!

Don't FOMO into the market yet; the bear run isn't over!Earlier today, I took some time to scroll through Reddit and Twitter, where I saw discussions suggesting that the recent pullback in crypto is the first leg of the highly anticipated bull run.

While I largely agree that the bull run is far from over, a broader look at price movements across multiple markets indicates that the bear market isn’t over yet.

To prove this point, I will be analysing Bitcoin's price charts.

On Bitcoin's daily chart, it's clear that the current price movement is more of a correction than a reversal.

Zoom in to the 4-hour chart and and you can see how the pullback moves in an ascending triangle. Over the next few days we might see price break below the channel and head for the area around point 'B'.

This will serve as the pullback for this short swing, where bulls will temporarily drive prices slightly above the most recent high before a sharp decline leads to the formation of a new low.

EURUSD 4H SHORTEURUSD 4H SHORT

The pair broke just exited a bullish channel and doing so broke the neckline of a double top, the pair now is doing a pullback to the neck line. The objective for the Double top is around 1.07074 that almost matches Fibo 38% in 1D chart, while the objective for the broken channel is around 1.051 taking the price to a strong resistance working now as support.

TON – Breakout or Breakdown?TON Coin – Breakout or Breakdown?

🔹 Currently moving in a downward channel.

📉 Lower highs & lower lows – a textbook bearish trend.

🚧 Right at a resistance zone.

Where could it go from here? Let's break it down!

TON’s Current Price Action

The chart clearly shows the downward channel—lower highs, lower lows, signaling trend weakness.

🎯 Right now, price is at resistance. From here, we either see a breakout or a rejection. (Spoiler: I’m leaning towards the latter.)

Why a Rejection Seems Likely

Price is at the top of the channel—if it doesn’t break out, it’s likely to return to the range.

The next key support sits around $2.80, making it a crucial level to watch.

Bearish RSI Divergence

On the 4H chart, RSI isn’t confirming the price action. Price is moving up, but RSI is trending down = classic bearish divergence.

This often signals trend weakness and a potential reversal.

Conclusion

⚠️ If price rejects at resistance, $0.90 is a key target. I expect it to reach this level—not today, not tomorrow, but somewhere around here will be the bottom.

The trend is still down—until we see a strong breakout, short setups remain favorable. If a breakout happens, time to reassess.

Are you bullish or bearish on TON? Drop your thoughts in the comments! 🔽

US100 - Testing Key Resistance: Will the 4H Trend Reverse?Market Structure & Trend Overview

The Nasdaq (US100) has been in a 4-hour uptrend, forming a series of higher lows and respecting an ascending channel after a prolonged bearish trend. This structure suggests that buyers are stepping in, and momentum may be shifting in favor of the bulls. However, the index remains at a critical decision point that could determine whether we see a confirmed bullish reversal or a continuation of the larger downtrend.

Key Zone: 4H Imbalance & Resistance Area

Currently, price action is testing a 4-hour imbalance zone, which has already acted as a strong resistance level twice. The market is struggling to break through this supply zone, which is crucial in determining the next major move. If price tests this area again and successfully breaks above it, it could confirm that buyers have gained control, signaling a potential trend reversal back into a bullish phase.

However, if price gets rejected from this level again, it could indicate that sellers are still dominant, increasing the probability of a breakdown from the ascending channel and a resumption of the bearish trend.

Bullish Scenario: Break & Hold Above Imbalance Zone

For a confirmed bullish reversal, Nasdaq must break above the imbalance zone with strong volume and sustain price action above it. A successful breakout could attract more buyers, leading to a push towards higher resistance levels, possibly targeting the $20,000 - $20,300 range in the short term.

Signs to look for in a bullish breakout:

✅ A decisive close above the imbalance zone with strong bullish momentum.

✅ Retesting the broken level as support, confirming it as a new demand zone.

✅ A continuation of higher highs and higher lows after the breakout.

Bearish Scenario: Breakdown of the Ascending Channel

If price fails to break through the imbalance zone and instead rejects for the third time, this could indicate a weakening bullish structure. The key support to watch is the lower boundary of the ascending channel. A confirmed break below this channel could invalidate the short-term uptrend, signaling a return to bearish price action.

If this occurs, Nasdaq could drop towards the key support level at $19,146, a previous liquidity zone where buyers may step in again.

Signs to watch for a bearish breakdown:

❌ A clear rejection from the imbalance zone.

❌ A break and close below the ascending channel.

❌ Increased selling pressure and a shift in market sentiment.

Final Thoughts: A Critical Inflection Point

Nasdaq is at a pivotal moment where the next move will determine the broader trend direction. If bulls can push price above the imbalance zone, we could see a confirmed bullish reversal with upside potential. However, if sellers regain control and force a breakdown of the channel, the downtrend is likely to continue, targeting the $19,146 level as a potential support zone.

Traders should closely monitor price action at the imbalance zone and the ascending channel boundaries, as these key areas will dictate the next major move. Whether we see a trend reversal or continuation, this setup presents significant trading opportunities in either direction.

Key Levels to Watch:

📍 Bullish Breakout Target: $19,900 - $20,000

📍 Bearish Breakdown Target: $19,146

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

GOLD → Consolidation (correction) before growth to $3100FX:XAUUSD is going into consolidation after strong growth on the back of dollar correction. The metal may test deeper support areas before attempting a new high

Gold is correcting, but remains in an uptrend

The decline in quotations may be seen as a buying opportunity, given the economic uncertainty due to Trump's tariffs and expectations of Fed rate cuts.

The Fed reiterated its forecast of two rate cuts in 2025 despite Powell's cautious comments. Gold is further supported by rising inflation risks and geopolitical tensions in the Middle East.

Resistance levels: 3045, 3057

Support levels: 3024, trending, 3004

Reaction to support is weakening, even amid the uptrend. Gold may stay in this consolidation until the middle of next week, or it may try to break out of the consolidation to retest deeper support zones, such as the rising trend line or the 3004 imbalance zone, from which the growth may resume.

Regards R. Linda!

Gold can continue to grow inside upward channelHello traders, I want share with you my opinion about Gold. This chart shows how the price initially rebounded from the support level, which aligned with the buyer zone, but soon reversed and dropped back down to the support line. After hovering near this line, the price entered a triangle pattern, where it bounced off the resistance line and fell to the support line, breaking below the support level. Following that move, the price reversed upward and returned to the buyer zone, where it consolidated briefly before declining again to the support line. From there, it bounced and began to climb. Shortly after, the price broke through the 2915 level and eventually exited the triangle pattern. From that point, the price started trending upward within an ascending channel, reaching the current support level, which overlaps with a key support area, before rising to the resistance line of the channel. Recently, the price pulled back to the support zone once again, and I believe there’s a good chance it will decline a little below from this area and continue its upward move within the channel, aiming for the resistance line. For this scenario, my TP is set at 3080. Please share this idea with your friends and click Boost 🚀

BTC: Accumulate energy for the rise and soar into the sky!📍BTC's volatility has narrowed, with selling pressure showing signs of weakening. Throughout the choppy price action, the 84000-83500 zone has established itself as a critical support area in the short-term structure. This level now serves as a key defensive line.

📍Following this consolidation phase, BTC may stage a rebound from this support region. If the price manages to break through the resistance around 84800 with strength, further upside momentum could drive it towards the 90000 level.

🔎Trade Idea:

BTCUSD:Buy at 83500-83000

TP:84500-85000

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

XAG/USD (Silver) – 1H Technical Analysis & Trade SetupThis analysis presents a high-probability bullish trade setup based on key price action principles, market structure, and technical indicators. The chart illustrates a potential reversal from a support zone, a descending channel breakout, and an overall shift in trend dynamics.

1. Market Structure & Key Price Levels

Before placing any trade, it's essential to analyze the bigger picture, including support and resistance levels, trend structure, and liquidity zones. Let's break down the key areas:

A. Resistance Area (Supply Zone) – $34.20 to $34.60

This horizontal resistance zone has historically acted as a selling pressure area where price faced rejection.

It represents a profit-taking zone for bulls and a possible reversal point for bears.

If price successfully breaks and closes above this resistance, it could signal further upside potential.

B. Support Level (Demand Zone) – $32.90 to $33.10

The price has consistently bounced from this region, indicating strong buying interest.

This level has acted as a demand zone, where institutions or large traders are likely accumulating positions.

A strong bullish reaction from this zone strengthens the reversal scenario.

C. Change of Character (CHoCH) – Key Structural Shift

A Change of Character (CHoCH) is marked on the chart, indicating a potential shift from a bearish to a bullish trend.

This is one of the most reliable signals when transitioning from a downtrend to an uptrend.

2. Chart Pattern & Price Action Analysis

A. Descending Channel Formation (Bullish Reversal Pattern)

The market has been forming a descending channel, which is a corrective pattern rather than a continuation pattern.

This structure consists of lower highs and lower lows, indicating short-term selling pressure.

However, when such a pattern forms near strong support, it often precedes a breakout and trend reversal.

A confirmed break above the channel's upper trendline will serve as a bullish breakout signal.

B. Liquidity Grab & Stop Hunt Consideration

Many retail traders place stop-loss orders below the support zone, making it an area of liquidity accumulation.

The market may attempt to sweep these stops before moving up, which aligns with institutional trading behavior.

If price momentarily dips below the support and then quickly reverses with strong bullish momentum, it confirms a stop hunt and a possible reversal setup.

3. Trading Strategy & Setup

To maximize profits while managing risk, we need a well-structured entry, target, and stop-loss strategy.

📌 Entry Strategy

Aggressive Entry:

Enter a buy position within the support zone ($33.00 - $33.10) if bullish price action (e.g., bullish engulfing candle) confirms buying pressure.

Conservative Entry:

Wait for a clear breakout from the descending channel’s upper trendline, then buy on a retest.

This reduces the risk of a fakeout and provides higher confirmation.

🎯 Target Levels (Take Profit Zones)

First Target (TP1) – $34.26

This is a key resistance level where price previously reversed.

Partial profit-taking is recommended here to secure gains.

Second Target (TP2) – $34.60

If momentum continues, price could reach this extended target.

Strong breakout volume would support this move.

🛑 Stop Loss (SL) Placement

Stop-loss should be set below the support zone ($32.45).

This ensures adequate risk management and avoids premature stop-outs.

If price breaks below this level with strong selling volume, the bullish setup is invalidated.

4. Risk Management & Trade Considerations

📌 Risk-to-Reward Ratio (RRR):

The trade setup offers an RRR of at least 1:3, making it a high-probability trade.

📌 Possible Fakeouts & Confirmation Signals:

If price breaks above the descending channel but fails to hold above support, it's a sign of a fake breakout.

Watch for strong bullish volume and clear break of previous lower highs before entering long.

📌 Fundamental Factors:

Keep an eye on economic reports, Federal Reserve speeches, and USD strength, as they heavily influence Silver prices.

5. Conclusion – High-Probability Bullish Setup

Descending channel breakout, strong support level, and CHoCH indicate a potential bullish reversal.

If buyers successfully defend the support zone, price is likely to target $34.26 – $34.60.

Risk management is crucial – waiting for confirmation reduces chances of a failed trade.

🚀 Watch for bullish confirmation before entering!

EURJPY → False breakout of key resistance ...FX:EURJPY is forming a false breakdown of resistance and draws us a reversal pattern against the upper boundary of the descending price channel, as well as the pressure on the market creates the correction of the dollar...

On the daily chart the structure is bearish. After the false breakout of the global resistance a correction is formed, within which the price can test the imbalance zone or the previously broken resistance and continue its fall after the liquidity capture. The global trend is neutral and in this case it is worth considering local support levels as targets

Resistance levels: channel boundary, 162.3, 163.0

Support levels: 160.84, 158.9

A retest of the channel resistance or the area of 162.4 - 163 is possible. But any return of the price under the resistance of the descending channel and consolidation of the price in the selling zone may provoke further decline

Regards R. Linda!