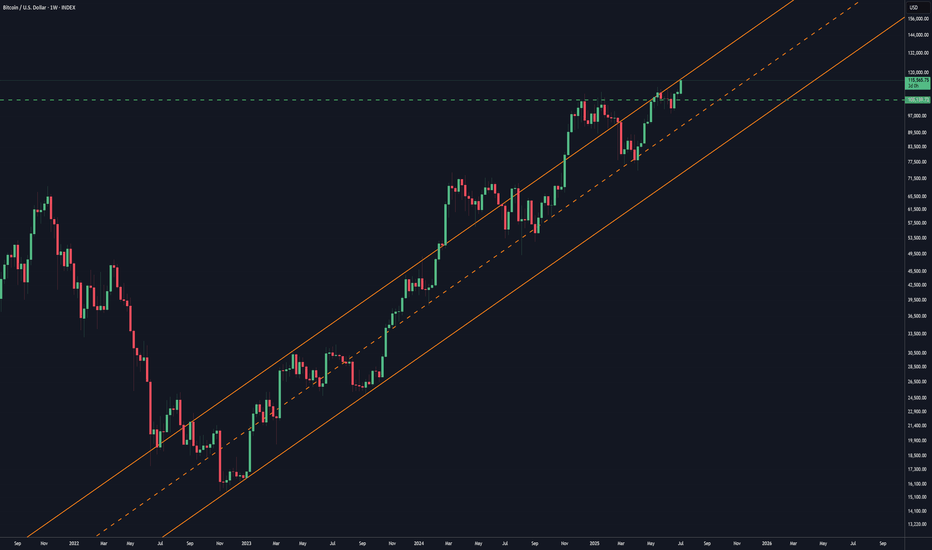

BITCOIN → Stopping after the rally? What next? 125K or 110K?BINANCE:BTCUSDT rose and updated its historical maximum to a new record of 118K with “kopecks” (different prices on different exchanges). Now the price has supposedly stopped and entered a consolidation phase, but it is too early to draw any conclusions based on this alone...

Fundamentally, Bitcoin rose following the SP500 and NQ100 indices. The reasons are clearly geopolitical. The correlation level is not high, but the flagship is following the stock indices, which are also updating their historical highs.

Technically, Bitcoin has emerged from a two-month consolidation and entered a realization phase. So what's next? Continuation of the phase or correction? Let's take a look.

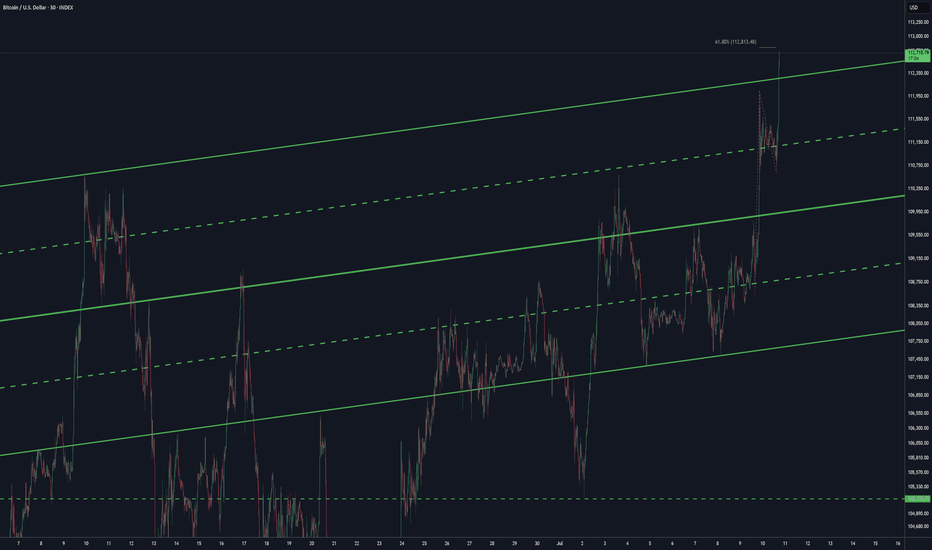

On the daily chart, I would highlight two zones. The risk and sell zone is below 117,500. If the price closes below this zone today/tomorrow, we will most likely be able to look for signals for a possible correction. As part of the correction, we can expect a decline to 115,500, 114,300, or even to the old ATH of 112K.

The second zone is the buying zone. A closing price above 118,400–118,900 and consolidation with the gradual formation of a breakout of structure may hint at a possible continuation of growth toward psychological targets.

Resistance levels: 118,400, 118900

Support levels: 117100, 116700, 115500

In the chart above, I have highlighted the situations, levels, and zones that interest me more precisely.

Now I am waiting for Bitcoin to retest resistance or support and confirm certain levels, based on which decisions can be made. I think that in the near future, Bitcoin will show us where it is headed. Updates will be published as something interesting emerges...

Best regards, R. Linda!

Parallel Channel

EURUSD - OPPORTUNITY TO PLAY BOTH SIDES OF DESCENDING CHANNEL CMCMARKETS:EURUSD

TRADING IDEA - EURUSD MOVES WITHIN A DESCENDING CHANNEL - OPPORTUNITY TO PLAY BOTH SIDES

EURUSD has been trading within a descending channel since the beginning of the month. Nearby the upper border of the channel there is SMA200 on a 30-m timeframe, pushing on the pair. Generally speaking, all major moving averages are pushing on the EURUSD, the short-term bearish trend continues, so I decided to open

🔽 a market sell order at 1.16688 with

❌a stop loss at 1.16985 and

🤑a take profit at 1.16324

Later I expect a rebound from the lower border with a potential uprise towards upper border of the descending channel.

PENGU = ETF Catalyst + Whale Accumulation = +30% More Upside?Today, on the weekend, I want to analyze the Pudgy Penguins project with the PENGU ( BINANCE:PENGUUSDT ) token from a fundamental and technical perspective .

Please stay with me.

Why did PENGU surge nearly 40% in just 48 hours? Here’s what’s driving it:

------------------------------------------

Fundamental Analysis:

1. ETF Momentum via Cboe:

On June 26, Cboe officially filed a 19b-4 form for a new ETF that includes Pudgy Penguins and PENGU as major components.

Although not yet approved, this single move has fueled strong institutional anticipation, similar to what happened with Bitcoin ETFs in early 2023.

The market often prices in future narratives — and this ETF storyline has been a powerful one.

2.Whale Accumulation Signals

According to Nansen data, large holders have increased their balances by 11.37%, and notable wallets linked to public figures by 7% over the last 30 days.

Such coordinated accumulation often precedes major price moves, and that pattern seems to be repeating here.

3.NFT Ecosystem Boost

The Pudgy Penguins NFT collection saw a 400%+ surge in sales volume.

This sharp increase in NFT activity has reignited attention toward the broader Pudgy ecosystem, which naturally benefits its native token, PENGU.

Risk Note:

The ETF is not yet approved — we're still in the hype phase.

Volatility remains high, and strong pullbacks are common in low-liquidity tokens like PENGU.

If whale activity continues and institutional narratives grow, the upside potential remains — but so does the downside risk.

------------------------------------------

PENGU token started to rise from the Support zone($0.01-$0.0076) . One of the signs of a continuation of the uptrend was the break of the upper line of the descending channel .

Educational Note: One of the price targets after a channel break can be as wide as the width of the broken channel.

In terms of Elliott Wave theory , it seems that the PENGU token has completed the Double Three Correction(WXY) , and we can wait for the next impulsive waves .

I expect the PENGU token to attack the Resistance zone($0.0128-$0.0118) again, and if this zone is broken , it can increase to at least $0.0137(+30%) .

What is your idea about the Pudgy Penguins project?

Note: If the PENGU token drops below $0.01, we can expect a break of the Support zone($0.01-$0.0076).

Please respect each other's ideas and express them politely if you agree or disagree.

Pudgy Penguins Analyze (PENGUUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

2281: Bullish Harmonic Pattern2281: Bullish Harmonic Pattern

2281 is struggling since last ATH in Sept 2024. Beautifully forming a Bullish harmonic pattern at significant support level.

Breakout of descending parallel channel is observed. Formation of HH and HL confluence is also favoring bulls.

Take Entry now or

After formation of another HH (breakout of psychological support level of 100)

Trail your stop loss accordingly.

Manage your risk.

Enjoy the ride!

LTTS Weekly Trade Setup(14th-18th July 2025) – Parallel ChannelThis week, L&T Technology Services (LTTS) is showing a potential breakout opportunity that requires patience and precision. As the stock approaches a key resistance zone near ₹4445, traders should resist the urge to jump in early and instead wait for a breakout and confirmed re-test before entering any long positions.

Let’s break this down.

1. Why the Breakout is Important

- LTTS has been consolidating within a parallel channel between ₹4280 (support) and ₹4445 (resistance). Breakouts from such structures often trigger significant moves — but only when confirmed.

- A false breakout can trap early traders. Hence, waiting for the price to break above ₹4445 and then re-test this level is critical.

2. The Strategy – Wait and React

📌 Step 1: Watch for Breakout

Monitor price action as it approaches and breaches the ₹4445 resistance.

Look for strong bullish candles with volume to validate the breakout.

📌 Step 2: Wait for Re-test

After breakout, price may pull back to test the previous resistance.

This re-test acts as a confirmation that bulls are defending the breakout.

📌 Step 3: Look for Confirmation

Enter only when you see a bullish candlestick pattern (like a bullish engulfing or hammer) near the re-test level on 15-min or 1-hour charts.

🛡️ Stop Loss:

Place your stop below the swing low of the re-test.

This protects you if the breakout fails.

🎯 Target:

Profit booking zone is near ₹4580–₹4600.

Risk/reward ratio: 1:2, 1:3, 1:4+

3. Why Re-test Entries are Powerful

They allow low-risk entries with a tight stop loss.

You avoid chasing price and reduce emotional trading.

Confirmation helps you filter out false breakouts.

4. Final Words

In trading, discipline often beats speed. This LTTS setup is all about timing and structure.

🔔 Watch for the breakout.

🧘♂️ Wait for the re-test.

🎯 Enter only with confirmation.

If executed properly, this trade offers a clean, high R:R opportunity with a clearly defined setup.

EURUSD: Detailed Support & Resistance Analysis 🇪🇺🇺🇸

Here is my latest structure analysis and important

supports and resistances for EURUSD for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD - Weekly Resistance Might Shift The Momentum!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURCAD has been overall bullish trading within the rising channel marked in blue. However, it is currently approaching the upper bound of the channel.

Moreover, the red zone is a strong weekly resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and resistance.

📚 As per my trading style:

As #EURCAD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP - Follow The Bulls!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been overall bullish trading within the rising channel marked in blue. And it is currently retesting the lower bound of the channel.

Moreover, the orange zone is a strong daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and support.

📚 As per my trading style:

As #EURGBP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SOLUSDT → Countertrend correction and hunt for liquidityBINANCE:SOLUSDT looks quite promising on the bullish side. The price is testing one of the key resistance levels within the local trend rally. A correction is forming. Is it beneficial for us?

On the higher timeframe, we see a change in character, a breakout of the trend resistance, and the formation of an upward trend support line. Bitcoin is still bullish (locally) at this time, but it is consolidating, which generally provokes a correction in SOL as well. Focus on the 150-149 area. If the bulls are able to keep the price above this zone after the retest, followed by the formation of momentum, this can be considered a positive medium-term sign.

Locally, the price within the trading range of 149.36 - 158 is heading towards the area of interest and liquidity (eql) at 149.36. The current sell-off is most likely triggered by a large player seeking a more favorable entry into the market.

Resistance levels: 154.75, 156.8

Support levels: 149.36, 147.93

In the current situation, it makes the most sense to consider an intraday trading strategy. A countertrend correction and a retest of support could attract buyers...

Best regards, R. Linda!

Ethereum Wave Analysis – 11 July 2025- Ethereum broke resistance zone

- Likely to rise to resistance level 3140.00

Ethereum cryptocurrency recently broke the resistance area lying at the intersection of the key resistance level 2885.00 (which has been reversing the price from February) and the resistance trendline of the daily up channel from June.

The breakout of this resistance zone accelerated the active impulse waves 3 and (3).

Given the predominantly bullish sentiment seen across the crypto markets, Ethereum cryptocurrency can be expected to rise to the next resistance level 3140.00 (former support from December and January).

Ethereum can make a small correction before it continues to growHello traders, I want share with you my opinion about Ethereum. After a long period of consolidation within a descending triangle, Ethereum broke out and started forming a steady upward channel. The impulse move from the buyer zone gave the market fresh bullish energy. We saw the price pushing through key resistance levels, showing strong momentum and confidence from buyers. Eventually, ETH reached a local peak and is now hovering just above the current support level at 2835. This area is crucial - it previously acted as resistance and has now turned into a support area, giving bulls a chance to regroup. Based on the structure, I expect a short-term correction toward the support area, followed by a continuation to the upside. The trend remains strong, and the impulse is not yet exhausted. That’s why I set my TP at 3240 points, which aligns with the upper expansion target based on previous movement. Given the breakout, strong uptrend, and support zone now being retested, I remain bullish and anticipate further growth from the current levels. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

SILVER (XAGUSD): Correction is Over?!

It looks like Silver has finally completed a consolidation within

a wide horizontal parallel channel on a daily.

A new higher high formation today indicates coming growth.

Because if its Friday, I suggest looking for trend-following buy from Monday.

Let the market close above the underlined resistance to let it set a Higher Close

as well.

Look for buying after a pullback, aiming at 38.0 as the first goal.

❤️Please, support my work with like, thank you!❤️

GOLD → Distribution. There is potential for growth to 3450–3500FX:XAUUSD breaks through consolidation resistance and forms a distribution pattern. A breakout of 3345-3358 could lead to another rally amid high economic risks...

Gold is rising for the third day in a row amid growing concerns about new tariffs announced by Trump. He threatened to impose tariffs on Canada and most of its trading partners, as well as the EU. Despite the strengthening of the dollar, demand for gold remains strong due to uncertainty and expectations for US inflation data next week. Investors are cautious ahead of CPI and the Fed's possible response

The correlation between gold and the dollar is declining, with gold rising due to geopolitical reasons amid high economic risks.

If the bulls keep the price above 3300-3345, the market could be extremely positive for 3400-3500.

Resistance levels: 3345, 3358

Support levels: 3330, 3308

Gold has broken through the resistance of the “triangle” consolidation pattern and is forming a distribution phase towards the zone of interest 3345 - 3358, from which a small correction may form before growth. Since 3345 is an intermediate level, the focus is on 3358. I do not rule out the possibility of a long squeeze of the support levels 3330, the triangle support, and 3310 before the growth continues.

Best regards, R. Linda!

Altcoins Market Cap: We on the Verge of a 5T Exposion!Hey crypto traders! Let’s dive into this monthly chart of the Altcoins Market Cap. You won’t believe what’s brewing!

We’re currently approaching a critical channel support at 200B, a level that might act as a springboard for massive rally — check out the jumps from channel support in 2019 and 2023! Each time the market cap hit this support, it skyrocketed, and now we’re at that pivotal moment again.

The chart projects a jaw-dropping target of $5T within the next 24 months if history repeats itself!

The price action shows we’re testing the lower boundary of this ascending channel, with the market cap sitting around 239.65B. A bounce here could send altcoins on a parabolic run, potentially hitting 5T by mid-2026. But if support fails, we might see a dip toward 100B — let’s keep an eye out!

Key Levels to Watch:

Support: 175B (channel support)

Resistance: 1.55T, 5T (projected target)

Breakdown Risk: 100B

Are altcoins about to explode to 5T, or will we see a deeper correction? Drop your thoughts below!

PS take a look at others vs. btc price action here:

EURUSD - Bears Are on the MoveHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURUSD has been overall bearish trading within the falling wedge pattern marked in red. And it is currently retesting the upper bound of the wedge.

Moreover, the blue zone is a strong structure.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and structure.

📚 As per my trading style:

As #EURUSD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Another channel resistanceThere is of course this quite significant channel that forms the base of this entire move, and also frames back further in time. After all was said and done, this wouldn't be surprising if it contained the price as it has done previously. Not to say it can't be sustained above it, because it certainly doesn't rule anything out, but it's there nonetheless.

Bitcoin dominance chart ready to dump?Bitcoin dominance aka the btc.d chart has been in these 2 rising channels now for a long long tie, after ust recently being rejected down fro the top trendline of the neon yellow channel, there seems to be an opportunity here for it to potentially head down to retest the bottom trendline of that channel as well. If this occurs this could lead to an altcoin season. Price is right now combating the 50ma(in orange) and trying to maintain it as support. If this moving average flips to solidified resistance that greatly increases the chances of price going down to retest that bottom yellow trendline. Being that both of these channels are rising channels probability favors price action eventually breaking down from them instead of up so I have arbitrarily placed the measure move break down target of the yellow channel in a random spot below roughly where price could break down from the channel were it to be rejected strongly enough here by the 50ma. It’s retested this bottom trendline multiple times in the past and has always found away to avoid the breakdown thus far though so a breakdown there is definitely not guaranteed if it does retest the trendline, but even heading back down to retest the trendline in the first place may provide enough momentum for an alt season *not financial advice*

Add-onsAs far as break outs go, this might be all it goes but I'd like to see it get a bit technical and hit that first level at the 618 before retesting the channel. If it can hold up there and maybe flush a bit out, then for me it's an adding opportunity. It might be the last chance we see these prices. It can always be wrong, but that's what stops are for on trading funds.

Break of downward sloping channel LongNike has swept liquidity and is now showing a strong bounce to the upside.

Although I didn’t manage to enter the initial long, I am monitoring for a break above the current downward-sloping channel. A clean breakout followed by a retest would provide a more reliable entry point. I’m not aiming to catch the absolute bottom—I’d rather wait for confirmation of trend reversal.

A move above the monthly level at 79.46 would be an additional sign of strength and increase conviction in the long setup.

There is still significant overhead resistance, particularly around the point of control aligned with the anchored VWAP near 92.50. That area would be my first target. However, if momentum continues, there is potential for a move towards the 122 level.

After breaking support level, Euro can continue to fallHello traders, I want share with you my opinion about Euro. After forming an ascending channel, the price steadily moved higher and reached a local range area near 1.1850 points. However, once it entered this zone, the momentum faded. The market started showing signs of distribution, and we saw multiple attempts to push higher being rejected. This range acted as a cap, preventing further growth. Now, the price has pulled back and is trading near the current support level at 1.1700, which also coincides with the support area. This zone has already been tested several times, and each bounce has been weaker than the previous one. That suggests growing pressure from sellers. Looking at the broader structure, the price exited the previous triangle formation with an upward move, but now that impulse has exhausted. The rising wedge is also broken. Based on the behavior at resistance and the weakness around the current support, I expect a breakdown from the range and further decline toward TP 1 at 1.1500 points. If bearish pressure continues, the price could eventually reach the major buyer zone around 1.1345 - 1.1300 points. Given the weakening momentum, retests of support, and lack of bullish continuation, I remain bearish and anticipate a continuation of the downtrend. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Aussie: Still Growing!

CAPITALCOM:AUDUSD

The bullish momentum continues after our last successful AUDUSD setup, and a move toward the 0.65900 resistance area looks probable now.

🪙 My Trading Plan:

🔼 BUY Stop: 0.65648

❌ Stop Loss: 0.65320

✅ Take Profit: 0.65965

💡 Why am I buying here?

✅ Price broke recent resistance at 0.65500, activating buy trades.

✅ RSI confirm ongoing bullish momentum 📊.

📰 Fundamental Situation:

🏦 RBA Rate Decision Supports AUD

The Reserve Bank of Australia (RBA) surprised markets by holding rates steady at 3.85% 🏛️, diverging from expectations of a cut. This cautious stance reflects the RBA’s preference to wait for clearer signs of slowing inflation 📉 before adjusting policy further.

Governor Michele Bullock emphasized that inflation risks remain persistent ⚠️, driven by high labor costs and weak productivity, possibly requiring a longer period of restrictive policy ⏳. Deputy Governor Andrew Hauser noted the bank is closely monitoring global risks 🌐, especially US tariff developments, underscoring sensitivity to global headwinds that could impact trade and growth 📦.

🌎 Trade Tensions in Focus:

President Trump ruled out extending tariff deadlines beyond August 1 ⛔, announcing new duties:

🔹 50% on copper 🪙

🔹 Potential 200% on pharmaceuticals 💊

🔹 10% on goods from BRICS 🌐

These moves are likely to intensify global trade tensions ⚔️, potentially impacting commodity flows and inflation, which the RBA and markets will continue to monitor closely.