Patterns

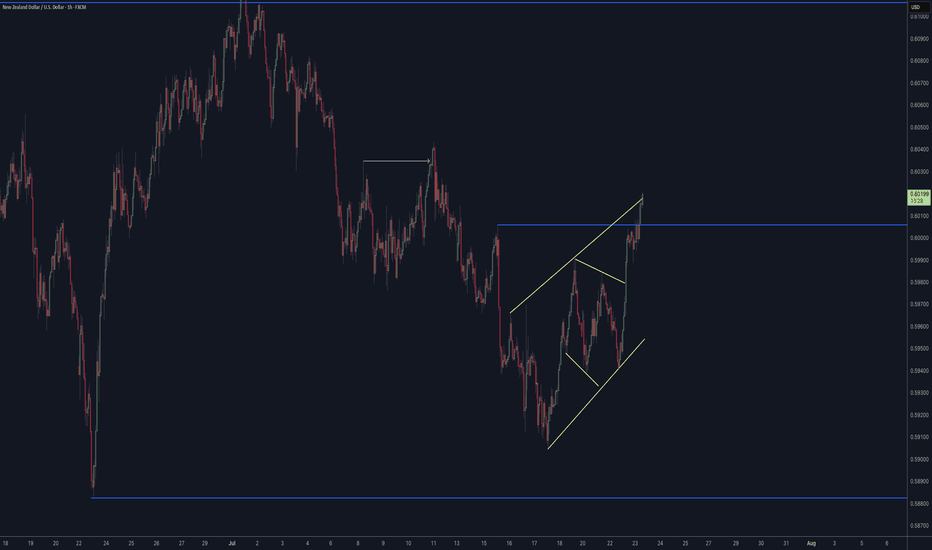

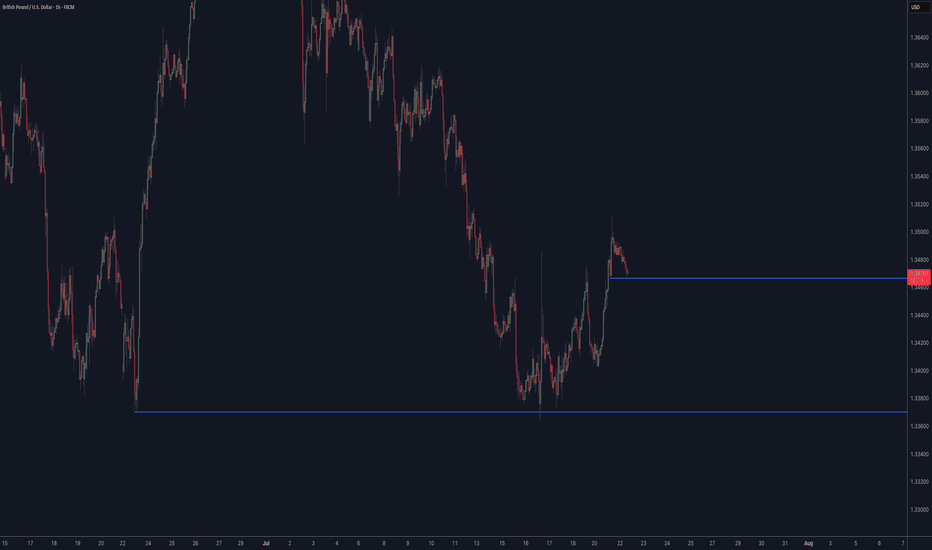

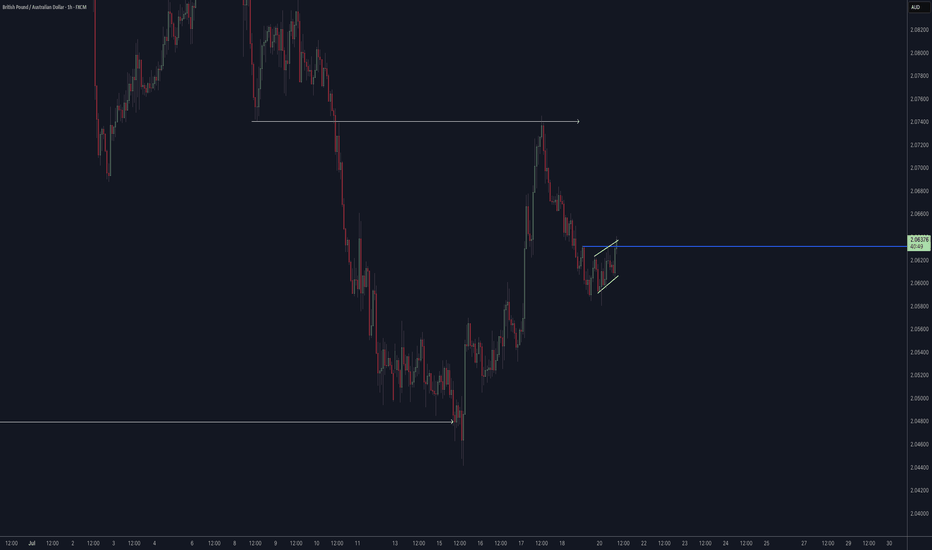

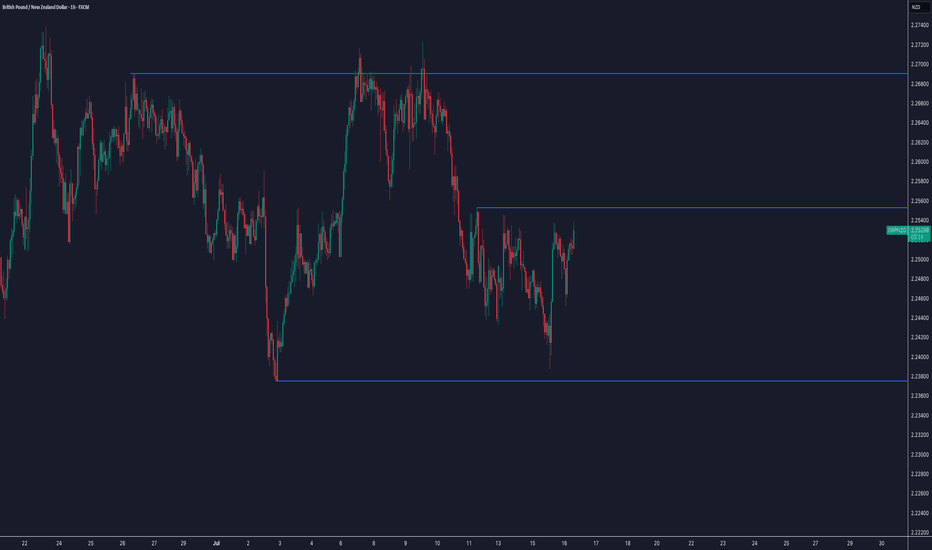

AUDCAD / GBPAUD Trade Recaps 01.08.25A tester trade on AUDCAD with the reasons explained as to why this was a test position, and a short position executed on GBPAUD. Solid setup that this time around just didn't commit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

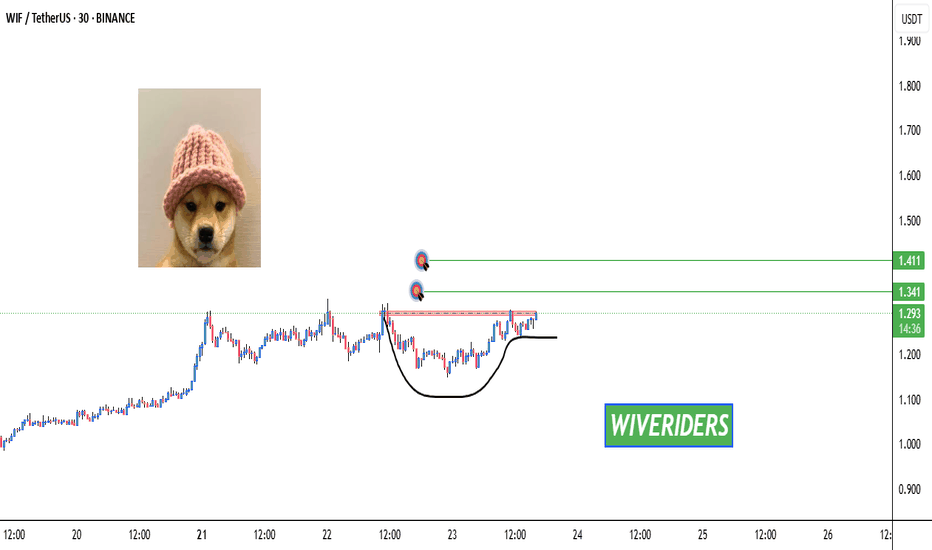

Bullish Cup & Handle Pattern Formed 🚨 SEED_WANDERIN_JIMZIP900:WIF Testing Red Resistance – Bullish Cup & Handle Pattern Formed 📈

SEED_WANDERIN_JIMZIP900:WIF is currently testing the red resistance zone and has formed a bullish cup and handle pattern on the chart.

If a breakout occurs, potential upside toward:

✅ First Target: Green line level

✅ Second Target: Green line level

Wait for breakout confirmation before entering long. 📊

Patience is key—watch this closely! 💼💸

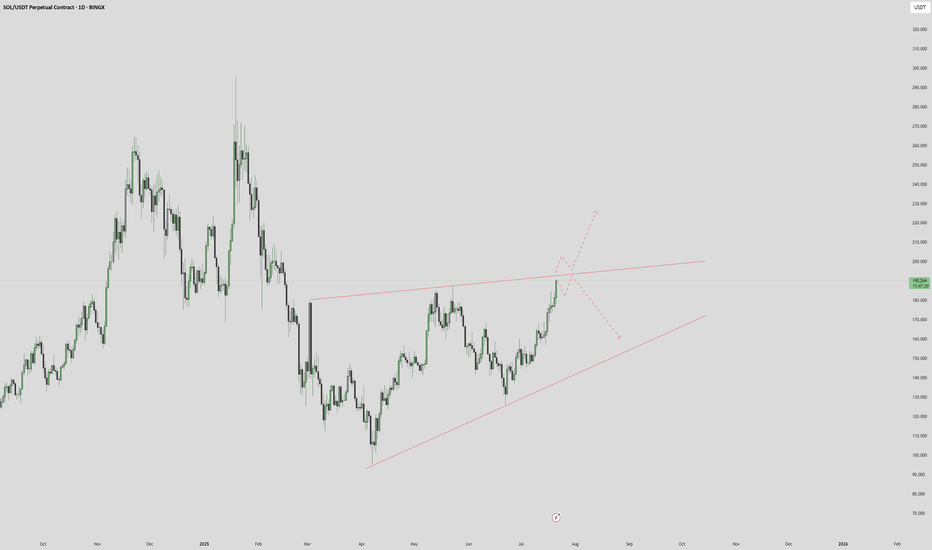

Solana (SOL/USDT) 4H Reverse H&S PatternSolana (SOL/USDT) – 4H Market Outlook | July 1, 2025

Introduction

SOL has formed a reverse head and shoulders pattern, followed by a clean breakout above resistance. While the lower time frame is bullish, the higher time frame remains bearish, creating a short-term opportunity within a broader downtrend.

Context 1: Key Zones

Supply Zone: 176 – 187

Demand Zone: 126 – 143

Psychological Levels: 140 and 160

Context 2: Technical Structure

Pattern: Reverse Head & Shoulders

Breakout: Confirmed above neckline/resistance

FVGs:

One below price (within demand)

One above price (potential target)

Golden Pocket: Sits just above lower FVG and inside demand — strong confluence support

Context 3: Volume Insight

OBV Indicator: Shows a sudden volume spike, adding strength to the breakout and the bullish pattern confirmation.

Bullish Scenario

Price pulls back into the golden pocket + FVG + demand zone

Finds support → bounces to form higher low

Second leg of the move breaks swing high → targets upper FVG and 160 psychological level

Bearish Scenario

Price breaks back below demand zone and invalidates the golden pocket

Fails to hold structure → reverts to macro bearish trend

Potential retest of previous swing low below 126

Summary

SOL is showing bullish momentum on the 4H after completing a reversal pattern and spiking in volume. A pullback into the demand zone confluence may offer a strong long setup — but failure to hold could revalidate the higher timeframe downtrend.

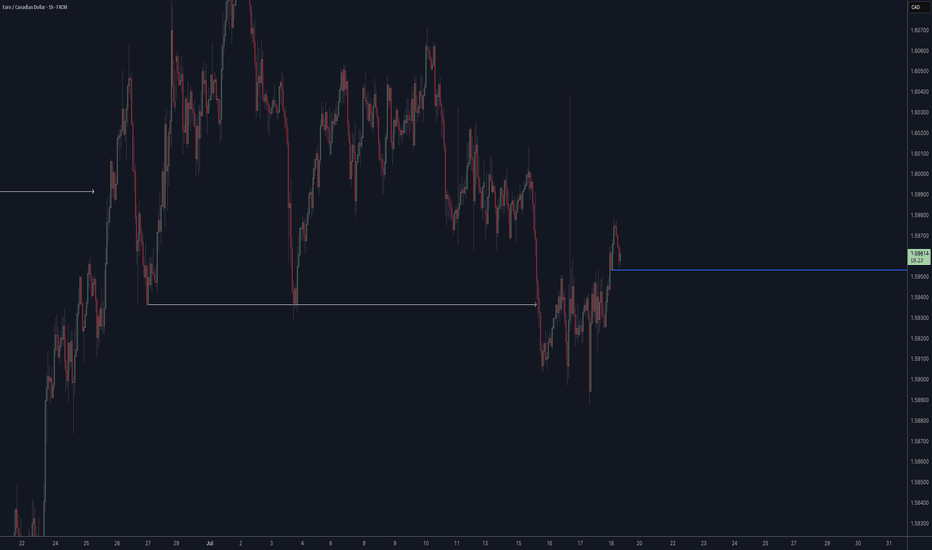

COIN -- Major Trendlines + Bearish Divergence = Breakdown?Hello Traders!

Today I have shared the chart of COINBASE. Of course we cant know for sure what price will do, however you can take clues and combine them to give you a high probability reading of the chart.

Here are the clues:

1) MAJOR TRENDLINE

2) TRENDLINE

3) BEARISH DIVERGENCE

4) BULL FLAG MEASURED MOVE

When we combine these clues, a very bearish picture is painted... This signals to me that there is a high probability price will likely reverse and trade to the downside in the near future.

I hope everyone enjoyed this post and is able to use it as an educational tool.

Thanks everyone and best of luck on your trading journey!

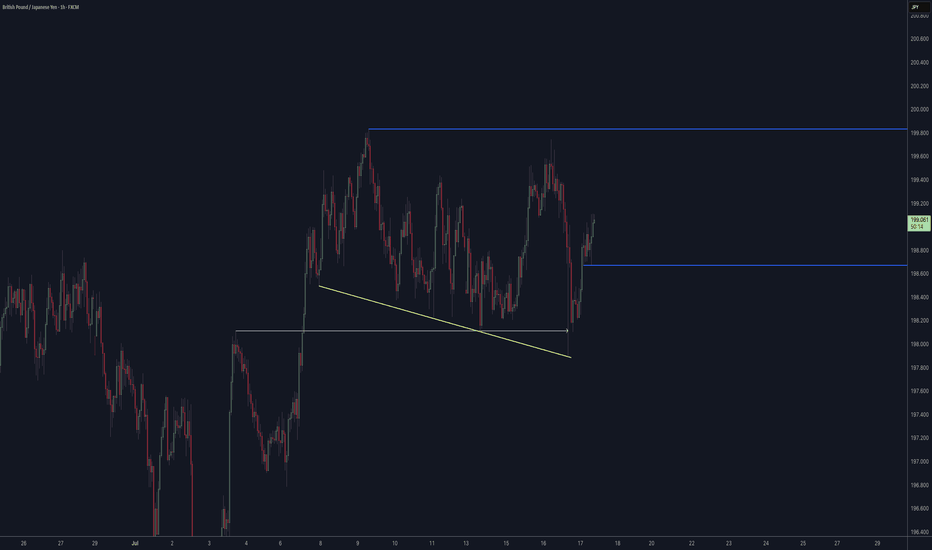

APT - Don't tell me this pattern won't repeat- This time is the charm, APT is is reversing from lower low on weekly chart.

- just like last two time, it is expect to forma new HL.

- there is a high chance that previous two patterns will repeat again

Entry Price: 5.22

Stop Loss: 3.4

TP1: 6.6632

TP2: 8.5059

TP3: 12.6945

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

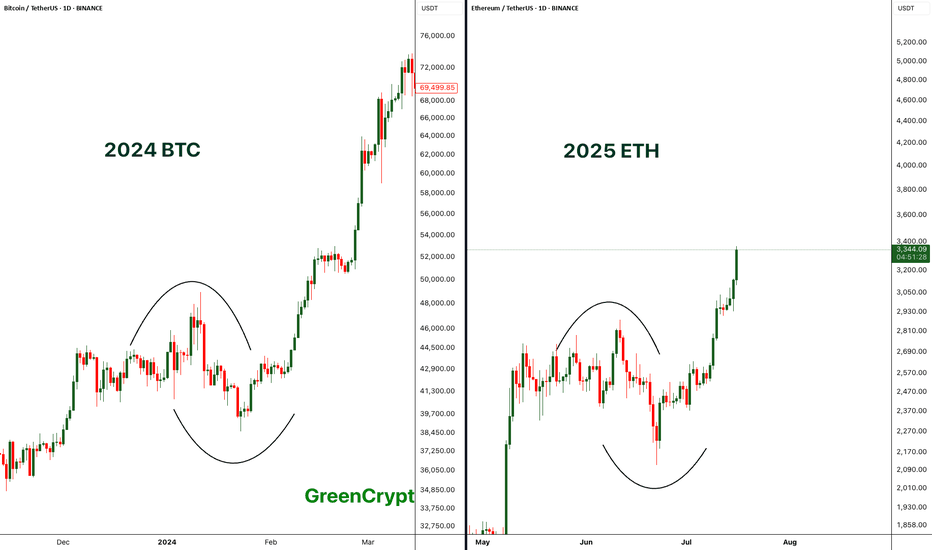

Comparing BTC 2024 with ETH 2025 - Perfect Match- If compare the chart pattern of BTC from 2024 with the current 2025 ETH pattern, wee see exactly similar chart patterns being formed here.

- Price started consolidating then it had fake breakout towards both the sides and finally the real breakout.

- BTC breakout push the price towards the new all time high above 69K, if we ETH follows similar trend then we can expect new all time high on ETH.

Let's see how it plays out.

Stay tuned for more updates.

Cheers

GreenCrypto

DOW (DJI) -- Preparing For The Next Big Move?Hello Traders!

The chart of the DOW is really quite incredible... Recently price formed a textbook Inverse Head & Shoulders pattern, which led to a nice nearly to the all time high. Furthermore price looks to be consolidating in a Bullish Pennant just below the all time high resistance level.

The reason the Pennant below resistance is so significant is because this signals that investors are likely preparing to drive price higher to new highs. Think about it like a fighter resting before the next big fight.

Triple Top: In addition to the pennant price has now hit this resistance level for the 3rd time. The more times price hits a level typically the weaker it gets. After the 3rd hit the chance of a breakout increases dramatically.

In Summary: The "Triple Top" in conjunction with the "Bullish Pennant" means that there is undoubtedly a very high probability that price will breakout and make new all time highs.

This post is primarily meant to be educational vs a trade idea. Its charts like this that invigorate my technical analysis side and I hope it does for you as well.

Best of luck on your trading journey!