PDD

PDD Stock Trading Plan (2025-07-12)PDD Stock Trading Plan (2025-07-12)

Final Trading Decision

1. Comprehensive Summary of Each Model's Key Points

DS Report

Technical Analysis: Price: Currently at $104.91, facing short-term bearish pressures with significant support at $104.83. Indicators: Short-term indicators (30-min) show bearish signals, while daily indicators hint at a potential bullish reversal (e.g., MACD bullish divergence). Sentiment: Mixed headlines with a stable VIX suggest a favorable but cautious entry environment. Trade Strategy: Long with a target of $108.70 and stop loss at $104.10 based on recent support levels.

LM Report

Technical Analysis: Price: Above the long-term bullish trend but facing near-term resistance. Indicators: Neutral RSI levels do not suggest a clear direction. MACD shows some signs of hesitance. Sentiment: Slightly bullish due to institutional flows and a falling VIX but lacks strong conviction. Trade Strategy: Suggests a long position at $105.50, with a profit target of $113.64.

GK Report

Technical Analysis: Describes a neutral situation with prices around key EMAs and exhibiting consolidation. Weak momentum signals indicate uncertainty regarding outright positions. Sentiment: Highlights mixed news with both bullish and bearish implications. Trade Strategy: Recommends not to trade due to the unclear directional bias.

CD Report

Technical Analysis: Confirms short-term bearish momentum with price below moving averages and mixed momentum indicators. Suggests a moderately bearish sentiment based on resistance levels. Sentiment: Slightly positive VIX implies stability; however, recent call volumes show mixed institutional sentiment. Trade Strategy: Strong short position recommended to profit from resistance at $105.70.

2. Areas of Agreement and Disagreement

Agreement:

Most models agree on near-term bearish indicators (e.g., weak momentum, mixed MACD signals across timeframes). Multiple reports note the importance of the $104.30-$106.20 price range as critical support/resistance.

Disagreement:

Long vs. Short Positions: DS and LM suggest potential long positions based on technical rebounds, while CD firmly recommends a short position anticipating downward movement. Market Sentiment: Some models see potential bullish opportunities in VIX stability and call volume, while others express caution due to mixed signals.

3. Conclusion and Recommendations

Overall Market Direction Consensus

The market is in a neutral to moderately bearish state based on the conflicting signals from the models. The current indicators do not suggest a strong bullish trend, while technical analysis indicates possible downward momentum.

Recommended Trade

Direction: Short Position Entry Price: $104.90 at market open. Stop Loss: $106.20 (1.2% loss). Take Profit: $102.50 (2.3% gain). Position Sizing: Based on a $10,000 account with a 2-3% risk tolerance, risking approximately $100-$120 total. Holding Period: 3-4 weeks maximum. Confidence Level: 65% based on resistance rejection and mixed sentiment.

Key Risks and Considerations

Risk of a market reversal if bullish news arrives or a strong institutional buying momentum occurs. Close monitoring of technical indicators is required, particularly the MACD and RSI, as conditions shift either direction could warrant position adjustments.

TRADE_DETAILS (JSON Format)

{ "instrument": "PDD", "direction": "short", "entry_price": 104.90, "stop_loss": 106.20, "take_profit": 102.50, "size": 200, "confidence": 0.65, "entry_timing": "open" }

📊 TRADE DETAILS 📊 🎯 Instrument: PDD 📉 Direction: SHORT 💰 Entry Price: 104.9 🛑 Stop Loss: 106.2 🎯 Take Profit: 102.5 📊 Size: 200 💪 Confidence: 65% ⏰ Entry Timing: open

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Temu's Price Magic: Shattered by Tariffs?PDD Holdings, the parent entity behind the popular e-commerce platform Temu, confronts a severe operational challenge following the recent imposition of stringent US tariffs targeting Chinese goods. These trade measures, particularly the dismantling of the "de minimis" rule for Chinese shipments, directly threaten the ultra-low-cost business model that fueled Temu's rapid expansion in the US market. The elimination of the previous $800 duty-free threshold for individual packages strikes at the core of Temu's logistical and pricing strategy.

The impact stems from newly enacted, exceptionally high tariffs on these formerly exempt low-value parcels. Reports indicate rates escalating to 90% of the item's value or a significant flat fee, effectively nullifying the cost advantages Temu leveraged by shipping directly from manufacturers in China. This fundamental shift disrupts the financial viability of Temu's model, which relied heavily on tariff-free access to deliver goods at minimal prices to American consumers.

Consequently, significant price increases for products sold on Temu appear almost inevitable as PDD Holdings grapples with these substantial new costs. While the company's official response is pending, economic pressures suggest consumers will likely absorb these charges, potentially eroding Temu's primary competitive advantage and slowing its growth momentum. PDD Holdings now faces the critical task of navigating this disrupted trade landscape and adapting its strategy to maintain its market position amidst heightened protectionism and geopolitical tension.

Pinduoduo $220PDD has a lot of potential to rise to $220 and above. China has been battered and this stock trades with a 12 PE ratio. That's about as cheap of a stock with revenue growth like this you're going to find.

The CSI 300 index has finished it's 2022 correction and is in a uptrend likely supporting PDD rising.

Good luck!

Filecoin Dips 8% Amidst Proof of Data Possession (PDP) LaunchThe Filecoin ecosystem is at a pivotal moment, balancing technological innovation with market volatility. Amidst a broader downturn in the crypto market, including Bitcoin’s slide, Filecoin ( LSE:FIL ) has experienced an 8% decline. However, beneath the price dip lies a significant fundamental development—the introduction of Proof of Data Possession (PDP), a breakthrough mechanism enhancing data accessibility and storage security.

PDP and Fast Finality (F3) Reshape Filecoin’s Future

The Filecoin ecosystem is making strides with the introduction of Proof of Data Possession (PDP), which complements the existing Proof of Replication (PoRep). PDP enables efficient, periodic verification of stored data without the need for resource-intensive decoding. This advancement is particularly beneficial for hot storage solutions like Storacha and Akave, the first adopters of PDP.

The PDP rollout follows a structured timeline:

- February 2025: Final contract optimizations, Curio-PDP pipeline development, and integration with Storacha.

- March 2025: External audit, PDP explorer launch, and monitoring of storage provider performance.

- End of March 2025: PDP goes live on Filecoin Mainnet, marking a major milestone in decentralized storage security.

Fast Finality (F3) Accelerates with New Activation Mechanism

Filecoin’s Fast Finality (F3) mechanism, originally requiring two network upgrades, now features a delegated authority mechanism for quicker activation. This smart contract-based approach allows the Filecoin implementation teams to set key F3 parameters on-chain, reducing delays while maintaining security and transparency. With faster finalization, Filecoin enhances network usability, making storage transactions more efficient. The F3 contract is live and open for community review.

FIP-00XX: Per-Sector Fee Proposal to Improve Economic Sustainability

A new proposal, FIP-00XX, aims to replace the batch balancer fee with a per-sector fee, optimizing Filecoin’s economic model. This change encourages sector batching and proof aggregation, reducing gas costs for Storage Providers (SPs) while improving scalability. The proposal eliminates outdated gas-limited constraints, allowing the protocol to evolve with fewer bottlenecks.

Technical Outlook: Is a Bullish Reversal in Sight?

As of writing, LSE:FIL is down 7.92%, trading within a bearish pattern. However, the token appears oversold, with the Relative Strength Index (RSI) at 32.54, suggesting an impending trend reversal. Historically, RSI levels below 35 have signaled buying opportunities, hinting at a potential shift in momentum.

Support and Resistance Levels

- Support: The 1-month low pivot is currently acting as a temporary support for $FIL. If the price holds above this level, we could see a rebound; however, a break below could trigger further downside.

- Resistance: The 38.2% Fibonacci retracement level at $4.70 is acting as a strong resistance. A breakout above this point could send LSE:FIL into a bullish phase, with $15 as a long-term target.

Furthermore, LSE:FIL is currently trading below key moving averages (MAs), further reinforcing its oversold nature. A decisive move above the 50-day MA would strengthen the bullish case, attracting traders looking for a reversal.

Conclusion

While LSE:FIL faces short-term bearish pressure, its technical indicators and fundamental developments suggest an optimistic long-term outlook. The launch of PDP and F3 advancements could boost adoption, reinforcing Filecoin’s role in decentralized storage. Traders should watch for a breakout above $4.70, which could pave the way for a strong recovery.

The question remains—will LSE:FIL capitalize on its technological progress and defy market weakness? Only time will tell, but the foundations for a strong comeback are certainly in place.

$PDD has 50-60% upside from $100- NASDAQ:PDD has solid growth and temu is currently launching into new regions with TAM increasing with each entered zone.

- Chinese equities are dirt cheap and have performed badly in last 4 years. Trump was seen as detrimental for chinese equities. However, I will play the devil's advocate here and say Trump will be good for China. If US wants to prosper then it's better to sort deals and grow together vs making china as enemy economically.

- Lot of companies of US have manufacturing in China and Chinese consumers especially middle class is getting stronger thus offering selling opportunities for US companies.

- China will ease monetary policy to revive the demand and consumption which should boost economy

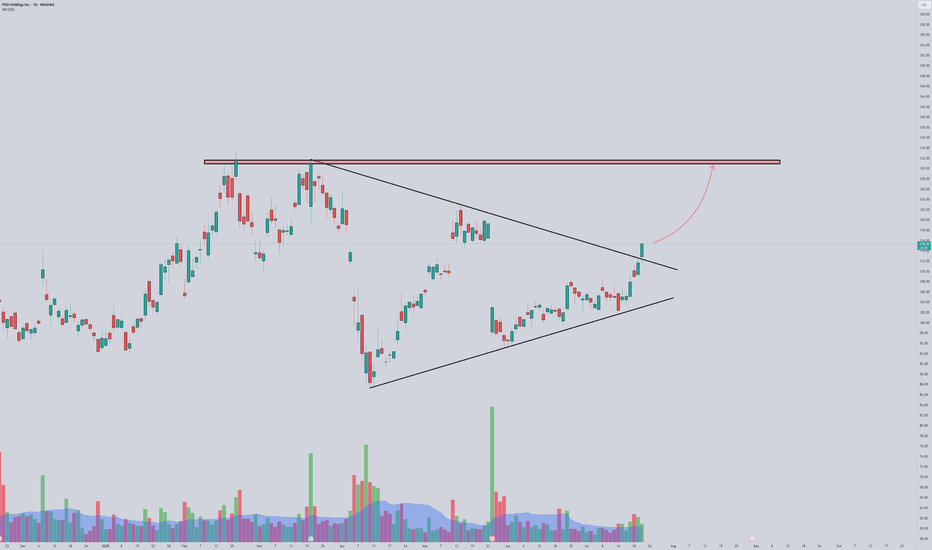

$PDD Long to $106-$108I entered into a long on NASDAQ:PDD at $97.50 and am moving my stop loss up to $97.5 from $95. Either PDD breaks $100 and we reach downtrend resistance around $106-$108, or it gets rejected here and goes down further. I'm positioning myself in case this happens, potentially losing current profit but leaving the trade open for an additional 7-9%.

JD.COM PT63$ after breaking the long term trendlineJD.com broke the minor trend lines and is heading towards the long term trendline. This level is also enforced by prior highs/lows that acted as pívot points.

If broken, I would expect to extend the final of the third Elliot leg to the 63$ area, then back test the broken trendline, and then attack the ATH again.

Please let me know your thoughts!

PDD is a strong buy after misunderstood earningsPDD (Temu) shares have fallen over 30% after recent earnings implied they have missed their targets by a massive margin, and a cautious comment indicating there might be macro issues going ahead.

However, only revenue has missed targets - by only 3% - effectively meeting the markets sky-high expectations.

Looking at the actual releases, EPS is 2.97 in Q2 2024, which actually beat the expectation. The company is still experiencing massive growth - even while, as outlined in the meeting notes around supply chain streamlining, they have simply had some short term costs in this regard.

A 30% drop in share price is an extreme overreaction and I expect a quick and violent retrace once the market has cleared its head.

"Buy when there is blood on the streets" - especially without reason.

Disclaimer: This idea is not intended as investment advice and should not be interpreted as an offer to sell or a recommendation to purchase any asset. Any decisions made based on the information presented in this idea are the sole responsibility of the individual. All investment decisions should be made independently, taking into account your financial situation and objectives.

PDD Holdings: A Strategic Pivot or a Tempestuous Trial?As PDD Holdings, the e-commerce titan behind Pinduoduo and Temu, confronts a landscape fraught with intensifying competition, economic challenges, and evolving consumer preferences, the question of its future trajectory becomes increasingly pressing. Can the company successfully navigate these turbulent waters, or will it succumb to the tempestuous forces at play?

PDD Holdings, once a beacon of e-commerce growth in China, finds itself at a critical juncture. The company's recent second-quarter earnings report, marked by a revenue shortfall and cautious outlook, has sent shockwaves through the market. PDD's strategic pivot, prioritizing long-term value over short-term profitability, while commendable, may face significant challenges in the near term.

As PDD grapples with domestic pressures, the company's international expansion strategy, spearheaded by Temu, presents both opportunities and risks. The potential for global growth is undeniable, but the competitive landscape is fiercely contested, with established players like Amazon and Shein vying for market share.

The question of whether PDD can successfully navigate these challenges is a complex one. On the one hand, the company possesses a strong financial foundation, with a robust cash position that can provide a buffer during difficult times. Additionally, PDD's commitment to user acquisition beyond China could be a critical driver of future growth.

On the other hand, the intensifying competition within the e-commerce sector, coupled with the economic uncertainties in China, pose significant headwinds. PDD's ability to adapt and innovate in such a rapidly evolving environment will be crucial to its long-term success.

Investors are closely watching PDD's every move, with opinions on the company's future sharply divided. Some view the current low valuation as an attractive entry point, particularly considering Temu's potential for international expansion. Others, however, remain cautious, citing the ongoing challenges in China, management's tempered outlook, and the possibility of declining profitability.

Ultimately, the fate of PDD Holdings hinges on its ability to successfully execute its strategic vision, adapt to changing market conditions, and deliver sustainable value to its investors. The road ahead is likely to be fraught with challenges, but with careful navigation and strategic decision-making, PDD may emerge as a resilient and thriving e-commerce powerhouse.

PDD Stock Plummets 28% on Q2 Revenue MissPDD Holdings (NASDAQ: NASDAQ:PDD ), the parent company of the discount e-commerce platform Temu, saw its stock plummet by 28% on Monday following a disappointing second-quarter earnings report. The China-based company, which also operates Pinduoduo, missed analyst expectations, signaling challenges ahead in a competitive landscape that could stifle its rapid growth trajectory.

Earnings Report: Slower Sales Growth

For the quarter ending June 30, PDD Holdings reported an adjusted earnings of 23.24 yuan per American depositary share (ADS), equating to $3.27 per ADS, with total revenue of 97.06 billion yuan, or $13.64 billion. Despite the impressive year-over-year earnings growth of 122%, the company fell short of Wall Street's expectations, which had forecast earnings of 20.43 yuan per ADS on sales of 100.2 billion yuan, or $14.1 billion.

This marked a significant slowdown from the 131% revenue growth rate the company achieved in the first quarter of 2024. The market's reaction was swift, with NASDAQ:PDD stock tumbling below its 50-day and 200-day moving averages, critical technical support levels that signal potential further declines.

Technical Analysis: A Bearish Breakdown

From a technical perspective, PDD's stock chart is flashing warning signs. The stock's plunge on Monday created a gap down, breaking through the 21-day, 50-day, and 200-day moving averages. This breakdown is particularly concerning for technical traders, as it suggests a bearish trend reversal.

The Relative Strength Index (RSI) which is at 24.51 has also dipped into oversold territory, which could indicate potential short-term buying opportunities. However, with the stock trading well below its key moving averages, the overall trend remains bearish. The next level of support is around the $90 mark, where the stock last found a floor in October 2023. If this level fails to hold, NASDAQ:PDD could see further declines, with potential downside targets around the $85 range.

Intensifying Competition: A Threat to Revenue and Profitability

PDD Holdings (NASDAQ: NASDAQ:PDD ) has warned that intensified competition is likely to put pressure on both its revenue growth and profitability. The company's Vice President of Finance, Jun Liu, acknowledged in the earnings release that external challenges and increased competition would inevitably slow down the rapid revenue growth that PDD has enjoyed in recent years.

In China, PDD faces fierce competition from e-commerce giants Alibaba (BABA) and JD.com (JD), both of which have ramped up discount offerings to capture more market share amid sluggish consumer spending. PDD's international operations, particularly through its Temu platform, are also under threat as rivals like Amazon (AMZN) and Shein adapt to Temu's disruptive model.

Amazon, in particular, is reportedly developing a Temu-like platform that would sell low-cost goods directly from Chinese manufacturers to U.S. consumers, posing a significant threat to Temu's rapid growth in international markets. This heightened competition could force PDD to increase its marketing and operational expenditures, further squeezing profit margins.

Strategic Response: Short-Term Sacrifices for Long-Term Gains

In response to these challenges, PDD Holdings' leadership has indicated that the company is willing to make short-term sacrifices to ensure long-term growth. Co-CEO Lei Chen emphasized the need to invest heavily in the platform's trust and safety, support high-quality merchants, and improve the overall merchant ecosystem. This strategic shift suggests that PDD is prepared to see a decline in profitability as it navigates an increasingly competitive landscape.

Chen's remarks highlight the company's commitment to bolstering its platform's resilience and maintaining its market position, even if it means enduring near-term financial pain. This approach could help PDD weather the storm, but investors should brace for continued volatility in the stock as the company implements these changes.

Conclusion: A Pivotal Moment for PDD Holdings

PDD Holdings (NASDAQ: NASDAQ:PDD ) is at a critical juncture as it grapples with slower-than-expected revenue growth and intensifying competition. The company's willingness to invest in its platform and accept short-term sacrifices may pay off in the long run, but the immediate outlook remains uncertain. With its stock breaking key technical levels, PDD faces a challenging road ahead as it seeks to maintain its growth trajectory in an increasingly competitive e-commerce landscape.

Investors should closely monitor the stock's technical indicators and be prepared for potential further declines if key support levels fail to hold. However, for those with a long-term perspective, PDD's strategic investments could eventually lead to a recovery, provided the company successfully navigates the challenges ahead.

HSI - KWEB - FXI - YINN --- China UptrendChart is self explantory. Bottomline I think we came to the end of 4 year long bear market in China. If they don`t blow up the Taiwan issue, coast is clear.

Econ gathering on 14-16 July, CCP will explain it reforms. I don`t buy what they sell but they would most likely provde liquidity to the market pre and post this economic forum which they do every 5 years. Even for a small pop, this could be a nice play.

BABA - PDD - JD - Tencent...ideally I play with YINN but all the names will benefit eventually.

PDD Stock Jumps 6% Following Strong Q1 Earnings For Temu NASDAQ:PDD stock surged 6% on Thursday, following strong Q1 earnings for Temu parent company PDD Holdings ( NASDAQ:PDD ). Sales jumped 131% year-over-year for the March-ending quarter. On the stock market today, U.S.-listed NASDAQ:PDD stock is up 6% at 156.14 in higher than usual volume. NASDAQ:PDD Holdings includes China-focused e-commerce platform Pinduoduo and international discount retail platform Temu. Shares of NASDAQ:PDD surged nearly 80% in 2023, as Temu expanded rapidly in the U.S. and elsewhere.

Both Alibaba (BABA) and JD.com (JD) posted better-than-expected sales for their March quarters last week. The tech giants are PDD's main competitors in China. Analysts were mostly positive on PDD's Q1 results. Morningstar analyst Chelsey Tam upped the research firm's fair value estimate for PDD stock to by 8% to 230.

PDD Holdings beat first-quarter revenue estimates on Wednesday, powered by its international shopping site Temu and growing consumer interest in its Chinese discount e-commerce platform Pinduoduo. The company's revenue rose 131% to 86.81 billion yuan ($11.99 billion) in the first quarter, compared with analysts' average estimate of 75.66 billion yuan, based on LSEG data. PDD's shares were up 5.7% in pre-market trading.

Consumers in China have turned to less expensive shopping platforms such as Pinduoduo and Bytedance's Douyin at a time when a property sector downturn and rising local debt have weighed on the country's economic growth. NASDAQ:PDD 's co-CEO Chen Lei told analysts in a call following the company's earnings release that competition has been fierce in the first quarter, with consumers growing accustomed to making purchases from a variety of platforms, rather than defaulting to just one.

Technical Outlook

NASDAQ:PDD stock is up 6.14% as of the time of writing. NASDAQ:PDD stock appears to be overbought with a Relative Strength Index (RSI) of 76.78 which made it primed for a trend reversal. The stock's daily price chart depicts a double bottom that lasted for about 5 weeks before the uptrend.

PDD Holdings Options Ahead of EarningsIf you haven`t bought PDD before the previous earnings:

Then analyzing the options chain and the chart patterns of PDD Holdings prior to the earnings report this week,

I would consider purchasing the 140usd strike price Calls with

an expiration date of 2024-6-21,

for a premium of approximately $10.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PDD Holdings' Temu Operator Surpasses Revenue ExpectationsPDD Holdings ( NASDAQ:PDD ) emerges as a formidable player, surpassing revenue expectations in its fourth-quarter earnings report. The driving force behind this success? Temu, its global platform, which has seen remarkable growth propelled by strategic end-of-year promotions and a surge in demand during China's Singles Day festivities.

Robust Growth and Financial Performance

The numbers speak volumes: PDD's fourth-quarter revenue soared to 88.88 billion yuan ($12.35 billion), surpassing analyst estimates by a significant margin. This achievement marks a staggering 123% year-on-year growth, following a robust 94% rise in the third quarter. What's more, this remarkable performance comes despite the lingering impact of COVID restrictions in China during comparable quarters in 2022, which were only lifted in December of that year.

Challenges and Uncertainties Ahead

However, amidst this success, challenges loom on the horizon. Concerns over political tensions between the U.S. and China pose a potential threat to Temu's continued growth in key markets. Analysts have cautioned that heightened scrutiny from policymakers, similar to what has been witnessed with platforms like TikTok, could impact PDD's operations. Additionally, supply chain disruptions and evolving consumer sentiments present ongoing challenges that PDD must navigate as it continues to expand its global footprint.

Optimism and Future Outlook

Despite these uncertainties, NASDAQ:PDD remains optimistic about its future prospects, particularly in its home market of China. With the government's support through macro policies aimed at bolstering consumer sentiment, PDD's subsidiary, Pinduoduo, anticipates further growth opportunities in the domestic market.

Market Dominance and Competitive Edge

Moreover, NASDAQ:PDD 's ascent to become the most valuable Chinese e-commerce company by market capitalization underscores its position as a dominant force in the industry. Surpassing Alibaba Group Holdings in market value further solidifies PDD's standing and underscores its potential for continued success in the ever-evolving world of e-commerce.

Conclusion

In conclusion, NASDAQ:PDD Holdings' impressive fourth-quarter performance, driven by the success of its global platform Temu, signals a promising trajectory for the company amidst a challenging and dynamic market environment. As it navigates through uncertainties and embraces opportunities, PDD's innovative approach and strategic vision position it for sustained growth and success in the years to come.

5 Investors Betting Big on Pinduoduo (PDD) StockNASDAQ:PDD is soaring higher after a blowout third-quarter earnings report.

Let’s take a look at Pinduoduo’s largest shareholders:

1. Sequoia Capital: 48.23 million shares. Sequoia acquired 45.04 million shares during Q3.

2. Baillie Gifford: 35.66 million shares. Baillie acquired 4.5 million shares during Q3.

3. BlackRock: 27.87 million shares. BlackRock acquired 3.73 million shares during Q3.

4. Vanguard: 24.10 million shares. Vanguard acquired 6.63 million shares during Q3.

5. FMR: 17.63 million shares. FMR acquired 4.33 million shares during Q3.