PEPEUSDT

PEPE/USDT:BUY LIMITHi friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

PEPE resparking the FLAME to PARABOLICA SKY from here. 0.0000070PEPE 2024 has been a rosy one to say the least.

It has gone parabolic last year reaching an impressive ATH of $0.00002803, a quadruple increase in its valuation.

This year, along side the mother coin BTC, the market went on a bleed mode season --cooling down what has heated up for so long. MEMEs suffer the most -- returning to ground back to the base, or even lower due to extreme volatility.

Today, PEPE is starting to show some basing behavior -- hinting of an impending price shift from the current range. It took weeks for this coin to accomplish this saturation levels.

We expect price to reverse to the upside from this bargain levels. A rare opportunity to seed before it re-attempt the multiple x price growth.

If you notice on our diagram, NET LONGS / BUYERS are trying to respark the price around here conveying massive accumulation -- pre hinting of a massive price surge ahead thats about to transpire soon.

BTC is also showing some long term shifting behavior -- which will benefit the market including PEPE. When the heat up starts, fomo season starts, and you know what happens thereafter.

Spotted at 0.00000700

Target at x4 price at ATH 0.00002803

TAYOR. Trade safely.

PEPE: Bear Market Bottom or Just a Dead Cat Bounce?Overview:

BINANCE:PEPEUSDT PEPE experienced a brutal three-month bear market, shedding around 80% of its value from its peak. Currently, PEPE is at a crucial juncture, having reached an important cluster support level—a zone historically respected by traders and often indicative of short-term reversals.

Technical Analysis:

- Bearish Trend (3 months): An 80% decline signals severe selling pressure, common in meme coins after parabolic rises.

- Cluster Support Zone: The current price area (highlighted clearly on the chart) has historically attracted buying interest. It has served multiple times as a pivot point.

- Price Action: The recent bounce looks tentative, indicative of a potential "dead cat bounce" scenario—a temporary recovery in prices before a continuation of the bearish trend.

Key Levels to Watch:

- Immediate Support: Current cluster around 0.006-0.007 USDT. A decisive break below may trigger another sharp sell-off.

- Resistance: Strong overhead resistance around 0.010 USDT, crucial for bulls to regain control. A failure to breach could confirm bearish continuation.

Opinion:

From my experience navigating multiple crypto cycles, meme coin rallies typically end in severe corrections like this one. A bounce at current levels is expected, but caution is essential. This looks like a classic bear market relief bounce rather than a true trend reversal.

Trading Strategy Recommendation:

- Short-term traders may consider playing the bounce cautiously, setting tight stops below the recent lows.

- Long-term investors should remain cautious. Wait for stronger confirmation, ideally above resistance at 0.010 USDT, to confirm the bearish trend is weakening.

Conclusion:

PEPE is currently at a critical inflection point. While a short-term bounce is probable, remain vigilant for confirmation before taking major positions. Protect your capital and trade wisely.

Stay safe & trade smart.

What do you think about PEPE's current situation? I'd love to hear your insights below.

#PEPE #CryptoTrading #TechnicalAnalysis #CryptoVeteran #TheCryptoFire

UNIUSDT UPDATEUNIUSDT is a cryptocurrency trading at $6.780. Its target price is $10.000, indicating a potential 50%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about UNIUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. UNIUSDT is poised for a potential breakout and substantial gains.

PEPE/USDT 1H: Testing Resistance – Can Bulls Push Toward 0.0000PEPE/USDT 1H: Testing Resistance – Can Bulls Push Toward 0.00000780?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 7/10):

Price at 0.00000734, currently testing a key resistance level.

RSI at 54.41, indicating neutral conditions with room for further upside.

Clean order block formation at 0.00000640, suggesting strong underlying support.

No significant divergences present, making confirmation crucial for continuation.

LONG Trade Setup:

Entry: 0.00000720 - 0.00000734 zone.

Targets:

T1: 0.00000760 (first resistance).

T2: 0.00000780 (next liquidity zone).

Stop Loss: 0.00000640 (below recent support).

Risk Score:

6/10 – Moderate risk setup; requires confirmation at resistance levels.

Market Maker Activity:

Accumulation visible at higher lows, with decreasing selling pressure.

Recent higher low formation suggests potential continuation toward upside targets.

Strong support established at 0.00000640, reinforcing a favorable risk-to-reward ratio.

Recommendation:

Long positions are favorable in the 0.00000720 - 0.00000734 range.

Watch for breakout confirmation above 0.00000740 before increasing exposure.

If rejection occurs at resistance, wait for a retest of 0.00000700 before re-entering.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

KDAUSDT UPDATEKDAUSDT is a cryptocurrency trading at $0.4898. Its target price is $0.8000, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about KDAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. KDAUSDT is poised for a potential breakout and substantial gains.

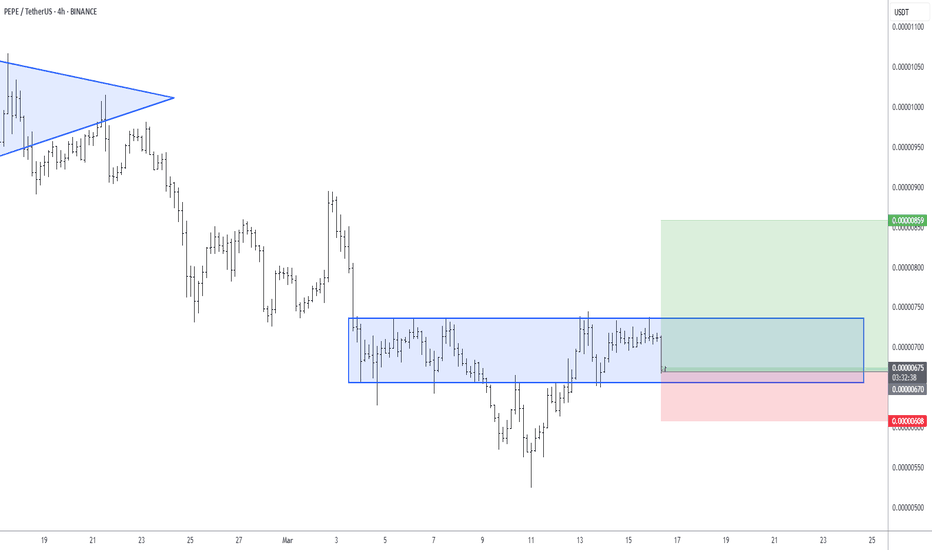

$PEPE - Local SupportCRYPTOCAP:PEPE | 4h

The price is now outside the distribution curve and is starting to establish a base here

If we can hold .0070 to .0068 (PoC), I believe we could test .008 to .009 (short-term target).

I expect the price would pull back down to the current level .0070s before we reach higher targets.

DOTUSDT IDEADOTUSDT is a cryptocurrency trading at $4.415. Its target price is $7.500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about DOTUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. DOTUSDT is poised for a potential breakout and substantial gains.

GMXUSDT UPDATEGMXUSDT is a cryptocurrency trading at $15.52. Its target price is $30.00, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about GMXUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. GMXUSDT is poised for a potential breakout and substantial gains.

Is Pepe’s bearish trend about to test the 0.000005 support?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Pepe 🔍📈.

Pepe is currently positioned at the upper boundary of a descending channel, signaling potential bearish momentum. I foresee a minimum decline of 29%, targeting the critical support level at 0.000005. While the primary trend points downward, there may be temporary upward movements or periods of consolidation along the way. These fluctuations are typical in such market conditions and could offer brief opportunities for traders. Overall, the downward trajectory remains the dominant outlook.📚🙌

🧨 Our team's main opinion is: 🧨

Pepe’s stuck at the top of a falling channel, with a 29% drop to hit the 0.000005 support, but some quick pumps or sideways action might pop up. 📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

KAVAUSDT UPDATEKAVAUSDT is a cryptocurrency trading at $0.4711. Its target price is $0.7500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about KAVAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. KAVAUSDT is poised for a potential breakout and substantial gains.

FTTUSDT UPDATEFTTUSDT is a cryptocurrency trading at $1.3195. Its target price is $3.0000, indicating a potential 100%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about FTTUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. FTTUSDT is poised for a potential breakout and substantial gains.

LUNAUSDT UPDATELUNAUSDT is a cryptocurrency trading at $0.1946. Its target price is $0.3500, indicating a potential 85%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about LUNAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. LUNAUSDT is poised for a potential breakout and substantial gains.

TAOUSDT UPDATETAOUSDT is a cryptocurrency trading at $263.8. Its target price is $360.0, indicating a potential 45%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about TAOUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. TAOUSDT is poised for a potential breakout and substantial gains.

FIDAUSDT UPDATEFIDAUSDT is a cryptocurrency trading at $0.1094. Its target price is $0.2400, indicating a potential 100%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about FIDAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. FIDAUSDT is poised for a potential breakout and substantial gains.

OMUSDT UPDATEOMUSDT is a cryptocurrency trading at $6.2800. Its target price is $8.0000, indicating a potential 25%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about OMUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. OMUSDT is poised for a potential breakout and substantial gains.

Key Resistance Zone for Pepe – 39% Drop Ahead?Hello and greetings to all the crypto enthusiasts, ✌

In several of my previous analyses, I have accurately identified and hit all of the gain targets. In this analysis, I aim to provide you with a comprehensive overview of the future price potential for PEPE , 📚💡

The price of Pepe Meme Coin has been experiencing an atypical and sharp downtrend, approaching a critical monthly resistance zone. If this resistance fails to hold, we could face another substantial drop of approximately 39% , potentially bringing the price to the 0.00000500 level. This price point serves as a significant support area, historically acting as a strong defense against further declines. The outcome largely hinges on whether this support can withstand the selling pressure in the coming days. 📚🎇

🧨 Our team's main opinion is: 🧨

Meme Coin Pepe is facing a sharp drop and nearing a key resistance; if it breaks, we could see a 39% decline to the 0.00000500 support level, which has historically held strong. 📚🙌

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

SHELLUSDT UPDATESHELLUSDT is a cryptocurrency trading at $0.3100. Its target price is $0.4500, indicating a potential 60%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about SHELLUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. SHELLUSDT is poised for a potential breakout and substantial gains.

ACAUSDT UPDATEACAUSDT is a cryptocurrency trading at $0.0430. Its target price is $0.0800, indicating a potential 80%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about ACAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. ACAUSDT is poised for a potential breakout and substantial gains.