Are we close to observe a breakout on NVAX ?Novavax COVID-19 vaccine more than 90% effective in U.S trial according to Reuters. Despite positive news (which we do not trade), we will share with you our current view on Novavax.

a) The price is inside a descending Wedge, and due to positive news, we are observing a bullish GAP, and we may see the price outside the Wedge pattern

b) The general strategy we will use to develop bullish setups on the pharmaceutical company is waiting for the price to reach 250 - 270 and then an ABC corrective pattern, as you can see on the chart.

c) IF that scenario happens, we will trade above B, and our stop loss will be set below C

d) Regarding the targets, we will be using the Fibo Extensions of the major descending wedge

Thanks for reading!

Pharmaceuticals

$RAD At an important area of contention$RAD At an important area of contention. I'll be watching closely for a break above. I'm liking the setup if it can close above resistance.

SBFM New 52 Week Hi | Possible moon situation coming?Bullish news on cancer research and a looming patent publish date ETA June 1st. Earnings suck but they're shedding debt notes maybe for a buyout? Heads up on breakouts (short sellers wet dream). Cups within cups within cups. Dunno, DYOR and not investment advice.

PIRS - To the $4 💰-The company said that it has reached into a multi-program research collaboration and license agreement with Genentech, a member of the Roche Group, to discover, develop and commercialize locally delivered respiratory and ophthalmology therapies that leverage Pieris’ proprietary Anticalin® technology.

-PIRS went on to explain that the collaboration will enable it to combine its robust discovery engine with Genentech’s targets, as well as its preclinical and clinical development expertise. As a result, the two will work together to create novel therapies for the treatment of respiratory and other ophthalmological diseases.

-Importantly, these two focus areas of the collaboration are uniquely suited to the advantages offered by the small size of Anticalin proteins when delivered locally.

-Under the terms of the agreement, Pieris will receive $20 million as an upfront payment and may be eligible to receive more than $1.4 billion in additional milestone payments across multiple programs, as well as tiered royalties for commercialized programs.

-In exchange, PIRS will be responsible for the discovery and early preclinical development of the programs. Genentech will be responsible for IND-enabling activities, clinical development, and commercialization of the programs. Moreover, Genentech will have the option to select additional targets in return for an option exercise fee.

-This news is huge! First and foremost, entering into a partnership with a company the size of Genentech comes with several advantages. Not to mention, the funding offered through this partnership will help to bolster Pieris Pharmaceuticals’ balance sheet.

-At the same time, none of the internal programs at the company are included in the partnership, meaning that everything that comes out of this collaboration will be a new revenue opportunity.

Trading Idea - #Ocugen#Ucugen breaking out of the ascending triangle.

- Trend continuation to 20.00 USD expected!

- Ocugen Inc. is a biopharmaceutical company focused on the development, development and commercialization therapies for eye diseases.

- Ocugen is developing a vaccine against COVID-19.

- Number of employees: 15 people.

Is this love, baby, or is it confusion?This is an Elliot Wave projection suggesting we've just completed Wave 2 of a standard 5 Up formation.

Wave 2 is often a 0.5 or 0.618 pullback on Wave 1.

Wave 3 is often related to Wave 1 by 1:1, 1:1.618, or 1:2.618 (don't ask me why).

Wave 4 often pulls back to the .382 of Wave 3.

Wave 5 is least reliable and may replicate Wave 1 when Wave 3 extends, or extend to the 1.618 if Wave 3 replicates Wave 1 (again, dont ask me to explain this woo woo theory).

Possible Wave 2 targets ($CAD): 8.88, 10, 11.65, 16

Possible Wave 5 targets: 11, 13.37 14.59, 20

The MACD is turning up with a bullish divergence shown in yellow.

NOTE This analysis is akin to random guessing and finger painting. These price targets and predictions are in no way intended as finacial advices.

If you want to be independently financially, we recommend education as the first and foremost step in your journey.

Syndax is about to see huge gains to ~$24 a share again. Syndax Pharmaceuticals recently had POSITIVE interim data on their phase 2 study in SNDX-5613 for Leukemia. This data was positive as they saw a 48% overall response rate in patients with MLLr or NPM1c; 67% of responders achieved minimal residual disease-negative status. Out of 43 of patients evaluated, 31 were able to be used as for significant data. These two pieces of news are huge as Leukemia is an extremely life threatening disease where more than 50% of people are dead within 5 years. Any drug that can help save these peoples lives is priceless and the upside of this company is definitely there. I believe the sell off was a big Hedge fund taking their profits and exiting as they were not satisfied with the Positive results from the study, causing stop losses and further panic selling. This has also caused an overcorrection in the stock price which should correct once another big player enters and brings the rest of the bulls with them.

There is a rough bottom at $13 currently on the stock and it is possible for the stock to go down further as this is simply my opinion and is for educational purposes only.

SUNPHARMA long term speculationWith a multi-year breakout and current pharma sector conditions, I believe it's going to outperform the sector.

Disclaimer: for education purposes only not recommended for trade.

can use both weekly and daily timeframe for getting the big picture.

Check the notes points for further clarity

#sunpharma

HEPA - a good buy opportunity? Very likely for me!First of all, I am not an expert when it comes to pharmaceutical companies!

Why did I pick Hepion Pharmaceuticals (@hepionpharma)?

1. From a business perspective, they are healthy (Quick Ration of Assets vs. Liabilities is 9 to 1)

2. They came from a super high share price and are currently on a super low level

3. They are working on a product CRV431 (recently completed Phase 1 of 3) to tackle chronic liver disease and so far the results seem promising: Half a billion people worldwide are at risk unless new therapies are found.

CRV431 is Hepion’s clinical phase, lead oral drug candidate for nonalcoholic steatohepatitis (NASH) and viral hepatitis-induced liver disease. CRV431 meets all of Hepion’s criteria for an effective and unique pleiotropic liver disease drug.

Currently Phase 1 consists of three parts and the collective data from the Parts 1 and 2 demonstrate a favorable pharmacological, pharmacokinetic, and safety profile for CRV431. Part 3 data results are expected and with Phase 2 we might see bigger interest.

Take a look at the chart and the health of the company with future prospective - then shape your own opinion.

- This is no financial advice, so trade with care!-

For transparency reasons: I am invested in $HEPA with 2/10 of my stock account size.

APOP Cellect Biotechnology Upside PotentialNext time when you see those upside spikes is a chart, that is and extremely bullish sign. Maybe some insider buys!

Cellect Biotechnology Ltd. (NASDAQ: APOP), a developer of innovative technology that enables the functional selection of stem cells, and Quoin Pharmaceuticals Inc. (“Quoin”), a privately held specialty pharmaceutical company, today announced that the Boards of Directors of the two companies have unanimously approved a definitive Merger Agreement. (globenewswire.com)

Market Cap of only 13.644M. This still has room to grow!

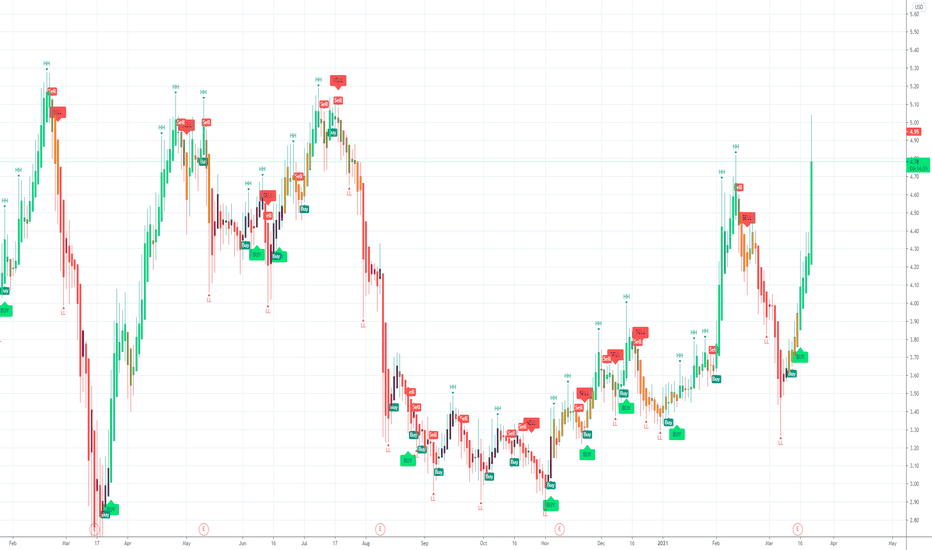

If you are interested to test some amazing BUY and SELL INDICATORS which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

SNCA has broken out of a descending channel

Catalyst Seneca Biopharma, Inc. (Nasdaq: SNCA) entered into a agreement with a privately held company Leading BioSciences, Inc. (“LBS” for a merger with to form Palisade Bio, Inc.

SNCA has broken out of a descending channel and retested the upper trend line.

The idea is self explanatory targets and stop loss is marked on the chart.

A good risk management is key to success in the financial markets. Risk only a small portion of your portfolio in this risky but potential trade.

CPRX Catalyst Pharmaceuticals $40M Repurchase P/E Ratio 6.5 WOWCatalyst Pharmaceuticals is a biopharmaceutical company that specializes in therapies for rare neurological and neuromuscular diseases. It announced its fourth-quarter and 2020 financial results on March 15, 2021, reporting a 16% increase in revenue for fiscal 2020 and a 30% increase in operating income. (investopedia.com)

The company posted adjusted earnings of $0.11 per share, up 57% year-over-year, with the figure exceeding analysts’ expectations of $0.09 per share.

The company remains focused on acquiring or in-licensing innovative, technology platforms and early stage programs in therapeutic areas different from neuromuscular diseases. (smarteranalyst.com)

CPRX it`s an easy 50% in my opinion.

$40 Million Share Repurchase.

Market Cap 453.715M.

PE Ratio (TTM) 6.15.

75mil revenue, 119mil earnings in 2020

haven`t seen such a great balance sheet on a penny stock.

now trading at 4,94usd.

3/18/2021 Roth Capital Boost Price Target Buy $6.50 ➝ $7.00

H.C. Wainwright analyst Andrew Fein reiterated a Buy rating on the stock with a price target of $9

If you are also interested to test some amazing BUY and SELL INDICATORS that i use, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

ACAD (ACADIA PHARMACEUTICALS INC) BUY

ACAD LONG SET UP, ACAD Gapped down over 25% to a New 52 week low.

Price should bounce and fill in the Gap in the market

ACAD also filled its previous Buy gap from Sep 4th 2019

Title: Buy ACAD (ACADIA Pharmaceuticals)

Asset: Stock

Platform: Robinhood/WeBull/Etrade/ 401k account

Symbol: ACAD

Type: Buy Market Execution / Buy Limit

Time Frame: 1D

Entry Price 1: $26.50 ACTIVE

Entry Price 2: $22.50(PENDING)

Stop Loss: $19.50 (70 Pips)

Take Profit 1: $33.00 (70 pips)

Take Profit 2: $38.00 (140 pips)

Take Profit 3: $44.00 (200 pips)

Take Profit 4: $54.00 (300pips)

Status: 🏃🏽♂️Active🏃🏽♂️

Sector: Health Technology

Industry: Biotechnology

ACADIA Pharmaceuticals operates as a biopharmaceutical company. It focuses on the development and commercialization of medicines to address unmet medical needs in central nervous system, or CNS, disorders. The firm's products include Nuplazid, which is used for the treatment of hallucinations and delusions associated with Parkinson's disease psychosis. The company was founded by Mark R Brann on July 16, 1993 and is headquartered in San Diego CA