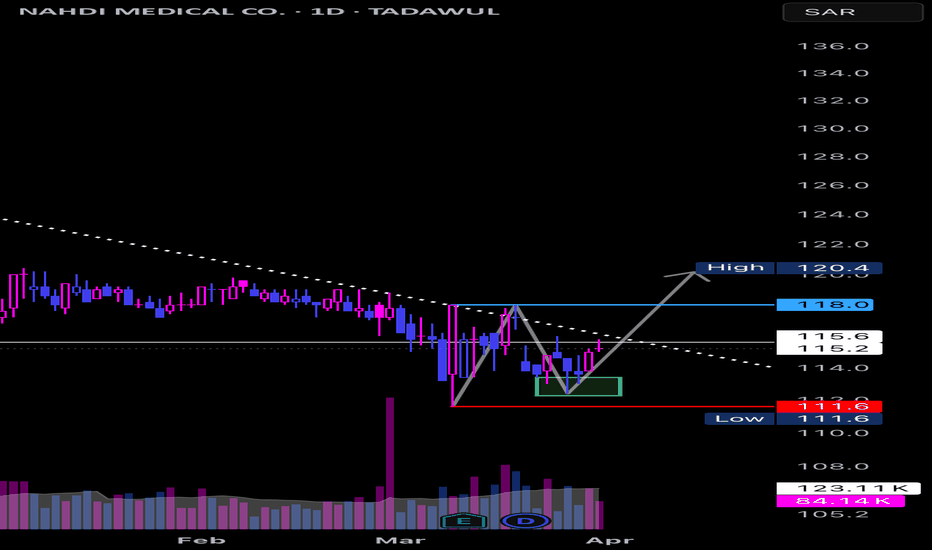

Nahdi Medical Co. (4164) - False Breakdown & Trendline Breakout?🚨 Nahdi Medical Co. (4164) recently experienced a false breakdown below 115.6, but has since recovered above it. With the stock now testing a downward trendline, crossing this line could signal the start of a new upward move. 📈

💡 Key Points:

• Current Price: 115.2

• False Breakdown at: 115.6

• Key Resistance at: 118

• Support/Stop Loss: 111.6

• Target: Potential upward swing after breaking 118

📊 Technical Analysis: The false breakdown below 115.6 followed by a recovery signals a potential bullish reversal. If the stock breaks the downward trendline and crosses above 118, it will confirm a new upward swing.

📈 Trade Strategy: The price range between 111.6 and 118 is an ideal buying zone. A breakout above the downward trendline and 118 will confirm the start of a new upward wave. Enter with a stop loss at 111.6, and if 118 is breached, expect the rally to continue.

What are your thoughts on Nahdi Medical Co.’s price action? If you think I missed something or see a different pattern, feel free to share!🔥

Pharmacy

CVS Health Corp | CVS | Long at $61.00NYSE:CVS Health Corp will need a revision to its business model in order to survive an ever-changing retail/pharmacy environment. However, with a P/E of 10x, debt-to-equity of less than 1x, growing cash flow, and dividend yield of 4.3%, the stock seems quite undervalued. Perhaps activist investors will soon step in, but if history repeats, there may be a nice bounce ahead as the price consolidates in the GETTEX:50S and low $60s. Thus, near its current price of $61, NYSE:CVS is in a personal buy zone.

Target #1 = $66.00

Target #2 = $68.00

Target #3 = $75.00

Target #4 = $79.00

Walgreens Boots Alliance (WBA) is gearing up for a potent ...Walgreens Boots Alliance (WBA) is gearing up for a potential breakout, presenting an enticing opportunity for investors.

Recent news indicates that Walgreens is restructuring its business model and focusing on cost-cutting measures, which could significantly enhance profitability. Additionally, the company's efforts to expand its healthcare services and improve in-store experiences align well with market trends, making it well-positioned for growth. As analysts project a possible 15% surge in the stock price, now may be the time to consider WBA as a solid investment.

BOOOOOOOOOOOM...

DR. REDDY LABThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy KG

WBA - go fill in that gap, damn it! Walgreens Boots Alliance Trading at 75.8% below our estimate of its fair value

Earnings are forecast to grow 83.28% per year

Trading at good value compared to peers and industry

WBA stock is a strong buy due to its consistent dividend yield, robust global presence, and strategic initiatives in healthcare and retail. The company's expansion into digital health positions it for future growth.

A Stock on the Brink of Breakthrough?Introduction:

In the ever-evolving landscape of biopharmaceuticals, Connect Biopharma Holdings Limited (NASDAQ: CNTB) emerges as a beacon of potential, navigating through the complexities of drug development with promising advancements and strategic maneuvers. This analysis dives into the core of CNTB's recent activities, financial health, and future prospects, shedding light on why this stock might just be the next big thing in the biotech sphere.

A Strategic Pivot: Key Developments and Milestones

Connect Biopharma, with its focus on developing novel therapies for autoimmune diseases and inflammation, has recently made headlines with significant strategic developments. The company's lead product candidate, rademikibart, is currently under pivotal trials for atopic dermatitis (AD) in China, with an NDA submission expected by Q1’24 and potential approval as early as 2025. Moreover, their global Phase 2 trial for rademikibart in asthma is on track, with last patient visits expected in October 2023 and topline readouts anticipated in Q4’23.

Financial Health: A Closer Look at the Numbers

The financial results for the first half of 2023 reveal a company steadfast in its research and development endeavors, albeit with a keen eye on sustainability. With cash, cash equivalents, and short-term investments of USD 131.6 million as of June 30, 2023, Connect Biopharma appears well-capitalized to support its operations into at least 2026. Notably, a decrease in R&D expenses and administrative costs compared to the previous year underscores a strategic allocation of resources towards its most promising projects.

Market Position and Technical Outlook

As of recent trading sessions, CNTB stock demonstrated a notable uptick, trading at $1.30 with a 7.44% increase. This movement, coupled with a consensus rating of "Buy" from analysts and a projected upside of over 500%, positions CNTB as a stock with significant growth potential. The company's stock price range over the past 52 weeks — from $0.5350 to $2.8400 — further highlights its volatility and the opportunity for substantial gains.

Conclusion: A Future Ripe with Opportunity

Connect Biopharma stands at the forefront of breakthrough treatments for autoimmune diseases, backed by a solid financial foundation and strategic clinical advancements. With key milestones on the horizon and a favorable market outlook, CNTB represents a compelling opportunity for investors keen on the biopharmaceutical sector. As the company progresses towards its pivotal trial outcomes and regulatory submissions, the potential for significant value creation looms large, making CNTB a stock to watch closely in the coming months.

---------------

NOT TRADING ADVICE. ALWAYS DO YOUR OWN RESEARCH.

Walgreens: Quarterly Bullish Piercing Line at PCZ of Bullish BatThere is a Bullish Piercing Line at the PCZ of a Bullish Bat that is visible on the Quarterly time frame. We also have MACD and RSI Bullish Divergence to go along with it as well as Increasing Volume. This could be the start of something big for the price action and I speculate that shares of Walgreens could rise up to around $58 over the coming months.

CVS | FINALLY Time to Enter | LONGCVS Health Corporation provides health services in the United States. The company's Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services. It serves employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers, governmental units, government-sponsored plans, labor groups, and expatriates. Its Pharmacy Services segment offers pharmacy benefit management solutions, including plan design and administration, formulary management, retail pharmacy network management, mail order pharmacy, specialty pharmacy and infusion, clinical, and disease and medical spend management services. It serves employers, insurance companies, unions, government employee groups, health plans, prescription drug plans, Medicaid managed care plans, plans offered on public health insurance and private health insurance exchanges, other sponsors of health benefit plans, and individuals. This segment operates retail specialty pharmacy stores; and specialty mail-order, mail-order dispensing, and compounding pharmacies, as well as branches for infusion and enteral nutrition services. The company's Retail/LTC segment sells prescription and over-the-counter drugs, consumer health and beauty products, and personal care products; and provides health care services through its MinuteClinic walk-in medical clinics. This segment also distributes prescription drugs; and provides related pharmacy consulting and other ancillary services to care facilities and other care settings. As of December 31, 2021, it operated approximately 9,900 retail locations and 1,200 MinuteClinic locations, as well as online retail pharmacy websites, LTC pharmacies, and onsite pharmacies. The company was formerly known as CVS Caremark Corporation and changed its name to CVS Health Corporation in September 2014. CVS Health Corporation was founded in 1963 and is headquartered in Woonsocket, Rhode Island.

$RAD At an important area of contention$RAD At an important area of contention. I'll be watching closely for a break above. I'm liking the setup if it can close above resistance.