PIDILITIND: High-Probability Trade Setup1️⃣ Current Market Structure & Fibonacci Setup

The price is currently in a corrective wave, forming a potential ABC pattern from the swing high of ₹3,385.40.

The correction aligns with the crucial 113%-127% retracement zone, a powerful reversal area often referred to as the golden extension zone.

Support Zone: ₹2,945 - ₹2,886 (Demand Zone)

Golden Retracement Zone: ₹2,817 - ₹2,850

Stop Loss: Below ₹2,817 (Day Close Basis)

Target Zone: ₹3,332 - ₹3,364 (Volume Imbalance Zone)

2️⃣ Why is the 113%-127% Retracement Zone Important?

Liquidity Grab: This zone often acts as a "trap" where liquidity is taken before the market reverses.

Reversal Point: It overlaps with demand zones and volume imbalances, making it a high-probability area.

Harmonics: Possible completion of a corrective wave C in this range, signaling a potential trend reversal.

3️⃣ Volume & Break of Structure (BoS)

Volume Imbalance: The price has left a gap at higher levels, which will likely act as a magnet for future bullish moves.

Break of Structure: A breakout above ₹3,075 will confirm bullish continuation toward the ₹3,332-₹3,364 zone.

4️⃣ Trade Plan with Confluences

Entry Zone: ₹2,945 - ₹2,886

Stop Loss: Below ₹2,817 (Day Close Basis)

Target 1: ₹3,162.35 (Immediate Resistance)

Target 2: ₹3,332 - ₹3,364 (Volume Imbalance Zone)

Confluence Factors:

Price nearing a demand zone with FVG overlap.

113%-127% retracement aligns with Fibonacci and market psychology.

Wave C correction appears to be completing.

5️⃣ Risk Management

Always prioritize risk management in your trades.

Position sizing should align with your risk tolerance.

Monitor price action near ₹3,075 for confirmation of bullish strength.

If the price breaks ₹2,817, reassess the setup.

Key Takeaway :

Pidilite Industries offers a great educational case study on using Fibonacci, demand zones, and structural analysis together. The golden retracement zone and volume imbalance make this a high-probability trade idea for both swing and positional traders.

If you find this analysis insightful, drop a like 👍 , leave your thoughts in the comments, and follow for more educational market insights! 📊📈

PIDILITIND

PIDILITINDNSE:PIDILITIND

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

SWING IDEA - PIDILITE INDUSTRIESPIDILITE INDUSTRIES looks good for a swing trade. This stock is a fundamentally strong and is now available at a discount as per technicals.

The Reasons are listed below :

Strong support at 2250-2300 levels.

Formed a strong bullish engulfing candle on weekly timeframe.

0.382 Fibonacci support.

Broke falling wedge pattern i.e a bullish sign.

Holding onto 2450 levels from last 2 weeks.

Target - 2735 // 2918

SL - 2300 on closing basis

PIDILITIND:: @Triangle BreakoutA strong demand is identified in this stock at 2300 levels...

facing resistance at 2800 levels...

Price is ready to breakout from this resistance levels...A traingle pattern is detected in this stock..

if price breaks this range will get sharp moment to the upside...taken the trendline support multiple times...if price breaks the bullish trendline will look for short side.

wait for the price to break upside...keep an alert in this stock at 2900 levels..

no sign of bearishness is observed in this stock.

{PIDILITE}:{SHORT for 3:1}

Price has reacted to a Monthly Supply (Left Side) to reach The Fresh Monthly Demand, basically this is a PPullback before the Upward Impulse, still the Reward to Risk ratio is favourable hence shorting,

The Exit is @ Monthly Demand Entrance so Exit on Time is as critical as the Entry,

ENJOY THE RIDE ! ! !

PIDILITIND CONOLIDATION BREAKOUT SOON!!The price consolidating itself near demand zone from a very long time. Price respects the support level of 2240 and takes support & moved towards upside to the breakout level. If price breaks the levels of 2355 and closes than we can expect good upmove in coming days.

#PIDILITIND📊

👉Keep in watchlist

👉Breakout Possible above 2855+ Close

👉Support At 2240

👉Good Consolidation near Demand Zone.

👉Above Breakout , Good move possible towards upside.✅🎯

PIDILITIND : Strong support zonePIDILITIND is trading in box range since long time and near strong support.

Good RR if we have breakout of Box range.

Levels are marked on chart for intraday. Follow price action and become Price action chart Specialist.

Like, Share, Comment for regular updates.

Disclaimer

I am not sebi registered analyst

My studies are Educational purpose only

Please consult with your Financial advisor before trading or investing

I may be 100% wrong as its my personal trade.

First Learn and then remove "L"

PIDILITIND Ltd - Perfect breakout from channel Pattern🔴DISCLAIMER

***** It's just for an educational purpose and so you must also follow your own technical analysis before taking up the trade ******

Aggressive traders enter at the breakout and conservative traders may give entry after retracement (Retracement is optional, we cannot expect every stock to take a retest after the breakout, it may also continue to have its bullish pressure after the breakout)

After reaching our targets, trail your stop loss to get maximum profit from the stock in a single trade

PIDILITIND - Bull Pennant breakout - Swing TradeThe above analysis is done purely on basis of Price Action & Chart Patterns.

The analysis is done on daily TF hence price may take few days to few weeks in order to reach the targets.

Trade setup is explained in image itself. Entry can be either above the breakout candle or on small pullbacks as well.

The above analysis is purely for educational purpose. Traders must do their own study before entering into any trade. Traders must trade as per their own risk taking capacity and money management.

Feel Free to comment or message me for any query or suggestion regarding this stock or Price Action Analysis.

Checkout my other ideas to understand how one can earn from stock markets with simple trade setups.

PIDILITE Industries shoing reversal from its support level.NSE:PIDILITIND

PIDILITE on daily chart taken a goods support and showing reversal.

Whats looks interesting here is the price and volume movement at its support level one can check the chart and observe the same.

There is nothing too much complicated here everything is just nice and simple as I expected.

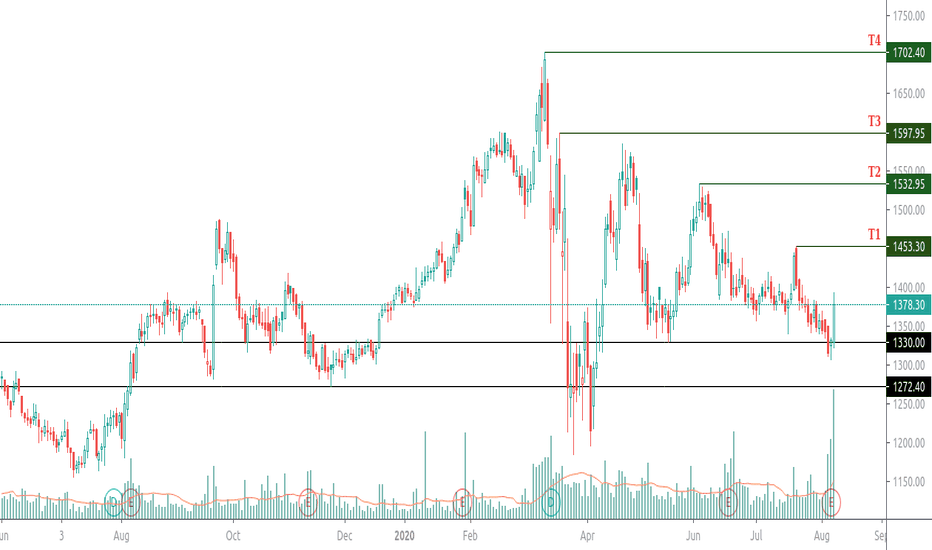

For positional traders its looks bullish on daily chart with SL 1270 Targets are mentioned on chart so do check.