BTC 4H Expansion scenario (Pseudo CRT with Elliott Wave)

This is just a sketch, but I found some interesting confluence between Pseudo CRT-like analysis and an Elliott count (expanded/running flat with A as a flat).

The automated indicator I created ("Seer Tee," doing the above-stated "pseudo-CRT" analysis) detected pivots for an upper-timeframe candles-based Modified Schiff Pitchfork.

From a bullish perspective, 89k-92k could be a target zone.

Invalidation below the thick white channel.

If the chart turns bearish, 80k will be the next stop.

Pitchforks

Litecoin analysis using multiple toolsPlease read the full analysis to get the complete picture.

Let's start with the trend lines.

We have three increasing angles of support trend lines. The third one marked with this week's low so it might change if we happen to get a lower low.

For the resistance we have R1 which is anchored at the ATH at the December 2024 top. This resistance trend line was tapped twice more, in January and February 2025, creating marginally lower highs marking the triple top which sent Litecoin to its recent low.

R1 and any of the support trend lines, most notably S2 create a symmetrical triangle. This triangle can break either way and any time. So in theory, it could take it's time until late 2026 or early 2027. If it breaks in 2026, I would expect it to breakdown given that would correspond to the bear market timing of the bitcoin four year cycle.

Next let's take a look at the pitchfork.

This is a Schiff pitchfork from the 2018 bear market lows to the all time highs to the 2022 bear market lows. Macro pitchforks like this one tend to be respected. We can see that the August 2024 low hit the outside line of the pitchfork. The 0.5 line (green) flipped multiple times in this cycle between being support and resistance.

The Schiff pitchfork in this case gives us the most conservative targets. More bullish targets are observed when switching to the modified Schiff pitchfork. However, for proper risk management it is better to start with the Schiff pitchfork and only if the price breaks the resistance levels, then switch to the modified Schiff. Here is the modified Schiff pitchfork:

We can see interesting price interaction here as well. The August 5th 2024 weekly close was still above the outside line. The currently weekly low also hit the outside line. Similarly to the Schiff pitchfork, the 0.5 line also flipped multiple times being support and resistance.

Zooming in on the price action since the December 2024 high, we can examine the Fibonacci retracement and how it aligns with the pitchfork, supply zones and a fair value gap (FVG).

At the time of this writing, we are about 5 hours away from a pretty bullish weekly candle about to close above the 0.236 Fib with the first significant volume increase since the week of February 24th. The next Fib levels are potential resistance levels. The 0.382 and 0.5 Fibs fall within the first supply zone. The 0.786 and the final 0.886 Fibs fall within the second supply zone. The most bullish artifact on the chart is the weekly FVG. These gaps tend to be filled and the one we have here borders the 0.618 Fib. Moreover, the pitchfork 0.5 line falls withing this FVG. If the FVG will be completely filled during a rally in the next few months, the price will break above the pitchfork 0.5 line and hit the resistance at 0.618 Fib.

If the price breaks the 0.618 Fib the next resistance area will be composed of the second supply zone, 0.786 and 0.886 Fibs and R1. Once this resistance area is cleared and price breaks above the December 2024 high at 147$ it can challenge the Schiff pitchfork median line with price targets at 180-190$ depending on when it will be hit. The median line is expected to be a major resistance, especially since it will be the first touch hitting it. If broken, the modified Schiff pitchfork gives targets at 230-250$ depending on when it will be hit.

For completeness, a quick look at the RSI and SRSI.

RSI is around 43. SRSI is about to cross bullish ( [ending the weekly close) and still needs both the fast line and slow line to cross 20 for a complete bullish signal.

No altcoin analysis is complete without examining the BTC pair.

LTCBTC had last week the lowest weekly close since the week of November 4th 2024. In the RSI this resulted in the first instance of a bullish divergence since the LTC significantly outperformed BTC in November 2024. A similar bullish divergence happened leading into the week of November 4th 2024. However, note that since January 2024 LTCBTC made lower lows while most of the time the RSI made higher lows. Therefore, we can observe a continued period of weekly bullish divergences since January 2024 but it only unfolded into significant outperformance in November 2024. So, the bullish divergence is clearly bullish but it is hard to tell if it will result in LTC outperforming BTC in the near or far future.

The SRSI is oversold but I wouldn't build too much on that.

Also, not shown, LTCBTC MACD and LMACD are clearly crossed bearish.

To sum up, LTC seems to have a clear path to the upside if the BTC bull run continues. As for whether or it will outperform BTC, it is hard to tell.

Algorand Long Trade, 6x Potential by 2026Algorand has retraced to the lower Median Line, presenting a strong investment opportunity.

With current economic conditions favoring altcoins, Algorand stands out.

Oversold at present, I project it to increase 6x from its current level, with a direct move toward the ML likely by 2026 — potentially spearheading the altcoin rally.

I’m personally invested in Algorand with a R/R ratio of 18:1.

Long Term Brent Outlook, $32 by 2026Weekly Brent has broken a clear barrier and formed a Bull Flag pattern, but the subsequent rally has been weak, not even reaching the breakout level.

The global economy is showing signs of weakening, leading to a reduction in oil demand. Concurrently, Trump's move to lift US production restrictions is boosting oil supply. However, the slight depreciation of the dollar is providing upward pressure on oil prices.

Given these factors, Brent remains relatively weak, and we may see a continued decline in line with Scenario 1, potentially targeting ML by 2026. Further downside is also likely.

Given the current conditions, I consider shorting oil at any reasonable price on lower timeframes.

How to Build a Super Pitchfork with Reaction & Trigger LinesIn this educational video tutorial, I guide you through the process of setting up a Super Pitchfork using the Bitcoin daily chart. This method is inspired by Patrick Mikula’s work in " The Best Trendline Methods of Alan Andrews. "

I demonstrate how to:

- Create and project reaction lines

- Generate bullish and bearish trigger lines

- Apply a personal timing technique for pitchforks based on Michael Jenkins’ methods by squaring significant pivots to the median line, reaction lines, and upper parallel to produce time-based reaction points anticipating potential market turns.

This walkthrough is for traders who already have a foundational understanding of pitchforks.

Inspired by the work of Patrick Mikula, this is how I personally apply and expand on the Super Pitchfork method in my own charting.

SUSD 4H Chart – Easy Trend with RSI Signal!SUSD on the 4H chart is in a steady uptrend within a channel since February. After a drop to the 0.285 level, it’s now at 0.382, sitting near the channel’s midline. RSI is at 54.26, showing neutral momentum—room to move either way. The yellow line suggests a potential push to the channel top at 1.0000000 if the trend continues. On the downside, 0.3500000 is key support to watch.

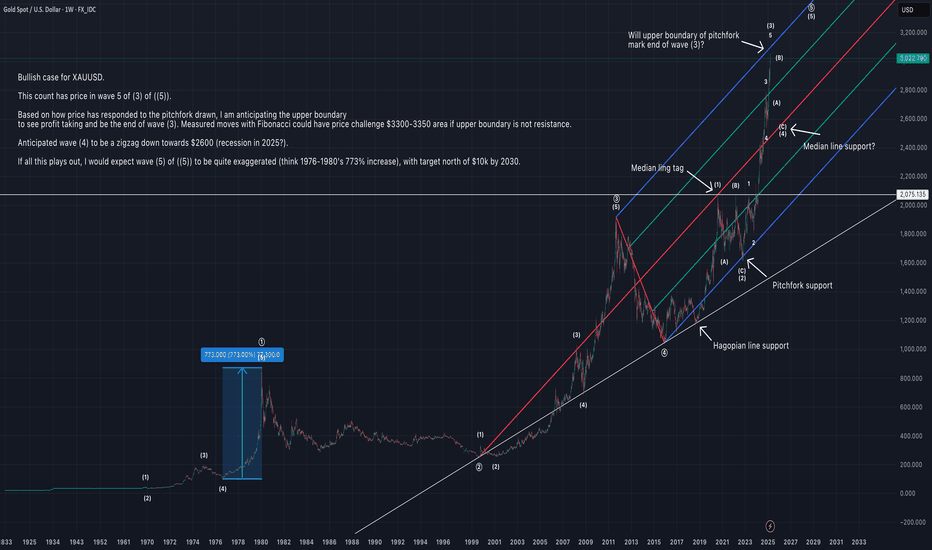

XAUUSD morning analysisBullish case for XAUUSD.

This count has price in wave 5 of (3) of ((5)).

Based on how price has responded to the pitchfork drawn, I am anticipating the upper boundary

to see profit taking and be the end of wave (3). Measured moves with Fibonacci could have price challenge $3300-3350 area if upper boundary is not resistance.

Anticipated wave (4) to be a zigzag down towards $2600 (recession in 2025?).

If all this plays out, I would expect wave (5) of ((5)) to be quite exaggerated (think 1976-1980's 773% increase), with target north of $10k by 2030.

DJT/SPX comparisonBearish case for equities.

Chart comparing DJT and SPX. DJT in wave ((c)) of regular flat, SPX in wave ((c)) of expanded flat.

SPX showing ending diagonal (wedge) to complete wave ((b)).

Bottom of SPX pitchfork (blue line) broke support and now acting as resistance.

This count anticipates each market to soon have a large (15-20%) 5-wave impulsive move down, DJT to complete wave 5 of (3) of ((c)) and SPX to complete wave (3) of ((c)).

After this proposed move, each market will have completed its wave (3) of ((c)).

I would expect wave (4) to be zigzag corrections for DJT and SPX before large wave (5)'s

to take price down towards March 2020 lows.

Gold’s Uptrend Strong, But Is a Short-Term Drop Coming?Gold ( OANDA:XAUUSD ) has increased by more than +5% over the past seven days and has managed to create new All-Time High(ATH) daily. The reasons for the increase in Gold prices include US economic statistics and the tensions in the Middle East that have increased these days.

The question is how long this bullish trend in Gold will continue. It seems that Gold needs at least a correction to continue its upward trend and I tried to find the starting zone of the correction with technical analysis tools (for the short term ).

Gold is moving near the Potential Reversal Zone(PRZ) , this zone could be a correction zone for Gold for at least the short term .

Gold also responds well to the Pitchfork tool lines , the Pitchfork lines can be considered as support and resistance lines for gold .

From an Elliott Wave theory perspective, Gold appears to be completing microwave 5 of main wave 5 (these five waves are likely to be part of main wave 3 ).

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect Gold to drop to at least $3,003 after breaking the Uptrend line , and my second target is $2,986 .

Note: The worst Stop Loss(SL) for your Short position could be $3,061.

Gold Analyze ( XAUUSD ), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

ETHUSD afternoon analysisETHUSD technical analysis.

Bears targeting median line (red line) of larger pitchfork by the end of August 2025.

Median line of smaller, bullish pitchfork never tagged, Hagopian line acted as support at blue arrows, now breached and acting as resistance.

Key levels/support at 1071.11 and 879.80, as well as parallel channel support.

SPX morning analysisTechnical analysis of SPX.

Bearish count/analysis presented, cleaned up to present important points.

Parallel channels frame price action since March 2020 low nearly perfectly, with key pivots pointed out. With count presented, ((B)) is 200% of ((A)).

End of ((B)) counted with impulse ending with ending diagonal wedge. Impulsive price action broke through pitchfork support, looking to see if support now becomes resistance.

If pitchfork median line (red line) cannot be tagged, should be taken as bearish sign, and return to October 2022 price as likely. If that idea plays out, looking for channels to provide support/resistance for price down towards March 2020 low.

SPX/DJT technical analysisChart comparing SPX and DJT.

SPX drawn with expanded flat, (b) is 200% of (a) and completes with ending diagonal wedge.

DJT drawn with regular flat, (b) ~90% of (a), wave (c) began in November of 2024 and currently in wave iii of (c).

Bears looking for SPX pitchfork support to break and become resistance, both SPX and DJT looking to eventually break October 2022 low and approach March 2020 lows to complete their corrective structures.

SPOT - My Mom Says I Have A short Bias...hmmm...Most of my Charts I analyze are currently showing a short setup. Mom says I'm shorting the whole world.

hmmm...

However, here's another one, just to keep the streak going. §8-)

Spotify is at the U-MLH = At the upper extreme.

The next natural move should be down to the Centerline.

Since I have no magic wand to show me the Future, I lean on my stats and my experience.

Shorting Spotify down to the Centerline or getting stopped out abve the U-MLH.

Simple (...but not easy ;-) )

...have to run, Mom calls for Dinner.

Will STXUSDT recover from a failed fifth Elliott wave?

We start our Elliott wave count at the bear market lows (Nov 2022). The first wave tops in March 2023 starting the second wave that bottoms at the 0.618 Fib (typical second wave). The third wave tops along with most of the crypto market in end of March or early April 2024. Then the fourth wave corrects more than expected barely holding the 0.382 Fib, the first wave high and the pitchfork median line support. The fifth wave starts in August 2024 and tops in December 2024, below the third wave high and rejecting from a pitchfork resistance. From here STX tumbled down.

STX recently found support at the outer line of a macro modified Schiff pitchfork. We can see that the price action interacted with the median line of this pitchfork throughout the bull run. If we are to hit that median line again, we get a pretty ambitious target at around 5$ by the end of July 2025.

Below I examine other pitchforks for more realistic price targets.

Looking at the same pitchfork on linear scale we again see price action interacting with median, 0.5 and outer lines of the pitchfork. This chart gives us a target price of around 1.9 by the end of July 2025.

Changing the pitchfork type to Schiff and looking at the log chart again shows price action interacting with median and 0.5 lines of the pitchfork. This chart gives us a target price of around 2.44 by the end of July 2025.

Some smaller pitchforks on the log chart provide us with additional resistance levels to keep in mind.

Similarly on the linear chart. Here we also see a pitchfork median line that served as support.

In recent price action we can see bullish divergence in RSI and SRSI. In addition, at the daily close, one should watch for bullish crosses in RSI and SRSI.

Will this be the turning point for STX? Time will tell.

SPX/DJT comparisonChart comparing SPX and DJT.

This count has SPX and DJT in wave ((2)) of ((5)), with wave ((2)) of SPX as an expanded flat and wave ((2)) of DJT as a regular flat.

For SPX, wave B of the expanded flat ends up being 200% of wave A (nearly to the tic). For DJT, wave B of the regular flat ends up being ~90% of wave A.

If correct, would expect wave C to target March 2020 lows.

US500/SPX morning analysisBearish analysis of US500/SPX.

Weekly RSI with bearish divergence.

Median line of pitchfork remains untagged, implying move down towards October 2022 low.

Convergence of fib levels/resistance at 6123.9-6144.4; length of move from October 2022 low is the same length as move from March 2020 low to January 2022 high, ATH with near-perfect tag of 2 fib channel expansion projected from January 2022 high to Octobe 2022 low.

SLM Volatility contraction bar entry& Median Line ExitAfter a month of sideways price action over the turn of the year, we get a new price high on the on the back of poor earnings. Price held and a low volume narrow range bar shows up. I would expect there should be more selling here but minor volume day. Take a long but stopped a few days later.

However price comes back in early Feb after holding the 50EMA.

Try another squat bar buy stop entry.

Price target the ML as Dr. Andrews says, "Price makes it to the median line 80% of the time".