Pivotlow

NQ Power Range Report with FIB Ext - 3/28/2024 SessionCME_MINI:NQM2024

- PR High: 18507.00

- PR Low: 18477.00

- NZ Spread: 67.0

Key economic calendar events

08:30 | Initial Jobless Claims

- GDP

09:45 | Chicago PMI

Prev session closed flat with high vol

- Another inventory dip back inside week range

- Holding inside prev 3 session range

- Last trading day of month ahead of long weekend

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 232.83

- Volume: 21K

- Open Int: 258K

- Trend Grade: Bull

- From BA ATH: -1.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

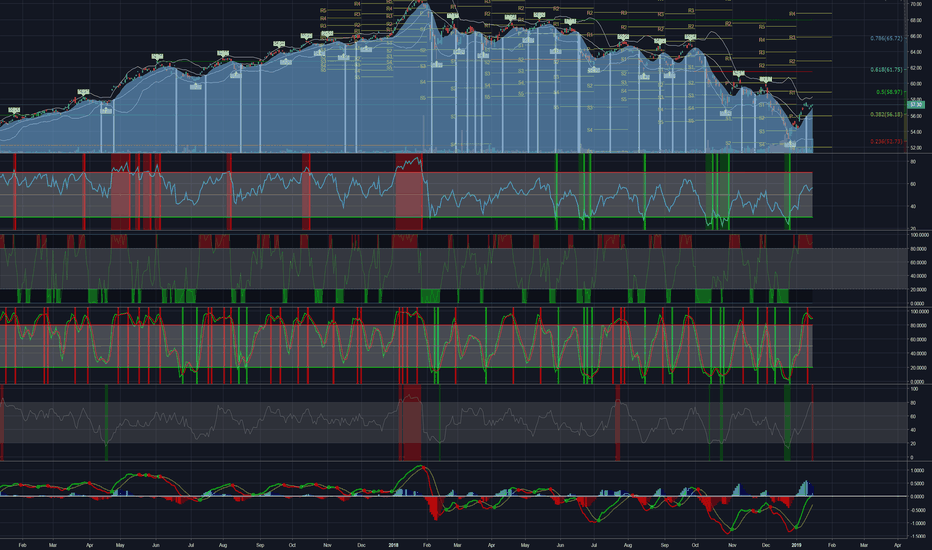

KO - a Warren Buffet Fav setup long from bottom of cycleKO as a long standing Buffet holding- is a slow mover with a decent dividend. For stock and

options traders like myself, it is now well positioned for a long trade. KO's recent pivot

highs were early to mid May with the highest trading volume at $64 according to the interval

volume profile. KO descended mid-May into June 1st and then had a Fib. retracement and

reversal. On the 4H chart, KO price is now at the bottom of the high volume area of the overall

while the RSI / MTF ( Chris Moody) shows relative strengths in the range of 25.

I see this as a classical opportunity to buy low and sell high. Trade specifics are a stop loss

of 59.30 and targets based on anchored VWAP lines of 61 (25% off) 62.5 (50%) and

63.75 (25%). As a low-risk trade for the stop loss compared with the potential profit, I will

devote 5 % of the account to this trade. Once price hits $60.25, I will raise the stop loss to

the break-even price of the entry and the trade will become stress and risk free. I will

select an entry buy focusing down onto the 5-15 minute time frame. Profits from a low

risk trade like this will be re-deployed into others a bit riskier as a means of stratifying

risk and its managment.

Introducing the Responsive Supply and Demand IndicatorIn this comprehensive tutorial, Stock Justice offers an insightful walkthrough of the enhanced Supply and Demand Indicator. We delve into the tool's advanced features, demonstrating its capacity to identify pivot points across multiple timeframes, its customization options, and ways to interpret its outputs. The video provides valuable guidance on how to navigate the settings of this powerful tool, from plotting circles and lines to adjusting the number of ranges to be analyzed. By the end of this tutorial, users will better understand how to utilize the Supply and Demand Indicator to optimize their trading strategy and make more informed decisions.

How Low Will it Go?Maybe halfway down the flagpole. Had a pennant form around 4700, usually a continuation pattern.

Might get another waterfall straight off, or a B wave and then lower. 50 DMA likely target for support.

Be Real Carefull about Buyin this Dip, these dots may not be done dippin. A bounce is certainly possible before lower, wouldn't bet on it.

We had two weak bounces, failed rallies on 1/6, 1/7 suggesting there just might not be much bounce in this Tigger.

There is a definite impulsive EW pattern in the downtrend suggesting it may bounce first and then rollover again.

(Not shown, see it better in smaller timeframe.) A pivot reversal will appear within a few sessions IMO, leading to a right shoulder.

Not investing advice; trade at your own risk! GLTA!!

#bitcoin - Daily Parallel Channel & Yearly PivotGood morning traders,

some of you have taken a long position yesterday, after the small inverted Head & Shoulder on a smaller interval seemed to break upwards. The target for this small IHS is roughly located just under the so important Yearly Pivot . The November is nearly finished and we will get new Monthly Pivots in a couple of days. To be honest, I am under the impression that it will be decided between the Channel Middle Line and the Yearly Pivot if this heads further down towards Quarterly S1 or will end this correcture. A bearish retest of that Yearly Pivot is within possibilities and would send us likely to the lower 6k´s.

To mention is the regular bullish divergence on this Daily and the fact it accepted again the Channel Support. We are not out of the woods, but have a new local low with a key-level to break, before further down-action. (blue)

Happy trading.

_________________

Neru

Major Resistance Ahead for Bitcoin.Bitcoin is approaching a major resistance point that it has already failed on the last two candles, forming a pivot. If this pivot begins to fail for a third time I will look for a Daily short play with a loose target around the daily pivot high and daily pivot low.

If we can S/R flip this Weekly Pivot then I will look for a Daily Long play with a loose target around 8900-9400.

FISERV, INC. (FISV): All The Pivots, Supports & ResistencesFind Winning Trades In Seconds >> efcindicator.com (Special Discount)

FISERV, INC. (FISV): All The Pivots, Supports & Resistences

RL breaks down below previous supportEarlier this month RL broke down below recent support and beyond the consolidation zone where price has been trading since mid-2013. The downtrend began to develop a few days after the earnings announcement on 4th February.

Throughout the majority of February price has been trading between the lows of 2014 and 2012 - with 2012 acting as support and 2014 as resistance. On Friday price broke below the 2012 pivot, with a very bearish bar, and the weakness looks likely to continue.

With the next major support zone at around $105 there is some room for price to continue to fall. There may be a retest of the 2012 pivot and, on the weekly chart, the 50ma is still above the 200ma (we would ideally like to see the weekly 50ma cross below the 200ma to give us an additional reason to short this stock).

RL is trading against the markets in general and, if entering this trade, it would be a longer-term sell (to give the bear trend time to develop). With over $25 to the next support level this could be a good opportunity for those who are happy to short stocks at this time.