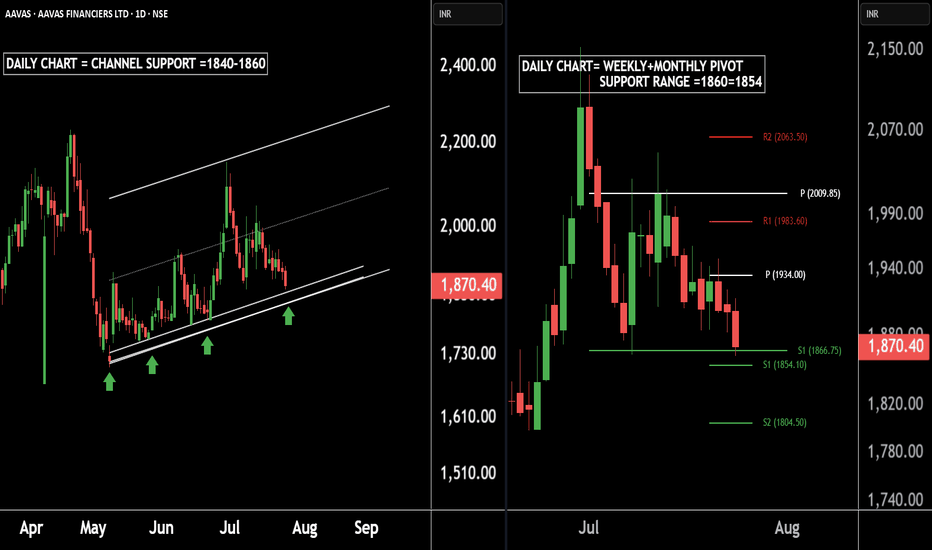

AAVAS Housing – A Hidden Gem for Medium-Term InvestorsThere are two charts of AAVAS FINANCIERS.

On the first chart AAVAS FINANCIERS is moving in a well defined parallel channel with support near at 1840-1860.

On the second chart AAVAS FINANCIERS is taking Weekly + Monthly support near at 1866-1854.

If this level is sustain ,then we may see higher prices in AAVAS FINANCIERS LTD.

Thank You !!

Pivotsupport

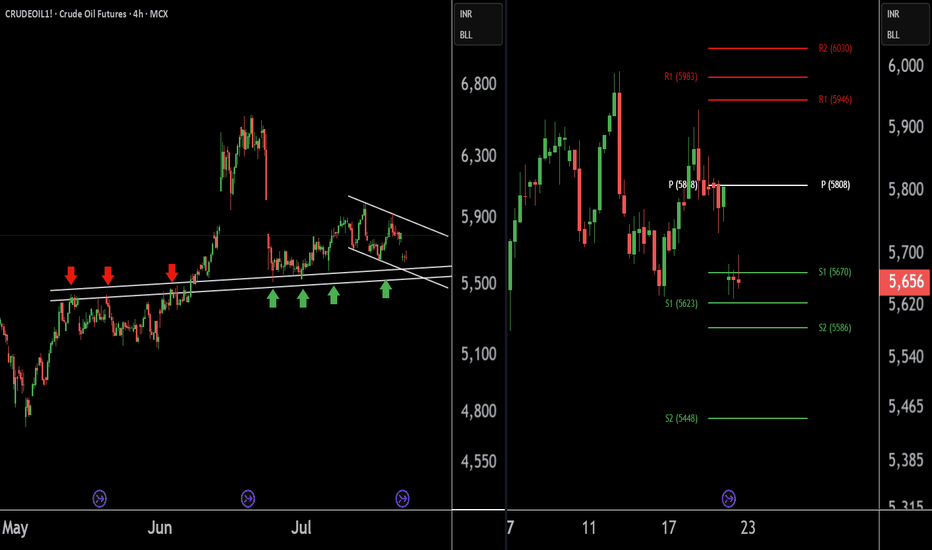

Crude Oil Buying Alert: Strategic Entry Point IdentifiedThere are two charts of Crude Oil on the 4-hour timeframe.

In the first chart, Crude Oil is sustaining near its lower point (LOP), with a support range of 5540-5580.

A-VWAP is also providing support to Crude Oil around the 5580 level.

The Pivot Point is also supporting Crude Oil around the 5580-5620 level.

If this level is sustain then we may see higher prices in Crude Oil.

Thank you !!

NQ Power Range Report with FIB Ext - 6/26/2024 SessionCME_MINI:NQU2024

- PR High: 19987.75

- PR Low: 19966.50

- NZ Spread: 47.75

Key economic calendar events

10:00 | New Home Sales

10:30 | Crude Oil Inventories

Retraced >98 Monday's range, inside print

- Auctioning above prev session high

- 19800 inventory pivot

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 10/30/23 +0.47% (open < 14272)

- Session Open ATR: 250.58

- Volume: 22K

- Open Int: 248K

- Trend Grade: Bull

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20383

- Mid: 19246

- Short: 17533

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Next Week's IWM, 21 Day Pivot Standard Deviation RangeLooks like the medium term bias is to the downside for small caps, as we see the weekly pivot (red solid line) fall below the monthly pivot (dark solid line) with AMEX:IWM closing below both.

Both deviation boxes represent two standard deviations above and below the a moving monthly pivot. We may see demand in the lower deviation range if we fall to start off the week.

A rally to start of the week will likely be met with resistance from our pivot points and a fresh downward move from the 21 day moving average.

Investors that want to take advantage of this medium term bias could short volatility in the short term (June/July) for IWM using AMEX:TZA but bet bigger on long volatility in the longer term (September/January2025).

Take any short term gains to the upside and hold onto your short thesis heading into the second half of the year, into 2025.

NQ Power Range Report with FIB Ext - 5/22/2024 SessionCME_MINI:NQM2024

- PR High: 18813.00

- PR Low: 18795.00

- NZ Spread: 40.0

Key economic calendar events

10:00 | Existing Home Sales

10:30 | Crude Oil Inventories

14:00 | FOMC Meeting Minutes

Continuing to grind into new ATH

- Holding above prev session high

- Daily pivot off 18600 range (inventory)

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 10/30/23 +0.47% (open < 14272)

- Session Open ATR: 219.76

- Volume: 12K

- Open Int: 245K

- Trend Grade: Bull

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 19246

- Mid: 18106

- Short: 17533

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NAS100 Down or Up?NAS has been going up and down for a while now. I'm looking for it to indicate whether we are going to break pattern and move upward.

If not, we will see the lower highs and lower lows start to creep downward today.

If making an entry, I would need to give enough room for retracement either way

NQ Power Range Report with FIB Ext - 4/5/2024 SessionCME_MINI:NQM2024

- PR High: 18118.50

- PR Low: 18074.75

- NZ Spread: 97.75

Key economic calendar events

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

Cheap discount margins raised for employment numbers

- Massive inventory run prev session

- Holding near lows from Mar 15-19 (pivot level)

- Prev daily bar engulfing 2 preceding sessions

Evening Stats (As of 1:55 AM)

- Weekend Gap: +0.21% (filled)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 244.60

- Volume: 41K

- Open Int: 260K

- Trend Grade: Bull

- From BA ATH: -3.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/4/2024 SessionCME_MINI:NQM2024

- PR High: 18394.00

- PR Low: 18377.75

- NZ Spread: 36.25

Key economic calendar event

08:30 | Initial Jobless Claims

Back inside prev week's inventory zone

- Vol spike at session open up 90+ points

- Holding near prev session highs, above the close

- Another potential pivot off daily 20-32 Keltner avg

Evening Stats (As of 12:05 AM)

- Weekend Gap: +0.21% (filled)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 228.85

- Volume: 22K

- Open Int: 260K

- Trend Grade: Bull

- From BA ATH: -1.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 2/22/2024 SessionCME_MINI:NQH2024

- PR High: 17710.00

- PR Low: 17675.50

- NZ Spread: 77.25

Significant calendar events

08:30 | Initial Jobless Claims

09:45 | S&P Global US Manufacturing PMI

- S&P Global Services PMI

10:00 | Existing Home Sales

11:00 | Crude Oil Inventories

FOMC volatility driving price back to weekly supply

- Daily print, pivot long

- Pushing ~70 points above prev session high

- Finding resistance near Tuesday's highs

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 248.28

- Volume: 47K

- Open Int: 286K

- Trend Grade: Bull

- From BA ATH: -1.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18106

- Mid: 16963

- Short: 16391

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 2/16/2024 SessionCME_MINI:NQH2024

- PR High: 17960.00

- PR Low: 17944.25

- NZ Spread: 32.25

Key economic calendar events

08:30 | PPI

Inching above Wed's high, prev session close

- Daily print, 17600 pivot long

- Discount margins raised for PPI

Evening Stats (As of 1:25 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 223.72

- Volume: 21K

- Open Int: 286K

- Trend Grade: Bull

- From BA ATH: -1.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18106

- Mid: 16963

- Short: 16391

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

SOLUSDT|A very important resistance area and the fate of SolanaHi guys, this is my overview for SOLUSDT.Feel free to check it out and leave your comments in the comments section.

With the sharp and strong growth that Solana experienced, it has now reached an area that is of great importance in all major time frames, monthly, weekly and daily.

With the return from this area and even unsuccessful attempts to make a new high, we now see that both a lower high and a lower low have formed than the previous low.

This is a sign of weakness in the previous upward trend. In my opinion, this weakness in the trend can reduce the price of Solana to the price of 72.26 dollars and the next level is 41.83 dollars.

AAVEUSDT|The end of the BULLISH trendAfter the upward lag that started at the price of 63 dollars, it has continued its upward trend in the form of an ASCENDING channel.

By reaching the resistance levels, we saw returns from these areas as long shadows, which indicates high liquidity in these areas and it is difficult to pass through these areas.

Multiple reversals from these areas show the weakness of the momentum, if the last downward movement leads to the breaking of the channel, we can enter sales transactions in the reversals to the channel, up to the support levels created by the origin of the movement.

The prices of 78.26 and 63.51 are suitable targets for selling transactions.

GOLDEN STAR|Important demand areas for entering sales orders.Here we currently have support from which we have seen upward scalp reactions.

-One point that we should consider is that the selling pressure is more on gold at the moment. Because of this sales transactions can have a higher winning percentage.

-To enter sell orders, we should consider the supply areas around the price of 2068 and the price area of 2074, of course, with proper confirmation.

If we want to say the important areas for entering into buying transactions, the price areas of 2048 and 2033 are valid areas for buying transactions.

GBPJPY will fluctuate in a wide range!Strong Bullish candles and weaker bearish moves. Candles are begging traders: BUY!

But the super bullish channel might be broken this time. Remember these kind of channel won't last long!

Take a look at GBPUSD

Pound is going to be weaker against USD

Same for USDJPY:

If I want to favor one to another I'll choose GBP so our suggested entries in lower time frames could be found around:

LONG AT: 181.05

AND : 177.71

SL : below 176.71

Take profit points:

183.00

186.00

Any breaking news or an important one, could devaluate this analysis. Also, breaks out of the yellow range is expiration of the idea.

Bitcoin's Line in the Sand is at 25,200 RN!Traders,

There is one line that I am especially focused on right now. Many of you, my followers, are already familiar with what this line is. In this video, I discuss the 25,200 level, why it is important, and what happens if this level of support breaks.

Stew

USDJPY I Weekly outlook and trade opportunity!Welcome back! Let me know your thoughts in the comments!

** USDJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

GOLD Possible scenarios."Bullish Scenario" will be activated after breaking 1939.50. 1st tp is around 1948.

"Bearish Scenario" will be activated in case of price crossing the bullish-trend-line under.

In that case a reaction to the 1917.400 could provide a long opportunity there.

If Hawks seems to be more powerful in FOMC meeting, you should wait for the "2nd bearish scenario"

NZDCHF I Potential short-term buyWelcome back! Let me know your thoughts in the comments!

** NZDCHF Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

AUDCAD I Headed up from pivot supportWelcome back! Let me know your thoughts in the comments!

** AUDCAD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

U - buy the dipsSince last November, Unity had been whipped in a wide range between 24 to almost 43 at least twice and now looks to retest $43 again in the coming days (weeks). The odds of a successful break out of this range has increased with the announcement on 5th June by AAPL of it's partnership with Unity on the Apple Vision Pro.

Volume was great after the annoucement and although the stock started to sell off by the next day, it eventually found support at the 38.2% fibonacci retracemnt of it's most recent AB upswing. This forms the near term pviot which is a good place to place an initial stop (at least 50cts below) for those initiating a long trade now.

While the 42-43 might still pose some headwinds in the near term, I suspect that the next retracement from there will be "shallow" and not going to bring it right back to the range low at 24+ (as had happened several times in the last 7 months. This is because dynamics of the overall market sentiment has been changing to more bullish now. However, a trailing stop will help if this speculation is wrong.

p/s with FOMC round the corner, the market could sell off after, and if it does, it could provide a much needed breather before trend resumption. Hence I would view any near term pullback as opportunity to long stocks that are looking technically attractive.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Take care and Good Luck!

A diamond is about to shine!The price action is printing a peak formation making an iv wave of a potential expanding diagonal ending. This contractive path suggests a possible diamond pattern to be formed, in which structure price can form a counter triangle. The expected swing down tends to led the price to extend an 2.618 Fibonacci ratio of a potential Harmonic Bat C-D leg @ pivot support level, as shown on this chart.

EURGBPEURGBP has been examined in different dimensions:

1- Strong supply and demand levels that I identify with my own indicator and system.

2- The structure of recently formed waves

3- Current market momentum

4- The structure of classical and price patterns

In this idea, I identified the direction of the market in different ways and in the second step, I analyzed the potential of continuation or reversal. Usually, paying attention to the trend and strength of the trend can greatly increase the accuracy of the analysis.

In general, I tried to describe the continuation of the movement in the simplest possible way in the diagram.

⚠️ Disclaimer: