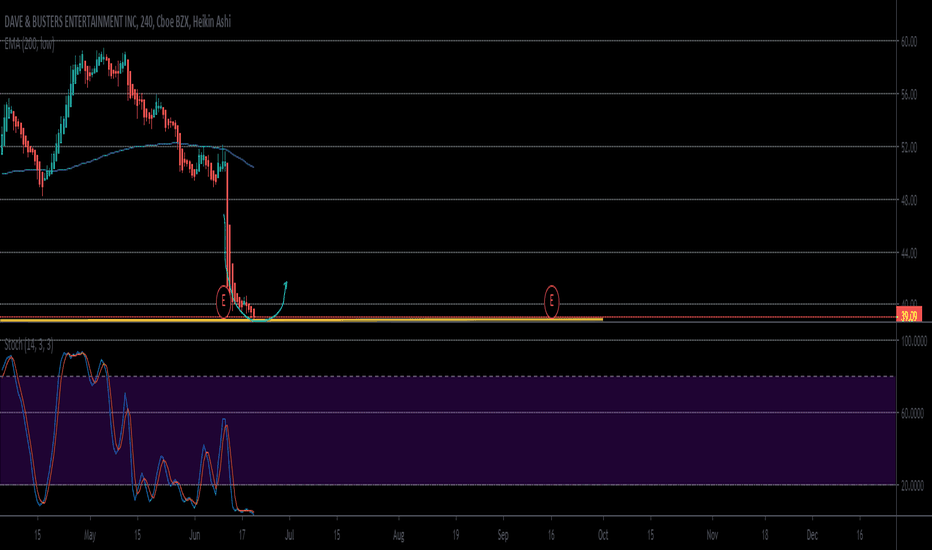

$Play LongTradingView

Open position at $39

Stop loss at $37

Take profit at $42

Dave and Buster looks pretty bottom out on the daily time frame, it's near a triple bottom and pretty much can't go down further unless market tanks.

We might enter a bullrun so this would be a pretty good long shot play.

PLAY

FSN Going Live on June 30 Sundaywent all in together with Binance folks as it's migrating in the coming days in tune with launching it's main net

Play..resistant cleared.Today we are going to look at Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) to see whether it might be an attractive investment prospect. Specifically, we’ll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

Firstly, we’ll go over how we calculate ROCE. Second, we’ll look at its ROCE compared to similar companies. Last but not least, we’ll look at what impact its current liabilities have on its ROCE.

Understanding Return On Capital Employed (ROCE)

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. All else being equal, a better business will have a higher ROCE. Ultimately, it is a useful but imperfect metric. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that ‘one dollar invested in the company generates value of more than one dollar’.

lets play PLAY!Today we are going to look at Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) to see whether it might be an attractive investment prospect. Specifically, we’ll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

Firstly, we’ll go over how we calculate ROCE. Second, we’ll look at its ROCE compared to similar companies. Last but not least, we’ll look at what impact its current liabilities have on its ROCE.

$CODI - Been waiting for this long and it's here!CODI - Compass Diversified Holdings

CODI acts very similar to Berkshire Hathaway in how they pick and manage companies. This has been on my radar since high $17 range in late 2017. I'm really comfortable with this entry although I wished I could've picked them up earlier. I am, however, comfortable with my entry at 15.55 (500 shares) since we are back above major support levels. This play pays out an annual 8.5% dividend so I'll be holding this for a long time.

My entry of 500 shares was at $15.55 today, February 12th, 2019. More info at wingtrades.com

$NYMT long term dividend play!NYMT - New York Mortgage Trust

This is one of my dividend holdings that I picked up today (1,000 shares). Not only does it pay a fantastic dividend, but we are right on the cusp of a long-term breakout and constantly above earnings expectations. Multi-year hold.

My entry of 1,000 shares was at $6.33 on Friday, February 8th 2019. More info at wingtrades.com

A winter sunday play on Bitcoin, bulls towards $4600 [BTFD] quick play on bitcoin today, please give a thumbs up if you like the chart....

we are looking to get a long position/buy into bitcoin for a quick scalp on sunday

targeting the 0.882fib level and 21 EMA (blue line)on the daily chart:

there is a very good chance we will hit this target of $4630 and possible short from that area back down to $4k is very probable in next 24-48hrs to retest lows before weekday markets open

if there is momentum and timing is right we could see a move beyond $5k but currently thats not so likely as what has been stated above regarding the rebound off resistances due to the Fib and EMA

Stop loss at $4080

Good trades y'all

for more updates please join our BTFD channel on telegram (search BTFD)

STRAT - Stratis falling wedge in playLooking at the 4h chart and the indicators we see room for growth in both RSI + STOCH RSI, bottoms have been andor are close to being hit.

(This is not financial advice, this is a volatile market where anything can happen)

GSL Shippers Heating Up/Merger NewsGSL and Posiedon have agreed to a merger to take place sometime in November. GSL is being valued @ $1.78 a share by Posiedon and receiving over $200mln. With GSL trading at close today at $.95 the upside on the deal alone is great.

But also now take into account the shipper run that has taken place the past couple Novembers and I believe we have a perfect set of circumstance for a nice upside potential for GSL. Given that GSL ran to over $4 in Nov 2016 and $2 in Nov 2017 we could see $1.78 and more.

Check out the top trend line on the monthly chart below.

www.tradingview.com

seekingalpha.com

S&P PlaytimeS&P has retraced from all-time high back to breakout. Current options position is (slightly) net short but approaching 0 deltas and considering going net long with some shorter dated end of month calls. Also short on UVXY just in case we chop around for a while.

Lots of potentially juicy decisions and policies to look out for right now:

-US-China tradewar updates (200 billion or nah)

-US Federal Interest rate decision end of September (postponement of hikes could indicate fed worry over trade war's negative effect on US economy)

-NAFTA negotiation result eh

How to trade BTC using Ichimoku (1D chart)Right... Without going into too much detail, BTC is more ''bullish'' than it has been all year so far, according to the cloud.

At the moment, on the 1 day chart, we have:

(1) Lagging span above the price - which is, in my opinion, one of the best early and aggressive entry signals for traders, this is a very weak bullish signal but usually the first component to flip from bearish to bullish.

(2) A (weak) bullish TK cross below the cloud. Once again, a confirmation that we are heading into bullish territory.

Current situation:

*BTC is currently within the cloud, which indicates that price action is neutral, there is neither a bullish or bearish trend established. Keep this in mind.

*We have a flat Kumo edge (indicated with the yellow line) , which a lot of Ichimoku traders see as a ''magnet'', it is the .5 fib from the last peak and last bottom. Price tends to move towards that line.

*The Bearish Kumo (cloud) is getting thinner, and might even flip bullish for the first time this year, this would be another confirmation that we are headed towards bullish territory. However, the cloud was thinner mid-June so don't rely on this yet, just keep an eye on it.

TLDR; What to do:

1. Keep an eye on BTC and watch it move through the last major resistance (the Kumo edge - indicated with the yellow line)

2. If it fails to break this resistance keep in mind that we might test the resistance again and break through it and BTC is bullish as hell.

3. If price declines and hits the lower edge of the cloud (major support) it will either bounce, or break through the cloud - breaking through the lower cloud edge would be incredibly bearish and means that we will most likely see new lows.

Gardner Denver Holdings - $GDI - BTFD! - outside of stddev bands$GDI - Looks to be far out of the linear regression 255-day - 2x standard deviation band. I haven't found any negative press upon an initial screening, so I'll prepare tomorrow morning to search in depth to find more news / catalysts. Otherwise, I plan an entry into some calls while I BTFD.

6/14/18 GDI is going to perform a presentation at a conference. I'm assuming it's not a big deal or major catalyst, but who knows.

Reaching RSI and EMA resistanceRSI is reaching prior resistance around 60 aswell as the 50 EMA on the daily. Still in a nice channel. I would be careful to call it a wedge at this point.

A break could bring support on top of the EMA and give yet another uptrend confirmation. Will bring obstacles around previous resistances at 8600 and major 9100. A rejection at EMA could initiate a double top, or more likely a very much needed healthy retracement for a new bounce at 7400-7800 depending on the rejection. A high Risk/Reward ratio right now. In other words a no-trade zone.

ETCETH Opportunity Still Exist, Several Pivots ConfirmBuilding on last idea and cleaned up chart . Same information as previous (linked) except a few extra confirmed pivots. Stop moved up from 0.0368 to 0.0398, assuming a 1-2 is in and another 1-2 (small) is being put in, stop under the 0.786 of the smallest, most recent 1-2. As with all alts, upside movement is most often associated to non "crashing" of the big 2, eth and btc that is.

The red dashed lines are where the algo's will most likely sell off if they aren't closed out.

Price correlation chart.

www.sifrdata.com

4hr

Last idea (same as this one)

Gold: XAUUSD Gold/Dollar play Update: Careful Here !GOLD: XAUUSD Gold/Dollar Play (continued) Neutral Here ahead of DXY break down

Gold longs on back of DXY weakness need to be careful here.

Still believe that the inverted flag formation on DXY chart

(right) is a continuation pattern prior to DXY dropping down

and out of the lower parallel down to 92.62. That will propel

gold as high as 1297 at least and more likely back to 1305 as

this move develops. But we cannot turn aggresssively bullish

of Gold until that lower parallel is busted on the downside.

Each test of the lower parallel on DXY tells us to close down

Gold longs again...and wait for that break down on DXY.

Gold/Dollar play: Take profits as DXY sticks at 93.99 for nowGOLD: XAUUSD Update

Gold is now testing the first resistance line at 1281 whilst DXY

is holding stubbornly above 93.99-93.94. Gold cannot rise

whilst DXY holds up. It needs DXY to break below 93.94 now

to fire gold as high as 1305. Suggest taking profits here and

only going long gold again when 1281 is broken on upside by

100 pips and it's confirmed by DXY breaking down below 93.94

again.