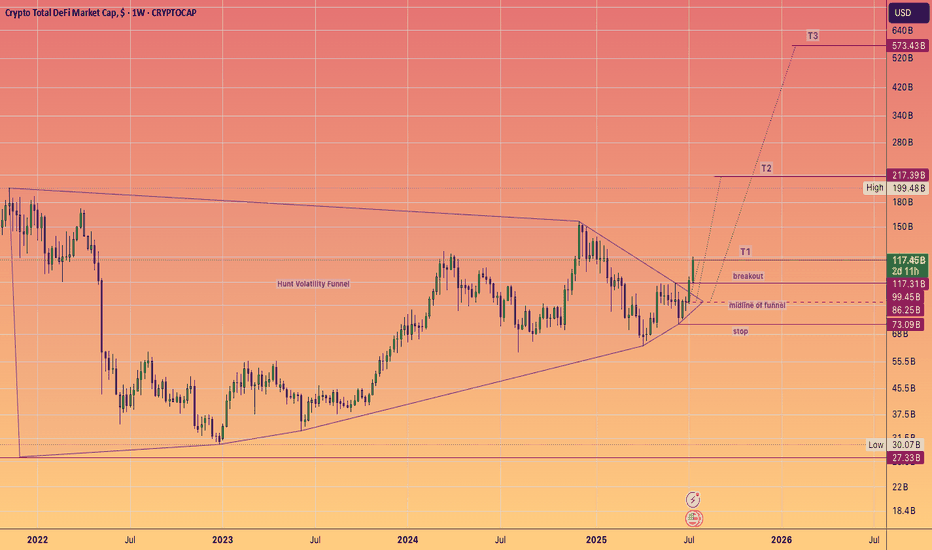

DeFi Moonshot! Moon mission to $573 Billion dollars!DEFI fuelled by Ethereum, built on proven protocols and stablecoin legislation is ready to keep cranking higher for the rest of the year. And instead of a Defi summer of emergence (2020), a multi season of adoption that takes it to half a trillion dollars, hitting these targets of a #HVF

@TheCryptoSniper

The components set to benefit are:

Uniswap #UNI ~ $12.3 Billion

Lido DAO #LDO ~ $9.1 Billion

Aave #AAVE ~ $7.5 Billion

MakerDAO #MKR ~ $4.6 Billion

GMX #GMX ~ $2.5 Billion

Curve #CRV ~ $1.9 Billion

Synthetix #SNX ~ $1.1 Billion

Pulsex #PLSX ~ $0.46 Billion

Key points:

The #TotalDefi index is currently at $117B aligning closely with the $123.6B of TVL

As we see hundreds of billions of dollars get digitized watch this index climb onwards and upwards... With $1 Trillion dollars and obvious milestone that is surely set to be met ... one day.

Plsx

PULSECHAIN v ETHEREUMFirst objective: To get back in the Yellow basing range.

Second objective: Test the upper boundary of the Yellow range.

Third objective: Breakout

Pulsechain's marketcap is less than the ETH that is publicly held by Richard Heart from the PLSX public raise.

Reminder RH beat the SEC

Funds are clear.

Tickers have regulatory clarity as deemed non securities.

Mid July Richard can talk freely if he so wishes.

Irrational prices right now.

Signs of capitulation on Twitter and on chain.

PULSEX TO DO A 17XPulseX DEX received one of the biggest public funding rounds in crypto history at 1 billion dollars.

It also is one of the few crypto tokens to receive regulatory clarity as been determined not to be a security.

It also trades at a 40% discount to that raise!

It also exhibits a wonderful technical pattern that is YET to trigger and breakout.

Which other crypto setup right now is giving you this kind of risk/reward?

PulseChain Unveiled: Scalability, Speed, & its Strategic Rise PulseChain is an Ethereum fork, aimed at addressing some of Ethereum's limitations like scalability and transaction fees. PulseChain was created by Richard Heart, who is also known for founding the HEX cryptocurrency. After years of anticipation, PulseChain's mainnet went live in May 2023. It was accompanied by significant community interest and a substantial airdrop.

Key Features:

Ethereum Compatibility: PulseChain is a full-state hard fork of Ethereum, meaning it replicates the entire state of Ethereum's blockchain, including all transactions, accounts, and smart contracts at the time of the fork.

Proof of Stake (PoS): Unlike Ethereum's previous Proof of Work (PoW) system at the time PulseChain was conceived, PulseChain uses a PoS consensus mechanism, which is more energy-efficient.

Lower Transaction Fees: One of the primary goals of PulseChain is to offer lower transaction fees compared to Ethereum, aiming to make it more accessible for users and developers.

Faster Block Times: PulseChain boasts faster block times (initially aiming for 10 seconds, later adjusted to 3 seconds) than Ethereum, which was intended to improve transaction speeds.

PLS Token: The native token of PulseChain is PLS, which is used for transaction fees, staking, and governance within the network. PLS tokens were distributed through a "sacrifice" phase where users donated various cryptocurrencies to receive PLS.

WPLS Token: The wrapped version of Pulse on PulseChain, known as Wrapped Pulse (WPLS), is a token that allows the native PulseChain token, PLS, to be used on decentralized exchanges (DEXs) and other platforms where native PLS might not be directly supported. This mechanism essentially extends the use of PLS beyond PulseChain's native network, enhancing its utility and reach across different blockchain ecosystems.

Use Cases and Ecosystem:

PulseX: PulseChain launched with its own decentralized exchange (DEX) called PulseX, similar to Uniswap, which allows token swaps on the PulseChain network.

Airdrops: The launch strategy included one of the largest airdrops in history, aiming to duplicate Ethereum-based tokens and NFTs on PulseChain, offering instant utility.

Validators: Users can stake PLS to become validators or delegate their stake to validators, securing the network and earning rewards.

Purpose: WPLS enables PLS to be traded or used in environments that require ERC-20 or similar token standards for compatibility, like certain DEXs on Ethereum or other blockchains.

Trading: WPLS can be bought, sold, and traded on exchanges, providing liquidity for PLS in different ecosystems.

Bridging: Users can bridge PLS from PulseChain to Ethereum (or vice versa) by converting it to WPLS, effectively allowing PLS to interact with Ethereum's ecosystem.

Availability: WPLS can be found on platforms like PulseX, PulseX V2, and other DEXs, with trading pairs against other cryptocurrencies such as Ether (ETH) or stablecoins.

DeFi: Apart from trading, WPLS can be used for yield farming, staking, or any DeFi application where PLS might not be natively supported.

Technical Analysis:

Presently, WPLS suggests a potential double bottom chart pattern. A double bottom formation is a chart pattern used in technical analysis that signals a potential bullish reversal after a downtrend.

Pattern Formation: It consists of two distinct troughs or lows at roughly the same price level, resembling the letter "W". The price drops to a support level, rebounds, then drops back to the same support level before finally rising again.

Support and Resistance: Between the two lows, there's a peak which forms a resistance level. The confirmation of the pattern occurs when the price breaks above this resistance.

Bullish Signal: The pattern indicates that sellers have tried to push the price down but failed twice at the same level, suggesting that buying pressure is starting to overcome selling pressure.

Volume: Ideally, volume decreases on the second bottom and increases significantly on the breakout above the resistance, confirming the reversal.

Trading: Traders might enter long positions when the price breaks above the resistance, setting stop losses below the double bottom to manage risk. The price target can often be estimated by measuring the height from the support to resistance and projecting that distance upward from the breakout point.

In essence, a double bottom pattern suggests that after testing a support level twice, the market might be ready to move upwards, indicating a shift from a bearish to a bullish trend.

Additionally, WPLS has reentered one of the most critical levels of the broader Fibonacci retracement tool, the 61.8% level or the Golden Ratio.

Golden Ratio: The 61.8% level is derived from the Golden Ratio, which is approximately 1.618 or its inverse, 0.618. This ratio is found in nature, art, and architecture, and in financial markets, it's believed to represent a natural balance point.

Support and Resistance: In market analysis, this level often acts as a significant support or resistance. If a price retraces to this level during an uptrend, it might be seen as a buying opportunity, suggesting the previous trend might resume. Conversely, in a downtrend, reaching this level might indicate a potential last chance for selling before a possible reversal.

Psychological Impact: Traders worldwide use Fibonacci levels, creating a self-fulfilling prophecy where many traders watch and act on the same levels, enhancing their significance due to collective market psychology.

Confirmation: A price reaction (bounce or rejection) at the 61.8% level can confirm the validity of the previous trend. If the price doesn't respect this level, it might signal a weakening of the trend or a deeper correction.

Risk Management: Traders often use the 61.8% retracement as a point to set stop-loss orders or to adjust their risk management strategies, knowing it's a level where the market might react strongly.

The 61.8% Fibonacci retracement level is pivotal in technical analysis because it aligns with the Golden Ratio, acts as a key support/resistance point, influences trader behavior due to its widespread use, and can provide insights into potential market turns or continuations. However, like all technical tools, its effectiveness should be combined with other forms of analysis for more reliable trading decisions.

TLDR:

PulseChain, represents a notable attempt to address Ethereum's scalability and transaction fee issues through its full-state hard fork approach, offering lower fees and faster block times. Its native token, PLS, along with its wrapped version, WPLS, extends functionality across different blockchain ecosystems, enhancing its utility for trading, yield farming, and staking. The recent technical analysis indicates that WPLS might be forming a double bottom pattern, suggesting a potential bullish reversal if the price breaks above the resistance formed by the pattern's peak. Furthermore, WPLS's reentry at the 61.8% Fibonacci retracement level, known as the Golden Ratio, adds another layer of significance, potentially acting as a critical support or resistance point. This confluence of technical indicators points towards a pivotal moment for WPLS, where the market could see either a resumption of the prior uptrend or a deeper correction if the levels are not respected. However, while these patterns and levels provide valuable insights, they should be approached with caution, ideally in conjunction with broader market analysis, due to the volatile nature of cryptocurrency markets. The success of PulseChain and WPLS will ultimately depend on ongoing network performance, community support, and the broader acceptance within the DeFi ecosystem.

Ideas on PLS/USD. High risk 2x Potential Cup and HandleOh boy, this is an interesting one. Read the long notes on the chart. MEXC:PLSUSDT may be forming a cup and handle, which would be great for ICO bag holders. Resistance levels at 0.0001 and 0.00023 from ICO taking or locking in profit.

PULSECHAIN Can 2.6X versus #ETH - W PatternWow #PLS got destroyed.

Retail investors got dunked on.

Richard Heart conducted a crowd raise to the retail public

with no cap.

It was heavily hyped.

So it was heavily oversubscribed.

there was no vesting period

usually 1-2 year period after a launch is the norm for VC/ accredited investors.

Expectations were not aligned with realities for normal people.

This allowed for a free for all of heavy selling

during which the network was just getting started & bootstrapped.

So I feel the pain of people who waited for 2 years only to have PLS drop 90% against #Ethereum

whilst ETH found it's bear market bottom at 880 dollars.

A double kicking to your private parts.

Max pain also brings Max reward.

Crypto profits are harvested from the tears of people who buy and sell at the wrong time.

I believe we can start seeing a recovery in this ratio going forward

and Also I still believe ETH will kick on to $3400 very soon.

Could PULSEX do a 12X from here?That is the Logarithmic cup and handle target

The current price is also around about the rate after bonuses that supporters of free speech and movement :) received with bonus amplifiers if they were in a large pool --- roughly I don't know the details

So it makes sense that numbers slightly above a 10X is where Pulsex may struggle, to get much beyond.

Lets see how this plays out

good luck in your speculations.

#PLSX

#PLS

#HEX

#RichardHeart

#SEC

HEX - Rallying war cry from Richard Heart!Evidence that RH is going to do battle with the corrupt SEC

from recent tweets.

Tweets like this give encouragement to the troops, and hopes for brighter days ahead.

Crypto speculators much like voters for in their political leaders crave exhibition of strength, & intelligence. This civil suit gives a platform for RH to demonstrate those key attributes...

Price action is a mixture of things

Confidence is a major part (along with momentum and liquidity obviously)

I still believe Pulsechain would be the asset of choice to accumulate

But #HEX and #PLSX will go along for the ride.

Fake Elon Tweet to Pump Hex?Pulse chain launch was an obvious buy the rumor sell the news event for hex as it clearly began to plumett within mintues of launch.

Personally I am far from a hex maxi and find little to no use for it.

At the end of the day it has a chart, community of supporters, and past explosive style price action. At this point it is CLEARLY not a scam there is just little to no need for it in the real world like many other coins. Extremely HIGH RISK / Reward environment.

Currently there is a tweet from elon musk responding to a statement metioning a "hexidecimal" where elon responds jokingly with "I have a fondness for Hex". Clearly a joke statement mimiking another three letter word spelled nearly the same.

Regarless Richard Heart was able to swoop in an take advantage with a response of thank you sparking a retweet frenzy as though elon was tweeing in support of it. Congrats hexicans lol.

Looking at a 4hr line chart it appears to be forming a possible cup and handle with very large swing trade ranges.

Not trading advice just an observaton. Trade accordingly if you choose.

LAST TANK 4 HEXload up on hex on this last dipp, there will be no more following

no financial advice -

new kid on the block pulsechain mainnet token $plsOptimistic for this fork of ethereum chain, Pulsechain has a big community and fan base. still early for technicals, but for me im buying a big bag and hodling, im expecting some upwards movement, from the bottom of this wedge, the weekends have lower volume then during the week, so it could go sideways, faster, cheaper, smoother than ether, ASX:PLS OSL:HEX AMEX:INC $plsx

.0004 Really Soon? OKX Launching PLS/USDTINEVITABLE. Okx is the first to list, soon we will see other exchanges following suit. Coinbase? Crytpo.com? See you guys at the top.

LESS THAN 500 DAYS 2 VICTORYThere is speculation of Pulsechain ( PLS ) & Pulesex (PLSX) launch, but one thing remains unchangeable: Hex on Ethereum (eHEX)

Let´s look back in 500 days and see how this turned out.

NO FINANCIAL ADVICE

Please do your own research, and do not use this as a projectile for your financial plan.

#HEX What if?...#Pulsechain launches towards the end of summer

10c is a clear psychological level, as is the most recent local high

The action around mainnet launch is going to be very volatile , much like pre and post big pay day.

The higher we go, the more stakes that will be EES'd as the price draws out that locked value, and we could see 10 cents tested again in the future.

What do u think?

Hex bull run headed to $1$1 is a bounce of 50% on the fib channel and about 26weeks of bull run...repeating similar overbought patterns on RSI and phoenix ascending.

If the liquidity keeps pumping in who knows how high it could go...possibly well beyond $1.

May get one more retrace to 5c before take off.

I hope everyone DCAd all the way down, keep your bags locked and take small profits because we could be at a whole new price range given 6-12 months.

LESS THAN 500 DAYS 2 VICTORYThere is speculation of Pulsechain ( PLS ) & Pulesex (PLSX) launch, but one thing remains unchangeable: Hex on Ethereum (eHEX)

Let´s look back in 500 days and see how this turned out.

NO FINANCIAL ADVICE

Please do your own research, and do not use this as a projectile for your financial plan.

PLSD PULSEDOGECOIN DAILY,ripping face & outperforming every coinRSI is getting wound up and will have to break out

to overbought position, or headed down to the bottom

of the RSI and will be a new bottom and oversold.

#HEX Bear market nearing completion!Gann Fann from the September top

has controlled the hex price, showing the various resistance and support lines which the price has respected.

#Hex can break free of the final Fan within the next two months!

We never got into the single digit territory, a front run from buyers stepping in.

Lining up perfectly for the much anticipated #PulseChain launch. Where it should be one the most liquid pairs with bridged liquidity back to #ethereum.

20-30 cent zone seems like a great price upon main-net release.

With price parity and staking rewards many people will see new ATH's on their portfolio values! Even after sacrificing for PLSX & PLS

Congratulations Hexicans!! Still only in it's third we have moved beyoind proof of concept, removed a good portion of speculators and with increased eyeballs from a new #Blockchain

Coin supply removed

A Hex price north of a $1 potentiality looks upon us within the coming 12 months :)

The most important chart of #HEX versus #BTCMost #alts cannot maintain value versus #Bitcoin on a meaningful timescale apart from #Ethereum

The history of older #altcoins over a period of more than 1 #crypto cycle has proven this.

In my eyes #HEX has held up quite well during its bear cycle, allowing early "lucky" or opportunistic investors to remove large amounts of value from this contract.

However its running consolidation against Bitcoin at these elevated levels since launch is setting up an explosive period of out performance.

The value of #pulsechain #hedron #pulseX could be the most value created in the entire Crypto ecosphere this year..

With scarcity of HEX showing itself in its realized inflation of 1.5% and supply shock on DEX's ... any new value created from pulsechain will provide a great catalyst to push hex on for the remainder of 2023.

A 88k Bitcoin at end of 2023 = $4.16 HEX

$22K BTC = $1.04 Hex

In regards to Bitcoin its recent action suggests we may have one push higher, rather than the bearish outlook that I feared was forming, which suggest an alt-coin run and renewed interest in crypto.