Plug Power (PLUG): Recovery Play or Terminal Decline?Plug Power Inc. (PLUG) , a company focused on green hydrogen and fuel cell technologies, stands as one of the most emblematic examples of a boom and bust cycle in the speculative clean energy sector.

It reached an all-time high of USD 75.49 in January 2021 , driven by market enthusiasm over the energy transition. However, since then, the stock has collapsed by more than 99% , hitting a low of USD 0.69 on May 16, 2025 . It currently trades below USD 2, reflecting a massive loss in market capitalization and deep investor distrust.

🧮 Fundamental Analysis

1. Business Model

Plug Power develops integrated systems for the generation, storage, and distribution of green hydrogen, mainly targeting logistics, mobility, and high-energy industrial sectors.

2. Financial Issues

Persistent losses: the company has been unprofitable for years. In 2024, it posted a net loss of over USD 700 million.

High operating costs and poor efficiency in hydrogen project execution.

Accounting concerns: the SEC flagged accounting issues in 2021 and 2022, further damaging institutional confidence.

3. Capital Dilution

Plug has repeatedly financed its operations through equity offerings, significantly diluting shareholders. Recent rounds were issued at very low prices, worsening the drop in share value.

4. Cash Position

As of June 2025, the company requires new capital to continue operations, facing the risk of issuing more shares or convertible debt under unfavorable terms.

⚠️ Key Risks

Delisting risk if the stock doesn’t remain above USD 1.00 in the short term.

Bankruptcy risk (Chapter 11) if no strategic financing or partnerships are secured.

The green hydrogen sector is still not cost-competitive without subsidies, and competition is fierce (Air Liquide, Linde, Bloom Energy, etc.).

✅ Opportunities

Potential to secure strategic alliances with utilities, automakers, or industrial partners.

Ongoing green subsidies from the U.S. and EU may offer short-term support.

Much of the negative outlook seems already priced in: current market cap is around USD 1.8 billion, with physical assets and contracts still in place.

📉 Technical Analysis

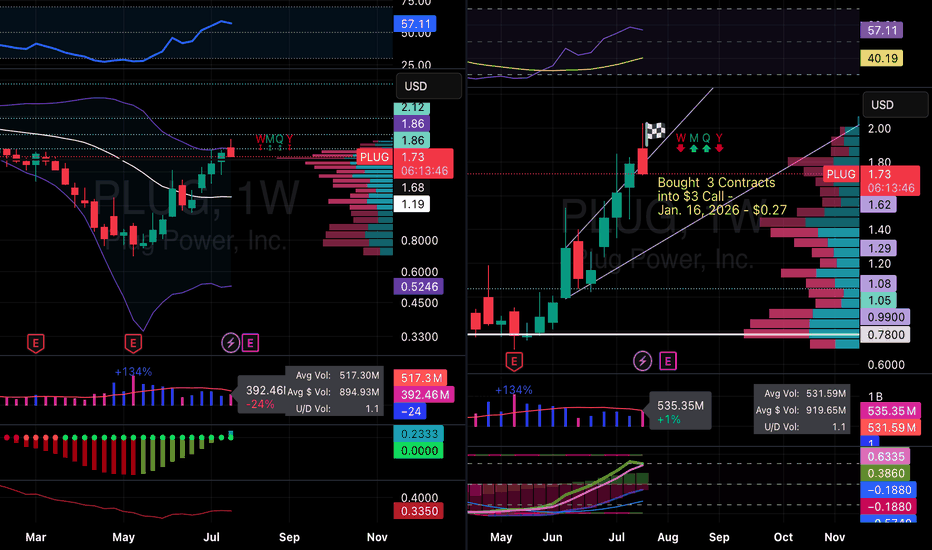

From its all-time low of USD 0.69, PLUG staged a strong rebound, gaining +294% to reach USD 2.03 on July 21, 2025 . It now trades in a consolidation zone between the 23.6% (USD 1.71) and 38.2% (USD 1.52) Fibonacci retracements , which may act as short-term technical support.

This is a high-risk, high-volatility stock , capable of generating outsized returns — or total losses. Strict risk management is essential.

Repeated Rejections at the 200-EMA

The 200-day exponential moving average (EMA 200) has acted as a dynamic resistance throughout PLUG’s multi-year downtrend. Over the past three years, the stock has attempted to break above it on at least three occasions — in 2022, 2023, and 2025 — but failed each time.

The most recent attempt, in July 2025, ended with a reversal after reaching USD 2.10, which also coincides with the 23.6% Fibonacci retracement from the all-time high. Unless the stock breaks above the 200-EMA with strong volume and an ascending price structure, the bearish trend remains intact.

🧠 Speculative Position

We are currently positioned with a bullish options strategy targeting a speculative upside:

📈 Buy CALL USD 2.00 (exp. January 16, 2026)

🛡️ Sell CALL USD 5.00 (same expiration)

→ This forms a Bull Call Spread, limiting downside risk while maintaining a favorable risk/reward ratio.

🧾 Conclusion

Plug Power is no longer a fundamentally sound investment , but rather a high-risk speculative play , comparable to a synthetic long-term call option . If the company survives, restructures its balance sheet, and secures strategic partners, the upside could be substantial — but the risk of total capital loss remains very real .

🧭 Suitable only for experienced traders with speculative capital and disciplined technical execution.

PLUG

Plugged InIn looking at the money flow for NASDAQ:PLUG , I see the EMAs 8 day and 21 day crossing into a new uptrend. The RSI is still below the overbought territory. The weekly is down with volume pouring in to get ready for the next leg. Sellers are slowing with the MACD. Looking ahead the money in the past has flowed into PLUG in the winter, therefore winter contracts look well priced and primed for the future growth based upon today's information. Let's see where it goes.

Remember do your own due diligence and research. Past performance doesn't equal future performance.

Plug Power: A Mirage or a Miracle?Plug Power (NASDAQ: PLUG), a key innovator in hydrogen energy solutions, recently experienced a significant surge in its stock value. This upturn is largely attributed to a strong vote of confidence from within the company: Chief Financial Officer Paul Middleton substantially increased his stake by acquiring an additional 650,000 shares. This decisive investment, following an earlier purchase, clearly signals robust conviction in Plug Power's future growth trajectory, despite prior market challenges. Analysts also reflect this cautious optimism, with an average one-year price target that suggests a significant upside potential from the current valuation.

A major catalyst for the renewed interest stems from Plug Power's expanded strategic collaboration with Allied Green Ammonia (AGA). This partnership includes a new 2-gigawatt (GW) electrolyzer project in Uzbekistan, part of a substantial $5.5 billion green chemical production facility. This facility will produce sustainable aviation fuel, green urea, and green diesel, positioning Plug Power's technology as foundational to large-scale decarbonization efforts. This initiative, backed by the Government of Uzbekistan, further solidifies a broader 5 GW partnership between Plug Power and AGA across two continents, highlighting the company's capability to deliver industrial-scale green hydrogen solutions.

While these strategic wins are promising, Plug Power continues to navigate financial headwinds. The company has faced recent revenue declines and currently reports significant annual losses and cash burn. To address capital needs, it is seeking shareholder approval to issue more shares. However, the substantial, multi-gigawatt contracts secured, particularly with Allied Green, underscore a strong future revenue pipeline. These projects affirm the critical demand for Plug Power's technology and its pivotal role in the evolving green hydrogen economy, emphasizing that the successful execution of these large-scale ventures will be key to long-term financial stability and sustained growth.

PLUG 1D Investment Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ volumed TE / T1 level

+ support level

+ biggest volume 2Sp-

+ weak test

+ first buying bar close level

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly Trend

"+ long impulse

+ support level

+ T2 level

+ biggest volume reaction bar

= below 1/2 correction"

Yearly CounterTrend

- short impulse

PLUG 1H Long Swing Conservative Trend TradeConservative Trend Trade

+ long impulse

+ 1/2 correction

+ volume zone

- strong approach

+ ICE level

+ support level

+ volumed Sp

Calculated affordable stop limit

1 to 2 R/R take profit

Daily Trend

"- short impulse

+ volumed TE / T1 level

+ support level

+ biggest volume 2Sp-

+ weak test"

Monthly Trend

"+ long impulse

+ support level

+ T2 level

+ biggest volume reaction bar

= below 1/2 correction"

Yearly CounterTrend

- short impulse

Will add more after successful test on 1H and / or after test completes on 1D.

PLUG power consolidation completed! Buy setupBuying now at discount levels near structural support. Expecting bullish thesis to be solidified once we recover above 1.9-2.2 levels.

Expecting fairly rapid progression to gap fill targets by 2026.

Strongly likely we see 6$ before summer 2025 & 10-12$ levels by end of yr

Planning to scale out of buy positions primarily at 10-12$ range. Will leave remainder for long term speculation for possible 14-20$ levels.

PLUG Powering Up For A Breakout?!Here I have NASDAQ:PLUG on the Daily Chart!

We can see that Monday, November 4th gave us a Very Bullish break to the Falling Resistance Price has been contained by forming the Wedge Pattern and with the Bullish Volume following the Break, gives this pattern a Bullish Bias after the strong decline since Jan. 2021.

The push for Greener and Cleaner way of Living and Transportation has the world in High Search for Electric Alternative means of fuel and along the pathway of Lithium and Rare Earth Metals is a new theory of Hydrogen powered Fuel Cells!

Currently Price is at $2.52, struggling with a Local Resistance Level after Price reached a new 4-Year Low @ $1.60, close to All Time Low @ .1155 visited in Jan. 2013. With the tight consolidation underneath the Falling Resistance followed with a Break candle and Close candle Above of the Falling Resistance, Confirms a Valid Break of said Falling Resistance and indicates Bullish Sentiment entering the market.

-Now, we must wait to see if Price decides to retest the Break of Falling Resistance around ( $2.25 - $2.20 ) and if Supported successfully, would generate a great Buying Opportunity!

-If Price does found Support here, I suspect Price we will run into Resistance @ ( $3.55 - $ 3.22 ) then will aim for the Fair Value Gap formed @ ( $5.58 - $5.14 )

Indicators:

- RSI Crossing 50

- Large Bullish Volume

Plug Power's Trend May Be Reversing Upward: First Target at $5NASDAQ:PLUG has lost 98% of its value since the beginning of 2021. Despite three corrections during this period, a trend reversal has not occurred.

However, the demand seen since September 2024 indicates that the price might be in a trend reversal phase.

If this is the case, the first price target is expected to be $5. Should the upward trend continue, the second target could be $7.5.

Target 28Following weekly chart.

Finally I got a bullish signal from my indicator, it's a nice time to buy before week close.

TP1 6.95

TP2 12.66

TP3 24

And Falling wedge break target 28

Also following EMA 100 which is 9.02 right now.

I will stop if the weekly close is under 2.21

Other than technical stuff, the company gets a huge loan guarantee, which supports technical insights.

Any comments on your side?

PLUG, getting ready for multi WEEKLY GAINS!PLUG is registering massive volume accumulation this past four weeks.

Net buy volume has surged +34% from its average numbers -- where buyers are getting ready to overtake sellers in anticipation of the stock's long term future upside valuation.

On weekly histogram, higher lows has been created -- conveying the incoming price growth of the stock.

Bubble up volume (bottom indicator) consistent appearance this past 4 weeks (after 4 months of continued sell off) is cementing the stocks intention to finally shift the trend -- to the upside.

Fundamentally, the management sees a rosier future revenue-wise with upcoming innovation / products despite stiff competition.

Spotted at 10.0

TAYOR.

Safeguard capital always.

------------------------------

FUNDAMENTAL NEWS : Reference TVIEW site.

Why did Plug Power stock pop today? CEO sees 2023 sales above consensus

Jun 13, 202307:37 GMT+8

Plug Power

PLUG surged to its highest in more than two months, +13.1% in Monday's trading after the company detailed plans for its investor day on Wednesday, which included above-consensus guidance for 2023 sales.

CEO Andy Marsh said visitors to its Rochester, N.Y., gigafactory will be able to "witness firsthand that we are not only selling and deploying tangible products but have also scaled up operations, supports our near-term revenue goals of $1.4 billion in 2023 and our long-term target of achieving annual sales of $20 billion by 2030."

Plug's new 2023 sales estimate is ahead of the $1.29B analyst consensus estimate and nearly double the company's 2022 revenues of slightly more than $700M.

US Offers Conditional $1.66 Billion Loan to Plug Power Inc.The U.S. Department of Energy has announced a conditional loan guarantee of up to $1.66 billion for Plug Power Inc, ( NASDAQ:PLUG ) aimed at facilitating the construction of up to six clean hydrogen production plants. The produced hydrogen is intended for use in fuel cell-electric vehicles for material handling, transportation, and heavy industry. The initiative is expected to yield an 84% reduction in greenhouse gas emissions compared to conventional hydrogen production methods, which rely on natural gas and result in significant carbon dioxide emissions unless captured and stored underground.

The current administration sees low-carbon hydrogen as pivotal in addressing climate change, particularly in powering heavy industries such as aluminum, cement, and steel, as well as long-haul transportation. The Department of Energy's Loan Programs Office emphasized that this move is set to unlock the potential of clean hydrogen, thereby contributing to the growth of a robust, American-led industry.

Plug Power's technology, known as electrolyzer stacks, will be utilized in the clean hydrogen plants. These electrolyzer stacks are manufactured at the company’s facility in Rochester, New York. Notably, Plug Power ( NASDAQ:PLUG ) is a leading commercial-scale manufacturer of electrolyzers in the United States.

Technical Outlook

Plug Power stock ( NASDAQ:PLUG ) was up 40% on Tuesday's market trading. The stock has risen from a falling wedge pattern trading with a moderate Relative Strength Index (RSI) of 67.31 which is sparsely overbought. The stock is trading slightly above the 100-day Moving Average (MA).

PLUG set up on support for Long EntryPLUG is on a 60 minute chart ascending in a relatively parallel channel and oscillating within

it. Price has cycled into the lower thick green support trendline. A falling wedge pattern is seen

It is now on its second touch of the support. PLUG has gained 75% in three weeks. As a green

energy small cap, it is sharing an uptrend with FCEL, QS and others.

I find PLUG properly situated to add to my position taking a trade of more shares long. I call it

buying a fall into support and buying a falling wedge set up for a breakout ( again).

Yesterday a successful put option scalp provided profit to redeploy here. I will roll over

options expiring February 16th into March 16th. The monthly call contracts have the narrower

spreads and better liquidity from volume.

PLUG Charts Course for Growth Amidst Green Hydrogen RevolutionsPlug Power Inc (NASDAQ: NASDAQ:PLUG ) has emerged as a trailblazer in the green hydrogen economy, reporting a year of strategic growth and operational milestones in its latest financial results. As the world shifts towards cleaner energy alternatives, PLUG's commitment to driving sustainability and energy independence through innovative hydrogen solutions has positioned it as a frontrunner in the transition to renewable energy sources.

Fueling Operational Excellence:

NASDAQ:PLUG 's relentless pursuit of operational efficiency has propelled significant revenue growth, underscored by advancements in hydrogen production capabilities and the expansion of its energy solution portfolio. The successful commissioning of the Georgia hydrogen plant, boasting the largest PEM electrolyzer system in the U.S., highlights PLUG's dedication to scaling up hydrogen production infrastructure.

Innovative Product Offerings and Market Expansion:

PLUG's foray into new product launches, including hydrogen storage tanks and mobile liquid hydrogen refuelers, showcases its commitment to driving innovation in the energy sector. Moreover, the expansion of NASDAQ:PLUG 's installed base with key customers and the introduction of a new platform for mid-market material handling sites signify its growing footprint in the material handling space.

Strategic Investments and Market Positioning:

Beyond operational achievements, NASDAQ:PLUG 's strategic investments aimed at promoting global sustainability and energy independence have reinforced its market positioning. With over 69,000 fuel cell systems deployed and plans to operate a green hydrogen highway, NASDAQ:PLUG is not just a player but a leader in the hydrogen fuel cell technology market. By targeting multiple green hydrogen production plants, NASDAQ:PLUG is laying the groundwork for a sustainable energy future.

Path to Decarbonization:

PLUG's CEO envisions a future where decarbonizing the economy is not just a goal but a reality. Through its green hydrogen initiatives, NASDAQ:PLUG is driving tangible progress towards achieving this vision.

Uline and Plug Power Forge Ahead with Hydrogen PartnershipPlug Power Inc. (NASDAQ: NASDAQ:PLUG ) and Uline, the renowned distributor of shipping and packaging materials, have announced a groundbreaking expansion of their partnership. This strategic collaboration underscores Uline's unwavering commitment to harnessing cutting-edge technology for operational excellence while propelling Plug Power into the forefront of the green hydrogen revolution.

The cornerstone of this expanded partnership is the deployment of Plug's state-of-the-art hydrogen infrastructure and fuel cell solutions at Uline's new campus in Kenosha, Wisconsin. With an eight-year commitment and a hefty $20,000,000 expansion investment, Uline is set to revolutionize its operations by embracing hydrogen-powered logistics on an unprecedented scale.

The integration of on-site hydrogen infrastructure, featuring an 18,000-gallon hydrogen storage tank and 17 hydrogen dispensers, will service four distribution centers within Uline's sprawling Kenosha campus. Furthermore, the partnership entails the adoption of 250 fuel cell forklifts, leveraging hydrogen generated on-site to fuel their operations. This visionary move not only enhances operational efficiency but also underscores Uline's dedication to sustainability and innovation.

Wade Goff, Director of Redistribution at Uline, lauds the transformative impact of Plug's hydrogen and fuel cell technology on their operations. He emphasizes how these solutions have significantly boosted productivity, aligning seamlessly with Uline's core principles of speed, passion, and operational excellence. By prioritizing the adoption of hydrogen-powered logistics, Uline sets a new benchmark for environmental stewardship within the distribution industry.

Andy Marsh, CEO of Plug Power ( NASDAQ:PLUG ), hails the expanded partnership with Uline as a testament to the game-changing potential of hydrogen and fuel cell technology. He emphasizes how Plug's solutions deliver unparalleled benefits in terms of productivity and predictability, perfectly aligning with Uline's business strategy of same-day turn-around. This collaboration not only reinforces Plug's position as a global leader in comprehensive hydrogen solutions but also underscores its pivotal role in driving the green hydrogen economy forward.

The roots of this transformative partnership date back to 2015 when Plug and Uline first joined forces at Uline's distribution center near its corporate campus in Pleasant Prairie, Wisconsin. Over the past eight years, Uline has leveraged Plug's fuel cell solutions across its operations, operating 270 fuel cell forklifts across six facilities. With this expanded partnership, Uline is poised to operate a total of 520 fuel cells and 34 dispensers across ten facilities, cementing its status as one of Plug's largest customers.

As Plug's hydrogen infrastructure takes shape at Uline's Kenosha campus, the stage is set for a paradigm shift in the logistics landscape. As Uline and Plug Power ( NASDAQ:PLUG ) forge ahead, they pave the way for a greener, more efficient future in logistics, leaving an indelible mark on the path to a hydrogen-powered world.

QS rising into earnings has shown momentumon the 15- minute gaining 4.6% in the Monday trading. The chart shows price crossing through

the high volume area from underneath it on Tuesday Feb 6th the breaking out from the upper

boundary with a retest the following two mornings and then separation from the high volume

area after that. Trading volumes have been consistent and constant with spikes after the

morning opens. QS has some attention as both a technology stock and a green energy penny

stock. I see this long trade as having a potential to go 10-15% if it beats the earnings forecasts.

The dual time frame RSI indicator is used to pinpoint best entries especially if scalping or

options trading. The best entry is on a lower time frame 3-5 minutes and the green faster RSI

crossing over the slower red line and both being over the 50 level. Good luck to traders

that take this trade.

FCEL Energy Penny Stock Buy the near term Bottom LongFCEL a penny alternative energy stock is at a near-term bottom sitting at the POC line

of the volume profile and a standard deviation below the intermediate-term mean VWAP

about a month out from a good earnings beat. Given the current administrations unwavering

support for green enerby sometimes with grants subsidies and other hand- outs I see FCEL

as getting some trader attention of the good kind unlike PLUG which announced a large public

offering to dilute investors. FCEL could steal some of those investors. The supertrend indicator

is signaling a reversal at the confluence of the POC line with the VWAP band as

mentioned. My target is the mean VWAP at 1.50 for about 35% upside with a stop loss at

the recent pivot low of $1.09 making for a reward-to-risk ratio of better than 6.

I see this as a swing trade with potentially 75 days in front of it given the earning report

for 24Q1 is due a bit beyond that and best risk management would be to take a partial

and size down going into earnings.

PLUG - flagging at rest for continuation LONGPLUG on the 120 minute chart is resting on its trend up. Earnings are about 4 weeks ahead.

The uptrend has been solid. Two bull flag patterns are noted along the way. They follow

pops on the Relative Trend Index indicator also showing bullish buying volatility on the

Relative Volatility indicator. I see the rest ( consolidation) as a good point to add into my

ongoing long position for PLUG which recently got an upgrade and higher target by more than

one analyst. For a basic and simple trade, take the 3rd upper VWAP band at 6.35 as the target

the mean VWAP at 4 as the stop loss for a basic3:! R:r trade. For something better zoom into

a 15-30 minute time frame reset the anchored VWAP and fine tune.

PLUG 's momentum continuation LONGPLUG's momentum had a good move today. PLUG is moving in a descending channel. Today

other EV stocks including TSLA, LCID, NKLA, FSR had big moves. TSLA's was the smallest in

percentage but the biggest in market cap regain. PLUG is now at the 0.5 Fib

retracement level. The zero-lag MACD and dual TF RSI indicators are about to cross the zero

and 50 levels respectively. The predictive tool ( Echo by LuxAgo) predicts a move to

5.95 by mid-February. This is about 50%. With the 11% move today, PLUG could be getting

overextended but the algo does not suggest that. As with other penny stocks risks are high but

a return of 50% in three weeks would offset the risk. I will trade PLUG here using a stop-loss

of 3.55 below that black horizontal Fib level. My $3.5 options for 2/2 did 300% unrealized

today. In the next 2 days I will roll them forward into the 2/16 expiration $4.5 strikes.

PLUG OR UNPLUG here are some lines.

I have no idea what it will look like, but there is definitely a massive downtrend that needs to break first. I mean, literally, once it breaks, pretty bullish to like 18, and there is potential to see some crazy numbers again, such as 54.

I like 6.54 or so as a potential buy target, but there is a low all the way down to 4 dollars. I think in the short term, it holds the $6.50 mark, but we could see like 5.98 or something quickly. If we see the $4 mark, it's probably going to be from that rejection trend. If we see it on the top side of the trend, BULLISH, if we see it on the bottom, be careful.

Plug Power's Green Hydrogen Plant Ignites Investor OptimismThe stock of hydrogen fuel cell company Plug Power (NASDAQ: NASDAQ:PLUG ) has been on a remarkable ascent, surging over 25% in the past five trading days alone. This impressive rally is attributed to several catalysts, including today's surge of 19.3% . Amidst a challenging period marked by a "going concern" warning in its third-quarter report, Plug Power ( NASDAQ:PLUG ) seems to be staging a remarkable comeback, fueled by a significant development: the operation of its new green hydrogen plant in Georgia, now touted as the largest liquid green hydrogen facility in the U.S.

Green Hydrogen Plant: A Financial Turning Point

After weathering a storm of financial uncertainty and a plunge in its stock value, Plug Power ( NASDAQ:PLUG ) provided a business update last week that breathed new life into the company. The cornerstone of this update was the successful commencement of operations at its green hydrogen plant in Georgia. The plant not only signifies a pivotal step towards sustainability but also a potential financial turning point for the company.

Cutting Costs and Boosting Revenue:

Plug Power ( NASDAQ:PLUG ) has faced financial challenges, including cash burn due to delays in its hydrogen production plans, leading to the purchase of hydrogen on the open market. However, the new Georgia plant is poised to be a game-changer, helping the company to cut costs and bolster revenue generation. With the plant now operational, Plug Power ( NASDAQ:PLUG ) is positioning itself to harness the growing demand for green hydrogen, driven by its applications in diverse industries.

Steel Industry Embraces Hydrogen:

The optimism surrounding Plug Power's ( NASDAQ:PLUG ) stock is further fueled by endorsements from industry players, including a notable mention from Cleveland-Cliffs, a leading U.S. steelmaker. In a recent fourth-quarter conference call, Cliffs CEO Lourenco Goncalves emphasized that "hydrogen is the real game-changing event in ironmaking and steelmaking." Goncalves's statement highlighted the transformative potential of hydrogen in these industries, positioning the United States as a frontrunner in adopting competitively priced green hydrogen for a true green industrial revolution.

The Road Ahead:

While Plug Power's ( NASDAQ:PLUG ) recent achievements have fueled optimism, it's essential for investors to remain cautious. The company is still on a journey toward realizing profits from its hydrogen production plans. As the new production facility ramps up, challenges and risks remain. Investors should carefully monitor Plug Power's ( NASDAQ:PLUG ) progress and be mindful of the evolving landscape in the hydrogen sector.

Conclusion:

Plug Power's ( NASDAQ:PLUG ) recent surge in stock value is indicative of a renewed optimism, driven by the successful launch of its green hydrogen plant in Georgia. With the potential to cut costs, boost revenue, and tap into the burgeoning demand for green hydrogen, Plug Power ( NASDAQ:PLUG ) is positioning itself at the forefront of the hydrogen revolution. As the company digs out of its financial hole, investors should tread carefully, mindful of the risks involved, even as Plug Power's ( NASDAQ:PLUG ) new production facility promises to be a catalyst for the company's future success in the evolving green energy landscape.

PLU Power Price crushed by dilution announcement LONGOn the 15 minute chart, PLUG got a deserving bad haircut today on the dilution announcement.

Buying shares in a chas burning enterprise is risky business. However, the prospects of

a rescue with a federal grant from the Green Left initiative can come any time. Shares

are on sale. So are OTM call options expiring after the recovery if there is one. Price is

showing a glimmer of a bounce with upgoing MACD lines and the fast RSI line rising and crossing

over the slower one and heading to the 50 level. I will take a long trade when price

gets through the Ichimoku cloud at 3.15 with a stop just below the cloud. I may add to

it when price gets over the upper VWAP band situated at 3.5 which is confluent with

the 0.5 Fib retracement price value. As a penny stock, all can afford

stock or options. As to the options, the monthly in two days if only a prospect for those trading

options.in a day-trade or nearly day trade fashion, I will look at the February 16 expiring

options with a strike of $ 4.00 to $ 5.00 and take a bunch of them allowing for secondary

targets and taking partial profits.