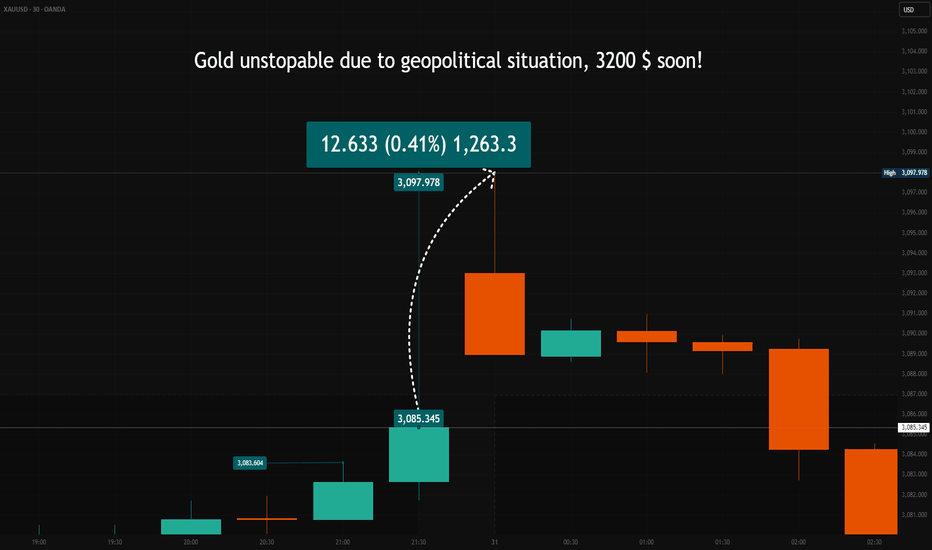

Gold Price Surges Amid Market Uncertainty – What’s Next?The late Friday session on March 28, 2025, ended with a strong rally in gold, as multiple price candles attempted to push higher. By 10 PM CET, gold had settled at $3,085.345, reflecting significant bullish momentum.

As the market reopened on Monday, the gold price gapped up by approximately +$12.5 , opening at $3,097.978 .

This type of price gap typically occurs when buyers are willing to pay more than the previous session’s close, signaling strong demand.

What’s Driving the Gold Rally?

The answer lies in a mix of tariffs, war, and recession fears. The global financial landscape remains highly unstable, and in times of uncertainty, gold historically acts as the preferred safe-haven asset. Investors are flocking to the precious metal as a hedge against economic instability.

Adding fuel to the fire, on April 2nd, additional U.S. tariffs imposed by President Donald Trump are set to take effect. This move could further disrupt markets, potentially driving even more capital into gold.

The Interest Rate Factor – A Hidden Risk?

While gold is surging, there’s a crucial factor to watch: Federal Reserve policy. So far, Fed Chair Jerome Powell has maintained a cautious stance on interest rates. However, if the situation deteriorates, the Fed might be forced to cut rates earlier than expected to stabilize the economy.

This could create a paradox for gold traders. While rate cuts typically support gold in the long run, a sudden policy shift could trigger a short-term sell-off as investors adjust their positions. If that happens, gold could see a sharp correction before resuming its trend.

Final Thoughts

Gold remains in a strong uptrend, but traders should stay cautious. If the Fed pivots and announces rate cuts sooner than expected, we could see a pullback in gold before the next leg higher. The coming days will be critical – keep an eye on April 2 and any shifts in Fed policy that could shake up the market.

👉 Will gold continue its rally, or are we facing a major pullback? Share your thoughts in the comments! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Political

Is the Euro's Stability a Mirage?The Euro Currency Index stands at a crossroads, its future clouded by a confluence of political, economic, and social forces that threaten to unravel the very fabric of Europe. Rising nationalism, fueled by demographic shifts and economic fragility, is driving political instability across the continent. This unrest, particularly in economic powerhouses like Germany, triggers capital flight and erodes investor confidence. Meanwhile, geopolitical realignments—most notably the U.S.'s strategic pivot away from Europe—are weakening the euro's global standing. As these forces converge, the eurozone's once-solid foundation appears increasingly fragile, raising a critical question: is the stability of the euro merely an illusion?

Beneath the surface, deeper threats loom. Europe's aging population and shrinking workforce exacerbate economic stagnation, while the European Union's cohesion is tested by fragmentation risks, from Brexit's lingering effects to Italy's debt woes. These challenges are not isolated; they feed into a cycle of uncertainty that could destabilize financial markets and undermine the euro's value. Yet, history reminds us that Europe has weathered storms before. Its ability to adapt—through political unity, economic reform, and innovation—could determine whether the euro emerges stronger or succumbs to the pressures mounting against it.

The path forward is fraught with complexity, but it also presents an opportunity. Will Europe confront its demographic and political challenges head-on, or will it allow hidden vulnerabilities to dictate its fate? The answer may reshape not only the euro's trajectory but the future of global finance itself. As investors, policymakers, and citizens watch this drama unfold, one thing is clear: the euro's story is far from over, and its next chapter demands bold vision and decisive action. What do you see in the shadows of this unfolding crisis?

Can France’s Economy Defy Gravity?The CAC 40, France’s flagship stock index, showcases the nation’s economic strength, driven by global giants like LVMH and TotalEnergies. With their vast international presence, these multinational corporations provide the index with notable resilience, allowing it to endure domestic challenges. However, this apparent stability masks a deeper, more intricate reality. Beneath the surface, the French economy grapples with significant structural issues that could undermine its long-term success, making the CAC 40’s performance both a symbol of hope and a point of vulnerability.

France confronts multiple internal pressures that threaten its economic stability. An aging population, with a median age of 40—among the highest in developed nations—shrinks the workforce, increasing the burden of healthcare and pension costs. Public debt, projected to hit 112% of GDP by 2027, restricts fiscal flexibility, while political instability, such as a recent government collapse, hampers essential reforms. Compounding these issues is the challenge of immigration. France’s immigrant population, particularly from Africa and the Middle East, faces difficulties integrating into a rigid labor market shaped by strict regulations and strong unions. This struggle limits the nation’s ability to leverage immigrant labor to offset workforce shortages while straining social unity, adding further complexity to France’s economic challenges.

Looking forward, France’s economic future hangs in the balance. The CAC 40’s resilience offers a buffer, but lasting prosperity depends on tackling these entrenched problems—demographic decline, fiscal constraints, political gridlock, and the effective integration of immigrants. To maintain its global standing, France must pursue bold reforms and innovative solutions, a daunting task requiring determination and foresight. As the nation strives to reconcile its rich traditions with the demands of a modern economy, a critical question looms: can France overcome these obstacles to secure a thriving future? The outcome will resonate well beyond its borders, offering lessons for a watching world.

England's Economic Crossroads and Banking ResilienceEngland’s economy is facing a complex array of challenges, driven by domestic social unrest, geopolitical tensions, and evolving labor dynamics. Recent riots, sparked by both marginalized Muslim communities and extreme right-wing groups, highlight deep-seated socio-economic issues. These tensions have been exacerbated by international events, such as the October 7, 2023, incident in Israel, which reverberated through England's Muslim community.

In addition to these social and geopolitical pressures, the economic indicators present a mixed picture. Inflation, unemployment, and a housing crisis have strained the economy, while regional conflicts, such as the Middle East and Russia-Ukraine wars, pose further risks to energy prices, trade, and security.

Amidst this backdrop, the Bank of England’s recent declaration that top UK lenders can be dismantled without taxpayer bailouts is a significant milestone. This statement reflects the progress made since the 2008 financial crisis in enhancing the resilience of the UK banking system through stricter capital requirements and resolvability assessments. However, emerging risks such as climate change, cyberattacks, and global financial interconnectedness require continuous vigilance and robust regulation.

Inspiration and Challenge:

As traders and investors, understanding the interplay between social dynamics, geopolitical tensions, and financial stability is crucial. England’s current economic state challenges us to think beyond traditional metrics and consider the broader implications of regional conflicts and social unrest on financial markets. The resilience of the UK banking system offers a glimmer of stability, but it also calls for ongoing scrutiny of emerging risks. Engage with this analysis to deepen your strategic insights and navigate the complexities of the global economic landscape.

Aussie depends on the economic conditions of ChinaWhile so many analysts believe that China will reduce Covid-19 restrictions and Aussie will start a bullish rally, I think authoritarian regimes do not care about demonstrations. Because giving importance to demonstrations is a message to the people that you will get the rest of your rights with demonstrations.

So any bullish breakout may turn out to be a false one. I'm looking for short trades now!

I'll risk less than normal on the USDCADDear colleagues, due to the continuation of the Iranian revolution against the Islamic regime and the ongoing violence of the oppressors of the ruling government of Iran, the possibility of insecurity in the Middle East region and oil export becoming extremely difficult is not zero. These conditions can increase the price of oil and the Canadian dollar. Of course, these events will have an impact in the long term, but for short-term analysis, it will also have an impact due to the fear of long-term actors.

My first short limit order will be around 1.3666

Trading the FOMC MeetingTomorrow we have another FOMC meeting. In 2022 we've seen ~3% moves during and/or by end of next day (shown on chart).

In my opinion (not financial investment advice)... There will be an initial move and then a rip in the opposite direction for a big move, as has happened in the past.

As bearish the economy is and I am personally, we may hear pre-midterm political "pivot" talk to drive markets up for voters. That said, tomorrow we could see a fast move lower followed by a rip up to ~4100 to fill that gap you see in the chart.

Whatever happens it will be extremely volatile.

Keep your stops tight and/or entry's accurate.

What you'll see on the chart is a gap indicator along with a market breadth indicator. We're finishing up these 2 free indicators and will be posting them for people to use very soon.

Good luck trading!

Market DislocationsAsset Bubbles

Political Events

Natural Disasters

Bankruptcy

Flash Crashes

The perfect cocktail exists currently as all of the below are relevant:

Asset Bubbles - Valuations are distorted by any Metric.

Political Events - Uncertainty continues to build.

Natural Disasters - Warnings on many potential Events.

Bankruptcy - The Federal Reserve is buying JUNK.

Flash Crashes - 1962 & 1987: Fear feeds upon itself.

Leverage only serves to create exponential Risk on the downside

as Volumes are outsized.

Both these events had immense support, the Fear overwhelmed intervention.

3 "Hydroxychloroquine is dangerous" study authors retract"Conspiracy theory". Took less than 1 month to prove me right. "I LiStEn To wHaT sCiEnCe SaYs".

I know I'll always be on the right side of history, what I don't know is how long it will take.

The enemy of the people perma progressives have already ignored the will of the majority many times and said they would not let go of power and use force if necessary?

The people of the UK were the first (again) to win their fight against the enemy of the people.

They probably feel they have to act now before the public regains power, and move to establish their NWO.

"A tribune of the plebs assaulted on the steps of the Senate house! Can you imagine a more terrible sacrilege? Our beloved Republic is in the hands of madmen. This is a dark day, and I stand at a fork in the road. I can abide the law and surrender my arms to the Senate - and watch the Republic fall to tyranny and chaos. Or, I can go home with my sword in hand and run those maniacs to the Tarpean Rock!" - Julius Caesar

The "democracy" paradigm of the last 2 centuries has brought the biggest inequality in human history, as well as the worst maniacs.

That absolute failure won't last forever.

Huge paradigm shift, huge, the biggest in hundreds of years.

I missed getting rich and building a bunker by little, or maybe there still is time.

The safest best way to go throught this would be to live in a nice rural area really far from any big city, and be self sufficient (electricity food water).

The world can become a banker run hell, or it could become a libertarian paradise of freedom and order.

The maniac sociopaths pedos murderers and rapists have to be ousted, this will be one of the greatest days for humanity.

SP500 What next?Hello investor,

SP500 is on important Support level region, we have buying defence on this level in the past few days. Yesterdey seens to be broken on downtrend side but today is forming a huge Bear trap in this level, we are also breaking the downtrend short term resistance line. We are facing a very delicated moment in the global economy, we cant predict what come next, the political decisions will make the SP500 next move go up or down, the virus situation will make the sp500 go up or down, in scenario like this tecchinical analyses we only will make our moves if the chart tell us what to do, but for this we need to wait the fundametal directed the price.

Please, push like button and follow us in our social medias.

Sterling: High volatility expected early next weekWell referenced political news is important.

Sterling could see serious volatility next week if political pundits are correct about Theresa May being forced out of her premiership next week in relation to Brexit confusion.

Rival MPs are already jostling for position as Wednesday is the big day.

The uncertainties could send GBP pairs into high volatility between 15 min to 4H time frames.

Avoid FOMO and getting stung, if you can.

EUR / TRY - Politics to remain on the spotlightSince late January, the Central Bank of the Republic of Turkey has produced consistent efforts to stabilize the currency. This has produced tangible results with a upward correction although persistent political tensions. Erdogan's referendum victory is likely to be the most market-friendly option. A "No" scenario may lead to early elections and a period of political uncertainty.

BREXIT & GEO-POLITICAL AFTERMATH: SHORT GBPUSD - HOW TO TRADEGBPUSD

- At the end of last week GU traded to lows of 1.32 on the brexit vote, before retracing substantially to 1.39 by the end of the day.

- GU retraced 600-700pips after the brexit event IMO solely as investors took profit from their shorts (which causes buying) - thus there was no structural reason for GU recovering e.g. it was that 1.32 had mispriced GU too low for the brexit vote.

On the back of this I expect the following for GU this week:

1. I have a 8/10 short conviction on GU and ultimately believe it will trade <1.30 by weeks end for the following reasons: -

- As on friday, the bearish movements we saw on GBP were 90% fast money trades and NOT real/ slow money positioning (due to different regulations and trading strategies) therefore, this week, slow/ real money will now be able to get behind the short sterling move thus providing momentum for GBP to move lower and sub 1.30.

*Fast money is hedge funds and slow money is asset managers*

- David Cameron UK PM also resigned following the result, thus putting further downside expectations on GBP in the near-medium term particularly as it as all come at once.

- Also the BOE plans to increase its QE by 66% 350bn to 600bn to support markets but this printing increasing GBP money supply affect puts downward pressure on the GBPUSD.

- Further, members of the European parliament have asked and put pressure on the UK to make their exit faster than previously expected, this puts further uncertainty around the brexit and increases the negative impact it may have on the economy and therefore the GBP speculation is made further bearish.

- As pictured I had expected the 1.356-1.382 range that had held at the end of last week to hold for the next 24hrs and for GU to trade relatively flat (24hrs for people to make decisions on positioning) however it looks like corporations and other entities have derisked their GBP exposure over the weekend hence we opened 300pips lower at 1.342.

- With this range broken we now trade in no mans land, thus with all the negative biases my target from now is for GU to drift towards the lows set from last week for now - If the market changes significantly within the next few hours (e.g. trades back into range) i will update this view.

- My target for GBP is <1.30 with a terminal value of 1.25 within the quarter - though i consider that the supportive (no hike) policy of the FOMC will ease GBPUSD losses somewhat. This in mind shorts at these levels are fair 1.34. Alternatively, I also encourage my favourite tactic of shorting/ fading any GBP rallies to 1.38/39 however the chance of GU realising such upside imo is only 50%, with bid trading dominating

Volatility update:

Current GU ATM 50 delta vols trade at 25%, which is surprisingly 2x higher than it was last week (the risk and volatility may not be over).

1wk GU ATM 50 delta vols trade at 30%, significantly higher than last week also.

However 1ms trade 20.49% and are significantly lower than they were last week (illustrating the event risk that has elapsed).

Current GU Option demand is skewed significantly to the downside, with Puts 27.5% vs calls 22.5% thus puts are in demand by about 20% more than calls - this supports current short views (RR -5).

1wk GU demand is also skewed in favour of downside coverage, with puts at 33% vs calls 28%, (RR -5%) with puts being demanded apprx 3% more than calls - supporting the near terms view of short GU

USDJPY as a measure of market risk.

I still suggest using UJ as a measure of GBPUSD market risk - the volatility seemingly isnt over, and with near term uncertainty high, it is prudent to track UJ and use breaks of its 101.2-103.2 range as signals of net risk on or risk-off commitment .e.g. UJ higher risk on (jpy selling), UJ lower risk off (jp buying).

The risk off move for GU imo is lower in this environment, and the risk-on move is higher. Thus, IMO UJ and GU are sync'd, and the two should be used as a tool.