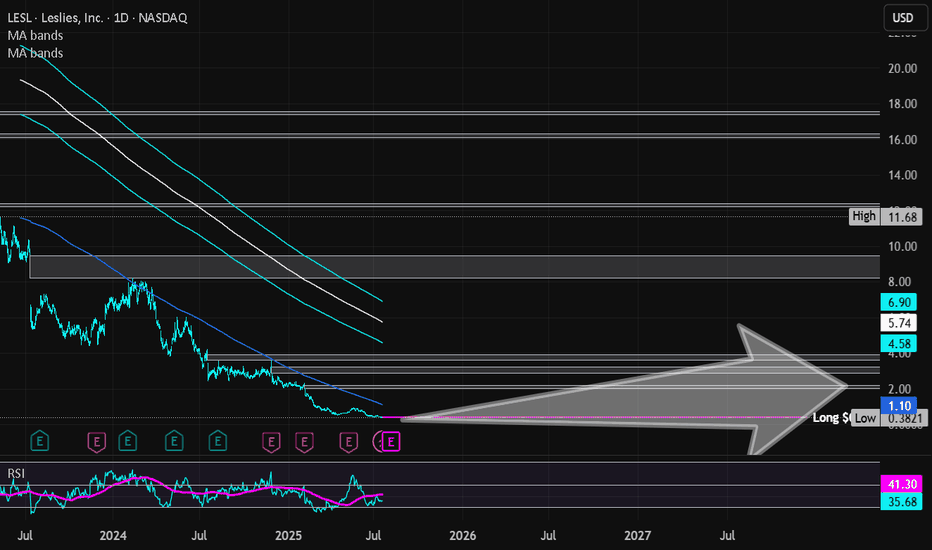

Leslies Inc | LESL | Long at $0.41**VERY risky trade - 25% or more risk of bankruptcy**

Leslies NASDAQ:LESL is a direct-to-consumer pool and spa care brand in the U.S., selling chemicals, equipment, and services. The stock dropped 88.86% last year due to weak demand, flat revenue, shrinking gross margins from stock write-downs, higher rent, shipping costs, and an earnings miss (-$0.25 vs. -$0.244). High debt, market share losses to e-commerce, and a competitive pool supply market also contributed.

On a positive note, the company generated $1.33 billion in revenue for fiscal year 2024. New leadership has entered the picture, cost-cutting is starting to happen, and summer season may boost pool sales. While 2025 is still projected to be a rough year, revenue is forecasted to grow 6.4% in 2026 and 2027 and earnings are likely to turn positive (based on company statements). While this is a *highly risky* play and there are absolutely better companies out there, I think there is a chance this ticker may get some steam in the near future. 7% short interest, 176 million float.

Thus, at $0.41, NASDAQ:LESL is in a personal buy zone.

Targets into 2027:

$1.00 (+143.9%)

$2.00 (+387.8%)

Pools

Cardano pools register $3.4 billion ADA in 12hrsCardano (ADA) has experienced a significant increase in the amount of ADA that has been deposited into its staking pools in only 12 hours on March 22.

Indeed, the large quantity of Cardano that inflowed into the 43 newly created staking pools was roughly around the figure of 3.8 billion ADA which equates to about $3.4 billion, at the time of publication, according to data from Cardano staking pool analytics platform pool.pm.

Noteworthy is that each pool has a stake of 72 million ADC, and the percentage of ADC coins that have been staked is over 83%, which is an impressive showing in the context of DeFi development.

Entry Point for Balancer Liquidity PoolsIf confirmed, this dip could be a great opportunity to enter a Liquidity Pool in Balancer. The returns are great at the moment with the liquidity mining.