POPCAT/USDT – Testing Demand Zone: Reversal or Breakdown?POPCAT/USDT is currently retesting one of the most crucial demand zones in its mid-term price structure, located between $0.2700 – $0.3037. This area has historically acted as a strong support level and has triggered significant rebounds in the past. The market's reaction here will be key in determining whether POPCAT is ready for a bullish reversal or heading for a deeper correction.

---

🔍 Market Structure & Price Action

The price has entered a sideways consolidation phase after a steady decline from the $0.4067 region.

So far, the support zone at $0.2700 has been respected multiple times, indicating buying interest remains active.

However, no clear bullish reversal pattern has formed yet, making the next movement critical.

---

🟢 Bullish Scenario (Reversal / Bounce)

If the price manages to hold above this demand zone and forms a higher low along with a strong bullish candlestick confirmation, we could see a potential trend reversal.

🎯 Potential bullish targets:

TP1: $0.4067 – Minor resistance, top of the current range.

TP2: $0.5714 – Mid-range resistance, a previous breakdown zone.

TP3: $0.8874 – Major resistance, the last high before the steep drop.

TP4: $1.5238 – $1.9510 – Psychological resistance zone, possible medium-term swing targets if bullish momentum strengthens.

🔐 Key confirmations:

Bullish engulfing / hammer candlestick on the 2D chart.

Increase in volume + breakout above range resistance.

---

🔴 Bearish Scenario (Breakdown Continuation)

If the price fails to hold $0.2700 and we see a clear daily or 2D candle close below the demand zone, this would indicate loss of bullish strength and open room for further downside.

🎯 Bearish targets:

TP1: $0.2100 – Psychological support level.

TP2: $0.1179 – All-time low and historical bottom.

⚠️ Risk factors:

Strong bearish candle close + high volume breakdown would confirm sellers’ dominance.

---

🧩 Pattern & Formation Insights

A horizontal base / accumulation range is visible within the demand zone.

If the price rebounds, we could be forming a double bottom – a classic reversal signal.

However, if the zone breaks, the chart may develop into a descending channel or bearish continuation pattern.

---

🧠 Trading Strategy Outlook

Swing Traders: Consider long entries within the demand zone ($0.2700–$0.3037) with a tight stop-loss just below the zone. Aim for multiple resistance levels as take-profit targets.

Breakout Traders: Wait for confirmation above $0.4067 with increased volume.

Bearish Setup: Short entry upon breakdown below $0.2700 with targets towards the next support zones.

#POPCAT #AltcoinAnalysis #CryptoTechnicalAnalysis #DemandZone #BreakoutOrBreakdown #USDT #MEXC #SwingTrade #CryptoSetup #BullishReversal #BearishBreakdown #ChartAnalysis #TradingView

Popcatusd

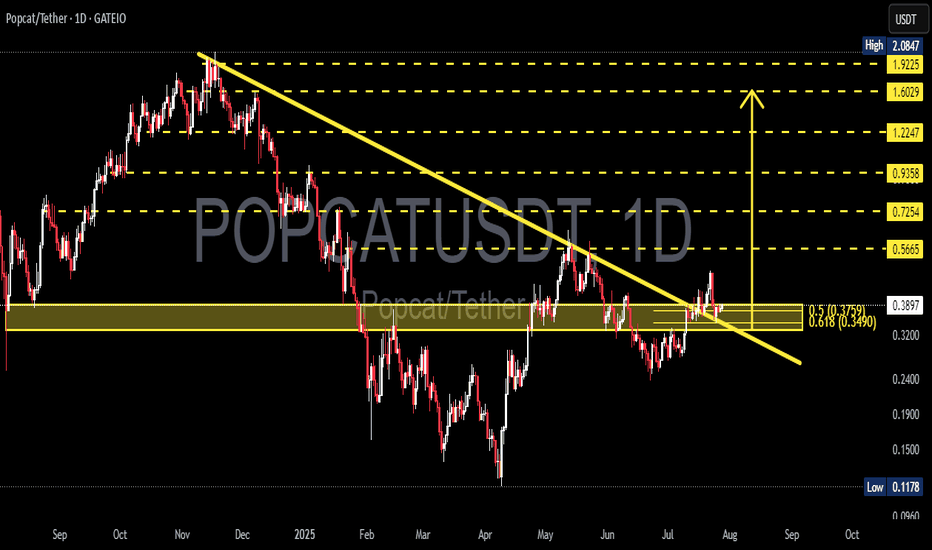

POPCATUSDT – Breakout Confirmation or False Signal?On the daily chart of POPCATUSDT, the price has recently broken out of a descending trendline that has been acting as resistance since December 2024. This breakout signals a potential trend reversal from bearish to bullish.

Currently, the price is in a retest phase, revisiting the breakout zone, which also aligns with a strong support and Fibonacci retracement area:

Support zone: $0.34 – $0.38

Fibonacci 0.618: $0.3490 (major technical support)

Fibonacci 0.5: $0.3759 (typical retest level after breakout)

If the price holds above this zone and forms a bullish confirmation candle, it strengthens the case for continued upward momentum.

---

Pattern and Market Structure:

Descending Triangle Breakout: The price has broken out of a long-standing descending triangle pattern, which is typically a bullish reversal signal — especially if supported by volume (not shown in chart but crucial).

Neckline Retest: The current move is retesting the breakout zone, a common behavior after significant breakouts.

---

Bullish Scenario:

If the price holds above the $0.34–$0.38 zone and forms bullish price action:

Potential targets based on Fibonacci levels:

Target 1: $0.5665

Target 2: $0.7254

Target 3: $0.9358

Major targets: $1.2247 and possibly $1.6029 if bullish momentum sustains

---

Bearish Scenario:

If the price fails to hold above $0.34 and breaks down below the support:

Potential downside towards $0.26 – $0.20 zone

If selling pressure intensifies, it may revisit the key support low around $0.1178

---

Conclusion:

POPCATUSDT is at a critical decision point. The breakout from the descending trendline is an early bullish signal, but confirmation from the $0.34–$0.38 retest zone is essential. If it holds, a strong bullish rally may follow. However, a failure to hold could signal a false breakout and resume the bearish trend.

#POPCAT #POPCATUSDT #CryptoBreakout #AltcoinAnalysis #ChartPatterns #TechnicalAnalysis #FibonacciLevels #CryptoTrading #BullishSetup #BearishScenario

POPCAT SHORT TRADE Popcat (POPCAT) is exhibiting a clear downtrend, with recent increases in sell-off volume suggesting continued bearish momentum. The coin has broken through a key resistance level and is consolidating below it, indicating acceptance of the lower price range. Targeting $0.2039 aligns with a previous support level, making it a logical objective for a short position.

POPCAT/USDT — Major Reversal in Play? Strong Bounce

📌 Quick Summary:

Altcoins are starting to show signs of life, and POPCAT/USDT is now sitting at a critical price structure. After a long and painful downtrend since November 2024, the price is consolidating near a powerful support zone — potentially signaling the start of a reversal phase. Is this the calm before a major breakout? Let’s dive into the technical setup.

🔍 Pattern & Market Structure:

🟨 Descending Triangle Pattern – with Signs of Accumulation:

A clear descending triangle has formed, typically a continuation pattern — but in this context, paired with strong demand at the base, it can signal a reversal.

The horizontal support ($0.27–$0.30) has been tested multiple times, holding firm, which suggests large-scale accumulation by smart money.

A breakout above the descending trendline would invalidate the bearish bias and open the door to a bullish surge.

📐 Descending Trendline (Yellow Line):

This line has been acting as resistance since November 2024.

A clean breakout from this line would serve as a strong bullish signal, likely attracting new buyers and triggering FOMO.

🟩 Bullish Scenario (Reversal Potential):

If the price successfully breaks above the descending trendline and holds above the breakout level, the following targets are in play:

1. 🎯 Target 1: $0.4067 – Minor horizontal resistance

2. 🎯 Target 2: $0.5714 – Previous support turned resistance

3. 🎯 Target 3: $0.8874 – Strong psychological and structural zone

4. 🎯 Target 4: $1.5238 to $1.9510 – Possible macro target if the crypto cycle enters full bullish mode

🧠 Market Psychology Insight: This type of breakout from a long-term downtrend often leads to high-momentum moves, especially if backed by volume. Swing traders and mid-term holders may see this as a golden entry.

🟥 Bearish Scenario (Continuation Risk):

If the price fails to reclaim the descending trendline and breaks below the demand zone:

1. ❌ A breakdown below $0.27 opens room for:

Minor support: $0.20

Long-term low: $0.0869

2. 📉 This would confirm extended bearish control and possibly a deeper retracement phase.

🧭 Strategy Tips for Traders:

✅ Aggressive Approach: Begin accumulating around the $0.27–$0.30 zone with tight stop-losses below $0.26

✅ Conservative Approach: Wait for a confirmed breakout and successful retest before entering toward the next key resistance levels

⚠️ Always combine technical setups with proper risk management and volume confirmation

💬 Final Thoughts:

POPCAT/USDT is at a key decision point. The current support zone shows signs of strength and accumulation by buyers, offering a potential launchpad for a powerful breakout. If the descending triangle breaks to the upside, this could mark the beginning of a trend reversal — with potential gains of 100%+ on the horizon.

The chart is setting up for something big. Are you ready?

#POPCAT #CryptoBreakout #AltcoinReversal #POPCATUSDT #DescendingTriangle #CryptoTrading #ChartAnalysis #BullishSetup #CryptoSignals #BuyTheDip #CryptoTechnicalAnalysis

POPCAT Looks Bullish (12H)At the bottom, a 3D pattern can be seen, which indicates that the downtrend had ended.

Now, after a strong break of the trigger line, it seems that the price is aiming to form a bullish 3D pattern.

The green zone is the area from which the price may initiate the third drive.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Be careful with POPCAT !!!Currently, POPCAT is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

PENGU | POPCAT | Meme Coins & The PROBLEM with ALTSPENGU has recently started trading on Coinbase (13 Feb) and many are waiting in anticipation for "the coinbase effect".

If you didn't already get into POPCAT, you may still have a chance on PENGU - but understand that the risk is EXTREMELY high with altcoins of late, especially meme coins:

________________

COINBASE:PENGUUSDC.P

BYBIT:POPCATUSDT.P

POPCAT - LONG - Good opportunityPOPCAT is now ready to give us a chance. Despite being a little late it is still in a good place for daily timeframe. This is a risky trade because the stop loss is tight; you can use an extended stop (SL 2 or SL 3), i will move it if I see a lot volatility. These currencies are also very volatile and high leverage should not be used.

TP 1: 1.15

TP 2: 1.25

TP 3: 1.55

SL 1: 0.7099 (risky)

SL 2: 0.68 (good)

SL 3: 0.62 (best)

POPCAT - Bullish Reversal - LONG - (Re-entry)We are at an excellent entry point. Little possibility of it reaching 0.88 in the short term. The stop loss is somewhat tight, so be careful. If you want more security, increase the stop by covering up to that point.

T1: 1.27

T2: 1.40

T3: 1.45

T4: 1.60

Stop loss:

1) 0.98

2) 0.88

*This is a re-entry from my last POPCAT idea

POPCAT - Bullish Reversal - LONGWe are at an excellent entry point. Little possibility of it reaching 0.88 in the short term. The stop loss is somewhat tight, so be careful. If you want more security, increase the stop by covering up to that point.

T1: 1.27

T2: 1.40

T3: 1.45

T4: 1.60

Stop loss:

1) 0.98

2) 0.88

POPCATUSDT Buy Zone IdentifiedThe broader cryptocurrency market faces uncertainty, with a possibility of no recovery by year-end. In light of this, I’ve adjusted my buy positions lower to reflect a more cautious approach.

For POPCATUSDT.P, the blue box highlights a key buy zone where I anticipate strong support. I plan to join as a buyer within this area, looking for a favorable entry point aligned with current market sentiment.

Key Points:

Buy Zone: Blue box region

Risk Management: Stop loss placed below the box

Potential Target: Await confirmation of a bounce for upside momentum

Remaining patient and disciplined will be crucial in navigating the current market conditions.

Disclaimer: This is not financial advice.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

#POPCAT can pomp 268% Here's why!POPCAT has broken out of its structure after 19 days of accumulation.

Indicators and oscillators are signalling a potential 268% pump to $4.50. Is this achievable? Given the current market momentum, with BTC holding steady and BTC dominance dropping sharply, this target is well within reach.

Coins like ATH, GOAT, FWOG, NEAR, and SLF are also set to pump hard, and POPCAT will likely move in tandem. Patience is the key here.

DYOR | NFA

If you like this chart, don’t forget to hit the like button and share your thoughts in the comments below.

Thank you!

#Peace 🚀

The Banana Zone Series - POPCAT Buy the Dip Levels (8 of 10)Alt-season is here. BTC breakout has been confirmed. If you missed positioning for the next level of exponential moves, what are some of the buy the dip zones while still have time for the bigger moves into the banana zone.

We continue the series with POPCAT.

As you can see in my analysis, pull backs to $0.9765 and below is my new accumulation zone. I will initiate some leveraged longs for new trades in preparation for the moves to the banana zone in the alt season.

For more aggressive traders, $1.22 and below can be the trigger longs with tight stops.

Not a financial advice so DYOR.

Popcat meme coin potential targetsI'm not a fan of meme tokens, but here is potential targets for Popcat on Sol

GATEIO:POPCATUSDT

Possible Targets and explanation idea

➡️Marked W fvg will be like a target for correction and from that level we can wait bounce

➡️Under marked green main support block

➡️On D timeframe got Sell signal from TradeOn indicator, no new buy signals

➡️After bounce first will be buy side liquidity sweep

➡️Money Power indicator no new money inflow, only fixation profit

➡️Market Mood indicator, the same story, coin still overbought.

➡️ Top for this one at least for middle term I can see around 1.25 B market cap

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

POPCATUSD Wait for a pull-back and buy.POPCATUSD has been trading within a Rising Wedge pattern and is currently on a new Bullish Leg (green). With the Internal Higher Highs trend-line just above, we expect a short-term pull-back towards the 1D MA50 (blue trend-line), which will present a buy opportunity at the bottom of the pattern. Our Target is 1.2500 short-term.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

$POPCAT Levels of InterestPOPCAT is now facing psychological resistance after hitting $1

I still betting for the CAT to hit beyond 1B in market capitalization, although we may see a short-term pullback

Wait for price to hit logical levels where the demand exceeds supply

Immediate resistance is around .87 to .90

I'm also watching .65 to .60 area where we can get a decent bounce