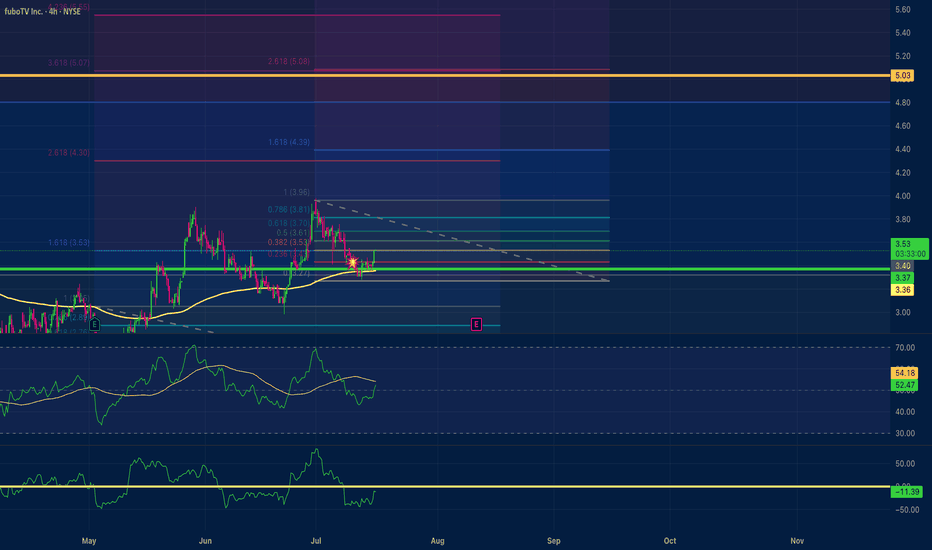

fuboTV $5.00 price target Positive Divergence Multi time frameMy trade on fuboTV has a $5.00 price target. With positive divergence multiple time frames 15,1hr, 4hr. An RSI scoop where the hrly RSI with a length setting of 36 shows upward momentum? The Chande momentum oscillator with a setting of 24 indicates the price may not stall at $4.50.

Positivemomentum

Bajaj FinservBajaj Finserv is at breakout point.

RSI show the bullish Divergence, if it give successfully breakout then we can see a bullish momentum around 1700-1720.

Bajaj Finserv breakout point pe trade krra h.

Agr hum Rsi ko dekhe toh yeh bullish divergence show krra h, agr breakout legit hota h toh hum 1700--1720 tak ki rally expect kr skte h.

Arihant Capital Markets Ltd. Riding the 5th Wave ImpulseArihant Capital Markets Ltd: Riding the 5th Wave Impulse

Daily Time Frame:

Elliott Wave Analysis: Arihant Capital Markets appears to be in an impulse move on the daily time frame, with completion of wave 4 as a correction.

Current Stage: Unfolding wave 5, with (i) and (ii) completed and a potential unfolding of wave (iii).

Price Targets: Anticipating levels of 96 and 104 plus.

Invalidation Level: A strict invalidation set below 63. Current Price Trading near 76.

Technical Indicators:

Breakout Confirmation : Price has given a breakout on the daily time frame with significant volumes.

Indicator Alignment: Major indicators like MACD, RSI, RK's Magic, RK's Brahmastra, etc., are aligning positively, supporting the bullish bias.

Snapshots: Attached snapshots of the indicators for reference.

Elliott Wave Concept - 5th Wave Impulse:

The 5th wave in Elliott Wave theory is often an impulse wave that signifies the final leg of a trend.

Impulse waves are characterized by strong, directional price movements.

Wave (iii) within wave 5 is typically the most powerful and extends higher, often exceeding the peaks of wave (i).

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing. I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Breakout with good intensity of Volumes on Daily and Hourly time frames

RK's Magic says positive on Daily

RK's Brahmastra says Positive bias on Daily

Possible Elliott wave structure could be this

MACD on Daily is positive and Strong enough

MACD on weekly too

RSI showing good strength on Daily chart

NSE : CCL Products - Coffee with twist Going strong - UpdatesNSE:CCL

CCL Products (India) Limited, a listed public company limited by shares was founded in the year 1994 with the vision of creating only the finest and the richest coffee in the world. At CCL Products we have taught ourselves to do business with integrity, commitment, customer orientation and an unwavering effort to maintain the highest quality standards in the industry. Our strong infrastructural backbone and a global client repertoire in over 90 countries have led us to evolve into the largest instant coffee exporter and private label manufacturer across the globe.

Disc: Invested , DYOR

Tight consolidation... BTC dont care and standing strong above 1Please keep in mind CME gap still not filled. Strong consolidation and looking beefy for a move within the next ten days it will have to choose a direction. I am leaning towards the upside due to the strength of BTC price fundamentals. I know alts have been getting hammered but it seems only when BTC dips alts take it 5 times harder.

I see this consolidation pattern bear/bull flags in the chart. There are bearish and bullish divergence within the chart and I think this tight consolidation pattern is brewing a possible nice move either to the upside or the downside. Once volume is back in think bulls continue this trend at least for the short term maybe atleast back to the first resistance of 11k -11.2k and ponltentially retest the 12.3k but we will see! Alts would make sense to have a nice rebound soon but market is wild so be careful during these uncertain times and dont get wrecked. I'm not a financial advisor this is educational content only do your DD please.

Inverse Head and Shoulder superimposed over an upward trend..Asymmetric inverse head and shoulder pattern: due to the pattern being super-imposed over a significantly upward moving baseline trend, propelled by inflation fueled by the global money printing?

Another point/consideration to add to the bullish narrative.

SEE ALSO:

BTC:USD -- Acceleration gaining, pulling up Momentum.

Determining if we are in a Bull/Bear market

H&S Inverse ***ON WATCH***W/ Confirmed breakout, PT ≈ 3.7.

Correvio completed CRME aquisition effective today. Also Q1ER w/ EPS miss, but REV beat. HS inverse w/ + daily detected momentum and MACD ready to cross, right after golden cross of 50 & 200 DMA on 09MAY.

ON WATCHGolden Cross pending on hourly w/ + Momentum ready to begin on daily and MACD pointed up on 0 is an overall good technical indicator. Volume profile matches typical H&S.

TRIGBTC a good long positionOscillators Momentum (10), MACD (12, 27) indicates a good buying opportunity. Moreover, VMA (20) HMA (9) MA (10,20), EMA(10,20) shows bullish mood of the coin.

As it also can be seen there is a hidden bullish divergence as the price follows the rule higher lows while price oscillator lower lows.

Summing up a trend reverse with a good indicators status we conclude that this coin is a profitable trade opportunity. Fundamentals are also great new partners and contracts are coming up.