ridethepig | EUR Market Commentary 2020.01.17Eyes on the NY session here with Euro approaching the 1.108/9x lows, I will be actively buying today and sticking with the bullish view with targets located at 1.124/5x.

You will see how large hands absorb all of the selling pressure and eat up late breakdown players expected an effortless momentum trade, whereas the reality is the strength of macro forces in play defending the area and will be beautifully demonstrated. The Seller realises the error of his way too late and began to run to the hills. The comedy goes as follows:

For example in this position:

The strength of the view can be protected in the fact that it is immune from the opposing breakdown. The distant view is decisive:

The key point here is that the calendar is light so we are trading technical flows, I am buying the lows at 1.108/9x with targets at 1.124/5x for the highs. While stops can be kept below 1.100x as it will take a break below to demand reassessment of the bullish view.

Good luck all those in G10 FX.

Powell

ridethepig | Dollar Weekly StrategyWith DXY sitting at resistance, I don’t see room for any further near term gains in Dollar. More importantly we are approaching key value levels for sellers from the last Q and large corporates have been spotted on the offer in USD. I have made the Dollar chart available and will publish it with al the more pleasure, since it is particularly interesting as we are sitting in the age of the Aggressive USD devaluation. So here is the chart:

Sellers are not afraid of the flank attack because strong macro forces are in play in the monthly chart. The play is centralised; buyers must begin to be felt and in addition the prospect of a breakout down is driving the desperation of the exchange:

This illustrates nicely the struggle that USD buyers face. Motto: first position, then defend, and finally breakdown. Markets starting to find their footing for 2020 after clearing NFP. Focus this week shifting to a round of important US macro prints, a key week for those trading USD pairs.

Good luck all those on the sell side in USD, major moves in play and important chart updates coming in the next few sessions. I will have live coverage as usual in the Telegram .

Thanks for keeping your support coming with likes, comments, questions, charts and etc!

ridethepig | The Breakout...Insufficient sizings followed through into USD after we cleared the kneejerk reaction in risk via US-Iran. The centre of the map at 1.128x is a strategically dubious setup and offers a great opportunity for EUR bulls to position early as we go into NFP ... how to attack from the wings .

By now you all know the necessary swing position we are trading;

What, however is less well-know is the strategic necessity to keep an eye on the macro themes, particularly in FX positions;

The centre of the technical map here is 1.128x. This means approach with warlike operations as we are never far away. I can remember the initial long-term map we positioned for here, which initially looked rather harmless as far as the flows were concerned; it occurred after the trade war exuberance:

The loss of momentum is important here for bears, because the position only appears to be an advanced one when in reality it can open up the entire swing. This is true of 90% of news flow positions.

Good luck all those trading the "opening move" ... EUR bulls can achieve the initiative with a skilful breakout. While invalidation will only come into play below 1.10 . As usual thanks so much for keeping your support coming with likes and jumping into the comments!

ridethepig | CAD Market Commentary 2020.01.09Interesting price action in USDCAD after another round of soft data from Canada. Poloz has a lot of work to do tonight if BoC are to move as rate markets are materially underpriced, especially on the front end. Expecting a dovish ‘fireside’ with early signs of encouraging demand above 1.30 this morning. Starting to cover shorts after the break through 1.304x has opened a move towards 1.31 and 1.317x, the original entries in the 2020 macro map:

USDCAD LMT BUY 1.304x => TP1 1.310x => TP2 1.317x | STP 1.299x

The reflation theme which is a bi-product of the dollar devaluation allowed CAD to outperform in the immediate term however now USD is in full control as CAD macro prints have started to turn down. As long as USD remains in first gear we will have room to test the topside again, as there are two sides to the currency pairs, rather than CAD strength in this move we are trading USD weakness.

As usual jump into the comments with your charts and questions to open the discussion, best of luck all those trading live and thanks for keeping the support coming with likes!!!

ridethepig | AUD Market Commentary 2020.01.09AUD completing the retrace and starting to form support as Trump confirms the end of the circus. Australian local macro prints have started to improve, particularly in the housing sector and on the trade side. For the menu tonight we have retail sales in play and a leg back towards 0.69x looks imminent.

On the macro side, RBA expected to cut once more in Feb to 0.5% and the rate cycle is already over. If data continues to improve and follow the solid unemployment prints we saw last week, then they will have missed the boat to cut once more as income tax cut later in the year. This will be enough to keep AUD in bid over 2020 and 2021 with a clean zig zag trading-wise.

While the multi-year chart is crystal clear:

Here AUDNZD would be worth thinking about increasing long exposure in order to follow up the coming RBNZ intervention / AUD outperformance leg. However, this plan to attack the highs is currently impossible, because AUD markets are still pricing a move from RBA in Feb. The correct manoeuvre, despite all counters will come from the AUD side:

We will do a deep dive into the USD side with NFP tomorrow for the flows in the live telegram with a round of chart updates and strategy outlooks.

GL all those in AUDUSD, thanks as usual for keeping the likes and comments rolling in!

ridethepig | GBP Market Commentary 2020.01.09A good time to update the Cable chart as we approach the first macro driven event risk of the year with NFP. As mentioned a few times the range we are trading is crystal clear with 1.33xx highs and 1.31xx lows. While the market is holding the key support at the lows, I maintain a view that a correction back towards the highs is both corrective and necessary to allow positioning for Brexit impact leg while the risk to the thesis comes from a break below the lows in the range and reassessment is only required should we break below.

I therefore look to sell the strength back towards 1.33 - 1.35 which will be enough to cap the highs for 2020. Should we see any strength extend in the short-term it will be a superb selling opportunity for those interested in adding weight to the in-house macro view. For those wanting to track the large swing we have been trading since the UK elections I would recommend the following diagrams:

GBPUSD

GBPAUD

EURGBP

UK markets pricing a Conservative majority as a "positive resolution" to Brexit is complacent and allows us an opportunity to capture those out of position and mis-pricing UK market access beyond 2020. To date we have traded a tremendous amount of conjecture around the Brexit chapter, yet many are quickly to forget we are yet to trade the "fact" leg.

...Best of luck to all those looking to trade NFP, a clean and simple spike back to the top of the short-term range in play for Cable. As usual thanks for keeping your support coming with likes and comments !!!

ridethepig | EUR Market Commentary 2020.01.07EUR ticking higher for the open as liquidity returns from the holiday period. On the whole I am happy with how the euro has held, while we discussed yesterday macro hands betting on the reflation theme are hardly moonwalking but we are making progress nonetheless.

Continue to buy dips here, I am becoming increasingly aggressive with sizings, however certainly aware that 1.12xx is proving difficult. A sustained failure to break here will see us retrace towards the lower end of 1.11xx otherwise its business as usual with the initial target at 1.125 (see below diagram).

Additionally, we can comfortably lean on the macro charts over the coming months as we see the green shoots reappearing in Europe:

Those mid and long term plays can continue to eventually target 1.21xx and 1.25xx in macro portfolios with most the hard work to begin the move largely complete:

While the Weekly technicals are much clearer:

Good luck to those trading EURUSD in 2020 and already in longs or for those waiting patiently on the sidelines for the momentum break to form.

As usual thanks so much for keeping your support coming with likes and jumping into the comments!

ridethepig | EUR Recycling We are talking here about a swing high which has to be broken. What can be doubtful here, you may ask... Of course we must direct the attacks towards the highs, but how does one do that if for some reason the highs cannot be shaken? Would it not be opportunistic to sweep the highs and entice profit taking before recycling longs. This is effectively what happened last week in EUR:

Here the bear is condemned to die for the common good, as a diversionary sacrifice. The only question markets are asking is a matter of "when" rather than "if" ... Since the Weekly chart we dissected in September, it would be helpful to start by reviewing the advance:

Sellers defence does not look very promising; after a possible escalation with US-Iran tensions or with FED USD devaluation via flooding supply side. So buyers play the breakout... exchanging the base for a new trend in 2020-2021:

As usual thanks sooo much for keeping your support coming with likes and jumping into the comments!

ridethepig | USDJPY 2020 Macro MapOn the USD side, we have dollar devaluation in play via Fed flooding the supply side and marking the monthly highs in Dollar:

On the JPY side, I am looking for an eventful year on the risk front. Japan will benefit in search of safety with late cycle fears only temporarily abating:

On the technical side, for those in a background with waves and wanting to dig deeper into the legs we are trading:

Even with yield advantage over JGBs I expect risk to control the flows in particular as we get close to US elections providing a choppy zig zag. There will be good demand for USDJPY below 105 (as Japanese investors have been riding the pig overseas) so look to take partial profits on the way, 100 remains my final target in the flow. Best of luck all those in USDJPY and positioning for 2020 flows - you can see other strategies below!

Thanks for supporting with a like and keeping your ideas and views coming in the comments!

ridethepig | AUD 2019 In ReviewHere we go with an update to AUD as we enter in 1H20.

Consumers remain the key to the flows here, in my books markets overpriced odds of another cut from RBA in Feb 2020 ahead of income tax cuts in the middle of the year to stimulate the recovery. After RBNZ surprise hold in Q419, NZD was able to sustain a strong bid. After AUD unemployment came in better than expected, smart money is tracking for the same course of action from RBA and AUD.

The shape of the Long-term Macro chart:

The housing market continues to rise with a lack of supply entering into expectation plays by 2021 via declining vacancies and higher rental prices. The low rates will act as a catalyst for price growth.

On the Corporate side , with PBoC using AUD to arbitrage the trade war business investment will continue to pick up in 2020. Scott Morrison will keep public infrastructure at high levels, while the weaker AUD in 2019 will continue to help exports.

Unemployment has shown signs of improving, spare capacity will last till end 2021 and keep inflation via wages benign. This is supportive of RBA remaining on hold and here betting on no further easing as long as macro conditions show signs of improvement and stability.

Dollar bear case:

Australia / New Zealand: Forecast summary

We can continue to update this thread over the coming Weeks, Months and Quarters so feel free to jump in with your idea generation to further the discussion for all.

Thanks for keeping the support coming with likes, comments and etc!!

ridethepig | DXY Market Commentary 2019.12.18A timely update to the Dollar chart in time for the NY session, with most of G10 FX trading at the bottom of the short term range markets are preparing for the final flush in USD before killing the year off on the FX board.

Lets start by reviewing our long-term map:

Here we are tracking the Monthly chart in Dollar from an Elliot Wave perspective; after 15 years of the previous bullish USD cycle we are reaching the end of the road.

For those tracking the USD devaluation you will know we are trading the final leg in the 5 wave sequence:

On the technical chart the channel support is holding on by a thread:

Best of luck all those looking for cheaper entry levels in the Dollar short leg, uncertainty around US growth is not going away. Even if the impeachment expectations fall we should see USD coming under significant pressure.

Thanks for keeping the support coming with likes, comments, questions and etc! And as usual jump into the conversations in the comments with your views.

Seige WarfareWith a breakout in play on the daily, the formation can advance towards 1.128x and 1.146x extension. The diagram below highlights the attempt shows little defence to transfer the attack on weekly:

Given what we have recognised on the technicals around the principled handicap bears have it makes it possible to construct the Macro chart:

When our opponent possesses a weakening defence it is worthwhile to push into the advance. In this case, after the Macro and Technical diagrams, we must continue to work the buy side with action towards the highlighted targets. As long as we are allowed to continue the grind higher, reassessment is only necessary below 1.110x. The weakness will appear miles in advance if it is the case and we can update the chart as we go.

Here the static weakness of the Dollar can be seen in detail, and in this case bears clearly with the advantage:

Remember when a cross shows static weakness, you should aggressively load against them and not be afraid to double the sizes. Now consider the positioning in the next diagram taken from " Apple in the worm "

Bulls encouraged Bear's hope that he was headed for a momentum break down, which mean exploitation for the macro swing was not all that difficult. Next came:

And now it is important for bulls that the break is tempered into an impulsive swing, the result of which will hold the key to unlocking the targets at 1.128x and 1.146x. Bulls are counting on the strength of the longer term Euro funded currency leg:

The correct march forward for bulls here is over the flank, so 1.197x and 1.125x resistance will be key to track for mid-term swings. On the other side, 1.093x and 1.087x will need to be taken in order to demand reassessment of the core bullish view I have constructed over the past three months. Here the win looks forced:

...Thanks all for keeping the support coming with likes, comments, charts and etc.

ridethepig | Getting our bearingsHere the bear is condemned to die for the common good, as a diversionary sacrifice. The only question markets are asking is a matter of "when" rather than "if" ... Since the Weekly chart we dissected in September, it would be helpful to start by reviewing the advance:

The correct march forward for bulls here over the flank, so 1.197x and 1.125x resistance will be key to track. On the other side, 1.093x and 1.087x will need to be taken in order to demand reassessment of the core bullish view I have constructed over the past three months.

I call this excessive generosity! All dips have been bough and those following are locked in with:

(i)

(ii)

After this march towards the border, remember to create an appetite, the bull must start the day with a hearty breakfast of the late and weak sellers going overboard on the Macro side:

We are sitting at the loading zone for year-end, for the flows and target-wise I am aiming for 1.16xx in Q420 and beyond 1.20xx into 2021. Invalidation for the trade will come in below the key support below and reassessment of the bullish view will only be necessary if we break through the gap from 2017 French Elections (both are highly unlikely to test now as USD devaluation has already begun via repo crisis).

On the USD side, here we are tracking the Monthly chart in Dollar from an Elliot Wave perspective; after 15 years of the previous bullish USD cycle we are reaching the end of the road with the USD devaluation acting as the global reflationary valve:

Good luck to those trading EURUSD in 2020 and already in longs or for those waiting patiently on the sidelines for the breakout to form.

As usual thanks so much for keeping your support coming with likes and jumping into the comments!

ridethepig | EUR Market Commentary 2019.11.27With Trump Administration desperately attempting to add momentum to the $ downside via another Fed cut and pressure on ECB, combined with a convergence in US-EU differentials will lead to a long-term rebound in EUR. I am expecting volatility to expand into year-end after completing the 76.4% retracement.

For those tracking the USD long-term chart from last month:

From a waves perspective a very important year on the macro front which opened up the major monthly reversal targets:

Initial monthly targets: 1.15

Long-term monthly targets: 1.20

Best of luck all those tracking EUR as we enter the final few pages in the year, and importantly, thanks all for keeping the likes and support coming.

ridethepig | EUR Market Commentary 2019.12.18Very little to update on EUR with flows on both sides clashing and causing minor chop inside the 1.11xx handle. Better numbers than expected from Germany this morning providing a gift for those adding on dips.

A quick review of the two positions we have traded live so far with the infamous "worm in the apple". A quick review of these charts:

As long as support at 1.110x holds I remain bullish looking for a break of 1.12xx to kill the year in FX markets. This will leave us in a very handsome position for the 2020 macro map:

Good luck all those buying EUR dips... Thanks for keeping the support coming!

ridethepig | AUD Market Commentary 2019.12.17A good time to update the AUD chart-pack after the updates from a dovish RBA. Soft on wages and consumption with emphasis on outlook reassessment in Feb. Unless we see the domestic story pickup dramatically in Australia it will continue to keep AUD stuck in low gear. Support is found here at 0.685x and sizes I’m seeing should be enough to carry us towards the widely tracked 0.695x target:

Buying dips makes sense...

Bulls in full control:

Macro Chart suggests a lot of upside for AUD:

NZD dips are also starting to look more attractive:

Thanks for keeping the support coming with likes, comments and etc. Good luck all those buying dips in AUD.

ridethepig | KRW 2020 Macro MapKorea's economy looks set to be forming a meaningful floor in Q4 and with a helping hand from a temporary pause in protectionism we should see KRW remain in bid for the first half of 2020.

For the domestic story, Korean exports have fallen which spilt over to the demand side. With this in mind, should the USD devaluation / reflationary theme pick up pace for the first half of 1H20 it will mean repricing in KRW. On the monetary side, cuts are widely priced from BoK for January. Fundamental risks to the thesis com from US-China trade and the significance of USD devaluation.

On the technicals, a textbook Steel Resistance has held at 1219.xx after completing an ABC target sequence. Very high odds a meaningful top is in place and invalidation to this count comes in above 1200.

Thanks for keeping the support coming with likes, comments, questions and etc. Another round of 2020 FX maps coming over the next few sessions. For those wanting to dig deeper with the 2020 strategies:

NZDUSD

USDJPY

EURUSD

EURSEK

USDCNY

ridethepig | MAJOR BREAKOUT IN PLAY FOR EURUSDWith Fed & ECB cleared a good time to update the EURUSD chartbook:

We have positioned live in two textbook cases:

For the technicals EURUSD remains rangebound till we break above the highs. Only a close above will suggest a more important base is in place and upgrade my thesis to a conviction. Plenty of resistance above the market, I see scope for 1.16 in 2020 but would expect this to attract some profit taking. Good luck to those trading EURUSD already in longs or for those waiting patiently on the sidelines for the breakout to form.

Thanks for keeping your support coming with likes and jumping into the comments!

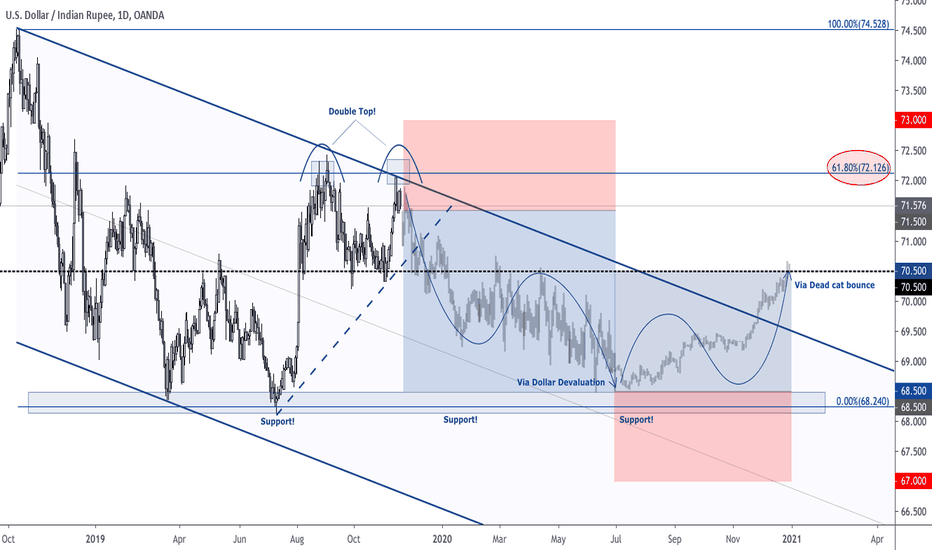

Large Swing In Play For USDINR in 2020Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry.

On the INR side, macro figures are starting to indicate further upside although still stuck in low gears. The tax cuts from the fiscal side doing some of the heavy lifting thanks to Modi (India's version of Trump). Inflation is subdue with a lot more slack left in the labour market and a cheap commodity board.

Should investors see the deficit handled appropriately then all boxes are checked for capital flows into India. Demand for INR looks set to improve and combined with the USD devaluation theme it makes a great few months for INR to see some appreciation.

Risks to my thesis come from US-China protectionism, private capex not picking up (low odds after the attractive tax cuts) and to a lesser extent if RBI push the INR down by accumulating.

Several bullish signals for the SPYThe bullish signals in my mind include:

1) Today's surge through resistance

2) The Fed keeping the rates the same from yesterdays meeting

3) Strong recent jobs report

4) USMCA trade agreement announced. Even though our politicians are mud slinging and financially irresponsible children, they managed to help the American worker and economy for once this year. I wish I only had to accomplish one thing per year :D

5) I believe our orange Thanos will now be able to use USMCA to make a trade deal more attractive for China; this is speculation but possible.

UK election results and ECB decisionConcluding a year that saw the central bank take down its benchmark rate three times, the Federal Open Market Committee on Wednesday met widely held expectations and kept the funds' rate at the same level. The Fed is completely satisfied with the current state of things. As a result, markets do not expect any changes in the monetary policy until the end of 2020. The dollar was sold out following the Fed’s decision and Powell’s comments. Our position on the dollar today is unchanged - we are looking for points for its sales.

Another promising position for today is pound purchases. General election 2019 polling day today Today, December 12. Its results can change not only the political situation in the country but also affect Brexit. Moreover, its influence can be quite diverse and even opposite. Detailed analytics on this issue is given in yesterday’s review. Here, we note that, in our opinion, the balance of threats/opportunities and profits/risks is biased towards profits and opportunities.

Christine Lagarde faces her first real test at ECB debut meeting. The era of Draghi is over, but what Lagarde will remember is still unclear. If she decides to express her vision and strategy, movements may well be in pairs with the euro. As for the parameters of monetary policy, today we do not expect any changes. So today it’s worthwhile to be more careful with the euro, on the one hand, be more careful, and on the other, the euro may well get out of hibernation, which will provide opportunities for earning.

And finally, a few words about the oil market. IPO Saudi Aramco the initial public offering is expected to raise at least $25.6 billion, making it the largest ever with a capitalization of $ 1.88 trillion. The oil market more than calmly reacted to this news. Nevertheless, so far our position on oil remains unchanged - we will continue to search for opportunities for oil purchases on the intraday basis.

ridethepig | RUB Market Commentary 2019.02.12Here we go for a round of EM FX market updates and with Oil on the move first up USDRUB.

After the doldrums of Thanksgiving liquidity is starting to enter back into play, although with market out of position there is no need to overload exposure. The USD tide is turning and clients here are pressing the buy side on RUB crosses to play the dollar sell-off.

More activity coming with NY session, a good level to pick up offers as the cross drives through technical momentum at 64.3x.

Best of luck all those in RUB

Expecting Weakness In Dollar Into Year EndA timely update to the Dollar chart after clearing Fed minutes. Nothing to update after the third cut, Fed front loading the DXY decline over the coming months and quarters.

Firstly lets start with our Long-term Dollar chart:

Mainstream media selling the orderly brexit resolution and reflationary growth rebound to strategically converge the gap with the US. This is on track to work, a master stroke which will weaken flows into US assets.

EUR will benefit as collateral here with global yields higher it is going to squeeze the hand of the over leveraged US market, which will be the start of the turndown in US Equities:

I also see EURUSD rallying next year:

As widely expected since 2018...

For the short-term flows, all eyes on 98.00 as the key level in play for the rest of the year. Expecting market to turn offer into year-end and I target the 96 handle with potential for USD to continue the decline well into 2020.

Best of luck all those trading USD, jump into the comments with your ideas and charts!