ETF Developers Buying Ahead of Q2 Earnings Reports: HDThis Dow component was the highest gainer for the average with a modest 2.10% gain yesterday. NYSE:HD price action was very controlled. Volume was slightly below average indicating it was likely ETF developers buying ahead of the earnings report.

Accumulation/Distribution indicator confirms this price range is a buy zone.

This is a technical setup to watch for pre-earnings runs for swing trading.

Pre-earnings

PG slow and steady long term winner with earnings coming LONGPG on the weekly chart gained 15% in a year and had a dip in the past two weeks with earnings

at the end of this week. PG persistently and consistently beats earnings estimates and pays a

dividend. Moreover, it consistently has a bit of a surge after earnings. I see this as an

opportunity to get a good stock on a 4% dip of a discount and hold it through earnings for

perhaps a 10% profit in two weeks while also picking up the quarterly dividend. Some traders

including those institutionally based believe that buying near to the middle line of the Bollinger

Bands is a good entry for getting fair value. I am one of them.

BTTR- a volatile pre-earnings high flying penny stock LONGBTTR has been slowly gathering steam since last week. Today the buying momentum

went into high gear with a big jump. This is a penny stock about as volatile as it gets

with its backstop far below current market price. With earnings in two days BTTR could

easily run another 30% turn around and fall. The price action and the MACD speak for

themselves. I will take a small position about 3% of my account with a stop loss of 10%

given the volatility. I will advance the stop loss but give room to account for the volatility.

I would like to make about 20-25% on this trade over 2-3 days and will have TV alerts to

let me know when the tide is about to go out. One alert will be the fade on the Price Momentum

Oscillator while the other price crossing down on the faster HMA.

CRM Setting Up for Earnings Next WeekCRM reports earnings next week. This was a pre-earnings run that settled into an unstable sideways trend and then went down due to a lack of strong retail buying.

Volume is exceedingly low to the downside. This is not a sell short setup. Buy zone support is too close from the bottom formation.

NVDA had a similar pattern and gapped up on its earnings release news.

Pre-earning cash on?Support 188 - if this breaks down then it will be a new trend, but this is a strong support as of now w.r.t long term trend.

potential move-ups 196/202, there is a high probability of this bouncing of this support with 6% volatility.

best bet check is to check for 15min ORB either ways a short term call for now testing theory.....

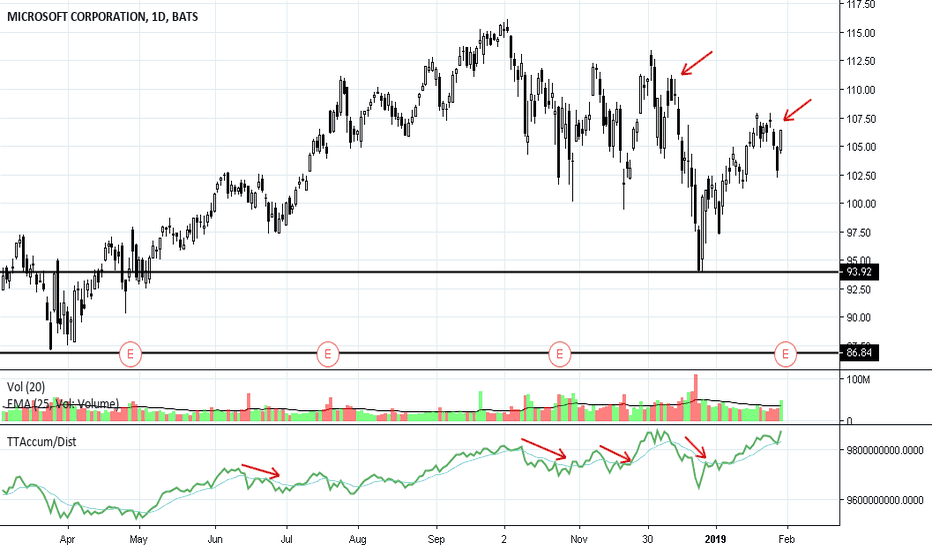

MSFT: No Pre-Earnings RunMicrosoft reported today after the market close. Unlike many other big blue chip companies, MSFT didn’t have a pre-earnings run up by professional traders. There was no tight compression or consolidation in the technical patterns. There were no strong white candles forming a run ahead of the earnings report. This is a stock traded mostly by retail traders right now, so a negative reaction to missing bottom line targets is par for the course. There is also the pressure of heavier than average rotation in this stock’s trend, best seen with Accumulation/Distribution indicators.

NFLX: Pre Earnings Run The speculative gains of what we call a “pre earnings” run ended ahead of the market open on Friday. Netflix is reporting an increase in the number of users but had a decline in revenues, which is a worrisome pattern that is occurring in many big-name companies thus far—many banks and the early tech stock reports. NFLX was being sold on the professional side ahead of Friday's open and was down about 3% in the premarket. How and IF the HFTs trigger to the downside on the earnings news this week will tell us what to expect for other stocks with similar earnings to revenues numbers for the 4th quarter of 2018.