Possible 2x On The Way For BAL/BTCBINANCE:BALBTC COINBASE:BALBTC COINBASE:BALUSD BINANCE:BALUSDT

BAL has a fairly nice setup with a likely bullish outcome on the BTC pair, with the price ranging between a massive descending wedge & looking ready for a macro breakout which would lead to a 2x in BTC price (likely higher)

Expecting a breakout towards that .369 retracement as the likely target for the first wave on the breakout!

The USD pair is also looking bullish on the macro scale too!

Watch this one over the next days & weeks!

PRE

DAO MakerDAO Maker is an investment platform and project accelerator that seeks to connect startups with smart capital.

History of analog projects:

DaoMaker - 90x (token sale price $ 0.1, ATH - $ 9)

DuckDao - 2000x (token sale price $ 0.05, ATH - $ 100)

A2DAO - 120x (token sale price $ 0.1, ATH - $ 12)

Bulk - ? (token sale price $ 0.01, ATH -?)

Tokens of such platforms are used to obtain allocations in initial sales projects.

These platforms are very popular.

They make project research, which is a filter for the crypto-startups.

This token sale can become a game-changer for the market participants with small capital.

Best regards EXCAVO

Presearch - A Decentralized Google, ready to Break OutPresearch, a decentralized search engine, is getting ready to break out of it's current price range and into the next. Target - about $0.16-$0.17 USD, then a drawdown back to $0.13 is likely, unless things get really crazy. I do expect PRE to be at $1 or more by the end of summer. I mean... a decentralized Google, complete with an ad network and everything? It's a no-brainer investment and already highly undervalued as it is, IMO.

$PRE long - 12 hour supportwould look to buy more $PRE in the green rectangle. would not be surprised if we never make it make it there. this bag is one of my longer term holds.

NZDJPY pre-market analysisIt's been a while since I've published anything, so here we go!

At the last week's close, price seemed to reverse upwards, so I need to find where it's going to end up.

I identified a downward trendline, and it crosses near the level that's associated with a prior consolidation period, so most would say that there's some sort of confluence going on here.

We now make a hypothetical trade, taking a recent high as SL, and the lower level of that side-ways move as TP.

And it has a lower than 1RR, which indicates that this trade is risky.

When a trade's risky, price will often move to its SL, right? Which leads us to the next step, which is moving our entry to match the previous SL

I hope that the market will drop after it has stopped out the people who took the 1st trade.

But I do have another setup in case that fails as well.

The rest of my thoughts are on the chart above for you guys to see.

Happy trading.

NZDJPY Potentially heading to pre-covid19 levelsTechnically

- On a strong resistance --> Hopeful to see slight retest before break up to levels before Covid-19

Fundamentals

- Risk on --> Economies around the world are opening up, this will potentially result to selloff in safe havens assets like Japanese Yen and Gold, this will likely result in medium term selloff of JPY against other countries currencies NZD in particular.

We are having a medium term bullish bias in the pair

BTC/USD Pre-halving Rally Hits $10k

Bitcoin price breached the $10,000 hurdle but failed to sustain gains towards $10,100.

Bitcoin halving volatility set to heighten over the weekend session; retest of $9,000 seems possible.

Bitcoin price soared to highs above $10,000 for the first time since February. The impressive surge occurred following a sustained breakout above $9,500. In just two engulfing candles, the bulls had breached the $10,000 zone. A new May high has been achieved at $10,087 but BTC/USD said goodbye to the levels above $10,000 as fast as it reached there. At the time of writing, Bitcoin is trading at $9,912 amid a building bearish trend supported by the desire by the sellers to revenge.

Bitcoin Halving Is Nigh

Bitcoin is set to undergo a mining reward halving. The event takes place every four years and sees mining rewards given to miners reduced by half. This year’s halving will take place in just three days and investors across the border want to be ready for the piece of cake following the halving as its impact is predicted to ted culminate in a price rally. The surge to $10,000 during the Asian hours on Friday can be attributed to pre-halving volatility created by increased network activity.

Bitcoin Price Technical Picture

BTC/USD technical picture turned bearish as soon as it hit highs slightly above $10,000. The RSI is also retreating from the overbought and hints to a developing bearish trend. The volume has decreased as investors wait for Bitcoin to confirm the breakout past $10,000. However, if support at $9,800 fails to hold, Bitcoin could dive lower to test $9,000. The range between $9,000 and $8,500 has a higher concentration of buyers and if tested, Bitcoin could also bounce back upwards. The major support remains at $8,400.

Bitcoin Intraday Levels

Spot rate: $9,912

Relative change: -95

Percentage change: -0.95%

Trend: Bearish

Volatility: Low

Pre-earning cash on?Support 188 - if this breaks down then it will be a new trend, but this is a strong support as of now w.r.t long term trend.

potential move-ups 196/202, there is a high probability of this bouncing of this support with 6% volatility.

best bet check is to check for 15min ORB either ways a short term call for now testing theory.....

Euro Triangle Breakout Before ECB...Load up Bears!!!Consolidation triangle has a breakout....

Looking for a simple retest of the 1.1040 area which is a nice retrace of the current move....

Also we finally broke below the moving averages so retesting in that same area of confluence..

Ill be looking to add in this confluence area in addition to my shorts from earlier in the weak (idea attached)

Note: Macd is poised to cross Zero threshold so a momentum move is near

Positioning for ECB which should be dovish

Aiming for the lows 1.097 for TP1 and 1.088 TP2

Happy Huntin' Happy Trappin'

BooBii

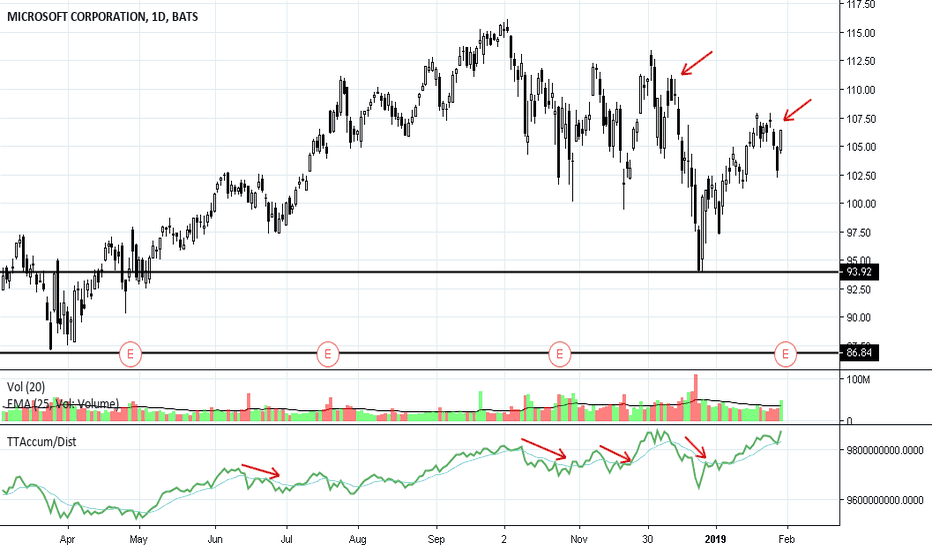

MSFT: No Pre-Earnings RunMicrosoft reported today after the market close. Unlike many other big blue chip companies, MSFT didn’t have a pre-earnings run up by professional traders. There was no tight compression or consolidation in the technical patterns. There were no strong white candles forming a run ahead of the earnings report. This is a stock traded mostly by retail traders right now, so a negative reaction to missing bottom line targets is par for the course. There is also the pressure of heavier than average rotation in this stock’s trend, best seen with Accumulation/Distribution indicators.

BOXL Pre Market GapperHello everyone! Today I have a short term chart analysis for BOXL. You can see the FULL video review by clicking the link below in my signature description!

I have new updated charts, and new video's every day. Please follow me on tradingview, and subscribe to me on youtube!

Leave any questions or comments below, and I will get back to you as soon as possible!

NFLX: Pre Earnings Run The speculative gains of what we call a “pre earnings” run ended ahead of the market open on Friday. Netflix is reporting an increase in the number of users but had a decline in revenues, which is a worrisome pattern that is occurring in many big-name companies thus far—many banks and the early tech stock reports. NFLX was being sold on the professional side ahead of Friday's open and was down about 3% in the premarket. How and IF the HFTs trigger to the downside on the earnings news this week will tell us what to expect for other stocks with similar earnings to revenues numbers for the 4th quarter of 2018.

EURUSD WATCH THIS PAIR! EURUSD ANALYSIS

So on the EURUSD we have had some interesting action happening in the past couple weeks. If you look on the weekly chart of this pair you will see we made a nice head and shoulders and about 2 weeks ago the right shoulder (where it is now) had breached to the downside and broke recent significant structure on the daily timeframe. What we saw last week was some decent strength from the buyers come in and pull price back and above that structure level of 1.15500 area. I didn't like how this looked so im posting this analysis because before that had happened I was on the short side bias for this pair, and I think it could still be a possibility of happening. BUT we need to see that seller interest come back in and play a role in this downside momentum. So lets break it down.

1D Chart:

*on this timeframe you can see that price broke recent significant structure at 1.15500 level

*did price hold? not very well. Due to this fact we want to just be watching this pair on the daily timeframe at this moment.

*if you look at the daily chart you will see that ther IS descending trend line that has been holding since beginning of June

*watch this pair once it comes into that descending trend line and if we start to see some signs of buyers dying out and strong sellers coming in, we may have some probability and sentiment to support a short on this pair

*there is also significant structure at 1.17500, watch this level too in case EU tries a fakeout above the trendline

4H Chart:

*on this chart it will give us a better idea of the momentum going on on the smaller scale

*this chart still represents a good amount of data but gives us a little better look into the buyers and sellers strength

*watch this chart for buyers to die out and strong seller strength to come in

ALWAYS have a trading plan when approaching the markets. Stay disciplined to this plan and make sure to always use proper risk. Never risk more than 2% of trading capital per trade and make sure you have a back-tested systematic approach in which you apply to the markets. If you come un-prepared then the markets will own you.

Cheers! Keep your eyes out !

OKSI CoiN - NEW CRYPTOCURRENCY EXCHANGEKSI Coin (oksicoin.com) is a decentralized WAVES token.

The main crowd project, which will be implemented at the expense of the proceeds from the sale of OKSI - a new, modern crypto-currency exchange (bitstels.com), which will have a number of significant advantages compared to the already functioning crypto-exchanges.

Advantages of future crypto-birzha (domain - bitstels.com)

- low commissions for transactions;

- low commission for input and output of funds and withdrawal of the crypto currency;

- absolute anonymity (trade without verification);

- Offshore servers;

- loyal support service that will respond to calls as soon as possible;

- trading only verified crypto-currencies;

- COMPENSATION PROGRAM for holders of OKSI COIN, which will be held at least once a year (more details can be read here - oksicoin.com)

Site - oksicoin.com