Bitcoin bulls, don't get your hopes up too soon. Your levels.I just want to take a quick minute to remind everyone that the previous trendline for which I drew the bottom of our bullish channel (GREEN) still remains significant despite the fact that it was already broken three times (down on the 10th, up on the 20th, and down again on the 25th).

That being said, I am not saying that we'll enter back into the channel again. But what I am saying that it can still act as overheard resistance, and indeed, as you can see from the chart, it has.

Bitcoin remains in semi-neutral territory here. Although, it is not bearish (downward sloping RED channel), it is also not bullish (at least, I wouldn't give it that credit) yet.

Any trades entered before the first week in August remain fairly high risk in my opinion, especially considering what we are seeing on my charts which is indecision/volatility.

Stay cautious and know your levels. The major levels I have indicated on the charts. Seven levels in our current area between the GREEN and RED trendlines are:

1) GREEN TL (currently around $2800

2) $2760

3) $2670

4) $2600

5) 50 MA (currently around $2550)

6) $2420

7) $2340 (which is also %78.6 Fib)

Happy trading friends!

Predictions

Stopped out! A drop out of bull channel. New entry prices.The market decided that they were not comfortable with the price we were at yesterday. If you follow my post, you'll remember how often I talk about the bottom trendline of my GREEN channel. It is significant. Still is. Once we entered back into the channel, I bought BTCUSD again. I updated my trailing stops often to follow the bottom of my GREEN channel trendline. Last night, I was stopped out.

New entries.

I am obviously still long on BTCUSD. My target is still in the $4000 area over the next couple of months. And we have NOT entered back into our bearish RED channel. In short we are in neutral territory here as the Bitcoin market is trying to decide where to go. If you're a believer (as I am) that the market will eventually go higher again here are some entry levels you can be looking at:

$2550 = 50 MA

$2420 = Huge support & Middle Bollinger Band

$2350 = 78.6% Fibonacci & Top of bearish RED channel.

Below this last level, I become a bear again.

Use safe trading practices and always put in your stops!

Happy trading friends.

Litecoin - I was wrong. Now what?Rookie mistake folks. I jumped the gun. In fact, if you read my last few posts, you'll observe that I had this suspicion. I was too impulsive with my Litecoin buy and bought all in at $50. I should have exercised sound discipline as all good traders do and simply started my buy in at this price point. If I would have dollar cost averaged in from there to where we went low (as I expected was possible), my average cost would have been somewhere around $43 instead of $50.

It doesn't feel good to admit your error. But I want to post this so that I am not the only one who learns from it. Maybe I can save others from the same mistake.

Since I am a swing trader (as I mentioned previously), sometimes holding positions for months on end, I don't think I will lose money. I DO THINK we will still hit our $60-75 price target sometime withing the next (2) two months. However, I will be missing that extra $7 per LTC for not being more patient.

Let's take a look back and evaluate my mistake a little further.

Where I went wrong:

My biggest mistake was to allow an underlying assumption regarding Litecoin taint my bias. I had said that Bitcoin will fall before Aug. 1st but because coin purest would be looking for alternatives, I had thought that Litecoin would hold the $46 support as Bitcoiners would now move their money into Litecoin. While some of this did happen, it was not to the extent I had expected. Litecoin did not hold it's $46 support.

Where I was right:

I had said that if we fall further the bottom of the Bollinger Band and 50 MA would help give us a lift. It did.

What I've learned:

How much this whole crypto market still follows and is heavily, heavily influenced by the price action of our leader, Bitcoin.

Where we go from here:

I do believe Litecoin has neared it's bottom at $34.78. You can see from my green channel that there is still more room down in the short term (next 4 days), however, I don't think well get there.

GOOD NEWS: We are still in the green channel, which means the bulls are still in control of Litecoin, unlike with Bitcoin.

Happy trading friends.

Bitcoin LEVELS & how low do we go before August 1?A few things I'd like to point out on this messy chart:

-----

First, I started my Fib retracement at a different date on this chart. Most, will start at Mar. 25th. That's fine. However, I chose to start mine at $1111 for several reasons:

1) $1111 is around the avg. price point on the daily for the few months leading up to our big pop in price.

2) When starting at $1111, I noticed how it corresponded almost exactly with major support/resistance levels. Hmmmm... interesting.

3) I'm not superstitious, but c'mon, $1111 y'all! That's dope! How can we go wrong?

-----

Second, it is important you know your levels. I'll only list here the levels that I have that are under our upward sloping red trendline because it is these that matter now:

$2275 - Key resistance. Also .382 Fib. Also, notice the intersection of upward sloping RED trendline, top of the RED downward sloping channel trendline, and this level at July 27, 2017. Interesting! In other words, we can say with high probability that we will NOT go higher than $2275 before July 27th.

Next level = $2110

Down from there = $2057 - Also around the .5 Fib level.

Then, all the way down to $1840 which is both around the low of May 27th and also the key .618 Fib level.

A few more levels down from here are $1772, 1682, and 1609.

Finally, we arrive down at our .786 Fib retracement level at around $1510. Now, NOTICE WHERE THIS INTERSECTS AND WHEN! The bottom support of our downward sloping red channel trendline will intersect our .786 Fib support on exactly August 1rst. What does this mean? I don't know. But I do find it fascinating to observe!

-----

Now, where will we go from here? Well, that's the question of the hour isn't it? A few have suggested that Segwit2x will NOT happen, that the miners will get in line and prevent the fork from even occurring, and that $1830 was our bottom. While this may be true, it seems to me there is quite a bit of speculation involved in this theory. However, you wouldn't be wrong to start your buy-in at this point. In fact, this is the price at which I have started to buy back in. However, we will need more from the charts before we really know the direction that we will go from here.

Two weeks is a good amount of time for these markets to remain uncertain and with great uncertainty comes lots of volatility. I really wouldn't be too surprised to see us hit the $1510 support. We'd have to do this within the next few weeks. But I am fairly certain we will not go lower than this at this point UNLESS, for some reason, we drop out of our downward channel before Aug 1rst. If so, I'll reanalyze then. There could be trouble.

-----

In conclusion, $1850 is a good price point to start your Bitcoin buy back. Dollar cost average in from here. We could go lower, but keep on buying. We could go higher. Again, keep on buying. I usually do around 20% per buy. If you missed the first $1850, no worries. I think we'll hit it again here soon before Aug. 1.

As always, happy trading friends.

*NOTE: Longer dashed support levels also represent Fibonacci levels.

Litecoin LTCUSD to test $45 support - Should bounce hereAs I stated in my last post, I may have jumped the gun a bit on my Litecoin purchase. I knew this. But because I am a swing trader, I did not want to miss out on opportunity at that $50 level which provided fairly strong support. The next support level I see is even bigger. Why? 3 reasons:

1) I have redrawn my Fib retracement from the lows on 3-30 to the high on 07-05. This now provides .236 retracement support at approx. $45.

2) The low of our 07-04 candle sits at around $45

3) The middle Bollinger Band and 20 MA should intersect the first two supports at this level.

If you have not already picked up some Litecoin, I would advise doing so at $45. You could always DCA down from there, should we go lower. I happen to believe we'll bounce at $45.

Happy trading friends.

Litecoin LTC/USD Contrarian View - Going Long Now!I see almost everyone going short on Litecoin. I've decided to become the contrarian voice crying in the wilderness yet again. I've just picked up a boat load of Litecoin at $50 even. I expect Litecoin to continue to trend up this month (more analysis on that at a later date). My guess right now is that Litecoin will hit $60-75 by the end of the month. But for now this is just a projection based upon the angle of my upward trending channel I've drawn.

Now let me make the case for my contrarian view based upon simple analysis:

1) Bitcoin (see my BTCUSD charts) cannot conquer the $2600 level. It has tried many times and failed. This indicates weakness in the Bitcoin market along with several other factors.

2) Bitcoin's weakness is Litecoin's strength, as crypto purist will probably NOT switch over to establishment backed coins such as Ethereum or Ripple. So, due to the BIP 148 fork due Aug 1 for Bitcoin, I see a continued outflow of capital fromf Bitcoin into Litecoin until this target date.

3) Litecoin has solid support at $50. Not only is this support from the 6-19 high but is also .236 Fib retracement.

Of course, I very well could have jumped the gun a bit here with my purchase and Litecoin could still drop down to the next major support that I see at around $45. But either way, I see continuation to the upside before that Aug. 1 date. And since I am a swing trader holding trades for weeks and months, I see this as a very profitable investment.

You could play it a bit differently than I did and purchase 50% of your Litecoin stake here and dollar cost average down to the $45 mark if you want to bet we'll go there (and we could). But, the risk is, you could get left empty handed should we suddenly jolt upwards from here. Your call.

Happy trading friends.

Look how perfect!Check this out! After breaking through our $2420 support, I became a bit nervous. We only had one more stop before the floor fell completely out and that was at the $2330 area. Fortunately, there was plenty of support to hold us today. We had the bottom of our channel, the 50 day MA, and the bottom of the Bollinger Band all holding us up at the same area. We held today, bounced, and it now looks like we will even close this candle far above $2420. As the market hits the far east tonight, we should get even more support. With this long awaited consolidation, the crypto market has had it's chance to catch a breath. We can now continue our move onwards and upwards.

As always, happy trading friends.

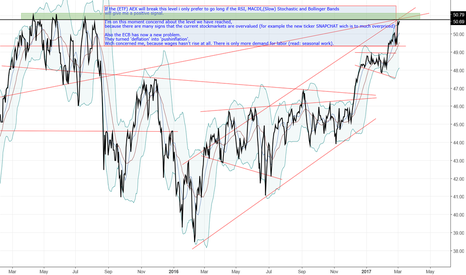

What will happen in the Netherlands and deflation or inflation?CHARTDESCRIPTION

If the (ETF) AEX will break this level i only prefer to go long if the RSI, MACDI,(Slow) Stochastic and Bollinger Bands

will give me a positive signal.

I'm on this moment concernd about the level we have reached,

because there are many signs that the current stockmarkets are overvalued (for example the new ticker SNAPCHAT wich is to much overpriced)

Also the ECB has now a new problem.

They turned 'deflation' into 'pushinflation'.

Wich concerned me, because wages hasn't rise at all. There is only more demand for labor (read: seasonal work).

GBP/USD Range OutlookWhile GBP/USD swiftly bounced from it’s brief foray below $1.20, price has once again been capped by the range that you can clearly see in the daily chart

The upper level of the range is definitely acting as resistance and the way it held again back in the first week of February puts Cable in play for shorts. Just keep in mind that it’s a 700 pip range and we’re already 250 pips off the highs. If that’s too close to the middle and not playing the edges for you, then fair enough. But as always, I would then look to zoom into an intraday chart and find an area of short term support turned resistance to manage risk around

Maby some correlation between Gold, Diamonds, S&P500 and NASDAQ?If we look at the figure we are seeing some high correlation between the Forex Gold and Diamond versus the Futures S&P500 and Nasdaq.

Prediction: this month Gold, Diamonds, S&P500 are going down

Prediction: this year Gold, Diamonds, S&P500 and NASDAQ are going up

How is it possible that there is some correlation between them? (my opinion)

You mostly find gold and diamnonds in the same country, mostly concentrate in Africa, South-America.

The S&P500 is correlated to Diamond and Gold companys because the S&P500 is a comparing of company's that are the most important in the US. If stocks of dollars and euro's are fall we can predict that the stocks of forex in Gold are rising, and because we know also that Gold is correlated to Diamonds we can assume that Diamons are going to be more value in the market.

Now we have one thing to understand: why the NASDAQ is correlated between these markets?

The answer at this could be something like: ''the NASDAQ is correlated because, we know that The S&P500 is a combination and comparing between the most important company's in the US. The US has some of the most powerfull and valuefull Electronic Company's. So When the S&P500 is rising (or falling) there is always some correlation in the market between them.

information: Bloomberg terminal, Wiki, is correlation one of the most important things in trading?

USDCHF - Divergence and broken supportPrice has been bouncing off the 0.9880 area for the last couple of weeks now. Finally, it has broken through. Also present is some divergence which can be seen using the MACD indicator and also the "rounding" of price.

I have entered at the 0.9888 and am looking for a nice move downwards. My stop loss is just above the previous S/R area. If price pushes above that area it is likely to keep going higher.

Reasons for short:

- Divergence

- Support and resistance

- Trend Line break

- Previous strong bearish move

XAU/USD - Trend line break down?Looking at the 4hr XAU/USD chart, I saw a nice bearish outside bar (BEOB) right at the longer term descending trend line. We had a small false breakout and a strong close below. To me, this indicates a move lower with the overall trend. I entered on a retrace to around the 50% Fibonacci retrace which is something I don't usually incorporate. I'm hoping we break through the lower band rising trend line and continue lower.

Confluence:

- Descending TL

- Fibonacci level

- BEOB

- Minor support/resistance @ 1215 level

EURUSD SHORT TERM PERSPECTIVE (SHORT) Short term targets on the downside, however key levels based on the Monthly chart 1.2000 looks ideal. I believe price would reach 1.100 levels. If the trend line is breached then we can see further downside targets 1.0500 then lower. However, once my short term target of 1.10500 is met I would be then waiting for PA confirmation for the long set up to 1.200.

*******WHOEVER SAID THAT YOU CAN'T PREDICT THE MARKETS???******Ladies and gentlemen, it's about time i come clean here and share with you my secrets of success in trading the stock market. It is no secret that many expert traders make outrageous claims about the market not being perfect and that it can't be predicted, and that it will always be 50/50 percent chance of success and failure. Well rest assured that their claims are nothing but dust. old news. Good news is that you can in fact predict the market with precision and three steps ahead of all the other market participants before it even happens! That is right! It is very true what you just read! In fact it is very scientific, theoretical, and mathematical! Its a very simple system that has been used by very few successful novice traders that have been keeping it a secret, and only they have known about it for some time, but now i am going to spill the beans and share their secret and mine for the very first time!

This system that i am going to share with you now has come a very long way, and quite frankly, this system has come such a long way that its creators are quite shockingly not what many traders hoped to expect. The creators of this golden opportunity system came from very humble beginnings, so humble that their social way of life playing online video games sparked the idea for the creation of what they now call D.I.P. Using all of their knowledge of online video gaming, their knowledge of astro physics, and their knowledge of meta physics they were able to put together D.I.P. and later put it to the test by trading Bitcoin. Whilst trading Bitcoin using D.I.P., they were able to predict the future pivot points three steps ahead of the market and create a LARGE CASH FLOW. Later, these humble heroes applied their method to stocks, futures, and currencies and got the very same results without failure!

Today, i share with you an example of their D.I.P. method . . .