DXY Just Broke Through the Lock… Where’s the Market Headed Now?🌅 Good Morning, Friends!

A few days ago, I marked 98.950 as a key threshold for the DXY index. As of today, that level has officially been broken—and the bullish momentum we anticipated is now kicking in. 📈

The next target? 101.000.

That said, it’s crucial to remember: DXY is heavily influenced by fundamental data. Stay alert and keep a close eye on key economic developments—they’re essential for navigating this move.

This breakout validates the analysis I shared with you all. And it wasn’t just about charts—it was about discipline, precision, and timing.

Every single like from you is a huge boost to my motivation. Thanks from the heart—your support drives me to keep sharing these insights! 💙

Priceaction

XAUUSD Market Update – July 30 Late NY Recap🔸Macro Context

Markets are still digesting Powell’s ongoing speech with no clear pivot signals. While FOMC tone remained cautious, no dovish surprise emerged. Trump’s upcoming comments keep geopolitical risks elevated. USD remains firm. Gold is reacting within key HTF demand as intraday volatility cools off.

🔸Bias Overview

Weekly Bias:

• Bearish rejection from the major supply wick 3439–3350

• Structure still below 3345, maintaining downside pressure

• Weekly RSI cooling off — no bullish divergence yet

Daily Bias:

• Lower high locked below 3345

• Price reentered the imbalance toward 3272

• Clean structure remains bearish unless we reclaim 3302

H4 Bias:

• Lower high formed at 3314

• Current price testing HTF Extreme Demand Base (3289–3272)

• Still bearish unless we see a confirmed M15 or H1 BOS from demand

🔸Key Structural Zones

🔺Above Price (3272):

• 3289–3294

Decision Block – M30 OB + FVG. First sign of momentum shift if reclaimed.

• 3302–3314

Supply Reversal – H1 OB + previous BOS zone. EMA alignment adds pressure.

• 3345–3350

Major Rejection Zone – H4 origin of last leg down. Strong resistance area.

🔻Below Price (3272):

• 3254–3264

Imbalance + OB – H4 FVG + clean demand zone. Buy setup only on deep flush + reversal PA.

• 3227–3214

HTF Demand Base – Daily OB + historical volume shelf. Final structural floor before deeper downside opens.

🔸Battle Plan

▶ Scenario 1 – Bearish Breakout

If 3272 fails with momentum and no reversal signs, expect continuation into 3254–3264.

No long trades unless BOS confirms.

▶ Scenario 2 – Reactive Long from Demand

If price gives a strong reaction from 3272 with BOS on M15 or H1 and clears 3294, then a recovery into 3302 is possible. Only valid with confirmed PA + EMA shift.

▶ Scenario 3 – Choppy Rejection from 3294

If price tests 3294 but fails, watch for rejections back toward 3272. Scalpers can fade reactions if no bullish structure forms.

🔸Final Thoughts

Price is once again testing our Extreme Demand Base from July 28 (3289–3272). The zone remains valid — but execution depends entirely on confirmation. Bears still in control unless we reclaim 3302 cleanly.

No need to rush. Best RR setups are found at clean structural edges.

Patience = profits.

—💬 Drop your thoughts in the comments.

❤️ Like if you appreciate the precision.

🔔 Follow GoldFxMinds for more sniper-level updates.

With you all the way,

— GoldFxMinds

📊 Analysis based on Trade Nation TradingView charts.

Sell the Rip? AUDUSD Retest Zone AlertHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDUSD has been overall bearish , trading within the falling red channel and it is currently retesting the upper bound of the channel.

Moreover, it is rejecting a structure marked in blue.

📚 As per my trading style:

As #AUDUSD approaches the red circle zone, I will be looking for trend-following sell setups on lower timeframes. (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Smart Money Technical Analysis – Bullish Potential XAUUSD Smart Money Technical Analysis – Bullish Potential from Strong Support

Gold (XAUUSD) is currently trading around $3,291.780, showing a potential bullish reversal setup from the strong support zone after a clear liquidity sweep and market structure shifts.

🔍 Key Technical Highlights:

✅ Strong Support Zone (Demand)

Price is reacting from a major demand zone (Strong Low) between $3,275 – $3,225, a level that previously triggered bullish rallies.

Multiple Breaks of Structure (BOS) and CHoCH indicate previous bullish control and a possible re-accumulation phase.

✅ CHoCH Near Support

A recent Change of Character (CHoCH) around the support area shows the first signs of smart money accumulation.

Liquidity below recent lows has been swept, triggering possible bullish intent.

✅ Bullish FVG (Fair Value Gap)

A clear Bullish FVG remains unmitigated around the mid-range, offering target confluence at $3,349.560.

Price may aim to rebalance inefficiency and fill the FVG as part of the bullish move.

✅ Resistance Zone Above

The resistance area near $3,325 – $3,350 acts as a short-term target for long positions.

Further resistance lies at the Buy-Side Liquidity & Weak High zone around $3,450 if momentum sustains.

🧠 Smart Money Concept Interpretation:

Liquidity Grab: Price dipped into strong demand to collect sell-side liquidity before potential reversal.

CHoCH + BOS Alignment: Indicates the market may now transition into a bullish phase.

FVG as Magnet: Price is drawn toward unfilled value zones—ideal for bullish target projection.

🎯 Trade Idea (Educational Purposes Only):

Bias: Bullish

Entry: Around current zone ($3,290)

Target: $3,349.560 (FVG zone)

Invalidation/SL: Below strong low (~$3,225)

+330% this morning $1.25 to $5.38 on massive 270 million volume🚀 +330% this morning 💥 $1.25 to $5.38 on massive 270 million shares traded volume so far

NASDAQ:SNGX money maker of the day!

2 Buy Alerts sent out, also posted it in my premarket watchlist while it was still up only +30%!

Forget about NASDAQ:MSFT NASDAQ:META NASDAQ:AMZN NASDAQ:NVDA NASDAQ:AAPL AMEX:SPY NASDAQ:QQQ they will never be able to create such gains in a single day or should I say minutes

This isn't options trading either, it's a stock that went up that much this morning

EURJPY Bullish Setup : EURJPY Forecast + Demand Zone🧠 Introduction: What's Happening on the Chart?

Today’s analysis on EURJPY is built on the MMC trading framework, which emphasizes the identification of institutional supply and demand zones, reaction points, QFL patterns, and volume bursts to map out high-probability trading paths.

We are currently observing a market in a corrective phase following a significant bearish drop. However, the presence of a major demand zone, along with a positive bullish pattern, suggests potential upside reversal or at least a short-term retracement.

🔍 Technical Breakdown – Zone by Zone

🔻 1. The Drop from 2x Supply Zone

EURJPY experienced a significant decline from the 173.60–174.00 area, which acted as a 2x confirmed supply zone.

Sellers took control with strong bearish candles that broke through previous minor support levels.

This drop was impulsive, showing momentum-driven selling, often linked with institutional activity.

🟩 2. Demand Reaction at Major Zone

Price entered a key demand zone marked in green (170.80–171.00), where historically buyers have stepped in.

A "Volume Burst" is visible here—large volume candles with long wicks to the downside, which typically indicate accumulation.

A positive pattern (possibly engulfing or a pin bar structure) has formed, signaling a potential bullish reversal or relief rally.

🧱 3. QFL Structure (Quantum Flat Line)

The chart highlights a QFL base, where the price consolidates after an initial drop, then continues lower before a sharp bounce.

QFL is often used to identify trap zones where retail traders are shaken out, and smart money enters.

The recent bounce from the QFL base suggests smart money might be accumulating for a reversal move.

📐 Key Levels and Zones

Type Zone/Level Role

🔵 Volume Burst Area ~170.80–171.00 Aggressive buyer entry; accumulation zone

🟢 Major Demand 170.80–171.20 Key structural low supporting bullish bias

🟠 SR Flip Zone 171.80–172.00 Crucial breakout/retest level

🔴 Minor Resistance 172.60–173.00 Short-term pullback zone

🟥 2x Supply 173.60–174.00 Strong reversal point; ideal target

🔁 Scenarios to Watch

📈 Scenario 1: Bullish Breakout and Rally (Blue Box 1)

If price breaks above 172.00, we expect:

A potential retest (bullish confirmation).

Continuation toward minor resistance at 173.00, and possibly the 2x supply zone at 174.00.

This aligns with the positive pattern formed at the base and the idea of a market rotation from bearish to bullish structure.

📉 Scenario 2: Rejection and Retest of Lows (Blue Box 2)

If the price fails to sustain above 172.00, sellers may step in:

Price could revisit the major demand zone again or even break down to 170.50.

This would invalidate the bullish setup in the short term and imply a larger continuation of the bearish trend.

🧠 Strategic Insights (MMC-Based Thinking)

The MMC approach teaches us to mirror the market’s emotion and behavior.

In this case, we see signs of:

Panic selling → smart money accumulation.

Institutional traps (QFL drop) → bullish absorption.

Traders applying MMC would anticipate reactive setups at the SR Flip Zone to determine next directional bias.

💡 Trade Ideas (For Educational Purposes Only)

Strategy Entry SL TP1 TP2

Aggressive Long 171.30–171.50 170.70 172.50 173.50

Breakout Retest Long 172.10 (after breakout) 171.50 173.00 174.00

Sell on Rejection 172.00 (bearish confirmation) 172.60 171.00 170.40

📌 Conclusion & Final Thoughts

EURJPY is showing a potential bullish reversal setup from a well-defined demand zone, supported by volume bursts and positive price action patterns. However, the SR Zone at 172.00 remains the key pivot—how the price reacts here will determine whether we see a deeper pullback or a continuation to test upper resistance levels.

Stay flexible and responsive. Let the market give confirmation before execution. As always, follow proper risk management and trade the reaction, not the prediction.

BTCUSD – Bullish Recovery Setup Forming Near Trendline Support🧠 Market Structure & Technical Breakdown

The BTCUSD 4H chart showcases a well-formed descending triangle or falling wedge structure with clearly respected major and minor descending trendlines. Currently, price action is testing a dynamic support zone, highlighted in green, which has been a strong reaction area in the past.

This area aligns with a bullish accumulation zone, from which buyers have previously stepped in to initiate impulsive moves. Given the confluence of diagonal support and horizontal price reactions, we may be on the verge of a bullish breakout opportunity.

📍 Key Zones & Trendlines

✅ Green Support Channel (Demand Zone): Acting as a key pivot for multiple recent rejections, this area (~114,000–113,000) is now being revisited again, offering potential buy interest.

📉 Minor Trendline: A short-term descending resistance around 120,000—likely the first barrier in case of a bounce.

📉 Major Trendline: A more extended dynamic resistance line connecting swing highs, currently intersecting near the 124,000 region.

🔄 Potential Price Scenarios

Primary Bullish Setup (MMC Plan):

Price bounces off the green demand zone.

Breaks above the minor trendline (~120K).

Pullback retest to confirm breakout.

Continuation toward the major breakout level (~124K and beyond).

Invalidation / Bearish Case:

A clean breakdown below 113,000 with strong bearish momentum would negate this setup, likely targeting the psychological support near 110,000.

🧠 MMC Mindset: Trade with Patience & Confluence

This is a classic accumulation-to-breakout scenario. Smart traders wait for confirmation—especially as BTC often exhibits false breakdowns before a major move. Monitor candle behavior, volume, and reaction to the minor trendline.

Let the market show signs of strength (like bullish engulfing, pin bars, or a breakout-retest) before committing to the upside. Avoid FOMO; the key is discipline and precision entry at structural break points.

✅ Trade Plan Summary:

Watch zone: 113,000–114,500 for bullish price action

Breakout level: Minor trendline (~120,000)

Target zone: 123,500–124,000 (Major resistance)

Stop-loss idea: Below 112,800 (Invalidation of structure)

BTCUSDT – Diametric G-Leg Underway?⏱ Timeframe: 4H / 1H

🔍 Method: NeoWave + Smart Money Concepts (SMC)

📍Posted by: CryptoPilot

⸻

🧠 NeoWave Progression Update

As outlined in our previous analysis, we are tracking a potential Contracting Diametric structure (A–G) originating from the March 2025 highs.

🚨 The G-Leg may now be actively unfolding.

Here’s what just happened:

• Price rejected sharply from the supply zone near 119,000–119,500, exactly where Wave F was expected to end.

• After a drop to 115,780 (minor trendline), price bounced, but failed to make a new high, stalling at 118,700, forming a lower high → classic signature of a developing G-Leg.

• This G-wave likely aims to break below Wave E low, seeking imbalance fills and structural resets.

⸻

📊 Smart Money Confluence (SMC / ICT)

• 🟥 Bearish Market Structure confirmed via MSS on 1H: Lower Highs + Internal BOS

• 🟨 Buy-side Liquidity above 120k was already swept

• 🔻 Price failed to reclaim OB block around 119.5k

• 🧩 FVGs remain open between 114.5k–113k, acting as magnet zones

• 📉 Expectation: Price may now break the ascending minor trendline and accelerate toward the major structure low

📌 Primary Scenario:

• Wave G of Diametric in motion

• Potential structure: Zigzag or Complex Combination

• Expectation: Bearish continuation to break below 113k

📌 Alternative Scenario:

• If price closes above 120.5k, diametric structure may be invalidated

• Watch for triangle/flat development instead

⸻

⚠️ Risk Management Note:

Price action near 118.7k–119.5k is crucial. Reclaiming that zone with strength changes the bias. Until then, sellers remain in control.

💬 Final Thought:

We’re tracking the final stages of a multi-month complex correction. The rejection at supply, combined with SMC signals and NeoWave symmetry, suggests sellers may push price into deeper demand zones soon.

⸻

📌 Follow CryptoPilot for advanced wave structure updates, market geometry insights, and ICT-style smart money traps.

💬 Share your views or alternate wave counts in the comments!

Gold 31 July – Bearish Bias Holds, Watching Supply ZonesGold (XAUUSD) Analysis – 31 July

Market structure is now aligned across both higher and lower timeframes:

H4: Bearish

M15: Bearish

This alignment strengthens the probability of trend-continuation setups in favor of the dominant downtrend.

🔄 Current Market Behavior:

The M15 chart is currently in a pullback phase, retracing toward its previous lower high and approaching a key supply zone.

📍 Key Supply Zones to Watch:

Zone 1 – Immediate Supply Zone (3299 – 3305)

• First area of interest where price may react.

• If respected and followed by M1 confirmation, a short setup could be initiated.

• Watch for signs of exhaustion or sharp rejection.

Zone 2 – Higher Supply Zone (3326 – 3332)

• If the first zone fails, this becomes the next high-probability area.

• Well-aligned with the broader bearish structure — expect stronger reaction potential.

• Suitable for cleaner high RR short trades if price reaches this level.

✅ Execution Plan:

• Observe how price behaves inside the marked zones.

• Only plan short entries after M1 confirmation — this adds precision and prevents premature entries.

• Stay patient. Let the market come to you and reveal intent before acting.

📌 Summary:

Bias: Bearish

Structure: H4 and M15 both support downside bias

Zones in Focus:

– Primary: 3299–3305

– Secondary: 3326–3332

Execution: Wait for confirmation before entering.

Risk-Reward: Maintain 1:3 RR minimum (e.g., 40 pip SL, 120 pip TP).

Let the structure guide your setups — not impulse.

📘 Shared by ChartIsMirror

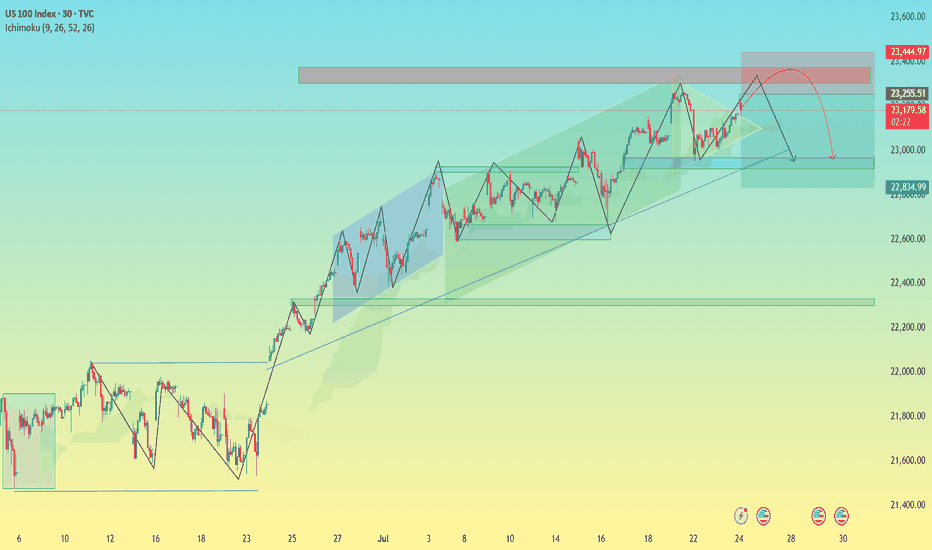

US100 Index – Potential Bearish Reversal in Key Resistance Zone🧠 US100 Index – Potential Bearish Reversal in Key Resistance Zone

Timeframe: 30-Minute | Chart Published: July 24, 2025

---

🔍 Overview

The US100 (NASDAQ) has been trading in a well-structured ascending channel, forming higher highs and higher lows. However, recent price action suggests that the index is testing a critical supply zone near 23,400, with signs of weakening bullish momentum. This may signal a potential corrective phase or bearish reversal.

---

📈 Technical Analysis Breakdown

🔵 Trend Structure:

Price is respecting a clear ascending trendline (blue), connecting multiple higher lows.

Multiple bullish flag/channel formations have been completed within the uptrend, showing healthy momentum until the current point.

🟥 Resistance Zone:

Strong supply zone marked between 23,250 – 23,450.

Price action shows stalling candles and rejection wicks within this zone, indicating buyer exhaustion.

⚠ Bearish Patterns:

The red path projection suggests a head and shoulders-like structure forming at the top of the channel.

This, along with divergence in wave strength and shrinking momentum, supports a potential reversal.

🔵 Key Support:

First support lies around 23,000 — aligning with the ascending trendline and previous consolidation.

If broken, next demand zone is around 22,835 – 22,900, where historical consolidation took place.

---

🔁 Projected Scenario (as per visual path)

1. Price may attempt one last push into the 23,400–23,450 zone (possible false breakout).

2. Rejection from this level could trigger a fall toward the ascending trendline support.

3. A confirmed break of the trendline can lead to a larger correction toward the 22,800 zone.

---

🧠 Unique Insight

This chart combines multi-timeframe structure recognition with a real-time reversal formation inside a long-standing bullish trend. The analysis doesn’t just rely on textbook patterns—it recognizes real-time price behavior shifts, which makes it valuable for proactive traders.

---

📌 Conclusion

While the trend remains bullish overall, caution is warranted as the US100 approaches a historically significant resistance zone. The setup offers a compelling risk-reward short opportunity for aggressive traders, especially if the price confirms a break below trendline support.

---

🔧 Next Steps for Viewers

> “Watch for a clean rejection candle or lower high at resistance before entering short. If trendline breaks cleanly, 22,835 could be the next target zone.”

XAUUSD Analysis : Channel Break, Demand Zone + SR - Interchange"High-Probability Zone Reaction & SR Flip Confirmation"

Gold (XAUUSD) is currently reacting from a significant support zone after completing a bearish breakout from a well-established ascending channel. The market structure indicates both threat and opportunity depending on how price behaves around key levels ahead.

🔍 Structure Breakdown & Price Behavior:

🔹 1. Rising Channel Violation

Over the past few weeks, price was comfortably moving inside a well-respected ascending channel, making higher highs and higher lows.

Recently, however, price broke below the lower boundary, which is often a bearish signal—indicating a possible trend reversal or a deeper correction phase.

Such breakdowns suggest buyers are losing control, and bearish sentiment is gaining strength.

🔹 2. Supply Zone Reaction & Drop

Before the breakout, we observed a sharp rejection from a high point, triggering a sell-off.

The price completed its move into a previously defined supply zone, resulting in a strong bearish impulsive leg that pushed it outside the channel.

This move shows clear institutional distribution—where large sellers unloaded positions around that zone.

📍 Key Zone Focus:

🟩 Previous Reversal / Demand Zone (Green Box)

Price is now sitting in a historically strong demand zone, which acted as a major reversal point in the past.

This area is marked as the first zone of interest where buyers might step back in to defend.

The green box represents a liquidity pocket where institutions previously accumulated positions—hence it’s a strong bounce candidate.

🟦 SR Interchange Zone (Blue Box)

The next major level above current price is the SR Interchange zone, around 3,320–3,340.

This level was previously broken and now acts as resistance.

It's crucial because it represents the battle zone where the market will decide whether to continue bearish or shift back bullish.

🧠 Market Psychology & Order Flow Insight:

The recent aggressive selling pressure from the highs, followed by a bounce from the demand zone, shows a shift from euphoria to fear.

Sellers are active at supply, while buyers are attempting to defend the previous demand.

The market is currently in decision mode—and the SR flip zone (3,320–3,340) will be the judge.

A break and retest above this level signals strength and potential for a trend resumption.

A failure to reclaim it would confirm bearish dominance and open doors for deeper targets.

🔄 Possible Scenarios Ahead:

📈 Scenario 1 – Bullish Rejection & Breakout:

If buyers successfully hold the 3,280–3,260 demand zone and push price above the SR Interchange zone, we can expect:

📍 Target 1: 3,360 (mid-term resistance)

📍 Target 2: 3,400–3,420 (previous high & upper trendline)

This would confirm a fakeout from the channel and a bullish continuation pattern.

📉 Scenario 2 – Failure at Resistance & Drop Continuation:

If price fails to reclaim the interchange zone, expect a retest of the green demand, followed by a potential drop toward:

📍 3,260 – local support

📍 3,240 – major support (unfilled demand below)

📍 3,220–3,200 – ultimate downside target

This would solidify a bearish market structure, confirming the sellers are in control.

🧭 Key Levels To Watch:

Level Type Price Range Significance

Supply Zone ~3,400–3,420 Major institutional selling area

SR Interchange (Blue) ~3,320–3,340 Critical resistance / flip zone

Current Price ~3,297 Watching reaction for momentum shift

Demand Zone (Green) ~3,280–3,260 Key support / bounce zone

Major Demand Pending ~3,240–3,220 Next support level if drop continues

✅ Conclusion:

Gold is at a critical inflection point.

The recent bearish breakout signals weakness, but the current support zone may provide a short-term bullish setup if buyers defend it effectively. A successful reclaim of the SR flip zone will shift sentiment bullish again. Otherwise, a deeper correction is likely.

This setup is ideal for both swing and intraday traders—look for confirmation signals at the current support and SR zone before executing trades.

EURGBP Analysis : Bearish Leg Nearing Completion + Target Zone📍 Overview:

The EURGBP pair has recently provided significant price action signals that suggest a high-probability reversal setup is unfolding. This analysis dives deep into market structure, supply and demand dynamics, and institutional price behavior using MMC principles.

The current focus lies in identifying a potential trend reversal opportunity after a sharp decline from a key supply level, as price nears a well-marked Reversal Zone. This detailed breakdown covers each phase to provide clarity and trade planning.

🧩 Phase 1: Consolidation Phase (Accumulation)

From July 11th to July 24th, EURGBP moved sideways within a clearly defined range-bound structure (highlighted in green).

This consolidation indicates a battle of control between bulls and bears, typically signaling accumulation or distribution depending on breakout direction.

The tight price action and wicks on both sides suggest market makers accumulating positions before a breakout.

Price eventually broke out to the upside, confirming bullish accumulation rather than distribution.

🚀 Phase 2: Impulse Move & 2x Supply Rejection

Following the breakout from the consolidation, price experienced a strong impulsive rally, catching breakout traders and pushing into a major supply zone.

The area where price reversed is marked as a 2x supply rejection zone, suggesting heavy institutional sell orders were triggered.

This zone aligns with a historical resistance level and is critical in the current structure.

Price failed to sustain the bullish momentum, forming a sharp drop right after tapping into supply, indicating strong selling pressure.

🔄 Phase 3: Market Structure Shift via QFL (Quick Flip Levels)

As the price dropped from the supply zone, two significant QFL levels were printed in quick succession.

QFL (Quick Flip Levels) represent a break in internal structure, showing that buyers were no longer defending the previous support zones.

These quick flips signal an aggressive shift in momentum from buyers to sellers.

Each QFL breakdown was followed by a new lower low, confirming the start of a bearish sequence or trend leg.

📉 Phase 4: Descending Trendline & Dynamic Resistance

After the QFL shifts, a clear downtrend channel formed, respected by multiple lower highs.

The descending trendline drawn from the supply zone peak has acted as dynamic resistance, rejecting every bullish pullback attempt.

This trendline provides technical confluence for intraday traders to manage risk and timing entries.

🟠 Current Market Context: Entering the Reversal Zone

Price is now approaching a marked Reversal Zone (highlighted in orange).

This zone represents a high-probability demand area, previously respected as a base before the rally to supply.

If price reaches this area and shows signs of exhaustion (e.g., bullish engulfing, long wick rejection, volume divergence), it may serve as a reversal point.

This zone aligns with MMC logic — market makers tend to react at zones of trapped liquidity, especially after stop hunts.

📈 Projected Scenario & Trade Setup:

Price drops into the Reversal Zone

A bullish rejection pattern appears (e.g., pin bar, engulfing candle)

Price retests and breaks the descending trendline to confirm a momentum shift

Entry can be taken post-breakout or with aggressive confirmation inside the zone

Stops placed below the zone; targets aligned with the previous QFL or trendline retest

⚠️ Key Notes for Traders:

Don't chase the move. Wait for reversal confirmation before entering.

QFLs offer strong structure-based levels to identify where the market flipped.

Use trendline confluence and volume confirmation for precise entries.

Monitor price action in the Reversal Zone — if invalidated, the downtrend may extend toward the next macro support.

Apply proper risk management and stay patient for the setup to fully develop.

📊 Summary:

🧭 Bias: Short-term bearish → possible reversal bullish

🎯 Entry Area: Reversal Zone (0.85800 – 0.86000 approx.)

⛔ Invalidation: Clean break and close below 0.85700

🏁 Potential Target: First TP near 0.86750; extended TP near 0.87050 (previous QFL level)

🔄 MMC Approach Recap:

This analysis follows the Market Maker Cycle (MMC) method, which involves:

Consolidation (Accumulation)

Manipulation (False Breakouts or Stop Hunts)

Distribution (Rapid Expansion & Flip Levels)

Re-Accumulation or Reversal

Each step is clearly defined in this chart, offering a blueprint for both trend traders and reversal specialists.

💬 Let's Talk:

What do you think about this setup? Are you seeing similar MMC patterns on other EUR or GBP crosses?

Drop your thoughts, charts, and questions below!

EURUSD Analysis – Supply Zones & Reversal Opportunities (MMC)Today’s EURUSD analysis focuses on identifying major supply zones, potential reversal points, and directional bias using the Mirror Market Concept (MMC) on the 8-hour timeframe.

1️⃣ Market Structure & Channel Supply Zone

The market recently formed a descending channel 📉, acting as a full supply zone where sellers dominated.

Every time price touched the upper boundary of this channel, we saw bearish reactions, proving this zone as a strong liquidity grab area.

Breakdown from the channel: After repeated attempts to break the channel to the upside, sellers regained control, pushing EURUSD lower and confirming bearish momentum.

2️⃣ Central Reversal Zone (Decision Point) ⚖️

Currently, price is consolidating around the Central Reversal Zone.

This zone is crucial because it can act as:

Reversal Point 🟢: If buyers step in aggressively, we might see a bullish leg toward previous swing levels, targeting resistance zones.

Continuation Zone 🔻: If sellers maintain pressure and break below this level, momentum will shift strongly bearish, aiming for deeper support.

Price behavior here will define short-term direction. Traders must wait for confirmation before committing to large positions.

3️⃣ Next Major Reversal Zone (High-Probability Demand) 🟩

Marked in green, this zone is expected to attract buyers if the current level fails.

Historically, these areas show high liquidity grabs and institutional activity.

If price reaches this zone, we expect significant bullish interest, making it a high-probability reversal area for medium-term buy setups.

4️⃣ Trade Scenarios

Scenario 1 (Bullish Reaction 🟢):

Price bounces from the Central Reversal Zone.

Possible targets: Previous structure highs inside the channel break zone.

Scenario 2 (Bearish Continuation 🔻):

Price fails to hold above and breaks lower.

Target: Next Major Reversal Zone for fresh liquidity accumulation.

5️⃣ Trading Approach & Risk Management 🛡️

Aggressive Approach: Intraday traders can scalp inside the Central Reversal Zone but must keep tight stop-losses to avoid fake-outs.

Conservative Approach: Wait for a clean break and retest confirmation, especially near the Next Reversal Zone for high-probability trades.

Maintain risk-to-reward (RR) ≥ 1:2 and avoid emotional trading during reversal attempts.

Summary:

EURUSD is at a critical juncture. The current market structure shows a bearish tone, but the Central Reversal Zone can still cause a temporary bullish reaction. A failure to hold will open the path toward the green reversal demand zone, where major buyers are likely to appear.

AUDCAD / GBPAUD Trade Recaps 01.08.25A tester trade on AUDCAD with the reasons explained as to why this was a test position, and a short position executed on GBPAUD. Solid setup that this time around just didn't commit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

USDJPY Analysis : Key Reversal Zone After Parabolic Rally🧠 Market Psychology & Structure

The USDJPY 4-hour chart reveals a classic parabolic curve pattern signifying an acceleration phase in bullish momentum. This phase typically occurs during the final stages of a bullish move, where price action becomes increasingly steep due to aggressive buyer participation.

The rounded curve drawn on the chart reflects momentum compression—where pullbacks become shallower, and higher highs are formed rapidly. However, this pattern often ends in a blow-off top or a sharp correction, especially when approaching key supply zones.

🧩 Key Technical Highlights

Major Break Zone: The previous resistance around 148.80–149.00 (now flipped to support) was clearly broken with strong bullish candles, confirming trend continuation.

Break Out Demand : Price retested the breakout zone (around 149.80–150.00) before launching higher, validating this level as a new demand zone.

Current Price Action: The pair is currently hovering around 150.50 after a powerful rally, showing early signs of exhaustion with smaller bullish candles and slight upper wicks.

🔍 Target Area – Next Reversal Zone (151.80–152.30)

The green highlighted zone marks a strong supply area / reversal zone, identified from:

Previous price rejections in historical data.

Overbought conditions due to vertical rally.

Completion of the parabolic structure (climax zone).

We can expect price to reach this zone in the coming sessions, where it may:

Face strong selling pressure.

Trigger short positions from institutional sellers.

Lead to distribution or reversal back toward the demand area near 150.00.

🔄 Forecast & Trade Plan

Scenario 1 (High Probability): Price taps into 151.80–152.30, forms bearish engulfing or rejection wick, then pulls back to 150.00 or lower.

Scenario 2 (Invalidation): Strong breakout above 152.30 with momentum—bullish continuation towards 153.00+ possible.

🧠 Trader’s Mindset (MMC Insight)

This chart suggests a matured bullish trend nearing exhaustion. As smart traders, we anticipate rather than react. Wait for the price to reach the supply zone, then observe for confirmation (bearish structure, divergence, candlestick pattern) before shorting.

Avoid chasing longs at these highs—risk-to-reward is no longer favorable. Patience will offer a much cleaner entry if the reversal unfolds as expected.

USDJPY 4H Analysis : Curve Breakout & Retest Completed + Bullish"Momentum Building Above Retested Demand – Will Bulls Take Control?"

📊 Market Structure Overview:

USDJPY has shown a clean bullish structure in recent sessions, supported by a strong demand retest and a steady parabolic curve formation (Black Mind Curve Line). The pair has successfully broken above a major resistance, retested it, and is now holding higher ground—suggesting potential for continued upside if current structure holds.

🧱 Detailed Technical Breakdown:

🔹 1. Demand & Retesting Behavior

The chart highlights a key demand zone (green box) that was previously used after a bullish move.

Price recently returned to this zone for a clean retest, validating its role as a strong support.

This type of retesting behavior is critical in smart money analysis, confirming that accumulation has occurred and sellers have been absorbed.

🔹 2. Major Breakout Confirmation

The previous major structure level has been decisively broken to the upside.

This level now acts as support, increasing the probability that the bullish move will sustain.

🔹 3. Black Mind Curve Line (Parabolic Structure)

A parabolic curved trendline supports the current price action, showing how bulls are gradually gaining momentum.

This curve represents buyer interest increasing over time, which often leads to an aggressive breakout when paired with retest confirmation.

📍 Key Price Zones:

Type Price Level (Approx.) Description

🔹 Retesting Zone ~148.800 – 149.100 Support zone after major breakout

🔺 Resistance Target (1) ~150.500 Bullish breakout target (short-term)

🔻 Downside Risk (2) ~147.000 – 146.500 Bearish invalidation zone if demand fails

🔹 Full Supply Area ~145.000 – 145.500 Historical supply zone if price fails completely

🔮 Trade Scenarios:

✅ Scenario 1 – Bullish Continuation (Primary Bias)

Retest is complete, and price is holding above the curve and demand zone.

If bullish momentum continues:

📈 Target 1: 150.50 – Near-term resistance and liquidity area

📈 Target 2: 151.20+ – Extension target if buyers dominate

Bullish Confirmation:

Price must stay above ~149.00 and continue forming higher highs.

Entry ideas: Wait for minor consolidation above current price or bullish breakout from mini range.

⚠️ Scenario 2 – Bearish Rejection

If price rejects from current level and breaks below the curve and demand zone (~148.80):

📉 First downside target: 147.00 (minor support)

📉 Final bearish target: 145.50 (full supply zone)

Bearish Confirmation:

Breakdown of curve support and close below the retesting zone with momentum.

Such a move would suggest buyers failed, and market may rotate lower.

🧠 Market Sentiment & Psychology:

Smart Money Behavior: Demand was filled cleanly and retested, indicating possible institutional interest at that level.

Momentum Curve: As shown by the black curve, momentum is rising gradually—this reflects confidence building among buyers.

However, price is near psychological resistance (150.00–150.50 zone), where heavy sell orders might be placed.

The market is in a decision zone, where confirmation of strength or failure will dictate the next 200–300 pip move.

🎯 Summary:

USDJPY is showing a bullish structure supported by:

A valid retest of demand

A clean breakout of major resistance

An ascending parabolic curve

If bulls defend the current zone, we may see a powerful continuation toward 150.50+. If price fails to hold above the retest zone, downside risks open toward 147.00 and potentially the full supply at 145.00.

📌 Trade Smart: Wait for price confirmation, manage risk with stop placement below the demand zone or structure lows, and avoid chasing the move.

USDJPY Forming Bullish Reversal | MMC Analysis + Target🧠 Chart Overview (2H Timeframe)

🔸 1. Head and Shoulders Inverse Pattern – MMC Bullish Blueprint

The chart beautifully shows an Inverse Head & Shoulders pattern, one of the most powerful reversal signals under MMC logic:

Left Shoulder: Formed after the initial drop and quick recovery.

Head : Deep liquidity grab and reversal from the lowest point (demand zone).

Right Shoulder: Higher low structure, indicating reduced selling pressure and shift in momentum.

This pattern is forming around a previous liquidity zone, which makes it more valid and aligned with smart money behavior.

🔸 2. Retesting Zone – Critical MMC Demand Area

Price is now retesting a highlighted demand zone, which acted as the springboard for the previous bullish move:

Bullish Pattern marked aligns with MMC’s concept of “Return to Origin”.

This zone also sits just above the right shoulder, confirming that buyers are defending aggressively.

If this level holds, we may see a strong continuation move to the upside.

🔸 3. Previous Reversal Zone (Supply) – Next Target Area

Marked in light green, this area is the next critical resistance:

Acts as liquidity target for institutions if price rallies.

Historically acted as a major reversal point.

Price is likely to show reactions or profit-taking behavior here.

Once broken and retested, it becomes a new support for further upside continuation (as marked on the chart).

🔸 4. Dual Scenarios – Bullish vs Bearish Pathways

Your chart correctly outlines two strategic possibilities:

✅ Bullish Scenario:

Price respects demand zone.

Breaks above previous reversal zone (149.000+).

Bullish continuation toward 149.800–150.500 range.

MMC tip: “If it goes bullish, use previous demand or double it” = Add confluence or stack demand zones for scale-in entries.

❌ Bearish Scenario:

If price breaks below retesting zone, bullish invalidation triggers.

Look to the previous all supply zone (Zone Pattern Must) for next reaction.

This scenario reflects smart money rejection of upside continuation.

🗂️ MMC Structural Elements Identified:

Zone/Pattern Role in Analysis

Inverse H&S Trend reversal signal

Retesting Zone Demand/entry area

Previous Reversal Zone First key resistance / next liquidity pool

Supply Zone Below Target in case of downside breakdown

MMC Logic Follow price structure, fakeouts, demand/supply traps

📈 Summary Outlook:

USDJPY is showing a technical bullish structure backed by MMC-based price psychology. The current pullback into a demand zone gives traders an excellent R:R opportunity for long positions, targeting higher zones upon breakout confirmation.

🟩 If bullish, breakout >149.000 will likely lead toward 150.000+

🟥 If bearish, breakdown <147.600 opens doors to deeper drop toward 146.000 zone (watch for reversal pattern).

🔑 Key Levels to Watch:

Type Level Range Notes

Support 147.600–147.800 Current retesting demand

Resistance 148.800–149.300 Previous Reversal Zone (Profit booking area)

Higher Resistance 150.500+ Final upside objective

Breakdown Zone <147.500 Flip to bearish scenario