XAU/USD Analysis – Wedge Breakdown & Bearish Trade Setup1. Chart Overview

The 15-minute XAU/USD chart shows a descending wedge pattern forming after a price rally. The wedge is characterized by a series of lower highs and lower lows, signaling a gradual weakening of bullish momentum. After consolidating within this wedge, the price has broken down, suggesting a bearish continuation.

This setup provides a high-probability short trade with clear entry, stop-loss, and multiple take-profit levels.

2. Key Technical Elements

A) Chart Pattern – Descending Wedge Breakdown

A descending wedge is typically a bullish reversal pattern when forming at the bottom of a downtrend. However, in this case, it appears at the end of a corrective move, making it a bearish continuation setup.

The upper trendline (black dashed line) acts as resistance, preventing price from breaking higher.

The lower trendline (solid blue line) represents temporary support.

The wedge narrows as price action contracts, leading to an eventual breakdown.

👉 Breakout Confirmation:

The price has broken below the wedge’s support trendline.

A minor pullback to retest the broken trendline suggests validation of the breakdown.

B) Resistance & Support Levels

1️⃣ Resistance Level (Sell Zone) – $3,100 to $3,135

This area previously acted as a supply zone, rejecting bullish attempts.

Price was unable to sustain above this level, leading to further downside pressure.

Stop-loss should be placed above this level ($3,135.57) to protect against invalidation.

2️⃣ Support Level (Buy Zone) – $3,050 to $3,056

This was a previous reaction zone where price briefly bounced before continuing lower.

Now acting as Take Profit 1 (TP1) at $3,056.58.

3️⃣ Breakout & Retest

After breaking the wedge, price retested the trendline but failed to reclaim it, confirming the bearish trend.

3. Trade Setup & Execution

🔵 Entry Point:

Short trade activation upon the breakdown and retest of the wedge structure.

Price rejection at the trendline confirms seller strength.

🔴 Stop-Loss:

Placed at $3,135.57, slightly above recent swing highs.

This protects against false breakouts or sudden reversals.

🎯 Take Profit Levels:

TP1 ($3,056.58): First target where buyers might step in.

TP2 ($3,022.39): Midway target, acting as another strong support.

TP3 ($2,985.44): Final target where price may stabilize or reverse.

4. Market Context & Confirmation Indicators

📉 Bearish Confirmation:

Strong downward momentum suggests continued selling pressure.

Price action is failing to make new highs, confirming lower highs and lower lows.

📊 Risk-to-Reward Ratio (RRR):

The trade offers a favorable RRR, as the downside potential is significantly larger than the stop-loss range.

⚡ Additional Confirmation:

A strong bearish candle confirmed the breakout, rejecting higher levels.

Potential support breakouts suggest that price could reach TP3 if bearish momentum continues.

5. Conclusion – Trading Strategy Summary

✅ Pattern Identified: Descending Wedge Breakdown (Bearish)

✅ Trade Direction: Short (Sell)

✅ Entry Trigger: Breakout & Retest of the Trendline

✅ Stop-Loss: Above $3,135.57 (Wedge Resistance Zone)

✅ Take Profit Targets:

TP1: $3,056.58

TP2: $3,022.39

TP3: $2,985.44

📌 Final Thoughts:

This setup provides a high-probability trade with a clear breakdown structure and downside potential. If the price continues to respect the bearish trend, reaching all TP levels is likely. However, traders should monitor for reversal signals and manage risk accordingly.

🔔 Risk Warning: Always use proper risk management and adjust positions according to market conditions! 🚀

Priceaction

2025-04-03 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: 18200 is the next huge support and it’s likely that we get there tomorrow and there I would conclude my W3 thesis. Doing another red day into the weekend seems most reasonable because who the duck wants to hold on to longs in the current environment?

current market cycle: strong bear - W3 ongoing - target is 18200ish and W5 should get us to 17500ish

key levels: 18000 - 20100

bull case: Bulls can make money buying new lows on days like today but bears made sure to only print lower highs. For tomorrow bulls can’t expect something different to happen. Best they can hope for is to stay closer to 20000 but I highly doubt that.

Invalidation is below 18100.

bear case: Bears have the 2024-04 and 2024-08 lows in sight and could get there tomorrow. They are in full control if they continue to print lower lows and lower highs. Right now the 1h 20ema is holding like a champ but my drawn bear trend line will most likely have to be adjusted tomorrow before EU open. Every bear who sold the spike down yesterday is betting on a measured move down which is around 17600. Can we get there tomorrow? Very unlikely. This is most likely a spike & channel pattern that started Wednesday and given that tomorrow is the end of the week, I expect market to now go above 19000.

short term: Bearish for 18400 or even 18200. Lower highs have to hold, so no prices above 19000 or market turns a tad more neutral at least on lower time frames. Bulls can only hope for long scalps on new lows and going sideways.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. W3 underway, W5 should get us to my target. If we get there, no matter how dire, you just have to buy some very long term investments there. Odds that Nasdaq will stay below 20000 for the next 5 years are so abysmally low.

trade of the day: Sell anywhere and hold or look which bigger 20ema holds and look for shorts near it. Today it was once again the 1h 20ema.

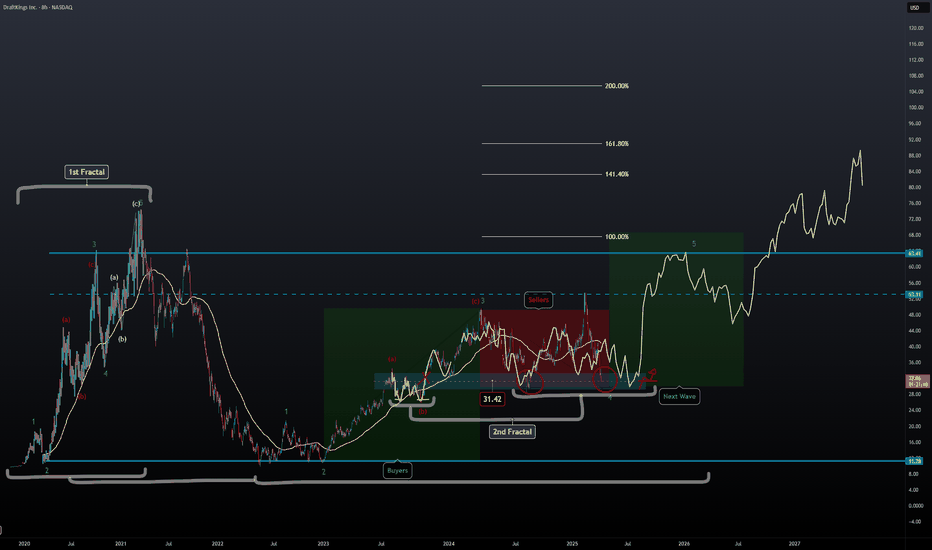

DKNG Update | Second Fractal | Extended TargetsPrice action looks very similar to the '23 Q3 play where we saw a double bottom move taking off from $26 - $49 which is also the ABC move that carried the 3rd impulse wave of the original fractal.

We're still in correction wave 4 and are about to start wave 5 shortly from now to July.

It's possible we could see price action higher than $74 based on the new fractal overlay and with the help of the fib extension.

Gold (XAU/USD) Breaks Ascending Channel – Bearish Move Ahead?📉 Market Structure:

Gold was moving in an ascending channel, but price has now broken below the support trendline.

This suggests a possible trend reversal or correction.

📌 Key Levels:

Resistance : $3,125 - $3,170

Support: $3,054 - $3,035

Target: $3,000 - $2,995

📊 Trade Idea:

A pullback to support-turned-resistance could give a short entry.

Bearish target: $3,000 if rejection holds.

Invalidation: If price reclaims $3,125.

🔍 Watch for:

Price reaction at the former channel support.

Possible retest before further drop.

Let me know if you need any modifications! 🚀

Is gold going to be eclipsed?

-------------------------

Timeframe: 240 Min

-------------------------

The price action suggests a completed impulse structure originating from the 2833 low, with gold now trading at an all-time high. Based on cluster zones and Fibonacci extensions, wave (5) still has the potential to extend toward the 3150-3200 range. This zone represents a key resistance level where buying momentum may slow down, signaling an impending shift in market dynamics.

Once wave (5) completes, it will mark the end of wave ((3)) of a higher degree, setting the stage for a corrective move. A retracement toward the previous wave (4) level is expected as wave ((4)) develops, aligning with historical corrective behavior after extended rallies. This phase will provide crucial insights into the market’s next major move. Stay tuned for further updates.

EUR/GBP Triangle Pattern - Bearish Breakdown SetupProfessional Analysis of the EUR/GBP Chart

This EUR/GBP (Euro/British Pound) daily chart from OANDA, published on April 3, 2025, highlights a key technical setup based on price action analysis, chart patterns, and support/resistance levels.

1. Market Context: Accumulation & Transition to a Triangle Pattern

Curve Zone Formation (Rounded Bottom):

The market initially exhibited a rounded bottom structure (curve zone) from July 2024 to February 2025, indicating a gradual accumulation phase.

This phase often signals a shift in market sentiment, where sellers lose dominance, and buyers start stepping in.

Breakout from Accumulation:

After reaching the support zone (~0.8250 - 0.8300), price rebounded sharply in March 2025, confirming strong buyer interest.

However, it failed to sustain upward momentum near the resistance zone (~0.8470 - 0.8500), leading to consolidation.

2. Formation of a Symmetrical Triangle Pattern

Lower Highs & Higher Lows:

Price action began forming a symmetrical triangle, a classic consolidation pattern that typically precedes a strong breakout.

The market is currently trading near the apex of the triangle, indicating that a breakout is imminent.

Potential Breakout Direction:

Symmetrical triangles are neutral patterns, meaning they can break either upward or downward.

However, the price structure and resistance rejection suggest a higher probability of a bearish breakdown.

3. Key Levels & Trading Setup

Resistance & Support Zones:

🔴 Resistance Zone (~0.8470 - 0.8500):

This area has repeatedly acted as strong resistance, where sellers have consistently pushed prices lower.

A breakout above this zone would indicate a bullish invalidation of the current bearish bias.

🟢 Support Zone (~0.8250 - 0.8300):

This level has held price multiple times, acting as key support.

A break below this zone would confirm bearish momentum, targeting lower price levels.

4. Bearish Trade Setup

📉 Entry Strategy (Short Position):

Wait for a confirmed breakout below the triangle’s lower trendline (~0.8320 - 0.8350).

A retest of the broken support turning into resistance would provide the best short entry.

📌 Stop-Loss Placement (~0.84764):

Positioned above recent highs and the resistance zone to minimize risk.

This ensures the trade is protected against potential false breakouts.

🎯 Profit Target (~0.81190 - 0.81134):

The projected move aligns with historical support levels, making it a logical target.

This level represents a previous market structure where buyers stepped in.

5. Conclusion & Trade Considerations

✅ Bearish Bias: The price action and pattern suggest a higher probability of a downside breakout.

✅ Defined Risk & Reward: A well-structured stop-loss and target level ensures a solid risk management strategy.

✅ Watch for Confirmation: Traders should wait for a confirmed breakout before entering a trade to avoid false moves.

📊 Overall Verdict: A high-probability short setup is forming, with a clear entry, stop-loss, and take-profit strategy. If the market respects the triangle breakdown scenario, this could lead to a significant bearish move toward the 0.81190 target.

EUR/USD Analysis Ascending Triangle Breakout – Bullish TargetOverview of the Chart:

The chart represents the EUR/USD (Euro to U.S. Dollar) pair on a 1-hour timeframe, showcasing a bullish ascending triangle breakout. The pattern indicates an upward continuation in the trend after a period of consolidation. This analysis will break down the key elements of the chart, the technical structure, and the potential trading strategy.

1. Market Structure & Key Zones

A. Market Curve Area (Early Trend Development)

The price started with a strong bullish trend leading up to the formation of the triangle.

The curved trendline suggests a gradual increase in buying pressure, indicating that the market was preparing for a larger breakout.

B. Resistance and Support Levels

Resistance Level (Red Arrow & Blue Box):

This level acted as a price ceiling where sellers previously dominated.

The market attempted multiple times to break this resistance before successfully breaching it.

Support Level (Green Arrow & Yellow Zone):

The price consistently found buyers at this level, reinforcing a higher low structure.

The rising support line within the triangle indicated strong accumulation by buyers.

2. Chart Pattern: Ascending Triangle Formation

The price action formed an ascending triangle, which is a well-known bullish continuation pattern.

The higher lows (trendline support) indicated buyers were gaining control, gradually pushing the price toward the resistance.

Eventually, the resistance was broken with strong bullish momentum, confirming a valid breakout.

3. Breakout Confirmation & Retest

The breakout above the resistance level came with high volume, indicating strong market participation.

After the breakout, a minor pullback (retest) occurred, confirming previous resistance as new support.

The price surged upward after the retest, validating the bullish trade setup.

4. Trade Setup & Risk Management

A. Entry Strategy

A trader would enter a buy (long) position after confirming the breakout.

Entry Trigger:

Either at breakout (high-risk, early entry)

Or after a successful retest (safer entry)

B. Stop Loss Placement

A stop loss is placed below the previous support level at 1.07276, ensuring risk is limited in case of a false breakout.

C. Target Projection

The target price is measured using the height of the triangle added to the breakout level.

Based on this calculation, the projected target is around 1.12838.

5. Conclusion & Trading Plan

The EUR/USD pair has executed a clean ascending triangle breakout, signaling further bullish movement.

The trading plan suggests:

✅ Entry: Buy after breakout confirmation or retest.

✅ Stop Loss: Placed below 1.07276 for risk management.

✅ Take Profit: Targeting 1.12838, based on the pattern’s height projection.

This setup presents a high-probability long opportunity in a trending market, with proper risk management to protect against potential reversals.

PY/USD Analysis: Rising Wedge Bearish Reversal & Short SetupThis chart represents the JPY/USD (Japanese Yen vs. US Dollar) on a daily timeframe (1D), published on April 3, 2025, via TradingView. The price action and technical indicators suggest a bearish outlook based on the formation of a Rising Wedge Pattern, a classic reversal structure signaling potential price depreciation.

1. Chart Structure & Identified Patterns

A. Rising Wedge Formation (Bearish Reversal Pattern)

The price has been moving in an uptrend, forming higher highs (HH) and higher lows (HL).

The two converging black trendlines indicate a rising wedge, a pattern that typically precedes a downside breakout.

A rising wedge is considered a bearish signal, especially when formed after a strong rally.

B. Support and Resistance Levels

Resistance Zone (Highlighted in Beige, Upper Range)

This level represents a historically significant supply area where selling pressure is expected.

Price action shows multiple rejections at this level, indicating the presence of strong resistance.

The red downward arrow further confirms that this level is acting as a cap on price movement.

Support Zone (Highlighted in Beige, Lower Range)

This area previously served as a strong demand level, where buyers stepped in, reversing the price.

The green upward arrow suggests that it played a critical role in the prior bullish move.

C. Key Price Levels

All-Time High (ATH) Marked at ~0.007155

This represents the historical peak price, which serves as a potential long-term resistance.

Stop-Loss Placement (~0.006959)

This is placed above the resistance level to manage risk in case of a false breakout.

Target Level (~0.006178)

Based on the wedge height, this level is calculated as the measured move after a breakdown.

2. Price Action & Market Sentiment

A. Recent Bullish Move

The market has been in a strong uptrend since hitting the support zone.

This move was characterized by higher lows and higher highs, reinforcing bullish momentum.

However, momentum appears to be weakening as the price struggles to break through the resistance.

B. Confirmation of a Bearish Reversal

The price has touched the upper resistance zone multiple times but failed to break through.

The trendline breakdown (expected move) suggests sellers are stepping in.

A lower high formation is seen as an early warning of a reversal.

3. Trade Setup: Short Position Strategy

This setup aligns with the principles of technical analysis, utilizing the Rising Wedge as a bearish reversal pattern.

A. Entry Strategy

Sell Entry Trigger: Enter a short trade upon a confirmed breakdown below the lower trendline.

Retest Confirmation: Ideally, wait for a pullback to the broken trendline before shorting to avoid false signals.

B. Risk Management

Stop-Loss Placement: Above the resistance zone at 0.006959, to protect against an invalidation.

Take-Profit Target: Set at 0.006178, calculated based on the wedge’s height projection.

C. Reward-to-Risk Ratio (RRR)

RRR = 2:1 or higher

The target level offers a risk-reward ratio that justifies the trade setup.

4. Summary & Final Outlook

Bearish Signals:

✅ Rising Wedge Pattern – A strong reversal indicator.

✅ Lower Highs and Weak Momentum – Suggests selling pressure.

✅ Failure to Break Resistance – Indicates bullish exhaustion.

✅ Projected Target Based on Wedge – Price expected to reach 0.006178.

Neutral Considerations:

If price does not break the lower trendline, the pattern is not validated.

If a false breakdown occurs, prices may briefly recover before falling.

Bullish Invalidation:

If the price breaks above 0.006959 and sustains above resistance, the bearish setup is invalidated.

Final Verdict:

📉 Bearish Bias – The market setup favors a downside move upon a confirmed breakdown.

🎯 Target: 0.006178 (Key support level).

⚠️ Risk: If the price does not break lower, consolidation may occur before a clearer move.

Silver Breakdown: Rising Wedge Bearish Move Towards Target1. Chart Overview

This 4-hour (H4) chart of Silver (XAG/USD) shows a clear Rising Wedge Pattern, a bearish technical formation. The price action recently broke below the lower support trendline, confirming a downside move. Several key levels, indicators, and trading strategies can be derived from this setup.

2. Identified Chart Pattern: Rising Wedge (Bearish Reversal)

A Rising Wedge is a pattern that forms when price consolidates between two upward-sloping trendlines, with the support line rising at a steeper angle than the resistance line. This pattern is considered bearish because it signals weakening buying pressure and an impending breakdown.

Uptrend Formation: The price had been moving within a wedge, forming higher highs and higher lows.

Volume Considerations: A wedge breakout is often accompanied by increasing volume, further confirming the trend shift.

Breakout Confirmation: The price has decisively broken below the lower boundary of the wedge, indicating that sellers are taking control.

3. Key Technical Levels & Trading Strategy

Resistance Level (Rejection Zone) – $34.00 - $34.50

The upper boundary of the rising wedge acted as strong resistance.

Multiple price rejections confirm sellers' dominance in this area.

Any future retest of this level may provide a new opportunity for short entries.

Support Level (Broken & Retested) – $32.50 - $32.80

This zone previously acted as strong support, preventing price from falling lower.

Now that price has broken this support level, it could act as resistance if a retest occurs.

A confirmed rejection here will further validate the bearish outlook.

Stop Loss Placement – $34.16

A logical stop-loss placement is slightly above the previous swing high and resistance area.

If price moves above this level, it would indicate that the breakdown has failed, invalidating the bearish setup.

Bearish Target – $30.76 (Measured Move Projection)

This level is derived from the height of the rising wedge pattern projected downward.

The area around $30.76 aligns with a previous support zone, making it a reasonable target for the current breakdown.

4. Price Action & Future Expectations

Current Market Sentiment: Bearish

The break below the wedge confirms a bearish sentiment.

A slight retracement to the previous support (now resistance) around $32.80 - $33.00 is possible before further downside.

If selling pressure remains strong, Silver is likely to reach the $30.76 target in the coming sessions.

Alternative Scenario: Bullish Recovery

If the price moves back above $34.16, the bearish outlook is invalidated.

A sustained move above this level could indicate a false breakdown and may push Silver toward new highs.

5. Trading Plan Based on This Setup

🔹 Entry Strategy:

Look for a retest of the broken support zone ($32.80 - $33.00) to enter short positions.

A rejection from this level with bearish confirmation (e.g., a bearish engulfing candle) strengthens the trade setup.

🔹 Stop Loss:

Placed above the wedge resistance at $34.16 to protect against false breakouts.

🔹 Take Profit Targets:

First Target: $31.50 (intermediate support level)

Final Target: $30.76 (measured move projection of the wedge)

6. Conclusion

This Rising Wedge Breakdown on Silver’s H4 chart presents a strong bearish trading opportunity with a well-defined risk-reward ratio. The break below key support signals continued downside, with $30.76 as the next major target. However, traders should monitor any retest of the broken support zone to confirm further selling momentum before entering new positions.

GBPAUD - Already Over-Bought!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been bullish trading within the rising channels in orange and red.

Currently, GBPAUD is retesting the upper bound of the channels.

Moreover, the $2.085 - $2.1 is a strong resistance zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper trendlines and green resistance zone.

📚 As per my trading style:

As #GBPAUD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin (BTC/USD) Rectangle Pattern Breakdown – Bearish Move1. Overview of the Chart & Market Context

The chart provided represents Bitcoin (BTC/USD) on the 1-hour timeframe, published on TradingView. This analysis highlights the rectangle pattern formation, key support and resistance levels, and a potential short trade setup with defined risk management.

The market structure suggests a bearish outlook, as Bitcoin attempted to break above a resistance level but failed, leading to a sharp decline. The price action now indicates further downside movement, aligning with a rectangle pattern breakdown.

2. Rectangle Pattern Formation

What is a Rectangle Pattern?

A rectangle pattern is a consolidation phase where price moves sideways within a defined range, forming multiple touches at resistance and support before a breakout occurs. It can serve as a continuation or reversal pattern, depending on the breakout direction.

In this case, the pattern has resulted in a bearish breakout, indicating that sellers have taken control of the market.

Key Characteristics of This Rectangle Pattern:

The upper boundary (resistance) is at 88,333 USD, where price repeatedly failed to break higher.

The lower boundary (support) is at 78,044 USD, which acted as a strong floor but is now under pressure.

The price moved within this range for an extended period, showing a balanced battle between buyers and sellers.

A failed breakout at resistance, followed by a sharp rejection, signals a bearish reversal.

3. Breakdown of Key Levels & Market Structure

A. Resistance Level – 88,333 USD

This level has been tested multiple times, but price failed to hold above it.

The recent failed breakout led to a strong bearish rejection, confirming resistance.

The price action formed a bearish engulfing candlestick, adding to the bearish bias.

B. Support Level – 78,044 USD

This zone has previously provided multiple bounces, showing strong buying interest.

However, with the recent break below this level, it may now act as resistance.

If the price retests this area and fails to break above, it confirms a bearish continuation.

C. Price Rejection and Market Structure Shift

The formation of lower highs and lower lows signals a transition from consolidation to a downtrend.

The price broke out of the rectangle pattern to the downside, confirming a bearish breakout.

If the support at 78,044 USD fails, the price may continue dropping toward 73,678 USD.

4. Trade Setup & Execution Plan

🔹 Entry Strategy

A short position is initiated after the bearish rejection at resistance (88,333 USD).

The breakdown of the rectangle pattern strengthens the short setup.

The price may briefly retest the broken support (78,044 USD) before continuing downward.

🔹 Stop-Loss Placement

The stop-loss (SL) is placed above 88,333 USD, ensuring that if price moves against the trade, risk is minimized.

This protects against any unexpected bullish reversal.

🔹 Profit Targets (Take Profit - TP)

TP1: 78,044 USD (previous support level) – A conservative target.

TP2: 73,678 USD (deeper support) – If bearish momentum continues, this is the extended target.

Trade Component Details

Entry Short after rejection at 88,333 USD

Stop-Loss (SL) Above 88,333 USD

Take Profit 1 (TP1) 78,044 USD

Take Profit 2 (TP2) 73,678 USD

Confirmation Breakout & retest of support

Risk-Reward Ratio Favorable (defined SL & TP)

5. Expected Price Action and Market Behavior

🔻 Bearish Scenario (Most Likely Outcome)

The price will continue to fall towards TP1 (78,044 USD) due to selling pressure.

If 78,044 USD fails to hold, Bitcoin is likely to test the next major support level (73,678 USD).

The structure of lower highs and lower lows supports the downtrend.

🔺 Bullish Scenario (Invalidation of the Short Setup)

If Bitcoin breaks above 88,333 USD, the bearish outlook is invalidated.

This could signal a potential trend reversal or bullish breakout.

6. Technical Indicators Supporting the Analysis

Several technical indicators can be used to confirm the bearish outlook:

📉 RSI (Relative Strength Index):

If RSI is below 50, it confirms bearish momentum.

If RSI is oversold (<30), a temporary bounce may occur.

📉 Moving Averages:

If the 50-period MA crosses below the 200-period MA, it confirms a bearish trend.

If price is below both MAs, it strengthens the bearish setup.

📉 Volume Analysis:

A high selling volume during the breakdown indicates strong bearish conviction.

If volume spikes near support levels, a potential bounce could happen.

7. Summary of Key Findings

Pattern Identified: Rectangle pattern with a bearish breakout.

Market Structure: Price formed lower highs and lower lows, signaling a downtrend.

Trade Setup:

Short trade after rejection at 88,333 USD.

Stop-loss above 88,333 USD to manage risk.

Profit targets at 78,044 USD (TP1) and 73,678 USD (TP2).

Risk Management:

Clear stop-loss and take-profit levels ensure a controlled risk-to-reward ratio.

If price moves against the trade, the stop-loss prevents excessive losses.

Technical Indicators:

RSI, Moving Averages, and Volume Analysis confirm the bearish outlook.

8. Final Thoughts & Trading Plan Implementation

This analysis presents a high-probability bearish trade setup using the rectangle pattern breakdown strategy. With proper risk management, traders can execute this short trade with a structured plan.

🔹 Actionable Trading Plan:

Wait for price confirmation – If BTC retests the broken support (78,044 USD) and rejects, this strengthens the trade idea.

Execute the short trade – Once confirmation occurs, enter a short position.

Manage risk appropriately – Stick to the stop-loss above 88,333 USD.

Monitor price action – Adjust take-profit levels based on momentum and support breaks.

If the price invalidates the setup by breaking above resistance, it is crucial to exit the trade and re-evaluate the market conditions.

Conclusion:

This Bitcoin (BTC/USD) rectangle pattern breakdown analysis provides a clear bearish trade setup, supported by market structure, technical indicators, and price action. The well-defined entry, stop-loss, and take-profit levels ensure a structured risk-reward ratio, making this a viable short trade opportunity.

Trend Changing Pattern (TCP) in Action: Live ExampleHey traders,

Following up on yesterday’s lesson about the Trend Changing Pattern (TCP), I wanted to share a real-time example using the CADJPY pair in an intraday downtrend.

Today, we spotted a TCP setup where price action gave us a classic reversal signal:

The market manipulated the low of the TCP zone with a single break.

This was followed by a W pattern and a second attempt that failed to make a lower low.

That failure to create a new low acted as our entry confirmation for a long position.

🔹 Entry: 103.71 (Long)

🔹 Stop Loss: 103.28 (Just below the break low for protection)

This trade setup perfectly illustrates how price structure and momentum shifts can help you catch early entries during trend reversals.

Stay sharp, manage your risk — and have a blessed trading day!

Gold (XAU/USD) – Rising Wedge Breakdown & Bearish SetupOverview

Gold (XAU/USD) has been in a strong uptrend, making consistent higher highs and higher lows. However, the price action has formed a Rising Wedge Pattern, which is typically a bearish reversal formation. This pattern suggests that the bullish momentum is weakening, and a potential sell-off could follow.

The recent breakdown of the wedge structure confirms the bearish bias, and sellers are now in control. Based on price action analysis, we can anticipate further downside movement toward key support levels.

📊 Technical Analysis – Rising Wedge Breakdown

1️⃣ Understanding the Rising Wedge Pattern

The Rising Wedge is a bearish pattern that occurs when the price consolidates within an upward-sloping channel but shows signs of exhaustion. Here’s how it developed:

Higher Highs & Higher Lows: The price consistently formed higher peaks and troughs, indicating an uptrend.

Declining Bullish Momentum: As the wedge progressed, price action became increasingly squeezed, showing reduced bullish strength.

Breakout Confirmation: Once the lower trendline of the wedge was breached, it confirmed that buyers were losing control and that sellers had stepped in.

2️⃣ Key Levels & Market Structure

🔵 Resistance Level: The upper boundary of the wedge around $3,150 - $3,163 acted as a supply zone, where sellers pushed prices lower.

🟠 Support Level: The lower boundary of the wedge, around $3,100 - $3,120, initially provided demand but eventually failed to hold.

🔻 Breakdown Confirmation: The price broke below the wedge, which is a strong bearish signal.

🎯 Trade Setup & Strategy

3️⃣ Bearish Trading Plan

Given the breakdown of the wedge pattern, the setup favors a short (sell) trade. Here’s how to approach it:

📉 Sell Entry:

The ideal short position is initiated after a confirmed break of the wedge’s support level.

📍 Stop Loss (SL):

A tight stop-loss is placed above the previous resistance at $3,163.67, ensuring risk is controlled if the trade goes against the bias.

🎯 Take Profit (TP) Targets:

TP 1: $3,080.66 – First major support level, where buyers might step in temporarily.

TP 2: $3,057.33 – Extended downside target, offering a greater risk-to-reward ratio.

4️⃣ Additional Price Expectations

Retest of the Wedge Breakdown: The price may pull back to the broken wedge support before continuing downward.

Stronger Bearish Momentum: If selling pressure remains strong, price could fall even lower, breaking TP 2.

Invalidation Level: If price climbs above $3,163, the wedge breakdown would be invalidated, signaling that bulls have regained control.

📌 Conclusion & Market Sentiment

🔹 Rising Wedge Breakdown Signals Further Downside – The market structure suggests that sellers are gaining control.

🔹 Sell Setup with Risk-Managed Approach – With a defined stop-loss and two profit targets, this trade offers a favorable risk-to-reward setup.

🔹 Gold’s Short-Term Bearish Outlook – The chart confirms a potential correction, and price may drop towards $3,080 and $3,057 if the bearish momentum continues.

📊 Final Thought:

This is a high-probability short trade based on classic technical analysis. Traders should monitor for confirmation retests and manage risk accordingly. ✅

Would you like any refinements or additional insights? 🚀

EURJPY Double Top - Bearish Reversal Ahead Toward Target!🔍 Chart Analysis: Identifying the Double Top Pattern

The EURJPY (Euro/Japanese Yen) 1-hour chart shows a classic Double Top pattern, which is a strong bearish reversal formation. This pattern occurs when the price reaches a significant resistance level twice but fails to break above it, indicating a potential shift from bullish momentum to bearish control.

1️⃣ Top 1: The first peak formed as buyers pushed the price higher, but strong resistance forced a pullback.

2️⃣ Top 2: The price attempted to break the same resistance level again but failed, forming a second peak at approximately 164.165, confirming that sellers are overpowering buyers.

3️⃣ Neckline (Support Level): The critical support level around 160.000 acted as a trigger for the bearish move. Once this level broke, the double top pattern was confirmed.

📌 Key Levels and Market Structure

🔹 Resistance (164.165): The highest level where sellers dominated, preventing further upward movement.

🔹 Support/Neckline (160.000): This level acted as a crucial pivot. Once broken, it signaled a trend reversal.

🔹 Take Profit Levels:

TP1 – 159.036: This serves as the first profit target, aligning with a prior demand zone.

TP2 – 157.200: The full projected downside move based on the double top pattern.

🔹 Stop Loss (SL): Above 164.165, ensuring a risk-managed approach in case of trend invalidation.

📉 Trading Strategy: How to Trade This Setup?

1️⃣ Entry Confirmation:

The ideal entry was after the price broke the neckline at 160.000 and retested it as resistance.

A breakdown candle with high volume confirmed seller dominance.

2️⃣ Stop-Loss Placement:

A stop-loss above 164.165 provides room for price fluctuations while protecting against false breakouts.

3️⃣ Profit Targets:

TP1: 159.036, securing partial profits.

TP2: 157.200, completing the double top measured move.

📊 Market Psychology & Price Action Insights

The double top pattern reflects a shift in market sentiment from bullish to bearish.

The repeated rejection at 164.165 signals a lack of buying strength, increasing the probability of a downward move.

The breakdown of the 160.000 neckline confirms that sellers have taken control.

The price action also shows a lower-high formation, reinforcing bearish momentum.

✅ Conclusion: Bearish Bias Until 157.200

This setup strongly favors short positions, as long as the price stays below 162.500.

A break above 164.165 invalidates the bearish setup, signaling a potential reversal.

Until then, the market remains bearish, with TP1 & TP2 as achievable downside targets.

💬 What’s your outlook on EURJPY? Drop your analysis below! 👇

2025-04-02 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: This is the event bears have prayed for, full blown trade war and this market is not positioned for any downside risk. Let’s see where we close this week. Below 21500 would be amazing but let’s close below 22000 first.

current market cycle: trading range

key levels: 21800 - 23000

bull case: Tbh, best bulls can hope for, is to stay above 22000. I can’t see this going above 22800 for the near future. If bulls do it, I am clearly wrong.

Invalidation is below 21900.

bear case: Bears got the event gift and now it’s about how fast do they want to get out of this. I expect the worst but stops for now are 22800. First target is a strong move below 22300, then bears need to break 22000 and print a lower low. If they do that, we most likely freefall to 22000. If things become real bad, we hit the big bull trend line from August tomorrow, likely around 21800.

Invalidation is above 22800.

short term: LFG. Trade small with wide stops.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Big up, big down. Triangle on the 4h chart and both sides made decent money today.

PhoenixLTD, 1W & 1DLooking very Good Channel Pattern and it is ready to Breakout

Enter into it after the upper trendline Breakout

it is Combination of Both Triangle and Channel Patterns , it can Break any time

so look an eye on it or make an Alert above trendline broke

Follow For More Swing Trade Ideas Like This

FluoroChem ,1WFirst Triangle Pattern is Breaked Out and Next Channel Pattern is Formed at Retest for Triangle Pattern .

Now Channel Pattern is Ready to breakout , SO look an Eye on it when Breaking

Only Enter after the breakout of upper Trendline of Channel Pattern .

Be Careful when entering at breakout

Follow for more Swing Trade Ideas Like This

BTC/USD Bullish Breakout from Rectangle PatternOverview:

The chart represents Bitcoin's price action against the US Dollar on the 1-hour timeframe, highlighting a Rectangle Pattern Breakout with a well-structured trade setup. This analysis will break down the pattern, key levels, and possible trading scenarios.

1️⃣ Chart Pattern Breakdown – Rectangle Consolidation

The price has been moving within a rectangle pattern (range-bound movement), where Bitcoin found support at lower levels and faced resistance at the upper boundary.

Rectangle Pattern: A continuation/consolidation pattern where price fluctuates between horizontal resistance and support before breaking out.

Curve Formation: The price action within the rectangle also forms a rounding bottom, indicating a potential shift from bearish to bullish sentiment.

Breakout Confirmation: BTC has broken out from the rectangle, suggesting bullish momentum.

2️⃣ Key Technical Levels

🔹 Support Level ($84,110)

This zone has acted as a strong demand area, preventing the price from falling further.

Buyers consistently stepped in at this level, making it a significant psychological floor for Bitcoin.

🔹 Resistance Level ($86,850 - $87,000 Zone)

This level had previously rejected upward movements, leading to multiple price pullbacks.

After the breakout, this area is expected to act as a new support level upon a retest.

🔹 Target Price ($89,931 – Next Resistance Zone)

If the breakout sustains, the next key target for bulls is around $89,931, based on prior resistance zones and technical projections.

🔹 Stop Loss ($84,110 – Below Support Zone)

A stop loss below the support zone ensures risk management in case of a false breakout.

3️⃣ Trading Strategy & Execution

📌 Entry Point – After price confirms the breakout above the rectangle’s resistance. Traders should wait for:

A pullback and retest of the broken resistance, which should now act as support.

A strong bullish candle confirming continuation.

📌 Take Profit (TP) – $89,931, based on historical resistance levels and price projection from the rectangle range.

📌 Stop Loss (SL) – Placed at $84,110, below the rectangle’s previous support zone to minimize downside risk.

📌 Risk-to-Reward Ratio (RRR) – The setup offers a favorable RRR, meaning potential profits outweigh the risks.

4️⃣ Market Sentiment & Additional Factors

✔ Bullish Outlook – The breakout signals strong buying interest and potential upside continuation.

✔ Volume Confirmation – Traders should monitor volume spikes during the breakout to confirm institutional participation.

✔ Economic Events & News – External factors like macroeconomic data or Bitcoin-related news can impact price action.

Conclusion – BTC/USD Trading Setup

Pattern Identified: Rectangle Pattern Breakout

Current Trend: Bullish breakout from consolidation

Trade Type: Long position (Buy setup)

Key Levels:

✅ Support: $84,110

✅ Resistance: $86,850 - $87,000

✅ Target: $89,931

✅ Stop Loss: $84,110

🔥 Final Thought : Bitcoin has broken out of a key consolidation range, signaling a bullish move towards $89,931. Traders should wait for confirmation and manage risk accordingly! 🚀📈